Global Generative AI in Insurance Market, By Deployment Model (On-premise and Cloud), By Application (Fraud Detection and Credit Analysis, and Others), By Technology (Machine Learning, Natural Language Processing, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

-

36875

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

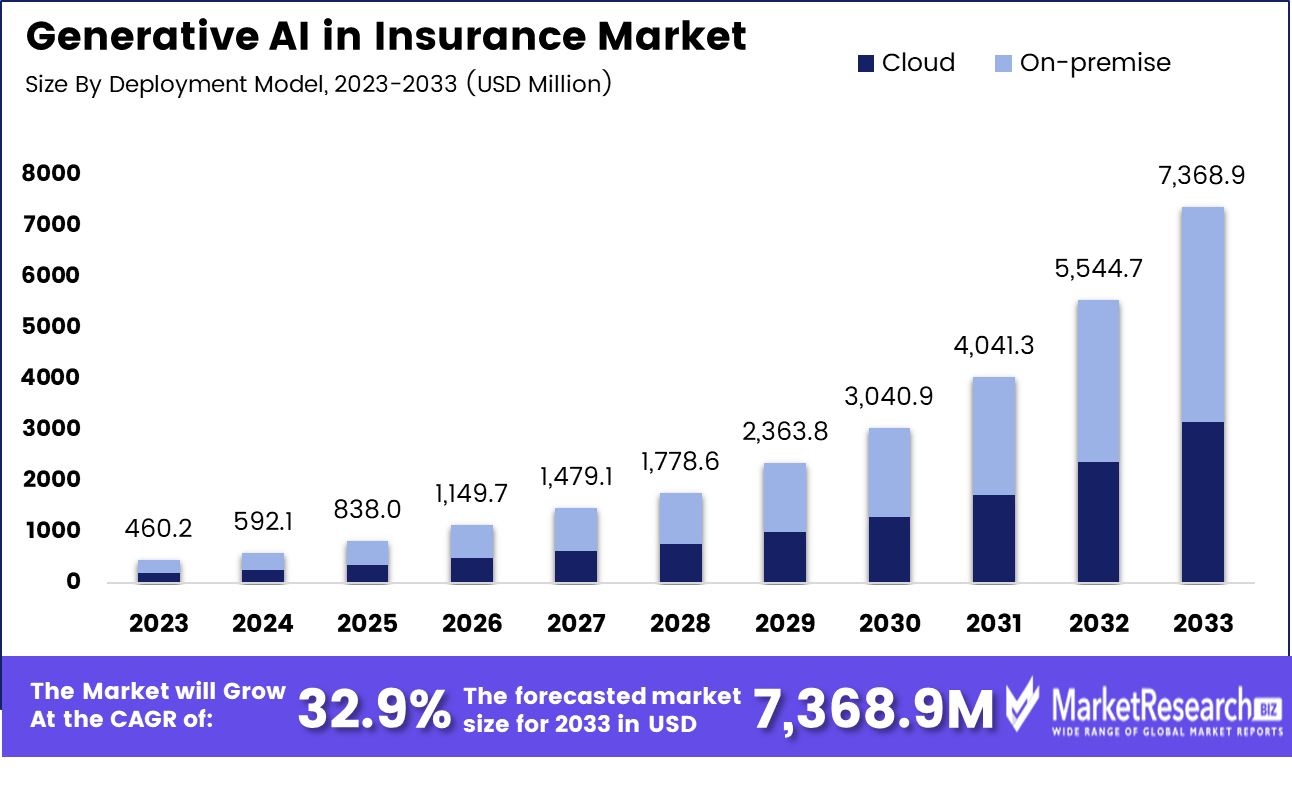

Global Generative AI in Insurance Market size is expected to be worth around USD 7,368.9 Mn by 2033 from USD 460.2 Mn in 2023, growing at a CAGR of 32.9% during the forecast period from 2024 to 2033. The surge in demand for advanced new technologies and the rise in banking sectors are some of the main key driving factors for generative AI in insurance.

The generative AI in insurance is defined as the application of artificial intelligence methods predominantly generative models like generative adversarial networks and variational autoencoders, to change different aspects of the banking sectors. This application also comprises using generative algorithms to examine huge amounts of data, including past claims, customer behavior, and potential risk factors to produce insights and enhance insurance techniques.

Generative AI simplifies tasks like fraud detection, risk assessment, and customized underwriting by producing synthetic data and simulating multiple situations. It allows insurers to enhance pricing precision by augmenting customer experience through customized products and services and streamlining claims methods. Furthermore, gen AI helps in the creation of innovative insurance products and the automation of daily tasks, by leading to more efficacy operations and better risk management. Generative AI in insurance focuses on propelling profitability, alleviating risks, and improving competitiveness in the growing insurance landscape.

Generative AI simplifies tasks like fraud detection, risk assessment, and customized underwriting by producing synthetic data and simulating multiple situations. It allows insurers to enhance pricing precision by augmenting customer experience through customized products and services and streamlining claims methods. Furthermore, gen AI helps in the creation of innovative insurance products and the automation of daily tasks, by leading to more efficacy operations and better risk management. Generative AI in insurance focuses on propelling profitability, alleviating risks, and improving competitiveness in the growing insurance landscape.According to Medium in November 2023, highlights that in 2022, more than 22% of customers stated dissatisfaction with their P&C insurance providers. The American Customer Satisfaction Index (ACSI) discloses a pressing requirement for improvement, particularly in areas like the availability of discounts, speed of claims processing, and clarity of billing statements. BCG highlights that gen AI applications provide substantial efficacy and cost savings all across the insurance value chain. One of the most notable revelations is the potential 40% to 60% savings in customer service productivity. Insurance agents currently spend about 35% of their time navigating through policies and terms. With Generative AI, this can be drastically decreased by permitting swift and accurate document queries. Moreover, 87% of customers believe their claims experiences influence their loyalty to an insurer.

