Generative Ai In Automotive Market Based on Deployment Mode(On-Premise, Cloud-Based), Based on Application(Advanced Driver Assistance Systems (ADAS), Connected Car Technologies, Autonomous Driving Technologies, Human-Machine Interfaces (HMIs), Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

37801

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

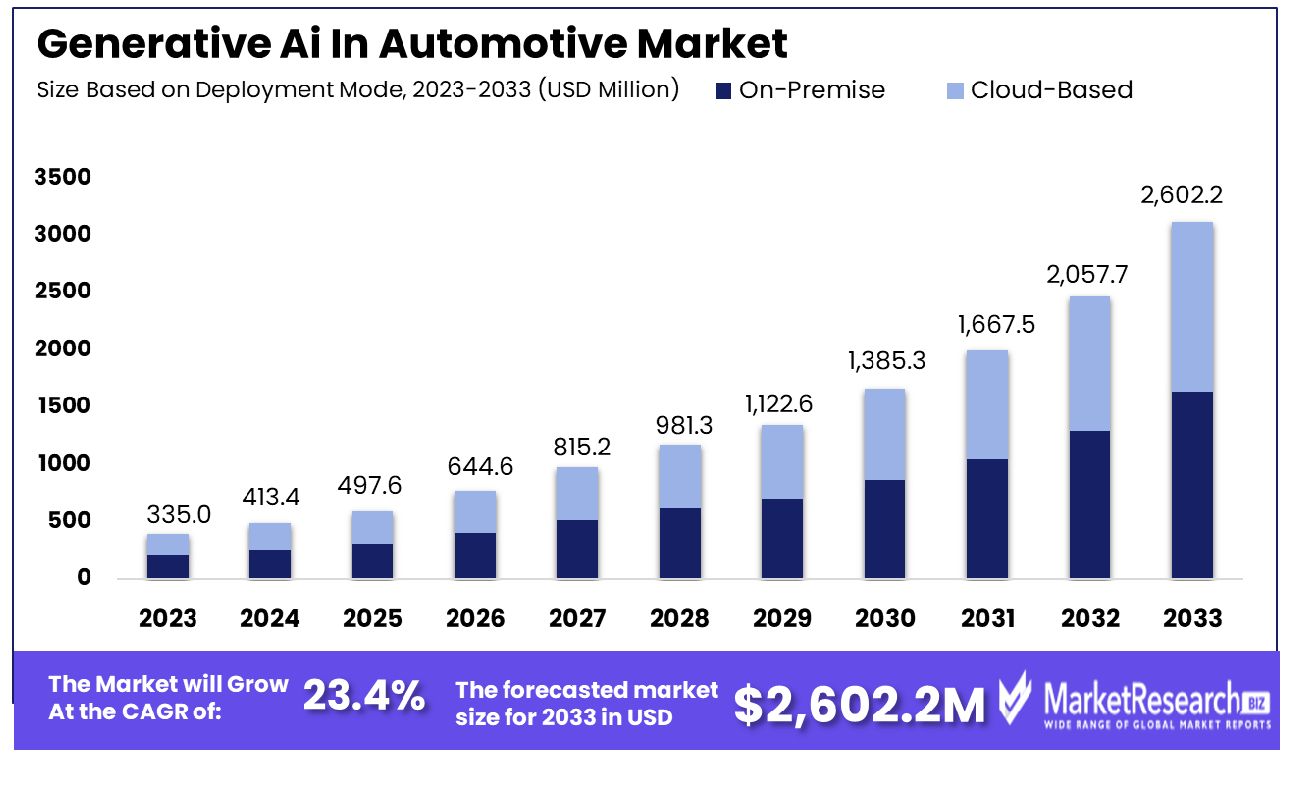

The Global Generative Ai In Automotive Market was valued at USD 335.0 million in 2023. It is expected to reach USD 2,602.2 million by 2033, with a CAGR of 23.4% during the forecast period from 2024 to 2033.

The surge in demand in the automotive industry and advanced technologies are some of the main driving factors for the generative AI in automotive market expansion. According to IEA in 2023, there was globally 14% of new electric vehicles were sold in 2022 which was 3X of the number that was sold in 2020. China accounts for more than 1/2 of all the electric cars sold globally.

Moreover, 6% of the new vehicles sold in the US have doubled the number that was sold in 2021. There are almost 2.3 million electric vehicles that were sold in the first quarter of 2023 and more than 25% in the same last decade. By the end of 2023, it is expected that more than 14 million vehicles will be sold in the market which will represent a 35% year-on-year surge with new buys accelerating in the second half of this year.

