Surfactants Market By Type(Anionic Surfactants, Non-ionic Surfactants, Cationic Surfactants, Others), By Origin(Synthetic Surfactants, Bio-based Surfactants), By Application(Home Care, Personal Care, Oilfield Chemicals, Food & Beverage, Agrochemicals, Textiles), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43032

-

Jan 2024

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Surfactants Market Size, Share, Trends Analysis

- Surfactants Market Dynamics

- Surfactants Market Segmentation Analysis

- Surfactants Industry Segments

- Surfactants Market Growth Opportunity

- Surfactants Market Regional Analysis

- Surfactants Industry By Region

- Surfactants Market Share Analysis

- Surfactants Industry Key Players

- Surfactants Market Recent Development

- Report Scope

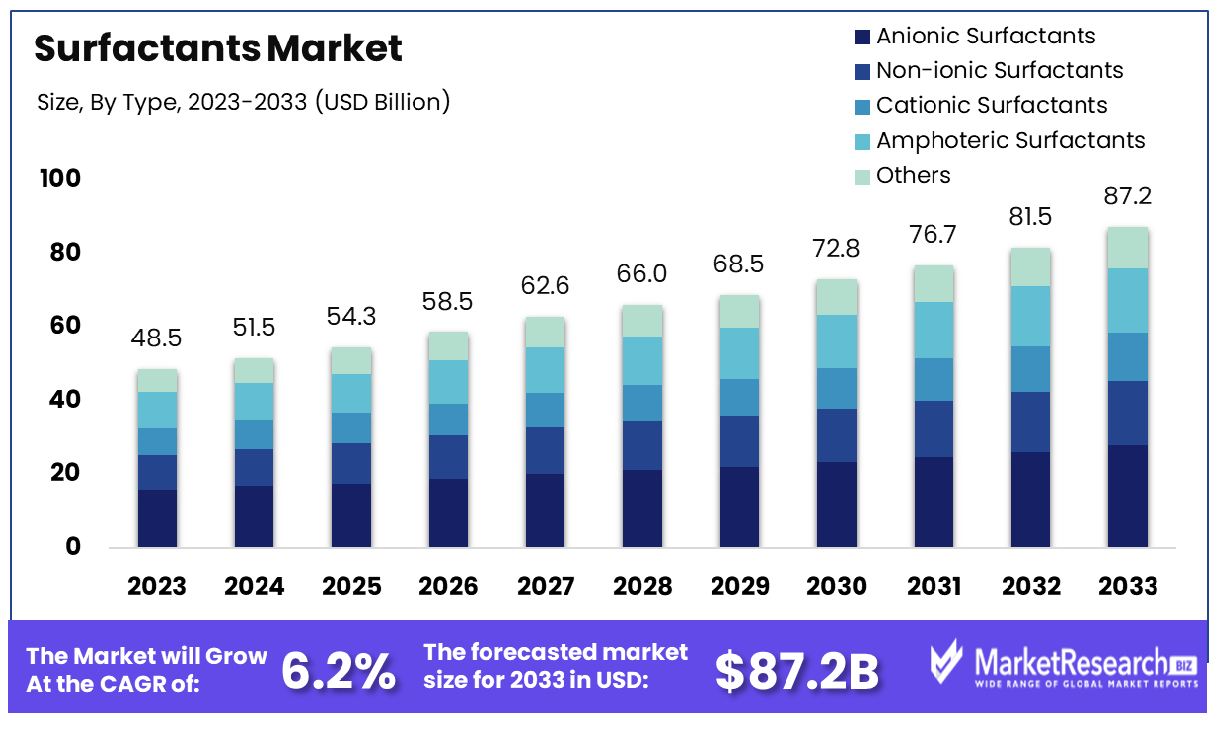

The surfactants market was valued at USD 48.5 billion in 2023. It is expected to reach USD 87.2 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

The surge in demand for household cleaning activities and the rise in the food and beverage industries are some of the main driving key factors for the surfactant market. Surfactants are generally compounds that decrease the surface tension of a liquid by making it more active and operative at pervading surfaces and eliminating dirt and other substances. These are also used in different types of cleaning products comprise laundry detergents and other cleaning purposes.

