Generative AI In Fintech Market Based on Component (Service, Software), Based on Deployment (On-Premises, Cloud), Based on Application (Credit Scoring, Compliance & Fraud Detection, Personal Assistants, and Others), Based on End-Use Industry, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

38918

-

July 2023

-

137

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving factors

- Restraining Factors

- Covid-19 Impact on Generative AI In Fintech Market

- Component Analysis

- Deployment Analysis

- Application Analysis

- End-Use Industry

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Market Share & Key Players Analysis

- Recent Development

- Report Scope:

Report Overview

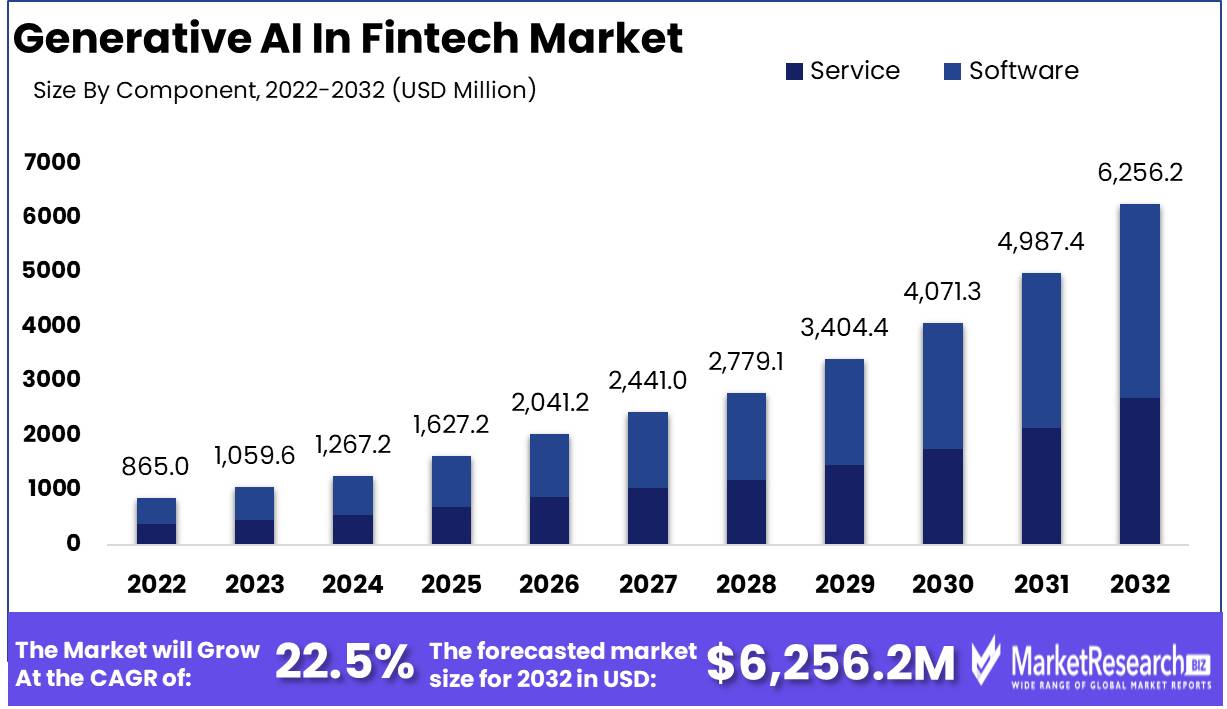

Generative AI In Fintech Market size is expected to be worth around USD 6,256.2 Mn by 2032 from USD 865.0 Mn in 2022, growing at a CAGR of 22.5% during the forecast period from 2023 to 2032.

The Generative AI In Fintech Market is a rapidly expanding industry that integrates the power of artificial intelligence and finance to transform the way we interact with financial services. This market report intends to provide an overview of the various facets of Generative AI in Fintech, including its definition, objectives, and significance. In addition, it emphasizes the benefits of employing generative AI in the financial sector, including increased efficiency, enhanced consumer experience, and improved risk management.

Significant advances in Generative AI in Fintech have paved the way for innovative developments. From fraud detection algorithms to personalized investment recommendations, these innovations have revolutionized the operations of financial institutions. Companies such as Sigmoidal, DataRobot, and ZestFinance have made substantial contributions to the industry by revolutionizing decision-making processes and optimizing financial operations.

In the fintech industry, numerous business applications for generative AI have enormous potential. For example, it can be used to create chatbots that provide personalized customer support, automate repetitive duties, and provide answers to frequently asked queries. In addition, Generative AI In Fintech Market can be used to predict market trends, evaluate creditworthiness, and detect fraudulent activities, thereby improving business operations as a whole.

Several examples from the real world demonstrate the successful implementation of Generative AI In Fintech Market. The use of automated investment platforms that employ AI algorithms to generate personalized investment portfolios based on an individual's risk preferences is one example of this. The use of generative AI to enhance fraud detection by analyzing patterns and anomalies in financial transactions is another illustration. These examples illustrate the transformative power of generative AI in the fintech industry and its capacity to drive innovation and expansion.

Driving factors

The Computerization of Financial Procedures

Automation has emerged as a propelling force in the ever-changing world of finance, revolutionizing financial processes across the industry. The incorporation of technology-enabled solutions has not only revolutionized the way we manage financial transactions, but it has also paved the way for personalized recommendations, enhanced customer experiences, and data analysis via the power of Generative AI in Fintech.

Enhanced Productivity via Automation

Automation is crucial for streamlining financial processes, eliminating manual errors, and enhancing overall operational efficiency. By automating repetitive tasks like data entry, account reconciliation, and document generation, businesses can significantly reduce human error and time-consuming manual labor. Financial institutions can now utilize sophisticated software solutions to automate complex calculations and processes, allowing them to concentrate on higher-value tasks.

Personalized Suggestions

In the era of data-driven decision making, personalized recommendations have become a fundamental aspect of the financial landscape. With the assistance of Generative AI, financial institutions can analyze vast quantities of customer data, such as transaction history, preferences, and risk profiles, in order to provide individualized and pertinent product suggestions. The incorporation of AI-powered recommendation engines enables financial institutions to comprehend customers' specific financial requirements and provide them with individualized investment strategies, insurance options, and loan products.

