Connected Car Market By Connectivity Solution (Embedded, Tethered, Integrated), By Application (Telematics, Infotainment, Driver Assistance, Combined telematics and infotainment), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37031

-

May 2023

-

177

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

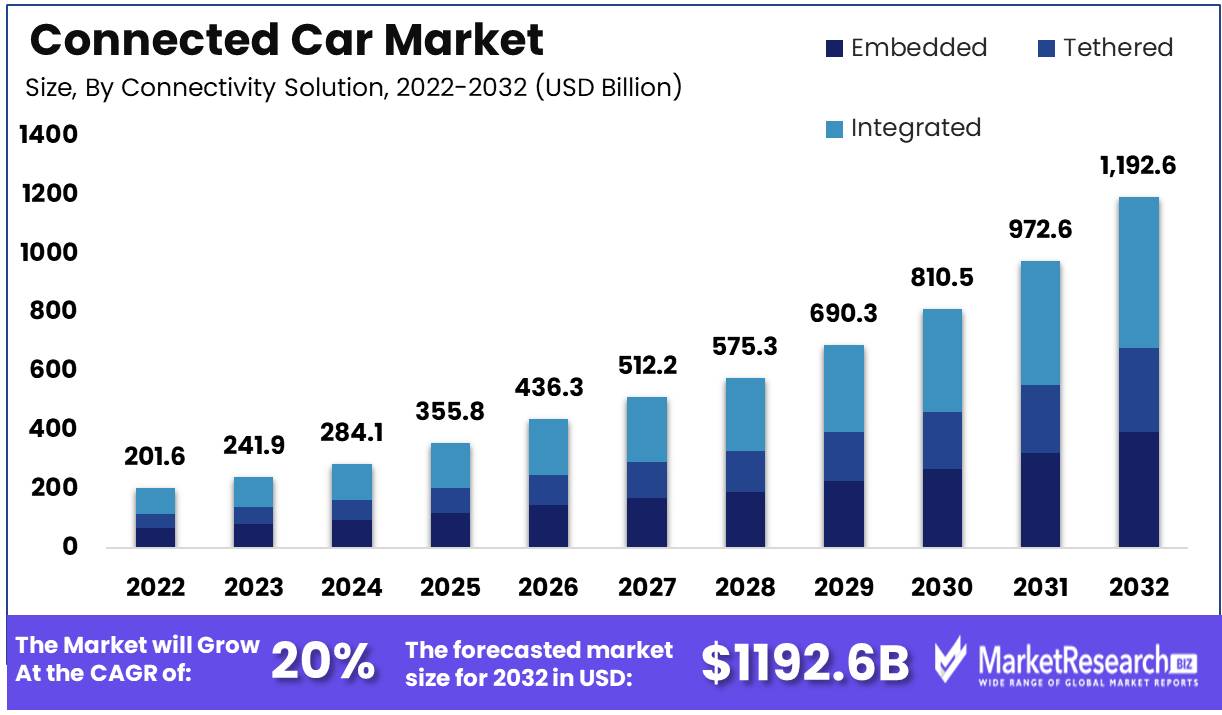

Connected Car Market size is expected to be worth around USD 1248.32 Bn by 2032 from USD 201.61 Bn in 2022, growing at a CAGR of 20% during the forecast period from 2023 to 2032.

The Connected Car Market is a new market that has garnered significant traction and interest over the past few years. The market consists of cars with internet connectivity, allowing them to communicate with the driver, other vehicles, and road infrastructure. This blog post is intended to provide a comprehensive overview of the Connected Car Market, including its definition and objectives, notable innovations, major investments, industries investing in the market, major market drivers, ethical concerns and responsible practices, and business applications of the technology. The definition of the Connected Car Market is the combination of internet connectivity and automobiles. This market's objectives include enhancing vehicle and passenger safety, convenience, and entertainment. The incorporation of internet connectivity enables real-time communication between the vehicle and its environs, enabling a variety of features including GPS navigation, automatic emergency response, and remote control of vehicle functions, among others.

