Generative AI in Trading Market By Type (Financial Data Generation and Market Simulation), By Application (Portfolio Optimization, Trading Strategy Development, and Risk Assessment and Management), By Deployment, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

-

38991

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

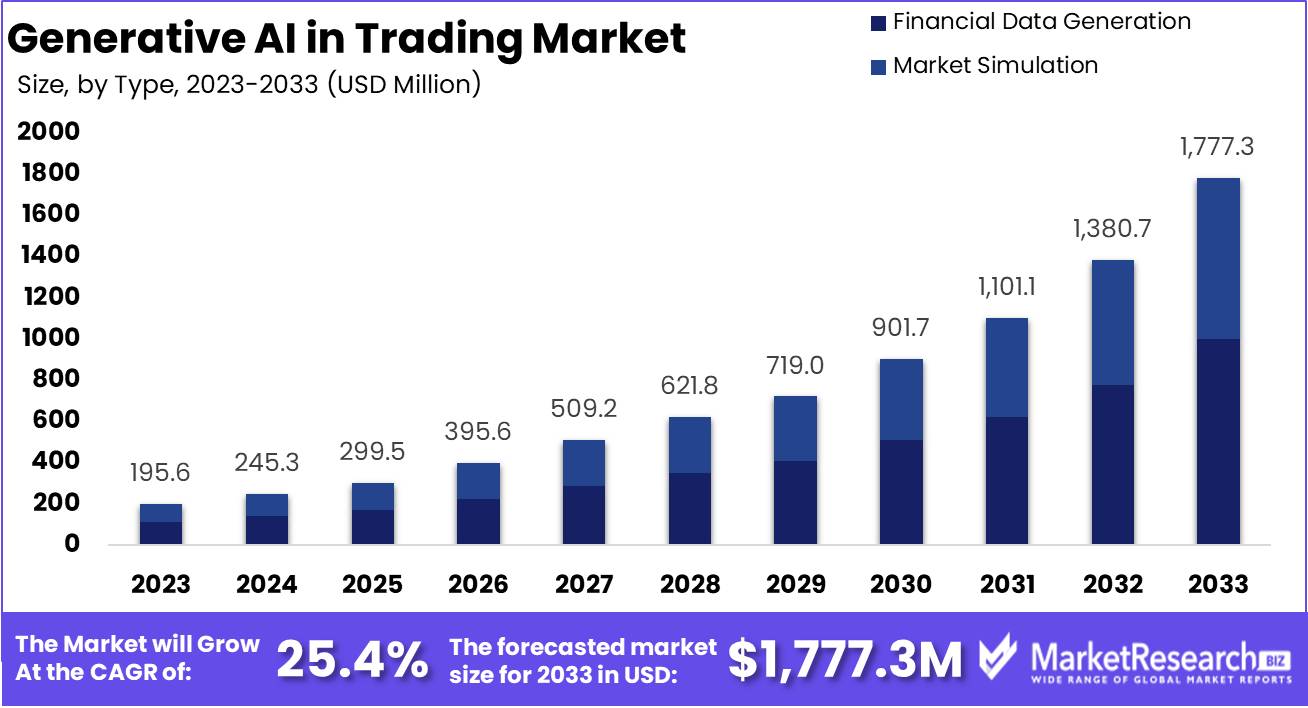

The Generative AI in Trading Market was valued at USD 195.6 million in 2023. It is expected to reach USD 1,777.3 Million by 2033, with a CAGR of 25.4% during the forecast period from 2024 to 2033.

The surge in demand for new advanced technologies and automation of trading techniques are some of the main key driving factors for generative AI in the trading market. Generative artificial intelligence in trading denotes the usage of AI to examine past financial market and stock information, gain investment ideas, create collections, and automatically purchase and trade stocks. GenAI stock trading practices different types of AI, and difficult algorithm predictions to analyze millions of information points and implement trades at the best prices. Generative AI stock traders also analyze forecast markets with precision and efficacy to mitigate challenges and offer higher return value.

