Gas Chromatography Market By Instruments (Systems, Autosamplers, Fraction Collectors, Detectors), By Accessories and Consumables (Columns Accessories, Flow Management Accessories, Consumables & Accessories, Fittings and Tubing, Pressure Regulators, Gas Generators, Other), By Reagents (Analytical Reagents, Bioprocess Reagents), By End User (Pharmaceutical, Oil and Gas, Food and Beverage, Agriculture, Cosmetics Industry, Environmental Agencies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends

-

48318

-

July 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

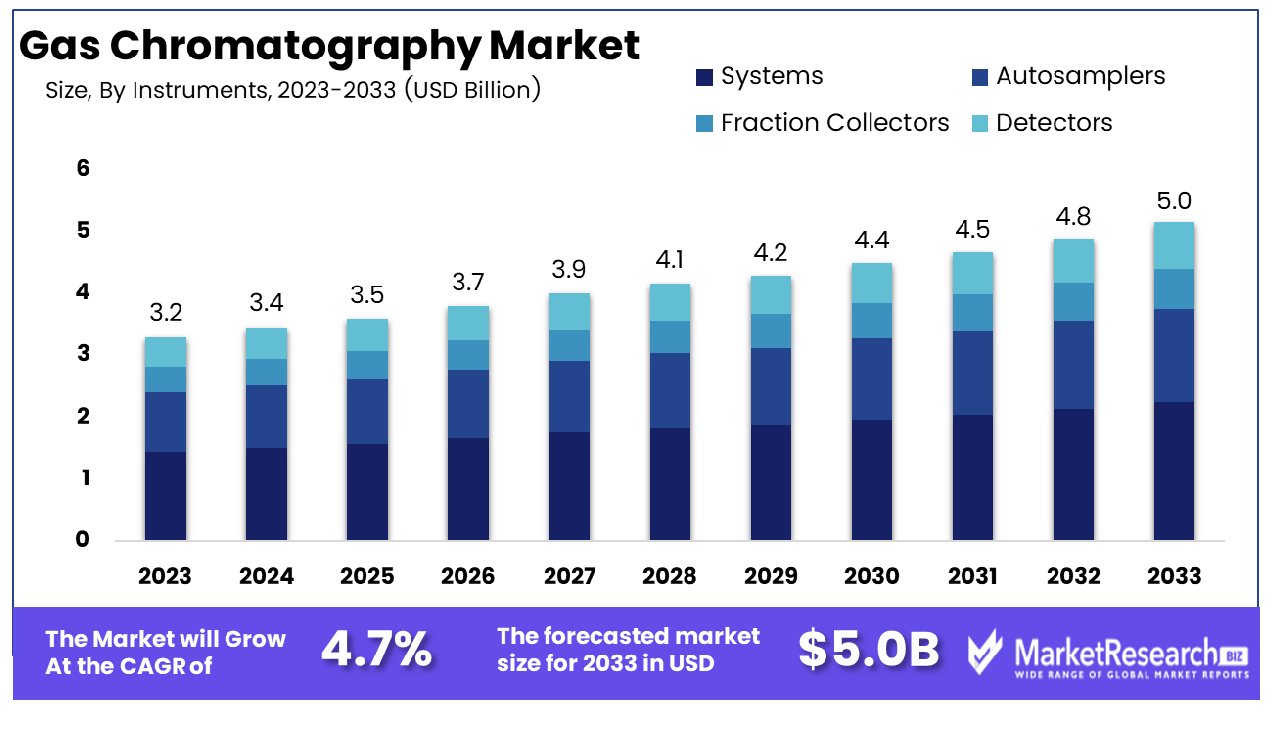

The Global Gas Chromatography Market was valued at USD 3.2 Bn in 2023. It is expected to reach USD 5.0 Bn by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

The gas chromatography market encompasses the development, production, and application of gas chromatography (GC) systems, instruments, and consumables used for separating and analyzing compounds in complex mixtures. Essential in industries such as pharmaceuticals, environmental testing, food and beverage, and petrochemicals, GC technology is vital for quality control, regulatory compliance, and research. The market is driven by advancements in GC technologies, increasing demand for precise analytical techniques, and growing applications in emerging fields like biotechnology and forensics. Continuous innovation and the integration of automation and digital solutions are enhancing the efficiency and accuracy of gas chromatography processes.

