Fingerprint Sensor Market By Type(Touch Sensors, Swipe Sensors), By Technology(Capacitive, Optical, Thermal, Others), By Application(Consumer Electronics Sector, Defense and Aviation, Government and Law Enforcement, Banking and Finance, Travel and Immigration, Commercial, Smart Homes, Healthcare, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

14191

-

March 2024

-

153

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

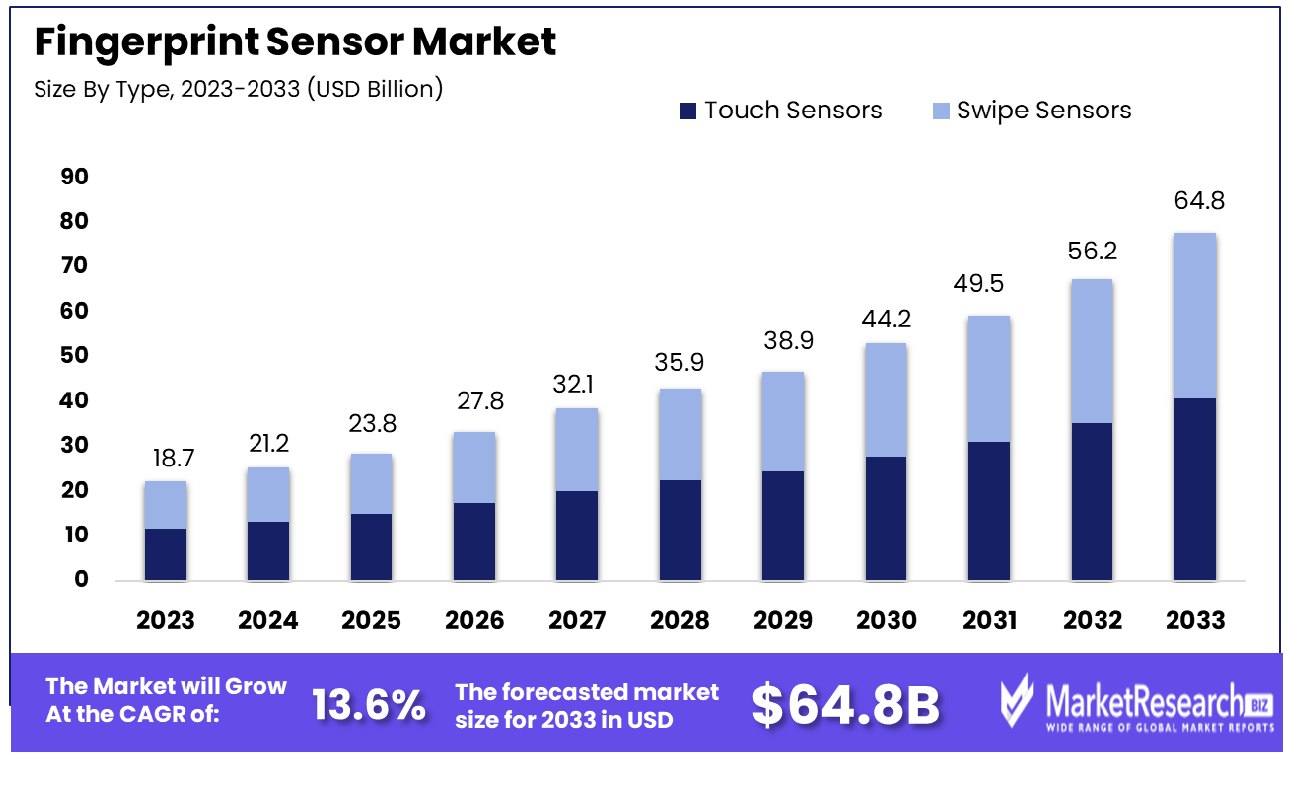

The global Fingerprint Sensor Market was valued at USD 18.7 billion in 2023, It is expected to reach USD 64.8 billion by 2033, with a CAGR of 13.6% during the forecast period from 2024 to 2033.

