Organic Spices Market By Product Type(Turmeric, Ginger, Basil, Cumin, Cinnamon, Clove, Pepper, Garlic), By Form(Powder & Granules, Flakes, Paste, Whole/Fresh), By Distribution Channel(Direct, Indirect, Online Retail), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43502

-

Feb 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

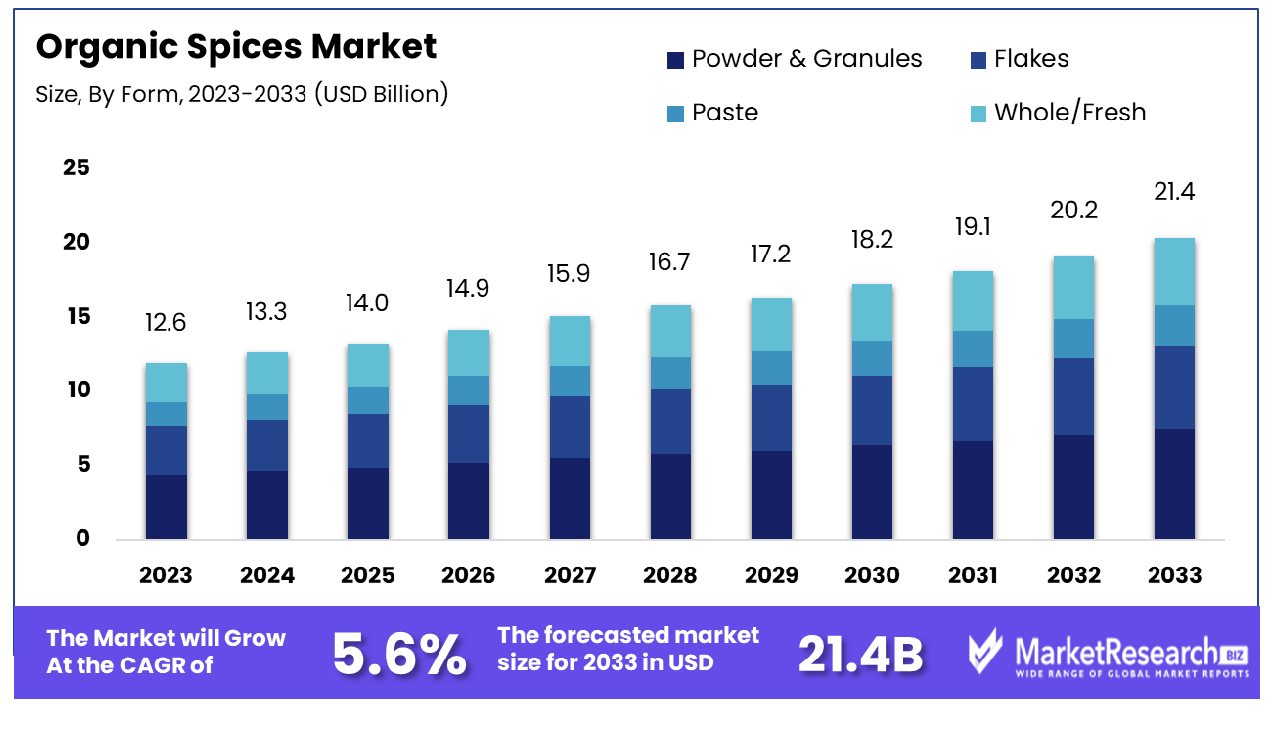

The organic spices market was valued at USD 12.6 billion in 2023, It is expected to reach USD 21.4 billion by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033. The surge in demand for organic food substances, implementation on using eco-friendly packaging, and rise in awareness regarding health consciousness are some of the main key driving factors for the organic spices market.

Organic spices are healthy cooking ingredients that are extracted from plants and yielded without the use of any artificial pesticides, genetically modified organisms, or herbicides. By accepting sustainable and environmentally friendly practices, organic species manufacturing focuses more on soil health, natural pest control techniques, and biodiversity. These species are cultivated in order with organic farming values, promoting ecological balance and decreasing the impact on ecosystems.

