Fasting Tea Market By Type (Matcha Green Tea, Assam Black Tea, Oolong Tea, Rooibos Tea, Earl Grey Tea, Others), By Form (Tea Bags, Loose Tea Leaves, Tea Capsules, Tea Strips, Others), By Functionality (Curbs Appetite, Provides Hydration, Aids Digestion, Improves Sleep Quality, Others), By Distribution Channel (Online Retail, Supermarkets and Hypermarkets, Health Stores and Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47511

-

June 2024

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

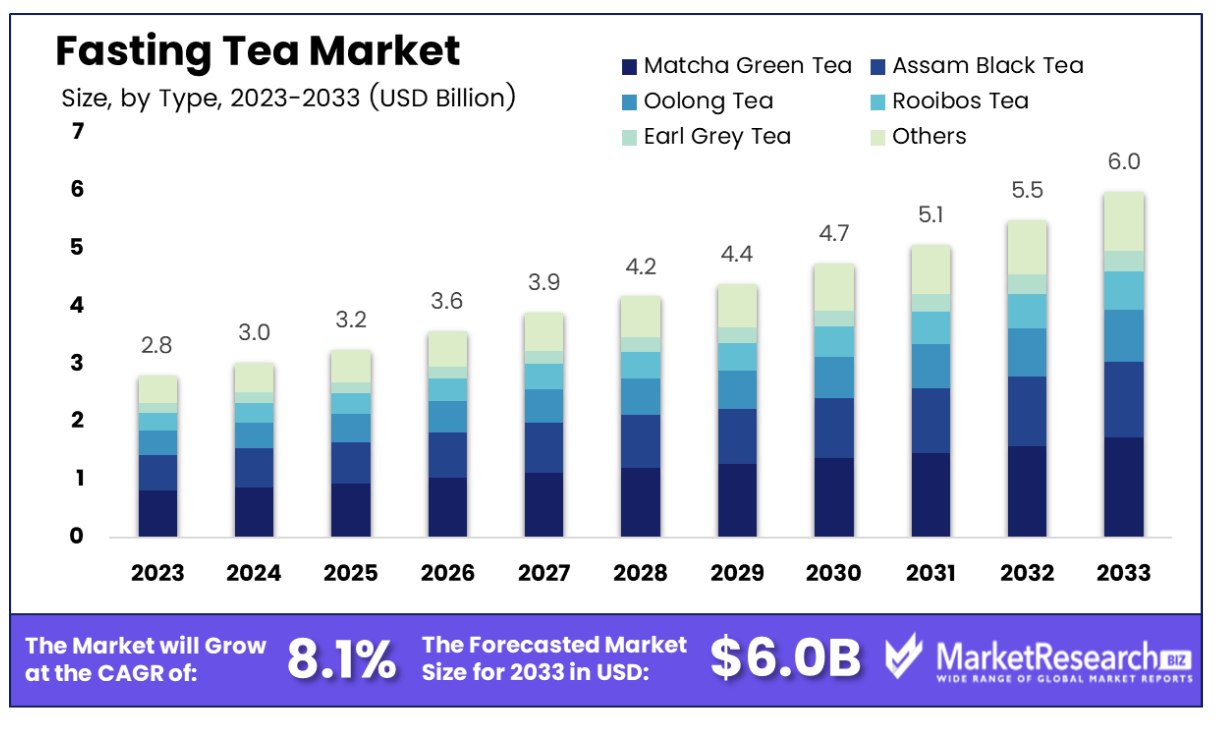

The Global Fasting Tea Market was valued at USD 2.8 Bn in 2023. It is expected to reach USD 6.0 Bn by 2033, with a CAGR of 8.1% during the forecast period from 2024 to 2033.

The Fasting Tea Market refers to the niche segment within the broader tea industry focused on products designed to support fasting regimens. These teas are formulated with ingredients known for their potential to promote satiety, enhance metabolism, and provide nutritional support during periods of fasting. With a rising trend towards intermittent fasting and health-conscious lifestyles, this market caters to consumers seeking convenient and effective solutions to complement their fasting routines.

The Fasting Tea Market is poised for significant growth as consumer interest in health-conscious beverages continues to rise. Fasting teas, formulated to support intermittent fasting regimens, are gaining traction among individuals seeking natural and effective ways to enhance their fasting experiences. This market segment leverages the proven benefits of tea consumption, such as promoting satiety and boosting metabolism, which are increasingly recognized in scientific literature.