Generative AI in insurance offers several benefits enhanced fraud detection through synthetic data generation, augmented risk assessment through scenario simulation, and customized underwriting for customers. It makes easy claims processing, enhances pricing precision, and nurtures new innovations, ultimately leading to better customer experience, satisfaction, and a rise in operational efficiency for insurers. The demand for generative AI in insurance will increase due to its requirement in the banking sectors which will help in market expansion in the coming years.

Key Takeaways

- Market Value: Global Generative AI in Insurance Market size is expected to be worth around USD 7,368.9 Mn by 2033 from USD 460.2 Mn in 2023, growing at a CAGR of 32.9% during the forecast period from 2024 to 2033.

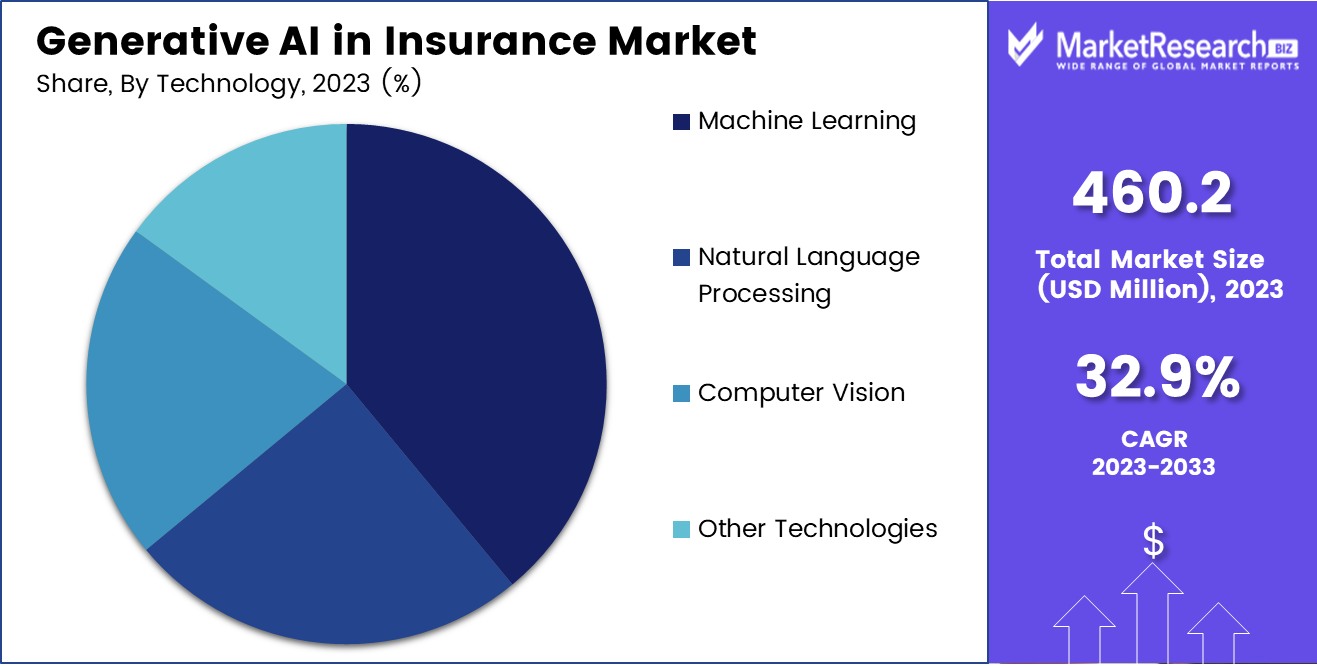

- Based on Technology: Machine learning powers generative AI in the insurance sector.

- Based on Application: Generative AI targets fraud detection and credit analysis in insurance.

- Based on Deployment Mode: Cloud deployment dominates, holding 60% of the generative AI insurance market.

- Based on End User: Commercial policyholders increasingly adopt generative AI in insurance.

