Global Generative AI in Manufacturing Market, By Application (Product Design, Prototyping, and Other ), By Deployment (On-premises and On the Cloud), By Industry Vertical (Automotive, Aerospace, and Other ) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

-

37136

-

July 2023

-

137

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

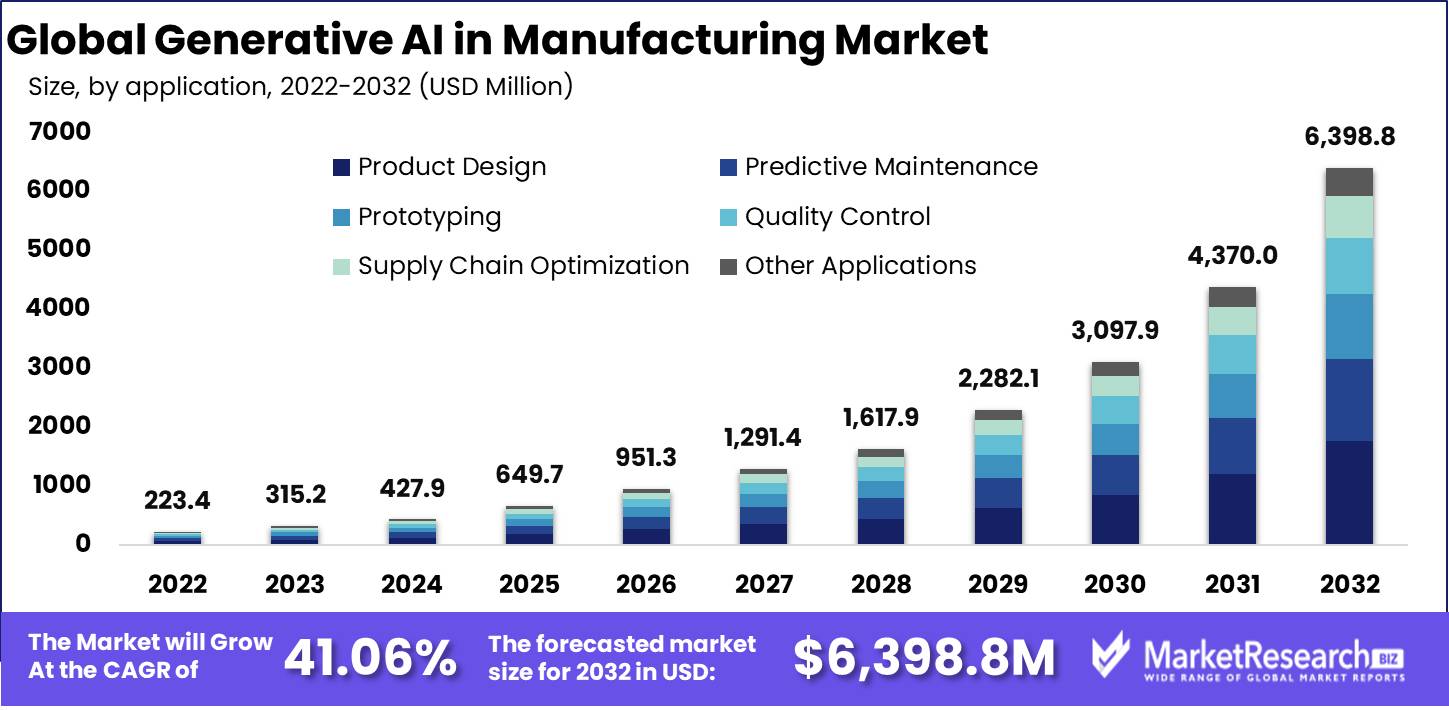

Global Generative AI in Manufacturing Market size is expected to be worth around USD 6,398.8 Mn by 2032 from USD 223.4 Mn in 2022, growing at a CAGR of 41.06% during the forecast period from 2023 to 2032.

Generative AI is a type of artificial intelligence that can generate unique and new outputs from input data. In the manufacturing sector, generative AI can be used to improve product designs, optimize production processes and reduce costs. In the manufacturing industry, AI is used to reduce costs, improve efficiency, quality control, and predictive maintenance. By using this companies can make new and unique designs of products to attract customers. Companies can save costs by reducing waste, optimizing production processes, and improving quality control.

Driving Factors

Increasing Demand for Automation, Advancements in AI Technology, and the Growth of Industry 4.0 are Driving the Generative AI in Manufacturing Market.

There is a growing need for generative AI within manufacturing. Automation is a rising focus in the manufacturing industry to reduce costs, increase the efficiency of machines & improve productivity. Generative AI is a powerful tool that can optimize production, improve quality control and automate design.