The Fasting Tea Market is poised for significant growth as consumer interest in health-conscious beverages continues to rise. Fasting teas, formulated to support intermittent fasting regimens, are gaining traction among individuals seeking natural and effective ways to enhance their fasting experiences. This market segment leverages the proven benefits of tea consumption, such as promoting satiety and boosting metabolism, which are increasingly recognized in scientific literature.The studies indicate that tea consumers exhibit lower mean waist circumference and BMI compared to non-tea drinkers, underscoring the potential health benefits associated with tea consumption (Tea consumers had lower mean waist circumference and lower BMI (25 vs. 28 kg/m2 in men; 26 vs. 29 kg/m2 in women; both P<0.001).

The nutritional profile of fasting teas further supports their appeal. Teas blended with ingredients like lemon, known for its minimal caloric content (11 calories and 1.2 grams of sugar per medium-sized lemon), align well with maintaining a fasted state throughout the day. This makes them a preferred choice for consumers mindful of their calorie intake during fasting periods.

the Fasting Tea Market represents a convergence of health-conscious trends and innovative product development. Key players in this market are capitalizing on these trends by offering diverse blends that cater to varying consumer preferences, from herbal infusions to green tea-based formulations. Moving forward, opportunities abound for brands to differentiate themselves through unique formulations, sustainable sourcing practices, and targeted marketing strategies that resonate with health-conscious consumers worldwide.

Key Takeaways

- Market Growth: The Global Fasting Tea Market was valued at USD 2.8 Bn in 2023. It is expected to reach USD 6.0 Bn by 2033, with a CAGR of 8.1% during the forecast period from 2024 to 2033.

- By Type: Matcha Green Tea holds a significant portion of the market, with a share of 29.6%. This indicates the popularity and demand for Matcha Green Tea among fasting tea consumers.