According to Forex, there are more than 13.8 to 50 million stock traders all across the globe while more than 4.3 million are active stock traders. The accurate number is still difficult to calculate because presently most individuals have smart electronic devices and anybody can start trading without any type of funding or investment. In Asia, there are more than 4,630,400 approx. online traders and there are also many online traders in each region.

Many generative AI trading firms use different types of tools such as machine learning, algorithmic predictions, and sentiment analysis to know the monetary market and utilise the information to estimate price variations, know the causes behind price change, bring out trades and selling process and supervise the ever-transforming marketplace. GenAI trading offers hedge investments, funds companies and stock stockholders with a swing of advantages. Generative AI in trading lessen the study time and enhance the accuracy, forecast patterns and decreases overhead costs.

Companies are using various types of advanced trading technologies to stay ahead in the stock market. For example, Imperative Executive Inc., are group of highly skilled traders, and engineers, Imperative Execution creates efficacy monetary exchanges with the help of its in-house product IntelligentCross, which uses artificial intelligence to examine stock value and makes sure the value sturdiness after trades are finished properly. This channel works with different types of trading agents and get over 100 million orders from financiers/investors per day, as per to its official website. The demand for the generative AI in trading will increase due to its requirement in the trading market and people’s interest in stock trading, that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Generative AI in Trading Market was valued at USD 195.6 million in 2023. It is expected to reach USD 1,777.3 million by 2033, with a CAGR of 25.4% during the forecast period from 2024 to 2033.

- By Type: Optimizing portfolios with AI maximizes returns, and minimizes risks efficiently.

- By Application: Financial data generation AI drives market insights, enhancing investment strategies.

- By Deployment: On-premises deployment emphasizes data control, security, and customized integration.

- Regional Dominance: North America dominates with 46.6% in the Generative AI trading market.

- Growth Opportunity: Generative AI revolutionizes trading strategies and personalizes wealth management.

Driving factors

Data Generation and Augmentation through Generative AI

In the rapidly evolving landscape of financial markets, Generative AI has emerged as a pivotal tool for traders aiming to enhance the robustness of their predictive models. By synthesizing artificial financial datasets that mirror real-time market dynamics, this technology enables a more nuanced analysis, enriching the decision-making process. The augmentation of existing datasets with synthetic information, meticulously generated by Generative AI, significantly improves the accuracy and reliability of trading algorithms. This advancement allows for a more comprehensive understanding of potential market movements, equipping traders with the insights needed to navigate the complexities of the financial arena effectively.

Market Simulation and Scenario Analysis via Generative AI

Generative AI is revolutionizing the way traders approach market simulation and scenario analysis. By leveraging this technology, traders can construct detailed simulations of market scenarios, enabling them to evaluate the repercussions of various external factors such as policy shifts or unexpected market disruptions. This capability is instrumental in devising strategic responses and anticipating the impact of such events on investment portfolios. Through the creation of artificial market environments, traders gain the ability to conduct thorough risk assessments and make informed decisions, thereby enhancing their strategic planning and resilience in the face of market volatility.

Enhancing Risk Management through Generative AI

The application of Generative AI in risk management signifies a transformative shift towards proactive risk assessment and mitigation in trading. By simulating extreme market conditions, this technology empowers traders to stress-test their trading systems and strategies, identifying potential vulnerabilities before they manifest. This preemptive approach to risk management not only increases the resilience of trading portfolios but also minimizes potential losses, ensuring a more stable and secure trading environment. Generative AI stands as a cornerstone in the modern trader's arsenal, offering sophisticated tools for navigating the complexities of financial markets with confidence and strategic foresight.

Restraining Factors

The Imperative of High-Caliber Data for Generative AI Models

The efficacy of generative AI models is intrinsically linked to the caliber and volume of the data utilized during their training phase. These models, by design, learn and derive patterns from vast datasets, enabling them to generate new content or make predictions based on the input they've been fed. However, this reliance on data quality presents a significant challenge. Data that is incomplete, outdated, or fraught with inaccuracies can severely compromise the performance of these AI models, leading to outputs that are at best suboptimal and at worst misleading.