The surge in demand for biometrics in the public and private sectors, various electronic devices, and the rise in advanced new technologies are some of the main key driving factors for the fingerprint sensor market. The figure print sensors are also called fingerprint scanners or readers, which is the biometric security technology that is developed to identify and provide individuals based on their unique figure print patterns.

It works by upholding and analyzing the ridges, valleys, and intricate points that are showcased in an individual’s fingerprint. The sensors change these unique features into a digital representation by building a distinctive biometric template for each individual. Generally integrated into electronic devices like smartphones, access control equipment, and laptops, figure print sensors offer a secure and convenient technique for user authentication. Individuals can reveal devices, access private and sensitive data, and authorize transactions that can simply done by placing their fingers on the sensors.

These sensors improve security by providing a more dependable and difficult-to-imitate form of identification, decreasing the consistency of old methods such as passwords or PINs. It is broadly adopted biometric technology, fingerprint sensors contribute to the new advancement of safe, secure, and individual-friendly authentication systems in different applications.

Biometric Update in July 2023, highlights that Next Biometrics has 5 years of biometric supply contract commercial agreement with an Indian OEM partner. The deal is worth USD 6.1 million which is up from the past reported Norwegian kroner, NOK 15 million. Originally the deal was worth USD 1.4 million and USD 2.8 million. Moreover, Next has also declared a design win and initial purchase order from a Chinese distribution associate, XM holder worth USD 93,000, which is NOK 1 million to be completed by Q4, 2023. Moreover, the gadgets 360 in March 2024, highlights that the Xiaomi 15 series has also launched a new feature which is an In-display ultrasonic fingerprint sensor.

Advanced technologies in building fingerprint sensors provide great security and easy user authentication. With the rise in concerns related to digital privacy, these sensors provide an easy and safe means of accessing personal devices, safeguarding locations, and sensitive information, substituting old methods, and contributing to improved user experience in multiple applications. The demand for fingerprint sensors will increase due to their requirement in various electronic devices that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The global Fingerprint Sensor Market was valued at USD 18.7 billion in 2023, It is expected to reach USD 64.8 billion by 2033, with a CAGR of 13.6% during the forecast period from 2024 to 2033.

- By Type: In the realm of touch sensor types, the dominance of Touch Sensors in the segment is unmistakable, showcasing widespread adoption across various applications, and solidifying their market leadership.

