Generative AI in Corporate Tax Management Market By Component (Services, Software), By Deployment Mode (Cloud, On-premises), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Tax Compliance, Tax Controversy Management, and Others), By Industry Vertical (Banking, Financial Services, and Insurance (BFSI), and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50735

-

Aug 2024

-

304

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Component Analysis

- By Deployment Mode Analysis

- By Enterprise Size Analysis

- By Application Analysis

- By Industry Vertical Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

The Global Generative AI in Corporate Tax Management Market was valued at USD 1.4 Bn in 2023. It is expected to reach USD 16.9 Bn by 2033, with a CAGR of 29.1% during the forecast period from 2024 to 2033.

The Generative AI in Corporate Tax Management Market focuses on the application of generative AI technologies to streamline and enhance corporate tax processes. This market includes AI-driven solutions for tasks such as document analysis, data extraction, compliance checks, and report generation. The growing complexity of tax regulations and the increasing demand for accuracy and efficiency in tax management are driving the adoption of generative AI in this field. As organizations seek to optimize tax strategies and reduce compliance risks, the market is poised for significant growth, offering innovative tools that transform traditional tax management practices.

The Generative AI in Corporate Tax Management Market is on the cusp of significant transformation as organizations increasingly turn to AI-driven solutions to navigate the complexities of corporate tax compliance and optimization. The integration of generative AI into tax management processes is not just a trend but a strategic move, aimed at enhancing accuracy, reducing manual workloads, and ensuring compliance with ever-evolving tax regulations. For instance, a 2024 survey revealed that 81% of professionals recognize the applicability of generative AI to their work, underscoring the growing confidence in AI’s role in corporate tax functions.

The Generative AI in Corporate Tax Management Market is on the cusp of significant transformation as organizations increasingly turn to AI-driven solutions to navigate the complexities of corporate tax compliance and optimization. The integration of generative AI into tax management processes is not just a trend but a strategic move, aimed at enhancing accuracy, reducing manual workloads, and ensuring compliance with ever-evolving tax regulations. For instance, a 2024 survey revealed that 81% of professionals recognize the applicability of generative AI to their work, underscoring the growing confidence in AI’s role in corporate tax functions.In the UK, 10% of tax practitioners have already incorporated generative AI into their daily operations, leveraging its capabilities for document analysis, data extraction, and report generation. These tasks, traditionally time-consuming and prone to human error, are now being streamlined through AI, resulting in more efficient and accurate tax management. The ability of generative AI to process vast amounts of data, identify patterns, and generate insights is proving invaluable in managing complex tax scenarios and ensuring compliance across multiple jurisdictions.

As the demand for generative AI in corporate tax management continues to rise, driven by the need for greater efficiency and precision, we can expect to see further advancements in AI capabilities tailored specifically for tax applications. Companies that adopt these AI-driven solutions will not only enhance their tax management processes but also gain a competitive edge by minimizing compliance risks and optimizing tax strategies.

The generative AI in corporate tax management market is poised for robust growth as more organizations recognize the benefits of AI-driven solutions in streamlining tax processes. The increasing adoption of AI by tax professionals highlights the significant impact this technology is having on the industry, setting the stage for continued innovation and efficiency gains in corporate tax management.

Key Takeaways

- By Component: Software dominates with 65%, essential for automating and optimizing tax management processes.

