Cloud Telephony Service Market Report By Service Type (IVR [Interactive Voice Response], ACD [Automatic Call Distributor], Call Recording, Call Conferencing, Voicemail, API Integration, Others), By Organization Size (Small and Medium-sized Enterprises [SMEs], Large Enterprises), By Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud), By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48894

-

July 2024

-

290

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

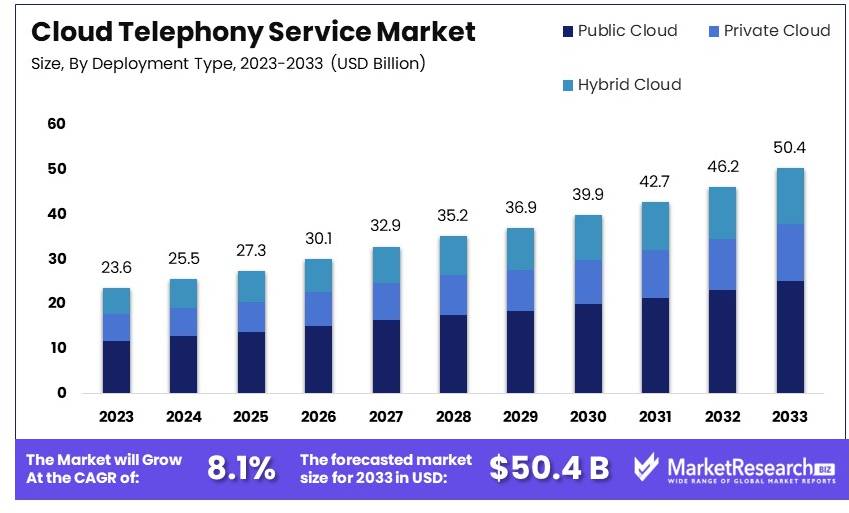

The Global Cloud Telephony Service Market size is expected to be worth around USD 50.4 Billion by 2033, from USD 23.6 Billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

The Cloud Telephony Service Market encompasses technology services that enable voice and data communication functions via the internet instead of through traditional on-premise hardware systems. This market includes services such as virtual phone numbers, voice and SMS APIs, and call management systems, all hosted on cloud infrastructure.

Businesses of all sizes leverage these services for cost efficiency, scalability, and flexibility, allowing them to manage communications without the need for extensive physical networks or hardware. The growth in this market can be attributed to the increasing demand for mobile workforce solutions, the need for robust disaster recovery strategies, and the general shift towards integrated and streamlined business processes. Cloud telephony services are pivotal for companies aiming to enhance their communication capabilities while reducing overhead costs.

The Cloud Telephony Service Market is poised for substantial growth, driven by increased adoption of remote work and the demand for scalable, cost-effective communication solutions. This market segment is witnessing a notable shift from traditional telephony to cloud-based systems, offering enhanced flexibility and integration capabilities.

Recent industry developments underscore this trend. 8x8 Inc. has launched an enterprise-grade cloud telephony solution tailored for Microsoft Teams, enhancing collaboration and communication for businesses. Additionally, Dialpad has expanded its unified communications-as-a-service (UCaaS) offerings through a strategic partnership with MIA Distribution in Australia, indicating a growing global interest and investment in cloud telephony solutions.

The market dynamics are influenced by several factors. The increasing need for seamless communication across diverse locations and devices is a primary driver. Enterprises are prioritizing investments in cloud telephony to support remote and hybrid work environments, ensuring business continuity and operational efficiency. Furthermore, the cost benefits associated with cloud telephony, including reduced infrastructure and maintenance expenses, are encouraging widespread adoption.

Technological advancements are also playing a crucial role in market expansion. The integration of artificial intelligence and machine learning in cloud telephony systems is enhancing functionality, offering features such as advanced call analytics, automated responses, and improved customer service capabilities. These innovations are attracting businesses seeking to leverage technology for competitive advantage.

