Generative AI in Investing Market By Deployment Mode (Cloud-Based and On-Premises), By Application (Portfolio Generation, Risk Assessment and Management, Market Analysis and Prediction, and Others), By End-Users (Institutional Investors, Retail Investors), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

-

39209

-

July 2023

-

162

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

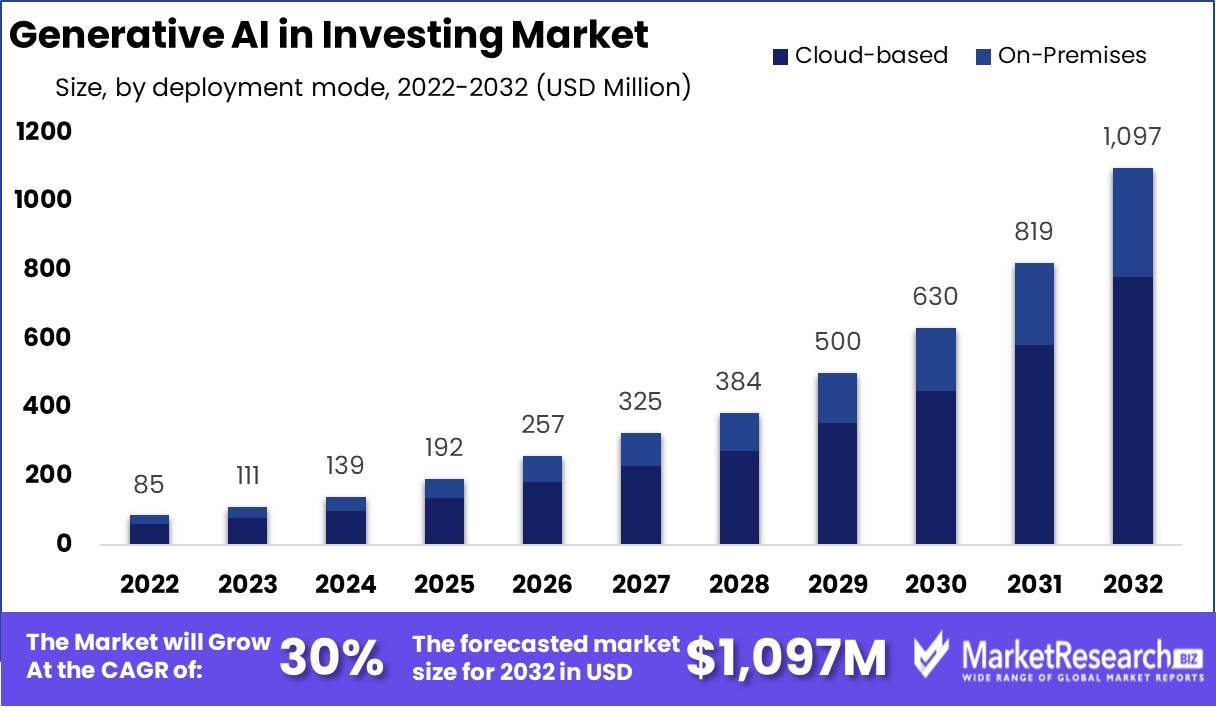

Generative AI in Investing Market size is expected to be worth around USD 1,097 Mn by 2032 from USD 85 Mn in 2022, growing at a CAGR of 30% during the forecast period from 2023 to 2032.

The desire for data-driven investment decision-making and the development of artificial intelligence is driving the rapid growth of global generative AI in the investing industry. Deep learning models and natural language processing are two examples of generative AI technologies used to analyze enormous volumes of historical and real-time market data, produce insights, and optimize investment portfolios.

These systems include advantages like increased trading techniques, improved risk assessment, individualized advice, and effective market analysis. Major players in the sector are developing cloud-based platforms, algorithmic trading tools, and portfolio management systems with generative AI capabilities. The generative AI in investing industry is anticipated to undergo tremendous growth and innovation in the next years because of its potential to revolutionize investment practices.

Driving factors

Several important elements are what fuel the global Generative AI in Investing Market. Firstly, generative AI approaches can be used to analyze and derive meaningful insights from the massive volumes of financial data that are becoming increasingly available thanks to improvements in computing capacity. Second, the adoption of generative AI solutions is driven by the need for improved investment decision-making, risk assessment, and portfolio optimization since they have the potential to increase accuracy, efficiency, and profitability.