Organic certifications make sure to follow strict guidelines and standards, ensuring consumers that the species are free from harmful chemicals and genetically engineered elements. Besides, health considerations, opting for organic species can aid ethical farming techniques and fair labor practices. The farming of organic spices contributes to a more sustainable and eco-friendly agricultural system, bringing into line with the increase in global demand for reliably sourced and wholesome food products.

Organic spices play an important role in encouraging health and environmental sustainability. By eluding synthetic pesticides and herbicides, organic spice farming decreases the chances of chemical residues in the final products, by contributing to better healthier, and more nutritious alternatives for consumers. These spices consist of higher levels of necessary nutrients and antioxidants by improving their capable health advantages.

In May 2023, Organic Spices Inc. a Fermont, California-based spice firm declared its entrance into the contract manufacturing and private label industry sector. Moreover, the report published by Martin Bauer in November 2023, highlights that Martin Bauer has successfully announced the procurement of Husarich Gmbh, a well-known producer of spices and herbs provided to different segments of the food industry.

There is a great importance of organic packaging that complements the health aspects. Organic packaging materials are generally eco-friendly, sustainable, and biodegradable, diminishing the environmental impact compared to conventional packaging. This type of tactic brings into line with the wider goal of decreasing the use of plastic and pollution. The demand for organic spices will increase due to their health benefits and different types of environmentally friendly practices that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The organic spices market was valued at USD 12.6 billion in 2023, It is expected to reach USD 21.4 billion by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

- By Product Type: The turmeric segment holds dominance within product types, reflecting consumer preference for its health benefits.

- By Form: Powder & Granules segment prevails as the preferred form for turmeric consumption due to convenience.

