Global Feminine Hygiene Wash Market By Product Type(Creams, Wipes, Spray, Bar, Gel, Others (foam, powder, cleanser etc.)), By Price Range(Low, Medium, High), By Distribution Channel(Online, Offline), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46325

-

May 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

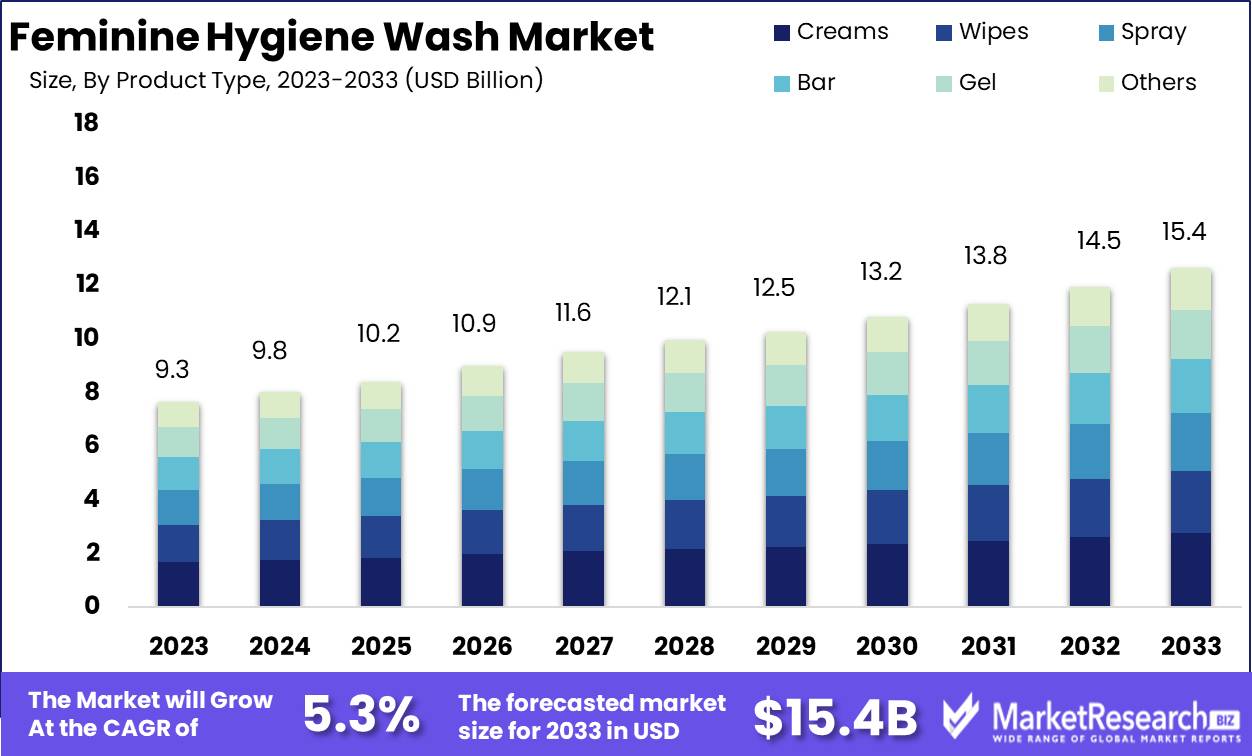

The Global Feminine Hygiene Wash Market was valued at USD 9.3 billion in 2023. It is expected to reach USD 15.4 billion by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

The Feminine Hygiene Wash Market comprises products specifically designed for intimate cleansing. These solutions are formulated to maintain the natural pH balance of the female genital area, promoting overall genital health and hygiene. The market includes a variety of products such as washes, wipes, and gels, catering to diverse consumer preferences and needs.

This sector is driven by an increasing awareness of personal hygiene, health consciousness among women, and innovations in product formulations. Executives in this market must navigate evolving consumer expectations and regulatory landscapes to effectively position their products and capitalize on emerging opportunities.

The global market for feminine hygiene washes is witnessing significant growth, driven by heightened awareness of personal hygiene and increased health consciousness among women worldwide. The market's expansion is underpinned by a critical backdrop of broader hygiene and sanitation challenges. In 2022, it was reported that approximately 2 billion people lacked basic hygiene services, with 653 million having no facilities whatsoever. This underscores the vast unmet need for hygiene products, including those for feminine care, particularly in underserved regions.

