Cement Market By Product Type(Portland Cement, Blended Cement, White Cement), By Application(Residential, Commercial, Infrastructure, Industrial and Institutional), By Distribution Channel(B2B/Industrial Segment, Retail/DIY), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43295

-

Feb 2024

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

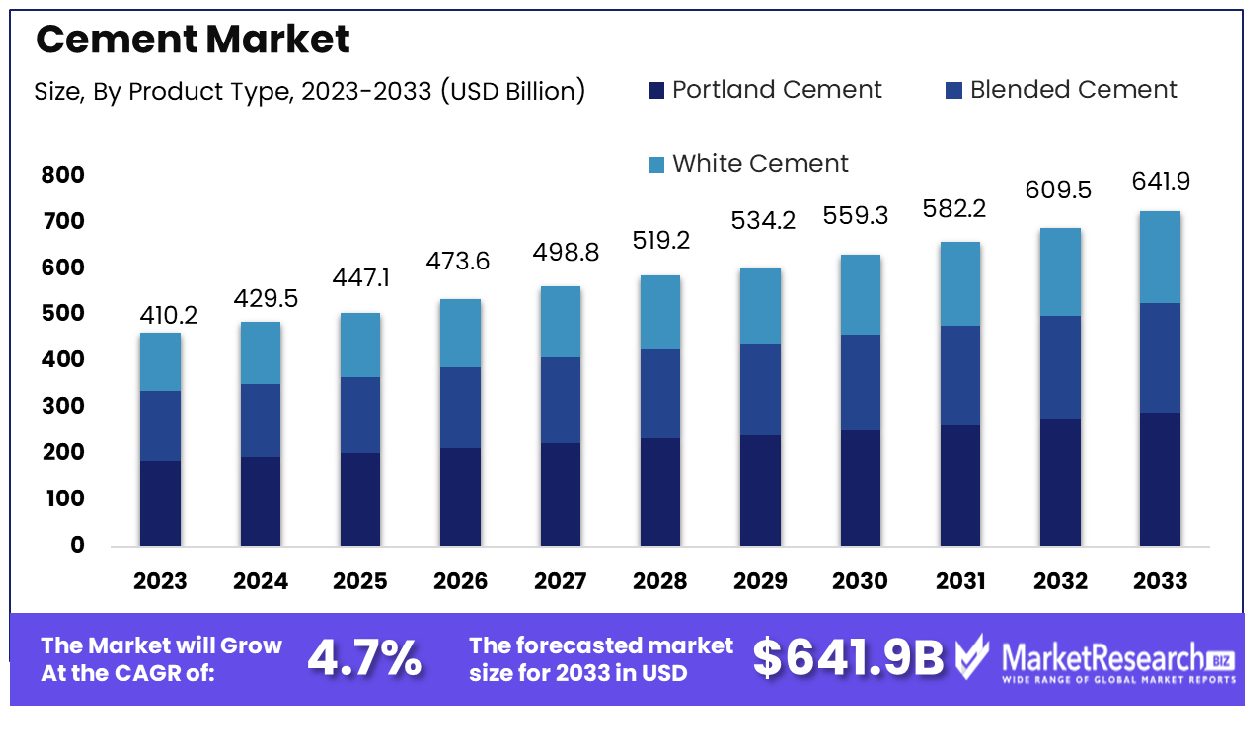

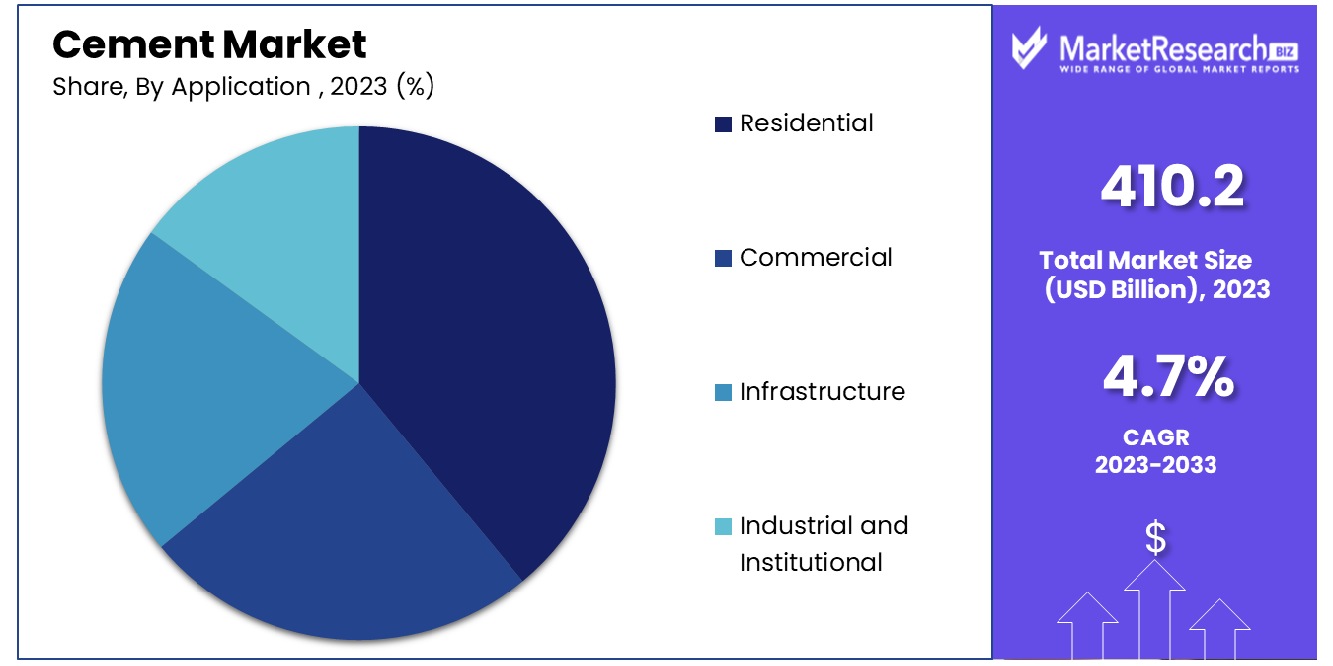

The Cement Market was valued at USD 410.2 billion in 2023. It is expected to reach USD 641.9 billion by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

The cement market encompasses the dynamic industry of manufacturing, distributing, and utilizing cementitious materials essential for construction and infrastructure development worldwide. Characterized by its indispensability in residential, commercial, and industrial projects, the market thrives on the demand for durable, sustainable building solutions.

Key factors driving its growth include urbanization, infrastructure investment, and technological advancements enhancing product quality and efficiency. As global populations surge and economies expand, the cement market assumes a pivotal role in enabling sustainable urbanization and fostering economic progress. Understanding market trends, regulatory landscapes, and innovation imperatives is paramount for stakeholders to capitalize on emerging opportunities and navigate challenges effectively.

The cement market stands at a critical juncture, grappling with the dual challenge of meeting escalating global demand while addressing sustainability imperatives. With cement manufacturing contributing approximately 7% of global carbon dioxide emissions, the industry faces mounting pressure to curb its environmental footprint. Despite advancements in production efficiency and emission reduction technologies, achieving carbon neutrality remains a formidable task.

Supporting data from the US Geological Survey underscores the magnitude of the challenge, revealing that cement production in the US alone amounted to an estimated 92 million metric tons in 2021. Leading states such as Texas, Missouri, California, and Florida play pivotal roles in shaping the industry's trajectory. However, the stark reality of carbon emissions underscores the urgent need for transformative action across the value chain.

Looking ahead, the global demand for cement is projected to surge from 4.2 billion metric tons today to 6.2 billion metric tons by 2050. This exponential growth presents both opportunities and challenges for industry stakeholders. Embracing sustainable innovations, such as green cement formulations and carbon capture technologies, will be paramount in navigating the transition towards a low-carbon future.