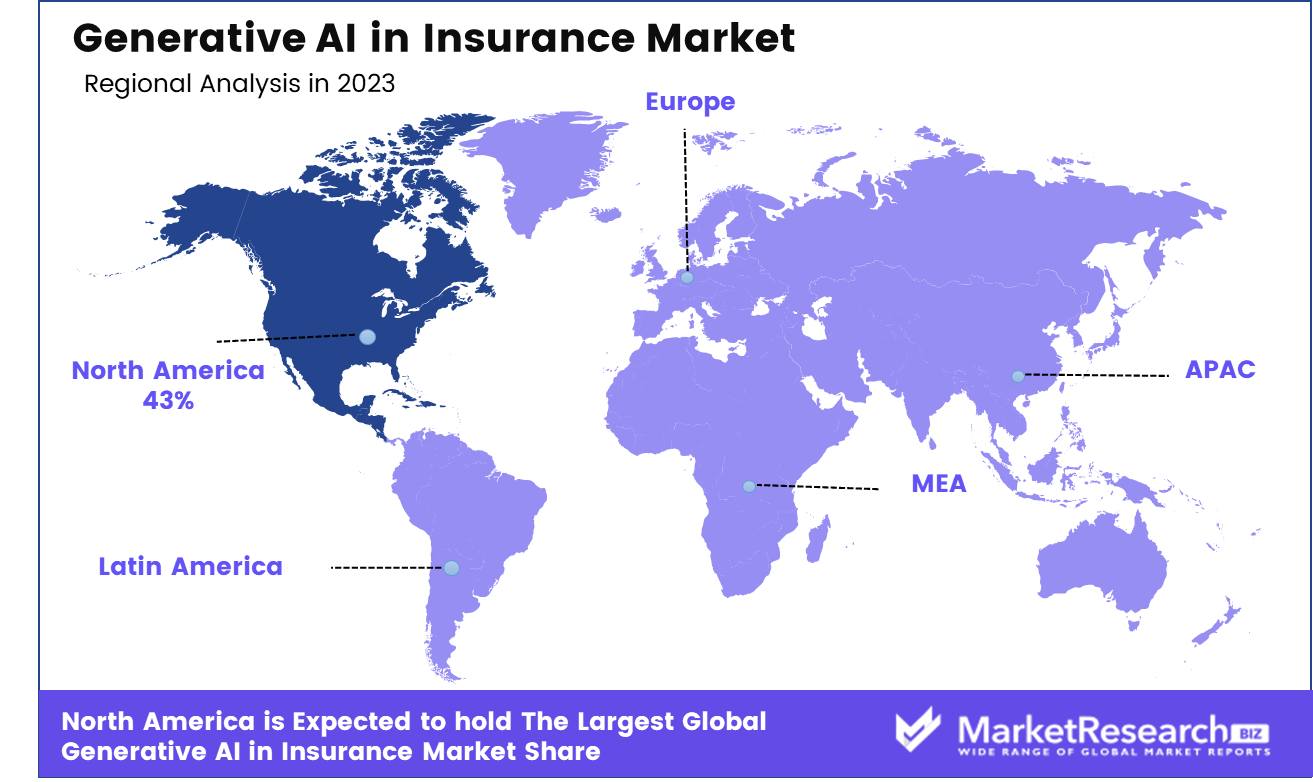

- Regional Analysis: North America leads Generative AI in the Insurance Market with 43%.

- Growth Opportunity: In 2023, the integration of generative AI in the insurance industry is set to enhance operational efficiency through cost-saving automation of routine tasks and revolutionize customer interactions by offering personalized experiences that boost satisfaction and loyalty.

Driving factors

Cloud Adoption: Catalyzing Flexibility and Speed in Insurance

Cloud adoption is a pivotal driver in the generative AI insurance market. By migrating core systems to cloud infrastructure, insurance companies gain remarkable agility, which is crucial in adapting to market changes and consumer demands quickly. This flexibility also facilitates the rapid deployment of innovative products, which is essential in a competitive landscape. Moreover, cloud computing enhances customer service capabilities by enabling more responsive and personalized interactions through advanced data analytics powered by AI. These advancements not only streamline operational processes but also improve the efficiency and accuracy of claims processing and risk assessment, thereby reducing costs and increasing customer satisfaction.

Ecosystem Integration: Enhancing Connectivity and Insight

The integration of ecosystems in the insurance sector is transforming traditional business models. By forming strategic alliances and integrating diverse data sources—such as IoT devices, public records, and third-party services—insurers can obtain a more holistic view of risks. This comprehensive data environment enhances predictive capabilities and risk management, allowing insurers to offer more tailored products and engage in proactive risk mitigation. Furthermore, ecosystem integration supports the implementation of generative AI tools that require vast, diverse data sets to generate insights, predict trends, and automate customer interactions, thus enriching the overall customer experience and operational resilience.

Next-Level Automation: Redefining Risk and Efficiency

The push towards automation in the insurance industry is reshaping the landscape, particularly in areas that were traditionally labor-intensive such as underwriting and claims processing. Generative AI contributes significantly to this shift by automating complex processes and decisions that typically require human judgment. This not only speeds up operations but also helps in managing and pricing risks more effectively, as AI systems can analyze large datasets quickly and with greater accuracy than humans. Additionally, automation through AI reduces the likelihood of human error and biases, leading to fairer and more consistent decision-making. As a result, insurers can offer more competitive pricing and better service, ultimately enhancing their market position and growth prospects.

Restraining Factors

Moral Hazard: Navigating the Pitfalls of Information Asymmetry

The deployment of generative AI in the insurance sector introduces a significant challenge in the form of moral hazard due to information asymmetry. In the insurance context, this occurs when there is a discrepancy between the information available to the AI systems and the users, which can lead to unpredicted or undesirable behaviors from the AI after policies are issued. This risk is particularly acute in scenarios where AI systems make decisions based on incomplete or biased data sets, potentially leading to unfair policy terms or pricing.

Such issues not only undermine customer trust but also pose regulatory risks, as insurers are held accountable for the actions of their AI systems. Managing this requires rigorous IoT data management, transparency in AI decision processes, and continuous monitoring to ensure outcomes align with ethical standards and regulatory requirements. Addressing these challenges is crucial for maintaining the integrity of insurance offerings and for the sustainable growth of AI applications in this sector.

Professional Responsibility: Upholding Standards with AI Integration

As generative AI becomes more integrated into the insurance industry, there is an increasing need to address the concerns regarding professional responsibility. Insurance professionals and attorneys are bound by ethical obligations to provide competent, accurate, and fair services. The use of AI tools must align with these duties, necessitating a deep understanding and oversight of how AI algorithms function and are applied in practice.

Missteps in AI deployment can lead to incorrect assessments, biased decision-making, or even legal liabilities if they fail to meet professional standards. Ensuring that AI tools are reliable and their outputs are verifiable becomes imperative to uphold professional integrity and protect consumer rights. These constraints are significant as they dictate the pace and manner in which AI technology can be ethically and effectively integrated into professional practices within the industry.

By Deployment Model Analysis

Generative AI in the insurance market sees 60% deployment in cloud environments, enhancing operational efficiencies.

In 2023, the Cloud deployment model held a dominant position in the Generative AI in the Insurance market, capturing more than a 60% share. This substantial market share underscores the significant preference for cloud-based solutions within the industry. The cloud's ascendancy in this segment is attributed to its scalable infrastructure, which supports the rapid deployment and integration of artificial intelligence technologies. Insurance companies are leveraging cloud platforms to enhance their data analytics capabilities, streamline claim processing, and foster innovative customer service solutions.

The advantages of cloud deployment, such as reduced operational costs, enhanced security measures, and superior data management capabilities, have made it an attractive option for insurance providers. These benefits are crucial, considering the vast amounts of sensitive data handled by the sector. Additionally, the flexibility offered by cloud infrastructure services allows for easier updates and integration of new AI features, which are essential for maintaining competitive advantage in a rapidly evolving market.

Conversely, the On-premise segment, while smaller, continues to hold relevance for insurance organizations prioritizing data control and regulatory compliance. Certain insurers opt for on-premise solutions due to specific security policies or in regions with stringent data residency laws. However, the trend toward digital transformation and cloud adoption is clear, driven by the need for agility and efficiency in the highly competitive insurance landscape.