Moreover, 6% of the new vehicles sold in the US have doubled the number that was sold in 2021. There are almost 2.3 million electric vehicles that were sold in the first quarter of 2023 and more than 25% in the same last decade. By the end of 2023, it is expected that more than 14 million vehicles will be sold in the market which will represent a 35% year-on-year surge with new buys accelerating in the second half of this year.Generative AI in the automotive industry helps to change the way vehicles are designed and manufactured. It is an innovative approach where AI can be implemented to build new content and ideas, which comprises discovering new design options based on the criteria that have been created by the developer.

Generative AI is based on ML models, which are very huge and are pre-trained on large amounts of information, which are known as foundation models. When generative AI is implemented in the automotive, it helps the manufacturers to quickly address the best options for complex systems like engines, lightweight models, and vehicle features.

As customers are getting more inclined towards electric cars, automotive organizations are seeking to influence AI to automate the backend process and submit loan documents. These companies are also offering a chance to incorporate scam detection potentiality, while concurrently providing customized bonuses to the end users. Beyond customization, generative AI provides a chance to structure and design sustainable automobiles.

Such technology enhances different aspects of car performance, which comprises power efficacy, making the way for eco-friendlier engineering and advertising sustainable transportation services. The demand for generative AI in the automotive will increase due to the high requirements and customization facilities in the automotive industry that will help to contribute to the market expansion in the coming years.

Key Takeaways

- Market Growth: The Global Generative Ai In Automotive Market was valued at USD 335.0 million in 2023. It is expected to reach USD 2,602.2 million by 2033, with a CAGR of 23.4% during the forecast period from 2024 to 2033.

- Based on Deployment Mode: On-Premise dominated deployment mode at 67.5%.

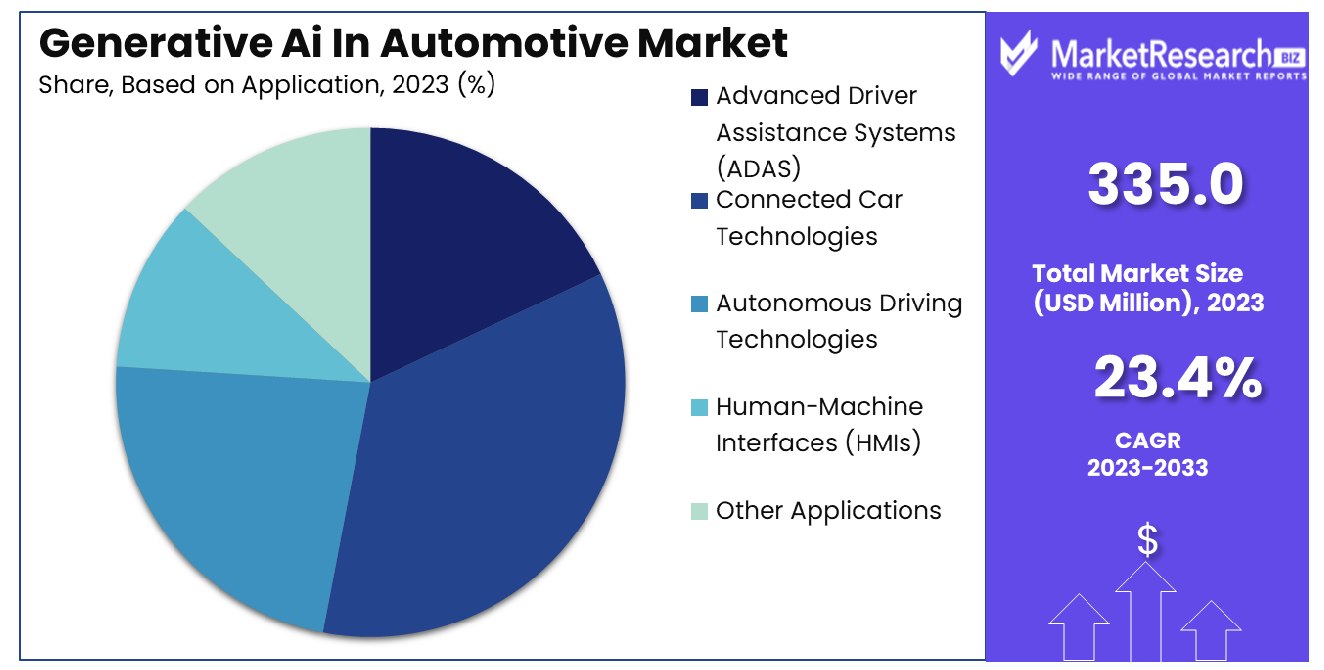

- Based on Application: ADAS led applications with 40.3%.