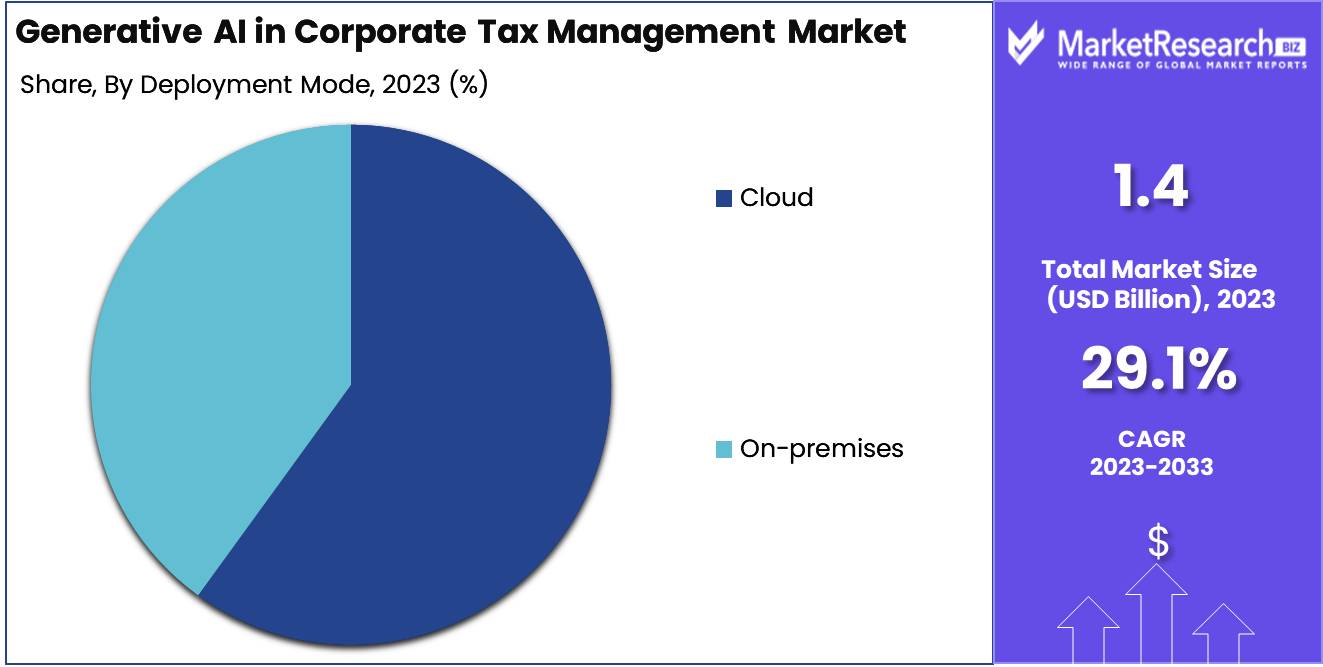

- By Deployment Mode: Cloud constitutes 60%, offering scalability and real-time updates for tax management.

- By Enterprise Size: Large Enterprises represent 55%, utilizing AI to manage complex tax compliance requirements.

- By Application: Tax Compliance makes up 40%, highlighting the importance of AI in ensuring regulatory adherence.

- By Industry Vertical: Banking, Financial Services, and Insurance (BFSI) accounts for 35%, leveraging AI for accurate and efficient tax management.

- Regional Dominance: North America holds a 40% market share, driven by stringent tax regulations and the need for compliance automation.

- Growth Opportunity: Expanding AI capabilities in predictive tax analytics can help companies optimize tax strategies and enhance compliance.

Driving factors

Navigating the Complexity of Global Tax Regulations Fuels Market Growth

The complexity of global tax regulations is a significant driver of growth in the generative AI in corporate tax management market. Multinational corporations face an increasingly intricate web of tax laws that vary by country, region, and even by local jurisdiction. Keeping track of these regulations, ensuring compliance, and optimizing tax strategies require a sophisticated approach that traditional methods struggle to provide.

Generative AI offers a solution by automating the analysis of vast amounts of regulatory data, enabling companies to quickly adapt to changes in tax laws and ensure compliance across multiple jurisdictions. This capability is critical for businesses looking to mitigate risks associated with tax audits, penalties, and reputational damage, thereby driving the adoption of AI-driven tax management solutions.