For industries where precision is paramount, such as healthcare, finance, or autonomous driving, the ramifications of flawed AI-generated decisions can be profound. Ensuring the integrity of the data, therefore, becomes a cornerstone in the deployment of generative AI systems, necessitating rigorous data curation and validation processes to uphold the high standards expected from these technologies.

Navigating Market Complexities with Generative AI

Generative AI models, despite their advanced capabilities, often struggle to fully comprehend the intricate dynamics of financial markets. These markets are influenced by a multitude of factors including economic indicators, geopolitical events, and even human psychology, creating a complex web of interdependencies that is challenging to model. The limitation in understanding such nuances can lead to inaccuracies in market predictions and financial decisions made by AI.

This underscores the need for a more sophisticated approach in AI training, one that incorporates not just quantitative data, but also qualitative insights into market sentiment, regulatory changes, and emerging trends. Bridging this gap requires an interdisciplinary approach, blending financial expertise with advanced AI techniques to enhance the models' grasp of market complexities. As AI continues to evolve, the integration of such nuanced understandings will be critical in mitigating risks and capitalizing on opportunities within the volatile realm of financial markets.

By Type Analysis

Financial data generation enhances accuracy and efficiency in forecasting. It revolutionizes decision-making processes for businesses.

In 2023, Financial Data Generation held a dominant market position in the "Based on Type" segment of the Generative AI in Trading Market, emerging as a pivotal tool for traders and financial analysts globally. This segment's ascendancy can be attributed to its profound ability to synthesize and interpret vast datasets, enabling more nuanced and predictive financial models. Generative AI's prowess in creating realistic and highly informative financial data simulations has revolutionized the way market participants engage with historical data, trend analysis, and future market forecasting.

The remarkable growth of Financial Data Generation within the Generative AI in Trading Market is underpinned by its unmatched efficiency in identifying patterns and correlations within complex market data that often elude traditional analytical methodologies. This capability not only enhances the precision of market predictions but also significantly reduces the time frame for data analysis, offering traders a substantial competitive advantage in a rapidly evolving market landscape.

Moreover, the integration of Generative AI technologies in financial data generation facilitates a more dynamic risk assessment and management framework, allowing for the simulation of various market scenarios. This aspect is crucial for developing robust trading strategies that can withstand unpredictable market movements and volatility, thereby fostering greater resilience and adaptability among trading entities.