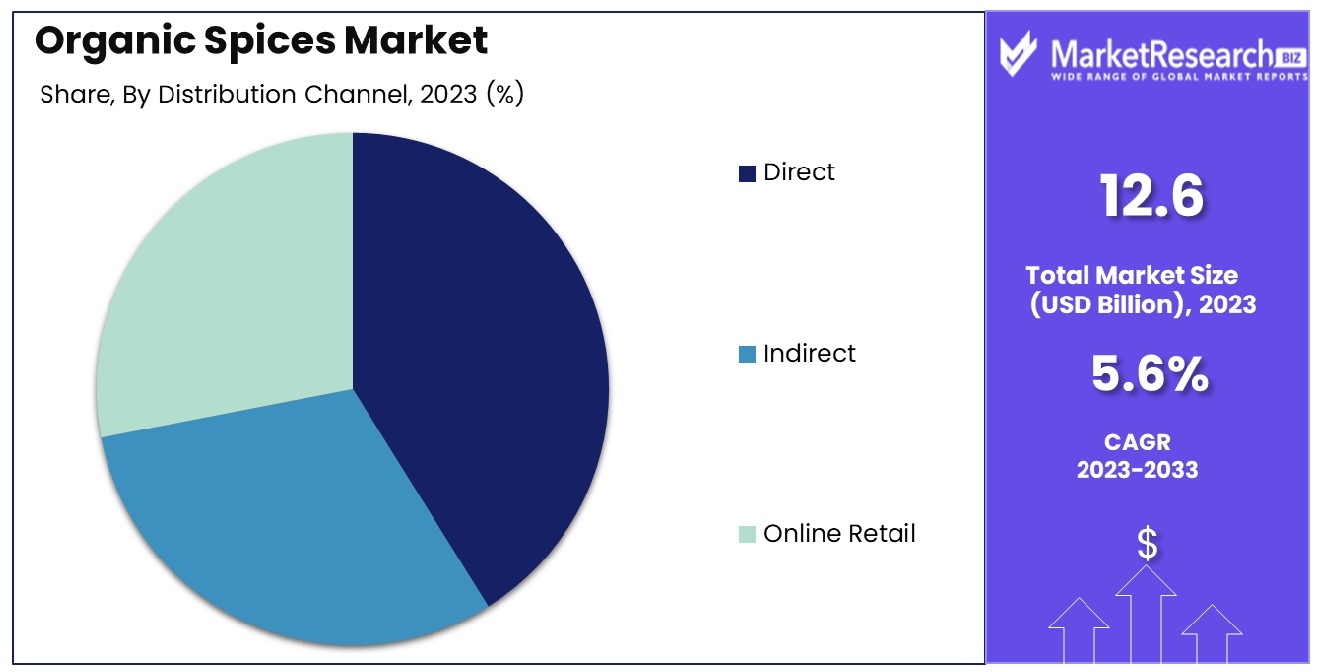

- By Distribution Channel: Direct distribution channel emerges as the dominant choice for turmeric products, streamlining accessibility for consumers.

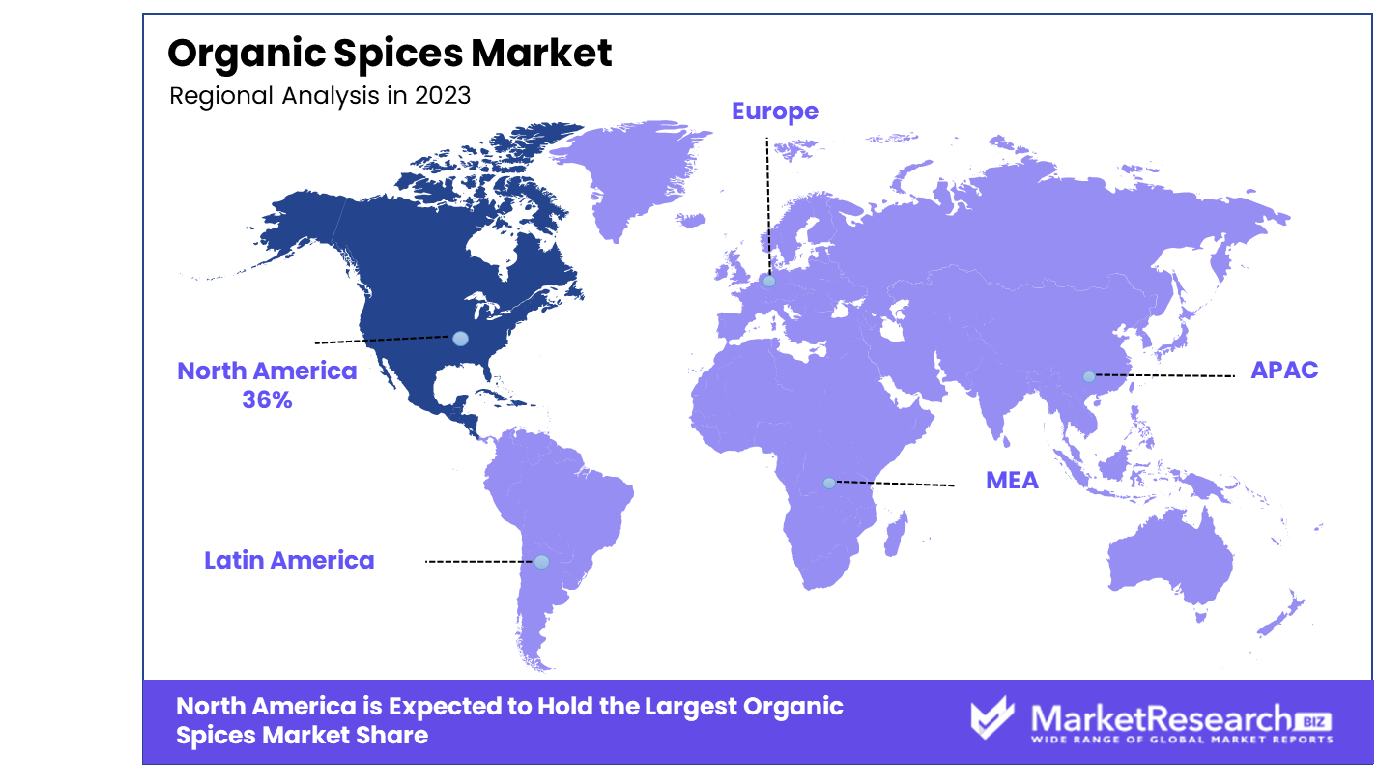

- Regional Dominance: North America Dominates with 36% Market Share in Organic Spices Market

- Growth Opportunity: Rising global demand for organic spices offers lucrative export potential, notably in India, with innovative packaging enhancing appeal and marketability.