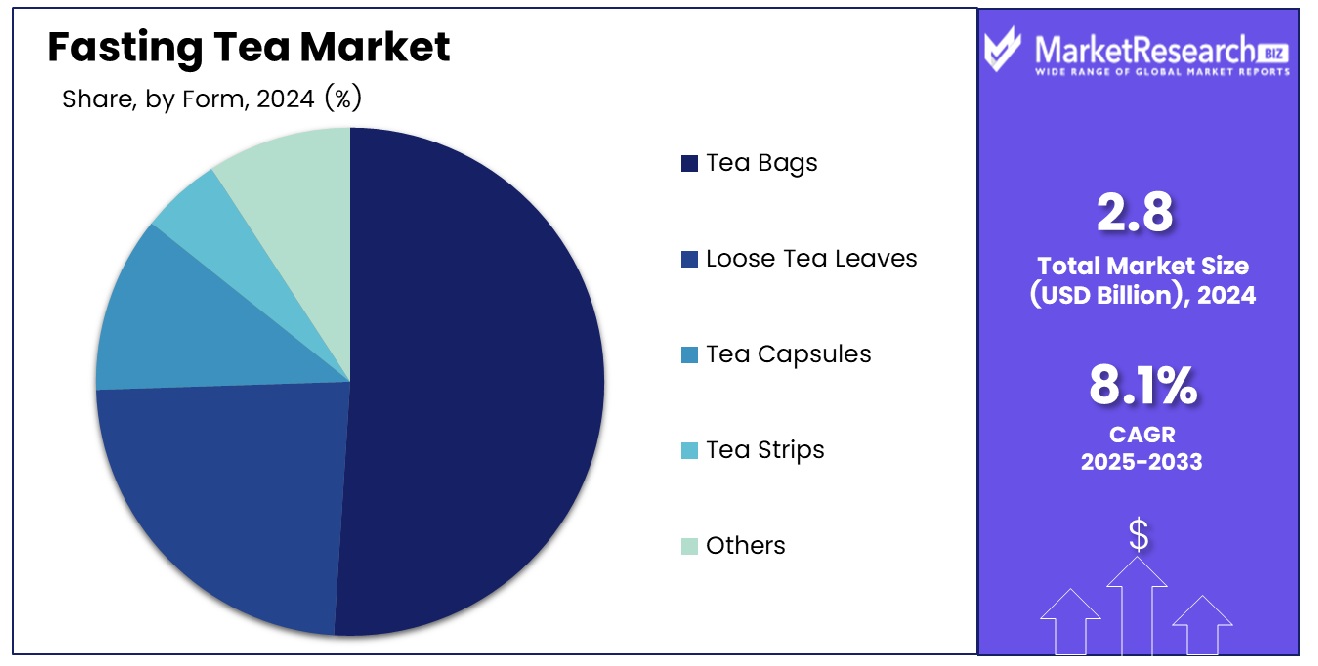

- By Form: Tea Bags dominate the market with a share of 51.3%. This shows that consumers prefer the convenience and ease of use provided by tea bags compared to other forms such as loose leaves or ready-to-drink options.

- By Functionality: Curbs Appetite functionality is a primary driver for consumers, making up 38.7% of the market share. This highlights the appeal of fasting teas for those looking to manage hunger during fasting periods.

- By Distribution Channel: Supermarkets and Hypermarkets are the leading distribution channels, accounting for 46.7% of the market. This indicates that a significant number of consumers purchase fasting teas from large retail stores.

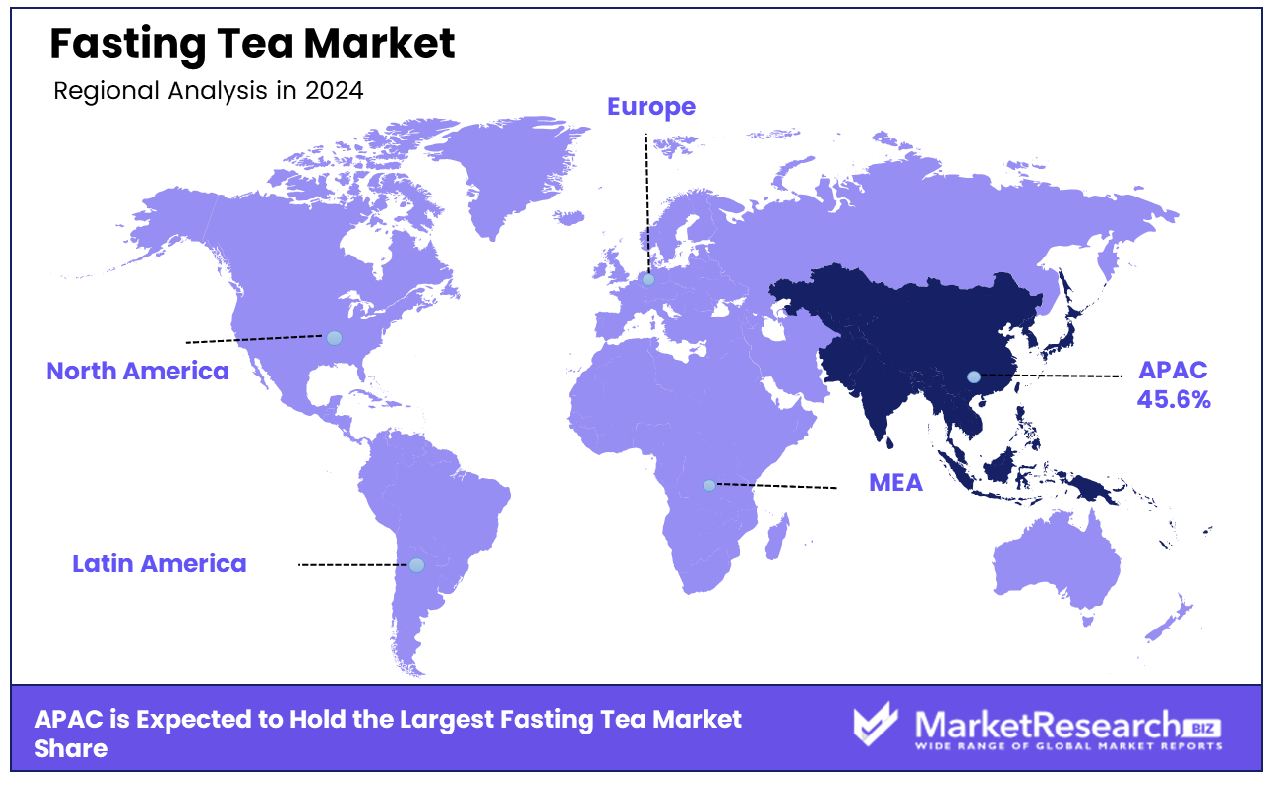

- Regional Dominance: The Asia Pacific region leads the market with a share of 45.6%. This dominance suggests a strong cultural preference for tea and an established market for fasting teas in this region.