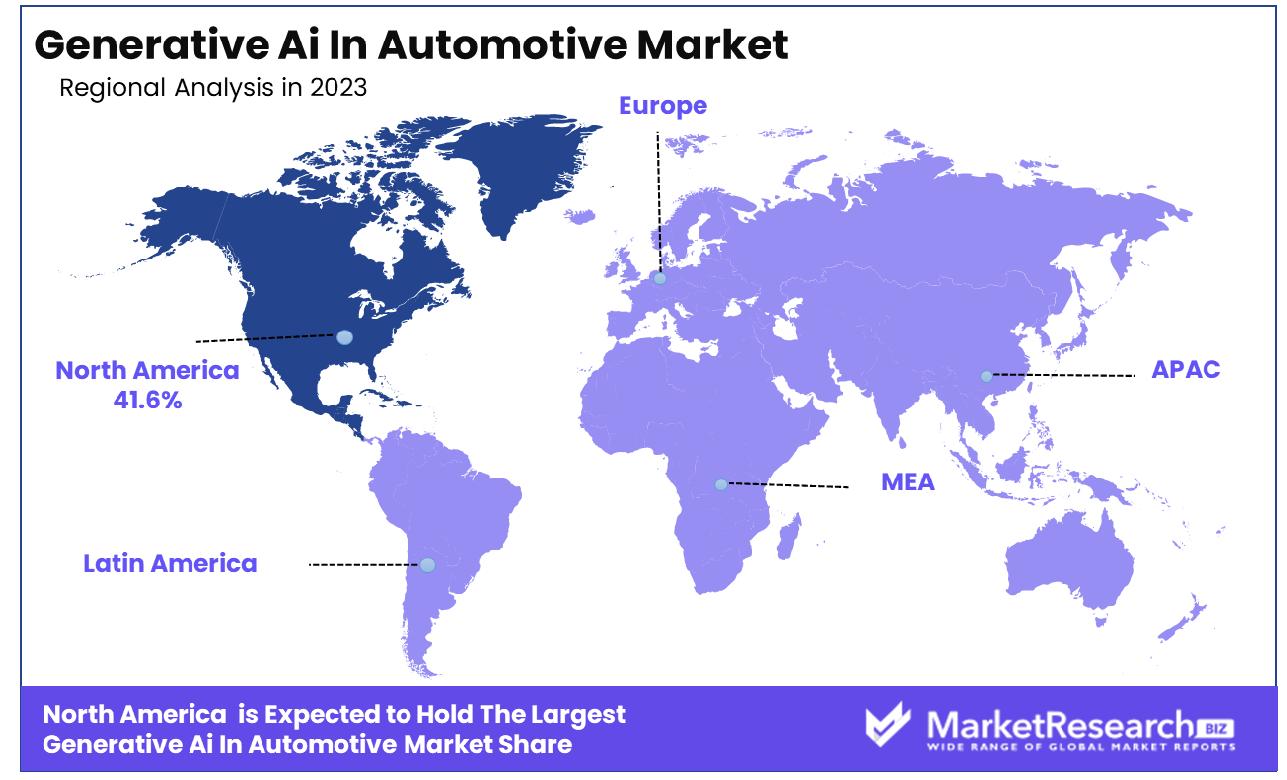

- Regional Dominance: North America holds a 41.6% share of the global Generative AI Automotive Market.

- Growth Opportunity:

Driving factors

Decoding Consumer Preferences: Personalization Pioneering Progress

Generative AI's role in decoding and anticipating consumer preferences is pivotal in driving a transformation toward personalized and responsive product development within the automotive industry. By harnessing advanced algorithms, automakers can analyze large datasets to identify consumer market trends and preferences at a granular level. This capability enables manufacturers to design vehicles that align more closely with individual customer desires and expectations, leading to enhanced customer satisfaction and loyalty.

The deployment of generative AI not only speeds up the product development cycle but also significantly reduces the costs associated with market research and product testing by predicting consumer responses before physical prototypes are developed.

Integration in Advanced Driver Assistance Systems (ADAS): Elevating Safety Through Innovation

Generative AI is revolutionizing vehicle safety and driving experiences by enhancing Advanced Driver Assistance Systems (ADAS). Through the integration of AI, these systems can process real-time data to make immediate adjustments that improve vehicle safety and operational efficiency. Generative AI contributes to the continuous improvement of safety features by learning from vast amounts of data, including driving conditions, obstacle detection, and driver behavior.

This learning process allows for the rapid implementation of enhancements in ADAS technologies, setting new safety standards and reducing the likelihood of accidents on the road. Consequently, this advancement not only boosts consumer confidence in vehicle safety but also fosters a more innovative market environment.

Transformation in Vehicle Design: Software-Centric Architecture Redefining Automobiles

Generative AI is at the forefront of a transformative shift in vehicle design and styling, significantly altering the composition of future automobiles. With a projected decrease in the share of hardware components and a rise in the importance of software and content, the automotive industry is moving towards a more software-centric architecture.

This transition emphasizes the role of generative AI in crafting intuitive and adaptive interfaces and functionalities, which enhance the user experience and introduce new forms of interaction between the vehicle and its occupants. The shift towards software-driven designs not only allows for greater customization and scalability but also positions automotive companies at the cutting edge of innovation, ready to leverage the growing importance of digital features in the competitive market.