Surfactants are the main ingredients in cleaning products. They are generally combined with solvents and inhibitors to reinforce their efficacy in eliminating grime, fuel oils, and grease. Many eco-friendly surfactants are used to decrease the environmental impact of the products by separating them at a faster pace than their normal counterparts. Manufacturers are focusing on the importance of surfactants, as they are very essential for cleaning purposes.

Due to its capability of decreasing the surface tension of water, which permits the water to spread more easily in wet areas, this makes the procedure of removing dirt and other harmful contaminants from the surface areas much more tranquil, as the water can go into the pores where the dirt is trapped inside. Surfactants are also beneficial for cleaning purposes as they help to dissolve and slacken contamination, as well as dangling dirt and other elements in the water solution so that it can be washed away easily.

Plant-based surfactants are extracted from natural sources like plants, which provide a more environmentally friendly and sustainable substitute for synthetic surfactants, which are made from non-renewable resources such as petroleum. By implementing plant-based surfactants, many consumers and industries can contribute to a clean and green future. Surfactants are not only used for cleaning purposes; they are also used in various applications, such as food processing, oil production, and personal care products such as toothpaste, shampoo, lotions, and body washes.

There are several benefits to using plant-based surfactants, such as that they are environmentally friendly and less toxic, and they can be used for many other purposes. These are biodegradable. Many industrial giants manufacture plant-based eco-friendly surfactants comprising Seventh Generation, Ecover, Methods, and others. These organizations provide a wide range of plant-based surfactants that cover all cleaning purposes. The demand for surfactants will rise because of plant-based surfactants that are environmentally friendly, and the businesses involved in this sector will also help to expand the market in the forecast period.

Surfactants Market Dynamics

Personal and Home Care Industries Boost Surfactant Market

The surfactant market is witnessing robust growth fueled by escalating demand from the personal and home care sectors. Surfactants' integral role in products like shampoos, body washes, toothpaste, detergents, and surface cleaners, coupled with the rising middle-class population and growing disposable incomes, particularly in emerging economies, is propelling this surge. This trend reflects a broader shift towards enhanced hygiene and cleanliness standards globally, significantly driving the market forward.

Manufacturing Innovations Expand the Surfactant Market

Advancements in manufacturing technologies are revolutionizing the surfactant market. The development of bio-based surfactants from natural sources, such as corn and coconut, is not only cost-effective but also environmentally friendly. Innovations like Galseer Tresscon, a solid surfactant system for shampoo bars, exemplify the industry's shift toward sustainability. This technology could dramatically reduce plastic waste, indicating a future where eco-friendly and efficient surfactants become the norm.

Agricultural Sector's Surfactant Adoption Spurs Growth

In the agricultural realm, surfactants are becoming increasingly pivotal. They enhance the efficacy of agrochemicals like pesticides and insecticides, meeting the global imperative to boost agricultural productivity. Innovations like Bionema Group's Soil-Jet® BSP100, with its biodegradable and plant-nurturing properties, demonstrate the market's potential for rapid growth. Field trials showing a 20-30% increase in efficiency over existing products indicate a significant market expansion, driven by the need for more effective agricultural practices.

Raw Material Price Volatility Restricts Surfactants Market Growth

The surfactants market is significantly impacted by the instability of raw material costs, predominantly due to their derivation from petroleum feedstocks. Fluctuating crude oil prices directly influence the cost of these raw materials, leading to erratic surfactant prices and unpredictability in profit margins for manufacturers. For instance, the volatility in crude oil prices affects the economic feasibility of surfactant production. This uncertainty complicates budgeting and pricing strategies for surfactant producers, posing a substantial challenge to the market's stability and substantial growth.