The gas chromatography (GC) market is poised for significant growth, driven by its essential role in various industries such as pharmaceuticals, environmental testing, food and beverage, and petrochemicals. The demand for high-precision analytical techniques is increasing as industries seek to meet stringent quality control and regulatory standards. Advancements in GC technologies are central to this growth, with innovations like the Environics Model 4000 systems enhancing calibration accuracy by up to ten times compared to standard thermal mass flow meters. This level of precision is crucial for reliable and consistent analytical results, making these advanced systems highly valued.

The introduction of Zero Air Generators (ZAG) provides contaminant-free air at flow rates of 20 SLPM and pressures of 30 psi, offering a flexible and cost-effective solution for GC calibration. These technological advancements are streamlining operations, reducing costs, and improving the reliability of GC analyses.

The introduction of Zero Air Generators (ZAG) provides contaminant-free air at flow rates of 20 SLPM and pressures of 30 psi, offering a flexible and cost-effective solution for GC calibration. These technological advancements are streamlining operations, reducing costs, and improving the reliability of GC analyses.The market is also benefiting from the integration of automation and digital solutions, which enhance the efficiency and accuracy of GC processes. Companies are increasingly investing in R&D to develop more sophisticated GC systems that can handle complex analytical demands and provide faster, more accurate results.

Key Takeaways

- Market Value: The Global Gas Chromatography Market was valued at USD 3.2 Bn in 2023. It is expected to reach USD 5.0 Bn by 2033, with a CAGR of 4.7% during the forecast period from 2024 to 2033.

- By Instruments: Systems make up 45% of the gas chromatography market by instruments.

- By Accessories and Consumables: Columns accessories account for 30% of the gas chromatography market by accessories and consumables.

- By Reagents: Analytical reagents constitute 60% of the gas chromatography market by reagents.