Rising Demand for Automation in Tax Planning Accelerates Market Adoption

The growing demand for automation in tax planning is another key factor contributing to the expansion of the generative AI in corporate tax management market. As companies seek to streamline their tax processes, reduce manual errors, and enhance efficiency, the adoption of AI-powered tools for tax planning becomes increasingly attractive.

Generative AI can automate complex tax planning tasks, such as scenario analysis, risk assessment, and optimization of tax liabilities, allowing tax professionals to focus on strategic decision-making. This shift towards automation not only improves accuracy and compliance but also reduces the time and resources required for tax planning, making AI-driven solutions an essential tool for modern corporate tax management.

Advancements in AI for Tax Calculation Enhance Market Capabilities

Advancements in AI technologies, particularly in the area of tax calculation, are driving significant growth in the generative AI in corporate tax management market. AI algorithms can now handle complex tax calculations with greater speed and accuracy than ever before, taking into account various factors such as tax rates, deductions, credits, and legal changes.

These advancements enable companies to perform real-time tax calculations, forecast tax liabilities, and optimize tax positions with unprecedented precision. As AI continues to evolve, its capabilities in handling increasingly complex tax scenarios will further enhance its value in corporate tax management, driving market growth.

Restraining Factors

High Implementation Costs and Data Security Concerns as Significant Barriers

The growth of the generative AI in corporate tax management market is restrained by the high costs associated with implementing AI-driven solutions and concerns over data security. Deploying generative AI systems for tax management requires significant investment in advanced technology, infrastructure, and integration with existing systems. For many companies, especially small and medium-sized enterprises (SMEs), these high upfront costs can be prohibitive, slowing the adoption of AI-based tax management tools.

The sensitive nature of tax data raises concerns about data security and privacy. Companies are wary of potential breaches and the risks associated with storing and processing sensitive financial information through AI systems. These concerns can lead to hesitation in adopting AI-driven tax solutions, thereby limiting market growth.

Limited AI Expertise Among Tax Professionals as a Restriction on Adoption

Another key restraint on the generative AI in corporate tax management market is the limited AI expertise among tax professionals. The integration of AI into corporate tax management requires a deep understanding of both tax laws and AI technologies. However, many tax professionals may lack the technical skills needed to effectively implement and manage AI-driven solutions.

This skills gap can create challenges in adoption, as companies may struggle to find or train personnel capable of leveraging AI tools to their full potential. The lack of AI expertise can also lead to resistance within organizations, as tax professionals may be hesitant to rely on technologies they do not fully understand. This restriction hampers the widespread adoption of generative AI in corporate tax management, slowing market growth.

By Component Analysis

Software components lead the generative AI corporate tax management market with a 65% share.

In 2023, Software held a dominant market position in the "By Component" segment of the Generative AI in Corporate Tax Management Market, capturing more than a 65% share. The increasing complexity of tax regulations and the demand for real-time processing and analysis have driven the adoption of sales tax software solutions in corporate tax management. These software solutions leverage generative AI to automate tax compliance, optimize tax strategies, and ensure accurate reporting, providing businesses with a competitive edge. The scalability, flexibility, and integration capabilities of software have made it the preferred choice for corporations aiming to streamline their tax management processes.The Services segment, which includes consulting, implementation, and maintenance, accounted for a smaller share of the market. However, the demand for specialized services is on the rise as companies seek to tailor their tax management solutions to specific needs and ensure seamless integration with existing financial systems. Despite this growth, the dominance of software solutions is expected to continue as they offer more comprehensive and efficient tools for managing corporate taxes.

By Deployment Mode Analysis

Cloud deployment dominates the market, accounting for 60% of the share.