Environmental Regulations Constrain Surfactant Industry Expansion

The shift towards stringent environmental regulations governing the use of non-biodegradable and toxic surfactants, such as Linear Alkylbenzene Sulfonates (LAS) and Alkylbenzene Sulfonates (ABS), is compelling the industry to pivot towards eco-friendly variants. This transition necessitates increased investment in research and development, elevating product development costs.

Notably, the European Union's ban on nonylphenol ethoxylates exemplifies these tightening regulations. As of January 2024, various regulatory frameworks, like the US Safer Choice Program and the EU's proposal for a regulation on detergents and surfactants, introduced in April 2023, aim to standardize industry practices. These regulations enhance environmental safety but also impose additional costs and complexities on surfactant producers, potentially hindering market steady growth.

Surfactants Market Segmentation Analysis

By Type Analysis

Anionic Surfactants dominate the surfactants market. This dominance is primarily due to their wide range of applications in detergents and personal care products. Anionic surfactants, known for their excellent cleaning and emulsifying properties, are key ingredients in products like shampoos, soaps, and laundry detergents. They work effectively in removing dirt and oils, making them the preferred choice in household and industrial cleaning applications.

Non-ionic, Cationic, Amphoteric, and other types of surfactants also hold significant shares in the market. Non-ionic surfactants are valued for their mildness and versatility, while cationic surfactants are used for their antimicrobial properties. Amphoteric surfactants, known for their compatibility with both anionic and cationic surfactants, are used in personal care industry products. However, the broad applicability and established presence of anionic surfactants in various consumer products underscore their market dominance.

By Origin Analysis

The surfactants market is segmented into Synthetic and Bio-based Surfactants. Synthetic surfactants, derived from petrochemical sources, have traditionally dominated the market due to their cost-effectiveness and wide range of functionalities.

However, there's a growing shift towards bio-based surfactants, driven by environmental concerns and sustainability initiatives. Bio-based surfactants are derived from renewable resources and are gaining popularity due to their eco-friendly profile and biodegradability. The trend towards green chemistry and sustainable products is expected to increase the demand for bio-based surfactants.