Furthermore, while 57% of the global population benefited from safely managed sanitation services in 2022, about 40% still lacked access to such facilities. This disparity highlights the potential for market growth in developing regions where the penetration of feminine hygiene products remains low. Companies are increasingly focusing on these areas, tailoring their products to meet the specific cultural and economic conditions that influence consumer behavior.

In response to these trends, leading market players are enhancing their product portfolios with natural and organic ingredients, catering to the growing consumer preference for products free from harmful chemicals. The market is also witnessing innovations in product offerings, with companies introducing biodegradable and sustainable products that align with global environmental concerns. This strategic focus not only addresses the immediate need for improved hygiene but also aligns with broader global sustainability goals, creating a dual growth avenue for the industry.

Key Takeaways

- Market Growth: The Global Feminine Hygiene Wash Market was valued at USD 9.3 billion in 2023. It is expected to reach USD 15.4 billion by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

- By Product Type: Creams led the product types with a 45% share.

- By Price Range: Medium price range prevailed, capturing 55% of the market.

- By Distribution Channel: Online channels dominated distribution, securing 60% dominance.

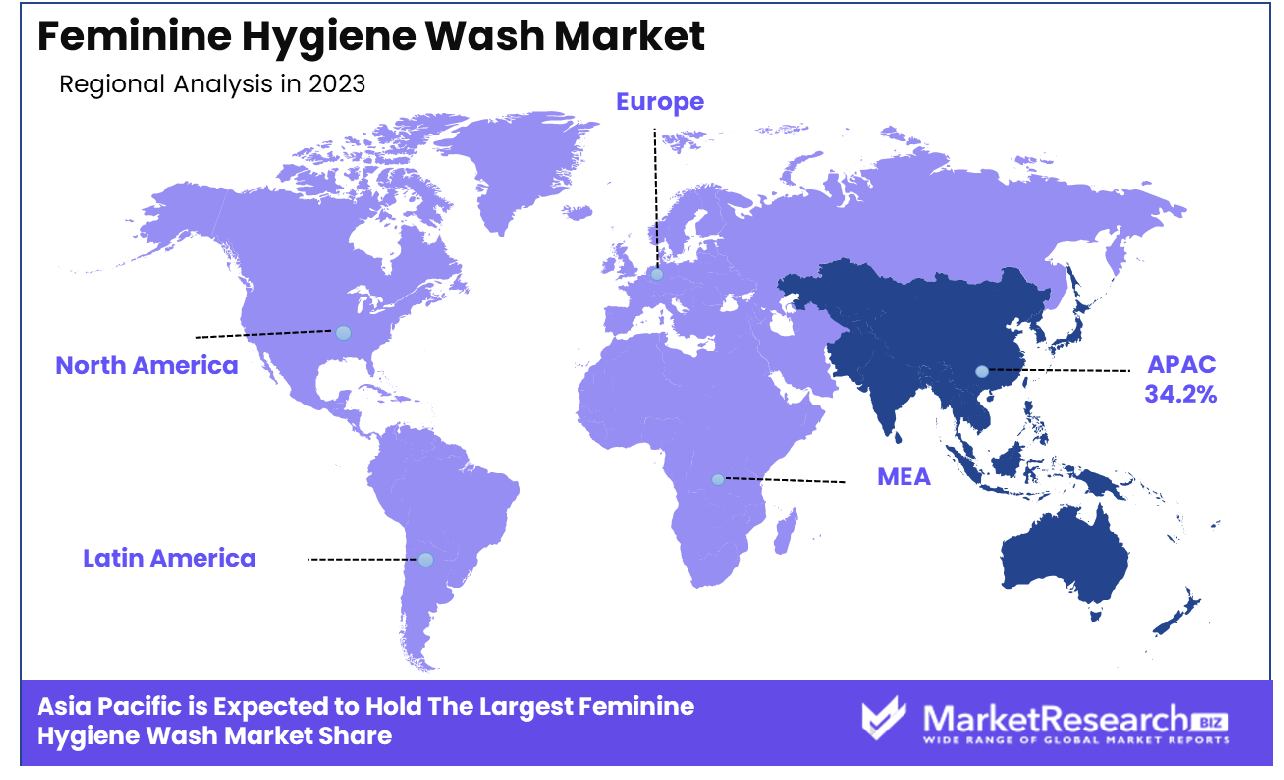

- Regional Dominance: The Asia-Pacific region holds a 34.2% share in the feminine hygiene wash market.