Key Takeaways

- Market Value: The Cloud Telephony Service Market was valued at USD 23.6 billion in 2023 and is expected to reach USD 50.4 billion by 2033, with a CAGR of 8.1%.

- By Service Type Analysis: IVR leads with 40%; its significance lies in enhancing customer interaction and service automation.

- By Organization Size Analysis: Large Enterprises dominate with 55%; they rely heavily on cloud telephony for scalable and efficient communication solutions.

- By Deployment Type Analysis: Public Cloud leads with 50%; it offers cost-effective and flexible deployment options for businesses.

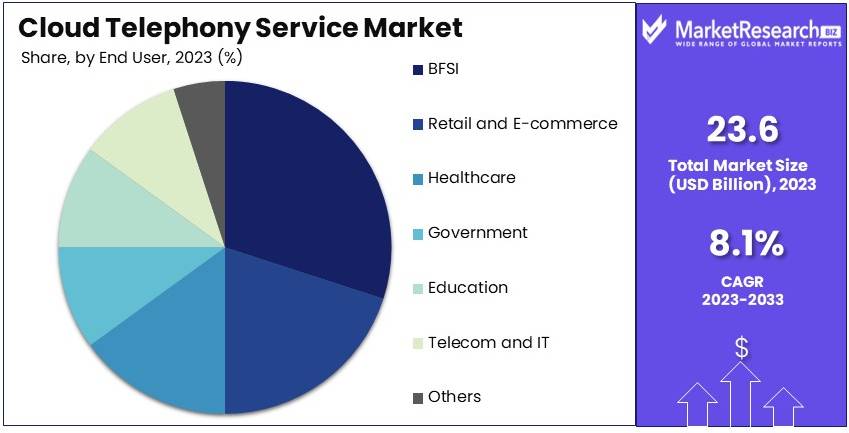

- By End User Analysis: BFSI sector dominates with 30%; this is due to the sector's need for secure and reliable communication systems.

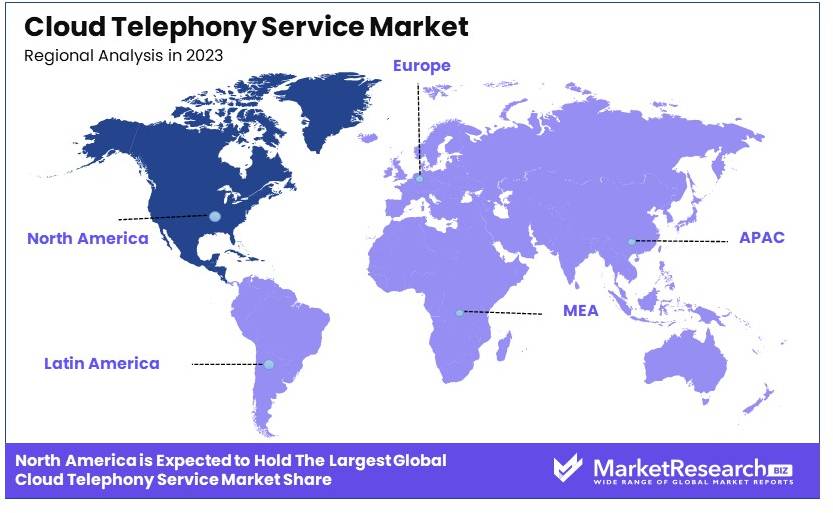

- Dominant Region: North America leads with 36%; this is driven by high technology adoption rates and the presence of major market players.

- High Growth Region: Asia Pacific is projected to show significant growth, attributed to the rapid digital transformation and increasing SME adoption.

- Analyst Viewpoint: The cloud telephony service market is rapidly growing with high competition. Future trends indicate robust demand from large enterprises and technological advancements.

- Growth Opportunities: Key players can capitalize on the increasing shift towards hybrid cloud solutions and enhance offerings through AI integration for better service delivery.