Superior Customer Service

Rising consumer expectations have compelled financial institutions to transfer their focus from transaction processing to relationship building. Automation and AI-powered technologies have enabled financial institutions to provide seamless, intuitive, and personalized services across multiple touchpoints, paving the way for improved consumer experiences. As a result of the automation of customer onboarding, account opening, and loan application procedures, interactions with customers are now more efficient and convenient.

Seizing Opportunities

The Generative AI in Fintech market has become a hotbed of innovation and opportunity as the fintech industry continues to experience accelerated growth. Companies that provide AI-powered solutions are flourishing because they allow financial institutions to remain ahead of the curve and meet customers' changing demands. In this flourishing market, it is essential for financial institutions to adopt automation and Generative AI in order to enhance operational efficiency and consumer experiences. By doing so, they can maintain competitiveness, expand revenue streams, and establish a sustainable future in the fintech landscape's rapid evolution.

Restraining Factors

Data Security Concerns

Data is often referred to as the new energy in the modern era. Its significance cannot be overstated, particularly in terms of fintech. With Generative AI In Fintech Market, a substantial quantity of data is involved. This raises questions about data privacy, security, and ethics. As more and more sensitive financial data is processed and analyzed, it becomes imperative to implement stringent data privacy safeguards. In addition, the General Data Protection Regulation (GDPR) and other international data protection laws add another layer of complication.

Navigating Regulatory Challenges

At the intersection of fintech and AI, complex regulatory challenges arise. Globally, governments and regulatory bodies are perpetually modifying their regulatory frameworks to keep up with the rapid rate of technological development. Nonetheless, achieving the optimal equilibrium between innovation and compliance remains a persistent obstacle. Regulators endeavor to safeguard consumers and preserve the integrity of financial systems. Alternatively, they must foster innovation and avoid impeding the development of the fintech industry.

Opposition from Institutions

While Generative AI offers tremendous potential for the fintech industry, its adoption by conventional financial institutions has been met with opposition. Several factors, including legacy systems, risk aversion, and cultural barriers, contribute to this. As the benefits of Generative AI become more evident, however, organizations are beginning to recognize the need to adopt this disruptive technology.

Potential Biases

One of the difficulties associated with Generative AI In Fintech Market is the possibility of algorithmic bias. Bias within AI systems can have far-reaching effects, especially in the fintech industry, where decisions influenced by AI algorithms can affect the financial well-being of individuals. Multiple sources can generate bias, including biased training data, algorithmic design, and inadvertent biases inherent in financial systems.

Covid-19 Impact on Generative AI In Fintech Market

Financial technology (fintech) has grown and innovated. The introduction of generative artificial intelligence (AI) technology is one of the most interesting advances in this area. Financial institutions might be transformed by generative AI. However, the COVID-19 epidemic has had a major influence on the global economy, including fintech. The pandemic's impact on the fintech industry's generative AI market will be examined in this piece.

The COVID-19 epidemic has hit fintech hard. As the globe went into lockdown and businesses closed, financial services demand changed. Traditional banks struggled to meet clients' shifting expectations, driving the introduction of digital financial alternatives. Generative AI's capacity to analyze massive volumes of data and provide real-time insights was important for fintech organizations facing pandemic difficulties.

The epidemic accelerated banking sector digitalization, which was already underway. Fintech organizations using generative AI were better able to handle remote operations and provide safe, efficient financial services. The rise of contactless and online transactions emphasized the need for cutting-edge AI solutions to automate operations and customize experiences. During these difficult times, fintech demand for generative AI surged tremendously.

Due to market volatility caused by COVID-19, financial institutions needed strong risk management methods. Generative AI helped fintech firms analyze and manage risks. Companies used AI systems to evaluate market trends, monitor consumer behavior, and uncover fraud and financial hazards. To preserve stability and business continuity throughout the pandemic, generative AI has to be integrated into risk management frameworks.

Component Analysis

The Generative AI in Fintech Market has witnessed significant growth in recent years, and one of the key factors driving this growth is the dominance of the software segment. The software segment has emerged as a major force, revolutionizing the fintech industry with its innovative solutions and applications.

Consumer trends and behavior also contribute to the dominance of the software segment. Consumers are increasingly embracing digital solutions and are demanding more personalized experiences. The software segment offers fintech companies the ability to develop customized solutions that cater to individual customers' needs and preferences. The software segment is anticipated to register the fastest growth rate over the forthcoming years due to its inherent flexibility and scalability. Software-based generative AI platforms can easily adapt to changing market demands and accommodate growing data volumes.