- Growth Opportunity: The global feminine hygiene wash market is growing due to a shift towards sustainable products and innovative development and marketing strategies enhancing product appeal and market reach.

Driving factors

Government Initiatives and Awareness Programs

Government initiatives and awareness programs significantly drive the growth of the Feminine Hygiene Wash Market. By promoting better hygiene standards and educating women about the importance of personal care, these programs increase awareness and acceptance of feminine hygiene products. For instance, countries like India have launched campaigns such as the 'Menstrual Hygiene Scheme' which aim to increase awareness among adolescent girls on menstrual hygiene.

These efforts are supported by non-governmental organizations and private partnerships that distribute feminine hygiene products to underserved areas, thus broadening the market reach. This strategic push not only enhances the market growth but also fosters a culture of health and wellness among women, potentially leading to a sustained demand.

Emergence of Eco-Friendly and Organic Products

The rise of eco-conscious consumerism has spurred the development and adoption of eco-friendly and organic feminine hygiene products. Consumers are increasingly preferring products that are safe for both their bodies and the environment, steering market trends towards natural ingredients and sustainable practices.

This shift is evidenced by the growth in sales of organic and natural hygiene wash products, which are perceived as safer and gentler alternatives to chemical-based counterparts. The demand for organic products is not just a trend but a significant shift in consumer preferences, influencing manufacturers to innovate and expand their product lines to include eco-friendly options, thereby fueling market growth.

Increasing Female Population and Urbanization

The global increase in the female population coupled with rapid urbanization acts as a critical driver for the Feminine Hygiene Wash Market. Urban areas, with their better access to products and information, provide a fertile ground for the adoption of feminine hygiene products. As more women move to urban areas, their exposure to modern retail environments and digital marketing increases, leading to greater product awareness and adoption.

This urban shift is accompanied by a rise in disposable incomes, allowing women to invest more in personal care products. Together, these factors contribute to a dynamic expansion of the market, as more women seek out products that offer convenience, effectiveness, and health benefits.

Restraining Factors

Regulatory Uncertainties Impacting Market Growth and Product Development

Regulatory uncertainties play a significant role in constraining the growth of the Feminine Hygiene Wash Market. The stringent regulations governing the approval and marketing of personal care products can lead to delays and increased costs in product development. For example, in the United States, feminine hygiene products are regulated by the FDA, which requires compliance with specific guidelines that can be both time-consuming and financially burdensome for manufacturers.

These regulatory hurdles can slow down the introduction of new products into the market, limit innovation, and subsequently reduce the speed at which the market can expand. Moreover, the variability of these regulations across different regions creates additional challenges for global brands aiming to expand their footprint, directly impacting market dynamics and growth opportunities.

Limited Availability of Eco-Friendly and Biodegradable Feminine Hygiene Wash Options

The limited availability of eco-friendly and biodegradable options within the Feminine Hygiene Wash Market also serves as a restraining factor. Despite the growing consumer demand for sustainable and organic personal care products, the market still faces a significant gap in the supply of these products. This discrepancy can be attributed to the higher production costs and the complex supply chain logistics associated with sourcing organic and sustainable materials.

Consequently, the scarcity of affordable eco-friendly options limits consumer choices and hinders the market's ability to fully capitalize on the shifting consumer preferences towards sustainability. This gap represents a missed opportunity for market growth, as there is a clear consumer interest in products that align with environmental values but insufficient market supply to meet this demand.

By Product Type Analysis

Creams held the largest product type share, dominating the market at 45%.

In 2023, Creams held a dominant market position in the By Product Type segment of the Feminine Hygiene Wash Market, capturing more than 45% of the market share. The appeal of creams can be attributed to their widespread availability and the perceived efficacy in maintaining personal hygiene, which resonates with consumer preferences. Market dynamics indicate that creams are preferred for their ease of application and the comfort they provide, factors that are highly valued by consumers.

Following creams, Wipes constituted the second largest category, favored for their convenience and disposability, which align with the fast-paced lifestyles of modern consumers. Sprays also carved out a significant niche, driven by their appeal as a quick and easy hygiene solution, especially among younger demographics. Meanwhile, Bar and Gel products collectively accounted for a notable portion of the market, with bars being appreciated for their eco-friendliness and cost-effectiveness, whereas gels are preferred for their soothing properties and formulation versatility.