By Application Analysis

Generative AI enhances fraud detection and credit analysis applications in the insurance market significantly.

In 2023, Fraud Detection and Credit Analysis held a dominant market position in the Generative AI in the Insurance Market, reflecting the industry's urgent need to combat financial crimes and enhance risk assessment processes. This segment, vital for its role in safeguarding against fraudulent activities, leverages advanced predictive capabilities of AI to identify patterns and anomalies that are often imperceptible to human analysts.

The application of Generative AI in Fraud Detection and Credit Analysis not only improves the accuracy of fraud detection but also speeds up the credit vetting process, thereby reducing the risk of financial losses. Insurance companies are increasingly relying on these AI-driven systems to sift through massive datasets and extract actionable insights, which can decisively influence their risk management strategies and financial decision-making.

Moreover, this technology empowers insurers to customize their approaches to risk evaluation, adapting dynamically to new fraud tactics and evolving credit profiles. The substantial impact of Generative AI in this segment stems from its ability to enhance informed decision accuracy and operational efficiency, which are crucial for maintaining profitability and customer trust in the competitive insurance market.

By Technology Analysis

Machine learning drives generative AI advancements in the insurance sector, enhancing analytics and automation.

In 2023, Machine Learning held a dominant market position in the Generative AI in the Insurance Market, indicating its foundational role in transforming industry operations. As a core component of Generative AI, machine learning technologies enable insurers to automate complex processes, enhance decision-making, and derive profound insights from vast amounts of data.

Machine Learning's superiority in this sector is largely driven by its ability to model probabilities and predict outcomes, which is crucial in risk assessment, pricing policies, and fraud detection. The adaptability of machine learning algorithms allows for continuous learning and improvement, directly correlating to more precise underwriting process and personalized insurance products that meet dynamic customer needs.

This technology not only streamlines operations but also supports the development of innovative solutions that can foresee and respond to customer demands and market shifts more effectively. For instance, machine learning models are instrumental in predictive analytics, which insurance companies use to identify high-risk clients or scenarios before they manifest as financial losses.

Although Machine Learning leads in adoption, other technologies like Natural Language Processing and Computer Vision are also making significant inroads. Natural Language Processing enhances customer interactions through chatbots and automated claims processing, while Computer Vision plays a critical role in assessing insurance claims and underwriting through image and video analysis.

By End-User Analysis

Commercial policyholders increasingly adopt generative AI for enhanced decision-making and risk assessment in insurance.

In 2023, Commercial Policyholders held a dominant market position in the "Based on End-User" segment of the Generative AI in the Insurance Market, showcasing significant adoption rates and integration depth. This segment has capitalized on the advanced capabilities of generative AI to enhance risk assessment, customize policies, and streamline claims processing, thus offering a competitive edge in operational efficiency and customer service.

Commercial policyholders, typically encompassing businesses across various scales and industries, have leveraged generative AI for more robust data analysis, enabling precise risk profiling and fraud detection. The use of AI-driven predictive models in this sector has facilitated a more dynamic pricing strategy, tailored to the specific needs and risk factors associated with each commercial entity. This not only improves the accuracy of premium determination but also optimizes the insurance offerings in alignment with business operations and potential liabilities.

The adoption of generative AI by commercial policyholders also reflects a trend towards automation and data-driven decision-making in corporate risk management. Companies are increasingly aware of the potential that AI holds in mitigating risks preemptively, rather than merely responding to them. This proactive approach is particularly appealing to enterprises looking to minimize downtime and financial losses associated with risk events.

In contrast, Individual Policyholders, while also beneficiaries of generative AI advancements, exhibit slower adoption rates and less integration complexity. Their focus remains predominantly on personalization and cost-efficiency, rather than the extensive automation and analytical depth that characterizes the commercial segment.

Generative AI in Insurance Key Market Segments

Based on Deployment Model

- On-premise

- Cloud

Based on Application

- Fraud Detection and Credit Analysis

- Customer Profiling and Segmentation

- Product and Policy Design

- Underwriting and Claims Assessment

- Chatbots

- Other Applications

Based on Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Other Technologies

Based on End-User

- Individual Policyholders

- Commercial Policyholders

Growth Opportunity

Enhanced Operational Efficiency through Cost Savings

In 2023, the insurance industry stands on the brink of transformation, primarily driven by the integration of generative AI technologies. These advanced systems promise significant cost savings by automating routine and low-risk tasks such as document processing and policy management. This shift not only reduces the financial burden associated with manual operations but also reallocates human capital towards more strategic activities, enhancing overall productivity gains and operational efficiency. By streamlining workflows, insurers can minimize expenses and optimize resource allocation, setting a new standard in operational agility.

Revolutionizing Customer Interactions with Personalized Experiences

Generative AI is poised to redefine customer engagement within the insurance sector. By harnessing the power of AI to analyze vast amounts of data, insurers can offer highly personalized Insurance policies and dynamic customer interactions. This capability enables insurance companies to exceed customer expectations through tailored communication and bespoke solutions, fostering a deeper connection with clients. The impact of such personalized experiences is profound, leading to increased customer satisfaction and loyalty, which are critical factors in an industry as competitive as insurance.

Latest Trends

Tailored Insurance Solutions through Personalized Policy Recommendations

As we look towards 2023, one of the most transformative trends in the insurance sector is the rise of personalized policy recommendations powered by generative AI. This technology enables insurers to design customized insurance products that align closely with individual customer needs and preferences. By analyzing data from various touchpoints, generative AI systems can identify unique risk profiles and suggest insurance policies that are not only optimal but also competitively priced. This trend towards customization is set to enhance customer satisfaction and retention, as clients increasingly seek solutions that reflect their specific circumstances and lifestyle choices.

Enhancing Customer Support with AI-driven Chatbots and Virtual Assistants

Another significant trend reshaping the insurance industry is the widespread adoption of generative chatbots and virtual assistants. These AI-driven tools are revolutionizing customer service by providing round-the-clock support and handling a multitude of inquiries with precision and efficiency. The capabilities of these virtual assistants go beyond mere communication; they are equipped to understand and process complex customer requests, offering solutions and assisting with claims processing. The impact of this trend is profound, as it not only improves operational efficiency but also elevates the customer experience, making interactions more engaging and responsive.