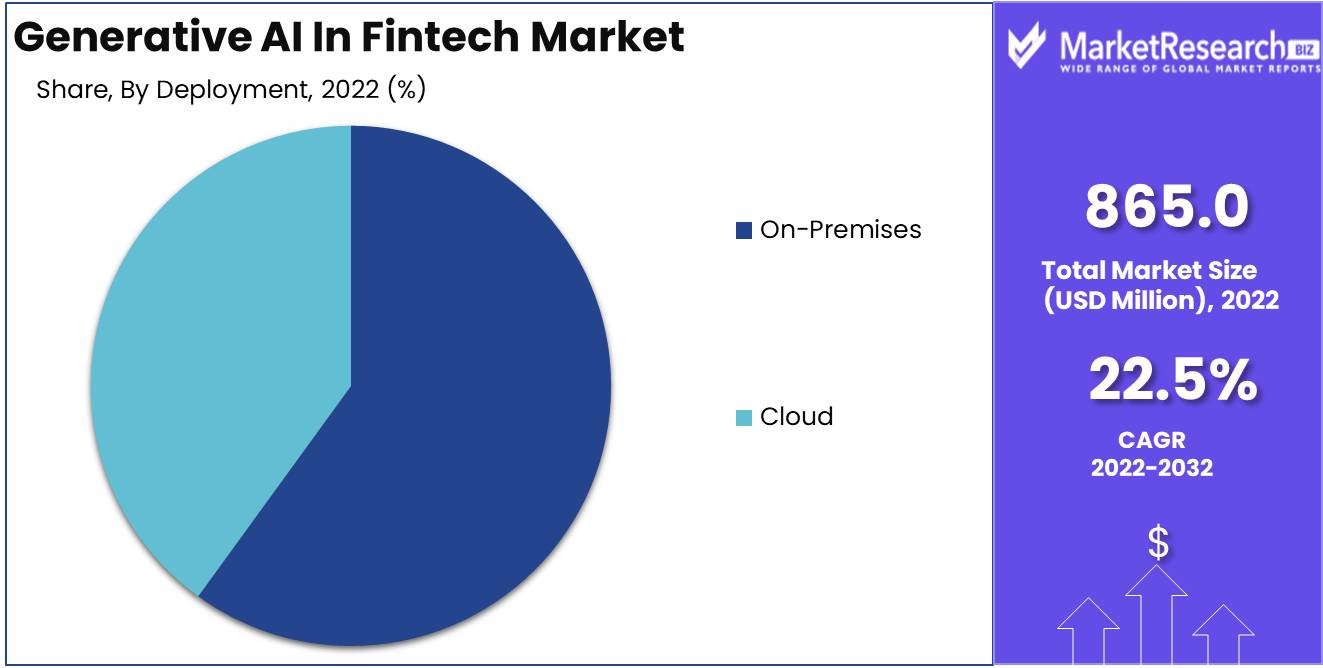

Deployment Analysis

In the Generative AI in Fintech Market, the on-premises segment holds a dominant position. Many fintech companies opt for on-premises deployment of generative AI solutions due to various reasons, including data security concerns, regulatory compliance requirements, and the need for greater control over their systems.

Consumer trends and behavior also influence the adoption of on-premises generative AI solutions. Customers are becoming more conscious of data privacy and are concerned about where their data is stored. They prefer solutions that allow them to maintain control over their data, and on-premises deployment meets this requirement. The on-premises segment is projected to register the fastest growth rate in the years to come due to the increasing demand for data security and compliance. Many organizations are recognizing the importance of protecting sensitive customer data and are investing in on-premises generative AI solutions to meet these requirements.

Application Analysis

Compliance and fraud detection are the dominant segments in the Generative AI in Fintech Market. The use of generative AI technology has revolutionized these areas, allowing fintech companies to effectively manage and mitigate risks associated with compliance and fraud.

Consumer trends and behavior also influence the adoption of compliance and fraud detection generative AI solutions. Customers are increasingly concerned about the security of their financial transactions and demand robust measures to protect their sensitive information. By implementing compliance and fraud detection generative AI solutions, fintech companies can provide customers with a secure and trustworthy platform, enhancing their confidence in online financial services. The compliance and fraud detection segment is anticipated to register the fastest growth rate in the forthcoming years due to the escalating need for enhanced security and regulatory compliance.

End-Use Industry

The retail banking segment dominates the Generative AI in Fintech Market. Retail banks are at the forefront of utilizing generative AI technology to enhance customer experiences, streamline operations, and stay competitive in the dynamic fintech industry.

Consumer trends and behavior also impact the dominance of the retail banking segment. Customers are increasingly turning to online and mobile banking services for convenience and ease of use. Retail banks are leveraging generative AI solutions to develop intuitive and user-friendly interfaces, offer personalized recommendations, and provide seamless digital banking experiences. The retail banking segment is expected to register the fastest growth rate in the forthcoming years due to the increasing demand for digital banking services and the need for seamless customer experiences.

Key Market Segments

Based on Component

- Service

- Software

Based on Deployment

- On-Premises

- Cloud

Based on Application

- Credit Scoring

- Compliance & Fraud Detection

- Personal Assistants

- Digital assistants

- Financial assistants

- Asset Management

- Predictive Analysis

- Insurance

- Debt Collection

- Business Analytics & Reporting

- Customer Behavioral Analytics

Based on End-Use Industry

- Retail Banking

- Investment Banking

- Stock Trading Firms

- Hedge Funds

- Other Industries

Growth Opportunity

Implementation of Blockchain

In numerous industries, including finance, blockchain technology has attracted considerable interest. Its decentralized nature and capacity to offer an immutable ledger make it an ideal fit for Generative AI In Fintech Market. This integration can facilitate secure and transparent financial transactions and strengthen mechanisms for detecting and preventing deception. The combination of generative AI and blockchain enables financial institutions to optimize operations, reduce costs, and increase overall efficacy.

Future of Financial Counseling

Robo-advisors have emerged as a game-changing instrument for financial planning and investment management as the fintech industry continues to evolve. These robo-advisors are empowered by generative AI, which enables them to provide highly personalized recommendations based on enormous quantities of data. Using generative AI algorithms, robo-advisors are able to analyze market trends, risk profiles, and investment objectives to provide customized investment strategies for each client. This technology revolutionizes the delivery of financial advice, granting individuals from all walks of life access to sophisticated financial planning.

Growth in Emerging Markets

Emerging markets offer a plethora of opportunities for the fintech industry, and the incorporation of generative AI can assist in realizing their maximum potential. These markets frequently lack access to conventional financial services, making them ideal for fintech innovation. This chasm can be bridged by generative AI solutions that are tailored to the specific requirements of these markets. By adapting their offerings to the cultural, linguistic, and regulatory characteristics of emerging economies, fintech companies can delve into new consumer bases and promote global financial inclusion.

Partnership with Fintech Platforms

The fintech ecosystem flourishes on collaboration, and generative AI can facilitate increased synergy between various stakeholders. Fintech platforms are an indispensable link between clients and financial services. By incorporating generative AI into these platforms, financial institutions are able to provide more personalized experiences, streamline operations, and enhance consumer engagement. In addition, collaboration between fintech platforms and specialists in generative AI can result in the creation of innovative products, such as AI-powered chatbots for customer support or fraud detection systems.

Latest Trends

Innovative Possibilities

Prepare to witness an unprecedented paradigm transition in the ever-changing financial technology industry landscape. Prepare for the emergence of generative artificial intelligence (AI) as the driving force behind the multifaceted transformation of Generative AI In Fintech Market. Explore the uncharted territories of AI-powered fraud detection, the credit scoring revolution, the marvel of natural language processing (NLP), the audacity of voice recognition, and the security of biometrics as we venture into the profound future shaped by generative AI.