The Others category, which includes foams, powders, and cleansers, also held a minor share of the market. These products cater to a specific segment of consumers looking for targeted solutions or prefer alternative formats over mainstream options. Overall, the segmentation within the Feminine Hygiene Wash Market highlights diverse consumer preferences and the importance of offering a variety of product forms to meet differing needs and usage occasions.

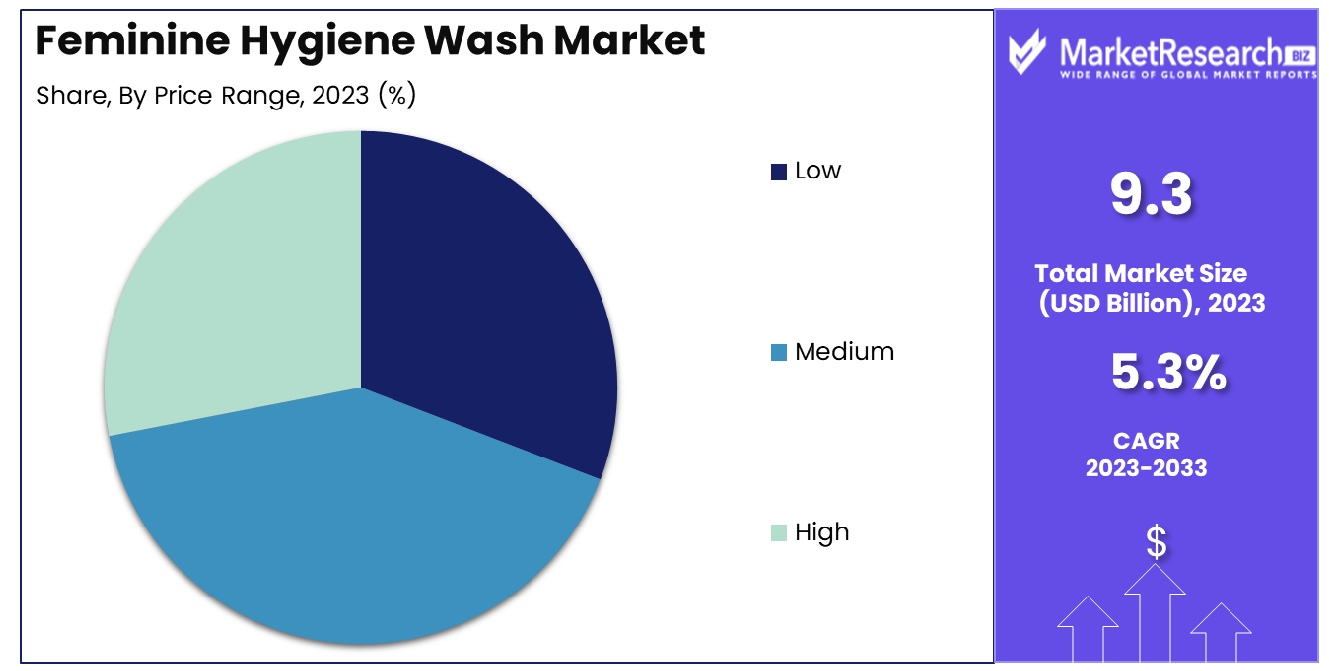

By Price Range Analysis

In the price range category, medium-priced items led with a 55% market share.

In 2023, Medium held a dominant market position in the By Price Range segment of the Feminine Hygiene Wash Market, capturing more than 55% of the market share. This segment's success can be attributed to its balance of affordability and perceived quality, which appeals to a broad consumer base seeking effective solutions without a significant financial commitment. The medium price range is strategically positioned to attract the middle-income bracket, which represents a substantial portion of the market demographic.

The Low price segment also captured a considerable share, appealing to cost-conscious consumers and those in emerging markets where affordability is a key purchasing factor. These products often focus on basic features and accessibility, aiming to attract a volume-driven segment of the market.

On the higher end of the spectrum, the High price range caters to a niche but profitable segment of consumers who prioritize premium ingredients, advanced formulations, and specialized product claims. Although this segment accounts for a smaller share of the market, it enjoys higher profit margins and is associated with brand loyalty and consumer trust in product efficacy and safety.

The distribution of market shares across these price ranges underscores the diverse financial thresholds and priorities within the consumer base of the Feminine Hygiene Wash Market. It reflects a stratified market where each segment meets distinct consumer needs, from basic hygiene to luxury and specialized care.