Regional Analysis

North America leads the Generative AI in the Insurance Market, holding a dominant 43% share.

The Generative AI market in the insurance sector is experiencing significant regional variances in adoption and innovation. North America is the dominant region, accounting for approximately 43% of the global market. This leadership is underpinned by advanced technological infrastructure and robust investments in AI and machine learning. U.S. insurers are leveraging generative AI for personalized policy creation, risk assessment, and fraud detection, driving efficiencies and enhancing customer experiences.

In Europe, the market is characterized by stringent regulatory frameworks guiding AI deployment, such as GDPR. Despite these hurdles, European insurers are progressively integrating AI to improve claim processing and customer interaction, with the UK and Germany leading in terms of adoption. The focus here is on ethical AI usage and data security, aligning with broader EU digital strategies.

Asia-Pacific is the fastest-growing region, driven by digital transformations in countries like China, Japan, and South Korea. Insurers in this region are utilizing generative AI to penetrate densely populated markets by automating underwriting and tailoring insurance products to diverse consumer bases. Moreover, initiatives by regional governments to support AI innovations are significantly aiding market growth.

Meanwhile, the Middle East Africa, and Latin America are emerging in their generative AI capabilities. In the Middle East, particularly the UAE and Saudi Arabia, there is a growing adoption of AI technologies fueled by government initiatives aimed at economic diversification away from oil dependency. Latin America is gradually recognizing the potential of AI in tackling insurance fraud and streamlining operational processes, though it faces challenges related to technology infrastructure and skilled workforce availability.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global Generative AI in Insurance Market is poised to experience substantial transformations, driven by the active participation of both incumbent and emerging technology companies. Key players like DataRobot Inc., Tractable, Google LLC, IBM, Allstate, Lemonade, Microsoft Corporation, and Amazon Web Services are strategically positioned to harness generative AI's capabilities to revolutionize various facets of the insurance sector.

DataRobot Inc. and IBM are leveraging their robust machine learning platforms to enhance predictive analytics for risk assessment and claims management, thereby reducing fraud and streamlining operational efficiencies. Tractable stands out for its application of AI in processing claims and assessing damages through visual data, significantly speeding up claims processing times and improving customer satisfaction.

Tech giants such as Google LLC, Microsoft Corporation, and Amazon Web Services are pivotal in shaping the market through cloud-based AI solutions that enable scalability and enhanced data security for insurance providers. These platforms facilitate vast data handling capabilities essential for training AI models, thereby improving the accuracy of customer insights and risk modeling.

Insurance incumbents like Allstate and Lemonade are integrating generative AI Models to personalize customer experiences and optimize pricing models. Lemonade, in particular, uses AI to handle claims and interactions with policyholders, setting a benchmark in customer service and operational efficiency.

Market Key Players

- DataRobot Inc.

- Tractable

- Google LLC

- IBM

- Allstate

- Lemonade

- Microsoft Corporation

- Amazon Web Services

- Other Key Players

Recent Development

- In April 2024, Swiss Re launched an augmented version of its Life Guide manual, now featuring "Swiss Re Life Guide Scout," a Generative AI-powered underwriting assistant developed in collaboration with Microsoft Azure OpenAI Service to enhance the efficiency and quality of Life & Health insurance underwriting.

- In April 2024, Majesco announced the Spring '24 Release of its software solutions, highlighted by Majesco Copilot enhancements, which integrate Generative AI across its comprehensive insurance technology portfolio, enhancing operational efficiency and customer interaction for insurers.

- In April 2024, According to a 2023 report by GlobalData, investments in AI technology companies disrupting the insurance sector increased by 18% year-on-year, reaching nearly $2 billion through private equity and venture financing globally, with advancements in AI and Large Language Models driving a new phase of innovation in risk analysis and claims processing.

- In April 2024, The IDC FutureScape: Worldwide Insurance 2024 Predictions report highlights that by 2027, 40% of AI algorithms used by insurers in the Asia/Pacific region will incorporate synthetic data to enhance fairness and compliance with evolving regulations such as the EU AI Act, amidst broader AI-driven innovations that are transforming the insurance industry.

Report Scope

Report Features Description Market Value (2023) USD 460.2 Mn Forecast Revenue (2033) USD 7,368.9 Mn CAGR (2024-2033) 32.90% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Model (On-premise and Cloud), By Application (Fraud Detection and Credit Analysis, Customer Profiling and Segmentation, Product and Policy Design, Underwriting and Claims Assessment, Chatbots, and Other Applications), By Technology (Machine Learning, Natural Language Processing, Computer Vision and Other Technologies), By End-User (Individual Policyholders and Commercial Policyholders) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DataRobot Inc., Tractable, Google LLC, IBM Watson, Allstate, Lemonade, Microsoft Corporation, Amazon Web Services, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Generative AI in Insurance Market Overview

- 2.1. Generative AI in Insurance Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Generative AI in Insurance Market Dynamics

- 3. Global Generative AI in Insurance Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Generative AI in Insurance Market Analysis, 2016-2021

- 3.2. Global Generative AI in Insurance Market Opportunity and Forecast, 2023-2032

- 3.3. Global Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Deployment Model, 2016-2032

- 3.3.1. Global Generative AI in Insurance Market Analysis by Based On Deployment Model: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Model, 2016-2032

- 3.3.3. On-premise

- 3.3.4. Cloud

- 3.4. Global Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 3.4.1. Global Generative AI in Insurance Market Analysis by Based On Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 3.4.3. Fraud Detection and Credit Analysis

- 3.4.4. Customer Profiling and Segmentation

- 3.4.5. Product and Policy Design

- 3.4.6. Underwriting and Claims Assessment

- 3.4.7. Chatbots

- 3.4.8. Other Applications

- 3.5. Global Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Technology, 2016-2032

- 3.5.1. Global Generative AI in Insurance Market Analysis by Based On Technology: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Technology, 2016-2032