In 2023, Cloud held a dominant market position in the "By Deployment Mode" segment of the Generative AI in Corporate Tax Management Market, capturing more than a 60% share. The cloud-based deployment model has gained widespread acceptance due to its scalability, flexibility, and cost-effectiveness. Companies are increasingly turning to cloud solutions to manage their corporate tax functions, as these platforms offer easy access to advanced AI tools and real-time data analytics. The ability to update software and apply changes seamlessly across multiple locations has made cloud deployment particularly attractive to large enterprises with complex tax management needs.On-premises solutions, while still relevant for organizations with stringent data security and compliance requirements, represented a smaller share of the market. These solutions provide greater control over data and system configurations, but their adoption is limited by the higher upfront costs and maintenance requirements. As cloud technologies continue to evolve and address security concerns, the shift towards cloud deployment in corporate tax management is expected to accelerate.

By Enterprise Size Analysis

Large enterprises represent 55% of the market.

In 2023, Large Enterprises held a dominant market position in the "By Enterprise Size" segment of the Generative AI in Corporate Tax Management Market, capturing more than a 55% share. Large enterprises, with their extensive operations and complex tax structures, are increasingly adopting generative AI solutions to streamline their tax management processes. The ability to handle vast amounts of data, ensure compliance across multiple jurisdictions, and optimize tax planning strategies has made generative AI software indispensable for large corporations. Additionally, the significant resources available to large enterprises enable them to invest in advanced AI-driven tax management solutions.Small and Medium-sized Enterprises (SMEs), while also recognizing the benefits of AI in tax management, accounted for a smaller share of the market. SMEs often face budget constraints and may lack the in-house expertise required to implement and manage AI-based tax solutions. However, as AI technologies become more accessible and affordable, the adoption of generative AI in tax management among SMEs is expected to grow, particularly as they seek to enhance their competitiveness and ensure compliance with tax regulations.

By Application Analysis

Tax compliance applications lead the market with a 40% share.

In 2023, Tax Compliance held a dominant market position in the "By Application" segment of the Generative AI in Corporate Tax Management Market, capturing more than a 40% share. The increasing complexity of tax laws and the growing scrutiny from tax authorities have made compliance a top priority for corporations. Generative AI solutions are being extensively utilized to automate and streamline compliance processes, ensuring that organizations meet their tax obligations accurately and on time. These solutions also help in identifying potential compliance risks and providing actionable insights to mitigate them, thereby reducing the likelihood of costly penalties.Other applications, such as Tax Planning and Advisory, Tax Reporting, and Tax Controversy Management, also contributed significantly to the market but captured smaller shares. Tax Planning and Advisory services are increasingly using AI to develop optimized tax strategies and enhance decision-making. Tax Reporting tools are critical for preparing accurate and timely tax returns, while Tax Controversy Management focuses on resolving disputes with tax authorities. Despite these advancements, the critical nature of compliance has ensured its leading position in the market, as companies prioritize meeting regulatory requirements.

By Industry Vertical Analysis

The BFSI sector dominates the industry verticals with a 35% share.

In 2023, Banking, Financial Services, and Insurance (BFSI) held a dominant market position in the "By Industry Vertical" segment of the Generative AI in Corporate Tax Management Market, capturing more than a 35% share. The BFSI sector's complex regulatory environment and the need for meticulous tax management have driven the adoption of generative AI solutions. These AI-driven tools assist in automating tax calculations, ensuring compliance with evolving tax laws, and optimizing tax strategies, which are essential for maintaining profitability in a highly competitive industry. The ability to analyze large volumes of financial data in real-time has made generative AI indispensable in the BFSI sector.Other industry verticals, such as Healthcare and Pharmaceuticals, IT and Telecommunications, Manufacturing, and Retail and eCommerce, also adopted generative AI for tax management but on a smaller scale. The Healthcare and Pharmaceuticals sector, driven by the need for compliance with stringent regulations, has seen steady growth in AI adoption. The IT and Telecommunications sector is leveraging AI for its scalability and ability to handle vast data sets. Manufacturing and Retail are using AI to optimize tax planning and reporting, while the Energy and Utilities sector is focused on compliance and tax efficiency. Despite the broad applicability of AI across these sectors, BFSI remains the dominant vertical due to its specific requirements and the complexity of its tax management processes.