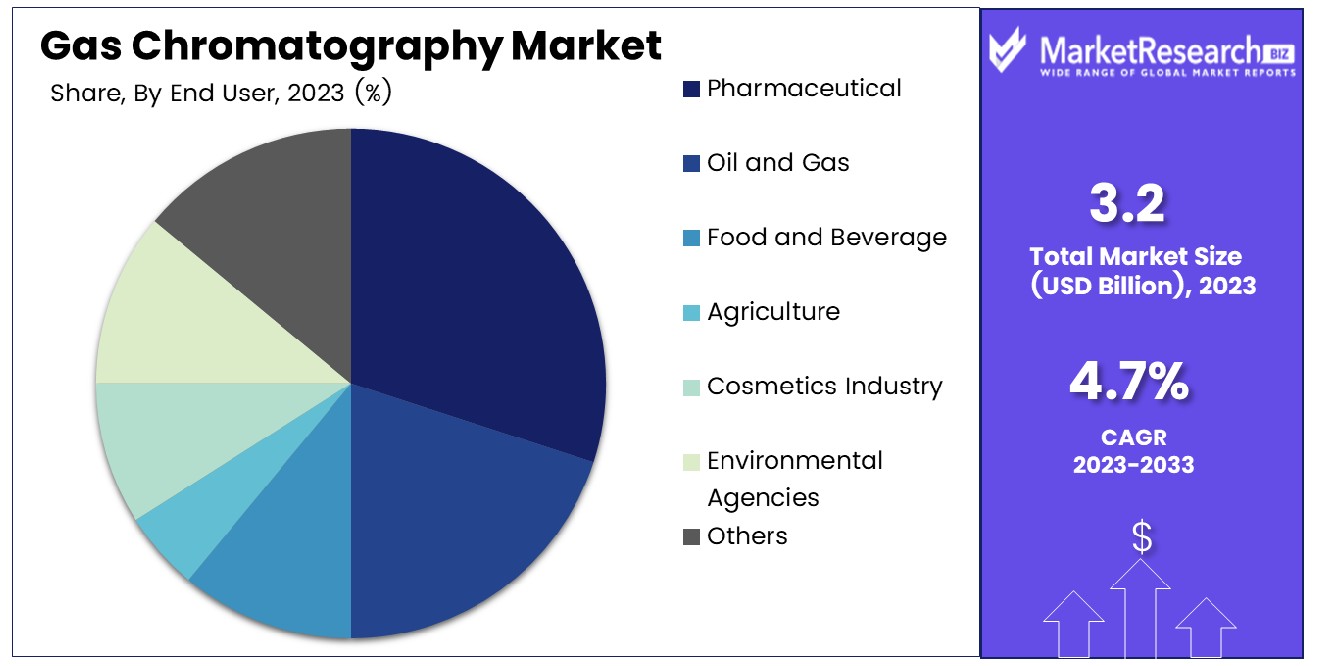

- By End User: The pharmaceutical sector represents 30% of the gas chromatography market by end-user.

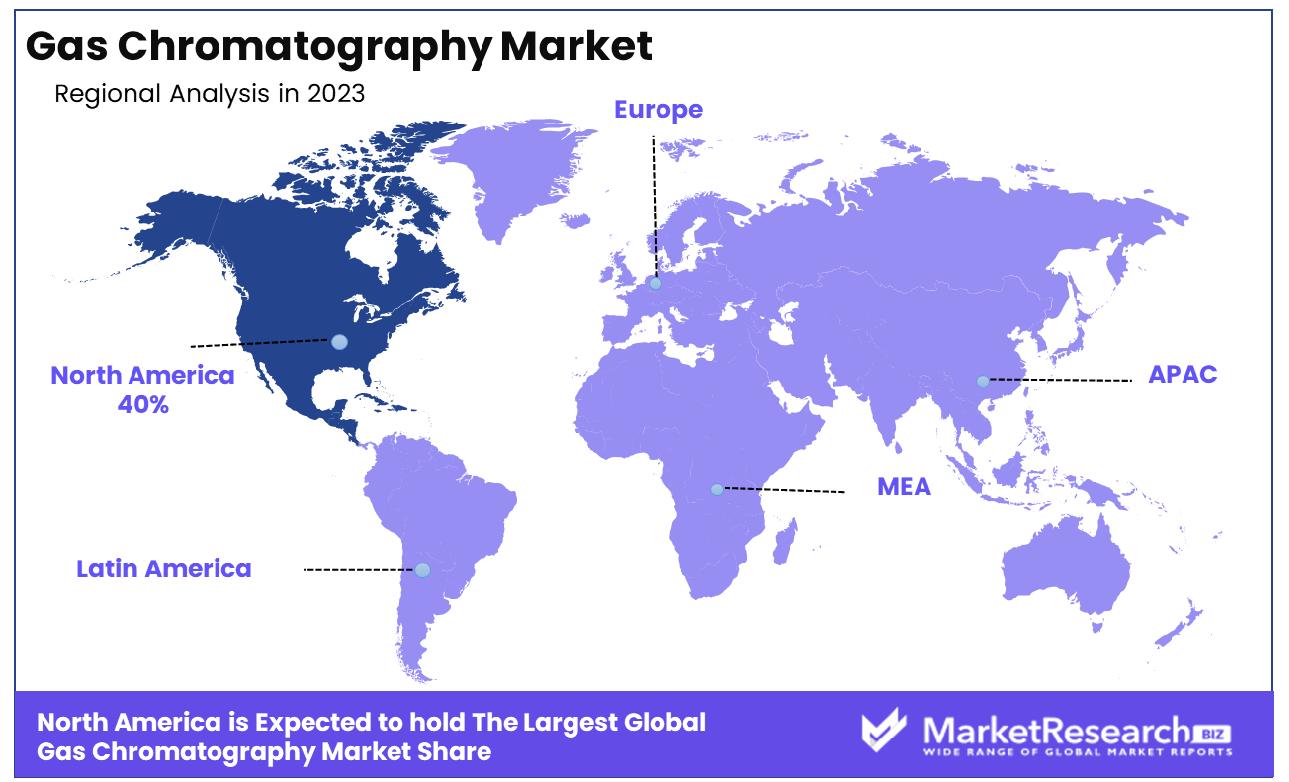

- Regional Dominance: North America leads with 40% of the market share, primarily due to the robust pharmaceutical industry and extensive R&D activities.