Driving Factors

Increasing Adoption of Cloud-Based Solutions Drives Market Growth

The transition to cloud-based solutions is a key driver in the expansion of the cloud telephony service market. Businesses are increasingly drawn to the scalability, cost-effectiveness, and ease of deployment of cloud infrastructure services. Cloud telephony services offer the distinct advantage of allowing businesses to adjust their communication resources to match their current needs, enhancing their ability to respond to business dynamics efficiently.

This adaptability is particularly appealing to both emerging startups and established enterprises, leading to widespread adoption. Companies like Twilio and RingCentral have experienced substantial growth by delivering versatile cloud-based communication platforms suitable for varied business sizes, demonstrating the robust demand in this sector.

Proliferation of Mobile Devices and Remote Workforce Drives Market Growth

The surge in mobile device usage and the shift towards remote work are significantly impacting the cloud telephony service market. These trends have heightened the need for services that support seamless communication across diverse geographic locations.

Cloud telephony bridges this gap by facilitating consistent and integrated communication capabilities, encompassing voice, video, and messaging. Solutions like Zoom and Microsoft Teams have thrived by offering cloud-based services that cater to the demands of a mobile and dispersed workforce, thus propelling market growth as businesses seek efficient ways to maintain connectivity and collaboration.

Cost Savings and Operational Efficiency Drives Market Growth

Cloud telephony services are transforming business communication models by eliminating the necessity for expensive on-premises infrastructure. This shift not only reduces capital expenditure but also minimizes ongoing maintenance costs, translating into considerable financial savings for businesses.

Moreover, cloud telephony enhances operational efficiency through advanced features such as call routing, interactive voice response (IVR), and sophisticated call analytics. This dual benefit of cost reduction and improved operational capabilities has made cloud telephony services increasingly popular. Providers like Amazon Connect and Vonage are capitalizing on this trend by offering economically efficient and feature-rich solutions, thereby driving further adoption and market growth.

Restraining Factors

Dependence on Reliable Internet Connectivity Restrains Market Growth

Cloud telephony services require stable and high-speed internet connectivity. Disruptions or outages can severely affect communication quality and reliability. Businesses in areas with poor internet infrastructure face significant challenges.

Natural disasters or emergencies can also disrupt internet connectivity, impacting cloud telephony services. This dependency on reliable internet can deter businesses from adopting these services, limiting market growth. In regions with inadequate internet infrastructure, businesses may hesitate to rely on cloud-based communication, slowing the market expansion.

Integration Challenges with Legacy Systems Restrain Market Growth

Integrating cloud telephony with existing on-premises systems or legacy applications can be complex. Compatibility issues and data migration challenges increase implementation costs and extend the adoption process.

Customization needs further complicate the integration, discouraging businesses with significant investments in legacy systems from fully embracing cloud telephony services. These integration challenges make businesses cautious about switching to cloud-based solutions, hindering the market growth. Ensuring smooth integration and reducing associated costs are crucial to encourage broader adoption.

Service Type Analysis

IVR (Interactive Voice Response) dominates with 40% due to its efficiency and cost-effectiveness.

The Cloud Telephony Service Market is segmented by service type into IVR, ACD, Call Recording, Call Conferencing, Voicemail, API Integration, and Others. IVR systems automate interactions with telephone callers, routing calls efficiently without human intervention. This service's popularity stems from its ability to enhance customer experience while reducing operational costs. Businesses can manage high call volumes effectively, which is crucial in sectors like retail and BFSI. The technology's integration with CRM systems enables personalized customer interactions, further driving its adoption. Innovations in AI have enhanced IVR capabilities, making interactions more intuitive and improving customer satisfaction.