As generative AI enables the customization of recommendations based on unique investor preferences and risk profiles, the industry is further fueled by the growing need for personalized investment advice and bespoke portfolio management solutions. Lastly, by increasing the capabilities and application of generative AI in the investment domain, ongoing research and development initiatives and constant developments in generative AI models and algorithms support the market's expansion.

Restraining Factors

Accessing and analyzing enormous volumes of financial data, including sensitive data, is crucial to the application of generative AI in investing. Data collection, storage, and processing are complicated by laws governing data privacy, such as GDPR, as well as by growing worries about cybersecurity and data breaches. As a result, the development of generative AI in the investing industry may be constrained.

The use of Generative AI in Investing Market presents moral questions, such as those about justice, bias, responsibility, and transparency. Regulators are concentrating more on ensuring that AI models and algorithms used in investing and banking uphold ethical norms. For market participants, the requirement for precise rules and regulations might provide difficulties and legal obstacles. Generative AI is transforming the trading market, optimizing strategies, enhancing decision-making, and increasing efficiency.

Covid-19 Impact on Generative AI in Investing Market

The pandemic's volatility and unpredictability have emphasized the value of data-driven decision-making in financial plans. Investors are looking for more precise and timely information to navigate market volatility, and generative AI has grown in importance because of its capacity to analyze big datasets and produce insights.

The pandemic has sped up the digital transition in a variety of sectors, including finance and investing. To automate operations, optimize portfolios, and improve remote risk assessment, businesses are embracing technology like generative AI more and more. This has helped the market for investments adopt generative AI technologies.

The pandemic has increased market volatility and unpredictability to a substantial degree, making it difficult to forecast and model market behavior with any degree of accuracy. The unusual nature of the pandemic has reduced the efficacy of conventional models, which has influenced the performance and accuracy of generative AI solutions. Generative AI in Investing Market models significantly rely on historical data.

Investor confidence is hesitant as a result of the economic slowdown brought on by the pandemic. Investment activity has decreased due to financial stability and market recovery uncertainty. Since investors are concentrating on risk reduction and capital preservation, this conservative attitude may have hampered the uptake of generative AI solutions.

By Deployment Mode Analysis

The Cloud-based Segment Accounted for the Largest Revenue Share in Generative AI in Investing Market in 2022.

Based on deployment mode, the market is segmented into Cloud-Based and On-Premises. Among these types, the Cloud-Based segment dominates the Generative AI in Investing Market with a 71% market share. Generative AI in Investing sector is provided by cloud-based deployment mode. Its scalability, adaptability, and affordability enable businesses to use cloud computing resources for data-intensive generative AI jobs. Cloud deployment makes it simple for anyone, everywhere, to access platforms for generative AI, enabling remote collaboration and real-time decision-making.

It also offers automatic updates and strong security features, removing the need for a substantial upfront investment in physical infrastructure and upkeep. The capabilities of generative AI in investing applications are enhanced by integration with other cloud services. To guarantee a seamless and secure cloud implementation, organizations must consider data protection, governance, and internet connectivity.

The On-Premises Segment is Fastest Growing Segment in Generative AI in Investing Market.

The On-Premises segment is projected to be the fastest-growing deployment mode segment in Generative AI in Investing Market from 2022 to 2031. Generative AI in the investment sector can benefit from specific advantages provided by on-premises deployment options. For sensitive financial data, in particular, it gives organizations better control over their infrastructure, data, and security. On-premises deployment enables low-latency data processing for real-time market analysis and high-frequency trading.

It allows for customization and the ability to fit the infrastructure to particular requirements. On-premises deployment, in contrast to cloud-based solutions, may have scalability issues and requires a sizable upfront investment as well as technical skills for setup and maintenance. To decide if on-premises deployment is the best choice for their generative AI in investment activities, organizations must carefully consider their needs, the sensitivity of their data, and their regulatory compliance duties.