Key Takeaways

- Market Growth: The Cement Market was valued at USD 410.2 billion in 2023, It is expected to reach USD 641.9 billion by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

- By Product Type: In the cement market, Portland Cement prevails as the dominant segment by product type.

- By Application: Residential construction emerges as the leading application segment within the cement market.

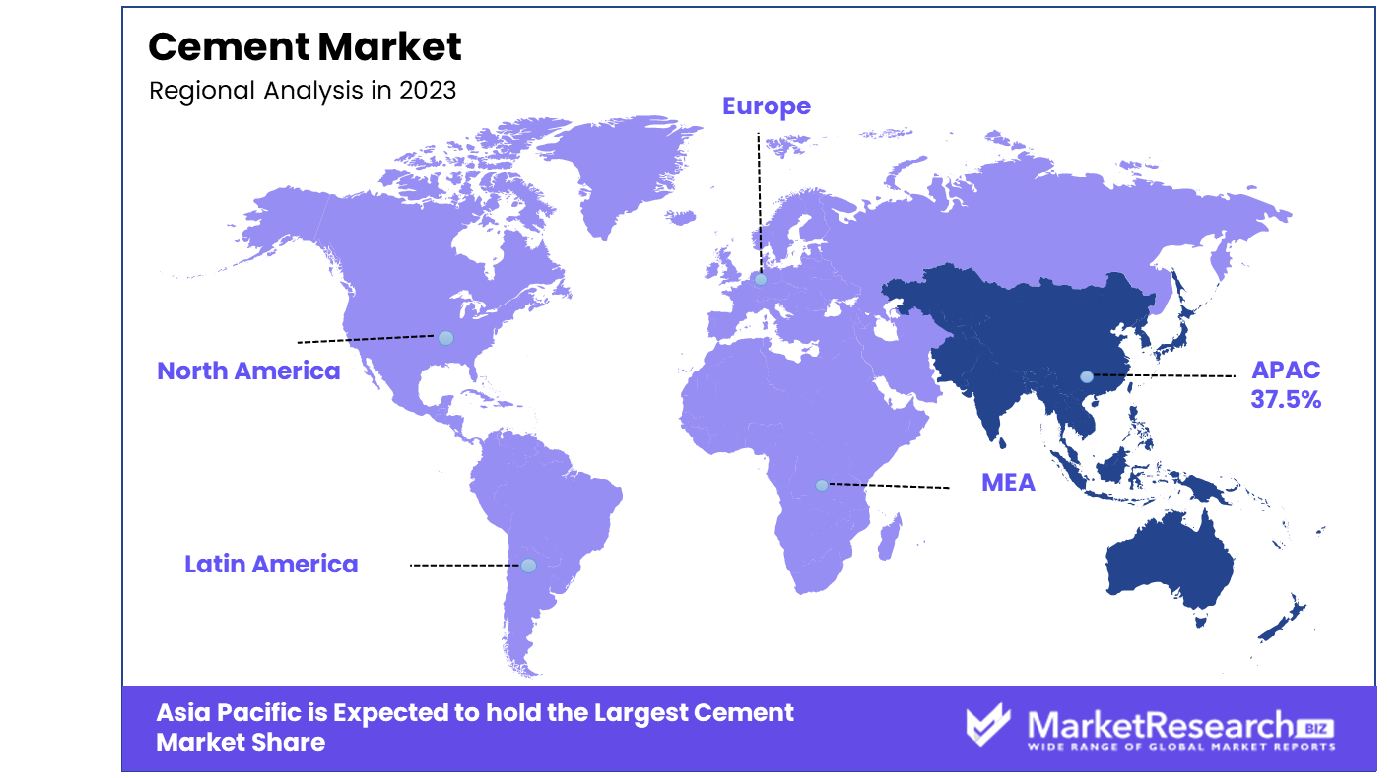

By Distribution Channel: B2B/Industrial distribution channels represent the dominant segment in the cement market's distribution landscape. - Regional Dominance: Asia Pacific Dominates with a 37.5% Market Share in the Cement Industry.