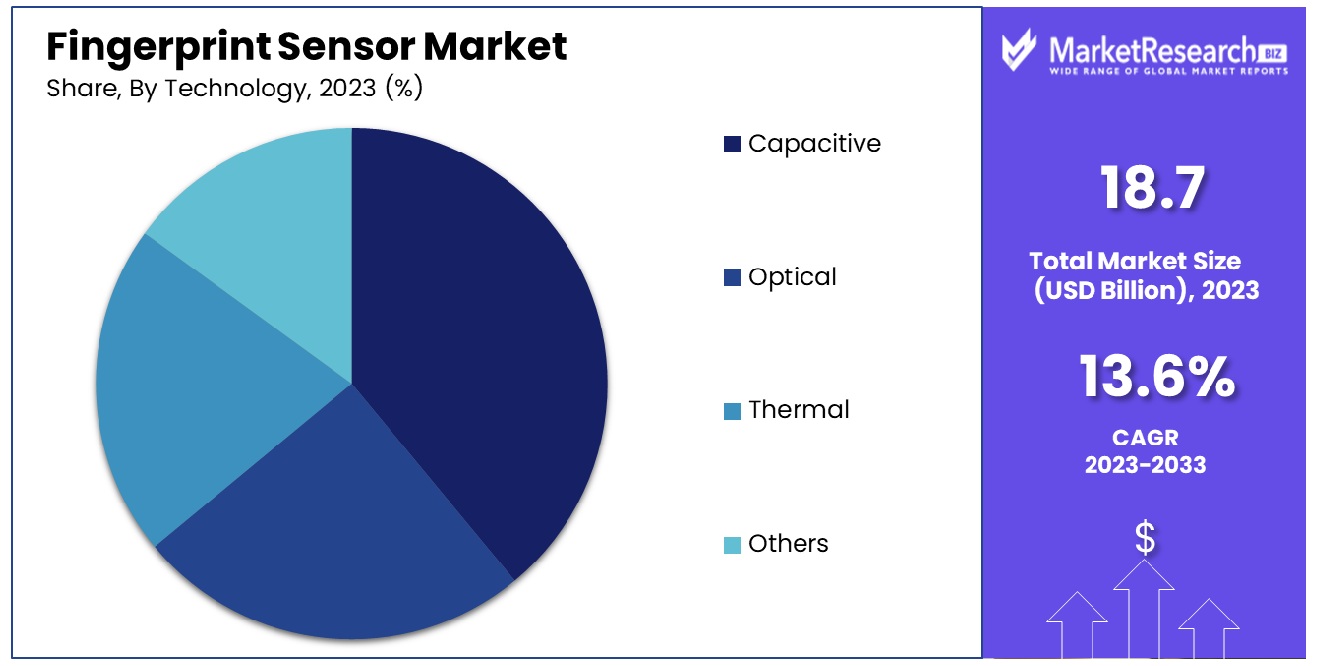

- By Technology: Within the technology categorization, Capacitive technology emerges as the paramount segment, evidencing its superior sensitivity and user experience, which accelerates its preference across industries.

- By Application: Regarding applications, the Consumer Electronics Sector stands as the preeminent domain, highlighting the sector's robust demand for touch technologies, thereby driving significant market expansion.