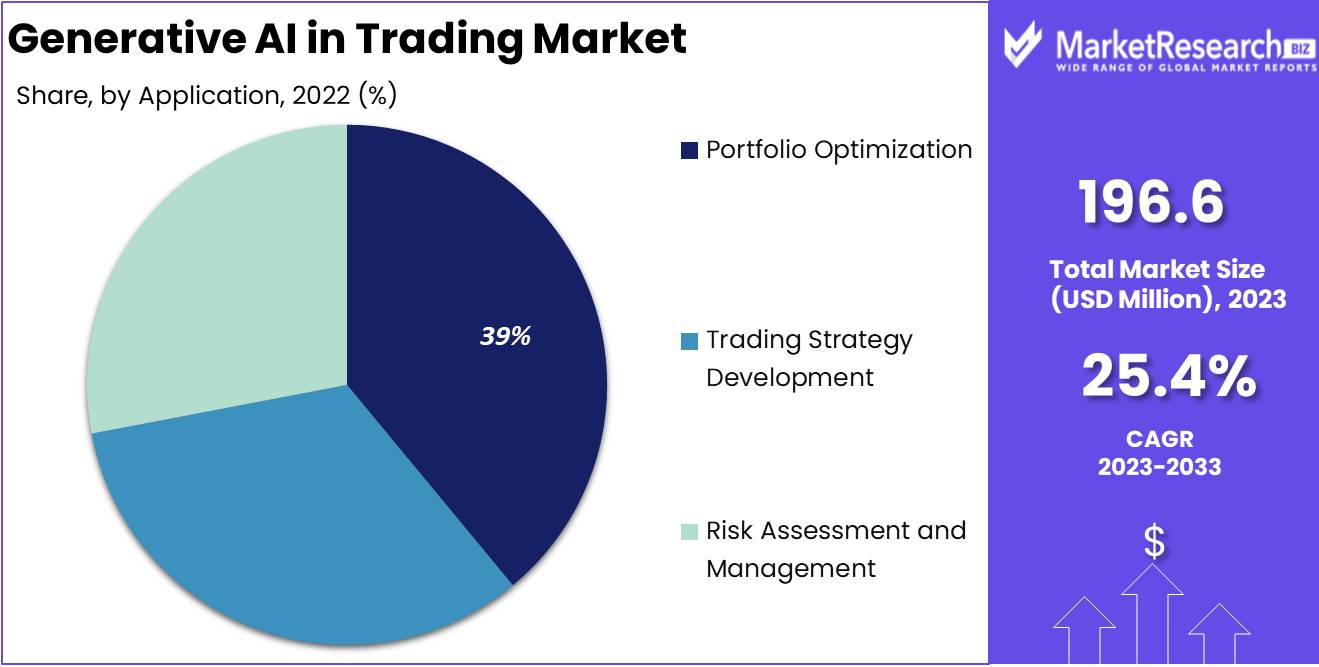

By Application Analysis

Portfolio Optimization streamlines IT landscapes, boosting efficiency and aligning tech investments with strategic business goals.

In 2023, Portfolio Optimization held a dominant market position in the "Based on Application" segment of the Generative AI in the Trading Market. This pivotal role can be attributed to the increasing demand for advanced analytical tools and algorithms that enhance investment decision-making processes. As the trading landscape becomes more complex and data-driven, market participants are seeking innovative ways to maximize returns while effectively managing risk. Generative AI, with its ability to simulate and predict market scenarios, has become an indispensable tool for portfolio managers.

The surge in the adoption of Generative AI for portfolio optimization stems from its capacity to process vast datasets, identifying patterns and correlations that are not readily apparent to human analysts. This capability enables the creation of more diversified and resilient investment portfolios. Furthermore, the integration of Generative AI facilitates real-time adjustments and scenario analysis, allowing for more dynamic and responsive investment strategies.

The financial sector's rapid digital transformation, coupled with an increasing reliance on data analytics and machine learning, has propelled Portfolio Optimization to the forefront of the Generative AI in Trading Market. Institutional investors, hedge funds, and asset management firms are increasingly leveraging these AI-driven tools to gain a competitive edge in the market.

By Deployment Analysis

On-premises deployment ensures data control and security, favored by organizations prioritizing privacy and customization.

In 2023, On-Premises deployment held a dominant market position in the "Based on Deployment" segment of the Generative AI in the Trading Market. This dominance is largely attributed to the stringent security requirements and regulatory compliance demands of financial institutions, which necessitate tight control over data and trading algorithms. In an era where data breaches can have monumental implications, the preference for on-premises solutions underscores the industry's prioritization of data sovereignty and security.

The on-premises approach offers trading firms and financial institutions the ability to leverage Generative AI capabilities while maintaining complete oversight of their data and infrastructure. This is particularly crucial in trading, where milliseconds can equate to millions in gains or losses, and where proprietary trading strategies are guarded as closely as state secrets. By hosting AI models and computing resources in-house, organizations can ensure that latency is minimized and that their intellectual property remains within their control, away from the prying eyes of competitors.

Furthermore, the on-premises model facilitates a higher degree of customization and integration with existing legacy systems, which is often a requisite in the complex IT environments of established financial entities. This capability enables firms to tailor Generative AI applications to their specific operational needs and trading strategies, enhancing their effectiveness and efficiency.