Restraining Factors

High Development Costs: Financial Barriers Limiting Broad Adoption

The integration of generative AI into the automotive industry is significantly hampered by high development costs. These costs stem from the need for substantial investments in research and development, advanced hardware for AI computation, and the acquisition of talent skilled in AI technologies.

This financial burden can be particularly restrictive for smaller manufacturers or those in emerging markets, where capital may be more constrained. High development costs deter widespread adoption as companies may hesitate to invest heavily without clear and immediate returns. This factor limits the potential market expansion of generative AI technologies in the automotive sector, as only well-capitalized firms can afford to explore and implement these innovations.

Regulatory Challenges: Navigating the Complexity of AI Integration

The integration of AI technologies, particularly in critical systems like automotive applications, faces stringent regulatory challenges that can complicate deployment. Regulatory bodies often require extensive testing and validation of AI systems to ensure they meet safety and reliability standards, which can delay product launches and increase development costs.

Furthermore, the evolving nature of AI technology means that regulations can struggle to keep pace with innovation, leading to uncertainties and inconsistencies in compliance requirements. These regulatory challenges can restrain the growth of generative AI in the automotive market by creating hurdles that slow down the adoption process and increase the risk associated with AI investments.

Based on Deployment Mode Analysis

Based on deployment mode, on-premise solutions dominated the market with a substantial 67.5% share.

In 2023, On-Premise deployment held a dominant market position in the Generative AI in the Automotive Market based on the deployment mode segment, capturing more than 67.5% of the market share.

This significant market share can be attributed to several key factors, including stringent data security requirements, the need for high-performance computing capabilities, and the preference for controlling physical infrastructure within the automotive industry. Organizations opting for on-premise deployment benefit from enhanced control over their AI systems, which is crucial for processing sensitive data and proprietary designs.

Conversely, the Cloud-Based deployment segment accounted for the remaining market share. Although smaller in comparison, this segment is anticipated to grow at a rapid pace due to its scalability, reduced upfront costs, and ease of access to advanced AI technologies.

Cloud-based platforms enable automotive companies to leverage the computational power and storage capabilities of cloud providers to scale operations dynamically. This model is particularly beneficial for startups and mid-size enterprises in the automotive sector that may not have the initial capital to invest in extensive on-premise infrastructure.

The deployment mode choices in the Generative AI sector are largely influenced by the specific needs of automotive manufacturers and suppliers. The choice between on-premise and cloud-based solutions often hinges on balancing cost, performance, and security, with larger enterprises frequently favoring on-premise setups to meet their rigorous data handling and processing requirements.

Based on Application Analysis

Regarding application, Advanced Driver Assistance Systems (ADAS) held a commanding 40.3% of the market.

In 2023, Advanced Driver Assistance Systems (ADAS) held a dominant market position in the "Based on Application" segment of the Generative AI in Automotive Market, capturing more than 40.3% of the market share. This segment, which leads the application of generative AI technologies, focuses on enhancing vehicle safety and driving efficiency through features such as adaptive cruise control, collision avoidance systems, and pedestrian detection capabilities.

Connected Car Technologies also formed a significant part of the market, integrating AI to facilitate vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications. This technology aims to improve traffic management, reduce accidents, and enhance the overall driving experience by allowing real-time data exchange.

The segment of Autonomous Driving Technologies is rapidly advancing, leveraging generative AI to simulate and optimize various driving scenarios. This helps in refining algorithms that control autonomous vehicles, enhancing their ability to make safer and more effective decisions without human intervention.

Human-Machine Interfaces (HMIs) utilize generative AI to create more intuitive and interactive user interfaces. This application focuses on improving the way drivers interact with their vehicles, making it easier to control vehicle functions and access information through voice commands and gesture recognition.

Key Market Segments

Based on Deployment Mode

- On-Premise

- Cloud-Based

Based on Application

- Advanced Driver Assistance Systems (ADAS)

- Connected Car Technologies

- Autonomous Driving Technologies

- Human-Machine Interfaces (HMIs)

- Other Applications

Growth Opportunity

Integration of Generative AI in Software-Defined Vehicles (SDVs)

The integration of generative AI into software-defined vehicles (SDVs) represents a significant growth opportunity within the global automotive market in 2023. This technology enables the development of intelligent, highly adaptive vehicle systems that can optimize their operations in real-time based on data-driven insights. Generative AI facilitates the customization of software functions in vehicles, from autonomous driving algorithms to personalized in-car experiences, enhancing both performance and user satisfaction.

The adaptability of SDVs powered by generative AI can lead to improved energy efficiency and safety, pivotal factors driving consumer demand and regulatory approval. Market analysts project that as automotive manufacturers increasingly invest in AI capabilities, the penetration of SDVs will expand, substantially boosting the sector's growth.