By Distribution Channel Analysis

Online distribution channels were predominant, capturing 60% of the market.

In 2023, Online held a dominant market position in the By Distribution Channel segment of the Feminine Hygiene Wash Market, capturing more than 60% of the market share. This significant preference for online channels can be largely attributed to the convenience, privacy, and wide range of choices available to consumers.

The growth in online sales is supported by the increasing penetration of internet services, the widespread use of smartphones, and the improvement in e-commerce logistics, offering fast and discreet delivery options that are particularly appealing for purchasing feminine hygiene products.

The Offline distribution channel, while still substantial, commands a smaller share of the market. This segment includes supermarkets, drugstores, and specialty stores, which remain important for consumers who prefer direct product inspection or immediate purchase. However, the shift toward digital platforms continues to shape consumer behaviors, influencing even traditional buyers to explore online options due to competitive pricing and promotional activities.

The dominance of online channels is expected to continue as e-commerce platforms enhance user experiences through personalized marketing, customer reviews, and augmented reality tools that simulate product trials. The integration of these technologies helps reduce the uncertainty associated with online purchases, further solidifying the position of online channels as the preferred method for purchasing feminine hygiene products.

Key Market Segments

By Product Type

- Creams

- Wipes

- Spray

- Bar

- Gel

- Others (foam, powder, cleanser, etc.)

By Price Range

- Low

- Medium

- High

By Distribution Channel

- Online

- Offline

Growth Opportunity

Growing Demand for Sustainable and Eco-Friendly Products

The global feminine hygiene wash market is witnessing a significant shift towards sustainable and eco-friendly products. This trend is driven by increasing consumer awareness about the environmental impact of their purchasing decisions and a growing preference for products that are both safe and sustainable. The demand for eco-friendly feminine hygiene products is not just a passing trend but a substantial shift in consumer behavior that is expected to propel market growth.

Companies that have invested in biodegradable, organic, and chemical-free washes are positioned to capitalize on this movement. This segment's growth is further supported by regulatory pushes for products that reduce environmental footprint, making sustainability a compelling avenue for market expansion.

Innovative Product Development and Marketing Strategies

Innovation in product development coupled with savvy marketing strategies is pivotal in driving the growth of the global feminine hygiene wash market. Companies are increasingly leveraging advanced technologies to create products that offer enhanced comfort, better protection, and additional health benefits. Moreover, marketing strategies that effectively communicate these benefits and engage with consumers on digital platforms are proving successful in capturing market share.

Social media campaigns, influencer partnerships, and targeted advertising are particularly effective in reaching a broader audience. The companies that excel in innovating both their products and their approach to marketing are likely to see robust growth and strengthen their market presence in 2023 and beyond.

Latest Trends

Growing Preference for Intimate Washes Over Regular Soap and Shower Gel

In 2023, the global feminine hygiene wash market witnessed a notable shift as consumers increasingly preferred intimate washes over traditional soap and shower gel products. This transition can be primarily attributed to the growing awareness of the specialized benefits these products offer, such as maintaining pH balance and preventing irritations, which regular soaps may compromise.

The marketing efforts by leading companies have effectively communicated these benefits, leading to a broader acceptance and integration of intimate washes into daily hygiene routines. This trend reflects a deeper consumer understanding and prioritization of specialized personal care, suggesting a stable growth trajectory for this segment.

Expansion of the Female Population and Rapid Urbanization

The expansion of the female population coupled with rapid urbanization has served as a significant growth lever for the feminine hygiene wash market in 2023. Urban settings offer greater access to markets and products, thus facilitating the adoption of feminine hygiene solutions among a broader base of consumers.

Additionally, urban women are often more exposed to modern retail environments and digital marketing campaigns, which influence purchasing decisions towards health-conscious and specialized personal care products. This demographic shift, supported by increasing disposable incomes in urban areas, is expected to continue propelling market growth, making it a critical area for stakeholders to monitor and engage with in the coming years.

Regional Analysis

The Asia-Pacific region holds a 34.2% share of the global feminine hygiene wash market.

The global feminine hygiene wash market exhibits distinct regional dynamics, underscored by varying consumer preferences and market penetration levels across North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America.