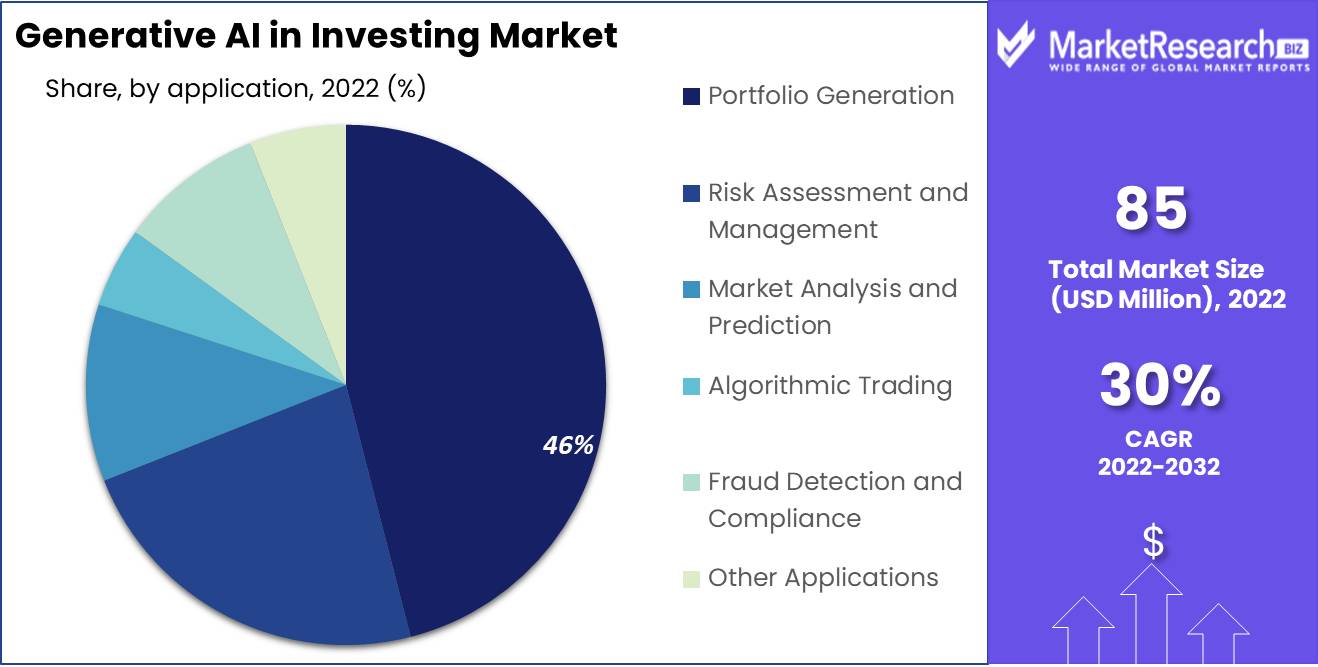

By Application Analysis

The Portfolio Generation Holds the Significant Share in the Application Segment of Generative AI in Investing Market.

Based on application, the market is divided into Portfolio Generation, Risk Assessment and Management, Market Analysis and Prediction, Algorithmic Trading, Fraud Detection and Compliance, and Other Applications. Among these, the Portfolio Generation segment is dominant in the application segment of Generative AI in Investing Market, with a market share of 46%.

One of the most important uses of generative AI in the investment space is portfolio generation. To create optimized portfolios that are suited to a particular set of investment goals and restrictions, generative AI models may analyze enormous volumes of historical market data, financial indicators, and risk profiles. Generative AI can locate diversification possibilities, risk-return trade-offs, and ideal asset allocations by using sophisticated algorithms and pattern recognition.

By automating and streamlining the portfolio design process, investors may ensure a more effective and data-driven approach to portfolio management. The decision-making process is improved by generative AI-driven portfolio generation, which enables investors to obtain superior risk-adjusted returns and modify portfolios in response to shifting market conditions.

Risk Assessment and Management is Identified as the Fastest Growing Application Segment in Projected Period.

Risk Assessment and Management is also an important format segment in Generative AI in Investing Market. It is expected to grow faster in the application segment of Generative AI in Investing Market. An essential use of generative AI in the investment sector is risk assessment and management. Generative AI models can examine historical market data, financial statements, macroeconomic indicators, and other pertinent data to evaluate and quantify investment risks.

Generic AI may produce artificial data to evaluate potential risks, including market volatility, credit risk, liquidity risk, and systemic risk, by simulating various market scenarios. As a result, investors are able to make better decisions and create efficient risk-reduction plans. Improved risk-adjusted returns and expanded risk management skills for investment firms and portfolio managers are all benefits of generative AI-driven risk assessment and management, which offers insightful information about the possible effects of various risk factors.

By End-User Analysis

The Institutional Investors Hold the Significant Share in End-User Segment of Generative AI in Investing Market.

Based on End-User, the market is divided into Institutional Investors, Retail Investors, Investment Banks and Financial Institutions, and Other End-Users. Institutional Investors dominate the market with 57% of the market share. Institutional investors such as asset management firms, hedge funds, pension funds, and insurance companies utilize generative AI in investing to optimize their investment portfolios, enhance risk assessment, and automate trading strategies.