Vehicle Design Enhancement Using Generative Design Algorithms

Generative design algorithms stand as a transformative technology in vehicle manufacturing, offering substantial growth opportunities in 2023. These algorithms employ AI to generate a multitude of design solutions optimized for specific parameters like weight, material utilization, durability, and aerodynamics. This approach not only accelerates the design process but also enables the creation of innovative, high-performance vehicle components that are lighter and more cost-effective.

The application of generative design significantly reduces the time and costs associated with R&D, while simultaneously enhancing the environmental sustainability of manufacturing practices. Industry experts anticipate that the adoption of generative design will become a competitive differentiator, driving adoption across leading automotive manufacturers and influencing market dynamics favorably.

Latest Trends

Enhanced Traffic Management Systems

In 2023, the global automotive market is witnessing a significant trend toward the integration of generative AI in enhancing traffic management systems. These systems, powered by advanced algorithms, are designed to analyze vast amounts of traffic data in real time, enabling predictive traffic modeling and management. The use of generative AI helps in optimizing traffic flow, reducing congestion, and improving overall road safety.

This technology also supports the development of dynamic routing algorithms that can adapt to changing traffic conditions instantaneously, thereby enhancing the efficiency of transportation networks. As urbanization continues to increase, the demand for smarter traffic solutions is expected to drive the adoption of these AI-enhanced systems, presenting a key growth opportunity in the automotive sector.

Fleet Management Optimization

Generative AI is revolutionizing fleet management in the automotive industry by optimizing operations through predictive analytics and maintenance. In 2023, this technology will be increasingly employed to analyze performance data across vehicle fleets, enabling predictive maintenance, fuel efficiency, and route optimization. Generative AI algorithms can anticipate vehicle maintenance needs, reducing downtime and operational costs.

Additionally, these algorithms optimize fleet routes and schedules to enhance logistical efficiency and reduce emissions. The deployment of generative AI in fleet management not only boosts operational efficiency but also supports sustainability goals. As companies prioritize cost efficiency and sustainability, generative AI in fleet management is poised to be a dominant trend, shaping the future of the global automotive market.

Regional Analysis

In 2023, North America holds a 41.6% share of the global generative AI automotive market.

The Generative AI in the automotive market is exhibiting significant growth across various regions, reflecting diverse technological adoption rates and automotive manufacturing capabilities. In North America, this market is particularly dominant, holding a 41.6% share. This prominence can be attributed to the advanced technological infrastructure and the presence of major automotive and technology giants investing heavily in AI-driven innovations.

In Europe, stringent regulations on vehicle emissions and safety have spurred the adoption of AI to enhance automotive design and manufacturing processes, leading to increased efficiency and reduced environmental impact. Europe's market is characterized by a high degree of innovation, with collaborations between automakers and tech firms to integrate AI in autonomous driving and predictive maintenance.

The Asia Pacific region shows rapid growth due to the expanding automotive manufacturing sectors in China, Japan, and South Korea, coupled with increasing investments in AI technologies. This region benefits from government support in technology advancements and a strong push towards electric vehicles, which extensively use AI for battery management and system optimization.

In contrast, the Middle East & Africa, and Latin America are emerging markets in the generative AI automotive sector. These regions show potential for growth with increasing urbanization and digital transformation. However, the adoption rate is moderated by the current infrastructural capabilities and the gradual pace of technological integration into local automotive industries.

Overall, while North America currently leads the global market due to robust technological integration and significant investments in AI, the Asia Pacific is poised for rapid expansion, potentially shifting future market dynamics due to its manufacturing capabilities and technological innovations.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Generative AI in Automotive market witnessed significant contributions from major industry players, each enhancing their competitive edge through innovative AI-driven solutions. BMW AG and AUDI AG, renowned for their pioneering approaches in automotive technology, have continued to integrate generative AI into their vehicle design and manufacturing processes, aiming to achieve greater customization and efficiency. Tesla Inc., leading in AI adoption, has further integrated generative AI to optimize its autonomous driving algorithms and vehicle functionalities, reinforcing its market dominance.

Intel Corporation and NVIDIA Corporation, as tech giants, have played crucial roles by providing advanced AI chipsets and computing solutions, essential for supporting complex AI applications in automotive systems. These companies have enabled other key players in the sector to enhance vehicular AI capabilities, particularly in autonomous and connected vehicle technologies.

Uber Technologies and Volvo Car Corporation have focused on leveraging generative AI to improve safety features and operational efficiency in their autonomous vehicle initiatives. Meanwhile, Honda Motors and Ford Motor Company are investing in AI to refine predictive maintenance and manufacturing processes, aligning with industry trends toward smarter, more reliable vehicles.