The Connected Car Market is significant because it offers numerous advantages to drivers, passengers, and the automotive industry as a whole. The incorporation of internet connectivity permits enhanced safety features, real-time traffic information, and access to entertainment and convenience options. In addition, connected cars provide valuable data that can be used to enhance the driving experience and create new business opportunities for companies in the automotive industry.

The Connected Car Market is ever-changing and introducing new innovations. Notable developments include the incorporation of machine learning and artificial intelligence into connected vehicle systems, the development of cloud-based applications, and the implementation of autonomous driving capabilities. Moreover, the introduction of electric vehicles and the incorporation of renewable energy into connected cars represent additional market innovations of significance. In the meantime, tech titans such as Google and Apple have also made substantial market investments. Numerous manufacturers have incorporated these new technologies into their products and services, including autonomous driving, electric vehicles, and cloud-based applications.

Diverse industries, including automotive, technology, and energy, are investing in the market for connected vehicles. Many automakers have invested in R&D to develop connected car systems with enhanced safety, convenience, and entertainment options. Meanwhile, tech titans such as Google and Apple have also made substantial investments in the market, with Google focusing on autonomous driving technology and Apple on electric vehicles.

Driving factors

Potential Changes in Regulation and Technological Impact

Regulatory changes could have an impact on Connected Car Market. The National Highway Traffic Safety Administration (NHTSA) in the United States, for example, is planning to introduce new legislation that would allow autonomous vehicles to operate without human intervention. This could create new opportunities for Connected Car Market. In the coming years, emerging technologies such as 5G enterprise and V2X (vehicle-to-everything) communication could influence Connected Car Market.

Disruptions and Competitive Environment

New market entrants and potential market disruptors, such as Uber and Lyft, may alter the competitive landscape of the Connected Car Market. These companies are altering the manner in which people travel and may alter the demand for connected cars. Self-driving cars are a potential disruptor that could completely transform the Connected Car Market. The connected car market and automotive towbar market exhibit promising growth prospects with increasing integration demands.

Emerging Tendencies and Consumer Conduct

Connected Car Market is also experiencing new developments and alterations in consumer behavior. Consumers are seeking cars that are more affordable, dependable, and fuel-efficient. Additionally, there is a developing trend toward shared mobility, which is anticipated to drive the demand for connected cars. In response, manufacturers are implementing sophisticated technology features and providing consumers with more affordable and sustainable options.

Restraining Factors

Difficulties and Obstacles in Developing Countries'

The connected car market has evolved as a prospective sector due to the rapid rate of technological innovation and advancements in the automotive industry. Connected cars integrate various features, such as entertainment, communication, safety, and navigation systems, to provide users with a convenient and personalized driving experience. However, despite its potential for substantial development, the lack of network connectivity infrastructure in developing countries is likely to pose a significant barrier to its advancement in the near future.

Impact of Limited Network Connectivity on Highways

On highways with limited network connectivity, vehicles are unable to communicate to the cloud and transmit data in real time. This problem is most prevalent in developing and underdeveloped regions, where the infrastructure to support seamless network connectivity is frequently lacking. This absence of network connectivity hinders the efficacy of connected cars. The lack of dependable communication channels precludes the implementation of sophisticated features, such as lane-departure warning systems and emergency call features, which improve road safety and reduce traffic accidents.

In developing nations, disparities in connected vehicle infrastructure exist.

Developing societies have less infrastructure for connected vehicles than developed nations. This is predominantly due to budget restrictions, which restrict investments in this industry. Significant investments and partnerships with technology providers are assisting developed nations in achieving higher connectivity levels. In developing nations, however, partnerships between infrastructure providers and automakers are still in their infancy.

Urban-Rural Difference and Its Effects

The prevalence of uninterrupted 3G and 4G networks in urban areas hinders the expansion of the connected car market. The network infrastructure in urban areas is superior and more advanced, allowing for real-time support of connected car features. In contrast, rural areas have limited or no coverage, resulting in connectivity issues and other issues. The same problem arises in countries like India, where there is a significant disparity between urban and rural 4G network availability. The lack of network connectivity in certain regions could result in a fragmented market, which could hinder the growth of connected cars.