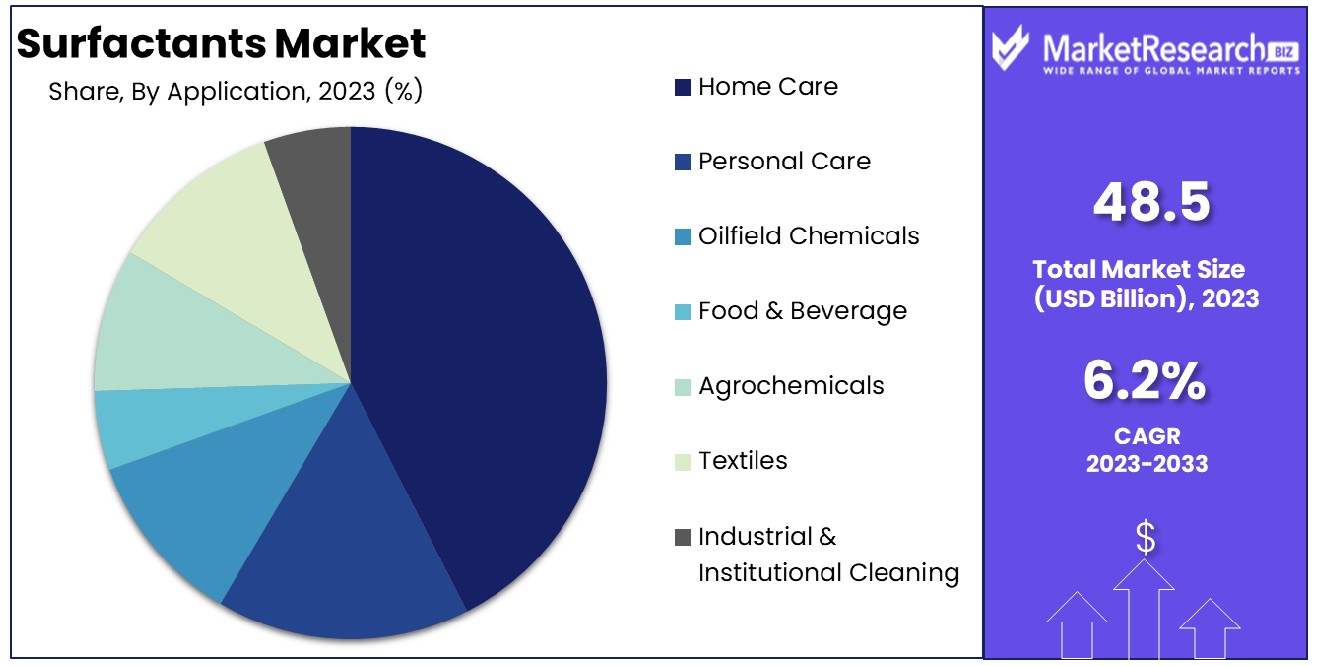

By Application Analysis

Home Care is the dominant application segment in the surfactant market. This segment includes a wide range of cleaning products such as laundry detergents, dishwashing liquids, and household cleaners. The effectiveness of surfactants in removing stains, soils, and greases makes them indispensable in home care products. The large consumer base and regular demand for home care products contribute significantly to the segment's dominance.

Other application areas like Personal Care, Oilfield Chemicals, Food & Beverage, Agrochemicals, Textiles, Plastics, and Industrial & Institutional Cleaning also utilize surfactants extensively. In personal care, surfactants are used for their foaming and cleansing properties. In industrial applications, they serve as emulsifiers, wetting agents, and dispersants. Despite this, the sheer volume and consistent demand in the home care sector solidify its position as the leading application segment in the surfactants market.

Surfactants Industry Segments

By Type

- Anionic Surfactants

- Non-ionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

- Others

By Origin

- Synthetic Surfactants

- Bio-based Surfactants

By Application

- Home Care

- Personal Care

- Oilfield Chemicals

- Food & Beverage

- Agrochemicals

- Textiles

- Industrial & Institutional Cleaning

Surfactants Market Growth Opportunity

Multifunctional Surfactants: A New Era of Versatility and Efficiency

The increasing market for surfactants that can be multifunctional offers an opportunity for significant growth and innovation within the market for surfactants. Consumers and industries are increasingly seeking surfactants that can perform various functions such as emulsification, dispersion, wetting, and foaming, all within a single product.

This trend opens up avenues for research and development in creating versatile, hybrid surfactants that can meet these multifaceted requirements. The development of such products would not only satisfy customer demands for efficiency and functionality but also potentially streamline manufacturing processes and reduce costs, thus driving growth potential in the surfactant market.

Embracing Green Chemistry: A Sustainable Future for Surfactants

The incorporation of green chemistry principles into the manufacturing of surfactants presents significant growth of surfactant opportunities within the market. As environmental concerns become more prominent, there is a rising demand for sustainable and eco-friendly products.

By adopting green chemistry, manufacturers can make surfactant production processes more environmentally friendly, reducing the ecological footprint and addressing consumer concerns about sustainability. This approach can lead to the development of new, greener surfactants that resonate with environmentally conscious consumers and industries, thereby expanding the market reach and appealing to a broader, more sustainability-focused audience.