These organizations often handle large volumes of data and require sophisticated tools to analyze and generate insights for making informed investment decisions.

Key Market Segments

Based on the Deployment Mode

- Cloud-Based

- On-Premises

Based on Application

- Portfolio Generation

- Risk Assessment and Management

- Market Analysis and Prediction

- Algorithmic Trading

- Fraud Detection and Compliance

- Other Applications

Based on End-Users

- Institutional Investors

- Retail Investors

- Investment Banks and Financial Institutions

- Other End-Users

Growth Opportunity

Advanced and complex investment strategies can be created thanks to generative AI. Investors can spot intricate patterns, correlations, and anomalies in financial data by using deep learning models and generative algorithms that may not be immediately obvious to human analysts. This may result in the development of cutting-edge investment plans that provide businesses with a competitive edge.

Thanks to generative AI, individual investors can receive personalized investing services more easily. Generative AI models can produce customized investment advice and unique portfolios by taking into account elements like risk tolerance, investment goals, and personal preferences. Generative AI models help improve compliance and risk management initiatives in the financial sector. Generative AI can assist in identifying and mitigating potential risks, enhancing regulatory compliance, and bolstering fraud detection systems by analyzing massive volumes of data and modeling various risk scenarios.

Increased market integrity and stronger risk management procedures may result from this. Generative AI can help investors keep up with market trends, news, and sentiment by processing and analyzing data in real-time. Making timely investment decisions, seizing opportunities, and modifying investment strategies in response to shifting market conditions can all be aided by real-time research. This may provide you with a competitive edge in active and quick-moving markets.

Latest Trends

The market for generative AI in investment is seeing a rise in deep reinforcement learning, which combines deep learning and reinforcement learning. Through trial and error, this method enables generative AI models to learn the best investment strategies, enhancing their decision-making and portfolio management capacity. In the generative AI in the investment market, there is a growing focus on creating explainable AI models.

Explainable AI techniques aim to make generative AI models transparent and interpretable, allowing investors and regulators to comprehend the underlying assumptions and justifications for generated insights and judgments. In the investment market, generative AI models are being used to enhance data. These models can assist in overcoming the problem of little or unbalanced datasets, improving the resilience and precision of investment models and forecasts.

In the market for generative AI in investing, the merging of several generative models, including GANs (Generative Adversarial Networks) and VAEs (Variational Autoencoders), is gaining ground. This fusion technique increases the performance and capabilities of generative AI systems by utilizing the advantages of various generative models, such as enhanced data creation or latent space representation. The use of generative AI in investing raises several ethical issues that are becoming more significant.

This entails addressing concerns about biases, justice, and the appropriate use of AI models. To ensure that generative AI systems are utilized ethically and comply with legal requirements and societal standards, stakeholders are concentrating on creating ethical frameworks and guidelines.