The development of advanced generative AI models has been facilitated by the continued advancements in artificial intelligence technology notably deep learning. These models can handle complex data sets & produce more accurate and realistic results. This is driving the adoption and use of generative AI for manufacturing.

Industry 4.0 is the latest trend in manufacturing that involves the integration of advanced technology such as IoT & big data. Generative AI can be used to enhance these technologies' capabilities, improve productivity and quality control and drive the growth of generative AI for manufacturing. It can be used to optimize design and improve performance. It can generate designs that are based on performance criteria, materials & other factors. This leads to more efficient and innovative product designs.

Generative AI reduces costs in manufacturing by optimizing production, decreasing waste, and improving quality control. It can help manufacturers reduce costs and remain competitive. The growing demand for generative AI is driving an increase in investment in this technology.

Restraining Factors

High Implementation Costs, Data Quality, and Availability are Restraining the Growth of the Market.

Costs can be high when implementing generative AI in the manufacturing process. Its essential investments are in hardware, software, and infrastructure as well as trained personnel to manage and maintain it. It can be difficult for mid-sized and small businesses to adopt this technology. To produce accurate and useful results AI models that generate data require a large amount of high-quality data.

In many cases, however, the data available is either of low quality or inadequate. This can make it difficult to train models effectively and limit their abilities. The use of generative AI for manufacturing can also pose new security risks. The technology requires that sensitive data such as product designs and manufacturing processes be accessed.

This could make it unsafe for cyber-attacks or other security breaches. This can pose a challenge to manufacturers in protecting their intellectual properties and ensuring the security of their systems. The implementation of generative AI into manufacturing requires also skilled personnel who are trained in artificial intelligence & data analytics. There is a shortage of such personnel. This makes it difficult for companies to find the best talent to implement and manage this technology.

The use of generative AI for manufacturing raises ethical issues, especially in relation to the potential for job displacement. As automation and AI progress, there is the risk that many jobs could become redundant resulting in unemployment and social disruption.

COVID-19 Impact Analysis

The pandemic caused major disruptions to global supply chains. This has had a knock-on effect on the manufacturing industry. This has caused shortages and delays and in goods & services in production which has in turn impacted the demand in manufacturing for generative AI.

The pandemic is causing a decline in investment activity. Many investors are becoming more aware when it comes to funding new ventures. This has made it harder for startups and smaller businesses in the generative AI market to secure financing. The pandemic has brought to light the importance of automation for the manufacturing industry.

Automation is becoming more important to maintain productivity and efficiency as many factories and facilities are shut down or operate at reduced capacity. This has led to an increased interest in generative AI, and other technologies which can optimize production processes. The pandemic is accelerating the adoption of digital technology across many industries including manufacturing. As companies seek to digitize their processes and operations, generative AI is becoming a key technology for improving efficiency and productivity.

Pandemics have forced many companies into adopting remote work and collaboration software to maintain business operations. This has led to an increased reliance on cloud solutions and other technologies which can facilitate remote working and collaboration. Generative AI is well suited to this new environment, as it can generate designs and models from a distance.

By Application Analysis

The Product Design Segment Accounted for the Largest Revenue Share in Generative AI in Manufacturing Market in 2022.

Based on application, the market is segmented into product design, prototyping, quality control, predictive maintenance, supply chain optimization, and other applications. Among these types, the product design is expected to be the most lucrative in the global generative AI in manufacturing market, with the largest revenue share of 27.4% and a projected CAGR of XX% during the forecast period.

Product design is an important application segment of the generative AI market. Generative design software helps product designers and engineers to create better, more efficient products by using algorithms that generate and evaluate multiple options.

Software for generative design can analyze parameters and constraints such as weight, material strength, and manufacturing limitations to create optimized designs that meet specific criteria. For example, in the automotive industry generative design software is used to create lighter and stronger vehicle components such as engine mounts and suspension components.

The Predictive Maintenance Segment is Fastest Growing Application Segment in Generative AI in Manufacturing Market.

The predictive maintenance segment is projected as the fastest-growing application segment in generative AI in the manufacturing market from 2023 to 2032 at a CAGR of XX%. Predictive maintenance is the use of machine learning and AI algorithms to predict equipment failures or maintenance needs before these occur. Generative AI can be used in manufacturing to optimize maintenance schedules, reduce downtime and predict equipment failures. This can help reduce maintenance costs, increase equipment reliability, and prolong the life of equipment.