Other segments, like ACD and Call Recording, play significant roles. ACD systems ensure calls are distributed to the most suitable agent, improving service quality and efficiency. Call Recording is vital for compliance and quality assurance in sectors such as finance and healthcare. Call Conferencing has seen a surge due to the rise in remote work, allowing seamless communication among geographically dispersed teams. Voicemail remains essential for businesses, providing a reliable way to capture missed calls. API Integration facilitates seamless connectivity between telephony services and business applications, enhancing functionality and user experience. Collectively, these services contribute to the market's growth by addressing diverse business needs.

Organization Size Analysis

Large Enterprises dominate with 55% due to extensive customer bases and higher call volumes.

The market by organization size is divided into Small and Medium-sized Enterprises (SMEs) and Large Enterprises. Large enterprises leverage cloud telephony to manage vast communication networks efficiently. These organizations require robust, scalable solutions to handle large volumes of customer interactions across multiple channels. Cloud telephony offers flexibility, enabling businesses to scale operations up or down based on demand. Cost savings from reduced infrastructure investments and maintenance costs are significant drivers for large enterprises adopting these services. Additionally, advanced features like analytics and reporting tools help these enterprises gain insights into customer behavior and operational performance.

SMEs also contribute significantly to market growth. Cloud telephony provides them with access to advanced communication tools without the need for substantial capital expenditure. This technology levels the playing field, allowing SMEs to compete with larger counterparts. The ability to enhance customer service, improve internal communication, and integrate with other business systems makes cloud telephony attractive to SMEs. As more SMEs embrace digital transformation, their adoption of cloud telephony services is expected to rise, further driving market expansion.

Deployment Type Analysis

Public Cloud dominates with 50% due to its cost-effectiveness and scalability.

The market is segmented by deployment type into Public Cloud, Private Cloud, and Hybrid Cloud. Public cloud deployment offers several advantages, including reduced upfront costs, easy scalability, and flexibility. Businesses of all sizes can access cutting-edge telephony services without significant investments in hardware. Public cloud solutions are maintained by service providers, ensuring high availability and continuous updates. This deployment model is particularly attractive to SMEs and startups looking for affordable, scalable communication solutions. The increasing availability of high-speed internet and advancements in cloud technology further drive the adoption of public cloud telephony.

Private Cloud and Hybrid Cloud deployments also play crucial roles. Private cloud solutions cater to organizations with stringent security and compliance requirements. These deployments offer enhanced control and customization, making them ideal for sectors like BFSI and healthcare. Hybrid Cloud combines the best of both worlds, providing the flexibility of the public cloud while maintaining the security of the private cloud. This model is gaining traction among enterprises seeking a balanced approach to cloud telephony. The hybrid cloud enables seamless integration of on-premises infrastructure with cloud resources, supporting diverse business needs and ensuring business continuity.

End User Analysis

BFSI dominates with 30% due to high demand for secure and efficient communication solutions.

The end user segments in the market include BFSI, Retail and E-commerce, Healthcare, Government, Education, Telecom and IT, and Others. The BFSI sector relies heavily on cloud telephony for efficient customer service, fraud detection, and secure communications. The need for reliable, scalable solutions to handle large volumes of customer interactions drives adoption in this sector. Cloud telephony provides advanced features like call analytics, automated customer support, and seamless integration with banking applications, enhancing customer experience and operational efficiency. The regulatory compliance capabilities of cloud telephony are crucial for BFSI, ensuring secure and compliant communication channels.

Other sectors also contribute to market growth. Retail and E-commerce use cloud telephony to manage customer inquiries, support sales, and streamline operations. The rise of online shopping has increased the demand for efficient customer service solutions. Healthcare providers utilize cloud telephony for patient communication, appointment scheduling, and telemedicine services. Government and education sectors benefit from improved communication, enabling better service delivery and collaboration. Telecom and IT companies leverage cloud telephony to enhance customer support and manage internal communication. These diverse applications underscore the broad appeal and versatility of cloud telephony services, driving market expansion across multiple industries.