Identifying Financial Fraud

The unraveling of the complex web of financial crime has become a thrilling game of intellect. Once believed invincible, conventional methods of fraud detection now fail in the face of the ever-evolving strategies employed by cunning fraudsters. Nevertheless, observe the disruptive power of generative AI! Observe the emergence of sophisticated algorithms that continuously learn and adapt to fraudulent patterns. With their insatiable appetite for data, these algorithms detect suspicious transactions or activities with unrivaled accuracy, forming an impregnable shield to protect businesses and consumers from potential losses.

Credit Scoring and Insurance

Observe the transformation of creditworthiness evaluation as it occurs before your eyes. Credit assessment and underwriting, formerly constrained by limited data points and laborious manual processes, undergo a radical transformation. In the domain of AI integration, financial institutions bask in the grandeur of sophisticated algorithms capable of harnessing immense datasets and even venturing into the realms of unconventional data sources. Behold the emergence of a more comprehensive and accurate evaluation of creditworthiness, which expedites loan approval procedures while minimizing risks.

Sentiment Analysis Released

Explore the domains of sentiment monitoring, where the fintech industry is undergoing a revolutionary transformation. Observe as the powerful NLP algorithms emerge, equipped to analyze vast amounts of textual data. Customer feedback, social media posts, and online evaluations are woven into a magnificent tapestry that accurately depicts sentiment. Through this miraculous prism, financial institutions are able to gain invaluable insights into their customers' very souls. Armed with this knowledge, they skillfully customize their products and services, creating an experience that is unparalleled. Customer gratification reverberates, paving the way for prosperous business growth.

Voice Recognition

Cast off the shackles of antiquated authentication techniques and immerse yourself in the world of voice recognition technology. The seamless interweaving of generative AI algorithms unravels the mystery of customer identities through voice biometrics. A symphony of secure and convenient authentication is replacing the era of burdensome passwords and PINs. As the digital landscape rapidly evolves, the pursuit of seamless and secure authentication becomes increasingly crucial. Voice recognition emerges as the virtuoso in this innovation symphony, composing a masterpiece for fintech companies.

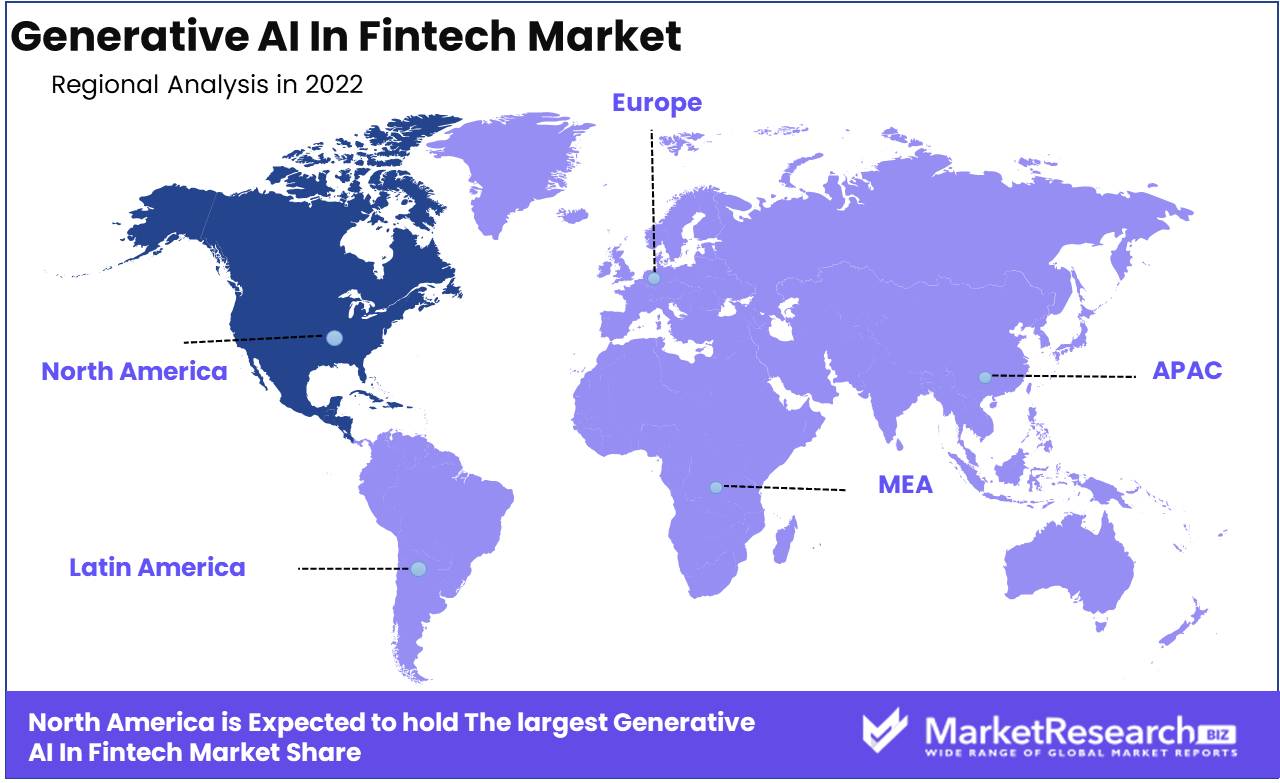

Regional Analysis

Generative AI In Fintech Market Is Dominated By North America. In the world of fast-paced financial technology, one technology has been creating waves: Generative AI. With its ability to generate, learn, and adapt, revolutionizing Generative AI In Fintech Market. In this Report, we will delve into North America's dominance in the Generative AI space and investigate the reasons for this remarkable accomplishment.

Due to a confluence of factors, North America has become a leader in the field of Generative AI. Together, visionary research institutions, cutting-edge technology firms, and a thriving start-up ecosystem have created an environment conducive to innovation. This has resulted in the development of revolutionary technologies that have placed North American companies at the vanguard of the revolution in Generative AI.

A flourishing culture of research and development is one of the primary factors for North America's preeminence. MIT, Stanford, and UC Berkeley have consistently produced ground-breaking research in the field of artificial intelligence. These research institutions foster a culture of innovation and exploration by attracting brilliant minds from around the world.