Key Market Segments

By Component

- Services

- Software

By Deployment Mode

- Cloud

- On-premises

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Tax Compliance

- Tax Controversy Management

- Tax Planning and Advisory

- Tax Reporting

- Others (Tax Research, Audit Support, etc.)

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Energy and Utilities

- Healthcare and Pharmaceuticals

- IT and Telecommunications

- Manufacturing

- Retail and eCommerce

- Others (Government, Education, Transportation, etc.)

Growth Opportunity

AI-Driven Tax Management Tools for Multinationals as a Key Growth Avenue

In 2024, one of the most significant opportunities for the generative AI in corporate tax management market lies in the development of AI-driven tax management tools tailored for multinational corporations. These companies operate in multiple jurisdictions, each with its own complex tax regulations, making compliance a challenging and resource-intensive task. AI-powered tools that can navigate this complexity, automate cross-border tax calculations, and ensure compliance across different tax regimes are increasingly in demand.

By adopting these solutions, multinationals can streamline their tax management processes, reduce the risk of non-compliance, and optimize their global tax strategies. This growing need for sophisticated tax management tools among multinational corporations is expected to drive substantial growth in the market.

Predictive Analytics for Tax Strategy Enhances Strategic Decision-Making

Another promising opportunity in 2024 is the use of predictive analytics within generative AI tools to enhance tax strategy. Predictive analytics leverages AI to analyze historical data, identify trends, and forecast future tax liabilities. This capability allows companies to proactively manage their tax obligations, optimize their tax positions, and make more informed strategic decisions.

By integrating predictive analytics into their tax management processes, companies can anticipate changes in tax laws, assess potential risks, and develop strategies to minimize tax burdens. The adoption of AI-driven predictive analytics is expected to become a crucial component of corporate tax management, offering companies a competitive edge in navigating an increasingly complex tax landscape.

Latest Trends

Integration of AI with Corporate Finance Systems Enhances Operational Efficiency

In 2024, a key trend in the generative AI in corporate tax management market is the integration of AI with corporate finance systems. As businesses increasingly seek to streamline their financial operations, integrating AI-driven tax management tools with existing enterprise resource planning (ERP) and financial management systems becomes a strategic priority. This integration enables seamless data flow between tax management and other financial functions, allowing for real-time analysis and more accurate tax reporting.

By connecting AI tools directly to corporate finance systems, companies can automate tax calculations, improve compliance, and reduce the risk of errors, ultimately enhancing operational efficiency and accuracy.

AI for Scenario Analysis in Tax Planning Drives Strategic Flexibility

Another significant trend in 2024 is the growing use of AI for scenario analysis in tax planning. Scenario analysis allows companies to evaluate the potential outcomes of different tax strategies under various economic conditions and regulatory environments. Generative AI can quickly simulate multiple tax scenarios, helping businesses identify the most advantageous tax strategies while minimizing risks.

This capability is particularly valuable in a global context, where tax laws are constantly evolving, and companies must adapt to changing circumstances. The use of AI for scenario analysis provides businesses with greater strategic flexibility, enabling them to make informed decisions that align with their financial goals and regulatory requirements.

Regional Analysis

North America dominates the Generative AI in Corporate Tax Management Market with a 40% share.

In 2023, North America held a dominant position in the Generative AI in Corporate Tax Management Market, capturing 40% of the regional market share. This dominance is attributed to the region's advanced adoption of AI technologies, particularly in the finance and tax sectors. The United States, in particular, leads the market with significant investments from both public and private sectors in AI-driven tax management solutions. These solutions leverage generative AI to automate complex tax calculations, optimize compliance processes, and provide predictive insights for strategic tax planning.North America's strong position is also driven by the region's regulatory landscape, which increasingly requires businesses to navigate complex tax codes and compliance requirements. Generative AI helps corporations manage these complexities by offering more accurate and efficient tax solutions, reducing the risk of errors, and ensuring compliance with evolving tax laws. Furthermore, the presence of major technology companies and AI startups in the U.S. and Canada has accelerated the development and adoption of AI tools in corporate tax management, reinforcing the region's leadership.