- Growth Opportunity: Green cement's rise aligns with sustainability demands; vertical integration enhances market control, offering growth avenues in a competitive landscape.

Driving factors

Urbanization Catalysts Cement Market Expansion

The meteoric rise in urbanization, with over half of the global populace residing in cities and a projection to reach 68% by 2050, signals robust growth for the cement market. The United Nations anticipates a significant urban population surge in countries like India, China, and Nigeria, thereby intensifying the need for urban infrastructure and housing.

This demographic shift is pivotal for the cement industry, as urbanization necessitates extensive construction activities, from residential buildings to public infrastructure, all requiring substantial cement usage. The burgeoning urban population in developing nations particularly underscores a sustained demand for cement, aligning with the sector's growth trajectory.

Residential Construction Fortifies Cement Demand

The surge in housing requirements, driven by worldwide population expansion, serves as a foundational element for the stability of the cement market. Notable is the burgeoning need for affordable housing in diverse markets, both developed and emerging. This trend solidifies a constant demand for cement. Illustrative of this trend, the United States reported significant housing activities in November 2023, including numerous building permits and housing starts.

Furthermore, the ASEAN region's construction sector, encompassing ten countries, displays a potential worth $250 billion, with growth rates outpacing global averages. The substantial growth observed in the residential construction sector serves as a pivotal catalyst for the cement market, underscoring its critical function within the worldwide housing industry.

Government Investment Fuels Cement Market Growth

Government expenditure on public infrastructure, encompassing educational facilities, healthcare, and transportation systems, is a substantial propellant for the cement market. In the U.S., the Bipartisan Infrastructure Law earmarks $1.2 trillion for comprehensive infrastructure projects, significantly impacting cement demand.

Furthermore, direct federal spending on infrastructure was substantial in 2022, complemented by a five-year plan involving $550 billion in transfers. This government investment in infrastructure underscores the integral role of cement in national development projects, enhancing its market demand and signaling sustained growth in the sector.

Restraining Factors

Stringent Environmental Regulations Constrict Cement Market Expansion

The cement industry, renowned for its high carbon emissions, faces significant challenges due to stringent environmental regulations. Annually, the sector contributes over 2.5 billion tons of CO2, drawing regulatory scrutiny, particularly in developed nations. These tightened emission standards are not only curbing production but also escalating production costs.

A pertinent example is the European Union's ambitious goal to slash cement industry emissions by more than 60% by 2050. Such regulatory pressures are compelling cement manufacturers to invest in greener technologies and practices, subsequently influencing market dynamics by increasing operational costs and potentially hindering growth in regions with strict environmental policies.

Market Saturation in Developed Regions Slows Cement Industry Growth

In mature markets like the United States, Europe, and Japan, the growth of the cement market is being hampered by market saturation and overcapacity. These regions, characterized by well-established infrastructure and a decelerated pace of construction growth, confront challenges of excess capacity.

This phenomenon is exemplified by China's ongoing struggle with overcapacity in its cement sector. For years, Chinese cement manufacturers have grappled with surplus production capabilities, which has led to intense competition, price wars, and diminished profitability. This saturation in key markets poses a significant barrier to the expansion of the global cement industry.

By Product Type Analysis

Portland Cement leads in product type diversity.

Portland Cement stands as the preeminent product type in the cement market. Characterized by its versatility and strength, Portland cement's dominance can be attributed to its widespread application in various construction activities, including residential, commercial, and infrastructure projects. Its fundamental role in the construction industry is driven by its suitability for a wide range of climatic conditions and its compatibility with various additives and aggregates, making it a universal choice for construction.

Blended Cement and White Cement are also significant segments. Blended cement, known for its sustainability and lower carbon footprint, is gaining traction due to increasing environmental concerns. White Cement, used for aesthetic purposes in architectural designs, has a niche but vital market. However, the sheer volume of construction activities relying on Portland Cement for structural integrity and durability underpins its dominant market position.