The robust funding and investment climate in North America has fueled the development of Generative AI in the fintech industry. Venture capital firms and angel investors actively seek out promising startups, providing them with the means to develop and scale innovative solutions. This influx of capital has enabled companies in North America to stretch the limits of what is possible with Generative AI.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

IBM Watson is a significant participant in the application of generative AI to the fintech market. IBM Watson's sophisticated natural language processing and machine learning capabilities have allowed it to create chatbots and virtual assistants that can comprehend and respond to complex financial queries. These intelligent virtual assistants can assist customers with account information, payments, and investment advice, among other duties.

Nvidia, a leader in GPU-based hardware and software solutions, is another significant participant in the industry. GPUs from Nvidia are designed to accelerate deep learning algorithms, making them ideal for generative AI applications. Diverse fintech companies are utilizing their technology to develop and deploy AI models capable of generating personalized investment strategies, fraud detection algorithms, and risk assessment models.

Alpaca and ForwardLane are also utilizing generative AI to revolutionize the fintech market. Alpaca, for example, offers a stock trading platform powered by AI that enables users to develop and deploy their own trading algorithms. ForwardLane, on the other hand, employs generative AI to provide wealth managers and financial advisors with personalized investment recommendations, enabling them to provide customized financial advice to their clients.

Top Key Players in Generative AI In Fintech Market

- Open AI

- Microsoft Corporation Company Profile

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- Air Products & Chemicals, Inc. Company Profile

- Other Key Players

Recent Development

- In 2023, Bank of America and Palantir's fraud detection system will use machine learning to analyze vast amounts of data and continuously learn from patterns. This will allow the system to identify suspicious activities and minimize financial fraud occurrences.

- In 2022, PayPal and Stripe's payment processing system will use machine learning algorithms to detect and prevent unauthorized activities. This will help to keep users' financial information safe and secure during online transactions.

- In 2022, Square and Affirm's lending platform will use machine learning to accurately assess the creditworthiness of borrowers. This will make it easier for individuals and businesses to get the credit they need, when they need it.

- In 2021, Chime and Sense Financial's financial management app will use machine learning to provide users with personalized budgeting tools and real-time spending tracking. This will help users to make informed financial decisions and stay on top of their finances.

Report Scope:

Report Features Description Market Value (2022) USD 865.0 Mn Forecast Revenue (2032) USD 6,256.2 Mn CAGR (2023-2032) 22.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Component (Service, Software)

Based on Deployment (On-Premises, Cloud)

Based on Application (Credit Scoring, Compliance & Fraud Detection, Personal Assistants, Digital assistants, Financial assistants, Asset Management, Predictive Analysis, Insurance, Debt Collection, Business Analytics & Reporting, Customer Behavioral Analytics)

Based on End-Use Industry (Retail Banking, Investment Banking, Stock Trading Firms, Hedge Funds, Other Industries)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Open AI, Microsoft Corporation Company Profile, Google LLC, Genie AI Ltd., IBM Corporation, MOSTLY AI Inc., Veesual AI, Adobe Inc., Synthesis AI, Air Products & Chemicals, Inc. Company Profile, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Generative AI In Fintech Market Overview

- 2.1. Generative AI In Fintech Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Generative AI In Fintech Market Dynamics

- 3. Global Generative AI In Fintech Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Generative AI In Fintech Market Analysis, 2016-2021

- 3.2. Global Generative AI In Fintech Market Opportunity and Forecast, 2023-2032

- 3.3. Global Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Component, 2016-2032

- 3.3.1. Global Generative AI In Fintech Market Analysis by Based on Component: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Component, 2016-2032

- 3.3.3. Service

- 3.3.4. Software

- 3.4. Global Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Deployment, 2016-2032

- 3.4.1. Global Generative AI In Fintech Market Analysis by Based on Deployment: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Deployment, 2016-2032

- 3.4.3. On-Premises

- 3.4.4. Cloud

- 3.5. Global Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Application, 2016-2032

- 3.5.1. Global Generative AI In Fintech Market Analysis by Based on Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Application, 2016-2032

- 3.5.3. Credit Scoring

- 3.5.4. Compliance & Fraud Detection

- 3.5.5. Personal Assistants

- 3.5.6. Digital assistants

- 3.5.7. Financial assistants

- 3.5.8. Asset Management

- 3.5.9. Predictive Analysis

- 3.5.10. Insurance

- 3.5.11. Debt Collection

- 3.5.12. Business Analytics & Reporting

- 3.5.13. Customer Behavioral Analytics

- 3.6. Global Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on End-Use Industry, 2016-2032

- 3.6.1. Global Generative AI In Fintech Market Analysis by Based on End-Use Industry: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on End-Use Industry, 2016-2032

- 3.6.3. Retail Banking

- 3.6.4. Investment Banking

- 3.6.5. Stock Trading Firms

- 3.6.6. Hedge Funds

- 3.6.7. Other Industries

- 4. North America Generative AI In Fintech Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Generative AI In Fintech Market Analysis, 2016-2021

- 4.2. North America Generative AI In Fintech Market Opportunity and Forecast, 2023-2032

- 4.3. North America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Component, 2016-2032

- 4.3.1. North America Generative AI In Fintech Market Analysis by Based on Component: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Component, 2016-2032

- 4.3.3. Service

- 4.3.4. Software

- 4.4. North America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Deployment, 2016-2032

- 4.4.1. North America Generative AI In Fintech Market Analysis by Based on Deployment: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Deployment, 2016-2032

- 4.4.3. On-Premises

- 4.4.4. Cloud

- 4.5. North America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Application, 2016-2032

- 4.5.1. North America Generative AI In Fintech Market Analysis by Based on Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Application, 2016-2032

- 4.5.3. Credit Scoring

- 4.5.4. Compliance & Fraud Detection

- 4.5.5. Personal Assistants

- 4.5.6. Digital assistants

- 4.5.7. Financial assistants

- 4.5.8. Asset Management

- 4.5.9. Predictive Analysis

- 4.5.10. Insurance

- 4.5.11. Debt Collection

- 4.5.12. Business Analytics & Reporting

- 4.5.13. Customer Behavioral Analytics

- 4.6. North America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on End-Use Industry, 2016-2032

- 4.6.1. North America Generative AI In Fintech Market Analysis by Based on End-Use Industry: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on End-Use Industry, 2016-2032