Driving factors

Organic Food Industry Fuels Spices Market

The organic food sector's robust growth trajectory significantly benefits the organic spices market. In the United States alone, the Organic Trade Association reports a surge in organic food sales, surpassing $60 billion in 2022. Organic spices have seen increasing consumer interest and are being chosen more and more often as part of cooking requirements. The trend reflects a broader shift towards organic consumption, underscoring the spices market's alignment with evolving dietary preferences and sustainability concerns.

Food Safety Concerns Elevate Organic Spice Demand

Food safety issues, including contamination in conventional spices, are driving consumers towards organic alternatives. The FDA notes that food fraud impacts 1% of the global food industry, costing approximately $10-$15 billion annually. This concern fosters a perception of organic spices as safer, bolstering their market appeal and adoption among health-conscious consumers wary of such risks.

Health Consciousness Spurs Organic Spice Growth

Growing health awareness is steering consumers away from non-organic spices, which may contain pesticide residues, towards organic variants seen as healthier options. This shift is fueled by an increasing understanding of the potential health implications associated with conventional spice consumption. Organic spices, devoid of synthetic pesticides, resonate with health-focused consumers, thus driving market expansion.

Rising Incomes Enable Premium Organic Spice Purchases

Globally rising household incomes empower consumers to invest in premium and higher-quality organic spices. This ability to allocate more financial resources towards superior spice options reflects not only an enhanced purchasing power but also a value-driven choice prioritizing quality and health benefits.

Restraining Factors

Premium Pricing of Organic Spices Limits Market Penetration

The organic spices market is grappling with the challenge of premium pricing, which acts as a significant barrier, particularly in developing nations. The cost differential between organic and conventional spices is substantial, with organic variants often exceeding 30% of the price of their non-organic counterparts. For instance, in India, a major spice-consuming country, organic turmeric powder is significantly more expensive than the regular variety. This price discrepancy makes organic spices less accessible to a broader consumer base, particularly in price-sensitive markets, thus inhibiting the market's expansion and reach.

Lack of Consumer Awareness Stifles Organic Spices Market Growth

An impediment to expanding the organic spice market is a lack of consumer knowledge about organic certification and the benefits associated with organic spices. In many regions, particularly in countries like China, there is a notable lack of understanding and knowledge about what distinguishes organic spices from conventional ones. This lack of awareness hinders the adoption and demand for organic spices, as consumers are not fully informed to appreciate or seek out the value these products offer. Consequently, this gap in consumer education and awareness serves as a significant constraint on market growth potential.

By Product Type Analysis

Turmeric Segment Dominates The Market By Product Type.

Turmeric has become the dominant product in the organic spice market. This prominence is largely due to its widespread use in culinary applications across various cultures and its increasing popularity in the health and wellness sector. Turmeric, known for its anti-inflammatory and antioxidant properties, has seen a surge in demand, particularly in the dietary supplement market and as a key ingredient in functional foods and beverages. Its versatility extends to cosmetic applications, further bolstering its market position.

Other spices like Ginger, Basil, Cumin, Cinnamon, Clove, Pepper, and Garlic also hold significant market shares. Each of these spices is cherished for its unique flavor profile and health benefits. For instance, Ginger is renowned for its digestive and medicinal properties, while Cinnamon is valued for its sweet, woody flavor and health benefits. However, the multifaceted applications of Turmeric, from culinary to medicinal, solidify its status as the market leader.

By Form Analysis

Powder & Granules Segment Holds Dominance In Form.

It is the Powder & Granules form that dominates the market for organic spices. The popularity of this form is due to its simplicity in usage, longer shelf lives as well as its ease of incorporation into various food products. Granulated and powdered spices provide consistency in flavor and are vital in kitchen cooking as well as industrial food production.