By Application Analysis

Residential applications drive market demand significantly.

In terms of application, the Residential sector is the dominant segment in the cement market. The continuous need for housing due to population growth and urbanization drives this segment's dominance. Residential construction relies heavily on cement for various purposes, from foundations to walls and finishing. The demand in this sector is also fueled by the renovation and remodeling activities in existing residential structures.

The Commercial, Infrastructure, Industrial, and Institutional segments also contribute significantly to cement demand. In commercial construction, cement is essential for building office spaces, shopping centers, and other commercial structures. Infrastructure projects like bridges, roads, and dams heavily depend on cement. However, the constant need for residential housing, coupled with the rise in urban development projects, firmly positions the Residential sector as the leading application segment for cement.

By Distribution Channel Analysis

B2B/Industrial segment dominates distribution channels for cement.

The distribution channel for cement is segmented into B2B/Industrial Segment and Retail/DIY. B2B/Industrial sales involve direct distribution to large construction companies and contractors, a critical channel for major infrastructure and commercial projects. This channel ensures a steady supply of cement in large quantities, catering to the bulk needs of industrial consumers.

The Retail/DIY segment, while smaller compared to B2B, is vital for smaller-scale construction projects and individual consumers. This segment caters to the needs of small builders, local contractors, and individual homeowners. The retail channel is crucial for the distribution of cement for home renovations, small residential projects, and DIY applications. However, the scale of demand from large-scale construction projects and the direct relationships with major construction firms underscores the significance of the B2B/Industrial Segment in cement distribution.

Key Market Segments

By Product Type

- Portland Cement

- Blended Cement

- White Cement

By Application

- Residential

- Commercial

- Infrastructure

- Industrial and Institutional

By Distribution Channel

- B2B/Industrial Segment

- Retail/DIY

Growth Opportunity

Green Cement Offers Sustainable Growth Opportunity

The shift towards green cement presents a significant growth opportunity within the cement market, particularly due to the increasing emphasis on environmental sustainability. Cement production is known for its substantial carbon footprint, spurring innovation in eco-friendly cement technologies. For instance, advancements in cement requiring less limestone and lower-temperature production processes are gaining traction.

The Global Cement and Concrete Association's Green Cement Technology Tracker highlights this trend by monitoring global investments in low-carbon cement technologies, especially in carbon capture and storage (CCS) projects. These developments offer cement companies an opportunity to capture market share from eco-conscious developers, aligning with global decarbonization efforts and evolving regulatory landscapes.

Vertical Integration Enhances Market Control and Expansion

Cement companies' move towards vertical integration, by acquiring assets such as ready-mix concrete manufacturers, aggregates suppliers, and logistics networks, represents a strategic avenue for market expansion. This approach enables firms to exert greater control over their supply chains, leading to enhanced operational efficiencies, reduced costs, and more robust resilience against market fluctuations.

Moreover, vertical integration offers diversified sales channels and enhanced pricing power. This strategic move not only streamlines operations but also allows companies to better respond to market demands and customer needs, ultimately fostering a more competitive position in the market and potential growth opportunities in both existing and new markets.

Latest Trends

Sustainable Solutions Surge Green Cement Revolutionizes Construction Practices

The cement market witnesses a shift towards eco-friendly alternatives like green cement, leveraging innovative technologies to reduce carbon emissions and environmental impact while maintaining structural integrity. Sustainable construction practices gain momentum, aligning with global sustainability agendas and consumer preferences.

Digital Transformation Reshapes Cement Industry Smart Technologies Enhance Efficiency and Quality

Embracing digitalization, the cement market adopts smart technologies such as IoT sensors, AI-driven analytics, and automation to optimize production processes, improve product consistency, and enhance operational efficiency. Real-time monitoring and predictive maintenance strategies revolutionize the industry, driving competitiveness and sustainability.