Key Market Segments

Based on Type

- Financial Data Generation

- Market Simulation

Based on Application

- Portfolio Optimization

- Trading Strategy Development

- Risk Assessment and Management

Based on Deployment

- On-Premises

- Cloud-Based

- Hybrid

Growth Opportunity

Trading Strategy Development: Leveraging Generative AI for Enhanced Market Strategies

In the dynamic realm of financial markets, the development of robust trading strategies remains paramount. Generative AI emerges as a transformative force, offering unparalleled capabilities to analyze vast datasets and discern intricate patterns within historical market trends. By harnessing this technology, firms can transcend traditional analytical methods, enabling the creation of predictive models that are both sophisticated and adaptive.

The application of Generative AI in trading strategy development extends beyond mere data analysis; it facilitates the simulation of numerous market scenarios, thereby testing the resilience and adaptability of trading strategies under varied conditions. This not only enhances the strategic foresight but also significantly mitigates risk, providing a competitive edge in the volatile trading environment. The continuous learning mechanism of Generative AI ensures that trading strategies evolve in tandem with market dynamics, ensuring sustained relevance and efficacy.

Financial Advisors and Wealth Management: Personalizing Solutions with Generative AI

In the domain of wealth management and financial advisory, personalization stands as a cornerstone of client satisfaction and engagement. Generative AI introduces a new paradigm in personalized financial planning, empowering advisors with deep insights and predictive analytics tailored to individual client profiles. By integrating Generative AI into their service offerings, financial advisors and wealth management firms can offer bespoke solutions that resonate with the unique financial goals, risk tolerance, and investment preferences of each client.

This technological innovation enables the crafting of dynamic financial plans that can adapt to changing market conditions and life circumstances, ensuring optimal asset allocation and portfolio performance. Moreover, Generative AI can enhance client interactions by providing real-time, data-driven recommendations, elevating the client experience to new heights. In this era of digital transformation, the adoption of Generative AI in financial advisory services is not merely an advantage but a necessity to meet the evolving expectations of informed and tech-savvy clients.

Latest Trends

Accelerated Data Analysis and Trading Velocity

In 2024, the global trading landscape will be increasingly influenced by Generative AI's capability to analyze vast datasets and execute trades at unprecedented speeds. This trend underscores a pivotal shift towards leveraging computational superiority to identify and act on market trends and patterns far more rapidly than human traders can. The essence of high-frequency trading is now defined by the algorithmic prowess of Generative AI, offering a distinct competitive edge by capitalizing on fleeting market opportunities.

Expanding Demand for Advanced Financial Solutions

The burgeoning growth within the Generative AI in Trading Market is predominantly fueled by a surge in demand for sophisticated financial tools and services. Market participants are increasingly seeking innovative solutions for financial data generation, comprehensive market simulations, and the refinement of portfolio management strategies. This trend is not merely about enhancing efficiency; it represents a deeper, more strategic integration of Generative AI to develop robust trading strategies, optimize risk assessment protocols, and manage portfolios with a level of precision and adaptability previously unattainable. The emphasis is on not just navigating the current market dynamics but also on preemptively strategizing for future uncertainties, thus ensuring a more resilient trading framework.