Their fine texture and concentrated flavor make them a preferred choice for seasoning and flavoring. Other forms like Flakes, Paste, and Whole/Fresh spices also contribute to the market diversity. Flakes are often used for garnishing and to add texture, pastes for marinades and base flavors, and whole/fresh spices for intense, aromatic flavors. Despite this, the versatility and user-friendliness of Powder & Granules affirm their dominance in the market.

By Distribution Channel Analysis

Direct Segment Is Dominant In the Distribution Channel.

Direct Distribution is the predominant channel in the organic spices market. This channel typically involves direct sales from producers or manufacturers to consumers, retailers, or food service providers. The direct distribution model ensures quality control, traceability, and often a more competitive pricing structure. It also allows for stronger relationships between producers and end-users, fostering loyalty and brand recognition.

Indirect and Online Retail channels are also significant but trail behind direct distribution in market share. Indirect distribution involves intermediaries, which can sometimes lead to increased costs and reduced control over product quality. Online Retail is rapidly growing due to the convenience of e-commerce, yet it faces challenges in ensuring the authenticity and quality of organic spices compared to direct sales.

Key Market Segments

By Product Type

- Turmeric

- Ginger

- Basil

- Cumin

- Cinnamon

- Clove

- Pepper

- Garlic

By Form

- Powder & Granules

- Flakes

- Paste

- Whole/Fresh

By Distribution Channel

- Direct

- Indirect

- Online Retail

Growth Opportunity

Export Potential: Gateway to Global Growth in Organic Spices

The rising global demand for organic spices presents a lucrative export opportunity, especially for countries like India, which are pivotal in organic spice production. In 2021, India's export value of organic spices reached about two billion Indian rupees, emphasizing its growing international prominence. Key markets in the U.S., Europe, and other developed regions are increasingly importing organic spices due to their purity, quality, and sustainability. For example, the surge in organic ginger exports from India to European markets showcases the expanding global footprint and the potential for further strong growth in this sector, driven by heightened consumer awareness and preference for organic products.

Innovative Packaging: Enhancing Appeal in the Organic Spices Market

Packaging innovation is playing a crucial role in transforming the organic spices market. Effective packaging solutions like vacuum packing not only preserve the freshness and quality of spices during transportation but also cater to consumer preferences for convenience and sustainability. Such innovations in packaging underscore the origin of the spices, boost shelf-life, and offer a visual appeal that resonates with modern consumers. This focus on packaging is pivotal in attracting new customer segments and enhances the marketability of organic spices, aligning with the trend towards more environmentally friendly and practical consumer products.

Latest Trends

Rising Demand for Ethically Sourced Spices

Consumers are increasingly prioritizing ethically sourced and sustainably produced organic spices. This trend stems from growing awareness regarding fair trade practices, environmental sustainability, and social responsibility. Companies are responding by sourcing spices from certified organic farms and implementing transparent supply chains, thereby meeting consumer demands for ethically sourced products.

Expansion of Online Retail Channels

With the proliferation of e-commerce platforms, the organic spices market is witnessing a significant shift towards online retail channels. Convenience, wider product selection, and ease of comparison shopping are driving consumers to purchase organic spices online. Additionally, the COVID-19 pandemic has accelerated this trend as consumers seek contactless shopping experiences. Consequently, companies are investing in robust online platforms, digital marketing strategies, and logistics infrastructure to capitalize on the growing demand for organic spices through online channels.

Regional Analysis

North America Dominates with 36% Market Share in the Organic Spices Industry

North America's commanding 36% share of the organic spices market can be attributed to a heightened consumer awareness regarding health and wellness, as well as an increasing preference for organic products. The U.S. leads this trend with its robust demand for organic herbs and spices, fueled by the growing popularity of ethnic cuisines and the rise in health-conscious consumers. Additionally, stringent food quality regulations and a surge in organic farming practices contribute significantly to the region's market strength.