- Growth Opportunity: The growing need for accurate and efficient analytical techniques in pharmaceuticals, environmental testing, and food safety is fueling the expansion of the gas chromatography market.

Driving factors

Pharmaceuticals and Biotechnology

The pharmaceuticals and biotechnology sectors are pivotal in driving the growth of the gas chromatography market. Gas chromatography (GC) plays a critical role in these industries due to its precision, efficiency, and versatility in analyzing complex compounds. In pharmaceuticals, GC is essential for drug development, quality control, and ensuring regulatory compliance. It aids in identifying impurities, analyzing drug formulations, and monitoring stability, thus guaranteeing the safety and efficacy of pharmaceutical products. As the demand for new and innovative drugs escalates, the reliance on advanced analytical techniques like GC is set to increase.

In biotechnology, GC is used extensively for metabolomics, proteomics, and lipidomics, enabling detailed molecular profiling and biomarker discovery. The expanding biopharmaceutical sector, characterized by a surge in biologics and personalized medicine, is further bolstering the demand for sophisticated analytical tools. With the global biopharmaceutical market projected to grow at a robust pace, the gas chromatography market is anticipated to witness substantial growth.

Rising Environmental Regulations

The implementation of stringent environmental regulations worldwide is significantly contributing to the growth of the gas chromatography market. Governments and regulatory bodies are increasingly focusing on monitoring and controlling environmental pollutants to address public health concerns and combat climate change. GC is a vital tool in environmental analysis, capable of detecting and quantifying pollutants such as volatile organic compounds (VOCs), pesticides, and greenhouse gases with high precision and accuracy.

The enforcement of regulations like the Clean Air Act in the United States, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and various other regional environmental policies are compelling industries to adopt advanced analytical techniques to comply with legal requirements. This regulatory landscape is driving the demand for gas chromatography systems, particularly in sectors such as petrochemicals, agriculture, and waste management.

Restraining Factors

High Equipment and Maintenance Costs

High equipment and maintenance costs are significant factors impacting the growth of the gas chromatography market. Gas chromatography systems are sophisticated instruments that require substantial investment, not only for initial purchase but also for ongoing maintenance and calibration. These high costs can be prohibitive, particularly for small and medium-sized enterprises and research institutions with limited budgets. The expense of maintaining GC systems includes regular servicing, replacement parts, and consumables, all of which add to the total cost of ownership.

This financial barrier can slow market penetration and adoption, especially in emerging markets or industries with tight budget constraints. However, this challenge also drives innovation. Manufacturers are increasingly focusing on developing cost-effective and modular GC systems that offer easier maintenance and lower operating costs.

Shortage of Skilled Professionals

The shortage of skilled professionals is another critical factor affecting the gas chromatography market. Operating and maintaining GC systems require specialized knowledge and expertise. Skilled technicians and analysts must be adept at calibrating equipment, interpreting complex data, and troubleshooting issues to ensure accurate and reliable results. The current deficit in trained personnel can lead to operational inefficiencies and errors, hampering the effectiveness of GC applications across various industries.

This shortage is particularly acute in regions where educational and training programs in analytical chemistry and instrumentation are limited. To address this issue, companies and educational institutions are investing in training programs and workshops to build a more skilled workforce. Online training modules and certifications are also becoming increasingly popular, providing flexible learning opportunities for professionals worldwide.

By Instruments Analysis

Systems were the leading instrument, securing 45% of the market share.