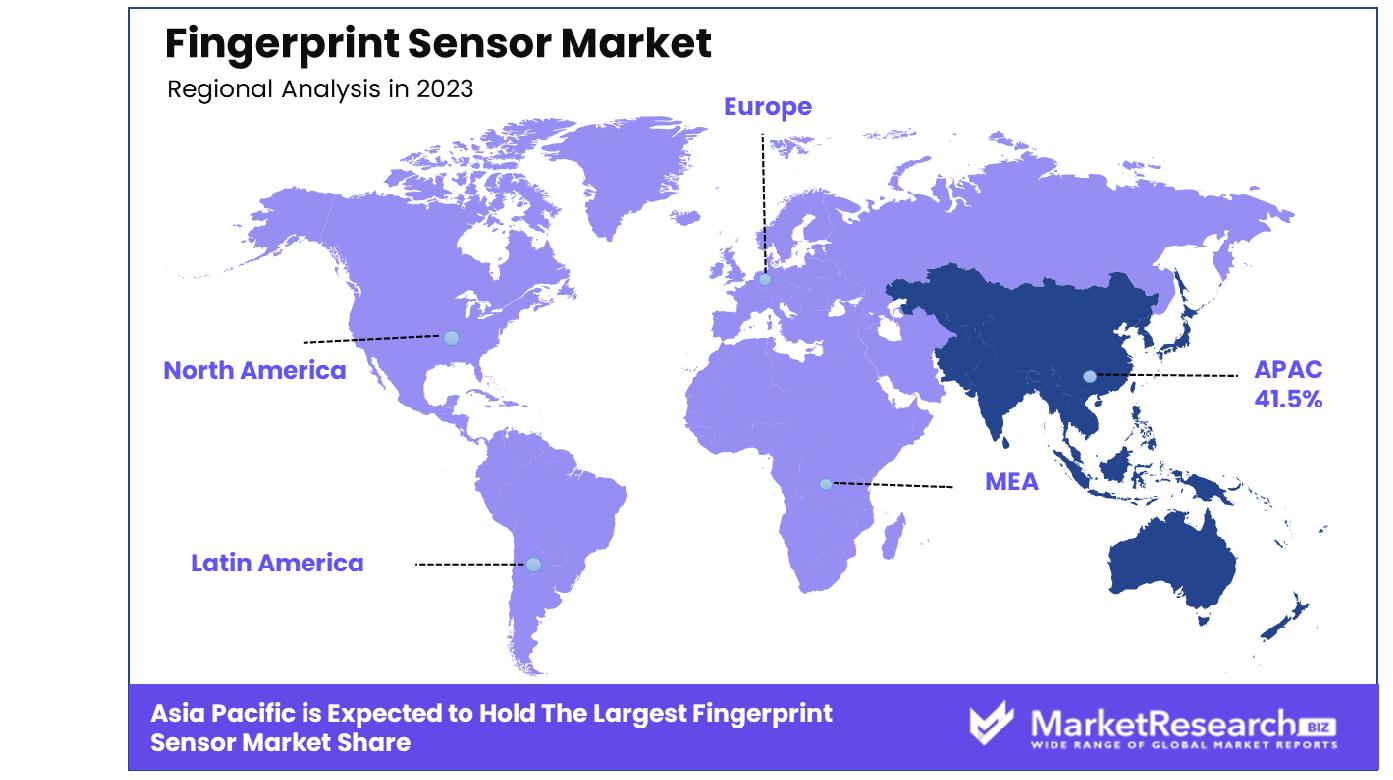

- Regional Dominance: In the Asia Pacific region, the fingerprint sensor market holds a dominant share of 41.5%.

- Growth Opportunity: In 2023, the global fingerprint sensor market will experience significant growth driven by rising demand for biometric authentication systems in emerging economies, increased adoption in the automotive industry, and integration with wearables and IoT devices.

Driving factors

Demand for Safe and Practical Biometric Authentication Techniques

The surge in demand for safe and practical biometric authentication techniques significantly underpins the growth of the Fingerprint Sensor Market. This demand is primarily driven by the increasing need for robust security measures across various sectors, including finance, healthcare, and personal devices. Fingerprint sensors, recognized for their uniqueness and difficulty to replicate, offer a higher level of security compared to traditional PINs and passwords, which can be easily forgotten or compromised.

As such, their integration into security systems is expanding, supported by advancements in sensor accuracy and the reduction of false acceptance rates. Furthermore, the user-friendly nature of fingerprint authentication enhances user experience, promoting its adoption in consumer electronics like smartphones, tablets, and smart home devices. This trend is not only a testament to the technology's reliability but also to its practicality in everyday applications, making it an indispensable component of modern security frameworks.

Increased Mobile Payment System and Online Transaction Adoption

The fingerprint sensor market is experiencing substantial growth, fueled by the widespread adoption of mobile payment systems and online services transactions. The convenience and speed of mobile payments have led to their increased use, necessitating secure authentication methods to protect sensitive financial data. Fingerprint sensors offer a seamless and secure verification process, integrating effortlessly with mobile devices.

This biometric technology enhances the security of mobile transactions by ensuring that the rightful owner of the device is initiating the transaction. As online shopping and digital banking continue to grow, the need for secure, fast, and convenient authentication methods becomes more pronounced. The integration of fingerprint sensors in smartphones and tablets, now commonplace, not only secures financial transactions but also promotes consumer confidence in digital commerce, thereby driving market expansion.

Technological Developments in the Fingerprint Sensor Market

Technological innovations play a vital role in driving the growth of the Fingerprint Sensor Market. Recent advancements in sensor technology have allowed manufacturers to produce more reliable, cost-effective fingerprint sensors. These advancements include improvements in sensor materials, such as ultrasonic waves or optical capture techniques, which enhance the accuracy and speed of fingerprint recognition. Moreover, the miniaturization of sensors has facilitated their integration into a wider array of devices, expanding their applicability beyond traditional security systems to include wearables, IoT devices, and even automotive applications.

This technological progression not only broadens the market's scope but also drives down costs, making fingerprint sensors more accessible to a diverse range of industries. The continuous evolution of sensor technology, coupled with its increasing affordability, is a key factor propelling the market forward, as it meets the growing demand for secure and convenient authentication solutions across various applications.

Restraining Factors

High Costs as a Barrier to Market Penetration

The Fingerprint Sensor Market faces significant growth challenges, primarily due to the high costs associated with the technology. The development, manufacturing, and integration of fingerprint sensors entail substantial financial investments, attributed to advanced materials, precision engineering, and the need for ongoing research to enhance reliability and performance.