North American organic spices markets are propelled by changing consumer tastes and stringent regulatory standards. The region has witnessed a substantial increase in organic farming, bolstered by government support and initiatives promoting sustainable agriculture. However, challenges such as price volatility, supply chain disruptions, and competition from conventional spice markets impact market dynamics. The trend towards local and ethical sourcing is also shaping industry practices.

Europe’s Influence on the Organic Spices Market

Europe boasts a substantial share of the organic spice market, characterized by ethical and sustainable sourcing practices. People's desire for organic products coupled with major importers like Germany and the UK boosting demand are driving this growth in market share.

Asia Pacific’s Role in the Organic Spices Market

Asia Pacific, traditionally the hub for spice production, plays a vital role in the organic spice market. Both its geographical diversity and recent shift towards organic farming practices play a vital part in meeting the worldwide demand for natural spices.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

Within the organic spice market, major companies play an essential part in setting trends both within the industry and consumer tastes. Organic Spices Inc. is a notable player, specializing in certified organic products, highlighting their commitment to sustainable and health-conscious offerings. UK Blending LTD and The Watkins Co. have established themselves with diverse product ranges, catering to both conventional and niche markets with their array of organic spices.

Daarnhouwer & Co and SunOpta Inc. have differentiated themselves through a focus on quality and traceability, appealing to consumers increasingly concerned with the origins and production processes of their food. Spice Chain Corporation and Husarich GmbH, on the other hand, have carved out a niche by offering unique blends and specialized products, tapping into the growing demand for culinary diversity.

Sabater Spices and AKO GmbH are recognized for their wide distribution networks and extensive product lines, making them significant players in the European market. Pacific Spice Company, Inc. and MOGUNTIA FOOD GROUP AG stand out for their large-scale operations and capacity to supply a broad spectrum of customers, from retail to industrial.

Market Key Players

- Organic Spices Inc.

- UK Blending LTD

- The Watkins Co.

- Daarnhouwer & Co

- SunOpta Inc.

- Spice Chain Corporation

- Husarich GmbH

- Sabater Spices

- AKO GmbH

- Pacific Spice Company, Inc.

- MOGUNTIA FOOD GROUP AG

- Associated British Food plc

- Olam International

- McCormick & Company

- Ajinomoto Co., Inc

Recent Development

- In December 2023, ORCO or Organic Condiments announced the release of 32 new items, in addition to their extensive range of 100 100% natural organic, healthful organic, and certified organic condiments as well as spices.

- In May 2023, Organic Spices Inc. announced that it has expanded into contract manufacturing and private label co-packing to bring value to customers.

- In January 2023, The Kraft Heinz Company, an American-based food and drink company, acquired Just Species Gmbh for an unknown amount. Through this acquisition, Kraft Heinz's strategy for global expansion focused on tasting elevation. The company plans to make use of its size and versatility to increase Just Spices' market share in the rapidly growing industry of taste elevation beyond the current range.

Report Scope

Report Features Description Market Value (2023) USD 12.6 Billion Forecast Revenue (2033) USD 21.4 Billion CAGR (2024-2032) 5.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Turmeric, Ginger, Basil, Cumin, Cinnamon, Clove, Pepper, Garlic), By Form(Powder & Granules, Flakes, Paste, Whole/Fresh), By Distribution Channel(Direct, Indirect, Online Retail) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Organic Spices Inc., UK Blending LTD, The Watkins Co., Daarnhouwer & Co, SunOpta Inc., Spice Chain Corporation, Husarich GmbH, Sabater Spices, AKO GmbH, Pacific Spice Company, Inc., MOGUNTIA FOOD GROUP AG, Associated British Food plc, Olam International, McCormick & Company, Ajinomoto Co., Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Organic Spices Inc.

- UK Blending LTD

- The Watkins Co.

- Daarnhouwer & Co

- SunOpta Inc.

- Spice Chain Corporation

- Husarich GmbH

- Sabater Spices

- AKO GmbH

- Pacific Spice Company, Inc.

- MOGUNTIA FOOD GROUP AG

- Associated British Food plc

- Olam International

- McCormick & Company

- Ajinomoto Co., Inc