Furthermore, Tencent and Microsoft are instrumental in developing AI platforms that support automotive companies with tools for data analysis, enhancing decision-making processes in vehicle production, and market strategies.

Collectively, these key players are driving forward the integration of generative AI in the automotive industry, focusing on innovation, safety, and sustainability, thus shaping the future dynamics of the market. Their efforts are pivotal in addressing the evolving needs of consumers and adapting to the rapid technological advancements in the automotive sector.

Market Key Players

- BMW AG

- AUDI AG

- Intel Corporation

- Tesla Inc

- Uber Technologies

- Volvo Car Corporation

- Honda Motors

- Ford Motor Company

- NVIDIA Corporation

- Tencent

- Microsoft

- Other Key Players

Recent Development

- In December 2023, Microsoft and TomTom collaborated on a generative AI car voice assistant, enhancing automotive infotainment systems with natural language abilities and multiple action requests, aiming to revolutionize in-vehicle experiences.

- In August 2023, Automobile manufacturers face electrification and softwarization challenges. Tesla leads softwarization with Generative AI. Chinese firms are advancing. Wipro aids in software-defined vehicles with Generative AI solutions.

Report Scope

Report Features Description Market Value (2023) USD 335.0 Million Forecast Revenue (2033) USD 2,602.2 Million CAGR (2024-2032) 23.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Deployment Mode(On-Premise, Cloud-Based), Based on Application(Advanced Driver Assistance Systems (ADAS), Connected Car Technologies, Autonomous Driving Technologies, Human-Machine Interfaces (HMIs), Other Applications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BMW AG, AUDI AG, Intel Corporation, Tesla Inc, Uber Technologies, Volvo Car Corporation, Honda Motors, Ford Motor Company, NVIDIA Corporation, Tencent, Microsoft, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Generative AI in Automotive Market Overview

- 2.1. Generative AI in Automotive Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Generative AI in Automotive Market Dynamics

- 3. Global Generative AI in Automotive Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Generative AI in Automotive Market Analysis, 2016-2021

- 3.2. Global Generative AI in Automotive Market Opportunity and Forecast, 2023-2032

- 3.3. Global Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Deployment Mode, 2016-2032

- 3.3.1. Global Generative AI in Automotive Market Analysis by Based On Deployment Mode: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Mode, 2016-2032

- 3.3.3. On-Premise

- 3.3.4. Cloud-Based

- 3.4. Global Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 3.4.1. Global Generative AI in Automotive Market Analysis by Based On Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 3.4.3. Advanced Driver Assistance Systems (ADAS)

- 3.4.4. Connected Car Technologies

- 3.4.5. Autonomous Driving Technologies

- 3.4.6. Human-Machine Interfaces (HMIs)

- 3.4.7. Other Applications

- 4. North America Generative AI in Automotive Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Generative AI in Automotive Market Analysis, 2016-2021

- 4.2. North America Generative AI in Automotive Market Opportunity and Forecast, 2023-2032

- 4.3. North America Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Deployment Mode, 2016-2032

- 4.3.1. North America Generative AI in Automotive Market Analysis by Based On Deployment Mode: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Mode, 2016-2032

- 4.3.3. On-Premise

- 4.3.4. Cloud-Based

- 4.4. North America Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 4.4.1. North America Generative AI in Automotive Market Analysis by Based On Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 4.4.3. Advanced Driver Assistance Systems (ADAS)

- 4.4.4. Connected Car Technologies

- 4.4.5. Autonomous Driving Technologies

- 4.4.6. Human-Machine Interfaces (HMIs)

- 4.4.7. Other Applications

- 4.5. North America Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Generative AI in Automotive Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Generative AI in Automotive Market Analysis, 2016-2021

- 5.2. Western Europe Generative AI in Automotive Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Deployment Mode, 2016-2032

- 5.3.1. Western Europe Generative AI in Automotive Market Analysis by Based On Deployment Mode: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Mode, 2016-2032

- 5.3.3. On-Premise

- 5.3.4. Cloud-Based

- 5.4. Western Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 5.4.1. Western Europe Generative AI in Automotive Market Analysis by Based On Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 5.4.3. Advanced Driver Assistance Systems (ADAS)

- 5.4.4. Connected Car Technologies

- 5.4.5. Autonomous Driving Technologies

- 5.4.6. Human-Machine Interfaces (HMIs)

- 5.4.7. Other Applications

- 5.5. Western Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Generative AI in Automotive Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Generative AI in Automotive Market Analysis, 2016-2021

- 6.2. Eastern Europe Generative AI in Automotive Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Deployment Mode, 2016-2032

- 6.3.1. Eastern Europe Generative AI in Automotive Market Analysis by Based On Deployment Mode: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Mode, 2016-2032

- 6.3.3. On-Premise

- 6.3.4. Cloud-Based

- 6.4. Eastern Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 6.4.1. Eastern Europe Generative AI in Automotive Market Analysis by Based On Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 6.4.3. Advanced Driver Assistance Systems (ADAS)