These expenses are often passed down to consumers, making products with fingerprint technology less accessible to a broader market. As a result, the adoption rate in cost-sensitive sectors and emerging markets is hindered, limiting the overall growth potential of the market. However, it's important to note that as technology matures and economies of scale are achieved, the costs are expected to decrease, potentially opening up new opportunities for market expansion.

Accuracy Concerns Impacting Consumer Confidence

Another pivotal factor restraining the growth of the Fingerprint Sensor Market is the inaccuracy of certain fingerprint sensors. These inaccuracies manifest as false rejections and false acceptances, which not only inconvenience users but also raise security concerns. Fingerprint sensors' performance may be negatively impacted by various major factors, including skin conditions, age, and contamination on either your fingertip or the sensor surface.

In high-security settings, such as banking and national security, these inaccuracies are particularly concerning. The skepticism generated by these issues can lead to a reluctance among consumers and industries to adopt fingerprint sensor technology, thus impacting its growth. Addressing these accuracy issues through technological advancements and improved sensor algorithms is crucial for restoring confidence in fingerprint technology and fostering market growth.

By Type Analysis

In the touch sensor market, the dominant segment is Touch Sensors.

In 2023, Touch Sensors held a dominant market position in the "By Type" segment of the Fingerprint Sensor Market, juxtaposed with Swipe Sensors. This preeminence can be attributed to several major factors, including the widespread adoption of touch sensors in consumer electronics, biometric systems, and security solutions. The inherent advantages of touch sensors, such as their ease of integration into various devices, high reliability, and user-friendly interface, have significantly contributed to their market dominance.

The market dynamics of touch sensors are underpinned by technological advancements and the increasing demand for secure and convenient user authentication methods. Innovations in touch sensor technology have led to the development of more accurate, durable, and cost-effective sensors, thereby enhancing their appeal across numerous applications. Furthermore, the surge in smartphone penetration, coupled with the growing emphasis on security in digital transactions and access control systems, has bolstered the demand for fingerprint sensors, with touch sensors being the preferred technology.

Comparatively, swipe sensors, while still relevant, have experienced a slower growth trajectory. This can be partly attributed to their operational limitations and the shift towards more sophisticated and user-friendly authentication solutions offered by touch sensors. However, swipe sensors continue to find applications in specific niches where cost-effectiveness and compact form factors are prioritized over performance metrics.

The juxtaposition of touch and swipe sensors within the fingerprint sensor market illustrates a competitive landscape influenced by technological innovation, user preferences, and application-specific requirements. As the market evolves, touch sensors are poised to maintain their dominance, driven by continuous improvements in sensor technology and the expanding array of applications demanding reliable and efficient fingerprint authentication solutions.

By Technology Analysis

Capacitive technology has emerged as the dominant segment of technology.

Capacitive segment technology held a dominant market position in 2023 within the "By Technology" segment of the Fingerprint Sensor Market, comprised of the Capacitive segment, Optical Thermal, and other technologies. This could be attributed to its superior accuracy, reliability, and speed when it came to capturing high-resolution fingerprints utilizing the electrical capacity of human skin to form fingerprint patterns; making this method highly efficient across mobile devices as well as secure access control systems thus driving its adoption across various industries.

The market share captured by Optical technology follows, characterized by its use of light to capture an image of the fingerprint. Despite being one of the older technologies, its adoption remains strong due to significant advancements in imaging quality and security features. Optical sensors are particularly favored in environments where Capacitive sensors may struggle, such as in conditions involving dirt, moisture, or wear on the fingertips.

Thermal technology, although less common than Capacitive and Optical, has carved out a niche for itself in the Fingerprint Sensor Market. Thermal sensors detect fingerprint patterns through temperature differences between the ridge and valley portions of a fingerprint. This technology is appreciated for its unique ability to work in challenging conditions and its resistance to spoofing attempts.

The "Others" category encompasses emerging technologies and hybrid approaches that are in various stages of research, development, and market introduction. These technologies aim to address specific limitations of the more established methods or to offer competitive advantages in terms of cost, scalability, and integration capabilities.