Surfactants Market Regional Analysis

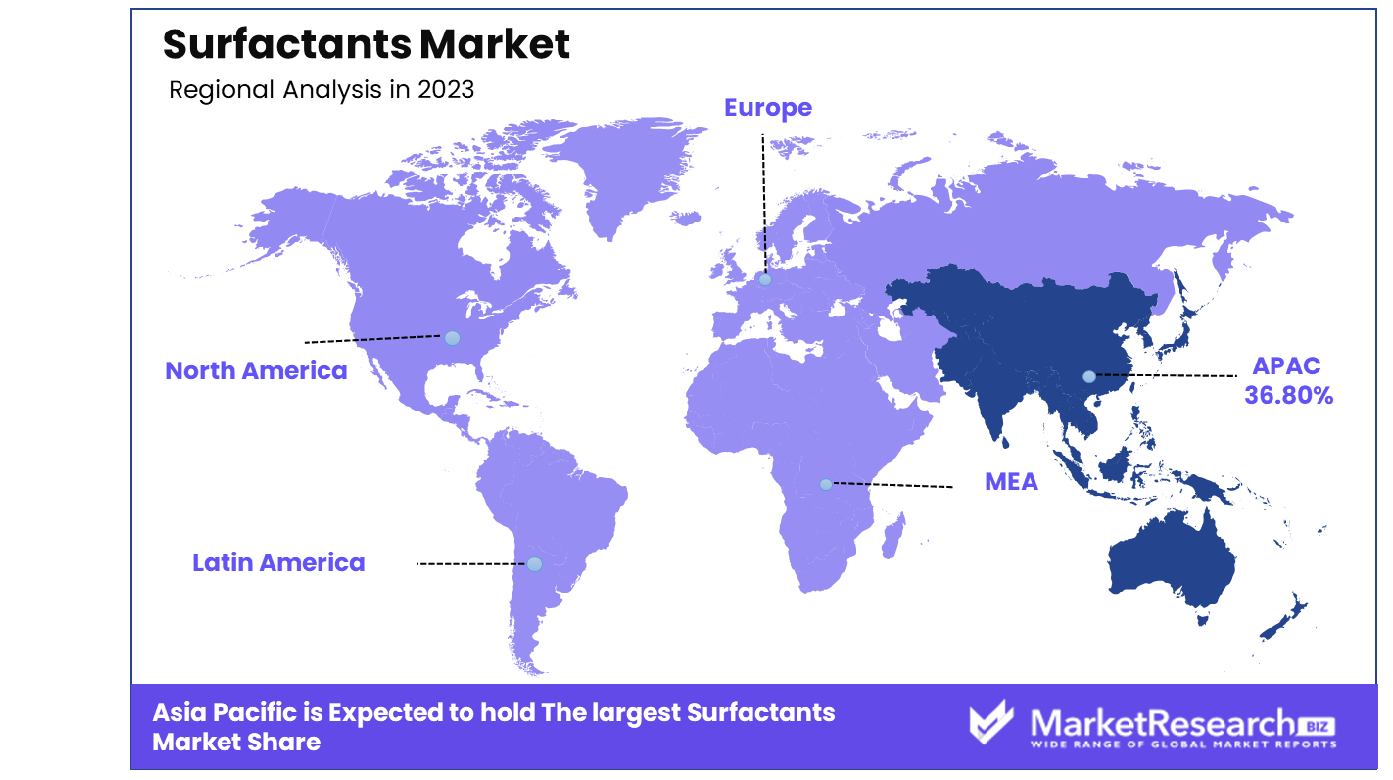

Asia Pacific Dominates with 36.80% Market Share in Surfactants Market

Asia Pacific’s leading position in the surfactants market, with a 36.80% share, is primarily driven by the region's expansive manufacturing sector and rapid industrialization. Countries like China, India, and Japan are major contributors, with their vast consumer base and growing demand for personal care and household products. The supply of raw materials as well as the presence of regional players have a major impact. Additionally, Asia Pacific’s burgeoning construction industry, which heavily utilizes surfactants in cement and concrete applications, plays a vital role in driving market growth.

The surfactants market in Asia Pacific is characterized by diverse applications across various industries, including detergents, personal care, textiles, and construction. The region's economic growth, coupled with rising consumer awareness about hygiene and personal care, has led to increased demand for surfactant-based products. Innovation and R&D in bio-based surfactants are also gaining traction in the region, driven by environmental concerns and regulatory policies promoting sustainable products. The competitive pricing and large-scale production capabilities further enhance the market dynamics in the Asia Pacific.

Europe: Focus on Sustainable and Bio-based Surfactants

Europe’s surfactants market is driven by a strong focus on environmental sustainability and the development of bio-based surfactants. Countries like Germany, France, and the UK are at the forefront, with regulations promoting eco-friendly products. The increasing consumer preference for green and natural products supports market growth in this region.