- Growth Opportunity: The fasting tea market is poised for significant growth due to increasing consumer interest in health and wellness trends.

Driving factors

Rise in Ready-to-Drink (RTD) Teas

Ready-to-Drink (RTD) teas have witnessed a significant surge in popularity due to their convenience and health benefits. Consumers are increasingly opting for beverages that offer both refreshment and health advantages, and RTD teas fit this criteria perfectly. These teas are pre-packaged and ready for consumption, eliminating the need for preparation time and catering to the busy lifestyles of modern consumers.

The convenience factor of RTD teas aligns well with the consumer preference for on-the-go consumption, driving the growth of the Fasting Tea Market. As fasting becomes more popular as a health practice, consumers seek beverages that complement their fasting routines without compromising on taste or nutritional benefits. RTD teas often come in various flavors and formulations, including herbal blends and low-calorie options, appealing to health-conscious consumers looking for fasting-friendly alternatives. This trend not only expands the market reach but also encourages innovation among tea manufacturers to cater specifically to the fasting segment.

Health and Wellness:

Health and wellness trends play a pivotal role in shaping the growth trajectory of the Fasting Tea Market. Increasing awareness of health benefits associated with tea consumption, such as antioxidant properties, metabolic boosters, and digestive aids, has fueled demand among consumers adopting fasting practices for health reasons. Tea, particularly herbal and green teas, is perceived as a natural and beneficial beverage choice during fasting periods due to its hydrating properties and potential to support detoxification and weight management goals.

Studies indicate that regular tea consumption correlates with reduced risks of chronic diseases, further bolstering its appeal in health-conscious consumer demographics. The integration of functional ingredients like herbs and botanicals into fasting teas enhances their nutritional profile, appealing to a broader audience interested in holistic health solutions. Market growth is also supported by the increasing availability of specialty fasting teas formulated to meet specific health needs, such as improved digestion, increased energy levels, and stress reduction, thereby expanding the market's appeal beyond traditional tea drinkers.

Restraining Factors

Change in Customer Preference

Customer preferences in beverages have been shifting towards healthier options, influenced by increasing health consciousness and a desire for functional benefits. This trend is particularly evident in the Fasting Tea Market, where consumers are gravitating towards beverages that align with their dietary practices and wellness goals. As more people adopt intermittent fasting and other fasting regimens for health reasons, there is a growing demand for beverages that support these lifestyles without compromising on taste or nutritional value.

Fasting teas cater to these evolving preferences by offering natural ingredients known for their health benefits, such as herbal blends that aid digestion or green teas rich in antioxidants. Manufacturers are responding to these preferences by innovating with formulations that specifically target fasting periods, emphasizing attributes like low calorie content, hydration support, and energy enhancement. This proactive approach not only meets consumer expectations but also fosters loyalty among health-conscious demographics seeking convenient, fasting-compatible beverage choices.

High Availability of Substitutes

Despite the availability of substitutes such as coffee, healthy energy drink, and flavored water, the Fasting Tea Market continues to thrive due to distinct advantages it offers. Unlike caffeinated beverages that may disrupt fasting states or sugary drinks that pose health risks, fasting teas are positioned as natural alternatives that provide hydration, essential nutrients, and metabolic support without added sugars or artificial additives.

The competitive landscape of substitutes has prompted tea manufacturers to differentiate their offerings through unique flavors, functional ingredients, and health-focused messaging. This strategic positioning helps fasting teas stand out in a crowded market, appealing to consumers seeking beverages that complement their fasting practices without compromising nutritional integrity.

By Type Analysis

Matcha Green Tea leads in type segment with 29.6% market share.

In 2023, Matcha Green Tea held a dominant market position in the By Type segment of the Fasting Tea Market, capturing more than a 29.6% share. Matcha Green Tea, known for its vibrant green hue and rich antioxidant properties, has surged in popularity due to its perceived health benefits and versatile use in various fasting regimens. Consumers are increasingly drawn to Matcha Green Tea for its ability to boost metabolism and provide sustained energy levels without the typical crash associated with caffeinated beverages.