The continuous development of fingerprint sensor technology is driven by increasing demands for security and identification in an increasingly digitalized world. As these technologies evolve, the market landscape is expected to witness shifts in dominance among the different technologies, influenced by advancements in materials science, digital imaging, and artificial intelligence. The competitive landscape is further shaped by the entry of major players and the development of innovative products that cater to the growing need for secure and convenient user authentication methods.

By Application

Within applications, the Consumer Electronics Sector stands out as the dominant segment.

In 2023, the Consumer Electronics Sector held a dominant market position in the "By Application" segment of the Fingerprint Sensor Market. This prominence can be attributed to the increasing integration of biometric authentication technologies across various consumer electronic devices, including smartphones, laptops, and wearable technology. The convenience, enhanced security, and quick authentication process offered by fingerprint sensors have significantly contributed to their widespread adoption in the consumer electronics industry.

Following closely, the Defense and Aviation sectors have also showcased a robust adoption rate of fingerprint sensors, driven by the critical need for secure access and identity verification mechanisms within these highly sensitive areas. The implementation of fingerprint sensors in defense and aviation enhances security protocols, ensuring that access is granted only to authorized personnel, thus maintaining the integrity of sensitive information and locations.

The Government and Law Enforcement segment has similarly capitalized on the benefits of fingerprint sensor technology, primarily for identity verification and security purposes. The adoption of fingerprint sensors facilitates the efficient and accurate processing of individuals, enhancing both national security measures and law enforcement operations.

In the Banking and Finance sector, fingerprint sensors have become an integral part of the security infrastructure, offering a secure and convenient method for customer authentication. This technology aids in minimizing fraud and unauthorized access, thereby protecting financial assets and personal information.

The Travel and Immigration segment benefits from the deployment of fingerprint sensors, streamlining identity verification processes, and enhancing border security. This technology allows for efficiently handling large volumes of travelers, ensuring accurate identification and improving overall operational efficiency.

Commercial security applications of fingerprint sensors are gaining traction, reflecting the technology's versatility and adaptability across various industries. This includes retail, hospitality, and education, where secure access and identity verification are increasingly prioritized.

The Smart Homes sector is seeing increasing adoption of fingerprint sensors to increase the convenience and security of home automation systems. This technology enables personalized access control, contributing to the safety and security of smart home environments.

In the Healthcare sector, fingerprint sensors are being utilized for patient identification, access control to restricted areas, and the secure handling of sensitive medical records. This technology improves operational efficiency while ensuring patient privacy and data security.

Other segments, including emerging industries and innovative applications, are exploring the use of fingerprint sensor technology, highlighting its potential for widespread adoption across various domains. Fingerprint sensors' versatility and security make them a vital technology in today's dynamic digital environment, meeting the varied needs of modern society.

Key Market Segments

By Type

- Touch Sensors

- Swipe Sensors

By Technology

- Capacitive

- Optical

- Thermal

- Others

By Application

- Consumer Electronics Sector

- Defense and Aviation

- Government and Law Enforcement

- Banking and Finance

- Travel and Immigration

- Commercial

- Smart Homes

- Healthcare

- Others

Growth Opportunity

Rising Demand for Biometric Authentication Systems in Emerging Economies

In 2023, the global fingerprint sensor market will see significant expansion as demand for biometric authentication systems surges - particularly among emerging economies. As countries continue to embrace digital transformation and prioritize security measures, the adoption of biometric technologies, including fingerprint sensors, has witnessed a substantial surge.

Governments, enterprises, and consumers alike are recognizing the importance of secure authentication methods to safeguard sensitive information and assets. This trend presents a lucrative growth opportunity analysis for fingerprint sensor manufacturers and suppliers to expand their market presence and capitalize on the evolving security landscape.

Automotive Industry's Adoption of Fingerprint Sensors

One factor driving the growth of the global fingerprint sensor market is its increased adoption within the automotive sector. As automotive manufacturers increasingly integrate advanced technologies to enhance vehicle security and user experience, fingerprint sensors are being integrated into vehicles for keyless entry, ignition systems, and personalized driver settings.

This trend reflects the growing emphasis on enhancing convenience, security, and connectivity in modern vehicles, thereby creating a substantial growth avenue for fingerprint sensor providers to cater to the automotive sector's evolving needs.