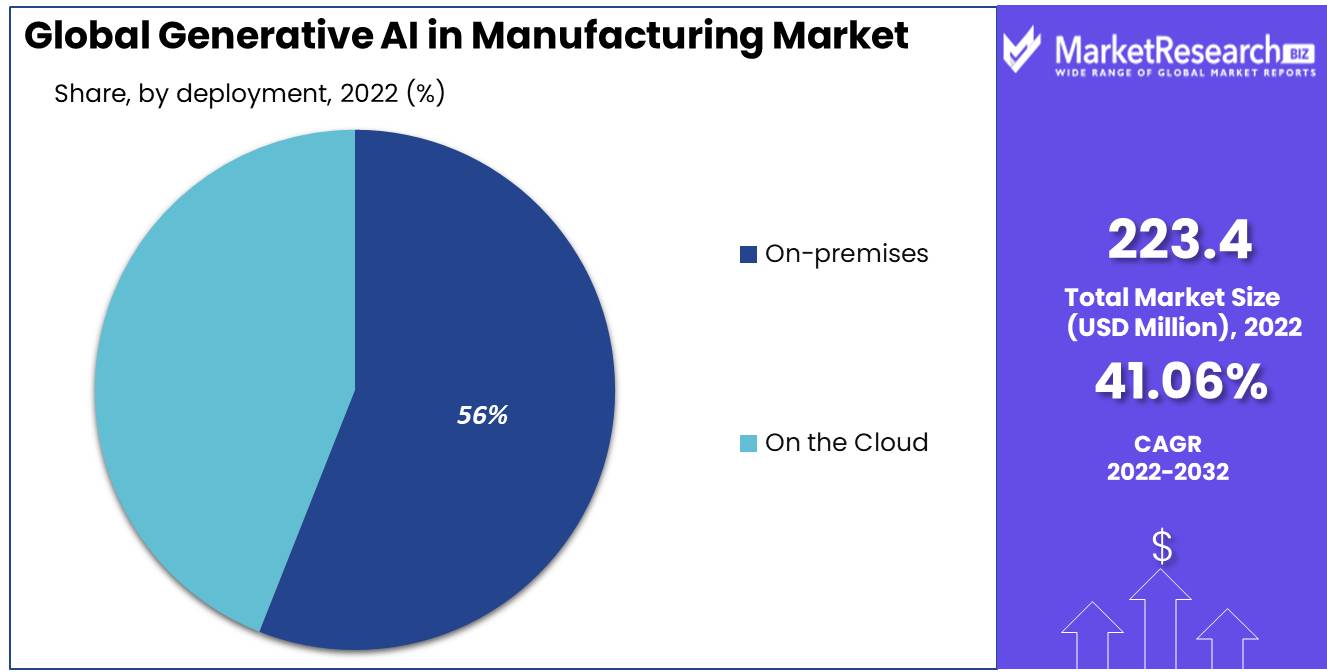

By Deployment Analysis

The On-Premises Holds the Significant Share in Deployment Segment in Generative AI in Manufacturing Market.

Based on deployment, the market is divided into on-premises and on the cloud. Among these, the on-premises segment is dominant in the deployment segment of generative AI in the manufacturing market, with a market share of 56% and a CAGR of XX%.

On-premises deployment is the installation of generative AI infrastructure and software within a company’s own data center, as opposed to using a cloud deployment model. Companies with strict security and compliance needs often prefer an on-premises deployment that allows them to retain complete control over their infrastructure & data.

On-premises deployments can also offer better performance and lower latencies as data analysis & processing can be done locally without relying upon a cloud-based architecture.

On the Cloud is Identified as Fastest Growing Deployment Segment in Projected Period.

On the cloud is also an important deployment segment in generative AI in the manufacturing market and it is expected to grow faster in the deployment segment in generative AI in the manufacturing market with a CAGR of XX%. On the cloud deployment is the installation of generative AI infrastructure and software on cloud-based platforms that can be accessed remotely over the internet.

Cloud based deployment is preferred by companies who want to benefit from the flexibility, cost-effectiveness, and scalability of cloud-based platforms without having to invest in data center infrastructure. Cloud deployment can provide easier access to analytics & data as data can easily be shared across teams and locations.

By Industry Vertical Analysis

The Automotive Segment Accounted for the Largest Revenue Share in Generative AI in Manufacturing Market in 2022.

Based on industry verticals, the market is segmented into automotive, aerospace, electronics, consumer goods, and other industry verticals. Among these types, the automotive is expected to be the most lucrative in the global generative AI in manufacturing market, with the largest revenue share of 33.5% and a projected CAGR of XX% during the forecast period.

Generative AI is used in many applications within the automotive sector, including product design and predictive maintenance. In product design, generative artificial intelligence can help automotive companies optimize designs, improve performance, and reduce weight and material usage.