- 3.5.3. Machine Learning

- 3.5.4. Natural Language Processing

- 3.5.5. Computer Vision

- 3.5.6. Other Technologies

- 3.6. Global Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On End-User, 2016-2032

- 3.6.1. Global Generative AI in Insurance Market Analysis by Based On End-User: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On End-User, 2016-2032

- 3.6.3. Individual Policyholders

- 3.6.4. Commercial Policyholders

- 4. North America Generative AI in Insurance Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Generative AI in Insurance Market Analysis, 2016-2021

- 4.2. North America Generative AI in Insurance Market Opportunity and Forecast, 2023-2032

- 4.3. North America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Deployment Model, 2016-2032

- 4.3.1. North America Generative AI in Insurance Market Analysis by Based On Deployment Model: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Model, 2016-2032

- 4.3.3. On-premise

- 4.3.4. Cloud

- 4.4. North America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 4.4.1. North America Generative AI in Insurance Market Analysis by Based On Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 4.4.3. Fraud Detection and Credit Analysis

- 4.4.4. Customer Profiling and Segmentation

- 4.4.5. Product and Policy Design

- 4.4.6. Underwriting and Claims Assessment

- 4.4.7. Chatbots

- 4.4.8. Other Applications

- 4.5. North America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Technology, 2016-2032

- 4.5.1. North America Generative AI in Insurance Market Analysis by Based On Technology: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Technology, 2016-2032

- 4.5.3. Machine Learning

- 4.5.4. Natural Language Processing

- 4.5.5. Computer Vision

- 4.5.6. Other Technologies

- 4.6. North America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On End-User, 2016-2032

- 4.6.1. North America Generative AI in Insurance Market Analysis by Based On End-User: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On End-User, 2016-2032

- 4.6.3. Individual Policyholders

- 4.6.4. Commercial Policyholders

- 4.7. North America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Generative AI in Insurance Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Generative AI in Insurance Market Analysis, 2016-2021

- 5.2. Western Europe Generative AI in Insurance Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Deployment Model, 2016-2032

- 5.3.1. Western Europe Generative AI in Insurance Market Analysis by Based On Deployment Model: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Model, 2016-2032

- 5.3.3. On-premise

- 5.3.4. Cloud

- 5.4. Western Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 5.4.1. Western Europe Generative AI in Insurance Market Analysis by Based On Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 5.4.3. Fraud Detection and Credit Analysis

- 5.4.4. Customer Profiling and Segmentation

- 5.4.5. Product and Policy Design

- 5.4.6. Underwriting and Claims Assessment

- 5.4.7. Chatbots

- 5.4.8. Other Applications

- 5.5. Western Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Technology, 2016-2032

- 5.5.1. Western Europe Generative AI in Insurance Market Analysis by Based On Technology: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Technology, 2016-2032

- 5.5.3. Machine Learning

- 5.5.4. Natural Language Processing

- 5.5.5. Computer Vision

- 5.5.6. Other Technologies

- 5.6. Western Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On End-User, 2016-2032

- 5.6.1. Western Europe Generative AI in Insurance Market Analysis by Based On End-User: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On End-User, 2016-2032

- 5.6.3. Individual Policyholders

- 5.6.4. Commercial Policyholders

- 5.7. Western Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Generative AI in Insurance Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Generative AI in Insurance Market Analysis, 2016-2021

- 6.2. Eastern Europe Generative AI in Insurance Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Deployment Model, 2016-2032

- 6.3.1. Eastern Europe Generative AI in Insurance Market Analysis by Based On Deployment Model: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Model, 2016-2032

- 6.3.3. On-premise

- 6.3.4. Cloud

- 6.4. Eastern Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 6.4.1. Eastern Europe Generative AI in Insurance Market Analysis by Based On Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 6.4.3. Fraud Detection and Credit Analysis

- 6.4.4. Customer Profiling and Segmentation

- 6.4.5. Product and Policy Design

- 6.4.6. Underwriting and Claims Assessment

- 6.4.7. Chatbots

- 6.4.8. Other Applications

- 6.5. Eastern Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Technology, 2016-2032

- 6.5.1. Eastern Europe Generative AI in Insurance Market Analysis by Based On Technology: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Technology, 2016-2032

- 6.5.3. Machine Learning

- 6.5.4. Natural Language Processing

- 6.5.5. Computer Vision

- 6.5.6. Other Technologies

- 6.6. Eastern Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On End-User, 2016-2032

- 6.6.1. Eastern Europe Generative AI in Insurance Market Analysis by Based On End-User: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On End-User, 2016-2032

- 6.6.3. Individual Policyholders

- 6.6.4. Commercial Policyholders

- 6.7. Eastern Europe Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Generative AI in Insurance Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Generative AI in Insurance Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Generative AI in Insurance Market Analysis, 2016-2021

- 7.2. APAC Generative AI in Insurance Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Deployment Model, 2016-2032

- 7.3.1. APAC Generative AI in Insurance Market Analysis by Based On Deployment Model: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Model, 2016-2032

- 7.3.3. On-premise

- 7.3.4. Cloud

- 7.4. APAC Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 7.4.1. APAC Generative AI in Insurance Market Analysis by Based On Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 7.4.3. Fraud Detection and Credit Analysis

- 7.4.4. Customer Profiling and Segmentation

- 7.4.5. Product and Policy Design

- 7.4.6. Underwriting and Claims Assessment

- 7.4.7. Chatbots

- 7.4.8. Other Applications

- 7.5. APAC Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Technology, 2016-2032

- 7.5.1. APAC Generative AI in Insurance Market Analysis by Based On Technology: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Technology, 2016-2032

- 7.5.3. Machine Learning

- 7.5.4. Natural Language Processing

- 7.5.5. Computer Vision

- 7.5.6. Other Technologies

- 7.6. APAC Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On End-User, 2016-2032

- 7.6.1. APAC Generative AI in Insurance Market Analysis by Based On End-User: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On End-User, 2016-2032

- 7.6.3. Individual Policyholders

- 7.6.4. Commercial Policyholders

- 7.7. APAC Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Generative AI in Insurance Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Generative AI in Insurance Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Generative AI in Insurance Market Analysis, 2016-2021