Following closely behind Matcha Green Tea is Assam Black Tea, which accounted for a significant portion of the market share. Assam Black Tea's robust flavor and higher caffeine content make it a preferred choice among consumers seeking a bold taste profile during fasting periods.

Oolong Tea also secured a notable share in the Fasting Tea Market segment. Renowned for its semi-oxidized processing method, Oolong Tea offers a balanced flavor profile that combines the freshness of green tea with the depth of black tea.

Rooibos Tea, with its caffeine-free composition and naturally sweet flavor, has carved out a niche within the Fasting Tea Market. Renowned for its rich antioxidant content and potential anti-inflammatory properties, Rooibos Tea appeals to consumers seeking a caffeine-free alternative that complements fasting routines while offering a refreshing and comforting taste experience.

Earl Grey Tea, distinguished by its distinctive bergamot aroma and citrusy notes, continues to attract a loyal consumer base within the Fasting Tea Market. Its mild caffeine content and aromatic profile make it an ideal choice for those looking to enjoy a flavorful tea without compromising their fasting goals.

The segment categorized as "Others" encompasses a variety of fasting teas, including herbal blends and specialty teas, which collectively contribute to the diverse landscape of the market.

By Form Analysis

Tea Bags dominate form segment with 51.3% market share.

In 2023, Tea Bags held a dominant market position in the By Form segment of the Fasting Tea Market, capturing more than a 51.3% share. Tea Bags are widely favored for their convenience, ease of use, and precise portioning, making them a preferred choice among consumers adhering to fasting regimens. The popularity of Tea Bags stems from their practicality in preparation, allowing for quick and consistent brewing without the need for additional accessories.

Following Tea Bags is Loose Tea Leaves, which also commands a significant portion of the market share. Loose Tea Leaves appeal to enthusiasts and purists who value the ritual of preparing tea and enjoy the customization of flavor and strength that loose leaf tea offers.

Tea Capsules represent another noteworthy segment within the Fasting Tea Market. Known for their convenience and consistency in flavor, Tea Capsules have gained traction among consumers seeking a quick and mess-free brewing experience.

Tea Strips constitute a smaller yet distinctive segment in the Fasting Tea Market. These innovative tea products offer a novel approach to tea brewing, providing a compact and portable option that appeals to on-the-go consumers.

The "Others" category encompasses a variety of alternative forms and innovations within the Fasting Tea Market. This segment includes options such as powdered teas, cold brew tea bags, and specialty formats tailored to specific dietary preferences and health goals associated with fasting.

By Functionality Analysis

By Functionality AnalysisCurbs Appetite holds strong in functionality segment with 38.7% market share.

In 2023, Curbs Appetite held a dominant market position in the By Functionality segment of the Fasting Tea Market, capturing more than a 38.7% share. Curbs Appetite teas are specifically formulated to help suppress hunger cravings, making them a popular choice among consumers practicing fasting for weight management or dietary control purposes. These teas often contain ingredients like green tea extract, yerba mate, or natural appetite suppressants, appealing to individuals looking to support their fasting regimen with products that promote satiety and control cravings effectively.

Following closely behind Curbs Appetite teas is Provides Hydration, which represents a significant portion of the market share. Hydration teas are designed to replenish fluids and electrolytes lost during fasting, offering a refreshing and health-enhancing option for consumers.

Aids Digestion also commands a notable share within the Fasting Tea Market's Functionality segment. These teas are formulated with ingredients known to promote digestive health, such as peppermint, ginger, or fennel. Aids Digestion teas are favored for their ability to alleviate discomfort and bloating commonly associated with fasting or dietary changes.

Improves Sleep Quality represents another distinct category within the Fasting Tea Market. These teas are crafted with calming ingredients such as chamomile, valerian root, or lavender, which are known for their relaxation-inducing properties.

The "Others" category encompasses a variety of additional functionalities and benefits offered by fasting teas. This segment includes teas designed for detoxification, immune support, stress relief, and specific health concerns associated with fasting.

By Distribution Channel Analysis

Supermarkets and Hypermarkets lead distribution with 46.7% market share.

In 2023, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Fasting Tea Market, capturing more than a 46.7% share. Supermarkets and Hypermarkets are pivotal channels for consumers seeking convenience and accessibility when purchasing fasting teas. These retail outlets offer a wide assortment of brands and varieties, making it easy for shoppers to compare products, find familiar brands, and discover new options that suit their preferences and dietary needs.