- 4.6.3. Retail Banking

- 4.6.4. Investment Banking

- 4.6.5. Stock Trading Firms

- 4.6.6. Hedge Funds

- 4.6.7. Other Industries

- 4.7. North America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Generative AI In Fintech Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Generative AI In Fintech Market Analysis, 2016-2021

- 5.2. Western Europe Generative AI In Fintech Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Component, 2016-2032

- 5.3.1. Western Europe Generative AI In Fintech Market Analysis by Based on Component: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Component, 2016-2032

- 5.3.3. Service

- 5.3.4. Software

- 5.4. Western Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Deployment, 2016-2032

- 5.4.1. Western Europe Generative AI In Fintech Market Analysis by Based on Deployment: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Deployment, 2016-2032

- 5.4.3. On-Premises

- 5.4.4. Cloud

- 5.5. Western Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Application, 2016-2032

- 5.5.1. Western Europe Generative AI In Fintech Market Analysis by Based on Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Application, 2016-2032

- 5.5.3. Credit Scoring

- 5.5.4. Compliance & Fraud Detection

- 5.5.5. Personal Assistants

- 5.5.6. Digital assistants

- 5.5.7. Financial assistants

- 5.5.8. Asset Management

- 5.5.9. Predictive Analysis

- 5.5.10. Insurance

- 5.5.11. Debt Collection

- 5.5.12. Business Analytics & Reporting

- 5.5.13. Customer Behavioral Analytics

- 5.6. Western Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on End-Use Industry, 2016-2032

- 5.6.1. Western Europe Generative AI In Fintech Market Analysis by Based on End-Use Industry: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on End-Use Industry, 2016-2032

- 5.6.3. Retail Banking

- 5.6.4. Investment Banking

- 5.6.5. Stock Trading Firms

- 5.6.6. Hedge Funds

- 5.6.7. Other Industries

- 5.7. Western Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Generative AI In Fintech Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Generative AI In Fintech Market Analysis, 2016-2021

- 6.2. Eastern Europe Generative AI In Fintech Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Component, 2016-2032

- 6.3.1. Eastern Europe Generative AI In Fintech Market Analysis by Based on Component: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Component, 2016-2032

- 6.3.3. Service

- 6.3.4. Software

- 6.4. Eastern Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Deployment, 2016-2032

- 6.4.1. Eastern Europe Generative AI In Fintech Market Analysis by Based on Deployment: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Deployment, 2016-2032

- 6.4.3. On-Premises

- 6.4.4. Cloud

- 6.5. Eastern Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Application, 2016-2032

- 6.5.1. Eastern Europe Generative AI In Fintech Market Analysis by Based on Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Application, 2016-2032

- 6.5.3. Credit Scoring

- 6.5.4. Compliance & Fraud Detection

- 6.5.5. Personal Assistants

- 6.5.6. Digital assistants

- 6.5.7. Financial assistants

- 6.5.8. Asset Management

- 6.5.9. Predictive Analysis

- 6.5.10. Insurance

- 6.5.11. Debt Collection

- 6.5.12. Business Analytics & Reporting

- 6.5.13. Customer Behavioral Analytics

- 6.6. Eastern Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on End-Use Industry, 2016-2032

- 6.6.1. Eastern Europe Generative AI In Fintech Market Analysis by Based on End-Use Industry: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on End-Use Industry, 2016-2032

- 6.6.3. Retail Banking

- 6.6.4. Investment Banking

- 6.6.5. Stock Trading Firms

- 6.6.6. Hedge Funds

- 6.6.7. Other Industries

- 6.7. Eastern Europe Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Generative AI In Fintech Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Generative AI In Fintech Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Generative AI In Fintech Market Analysis, 2016-2021

- 7.2. APAC Generative AI In Fintech Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Component, 2016-2032

- 7.3.1. APAC Generative AI In Fintech Market Analysis by Based on Component: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Component, 2016-2032

- 7.3.3. Service

- 7.3.4. Software

- 7.4. APAC Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Deployment, 2016-2032

- 7.4.1. APAC Generative AI In Fintech Market Analysis by Based on Deployment: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Deployment, 2016-2032

- 7.4.3. On-Premises

- 7.4.4. Cloud

- 7.5. APAC Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Application, 2016-2032

- 7.5.1. APAC Generative AI In Fintech Market Analysis by Based on Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Application, 2016-2032

- 7.5.3. Credit Scoring

- 7.5.4. Compliance & Fraud Detection

- 7.5.5. Personal Assistants

- 7.5.6. Digital assistants

- 7.5.7. Financial assistants

- 7.5.8. Asset Management

- 7.5.9. Predictive Analysis

- 7.5.10. Insurance

- 7.5.11. Debt Collection

- 7.5.12. Business Analytics & Reporting

- 7.5.13. Customer Behavioral Analytics

- 7.6. APAC Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on End-Use Industry, 2016-2032

- 7.6.1. APAC Generative AI In Fintech Market Analysis by Based on End-Use Industry: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on End-Use Industry, 2016-2032

- 7.6.3. Retail Banking

- 7.6.4. Investment Banking

- 7.6.5. Stock Trading Firms

- 7.6.6. Hedge Funds

- 7.6.7. Other Industries

- 7.7. APAC Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Generative AI In Fintech Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Generative AI In Fintech Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Generative AI In Fintech Market Analysis, 2016-2021

- 8.2. Latin America Generative AI In Fintech Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Component, 2016-2032

- 8.3.1. Latin America Generative AI In Fintech Market Analysis by Based on Component: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Component, 2016-2032

- 8.3.3. Service

- 8.3.4. Software

- 8.4. Latin America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Deployment, 2016-2032

- 8.4.1. Latin America Generative AI In Fintech Market Analysis by Based on Deployment: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Deployment, 2016-2032

- 8.4.3. On-Premises

- 8.4.4. Cloud

- 8.5. Latin America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Application, 2016-2032

- 8.5.1. Latin America Generative AI In Fintech Market Analysis by Based on Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Application, 2016-2032

- 8.5.3. Credit Scoring

- 8.5.4. Compliance & Fraud Detection

- 8.5.5. Personal Assistants

- 8.5.6. Digital assistants

- 8.5.7. Financial assistants

- 8.5.8. Asset Management

- 8.5.9. Predictive Analysis

- 8.5.10. Insurance

- 8.5.11. Debt Collection

- 8.5.12. Business Analytics & Reporting

- 8.5.13. Customer Behavioral Analytics

- 8.6. Latin America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on End-Use Industry, 2016-2032