Generative AI analyzes data from simulations or experiments to create new design concepts.It can also identify the best design parameters based on a set of requirements. This can help automotive manufacturers reduce the time and costs of designing new products while improving their performance and reducing their impact on the environment.

The Aerospace Segment is Fastest Growing Industry Vertical Segment in Generative AI in Manufacturing Market.

The aerospace segment is projected as the fastest-growing industry vertical segment in generative AI in the manufacturing market from 2023 to 2032 at a CAGR of XX%. Generative AI can help aerospace firms optimize their designs, improve performance and reduce weight and material usage.

Generative AI can create new design concepts by analyzing data from simulations or experiments. It can also identify the best design parameters to meet a set of requirements. Generative AI can be used to simulate complex systems and components such as aircraft engines or structural components. By analyzing simulation data, generative AI can identify possible problems and recommend design modifications to improve performance and decrease risk.

Generative AI in Manufacturing Key Market Segments

Based on Application

- Product Design

- Prototyping

- Quality Control

- Predictive Maintenance

- Supply Chain Optimization

- Other Applications

Based on Deployment

- On-premises

- On the Cloud

Based on Industry Vertical

- Automotive

- Aerospace

- Electronics

- Consumer Goods

- Other Industry Verticals

Growth Opportunity

Predictive Maintenance and New Product Design Creates the Opportunity in the Market.

Generative AI can revolutionize the manufacturing industry. It allows companies to automate complex production processes, optimize production lines and improve product quality. Businesses that want to streamline their operations or stay competitive can benefit from generative AI. Product design is a significant growth area for generative AI.

Generative AI helps companies create new designs or optimize existing ones using algorithms that generate and evaluate design options. This approach can save companies time and resources while producing more innovative products. Predictive maintenance is another area where generative AI has a significant impact. By analyzing data from sensors and other sources, the generative AI can assist companies in predicting when equipment will fail, allowing them to perform maintenance proactively to avoid costly downtime.

Generative AI is also able to help companies optimize production lines. It does this by analyzing data & identifying inefficiencies within the manufacturing process. This approach can reduce waste, improve the quality of products and increase productivity. Generative AI helps companies to improve their supply chain management by analyzing different data sources and identifying potential inefficiencies & bottlenecks in the supply chain. This approach can help businesses optimize their inventory levels, lower costs, and improve delivery times.

Latest Trends

Integration with Digital Twins, Evolution of Generative Design are the Latest Trends in the Market

Digital twins are virtual representations of physical assets & systems that can be used for simulation and optimization. Digital twins and generative AI are increasingly being integrated to create more accurate simulations of manufacturing processes.

Generative design is a method that uses algorithms to create and evaluate multiple design options according to a set criterion. This approach is becoming increasingly sophisticated with the use of advanced algorithms and machine-learning techniques to create more complex and optimized designs.

Predictive maintenance uses machine learning algorithms and data to predict when equipment will fail. This approach is becoming more common in the manufacturing industry with the use of IoT devices and sensors to collect data in real time and make more accurate predictions.

There are an increasing number of generative AI platforms that are specifically designed for the manufacturing industry. These platforms offer various tools and capabilities that can be customized to suit the needs of different manufacturing processes.

Generative AI which analyzes data from sensors and sources other than manufacturing, is increasingly being used to optimize the manufacturing process. This involves identifying inefficiencies and improvement opportunities. This approach can reduce waste, improve quality and increase productivity.