North America leads the market, Europe and Asia Pacific are also key regions with growing adoption of AI in tax management. In Europe, the focus is on integrating AI with existing enterprise resource planning (ERP) systems to enhance tax management capabilities. Asia Pacific is witnessing a rapid increase in AI adoption across various sectors, including finance, driven by the region's fast-paced digital transformation. However, North America's mature AI ecosystem, coupled with its focus on regulatory compliance, continues to make it the largest market for generative AI in corporate tax management.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the Generative AI in Corporate Tax Management Market is undergoing a transformative phase, driven by key players that are integrating advanced AI technologies into tax management solutions. CCH Tagetik (Wolters Kluwer) and Vertex, Inc. are at the forefront, offering AI-driven tax compliance and reporting solutions that streamline complex tax processes and ensure accuracy. These companies are leveraging AI to automate routine tax tasks, reducing the burden on corporate tax departments and improving compliance.

PwC, Deloitte, and KPMG are leading the market by incorporating generative AI into their tax advisory services, enabling them to offer more predictive and data-driven insights. These firms are focusing on AI-enhanced tax planning and risk management, which are becoming increasingly important as tax regulations evolve globally.

Tech giants like Microsoft, Google Cloud, and Amazon Web Services (AWS) are pivotal in providing the cloud infrastructure and AI tools necessary for building scalable tax management solutions. Their platforms are enabling companies to integrate generative AI into their existing tax systems, offering real-time analytics and reporting capabilities.

The Generative AI in Corporate Tax Management Market in 2024 is characterized by a blend of traditional tax service providers and technology innovators. Together, they are driving the adoption of AI in tax management, offering solutions that enhance accuracy, efficiency, and compliance in an increasingly complex regulatory environment.

Market Key Players

- CCH Tagetik (Wolters Kluwer)

- Infosys

- PwC

- SAP

- Vertex, Inc.

- Deloitte

- Sovos Compliance

- Amazon Web Services (AWS)

- Capgemini

- Intuit

- Oracle

- KPMG

- Google Cloud

- Accenture

- Microsoft

- EY

- IBM

- Wolters Kluwer

- Thomson Reuters

Recent Development

- In January 2024, Deloitte launched a new generative AI tool for corporate tax management, designed to reduce compliance errors by 20% and streamline reporting processes.

- In March 2024, SAP introduced an AI-powered tax management module that integrates with its existing ERP systems, enhancing data processing speed by 25% and improving tax accuracy.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Bn Forecast Revenue (2033) USD 16.9 Bn CAGR (2024-2033) 29.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Services, Software), By Deployment Mode (Cloud, On-premises), By Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Tax Compliance, Tax Controversy Management, Tax Planning and Advisory, Tax Reporting, Others), By Industry Vertical (Banking, Financial Services, and Insurance (BFSI), Energy and Utilities, Healthcare and Pharmaceuticals, IT and Telecommunications, Manufacturing, Retail and eCommerce, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape CCH Tagetik (Wolters Kluwer), Infosys, PwC, SAP, Vertex, Inc., Deloitte, Sovos Compliance, Amazon Web Services (AWS), Capgemini, Intuit, Oracle, KPMG, Google Cloud, Accenture, Microsoft, EY, IBM, Wolters Kluwer, Thomson Reuters Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- CCH Tagetik (Wolters Kluwer)

- Infosys

- PwC

- SAP

- Vertex, Inc.

- Deloitte

- Sovos Compliance

- Amazon Web Services (AWS)

- Capgemini

- Intuit

- Oracle

- KPMG

- Google Cloud

- Accenture

- Microsoft

- EY

- IBM

- Wolters Kluwer

- Thomson Reuters