- 6.4.4. Connected Car Technologies

- 6.4.5. Autonomous Driving Technologies

- 6.4.6. Human-Machine Interfaces (HMIs)

- 6.4.7. Other Applications

- 6.5. Eastern Europe Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Generative AI in Automotive Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Generative AI in Automotive Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Generative AI in Automotive Market Analysis, 2016-2021

- 7.2. APAC Generative AI in Automotive Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Deployment Mode, 2016-2032

- 7.3.1. APAC Generative AI in Automotive Market Analysis by Based On Deployment Mode: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Mode, 2016-2032

- 7.3.3. On-Premise

- 7.3.4. Cloud-Based

- 7.4. APAC Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 7.4.1. APAC Generative AI in Automotive Market Analysis by Based On Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 7.4.3. Advanced Driver Assistance Systems (ADAS)

- 7.4.4. Connected Car Technologies

- 7.4.5. Autonomous Driving Technologies

- 7.4.6. Human-Machine Interfaces (HMIs)

- 7.4.7. Other Applications

- 7.5. APAC Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Generative AI in Automotive Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Generative AI in Automotive Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Generative AI in Automotive Market Analysis, 2016-2021

- 8.2. Latin America Generative AI in Automotive Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Deployment Mode, 2016-2032

- 8.3.1. Latin America Generative AI in Automotive Market Analysis by Based On Deployment Mode: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Mode, 2016-2032

- 8.3.3. On-Premise

- 8.3.4. Cloud-Based

- 8.4. Latin America Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 8.4.1. Latin America Generative AI in Automotive Market Analysis by Based On Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 8.4.3. Advanced Driver Assistance Systems (ADAS)

- 8.4.4. Connected Car Technologies

- 8.4.5. Autonomous Driving Technologies

- 8.4.6. Human-Machine Interfaces (HMIs)

- 8.4.7. Other Applications

- 8.5. Latin America Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Generative AI in Automotive Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Generative AI in Automotive Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Generative AI in Automotive Market Analysis, 2016-2021

- 9.2. Middle East & Africa Generative AI in Automotive Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Deployment Mode, 2016-2032

- 9.3.1. Middle East & Africa Generative AI in Automotive Market Analysis by Based On Deployment Mode: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Deployment Mode, 2016-2032

- 9.3.3. On-Premise

- 9.3.4. Cloud-Based

- 9.4. Middle East & Africa Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Based On Application, 2016-2032

- 9.4.1. Middle East & Africa Generative AI in Automotive Market Analysis by Based On Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Based On Application, 2016-2032

- 9.4.3. Advanced Driver Assistance Systems (ADAS)

- 9.4.4. Connected Car Technologies

- 9.4.5. Autonomous Driving Technologies

- 9.4.6. Human-Machine Interfaces (HMIs)

- 9.4.7. Other Applications

- 9.5. Middle East & Africa Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Generative AI in Automotive Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Generative AI in Automotive Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Generative AI in Automotive Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Generative AI in Automotive Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. BMW AG

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. AUDI AG

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Intel Corporation

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Tesla Inc

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Uber Technologies

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Volvo Car Corporation

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Honda Motors

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Ford Motor Company

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. NVIDIA Corporation

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Tencent

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Microsoft

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Other Key Players

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Deployment Mode in 2022

- Figure 2: Global Generative AI in Automotive Market Attractiveness Analysis by Based On Deployment Mode, 2016-2032

- Figure 3: Global Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 4: Global Generative AI in Automotive Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 5: Global Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Generative AI in Automotive Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Figure 10: Global Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 11: Global Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Figure 13: Global Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 14: Global Generative AI in Automotive Market Share Comparison by Region (2016-2032)

- Figure 15: Global Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Figure 16: Global Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Figure 17: North America Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Deployment Modein 2022

- Figure 18: North America Generative AI in Automotive Market Attractiveness Analysis by Based On Deployment Mode, 2016-2032

- Figure 19: North America Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 20: North America Generative AI in Automotive Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 21: North America Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Generative AI in Automotive Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Figure 26: North America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 27: North America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Figure 29: North America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 30: North America Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Figure 31: North America Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Figure 32: North America Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Figure 33: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Deployment Modein 2022

- Figure 34: Western Europe Generative AI in Automotive Market Attractiveness Analysis by Based On Deployment Mode, 2016-2032

- Figure 35: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 36: Western Europe Generative AI in Automotive Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 37: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Generative AI in Automotive Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Figure 42: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 43: Western Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Figure 45: Western Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 46: Western Europe Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Figure 48: Western Europe Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Figure 49: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Deployment Modein 2022

- Figure 50: Eastern Europe Generative AI in Automotive Market Attractiveness Analysis by Based On Deployment Mode, 2016-2032