Following closely behind Supermarkets and Hypermarkets is Online Retail, which represents a substantial portion of the market share. Online Retail platforms have witnessed significant growth as consumers increasingly prefer the convenience of shopping for fasting teas from the comfort of their homes.

Health Stores and Pharmacies also command a notable share within the Fasting Tea Market's Distribution Channel segment. These specialized outlets cater to health-conscious consumers looking for teas that support specific dietary requirements or health goals associated with fasting.

The "Others" category encompasses a variety of alternative distribution channels within the Fasting Tea Market. This segment includes direct sales, specialty tea shops, and niche retailers that cater to specific dietary preferences or health-conscious communities.

Key Market Segments

By Type

- Matcha Green Tea

- Assam Black Tea

- Oolong Tea

- Rooibos Tea

- Earl Grey Tea

- Others

By Form

- Tea Bags

- Loose Tea Leaves

- Tea Capsules

- Tea Strips

- Others

By Functionality

- Curbs Appetite

- Provides Hydration

- Aids Digestion

- Improves Sleep Quality

- Others

By Distribution Channel

- Online Retail

- Supermarkets and Hypermarkets

- Health Stores and Pharmacies

- Others

Growth Opportunity

Growing Demand for Green Tea

The global fasting tea market is poised for substantial growth in 2024, driven significantly by the increasing demand for green tea. Green tea's popularity stems from its rich antioxidant properties and perceived health benefits, making it a favored choice among consumers adopting fasting routines.

Studies highlighting green tea's role in metabolism boosting and aiding weight management have further fueled its appeal, aligning perfectly with the health-conscious consumer base increasingly adopting intermittent fasting and other wellness practices. Market data indicates a robust compound annual growth rate (CAGR) for green tea extract products within the fasting tea segment, underscoring its pivotal role in shaping market expansion strategies.

Rise of Online Platforms

The proliferation of online platforms presents a promising avenue for the fasting tea market to expand its reach and accessibility in 2024. E-commerce platforms provide brands with a direct channel to engage with consumers seeking convenient, health-focused beverage options. The convenience of online shopping complements the fast-paced lifestyles of modern consumers, facilitating easier access to a wide range of fasting teas tailored to dietary preferences and health needs.

With online sales of beverages witnessing exponential growth, leveraging digital platforms for marketing, distribution, and consumer education becomes crucial for tapping into new market segments and enhancing brand visibility.

Latest Trends

Premiumization and Unique Flavors

In 2024, the fasting tea market is experiencing a notable trend towards premiumization and the introduction of unique flavors. Consumers are increasingly seeking high-quality tea products that offer enhanced sensory experiences and perceived value. This shift towards premium offerings is driven by rising disposable incomes and a growing appreciation for tea as a sophisticated beverage choice.

Manufacturers are responding by innovating with exotic tea blends, rare botanicals, and artisanal production techniques to cater to discerning palates and elevate the consumer experience. Market data suggests a rising consumer willingness to invest in premium fasting teas, positioning this trend as a significant growth driver for the market.

Natural and Organic Tea Products

The emphasis on natural and organic products continues to shape the landscape of the fasting tea market in 2024. Health-conscious consumers are increasingly prioritizing products that are free from synthetic chemicals, pesticides, and genetically modified ingredients. This trend is driving demand for organic fasting teas sourced from sustainably grown tea leaves and botanicals.

Manufacturers are leveraging certifications and transparent sourcing practices to build trust and credibility among eco-conscious consumers. The preference for natural ingredients extends beyond health considerations to include environmental sustainability, aligning with broader consumer values of ethical consumption and corporate responsibility.

Regional Analysis

Asia Pacific region dominates with 45.6% market share.

Asia Pacific emerges as the dominant region in the global fasting tea market, commanding a significant share of 45.6%. This growth is primarily driven by a large population base in countries such as China, India, and Japan, where traditional herbal remedies and wellness practices are deeply ingrained. Rapid urbanization, coupled with increasing disposable incomes, has further accelerated market expansion. The region is expected to maintain its dominance with robust growth projections, driven by continuous product innovation and strategic marketing initiatives.

North America exhibits a promising growth trajectory in the fasting tea market, driven by increasing consumer awareness regarding health benefits associated with fasting.The United States, in particular, is a key market due to rising adoption of intermittent fasting practices among health-conscious individuals.