In 2023, Systems held a dominant market position in the gas chromatography market, capturing more than a 45% share. Gas chromatography systems are comprehensive setups that include the chromatograph, data processing units, and often integrated detectors and autosamplers. These systems are crucial for performing a wide range of analytical procedures, offering high precision and reliability. Their extensive use in industries such as pharmaceuticals, environmental testing, and petrochemicals drives their significant market share. The continuous demand for accurate and efficient analytical techniques ensures the sustained growth of this segment.

Autosamplers represent a significant portion of the gas chromatography market. Autosamplers automate the injection process, enhancing precision, reproducibility, and throughput in analytical laboratories. They are essential for high-throughput environments and contribute to reducing manual errors. The increasing need for efficiency and automation in laboratories supports the robust demand for autosamplers.

Fraction Collectors play a critical role in preparative gas chromatography, allowing for the collection of separated components for further analysis or use. These instruments are vital in applications requiring purification and isolation of compounds, such as in pharmaceuticals and biotechnology. The specificity and efficiency provided by fraction collectors make them an integral part of advanced GC setups.

Detectors are essential components of gas chromatography systems, responsible for identifying and quantifying the components of a sample. Various types of detectors, including flame ionization detectors (FID), thermal conductivity detectors (TCD), and mass spectrometers (MS), are used depending on the application requirements. The versatility and critical role of detectors in achieving accurate analytical results underpin their substantial market share.

By Accessories and Consumables Analysis

Columns accessories accounted for 30% of the accessories and consumables segment.

In 2023, Columns Accessories held a dominant market position in the gas chromatography market, capturing more than a 30% share. Columns and their accessories are critical components in gas chromatography, responsible for the separation of chemical compounds. The demand for high-performance columns and related accessories is driven by their crucial role in achieving precise and accurate analytical results across various applications, including pharmaceuticals, environmental analysis, and food testing. Continuous innovation in column technology and the need for customized solutions further enhance their market dominance.

Flow Management Accessories represent a significant portion of the gas chromatography market. These accessories, which include flow controllers and splitters, are essential for maintaining optimal flow rates and ensuring consistent performance of the chromatography system. The increasing complexity of analytical procedures and the need for enhanced accuracy and reproducibility drive the demand for advanced flow management solutions.

Consumables & Accessories encompass a broad range of essential items such as syringes, vials, septa, and liners, which are crucial for the daily operation of gas chromatography systems. The recurring need for these consumables, along with their role in maintaining system integrity and performance, supports their substantial market share. The growth of laboratory activities and analytical testing across industries further fuels this segment.

Fittings and Tubing are integral to the setup and maintenance of gas chromatography systems. These components ensure secure connections and proper flow of gases and samples within the system. The reliability and durability of fittings and tubing are vital for preventing leaks and ensuring accurate analytical results, driving their steady demand.

Pressure Regulators are essential for controlling and maintaining the appropriate pressure levels within gas chromatography systems. These regulators are critical for ensuring consistent gas flow and optimal system performance. The need for precise pressure control in various analytical applications underpins the demand for high-quality pressure regulators.

Gas Generators provide a reliable and cost-effective source of carrier gases such as hydrogen, nitrogen, and zero air. The use of gas generators eliminates the dependency on gas cylinder, offering a continuous supply of high-purity gases. The increasing adoption of gas generators for their convenience and operational efficiency contributes to their growing market presence.

Other accessories and consumables include items such as detectors, automotive pumps, and software, which enhance the functionality and performance of gas chromatography systems. These components support specialized applications and contribute to the overall efficiency and accuracy of the analytical process.

By Reagents Analysis

Analytical reagents were the most utilized, with a 60% share.

In 2023, Analytical Reagents held a dominant market position in the gas chromatography market, capturing more than a 60% share. Analytical reagents are essential for the preparation, separation, and analysis of samples in gas chromatography. These reagents, including solvents, derivatization agents, and calibration standards, ensure accurate and reliable analytical results. The high demand for precise and consistent analytical performance across industries such as pharmaceuticals, environmental testing, and food safety drives the significant market share of analytical reagents. Continuous innovation and stringent regulatory requirements further bolster their critical role in the market.