Integration of Fingerprint Sensors with Wearables and IoT Devices

Integration of fingerprint sensors with wearables and IoT (Internet of Things) devices continues to gain ground in 2023, providing an exciting growth opportunity and forecast for the global fingerprint sensor market. With the proliferation of smartwatches, fitness trackers, and other connected devices, consumers are increasingly seeking convenient and secure authentication methods.

Fingerprint sensors offer a seamless and reliable biometric authentication solution, enhancing user privacy and device security. This trend underscores the importance of interoperability and seamless integration within the broader ecosystem of connected devices, driving the demand for fingerprint sensor technologies across various consumer electronics segments.

Latest Trends

Mobile Devices with Fingerprint Sensors

Integration of fingerprint sensors into mobile phones continues to be a crucial trend influencing the global fingerprint sensor market in 2023. With the ever-increasing emphasis on security and user authentication, fingerprint sensors have become ubiquitous in smartphones and tablets.

Manufacturers are consistently enhancing the accuracy and reliability of these sensors, thereby improving user experience and bolstering device security. This trend is driven by the growing demand for seamless and secure authentication methods, especially in the era of digital payments and sensitive data storage.

Sensors for Fingerprints in Access Control Systems:

Access control systems have witnessed a significant transformation with the adoption of fingerprint sensors. In 2023, the market for fingerprint sensors in access control systems is experiencing robust growth, fueled by the need for heightened security measures across various sectors including corporate offices, government buildings, and residential complexes.

Fingerprint sensors offer unparalleled security by providing unique biometric identifiers, thereby reducing the risk of unauthorized access and enhancing overall safety protocols. This trend underscores the increasing emphasis on biometric authentication solutions to fortify access control systems against potential security breaches.

Sensors for Fingerprints in Healthcare:

Fingerprint sensors have quickly become a trend in healthcare as an effective method to facilitate patient identification and medical record management. By integrating fingerprint sensors into healthcare devices and systems, healthcare providers can ensure accurate patient identification, streamline administrative processes, and safeguard sensitive medical information.

Moreover, fingerprint sensors offer a hygienic and convenient alternative to traditional identification methods, minimizing the risk of contamination and improving overall operational efficiency. Fingerprint sensors' growing use in healthcare illustrates its commitment to adopting cutting-edge technologies to maximize patient care delivery and protect data security.

Regional Analysis

In the Asia Pacific region, the fingerprint sensor market captures a significant share of 41.5%.

The fingerprint sensor market is witnessing robust growth across various regions, with distinct trends and drivers shaping each geographic segment.

In North America, the market is driven by the increasing adoption of biometric authentication across sectors such as banking, healthcare, and government. The region is characterized by a high level of technological advancement and stringent security regulations, contributing to the widespread deployment of fingerprint sensors. According to recent market data, North America accounted for approximately 27% of the global fingerprint sensor market in 2023.

In Europe, stringent regulations related to data privacy and security are driving the demand for biometric authentication solutions, including fingerprint sensors. The market is witnessing steady growth, propelled by the increasing adoption of smartphones and IoT devices integrated with fingerprint recognition technology. Europe accounted for around 22% of the global fingerprint sensor market in 2023.

Asia-Pacific emerges as the dominating region in the global fingerprint sensor market, capturing a significant share of approximately 41.5% in 2023. The region is witnessing rapid adoption of fingerprint sensors across various applications, driven by factors such as the proliferation of smartphones, rising concerns regarding cybersecurity, and government initiatives promoting biometric authentication. Countries like China, India, and South Korea are key contributors to the growth of the fingerprint sensor market in the Asia-Pacific region.

In the Middle East & Africa and Latin America regions, the fingerprint sensor market is also witnessing growth, albeit at a relatively slower pace compared to other regions. Factors such as increasing smartphone penetration, government initiatives for digitalization, and rising awareness about security measures are driving the demand for fingerprint sensors in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global fingerprint sensor market witnessed a dynamic landscape characterized by technological advancements, increased security concerns, and the growing integration of biometric solutions across various industries. Among the key players dominating this landscape, Apple Inc. maintained its stronghold, leveraging its innovative Touch ID technology across its product lineup. Synaptics Incorporated, renowned for its robust fingerprint recognition solutions, continued to drive market growth through partnerships and product diversification, catering to diverse consumer demands.