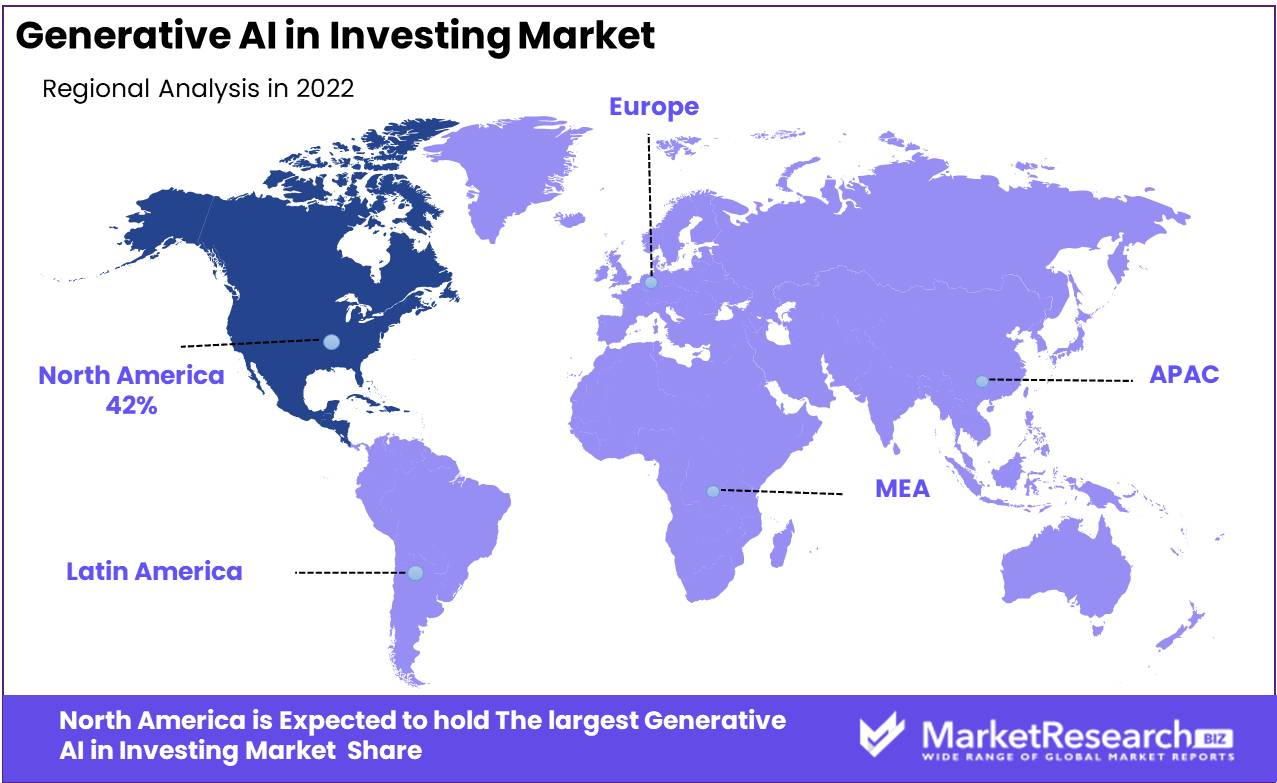

Regional Analysis

North America Accounted for the Largest Revenue Share in Generative AI in Investing Market in 2022.

North America is estimated to be the most lucrative market in the global Generative AI in Investing Market, with the largest market share of 42%. With the developed financial sector, advanced technical infrastructure, and emphasis on data-driven decision-making, North America is an important region for generative AI in investing market. Leading companies, academic institutions, and financial centers are located in the area, promoting innovation and generative AI solutions in the investment industry.

Silicon Valley and other cities like New York and Toronto are particularly rich in AI startups and technology firms in North America. Furthermore, the presence of top financial institutions and asset management companies offers a favorable environment for the use of generative AI in algorithmic trading, risk assessment, and portfolio optimization.

Asia Pacific is expected as Fastest Growing Region in Projected Period in Generative AI in Investing Market.

Asia Pacific is expected to be as fastest growing region in the forecast period in the Generative AI in Investing Market. A number of nations, including China, Japan, and South Korea, have become important players in this field thanks to their economies' rapid economic growth and technological developments. Deep learning algorithms are being used by generative AI to analyze vast volumes of data, find patterns, and produce investment insights, revolutionizing investment methods.

The region's strong financial ecosystem, along with its high degree of digitalization and expanding number of tech-savvy individuals, has created an atmosphere that is favorable for the widespread use of generative AI in the investment space.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Share & Key Players Analysis

These players included large technology companies like IBM, Google, and Microsoft and specialized firms such as Numeral and Sentient Technologies. These companies were developing innovative generative AI solutions that aimed to revolutionize investment strategies and decision-making processes. However, given the dynamic nature of the technology sector, it is important to note that the market landscape may have evolved since then, and there may be new players or changes in market share.

Top Key Players in Generative AI in Investing Market

- OpenAI

- IBM

- QuantConnect

- Numerai

- Sentient Technologies

- Kavout

- Kensho Technologies

- Other Key Players

Recent Development

- In September 2020, IBM introduced the IBM Watson Studio AutoAI, which aimed to simplify the process of building and deploying AI models, including generative AI models, for investment and financial analysis. The platform aimed to democratize AI adoption and make it accessible to a broader range of users.

Report Scope:

Report Features Description Market Value (2022) USD 85 Mn Forecast Revenue (2032) USD 1,097 Mn CAGR (2023-2032) 30% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud-Based and On-Premises); By Application (Portfolio Generation, Risk Assessment & Management, Market Analysis & Prediction, Algorithmic Trading, Fraud Detection & Compliance, and Other Applications); By End-Users (Institutional Investors, Retail Investors, Investment Banks and Financial Institutions, and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape OpenAI, IBM, QuantConnect, Numerai, Sentient Technologies, Kavout, Kensho Technologies, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- OpenAI

- IBM

- QuantConnect

- Numerai

- Sentient Technologies

- Kavout

- Kensho Technologies

- Other Key Players