Bioprocess Reagents represent a growing segment within the gas chromatography market. These reagents are used in the biotechnological and pharmaceutical industries for the analysis and processing of biological samples. As the biopharmaceutical sector expands, the demand for specialized bioprocess reagents is increasing. These reagents are crucial for maintaining the integrity and functionality of biological samples during chromatographic analysis. The growing focus on biotechnology research and the development of new biopharmaceutical products support the rising demand for bioprocess reagents.

By End User Analysis

The pharmaceutical sector constituted 30% of the end-user market.

In 2023, the Pharmaceutical sector held a dominant market position in the gas chromatography market, capturing more than a 30% share. Gas chromatography is vital in the pharmaceutical industry for drug development, quality control, and regulatory compliance. Its ability to provide precise and accurate analysis of complex compounds makes it indispensable for ensuring the safety and efficacy of pharmaceutical products. The continuous advancement in drug formulations and the stringent regulatory requirements drive the substantial market share of gas chromatography in this sector.

The Oil and Gas industry also represents a significant portion of the gas chromatography market. Gas chromatography is extensively used for analyzing hydrocarbon mixtures, monitoring environmental pollutants, and ensuring product quality in the oil and gas sector. The need for accurate and reliable analytical techniques to comply with environmental regulations and optimize production processes supports the robust demand for gas chromatography in this industry.

In the Food and Beverage sector, gas chromatography plays a crucial role in quality control, flavor analysis, and the detection of contaminants. The increasing focus on food safety and quality assurance drives the adoption of gas chromatography, making it an essential tool for manufacturers in this industry.

The Agriculture sector utilizes gas chromatography for pesticide residue analysis, soil testing, and monitoring of agrochemical levels. As the demand for safe and sustainable agricultural practices grows, the need for precise analytical methods like gas chromatography is becoming more prominent.

In the Cosmetics Industry, gas chromatography is used for the analysis of fragrance compounds, preservatives, and other ingredients. Ensuring product safety and compliance with regulatory standards drives the use of gas chromatography in cosmetics.

Environmental Agencies rely on gas chromatography for monitoring air and water quality, detecting pollutants, and ensuring compliance with environmental regulations. The increasing focus on environmental protection and sustainability fuels the demand for gas chromatography in this sector.

Others include a variety of industries such as chemicals, forensics, and biotechnology, where gas chromatography is used for specialized analytical applications. The versatility and precision of gas chromatography make it valuable across these diverse fields.

Key Market Segments

By Instruments

- Systems

- Autosamplers

- Fraction Collectors

- Detectors

By Accessories and Consumables

- Columns Accessories

- Flow Management Accessories

- Consumables & Accessories

- Fittings and Tubing

- Pressure Regulators

- Gas Generators

- Other

By Reagents

- Analytical Reagents

- Bioprocess Reagents

By End User

- Pharmaceutical

- Oil and Gas

- Food and Beverage

- Agriculture

- Cosmetics Industry

- Environmental Agencies

- Others

Growth Opportunity

Expansion in Emerging Markets

Emerging markets present substantial opportunities for the global gas chromatography market in 2024. As economies in regions like Asia-Pacific, Latin America, and Africa continue to grow, there is an increasing demand for advanced analytical technologies across various industries, including pharmaceuticals, environmental testing, and food safety. These markets are witnessing rapid industrialization and urbanization, leading to greater environmental monitoring needs and stricter regulatory requirements. The expansion of the pharmaceutical and biotechnology sectors in these regions drives the demand for precise and reliable analytical tools like gas chromatography.

Companies are strategically focusing on these emerging markets to capitalize on the growth potential. By establishing local manufacturing facilities, forming strategic partnerships, and offering affordable and modular GC systems tailored to regional needs, manufacturers can effectively penetrate these markets. This strategic expansion is essential for capturing new customer bases and driving overall market growth.