- 8.2. Latin America Generative AI in Insurance Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Deployment Model, 2016-2032

- 8.3.1. Latin America Generative AI in Insurance Market Analysis by Based On Deployment Model: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Model, 2016-2032

- 8.3.3. On-premise

- 8.3.4. Cloud

- 8.4. Latin America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 8.4.1. Latin America Generative AI in Insurance Market Analysis by Based On Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 8.4.3. Fraud Detection and Credit Analysis

- 8.4.4. Customer Profiling and Segmentation

- 8.4.5. Product and Policy Design

- 8.4.6. Underwriting and Claims Assessment

- 8.4.7. Chatbots

- 8.4.8. Other Applications

- 8.5. Latin America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Technology, 2016-2032

- 8.5.1. Latin America Generative AI in Insurance Market Analysis by Based On Technology: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Technology, 2016-2032

- 8.5.3. Machine Learning

- 8.5.4. Natural Language Processing

- 8.5.5. Computer Vision

- 8.5.6. Other Technologies

- 8.6. Latin America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On End-User, 2016-2032

- 8.6.1. Latin America Generative AI in Insurance Market Analysis by Based On End-User: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On End-User, 2016-2032

- 8.6.3. Individual Policyholders

- 8.6.4. Commercial Policyholders

- 8.7. Latin America Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Generative AI in Insurance Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Generative AI in Insurance Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Generative AI in Insurance Market Analysis, 2016-2021

- 9.2. Middle East & Africa Generative AI in Insurance Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Deployment Model, 2016-2032

- 9.3.1. Middle East & Africa Generative AI in Insurance Market Analysis by Based On Deployment Model: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Model, 2016-2032

- 9.3.3. On-premise

- 9.3.4. Cloud

- 9.4. Middle East & Africa Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 9.4.1. Middle East & Africa Generative AI in Insurance Market Analysis by Based On Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 9.4.3. Fraud Detection and Credit Analysis

- 9.4.4. Customer Profiling and Segmentation

- 9.4.5. Product and Policy Design

- 9.4.6. Underwriting and Claims Assessment

- 9.4.7. Chatbots

- 9.4.8. Other Applications

- 9.5. Middle East & Africa Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On Technology, 2016-2032

- 9.5.1. Middle East & Africa Generative AI in Insurance Market Analysis by Based On Technology: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Technology, 2016-2032

- 9.5.3. Machine Learning

- 9.5.4. Natural Language Processing

- 9.5.5. Computer Vision

- 9.5.6. Other Technologies

- 9.6. Middle East & Africa Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Based On End-User, 2016-2032

- 9.6.1. Middle East & Africa Generative AI in Insurance Market Analysis by Based On End-User: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On End-User, 2016-2032

- 9.6.3. Individual Policyholders

- 9.6.4. Commercial Policyholders

- 9.7. Middle East & Africa Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Generative AI in Insurance Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Generative AI in Insurance Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Generative AI in Insurance Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Generative AI in Insurance Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. DataRobot Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Tractable

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Google LLC

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. IBM Watson

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Allstate

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Lemonade

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Microsoft Corporation

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Amazon Web Services

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Other Key Players

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Deployment Model in 2022

- Figure 2: Global Generative AI in Insurance Market Attractiveness Analysis by Based On Deployment Model, 2016-2032

- Figure 3: Global Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 4: Global Generative AI in Insurance Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 5: Global Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Technologyin 2022

- Figure 6: Global Generative AI in Insurance Market Attractiveness Analysis by Based On Technology, 2016-2032

- Figure 7: Global Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On End-Userin 2022

- Figure 8: Global Generative AI in Insurance Market Attractiveness Analysis by Based On End-User, 2016-2032

- Figure 9: Global Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Generative AI in Insurance Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Figure 14: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 15: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Figure 16: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Figure 17: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Figure 19: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 20: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Figure 21: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Figure 22: Global Generative AI in Insurance Market Share Comparison by Region (2016-2032)

- Figure 23: Global Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Figure 24: Global Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Figure 25: Global Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Figure 26: Global Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Figure 27: North America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Deployment Modelin 2022

- Figure 28: North America Generative AI in Insurance Market Attractiveness Analysis by Based On Deployment Model, 2016-2032

- Figure 29: North America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 30: North America Generative AI in Insurance Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 31: North America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Technologyin 2022

- Figure 32: North America Generative AI in Insurance Market Attractiveness Analysis by Based On Technology, 2016-2032

- Figure 33: North America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On End-Userin 2022

- Figure 34: North America Generative AI in Insurance Market Attractiveness Analysis by Based On End-User, 2016-2032

- Figure 35: North America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Generative AI in Insurance Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Figure 40: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 41: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Figure 42: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Figure 43: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Figure 45: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 46: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Figure 47: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Figure 48: North America Generative AI in Insurance Market Share Comparison by Country (2016-2032)

- Figure 49: North America Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Figure 50: North America Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Figure 51: North America Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Figure 52: North America Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Figure 53: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Deployment Modelin 2022

- Figure 54: Western Europe Generative AI in Insurance Market Attractiveness Analysis by Based On Deployment Model, 2016-2032

- Figure 55: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 56: Western Europe Generative AI in Insurance Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 57: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Technologyin 2022

- Figure 58: Western Europe Generative AI in Insurance Market Attractiveness Analysis by Based On Technology, 2016-2032

- Figure 59: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On End-Userin 2022

- Figure 60: Western Europe Generative AI in Insurance Market Attractiveness Analysis by Based On End-User, 2016-2032

- Figure 61: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Generative AI in Insurance Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Figure 66: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 67: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Figure 68: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Figure 69: Western Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Figure 71: Western Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 72: Western Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Figure 73: Western Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Figure 74: Western Europe Generative AI in Insurance Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Figure 76: Western Europe Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Figure 77: Western Europe Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Figure 78: Western Europe Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Figure 79: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Deployment Modelin 2022

- Figure 80: Eastern Europe Generative AI in Insurance Market Attractiveness Analysis by Based On Deployment Model, 2016-2032

- Figure 81: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 82: Eastern Europe Generative AI in Insurance Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 83: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Technologyin 2022