Regional Analysis

Asia Pacific Dominates with 37.5% Market Share in Cement Industry

The commanding 37.5% market share of the Asia Pacific region in the cement market is primarily fueled by rapid urbanization, extensive infrastructure development, and growing housing needs. Countries like China and India, with their massive construction projects and urban expansion, are pivotal in this dominance. The region’s increasing population and economic growth have led to a surge in demand for residential and commercial buildings, directly influencing cement production and consumption.

Asia Pacific's market dynamics are shaped by its vast construction activities, government initiatives for infrastructural development, and availability of raw materials. The region's focus on developing smart cities and substantial investments in public infrastructure contribute significantly to the cement market. Additionally, the presence of major cement manufacturers in the region, coupled with technological advancements in manufacturing processes, plays a crucial role in market dynamics.

North America's Strategic Influence in Cement Market

North America's cement market is marked by technological innovation and sustainable practices. The region's focus on eco-friendly building materials and energy-efficient production processes defines its market position. Additionally, the revival of construction activities and infrastructure projects post-economic downturns contribute to the market's growth.

Europe's Progressive Role in Cement Industry

Europe's cement market is driven by its emphasis on sustainable and green construction materials. The region’s stringent environmental regulations have led to the adoption of alternative fuels and energy-efficient production methods. Moreover, Europe's well-established infrastructure and the renovation of aging structures provide a continuous demand for cement.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global cement market, a landscape defined by both regional dominion and international expansion, the listed companies represent a dynamic array of market leadership and strategic innovation. LafargeHolcim stands as a colossus with its significant global presence, pioneering in sustainable and high-performance building materials, setting the tone for industry standards.

Anhui Conch and China National Building Materials (CNBM), significant Asian players, have expanded aggressively, leveraging large-scale production and cost efficiencies. Their growth reflects the burgeoning demand in emerging markets, particularly in Asia.

Market Key Players

- LafargeHolcim

- Anhui Conch

- Cemex

- UltraTech Cement

- ACC Limited

- Ambuja Cements Limited

- China National Building Materials (CNBM)

- HeidelbergCement

- Sinoma

- Buzzi Unicem

- Votorantim Cimentos

- Dalmia Bharat Group

- China Shanshui Cement

- Huaxin Cement

- Jidong

Recent Development

- In December 2023, ThyssenKrupp Polysius and SCHWENK Zement jointly developed meca-clay, a groundbreaking technology enabling the activation of clay without thermal energy or fossil fuels. This innovation revolutionizes cement production with zero CO2 emissions.

- In November 2023, Heidelberg Materials, under its evoZero brand, introduced the world's first carbon-captured net-zero cement in Europe. Achieved through carbon capture and storage (CCS) technology, it offers transparent, traceable carbon proof for customers and contributes to carbon reduction targets.

- In 2023, BSI, in collaboration with the UK concrete industry, introduced new standards allowing the use of finely ground limestone from UK quarries in concrete mixes. This innovation aims to reduce carbon emissions by up to 5% per tonne of concrete, contributing to decarbonization efforts in construction.

Report Scope

Report Features Description Market Value (2023) USD 410.2 Billion Forecast Revenue (2033) USD 641.9 Billion CAGR (2024-2032) 4.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Portland Cement, Blended Cement, White Cement), By Application (Residential, Commercial, Infrastructure, Industrial and Institutional), By Distribution Channel(B2B/Industrial Segment, Retail/DIY) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape LafargeHolcim, Anhui Conch, Cemex, UltraTech Cement, ACC Limited, Ambuja Cements Limited, China National Building Materials (CNBM), HeidelbergCement, Sinoma, Buzzi Unicem, Votorantim Cimentos, Dalmia Bharat Group, China Shanshui Cement, Huaxin Cement, Jidong Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- LafargeHolcim

- Anhui Conch

- Cemex

- UltraTech Cement

- ACC Limited

- Ambuja Cements Limited

- China National Building Materials (CNBM)

- HeidelbergCement

- Sinoma

- Buzzi Unicem

- Votorantim Cimentos

- Dalmia Bharat Group

- China Shanshui Cement

- Huaxin Cement

- Jidong