- 8.6.1. Latin America Generative AI In Fintech Market Analysis by Based on End-Use Industry: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on End-Use Industry, 2016-2032

- 8.6.3. Retail Banking

- 8.6.4. Investment Banking

- 8.6.5. Stock Trading Firms

- 8.6.6. Hedge Funds

- 8.6.7. Other Industries

- 8.7. Latin America Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Generative AI In Fintech Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Generative AI In Fintech Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Generative AI In Fintech Market Analysis, 2016-2021

- 9.2. Middle East & Africa Generative AI In Fintech Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Component, 2016-2032

- 9.3.1. Middle East & Africa Generative AI In Fintech Market Analysis by Based on Component: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Component, 2016-2032

- 9.3.3. Service

- 9.3.4. Software

- 9.4. Middle East & Africa Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Deployment, 2016-2032

- 9.4.1. Middle East & Africa Generative AI In Fintech Market Analysis by Based on Deployment: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Deployment, 2016-2032

- 9.4.3. On-Premises

- 9.4.4. Cloud

- 9.5. Middle East & Africa Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on Application, 2016-2032

- 9.5.1. Middle East & Africa Generative AI In Fintech Market Analysis by Based on Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on Application, 2016-2032

- 9.5.3. Credit Scoring

- 9.5.4. Compliance & Fraud Detection

- 9.5.5. Personal Assistants

- 9.5.6. Digital assistants

- 9.5.7. Financial assistants

- 9.5.8. Asset Management

- 9.5.9. Predictive Analysis

- 9.5.10. Insurance

- 9.5.11. Debt Collection

- 9.5.12. Business Analytics & Reporting

- 9.5.13. Customer Behavioral Analytics

- 9.6. Middle East & Africa Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Based on End-Use Industry, 2016-2032

- 9.6.1. Middle East & Africa Generative AI In Fintech Market Analysis by Based on End-Use Industry: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based on End-Use Industry, 2016-2032

- 9.6.3. Retail Banking

- 9.6.4. Investment Banking

- 9.6.5. Stock Trading Firms

- 9.6.6. Hedge Funds

- 9.6.7. Other Industries

- 9.7. Middle East & Africa Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Generative AI In Fintech Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Generative AI In Fintech Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Generative AI In Fintech Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Generative AI In Fintech Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Open AI

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Microsoft Corporation Company Profile

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Google LLC

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Genie AI Ltd.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. IBM Corporation

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. MOSTLY AI Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Veesual AI

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Adobe Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Synthesis AI

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Air Products & Chemicals, Inc. Company Profile

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Other Key Players

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Component in 2022

- Figure 2: Global Generative AI In Fintech Market Attractiveness Analysis by Based on Component, 2016-2032

- Figure 3: Global Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Deploymentin 2022

- Figure 4: Global Generative AI In Fintech Market Attractiveness Analysis by Based on Deployment, 2016-2032

- Figure 5: Global Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Applicationin 2022

- Figure 6: Global Generative AI In Fintech Market Attractiveness Analysis by Based on Application, 2016-2032

- Figure 7: Global Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on End-Use Industryin 2022

- Figure 8: Global Generative AI In Fintech Market Attractiveness Analysis by Based on End-Use Industry, 2016-2032

- Figure 9: Global Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Generative AI In Fintech Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Figure 14: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Figure 15: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Figure 16: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Figure 17: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Figure 19: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Figure 20: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Figure 21: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Figure 22: Global Generative AI In Fintech Market Share Comparison by Region (2016-2032)

- Figure 23: Global Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Figure 24: Global Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Figure 25: Global Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Figure 26: Global Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Figure 27: North America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Componentin 2022

- Figure 28: North America Generative AI In Fintech Market Attractiveness Analysis by Based on Component, 2016-2032

- Figure 29: North America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Deploymentin 2022

- Figure 30: North America Generative AI In Fintech Market Attractiveness Analysis by Based on Deployment, 2016-2032

- Figure 31: North America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Applicationin 2022

- Figure 32: North America Generative AI In Fintech Market Attractiveness Analysis by Based on Application, 2016-2032

- Figure 33: North America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on End-Use Industryin 2022

- Figure 34: North America Generative AI In Fintech Market Attractiveness Analysis by Based on End-Use Industry, 2016-2032

- Figure 35: North America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Generative AI In Fintech Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Figure 40: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Figure 41: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Figure 42: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Figure 43: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Figure 45: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Figure 46: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Figure 47: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Figure 48: North America Generative AI In Fintech Market Share Comparison by Country (2016-2032)

- Figure 49: North America Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Figure 50: North America Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Figure 51: North America Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Figure 52: North America Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Figure 53: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Componentin 2022

- Figure 54: Western Europe Generative AI In Fintech Market Attractiveness Analysis by Based on Component, 2016-2032

- Figure 55: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Deploymentin 2022

- Figure 56: Western Europe Generative AI In Fintech Market Attractiveness Analysis by Based on Deployment, 2016-2032

- Figure 57: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Applicationin 2022

- Figure 58: Western Europe Generative AI In Fintech Market Attractiveness Analysis by Based on Application, 2016-2032

- Figure 59: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on End-Use Industryin 2022

- Figure 60: Western Europe Generative AI In Fintech Market Attractiveness Analysis by Based on End-Use Industry, 2016-2032

- Figure 61: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Generative AI In Fintech Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Figure 66: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Figure 67: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Figure 68: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Figure 69: Western Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Figure 71: Western Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Figure 72: Western Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Figure 73: Western Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Figure 74: Western Europe Generative AI In Fintech Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Figure 76: Western Europe Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Figure 77: Western Europe Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Figure 78: Western Europe Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Figure 79: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Componentin 2022

- Figure 80: Eastern Europe Generative AI In Fintech Market Attractiveness Analysis by Based on Component, 2016-2032

- Figure 81: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Deploymentin 2022

- Figure 82: Eastern Europe Generative AI In Fintech Market Attractiveness Analysis by Based on Deployment, 2016-2032

- Figure 83: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Applicationin 2022

- Figure 84: Eastern Europe Generative AI In Fintech Market Attractiveness Analysis by Based on Application, 2016-2032

- Figure 85: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on End-Use Industryin 2022