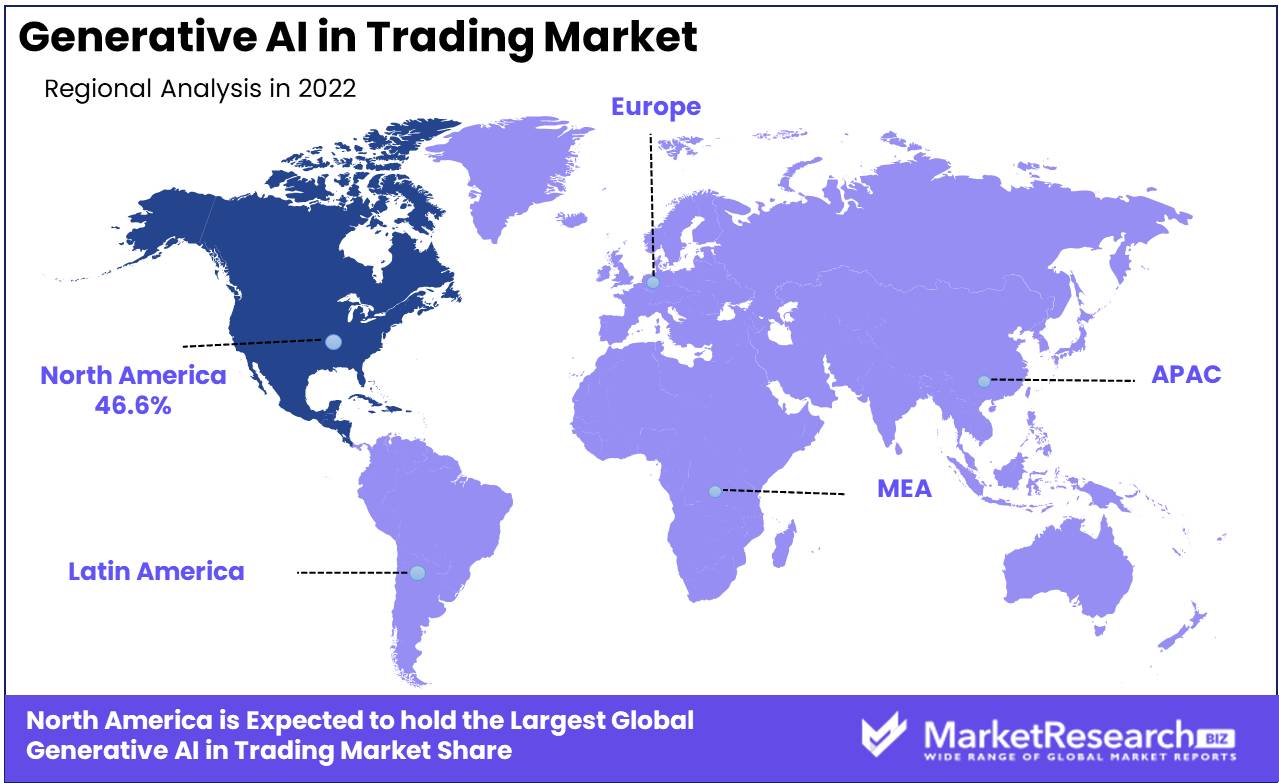

Regional Analysis

In the evolving landscape of the trading market, Generative AI has emerged as a transformative force, with its impact varying significantly across different regions. North America, at the forefront, accounts for a commanding 46.6% of the global market, underscoring its pioneering role in integrating AI technologies within trading platforms. This dominance is attributed to the region's robust financial infrastructure, high investment in AI research, and the presence of key market players driving innovation and adoption.

Europe follows, showcasing a keen interest in leveraging Generative AI to enhance trading algorithms, risk management, and compliance monitoring. The region's strict regulatory environment acts as a double-edged sword, promoting transparent, ethical AI use while sometimes slowing down rapid technological adoption. However, Europe's strong focus on AI ethics and data protection positions it as a leader in sustainable and responsible AI deployment in trading.

The Asia-Pacific region is witnessing a swift uptake of Generative AI in trading, fueled by its dynamic economies and rapid digital transformation. Countries like China, Japan, and South Korea are investing heavily in AI technologies, aiming to revolutionize their financial sectors and gain a competitive edge in global markets. The region's vast and growing investor base, coupled with governmental support for AI initiatives, signifies immense growth potential.

The Middle East & Africa, though nascent in the AI trading domain, is poised for significant growth. The region's efforts to diversify away from oil-dependent economies and invest in technological infrastructure are laying the groundwork for AI adoption in trading, with financial hubs like Dubai leading the charge.