Overcoming Connectivity Obstacles in Connected Car Market

Lack of connectivity infrastructure is anticipated to be a significant market growth restraint over the forecast period. Automobile manufacturers and technology suppliers are taking the necessary measures to address this problem. They are developing advanced technologies including Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communication systems that increase connectivity levels and provide real-time communication between vehicles and infrastructure. Additionally, they are developing inexpensive connectivity solutions that can support connected cars in underdeveloped regions.

By Connectivity Solution Analysis

The Integrated Segment is another crucial component of Connected Car Market, with features that improve the user experience and increase connectivity. In this section of the analysis, we will examine the factors driving the development of this segment, consumer trends and behavior, and why this segment is poised for explosive growth in the future years.

Advanced infotainment systems, Wi-Fi hotspots, and integration with popular mobile applications are increasingly sought after by consumers. In addition, there is a growing interest in personalization and customization, as consumers seek vehicles that can adapt to their specific requirements, preferences, and driving style. Given the rising demand for connectivity and integration, it is anticipated that the Integrated Segment will experience substantial growth in the coming years. As more features become available and consumers demand more connectivity options, manufacturers and technology firms compete to create the most advanced and user-friendly systems possible.

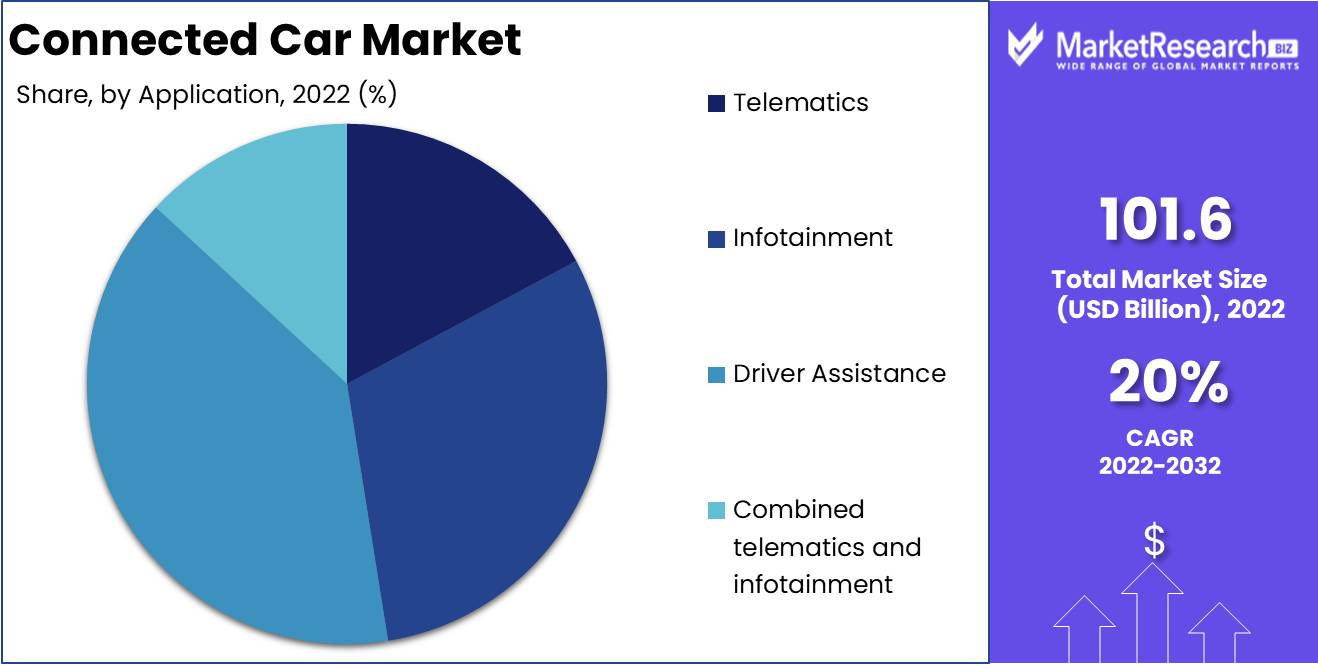

By Application Analysis

Among these segments, the Driver Assistance Segment dominates the market with a variety of sophisticated features that enhance driver safety, comfort, and productivity. In this section of the analysis, we will examine the factors driving the development of this segment, consumer trends and behavior, and why this segment is poised for explosive growth in the future years. Economic development in emerging economies such as China, India, and Brazil is one of the primary growth catalysts for the Driver Assistance Segment. The middle classes in these nations have grown rapidly and are increasingly able to afford high-tech vehicles with advanced safety features. In addition, many of these nations have a high incidence of traffic accidents, making safety features a consumer priority.