Technological Advancements

Technological advancements are at the forefront of driving growth opportunities in the gas chromatography market. Innovations in GC technology are enhancing the performance, efficiency, and usability of these systems. Developments such as the integration of advanced software for data analysis, miniaturized and portable GC devices, and the incorporation of automation and artificial intelligence are making gas chromatography more accessible and user-friendly.

These advancements enable more precise and faster analyses, reduce operational costs, and broaden the application scope of GC systems. Portable GC devices are increasingly used in field applications for environmental monitoring and on-site testing, providing immediate and reliable results. Automation and AI integration streamline workflows and improve data accuracy, making GC systems more appealing to industries with high throughput requirements.

Latest Trends

Integration with Mass Spectrometry

A key trend in the global gas chromatography market for 2024 is the increasing integration with mass spectrometry (GC-MS). This combination offers unparalleled analytical precision, enabling the detailed identification and quantification of complex compounds. GC-MS is becoming the standard in various industries, including pharmaceuticals, environmental testing, and food safety, due to its ability to provide high-resolution data and detect trace levels of substances.

This trend is driven by the need for more accurate and comprehensive analytical solutions that can meet stringent regulatory requirements and address complex analytical challenges.

Adoption of Automated and Miniaturized Systems

The adoption of automated and miniaturized gas chromatography systems is another significant trend shaping the market in 2024. Automation in GC systems enhances throughput, reduces human error, and improves reproducibility, making it ideal for high-volume testing environments such as clinical laboratories and industrial quality control. Automated systems streamline workflows, allowing for continuous operation and faster processing times.

Miniaturized GC systems, on the other hand, offer portability and ease of use, making them suitable for field applications and on-site testing. These compact systems provide rapid and reliable results, which are crucial for timely decision-making in environmental monitoring, forensic analysis, and food safety testing. The trend towards miniaturization and automation is driven by the demand for more flexible, efficient, and cost-effective analytical solutions.

Regional Analysis

North America remains the largest market for gas chromatography, with a 40% share.

North America, commanding a dominant market share of 40%, leads the global gas chromatography market. This predominance is underpinned by the extensive use of gas chromatography across various industries, including pharmaceuticals, environmental testing, and petrochemicals. The United States, in particular, drives regional growth with significant investments in research and development, supported by a strong regulatory framework that mandates rigorous analytical testing in food and drug safety, as well as environmental monitoring.

Europe is a substantial player in the gas chromatography market, driven by robust industrial applications and stringent regulatory standards. Countries such as Germany, the UK, and France are at the forefront, leveraging advanced technologies in the chemical, pharmaceutical, and environmental sectors. The European market benefits from high adoption rates of gas chromatography in quality control and research laboratories, backed by a solid network of academic and research institutions.

Asia Pacific is poised for the fastest growth in the gas chromatography market, fueled by rapid industrialization and increasing research activities. Key markets such as China, Japan, and India are witnessing a surge in demand, driven by expanding pharmaceutical, biotechnology, and petrochemical industries. The region's growth is further supported by government initiatives to enhance healthcare infrastructure and stringent environmental regulations, which necessitate advanced analytical technologies.

Middle East & Africa show emerging potential, with market growth primarily driven by the oil and gas sector, particularly in the Gulf Cooperation Council (GCC) countries. The adoption of gas chromatography in environmental testing and food safety is also gaining traction, supported by regional governments' focus on improving public health and safety standards.

Latin America presents moderate growth prospects, with Brazil and Mexico being the key contributors. The market in this region is bolstered by the expanding pharmaceutical and food & beverage industries. Increasing awareness about the benefits of gas chromatography in quality control and regulatory compliance is driving adoption.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global gas chromatography market is projected to experience steady growth in 2024, driven by advancements in pharmaceutical research, environmental analysis, and industrial applications. Key players are harnessing innovation and strategic expansion to maintain competitive advantages.

Thermo Fisher Scientific remains a market leader, leveraging its extensive portfolio of high-performance gas chromatography (GC) instruments and consumables. Their strong focus on customer-centric solutions and continuous innovation underpins their dominance.