Latin America, with its evolving financial markets, is gradually embracing Generative AI in trading. Initiatives to modernize banking and financial services, coupled with a growing startup ecosystem focused on fintech innovations, are setting the stage for AI-driven transformations in trading practices.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the burgeoning domain of Generative AI in Trading, key players like Numerai LLC, OpenAI LP, Kavout Inc., Aidyia Holdings Ltd., Sentient Technologies Holdings Ltd., and Pecan AI Ltd. are at the forefront of a paradigm shift. These entities are not just participants; they are trailblazers, redefining the boundaries of financial markets through the innovative application of AI technologies.

Numerai LLC, with its novel approach of crowdsourcing predictive models through a global tournament of data scientists, represents a democratization of financial strategies. This model harnesses a diverse set of insights, potentially leading to more robust and resilient trading algorithms.

OpenAI LP, the progenitor of some of the most advanced AI models to date, brings unparalleled generative capabilities to the table. Its models, capable of understanding and generating human-like text, can be leveraged to analyze vast quantities of financial data, uncover patterns, and generate actionable trading insights at a scale and speed previously unimaginable.

Kavout Inc., with its "K Score" system, exemplifies the use of machine learning to evaluate the investment potential of stocks. This approach, which integrates vast datasets and predictive analytics, can significantly enhance decision-making processes, offering a competitive edge in trading strategies.

Aidyia Holdings Ltd. and Sentient Technologies Holdings Ltd., both delve into the realm of AI-driven hedge funds, deploying complex algorithms that can predict market movements based on historical data and a multitude of variables. This predictive capability, grounded in deep learning and other AI methodologies, marks a significant evolution from traditional quantitative trading strategies.

Pecan AI Ltd., focusing on predictive analytics, underscores the critical role of accessible, accurate forecasts in trading. By simplifying the deployment of deep learning models, Pecan enables traders and financial analysts to anticipate market trends with greater precision, thereby informing more strategic trading decisions.

Collectively, these key players are not just shaping the Generative AI in Trading Market; they are setting the stage for a future where AI-driven insights become indispensable in the pursuit of market excellence. Their contributions underline a pivotal transformation, emphasizing data-driven strategies, predictive accuracy, and algorithmic innovation in redefining trading paradigms for 2024 and beyond.

Top Key Players in Generative AI in Trading Market

- Numerai LLC

- OpenAI LP

- Kavout Inc.

- Aidyia Holdings Ltd.

- Sentient Technologies Holdings Ltd.

- Pecan AI Ltd.

- Other Key Players

Recent Development

- In June 2023, At the A-Team Group's TradingTech Briefing New York, experts from Deutsche Bank, AB Bernstein, and Google discussed the transformative potential of generative AI in trading, emphasizing the importance of addressing data quality, bias, and regulatory concerns to unlock its benefits responsibly.

- In April 2024, GOOGL stock holds an Accumulation/Distribution Rating of B-minus. That institutional ownership rating analyzes price and volume changes in stock over the past 13 weeks of trading.

- In March 2024, Scotty the AI' ($SCOTTY) is leveraging AI to offer innovative crypto trading solutions like optimized exchanges via Scotty Swap and trend insights through Scotty Chat, blending meme culture with practical utility to capture industry attention.

Report Scope:

Report Features Description Market Value (2022) USD 195.6 Mn Forecast Revenue (2032) USD 1,777.3 Mn CAGR (2023-2032) 25.4% Base Year for Estimation 2023 Historic Period 2016-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Financial Data Generation, Market Simulation)

By Application (Portfolio Optimization, Trading Strategy Development, Risk Assessment, and Management)

By Deployment (On-Premises, Cloud-Based, Hybrid)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Numerai LLC, OpenAI LP, Kavout Inc., Aidyia Holdings Ltd., Sentient Technologies Holdings Ltd., Pecan AI Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Numerai LLC

- OpenAI LP

- Kavout Inc.

- Aidyia Holdings Ltd.

- Sentient Technologies Holdings Ltd.

- Pecan AI Ltd.

- Other Key Players