Consumers are becoming increasingly interested in vehicles with sophisticated safety features, especially those that can help prevent accidents and reduce the likelihood of injury. Consumers are willing to pay a premium for technologies such as automatic emergency braking, blind spot monitoring, and lane departure warning that are becoming standard on many models. In addition, there is a growing interest in advanced driver assistance systems (ADAS), which provide even more advanced features like automatic parking and adaptive cruise control. Given these trends, it should come as no surprise that the Driver Assistance Segment of the connected car market will experience the highest growth rate over the next few years. As more sophisticated features become standard and ADAS systems become more prevalent, consumers have higher expectations for automobiles. In addition, government regulations in a number of nations mandate the incorporation of certain safety features, which further drives the expansion of this market segment.

Key Market Segments

By Connectivity Solution

- Embedded

- Tethered

- Integrated

By Application

- Telematics

- Infotainment

- Driver Assistance

- Combined telematics and infotainment

Growth Opportunity

Low Penetration and Restricted to Luxury Automobiles

While the market for connected vehicles is expanding, it is still relatively young. As a result, the penetration rate is low, and the majority of these cars are limited to luxury vehicles. With the increasing prevalence of this technology, however, the penetration rate is expected to rise, and more cars, including mid-range and entry-level models, will incorporate this technology.

Tesla Offers Driverless Vehicles with Remote Parking

Tesla has been a pioneer in the market for connected vehicles and offers features that distinguish it from its competitors. One such feature is its autonomous driving with remote parking, which allows the vehicle to position itself. This feature is extremely helpful for drivers who have difficulty parking in confined spaces.

Parking Information in Real Time from Ford, Peugeot, Renault, Toyota, and Volkswagen

Several automobile manufacturers offer real-time parking information, providing drivers with accurate information regarding available parking spaces in real-time. This information is accessible via the vehicle's infotainment system, making it simpler for drivers to locate parking in congested areas.

Collaborations between automakers are becoming more prevalent, and these partnerships are propelling the popularity of connected cars. Automakers are collaborating to develop platforms that will enable drivers to access features from multiple automakers from a centralized location. This will result in decreased costs, making the technology more accessible to a wider spectrum of consumers.

Bosch and Ford collaborated to demonstrate connected valet parking

Ford has partnered with Bosch to demonstrate its connected valet parking feature, which enables drivers to drop off their cars at a designated location and have the vehicle position itself. This feature is extraordinarily useful for motorists in densely populated areas where parking is a nuisance.

Demand to be Driven by Smart City Initiatives and Advanced Connectivity Infrastructure

Smart city initiatives are gaining popularity, and these initiatives are propelling the demand for connected cars. With sophisticated connectivity infrastructure in place, connected cars can contribute to safer, more comfortable, and more efficient driving. This increased demand will propel the connected car market's expansion in the future years.

Latest Trends

The Explosion of Data in Connected Vehicles

Connected cars have become data aggregators, accumulating data about the vehicle's location, driver behavior, preferences, and overall health. This information is invaluable to automakers and industry stakeholders because it can be used to improve vehicle performance, safety, and comfort. However, the collection and use of this information exposes vehicles and drivers to potential cyber hazards.

User Data Protection in Connected Vehicles

Frequently, connected cars synchronize with the driver's infotainment system, which may contain sensitive information such as banking and medical data. This makes them desirable targets for cybercriminals. Recognizing the escalating cyberthreats, the automotive industry is developing solutions to protect connected cars and the valuable data they generate. Google and Apple have created cybersecurity applications for vehicles that detect and prevent unauthorized access, ensuring secure data transmission.

Collaborations to Strengthen Cybersecurity

In response to rising cybersecurity concerns, top firms in the automotive and cybersecurity industries are collaborating to create innovative solutions. DENSO, a prominent automotive technology manufacturer, collaborated with Dellfer, a cybersecurity firm, to develop ZeroDayGaurd 1.0, an innovative cybersecurity product designed particularly for the automotive industry. This collaborative effort enables automakers to effectively protect connected vehicles from cyber threats.