- Figure 51: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 52: Eastern Europe Generative AI in Automotive Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 53: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Generative AI in Automotive Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Figure 58: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 59: Eastern Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Figure 61: Eastern Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 62: Eastern Europe Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Figure 64: Eastern Europe Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Figure 65: APAC Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Deployment Modein 2022

- Figure 66: APAC Generative AI in Automotive Market Attractiveness Analysis by Based On Deployment Mode, 2016-2032

- Figure 67: APAC Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 68: APAC Generative AI in Automotive Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 69: APAC Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Generative AI in Automotive Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Figure 74: APAC Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 75: APAC Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Figure 77: APAC Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 78: APAC Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Figure 80: APAC Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Figure 81: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Deployment Modein 2022

- Figure 82: Latin America Generative AI in Automotive Market Attractiveness Analysis by Based On Deployment Mode, 2016-2032

- Figure 83: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 84: Latin America Generative AI in Automotive Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 85: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Generative AI in Automotive Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Figure 90: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 91: Latin America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Figure 93: Latin America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 94: Latin America Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Figure 96: Latin America Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Figure 97: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Deployment Modein 2022

- Figure 98: Middle East & Africa Generative AI in Automotive Market Attractiveness Analysis by Based On Deployment Mode, 2016-2032

- Figure 99: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Based On Applicationin 2022

- Figure 100: Middle East & Africa Generative AI in Automotive Market Attractiveness Analysis by Based On Application, 2016-2032

- Figure 101: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Generative AI in Automotive Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Figure 106: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Figure 107: Middle East & Africa Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Figure 109: Middle East & Africa Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Figure 110: Middle East & Africa Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Figure 112: Middle East & Africa Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- List of Tables

- Table 1: Global Generative AI in Automotive Market Comparison by Based On Deployment Mode (2016-2032)

- Table 2: Global Generative AI in Automotive Market Comparison by Based On Application (2016-2032)

- Table 3: Global Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Table 7: Global Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 8: Global Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Table 10: Global Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 11: Global Generative AI in Automotive Market Share Comparison by Region (2016-2032)

- Table 12: Global Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Table 13: Global Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Table 14: North America Generative AI in Automotive Market Comparison by Based On Application (2016-2032)

- Table 15: North America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Table 19: North America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 20: North America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Table 22: North America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 23: North America Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Table 24: North America Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Table 25: North America Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Table 26: Western Europe Generative AI in Automotive Market Comparison by Based On Deployment Mode (2016-2032)

- Table 27: Western Europe Generative AI in Automotive Market Comparison by Based On Application (2016-2032)

- Table 28: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Table 32: Western Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 33: Western Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Table 35: Western Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 36: Western Europe Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Table 38: Western Europe Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Table 39: Eastern Europe Generative AI in Automotive Market Comparison by Based On Deployment Mode (2016-2032)

- Table 40: Eastern Europe Generative AI in Automotive Market Comparison by Based On Application (2016-2032)

- Table 41: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Table 45: Eastern Europe Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 46: Eastern Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Table 48: Eastern Europe Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 49: Eastern Europe Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Table 51: Eastern Europe Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Table 52: APAC Generative AI in Automotive Market Comparison by Based On Deployment Mode (2016-2032)

- Table 53: APAC Generative AI in Automotive Market Comparison by Based On Application (2016-2032)

- Table 54: APAC Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Table 58: APAC Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 59: APAC Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Table 61: APAC Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 62: APAC Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Table 63: APAC Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Table 64: APAC Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Table 65: Latin America Generative AI in Automotive Market Comparison by Based On Deployment Mode (2016-2032)

- Table 66: Latin America Generative AI in Automotive Market Comparison by Based On Application (2016-2032)

- Table 67: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Table 71: Latin America Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 72: Latin America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Table 74: Latin America Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 75: Latin America Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Table 77: Latin America Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- Table 78: Middle East & Africa Generative AI in Automotive Market Comparison by Based On Deployment Mode (2016-2032)

- Table 79: Middle East & Africa Generative AI in Automotive Market Comparison by Based On Application (2016-2032)

- Table 80: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Deployment Mode (2016-2032)

- Table 84: Middle East & Africa Generative AI in Automotive Market Revenue (US$ Mn) Comparison by Based On Application (2016-2032)

- Table 85: Middle East & Africa Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Deployment Mode (2016-2032)

- Table 87: Middle East & Africa Generative AI in Automotive Market Y-o-Y Growth Rate Comparison by Based On Application (2016-2032)

- Table 88: Middle East & Africa Generative AI in Automotive Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Generative AI in Automotive Market Share Comparison by Based On Deployment Mode (2016-2032)

- Table 90: Middle East & Africa Generative AI in Automotive Market Share Comparison by Based On Application (2016-2032)

- 1. Executive Summary

-

- BMW AG

- AUDI AG

- Intel Corporation

- Tesla Inc

- Uber Technologies

- Volvo Car Corporation

- Honda Motors

- Ford Motor Company

- NVIDIA Corporation

- Tencent

- Microsoft

- Other Key Players