In North America, the market is driven by a high awareness of personal hygiene and a strong presence of leading brands. With stringent regulatory standards ensuring product safety and quality, North America continues to innovate in organic and natural formulations, appealing to health-conscious consumers. Europe mirrors this trend, with additional emphasis on eco-friendly and sustainable products, catering to the region's robust environmental regulations and consumer preferences for green products.

Asia-Pacific, the dominant region with a 34.2% market share, is propelled by a rapidly expanding consumer base and increasing urbanization. Countries like China, India, and Japan are witnessing a surge in the adoption of feminine hygiene products due to rising disposable incomes and greater awareness of women's health and hygiene. This region offers significant growth opportunities, particularly in emerging markets where penetration of feminine hygiene products is still evolving.

The Middle East & Africa region shows promising growth potential, albeit from a smaller base. The increasing influence of urban lifestyles and the gradual breakdown of taboos surrounding feminine hygiene contribute to market growth. Education and awareness campaigns are particularly effective in this region.

Latin America, though smaller in comparison, is experiencing growth driven by increasing consumer awareness and the availability of international brands. Countries like Brazil and Mexico are leading this growth, with local companies also beginning to emerge and compete.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global feminine hygiene wash market continued to be influenced by the innovative product offerings and strategic market positioning of key players such as LIFEON Labs, Oriflame Cosmetics, CTS Group, Lactacyd, and others. These companies have played a pivotal role in driving consumer preferences and expanding market reach through targeted marketing and product differentiation.

LIFEON Labs has been notable for its research-driven approach, focusing on formulations that align with natural and hypoallergenic trends, appealing to a health-conscious consumer base. Similarly, Oriflame Cosmetics leveraged its established brand presence in the beauty and personal care industry to cross-sell its hygiene wash products, effectively capitalizing on its loyal customer base.

CTS Group and Lactacyd have been instrumental in educating consumers about the benefits of specialized feminine hygiene products over traditional soaps and gels, thus fostering a shift towards more specialized care. Lactacyd, in particular, has gained traction in European and Asian markets with its pH-balanced and clinically tested products.

Emerging brands like The Happy Root and The Boots Company have focused on niche marketing and eco-friendly products, resonating well with younger demographics and environmentally aware consumers. Brands such as Combe and healthy hoohoo have emphasized the importance of chemical-free and gentle formulations, gaining significant market acceptance.

VWash, SweetSpot Labs, and Sliquid Splash have been successful in the North American market by offering convenience and advocating for daily use, which has helped normalize the routine use of feminine hygiene washes. Finally, companies like Corman and Nature Certified have tapped into the organic segment, emphasizing certifications and ingredient transparency to build consumer trust.

Overall, these key players are not only enhancing their product offerings but are also shaping consumer perceptions and habits in the feminine hygiene wash market, thereby driving growth and innovation across the sector.

Market Key Players

- LIFEON Labs

- Oriflame Cosmetics

- CTS Group

- Lactacyd

- C.B. Fleet

- Emerita

- The Happy Root

- The Boots Company

- Combe

- healthy hoohoo

- VWash

- SweetSpot Labs

- Sliquid Splash

- Corman

- Nature Certified

Recent Development

- In February 2024, Always, part of P&G, champions women's empowerment globally through research-driven initiatives. Recent efforts include tackling period taboos in India and combating period poverty worldwide, donating over 290 million products.

- In September 2023, TELUS #StandWithOwners winners Joni and Integra Health utilized technology to innovate in feminine hygiene and healthcare, respectively, enhancing accessibility and patient care.

Report Scope

Report Features Description Market Value (2023) USD 9.3 Billion Forecast Revenue (2033) USD 15.4 Billion CAGR (2024-2032) 5.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Creams, Wipes, Spray, Bar, Gel, Others (foam, powder, cleanser etc.)), By Price Range(Low, Medium, High), By Distribution Channel(Online, Offline) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape LIFEON Labs, Oriflame Cosmetics, CTS Group, Lactacyd, C.B. Fleet, Emerita, The Happy Root, The Boots Company, Combe, healthy hoohoo, VWash, SweetSpot Labs, Sliquid Splash, Corman, Nature Certified Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- LIFEON Labs

- Oriflame Cosmetics

- CTS Group

- Lactacyd

- C.B. Fleet

- Emerita

- The Happy Root

- The Boots Company

- Combe

- healthy hoohoo

- VWash

- SweetSpot Labs

- Sliquid Splash

- Corman

- Nature Certified