- Figure 86: Eastern Europe Generative AI In Fintech Market Attractiveness Analysis by Based on End-Use Industry, 2016-2032

- Figure 87: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Generative AI In Fintech Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Figure 92: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Figure 93: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Figure 94: Eastern Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Figure 95: Eastern Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Figure 97: Eastern Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Figure 98: Eastern Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Figure 99: Eastern Europe Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Figure 100: Eastern Europe Generative AI In Fintech Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Figure 102: Eastern Europe Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Figure 103: Eastern Europe Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Figure 104: Eastern Europe Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Figure 105: APAC Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Componentin 2022

- Figure 106: APAC Generative AI In Fintech Market Attractiveness Analysis by Based on Component, 2016-2032

- Figure 107: APAC Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Deploymentin 2022

- Figure 108: APAC Generative AI In Fintech Market Attractiveness Analysis by Based on Deployment, 2016-2032

- Figure 109: APAC Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Applicationin 2022

- Figure 110: APAC Generative AI In Fintech Market Attractiveness Analysis by Based on Application, 2016-2032

- Figure 111: APAC Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on End-Use Industryin 2022

- Figure 112: APAC Generative AI In Fintech Market Attractiveness Analysis by Based on End-Use Industry, 2016-2032

- Figure 113: APAC Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Generative AI In Fintech Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Figure 118: APAC Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Figure 119: APAC Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Figure 120: APAC Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Figure 121: APAC Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Figure 123: APAC Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Figure 124: APAC Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Figure 125: APAC Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Figure 126: APAC Generative AI In Fintech Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Figure 128: APAC Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Figure 129: APAC Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Figure 130: APAC Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Figure 131: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Componentin 2022

- Figure 132: Latin America Generative AI In Fintech Market Attractiveness Analysis by Based on Component, 2016-2032

- Figure 133: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Deploymentin 2022

- Figure 134: Latin America Generative AI In Fintech Market Attractiveness Analysis by Based on Deployment, 2016-2032

- Figure 135: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Applicationin 2022

- Figure 136: Latin America Generative AI In Fintech Market Attractiveness Analysis by Based on Application, 2016-2032

- Figure 137: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on End-Use Industryin 2022

- Figure 138: Latin America Generative AI In Fintech Market Attractiveness Analysis by Based on End-Use Industry, 2016-2032

- Figure 139: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Generative AI In Fintech Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Figure 144: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Figure 145: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Figure 146: Latin America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Figure 147: Latin America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Figure 149: Latin America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Figure 150: Latin America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Figure 151: Latin America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Figure 152: Latin America Generative AI In Fintech Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Figure 154: Latin America Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Figure 155: Latin America Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Figure 156: Latin America Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Figure 157: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Componentin 2022

- Figure 158: Middle East & Africa Generative AI In Fintech Market Attractiveness Analysis by Based on Component, 2016-2032

- Figure 159: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Deploymentin 2022

- Figure 160: Middle East & Africa Generative AI In Fintech Market Attractiveness Analysis by Based on Deployment, 2016-2032

- Figure 161: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on Applicationin 2022

- Figure 162: Middle East & Africa Generative AI In Fintech Market Attractiveness Analysis by Based on Application, 2016-2032

- Figure 163: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Based on End-Use Industryin 2022

- Figure 164: Middle East & Africa Generative AI In Fintech Market Attractiveness Analysis by Based on End-Use Industry, 2016-2032

- Figure 165: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Generative AI In Fintech Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Figure 170: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Figure 171: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Figure 172: Middle East & Africa Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Figure 173: Middle East & Africa Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Figure 175: Middle East & Africa Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Figure 176: Middle East & Africa Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Figure 177: Middle East & Africa Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Figure 178: Middle East & Africa Generative AI In Fintech Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Figure 180: Middle East & Africa Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Figure 181: Middle East & Africa Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Figure 182: Middle East & Africa Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- List of Tables

- Table 1: Global Generative AI In Fintech Market Comparison by Based on Component (2016-2032)

- Table 2: Global Generative AI In Fintech Market Comparison by Based on Deployment (2016-2032)

- Table 3: Global Generative AI In Fintech Market Comparison by Based on Application (2016-2032)

- Table 4: Global Generative AI In Fintech Market Comparison by Based on End-Use Industry (2016-2032)

- Table 5: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Table 9: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Table 10: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Table 11: Global Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Table 12: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Table 14: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Table 15: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Table 16: Global Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Table 17: Global Generative AI In Fintech Market Share Comparison by Region (2016-2032)

- Table 18: Global Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Table 19: Global Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Table 20: Global Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Table 21: Global Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Table 22: North America Generative AI In Fintech Market Comparison by Based on Deployment (2016-2032)

- Table 23: North America Generative AI In Fintech Market Comparison by Based on Application (2016-2032)

- Table 24: North America Generative AI In Fintech Market Comparison by Based on End-Use Industry (2016-2032)

- Table 25: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Table 29: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Table 30: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)

- Table 31: North America Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on End-Use Industry (2016-2032)

- Table 32: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Component (2016-2032)

- Table 34: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Deployment (2016-2032)

- Table 35: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on Application (2016-2032)

- Table 36: North America Generative AI In Fintech Market Y-o-Y Growth Rate Comparison by Based on End-Use Industry (2016-2032)

- Table 37: North America Generative AI In Fintech Market Share Comparison by Country (2016-2032)

- Table 38: North America Generative AI In Fintech Market Share Comparison by Based on Component (2016-2032)

- Table 39: North America Generative AI In Fintech Market Share Comparison by Based on Deployment (2016-2032)

- Table 40: North America Generative AI In Fintech Market Share Comparison by Based on Application (2016-2032)

- Table 41: North America Generative AI In Fintech Market Share Comparison by Based on End-Use Industry (2016-2032)

- Table 42: Western Europe Generative AI In Fintech Market Comparison by Based on Component (2016-2032)

- Table 43: Western Europe Generative AI In Fintech Market Comparison by Based on Deployment (2016-2032)

- Table 44: Western Europe Generative AI In Fintech Market Comparison by Based on Application (2016-2032)

- Table 45: Western Europe Generative AI In Fintech Market Comparison by Based on End-Use Industry (2016-2032)

- Table 46: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Component (2016-2032)

- Table 50: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Deployment (2016-2032)

- Table 51: Western Europe Generative AI In Fintech Market Revenue (US$ Mn) Comparison by Based on Application (2016-2032)