Danaher Corporation excels through its diverse subsidiaries like Phenomenex and Agilent Technologies Inc., offering comprehensive GC solutions that cater to a broad spectrum of industries. Their commitment to R&D and acquisitions strengthens their market presence.

Restek Corporation is recognized for its high-quality GC columns and accessories, emphasizing product reliability and customer service. Their focus on niche markets and customization capabilities provides a competitive edge.

Siemens brings its expertise in industrial automation and integration, offering advanced GC systems for process analytics. Their robust infrastructure and technological prowess enhance their appeal in industrial applications.

Edinburgh Instruments and SRI Instruments specialize in compact and portable GC systems, catering to academic and research institutions. Their innovation in user-friendly and cost-effective solutions makes them significant players in the market.

Agilent Technologies Inc. continues to be a powerhouse with its broad range of GC instruments, software, and consumables. Their strategic focus on next-generation technologies and robust customer support systems ensures their leadership position.

Regis Technologies Inc. and GL Sciences Inc. provide specialized GC solutions, focusing on high-performance columns and analytical services. Their niche expertise supports their market growth.

PerkinElmer Inc. integrates its GC offerings with comprehensive laboratory solutions, emphasizing efficiency and accuracy. Their strong presence in health and environmental sectors bolsters their market standing.

Merck KGaA (MilliporeSigma) and Phenomenex contribute significantly with their advanced GC columns and reagents, catering to complex analytical needs. Their focus on quality and innovation drives their market influence.

Falcon.io ApS, Trajan Scientific and Medical, and Virtusa Corp add to the market's diversity with specialized solutions and services. Their targeted approaches and technological advancements ensure their relevance.

General Electric Company and LECO Corporation leverage their engineering excellence and broad industrial reach to provide robust GC systems. Their focus on integration and innovation supports their competitive positioning.

Market Key Players

- Thermo Fisher Scientific

- Danaher.

- Restek Corporation

- Siemens

- Edinburgh Instruments

- SRI Instruments

- Agilent Technologies Inc.

- Regis Technologies Inc.

- GL Sciences Inc.

- PerkinElmer Inc.

- Merck KGaA

- Phenomenex

- Falcon.io ApS

- Trajan Scientific and Medical.

- Virtusa Corp

- General Electric Company

- LECO Corporation

Recent Development

- In December 2023, Shimadzu Scientific Instruments introduced the Brevis GC-2050, a compact gas chromatograph designed for rapid, on-site analysis with applications in environmental monitoring and industrial quality control.

- In July 2023, LECO Corporation has advanced flow modulation technology in comprehensive two-dimensional gas chromatography (GC×GC), improving productivity and performance for complex sample analysis, particularly in petrochemical and environmental sectors.

Report Scope

Report Features Description Market Value (2023) USD 3.2 Bn Forecast Revenue (2033) USD 5.0 Bn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Instruments (Systems, Autosamplers, Fraction Collectors, Detectors), By Accessories and Consumables (Columns Accessories, Flow Management Accessories, Consumables & Accessories, Fittings and Tubing, Pressure Regulators, Gas Generators, Other), By Reagents (Analytical Reagents, Bioprocess Reagents), By End User (Pharmaceutical, Oil and Gas, Food and Beverage, Agriculture, Cosmetics Industry, Environmental Agencies, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific, Danaher., Restek Corporation, Siemens, Edinburgh Instruments, SRI Instruments, Agilent Technologies Inc., Regis Technologies Inc., GL Sciences Inc., PerkinElmer Inc., Merck KGaA, Phenomenex, Falcon.io ApS, Trajan Scientific and Medical., Virtusa Corp, General Electric Company, LECO Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Thermo Fisher Scientific

- Danaher.

- Restek Corporation

- Siemens

- Edinburgh Instruments

- SRI Instruments

- Agilent Technologies Inc.

- Regis Technologies Inc.

- GL Sciences Inc.

- PerkinElmer Inc.

- Merck KGaA

- Phenomenex

- Falcon.io ApS

- Trajan Scientific and Medical.

- Virtusa Corp

- General Electric Company

- LECO Corporation