In Europe, the fasting tea market is expanding steadily, supported by a growing trend towards wellness and dietary supplements. Countries like Germany, France, and the United Kingdom are leading in terms of market share, collectively contributing to the global market. The presence of established health and wellness industries further fuels market growth in this region.

The Middle East & Africa region is witnessing a growing interest in fasting tea products, driven by cultural practices and a rising inclination towards health and wellness. Countries like UAE, Saudi Arabia, and South Africa are key markets within the region.

Latin America is experiencing moderate growth in the fasting tea market, influenced by increasing health consciousness and a shift towards natural and functional beverages. Brazil, Mexico, and Argentina are pivotal markets in the region. Expansion efforts by key market players and rising disposable incomes are expected to bolster market growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global fasting tea market presents a dynamic landscape with several key players shaping its direction and growth. Among these influential companies are Pique, The Natural Spot, Tea Culture of the World, Zi Chun Tea Co. Pty Ltd, IF Tea Company, Teacurry, Nutri Align, The Tea Shelf, Tata Tea, and AMLA GREEN. Each of these entities brings unique strengths and strategies to cater to the burgeoning demand for fasting teas worldwide.

Pique stands out with its innovative approach to tea crystals, offering convenient, high-quality options that appeal to modern consumers seeking both health benefits and ease of use. Their commitment to sustainability and transparency further enhances their appeal in an increasingly conscientious market.

The Natural Spot and Tea Culture of the World emphasize premium, organic ingredients sourced from diverse tea regions, catering to health-conscious consumers looking for natural and authentic products. Their strong emphasis on traditional tea brewing methods and ethical sourcing practices positions them as leaders in the premium fasting tea segment.

Zi Chun Tea Co. Pty Ltd and IF Tea Company focus on artisanal teas, leveraging centuries-old expertise to create unique blends that resonate with connoisseurs seeking a refined tea-drinking experience. Their dedication to quality craftsmanship and storytelling adds a layer of exclusivity and authenticity to their offerings.

Teacurry, Nutri Align, and The Tea Shelf target niche markets with specialized fasting tea formulations aimed at specific health benefits, such as detoxification, weight management, and stress relief. Their research-driven approach and customer-centric product development strategies ensure relevance and efficacy in meeting evolving consumer needs.

Tata Tea and AMLA GREEN, with their established brand equity and extensive distribution networks, wield significant influence in both domestic and international markets. Their mass-market appeal and diverse product portfolios make them pivotal players in shaping consumer preferences and market trends.

Market Key Players

- Pique

- The Natural Spot

- Tea culture of the world

- Zi Chun Tea Co. Pty Ltd

- IF Tea Company

- Teacurry

- Nutri align

- The Tea Shelf

- Tata Tea

- AMLA GREEN

Recent Development

- In May 2024, Kenya secures partnership with Liptons Teas and Infusions and Brown Investments to elevate tea as a premium global product, aiming to boost earnings for local farmers and enhance sector capacity through investments and training.

- In February 2024, Odyssey, a Ft. Lauderdale-based energy drink brand founded in 2021, secures $6M in equity investment led by Rocket Beverage Group, aiming to expand sales, marketing, and inventory for its functional mushroom-infused beverages.

Report Scope

Report Features Description Market Value (2023) USD 2.8 Bn Forecast Revenue (2033) USD 6.0 Bn CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Matcha Green Tea, Assam Black Tea, Oolong Tea, Rooibos Tea, Earl Grey Tea, Others), By Form (Tea Bags, Loose Tea Leaves, Tea Capsules, Tea Strips, Others), By Functionality (Curbs Appetite, Provides Hydration, Aids Digestion, Improves Sleep Quality, Others), By Distribution Channel (Online Retail, Supermarkets and Hypermarkets, Health Stores and Pharmacies, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pique, The Natural Spot, Tea culture of the world, Zi Chun Tea Co. Pty Ltd, IF Tea Company, Teacurry, Nutri align, The Tea Shelf, Tata Tea, AMLA GREEN Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pique

- The Natural Spot

- Tea culture of the world

- Zi Chun Tea Co. Pty Ltd

- IF Tea Company

- Teacurry

- Nutri align

- The Tea Shelf

- Tata Tea

- AMLA GREEN