Finding a Balance Between Security and User Experience

It is essential to prioritize cybersecurity, but this must be done without jeopardizing the seamless driving experience that connected cars offer. It is essential to strike a balance between security and user-friendliness. The development of intuitive and easily accessible cybersecurity solutions, such as user-friendly applications and secure data transmission protocols, ensures that drivers can experience the advantages of connected cars while remaining safe from cyber threats.

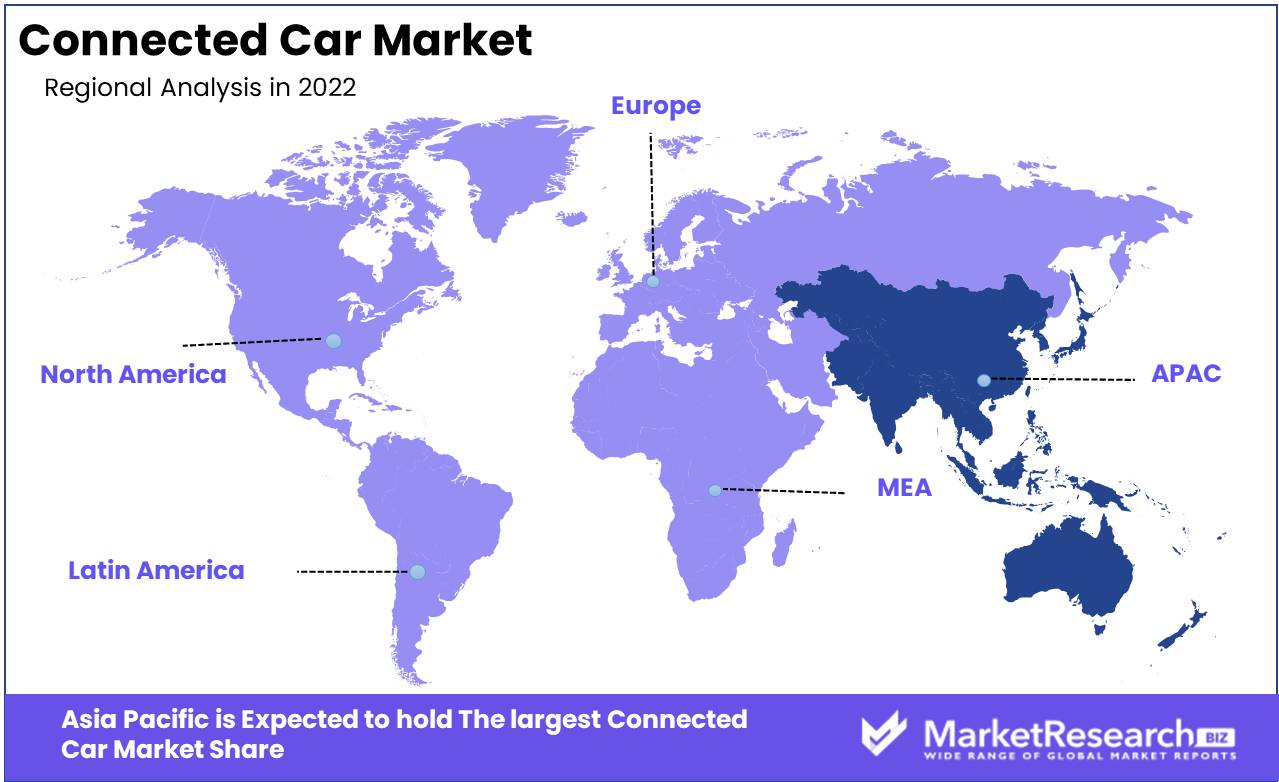

Regional Analysis

We are pleased to present the most recent information regarding the Asia-Pacific market, which is anticipated to experience significant growth over the forecast period. As an industry leader, we have analyzed the trends and projections and are anxious to share them with our readers. In this article, we will discuss the factors that contribute to the Asia-Pacific market's rapid CAGR growth, as well as the key considerations for businesses operating in this region.