North America: Advanced Technology and High Consumer Demand

In North America, the surfactants market benefits from advanced technological developments and high consumer demand, especially in the personal care and household sectors. The United States leads the market with its innovative product offerings and robust manufacturing sector. The region's focus on bio-based and environmentally friendly surfactants also contributes to market expansion.

Surfactants Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Within the Surfactants Market, a crucial sector of chemical manufacturing, the companies mentioned can be found in the shaping of global production, innovation, and application variety. BASF SE and Dow Inc. are industry leaders, known for their extensive range of surfactants used in various applications from detergents to personal care products. Their strategic positioning emphasizes technological innovation and sustainable production, significantly influencing global market trends.

Evonik Industries AG and Stepan Company stand out for their specialized surfactant solutions, catering to specific industrial needs. Their focus on tailored products underscores the market's move towards meeting diverse consumer demands.

Surfactants Industry Key Players

- BASF SE

- Stepan Company

- Evonik Industries AG

- Dow Inc.

- Nouryon

- Solvay S.A.

- Arkema

- Ashland

- Bayer AG

- Clariant

- Croda International PLC

- DETEN Quimica SA

- Cepsa

- Galaxy Surfactants

- Huntsman International LLC

- Kao Corporation

- Lonza

- Sanyo Chemical Industries Ltd

- Sasol

- Godrej Industries Limited

- Innospec

- Procter & Gamble

- Henkel Corporation

- Mitsui Chemicals America, Inc.

Surfactants Market Recent Development

- In January 2024, Galaxy Surfactants announces participation in the 13th HPCI India, showcasing innovations in home and personal care ingredients. Introducing three emollient additions, including two patented products, emphasizing sustainability and quality.

- In January 2024, Osaka University researchers develop a green and sustainable method for alkylamine synthesis using a platinum-molybdenum catalyst. The process operates under mild conditions, producing water as the sole byproduct, enhancing environmental sustainability in chemical syntheses.

- In January 2023, Siltech focused on improving the sustainability of its silicones, introducing PEG-dimethicone surfactants and alkyl dimethicone emulsifiers with high biobased carbon content, derived from feedstocks sourced from biobased materials.

- In September 2023, University of Birmingham researchers found surfactants in aerosols, like those from cooking and cleaning, form 3D structures, protecting hazardous chemicals and extending their atmospheric lifespan. The study highlights potential health risks and emphasizes ventilation during indoor activities.

Report Scope

Report Features Description Market Value (2023) USD 48.5 Billion Forecast Revenue (2033) USD 87.2 Billion CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Anionic Surfactants, Non-ionic Surfactants, Cationic Surfactants, Amphoteric Surfactants, Others), By Origin(Synthetic Surfactants, Bio-based Surfactants), By Application(Home Care, Personal Care, Oilfield Chemicals, Food & Beverage, Agrochemicals, Textiles, Industrial & Institutional Cleaning) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BASF SE, Stepan Company, Evonik Industries AG, Dow Inc., Nouryon, Solvay S.A., Arkema, Ashland, Bayer AG, Clariant, Croda International PLC, DETEN Quimica SA, Cepsa, Galaxy Surfactants, Huntsman International LLC, Kao Corporation, Lonza, Sanyo Chemical Industries Ltd, Sasol, Godrej Industries Limited, Innospec, Procter & Gamble, Henkel Corporation, Mitsui Chemicals America, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- Stepan Company

- Evonik Industries AG

- Dow Inc.

- Nouryon

- Solvay S.A.

- Arkema

- Ashland

- Bayer AG

- Clariant

- Croda International PLC

- DETEN Quimica SA

- Cepsa

- Galaxy Surfactants

- Huntsman International LLC

- Kao Corporation

- Lonza

- Sanyo Chemical Industries Ltd

- Sasol

- Godrej Industries Limited

- Innospec

- Procter & Gamble

- Henkel Corporation

- Mitsui Chemicals America, Inc.