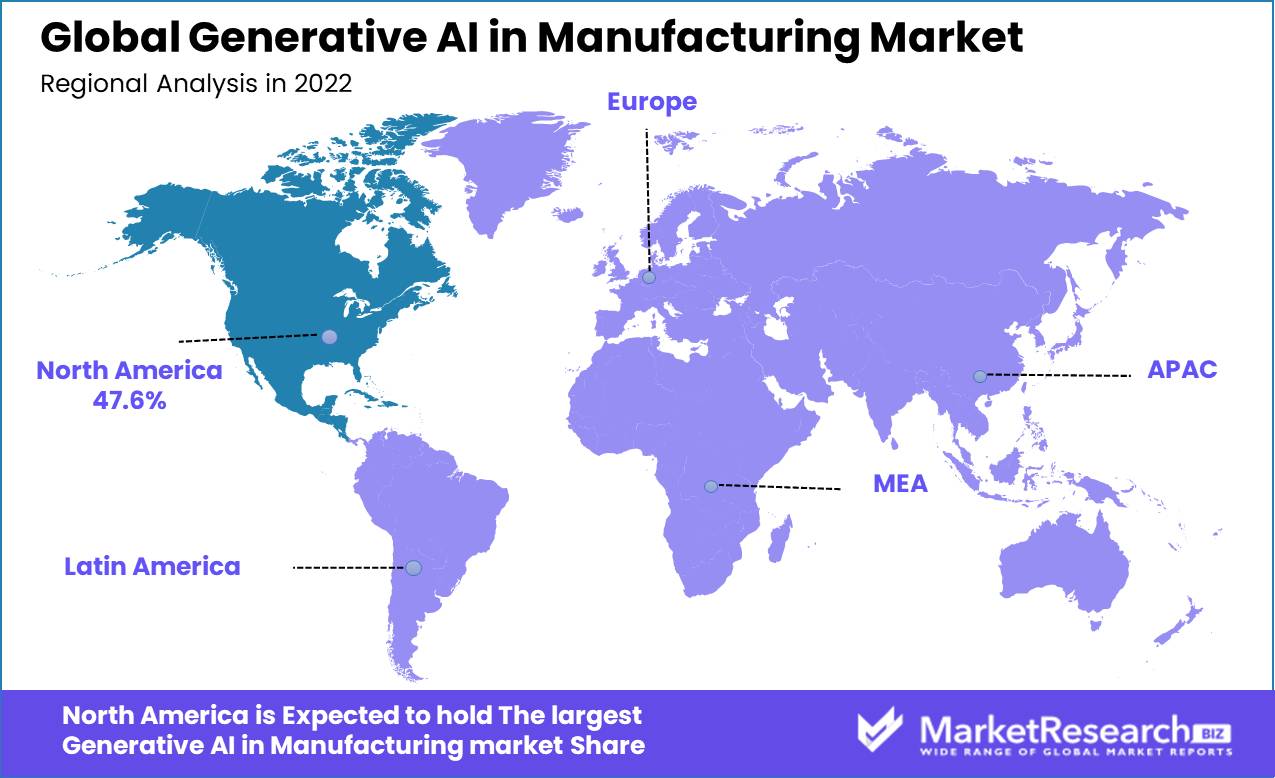

Regional Analysis

North America Accounted for the Largest Revenue Share in Generative AI in Manufacturing Market in 2022.

North America is estimated to be the most lucrative market in the global generative AI in manufacturing market, with the largest market share of 47.6%, and is expected to register a CAGR of XX% during the forecast period. North America is the largest market in North America for generative AI in Manufacturing, due to the high adoption of AI technologies. The US and Canada are major contributors to this region's growth.

Asia-Pacific is Expected as Fastest Growing Region in Projected Period in Generative AI in Manufacturing Market.

Asia-Pacific is expected as fastest growing region in the forecast period in the generative AI in manufacturing market with a CAGR of XX%. China, Japan, and South Korea are leading the market growth for generative AI. The adoption of AI and automation technologies in manufacturing is driving the growth of this market.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Share & Key Players Analysis

Generative AI in Manufacturing is fragmented. There are many market players like Autodesk, Siemens, Dassault Systems, and NVIDIA. Among these companies, many players are the leaders in the generative AI market for manufacturing and they all invest heavily in research and development to stay ahead of their competition. We can expect to continue to see innovation and competition as the market grows.

Market Key Players:

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Alphabet Inc.

- Siemens AG

- General Electric Company

- Autodesk Inc.

- NVIDIA Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Other Key Players

Recent Developments

- In 2021, Siemens announced a partnership with industrial robotics company Comau for the development of AI-powered manufacturing solutions. The partnership will focus primarily on developing software to optimize manufacturing processes and increase productivity.

- In 2020, Autodesk launched its generative software for the construction sector, allowing architects and engineers to use AI to optimize their building designs. The company has also launched a cloud-based generative service that allows users access to the software from anywhere.

Report Scope

Report Features Description Market Value (2022) USD 223.4 Mn Forecast Revenue (2032) USD 6,398.8 Mn CAGR (2023-2032) 41.06% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Product Design, Prototyping, Quality Control, Predictive Maintenance, Supply Chain Optimization, Other Applications) By Deployment (On-premises, On the Cloud) By Industry Vertical (Automotive, Aerospace, Electronics, Consumer Goods, Other Industry Verticals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SAP SE, IBM Corporation, Microsoft Corporation, Alphabet Inc., Siemens AG, General Electric Company, Autodesk Inc., NVIDIA Corporation, Cisco Systems Inc., Oracle Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Alphabet Inc.

- Siemens AG

- General Electric Company

- Autodesk Inc.

- NVIDIA Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Other Key Players