Fingerprint Cards AB, a pioneering force in fingerprint sensor technology, exhibited sustained growth, propelled by its commitment to research and development. Shenzhen Goodix Technology Co. Ltd., recognized for its cutting-edge biometric solutions, expanded its market reach globally, capitalizing on the rising demand for secure authentication systems.

IDEMIA France SAS emerged as a significant prominent player, offering comprehensive biometric solutions tailored to meet evolving security needs across industries. Egis Technology Inc. showcased notable advancements in fingerprint sensor technology, positioning itself as a reliable provider of secure authentication solutions.

NEXT Biometrics Group ASA continued to innovate, focusing on enhancing sensor performance and reliability to address diverse application requirements. Anviz Global Corporation, IDEX ASA, and Gemalto N.V. also contributed significantly to the market landscape, each bringing unique strengths and capabilities to the table.

Overall, the competitive dynamics within the global fingerprint sensor market in 2023 were shaped by a combination of technological innovation, strategic partnerships, and a growing emphasis on security across industries. As the market continues to evolve, these key players are expected to play a pivotal role in driving innovation and shaping the future of biometric authentication.

Market Key Players

- Apple Inc.

- Synaptics Incorporated

- Fingerprint Cards AB

- Shenzhen Goodix Technology Co. Ltd.

- IDEMIA France SAS

- Egis Technology Inc.

- NEXT Biometrics Group ASA,

- Anviz Global Corporation

- IDEX ASA

- Gemalto N.V.

Recent Development

- In March 2024, Huawei reportedly tested an ultrasonic fingerprint sensor for the Mate 70 series, a leap in biometric security. Rumored features include a Kirin chipset, HarmonyOS NEXT, a quad-curved 2K display, and enhanced camera capabilities.

- In February 2024, Garanti BBVA introduces the Bonus Platinum Biometric Card, pioneering secure payments via fingerprint scan. Deputy General Manager Murat ÇaÄŸrı Süzer emphasizes innovation for customer convenience. Mastercard underscores commitment to biometric security.

- In February 2024, Xiaomi unveils the Redmi Note 13 Series in Nairobi, Kenya, featuring upgraded camera systems, AMOLED displays, durability enhancements, and powerful processors, bridging mid-range and flagship smartphones.

- In December 2023, Fingerprint Cards unveiled new Thales Gemalto biometric payment cards with T-Shape sensor technology, enhancing transaction speed, power efficiency, and security for global deployment, advancing biometric payment card adoption worldwide.

Report Scope

Report Features Description Market Value (2023) USD 18.7 Billion Forecast Revenue (2033) USD 64.8 Billion CAGR (2024-2032) 13.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Touch Sensors, Swipe Sensors), By Technology(Capacitive, Optical, Thermal, Others), By Application(Consumer Electronics Sector, Defense and Aviation, Government and Law Enforcement, Banking and Finance, Travel and Immigration, Commercial, Smart Homes, Healthcare, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Apple Inc., Synaptics Incorporated, Fingerprint Cards AB, Shenzhen Goodix Technology Co. Ltd., IDEMIA France SAS, Egis Technology Inc., NEXT Biometrics Group ASA, Anviz Global Corporation, IDEX ASA, Gemalto N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Market Growth: The global Fingerprint Sensor Market was valued at USD 18.7 billion in 2023, It is expected to reach USD 64.8 billion by 2033, with a CAGR of 13.6% during the forecast period from 2024 to 2033.

-

-

- Apple Inc.

- Synaptics Incorporated

- Fingerprint Cards AB

- Shenzhen Goodix Technology Co. Ltd.

- IDEMIA France SAS

- Egis Technology Inc.

- NEXT Biometrics Group ASA,

- Anviz Global Corporation

- IDEX ASA

- Gemalto N.V.