The expanding middle class is one of the primary factors propelling the Asia-Pacific market's CAGR growth. As more individuals enter the middle-income bracket, the demand for products and services increases as well. This increase in demand creates substantial new opportunities for regional businesses.

Technological advancements are an additional important growth driver in the Asia-Pacific market. The region is renowned for its cutting-edge technologies and innovative solutions, which boost business productivity and efficiency. With sectors such as artificial intelligence, blockchain, and the Internet of Things (IoT) acquiring traction, businesses that can leverage these technologies are likely to experience accelerated growth.

The Asia-Pacific market's CAGR growth is also largely attributable to regional government policies. Governments in the region have instituted policies intended to increase foreign investment, thereby fostering economic expansion. For example, China's One Belt One Road initiative aims to promote infrastructure investment in Asia and beyond, thereby enhancing connectivity and fostering economic growth.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

As one of the most promising and disruptive technologies in the automotive industry, the connected vehicle market has attracted a multitude of market participants. In a market that is swiftly evolving, competition is fierce as key actors seek to gain an advantage over their rivals. Let's examine some of the main competitors in Connected Car Market.

Tesla, which is known for its innovative technology and luxury cars, is first on the list. Since becoming one of the first companies to offer internet connectivity in its vehicles, Tesla has led the market for connected vehicles. Their cars have a variety of features, including artificial intelligence, self-driving technology, and over-the-air software updates.

General Motors, which has existed for more than a century and remains a market leader, comes next. They have launched their connected car platform, OnStar, which offers emergency assistance, vehicle diagnostics, and roadside assistance, among other features.

Ford, BMW, Audi, Toyota, and Nissan are also major participants on the connected vehicle market. They are all making substantial investments in connected car technology and providing features such as intelligent infotainment systems and connected safety features.

Top Key Players in Connected Car Market

- Audi AG

- General Motors

- BMW AG

- General Motors Company

- Ford Motor Company

- Tesla Motors Inc.

- Google, Inc.

- Volvo Car Corporation

- Alcatel Lucent

- Delphi Automotive Plc

Recent Development

In February 2022, To satisfy tech-savvy consumers, the Connected Car Market is continually evolving. HARMAN Savari MECWAVE, an Ultra Low-Latency Edge-Based Compute Platform for V2X communications, was launched. Advanced driver assistance technologies will respond quickly and reliably on this platform, improving safety and efficiency.

In November 2021, Continental introduced their Next Generation Driving Planner. This clever software solution provides Level 3 highly autonomous driving for an unmatched driving experience. Their system uses real-time traffic updates and vehicle data to help drivers arrive safely.

In June 2020, Bosch launched the SMI230. Modern automobiles benefit from this innovative MEMS sensor's reliable navigation and realistic vehicle movement representation. This technology helps drivers navigate and enjoy a more immersive driving experience.

In September 2020, Visteon introduced their 2021 Ford F-150 digital cluster. High-resolution visuals and realistic drive modes provide drivers unprecedented power and personalization with this new digital cluster. Modern cars are adding the new digital cluster due to its sophisticated capabilities and user-friendly interface.

In October 2020, Airbiquity, a leader in connected car software, released the OTAmatic car Configurator. This sophisticated tool defines and manages connected car software, enabling seamless upgrades and maximum vehicle performance. Automakers and drivers will need the OTAmatic car Configurator as connected car demand grows.

Report Scope

Report Features Description Market Value (2022) USD 201.61 Bn Forecast Revenue (2032) USD 1248.32 Bn CAGR (2023-2032) 20% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Connectivity Solution: Embedded, Tethered, Integrated

By Application: Telematics, Infotainment, Driver Assistance, Combined telematics and infotainmentRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Audi AG, General Motors, BMW AG, General Motors Company, Ford Motor Company, Tesla Motors Inc., Google, Inc., Volvo Car Corporation, Alcatel Lucent, Delphi Automotive Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Audi AG

- General Motors

- BMW AG

- General Motors Company

- Ford Motor Company

- Tesla Motors Inc.

- Google, Inc.

- Volvo Car Corporation

- Alcatel Lucent

- Delphi Automotive Plc