- Figure 84: Eastern Europe Generative AI in Insurance Market Attractiveness Analysis by Based On Technology, 2016-2032

- Figure 85: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On End-Userin 2022

- Figure 86: Eastern Europe Generative AI in Insurance Market Attractiveness Analysis by Based On End-User, 2016-2032

- Figure 87: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Generative AI in Insurance Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Figure 92: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 93: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Figure 94: Eastern Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Figure 95: Eastern Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Figure 97: Eastern Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 98: Eastern Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Figure 99: Eastern Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Figure 100: Eastern Europe Generative AI in Insurance Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Figure 102: Eastern Europe Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Figure 103: Eastern Europe Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Figure 104: Eastern Europe Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Figure 105: APAC Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Deployment Modelin 2022

- Figure 106: APAC Generative AI in Insurance Market Attractiveness Analysis by Based On Deployment Model, 2016-2032

- Figure 107: APAC Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 108: APAC Generative AI in Insurance Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 109: APAC Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Technologyin 2022

- Figure 110: APAC Generative AI in Insurance Market Attractiveness Analysis by Based On Technology, 2016-2032

- Figure 111: APAC Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On End-Userin 2022

- Figure 112: APAC Generative AI in Insurance Market Attractiveness Analysis by Based On End-User, 2016-2032

- Figure 113: APAC Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Generative AI in Insurance Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Figure 118: APAC Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 119: APAC Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Figure 120: APAC Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Figure 121: APAC Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Figure 123: APAC Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 124: APAC Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Figure 125: APAC Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Figure 126: APAC Generative AI in Insurance Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Figure 128: APAC Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Figure 129: APAC Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Figure 130: APAC Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Figure 131: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Deployment Modelin 2022

- Figure 132: Latin America Generative AI in Insurance Market Attractiveness Analysis by Based On Deployment Model, 2016-2032

- Figure 133: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 134: Latin America Generative AI in Insurance Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 135: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Technologyin 2022

- Figure 136: Latin America Generative AI in Insurance Market Attractiveness Analysis by Based On Technology, 2016-2032

- Figure 137: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On End-Userin 2022

- Figure 138: Latin America Generative AI in Insurance Market Attractiveness Analysis by Based On End-User, 2016-2032

- Figure 139: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Generative AI in Insurance Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Figure 144: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 145: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Figure 146: Latin America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Figure 147: Latin America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Figure 149: Latin America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 150: Latin America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Figure 151: Latin America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Figure 152: Latin America Generative AI in Insurance Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Figure 154: Latin America Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Figure 155: Latin America Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Figure 156: Latin America Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Figure 157: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Deployment Modelin 2022

- Figure 158: Middle East & Africa Generative AI in Insurance Market Attractiveness Analysis by Based On Deployment Model, 2016-2032

- Figure 159: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 160: Middle East & Africa Generative AI in Insurance Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 161: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On Technologyin 2022

- Figure 162: Middle East & Africa Generative AI in Insurance Market Attractiveness Analysis by Based On Technology, 2016-2032

- Figure 163: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Based On End-Userin 2022

- Figure 164: Middle East & Africa Generative AI in Insurance Market Attractiveness Analysis by Based On End-User, 2016-2032

- Figure 165: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Generative AI in Insurance Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Figure 170: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 171: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Figure 172: Middle East & Africa Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Figure 173: Middle East & Africa Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Figure 175: Middle East & Africa Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 176: Middle East & Africa Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Figure 177: Middle East & Africa Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Figure 178: Middle East & Africa Generative AI in Insurance Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Figure 180: Middle East & Africa Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Figure 181: Middle East & Africa Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Figure 182: Middle East & Africa Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

List of Tables

-

- Table 1: Global Generative AI in Insurance Market Comparison by Based On Deployment Model (2016-2032)

- Table 2: Global Generative AI in Insurance Market Comparison by Based On Application (2016-2032)

- Table 3: Global Generative AI in Insurance Market Comparison by Based On Technology (2016-2032)

- Table 4: Global Generative AI in Insurance Market Comparison by Based On End-User (2016-2032)

- Table 5: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Table 9: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 10: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Table 11: Global Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Table 12: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Table 14: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 15: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Table 16: Global Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Table 17: Global Generative AI in Insurance Market Share Comparison by Region (2016-2032)

- Table 18: Global Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Table 19: Global Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Table 20: Global Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Table 21: Global Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Table 22: North America Generative AI in Insurance Market Comparison by Based On Application (2016-2032)

- Table 23: North America Generative AI in Insurance Market Comparison by Based On Technology (2016-2032)

- Table 24: North America Generative AI in Insurance Market Comparison by Based On End-User (2016-2032)

- Table 25: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Table 29: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 30: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Table 31: North America Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Table 32: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Deployment Model (2016-2032)

- Table 34: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 35: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On Technology (2016-2032)

- Table 36: North America Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Based On End-User (2016-2032)

- Table 37: North America Generative AI in Insurance Market Share Comparison by Country (2016-2032)

- Table 38: North America Generative AI in Insurance Market Share Comparison by Based On Deployment Model (2016-2032)

- Table 39: North America Generative AI in Insurance Market Share Comparison by Based On Application (2016-2032)

- Table 40: North America Generative AI in Insurance Market Share Comparison by Based On Technology (2016-2032)

- Table 41: North America Generative AI in Insurance Market Share Comparison by Based On End-User (2016-2032)

- Table 42: Western Europe Generative AI in Insurance Market Comparison by Based On Deployment Model (2016-2032)

- Table 43: Western Europe Generative AI in Insurance Market Comparison by Based On Application (2016-2032)

- Table 44: Western Europe Generative AI in Insurance Market Comparison by Based On Technology (2016-2032)

- Table 45: Western Europe Generative AI in Insurance Market Comparison by Based On End-User (2016-2032)

- Table 46: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Deployment Model (2016-2032)

- Table 50: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 51: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On Technology (2016-2032)

- Table 52: Western Europe Generative AI in Insurance Market Revenue (US$ Mn) Comparison by Based On End-User (2016-2032)

- Table 53: Western Europe Generative AI in Insurance Market Y-o-Y Growth Rate Comparison by Country (2016-2032)