Key Market Segments

By Service Type

- IVR (Interactive Voice Response)

- ACD (Automatic Call Distributor)

- Call Recording

- Call Conferencing

- Voicemail

- API Integration

- Others

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Deployment Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End User

- BFSI (Banking, Financial Services, and Insurance)

- Retail and E-commerce

- Healthcare

- Government

- Education

- Telecom and IT

- Others

Growth Opportunities

Advancements in Artificial Intelligence and Analytics Offer Growth Opportunity

The integration of artificial intelligence (AI) and advanced analytics into cloud telephony services is transforming how businesses interact with their customers. AI-driven features such as intelligent call routing, voice recognition, and sentiment analysis not only enhance the customer experience but also provide businesses with deep insights into customer behaviors and preferences.

Companies like Google Cloud and Amazon Web Services are at the forefront, developing solutions that leverage their robust AI capabilities to optimize communication processes. These advancements allow businesses to streamline operations and offer personalized customer service, thereby increasing efficiency and customer satisfaction. The growth in AI integration is expected to continue, driven by its proven impact on service quality and business intelligence.

Development of Industry-specific Solutions Offers Growth Opportunity

As cloud telephony becomes more prevalent, the demand for solutions tailored to specific industries grows. Service providers have a significant opportunity to expand their market by developing cloud telephony solutions that cater to the unique needs of sectors such as healthcare, finance, retail, and hospitality.

These customized solutions can address industry-specific requirements like compliance, security, and operational efficiency. For instance, in healthcare, cloud telephony can ensure HIPAA compliance and facilitate secure patient communication, while in finance, it can aid in maintaining rigorous data security standards. The tailored approach not only helps in penetrating various verticals but also enhances customer retention and satisfaction by meeting specific operational needs.

Trending Factors

Unified Communications as a Service (UCaaS) Are Trending Factors

Unified Communications as a Service (UCaaS) is rapidly gaining traction as it amalgamates various communication channels—voice, video, messaging, and collaboration tools—into a single, cloud-delivered platform. This trend is driven by the need for seamless communication solutions that enhance productivity and foster collaboration across different geographical locations and departments.

UCaaS solutions are particularly appealing in the remote work era, offering businesses the flexibility and scalability to support a distributed workforce. The convenience and efficiency of UCaaS platforms are expected to drive their adoption further, making them a significant trending factor in the cloud telephony market.

Internet of Things (IoT) Integration Are Trending Factors

Integrating cloud telephony services with the Internet of Things (IoT) enables businesses to unlock innovative applications that enhance operational efficiency and customer service. IoT-enabled cloud telephony can facilitate advanced use cases like asset tracking, remote monitoring, and predictive maintenance.

For example, companies can use IoT solutions to monitor equipment status and use cloud telephony to automatically alert technicians in case of anomalies. This integration not only improves responsiveness but also helps in preventive maintenance, ultimately enhancing service reliability and customer satisfaction. The convergence of IoT and cloud telephony is set to expand, driven by the increasing adoption of IoT across industries and the continuous evolution of cloud technologies.

Regional Analysis

North America Dominates with 36% Market Share in the Cloud Telephony Service Market

North America's substantial 36% share of the cloud telephony service market can be attributed to its advanced IT infrastructure and a high level of business digitization. The presence of leading cloud service providers and a competitive technology sector drive the adoption of cloud telephony services across businesses of all sizes. Additionally, the region's strong focus on customer service and the widespread shift toward remote work environments further amplify the demand for scalable and flexible communication solutions.

The market dynamics in North America are influenced by the widespread acceptance of cloud-based solutions that offer cost efficiency, scalability, and enhanced collaborative features. The increasing integration of AI and machine learning technologies into cloud telephony also boosts its appeal as businesses seek more intelligent communication solutions. Regulatory support for data security and privacy in cloud services reassures businesses and encourages the adoption of cloud telephony.

Regional Market Share Analysis:

- Europe: Captures about 29% of the market. Europe’s growth is supported by its strong regulatory framework for data protection and the increasing adoption of cloud services across its robust SME sector.

- Asia Pacific: Holds a 25% market share. This region's market expansion is driven by rapid digital transformation initiatives, economic growth in major economies, and the increasing need for cost-effective communication systems.

- Middle East & Africa: With a 5% market share, the region sees growth due to the gradual shift to cloud services among businesses looking to enhance operational efficiency and improve customer service.

- Latin America: Accounts for 5% of the market. Growth here is fueled by increasing digital literacy and the growing startup ecosystem, which demands flexible, scalable communication solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Cloud Telephony Service Market is led by several key players. These companies influence the market with innovative solutions and strategic positioning. The main players include 8x8, Inc., Cisco Systems, Inc., Microsoft Corporation, Avaya Inc., Vonage Holdings Corp., RingCentral, Inc., Nextiva, Inc., Twilio Inc., Grasshopper, Google LLC, Verizon Communications Inc., NTT Communications Corporation, and BT Group plc.

These companies drive market growth through advanced technologies and strong customer bases. Cisco Systems and Microsoft Corporation have leveraged their extensive global reach and technological expertise. They dominate the enterprise segment with robust, scalable solutions. Twilio Inc. is recognized for its versatile APIs, enabling seamless integration with various applications, thus enhancing its market presence.

RingCentral, Inc. and Vonage Holdings Corp. have positioned themselves as leaders in unified communications, offering comprehensive services that cater to businesses of all sizes. Their strategic acquisitions and partnerships have strengthened their market influence. Google LLC, with its Google Voice service, and Verizon Communications Inc. have leveraged their existing infrastructure and brand strength to capture significant market shares.

8x8, Inc., Avaya Inc., and Nextiva, Inc. are noted for their competitive pricing and flexible service offerings, which appeal to small and medium-sized businesses. Grasshopper targets entrepreneurs and startups with its user-friendly virtual phone system.

NTT Communications Corporation and BT Group plc benefit from their strong regional presence and established customer relationships. Their focus on integrating cloud telephony with broader IT services enhances their market positioning.

Market Key Players

- 8x8, Inc.

- Cisco Systems, Inc.

- Microsoft Corporation

- Avaya Inc.

- Vonage Holdings Corp.

- RingCentral, Inc.

- Nextiva, Inc.

- Twilio Inc.

- Grasshopper

- Google LLC

- Verizon Communications Inc.

- NTT Communications Corporation

- BT Group plc

Recent Developments

- June 2023: RingCentral announced it became the first global cloud provider to offer fully compliant cloud telephony services in India, adhering to local regulations.

- 2023: Cisco completed the acquisition of Splunk for $28 billion, aiming to boost its data and security capabilities.

Report Scope

Report Features Description Market Value (2023) USD 23.6 Billion Forecast Revenue (2033) USD 50.4 Billion CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (IVR [Interactive Voice Response], ACD [Automatic Call Distributor], Call Recording, Call Conferencing, Voicemail, API Integration, Others), By Organization Size (Small and Medium-sized Enterprises [SMEs], Large Enterprises), By Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud), By End User (BFSI [Banking, Financial Services, and Insurance], Retail and E-commerce, Healthcare, Government, Education, Telecom and IT, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 8x8, Inc., Cisco Systems, Inc., Microsoft Corporation, Avaya Inc., Vonage Holdings Corp., RingCentral, Inc., Nextiva, Inc., Twilio Inc., Grasshopper, Google LLC, Verizon Communications Inc., NTT Communications Corporation, BT Group plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- 8x8, Inc.

- Cisco Systems, Inc.

- Microsoft Corporation

- Avaya Inc.

- Vonage Holdings Corp.

- RingCentral, Inc.

- Nextiva, Inc.

- Twilio Inc.

- Grasshopper

- Google LLC

- Verizon Communications Inc.

- NTT Communications Corporation

- BT Group plc