Global Ev Connectors Market By Type(CCS, Chademo, GB/T, Tesla), By Charging level(Level 1, Level 2, Level 3 , Level 4), By Charging speed(Slow, Fast), By Voltage(AC, DC), By Application(Residential, Commercial), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

37451

-

August 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

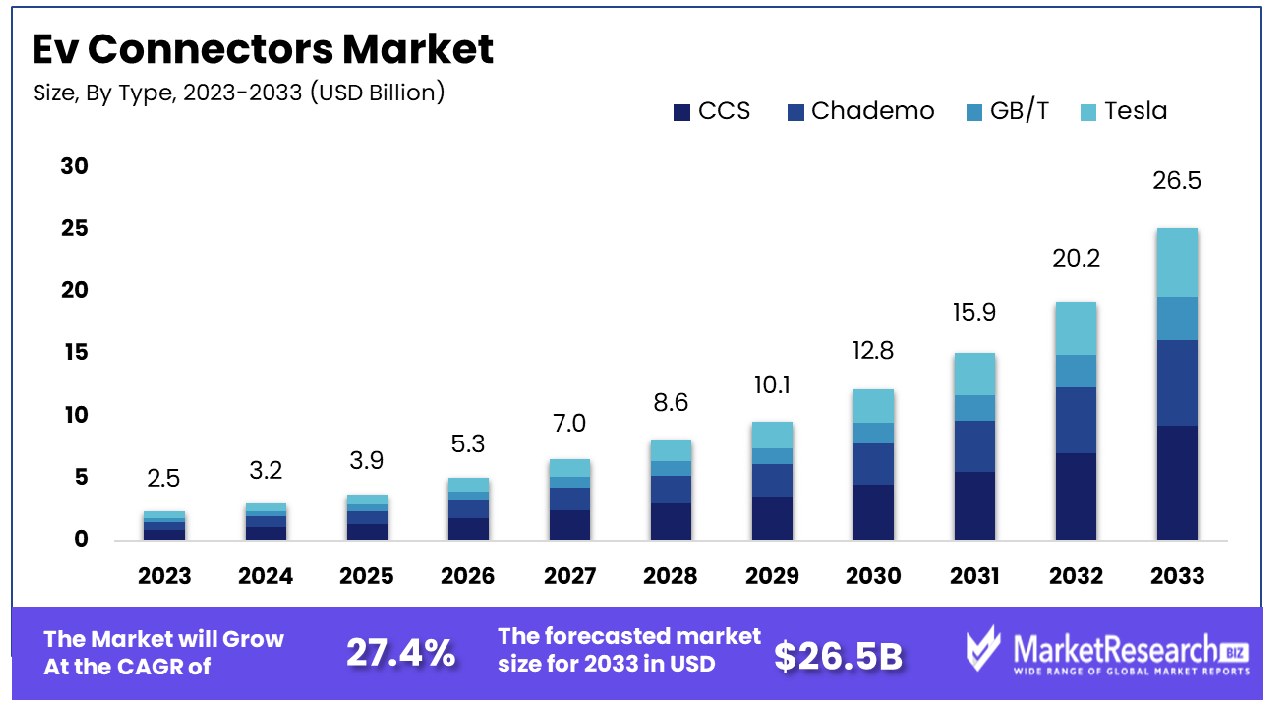

The Global Ev Connectors Market was valued at USD 2.5 billion in 2023. It is expected to reach USD 26.5 billion by 2033, with a CAGR of 27.4% during the forecast period from 2024 to 2033.

The EV Connectors Market comprises entities engaged in manufacturing and distributing electrical connection interfaces for electric vehicles (EVs). These connectors are essential for charging and power transfer between the vehicle and the charging station. As the electrification of transportation gains momentum globally, the demand for efficient, reliable, and standardized EV connectors intensifies.

This market is critical for supporting the infrastructure needed to sustain the growing adoption of electric vehicles. Strategic developments in this sector focus on innovation in connector technology, compatibility across different vehicle models, and compliance with international safety standards, aiming to enhance user convenience and promote widespread EV usage.

The EV Connectors Market is positioned at a crucial juncture, reflecting the pivotal role of infrastructure in the broader transition towards electric vehicles. As stakeholders intensify their focus on reducing carbon emissions, the demand for advanced, efficient EV charging solutions escalates, driving significant developments within this sector. Currently, the market offers a range of connector options tailored to diverse user needs and technological capacities.

For instance, basic Level 1 connectors utilize a standard 120V outlet, which, while widely accessible, provides a slow charge, adding approximately 5 km or 3 miles per hour to the vehicle's range, with full charge times extending beyond 20 hours. This option, although slow, presents a low-barrier entry point for EV owners without access to more sophisticated infrastructure.

In contrast, Level 2 connectors operate on a 240V outlet, enhancing charging efficiency substantially with speeds ranging from 30–50 km (20–30 miles) per hour and reducing full charge times to between 6 and 14 hours. This category has become a standard for residential and commercial settings, balancing speed and accessibility.

At the pinnacle of charging technology, direct current (DC) fast chargers revolutionize the market by offering rapid charging capabilities, achieving up to 200 km (124 miles) per hour and dramatically diminishing full charge times to between 20 minutes and an hour. This technology caters to commercial fleets and public charging stations, facilitating longer journeys and reducing downtime for vehicles.

The strategic importance of developing and enhancing EV connector technologies cannot be overstated. Innovations in this field are not only crucial for meeting consumer demand but also for fostering the scalability of electric mobility, aligning with global sustainability goals. The EV Connectors Market is expected to witness robust growth, driven by technological advancements, regulatory support, and increased consumer adoption of electric vehicles.

Key Takeaways

- Market Growth: The Global Ev Connectors Market was valued at USD 2.5 billion in 2023. It is expected to reach USD 26.5 billion by 2033, with a CAGR of 27.4% during the forecast period from 2024 to 2033.

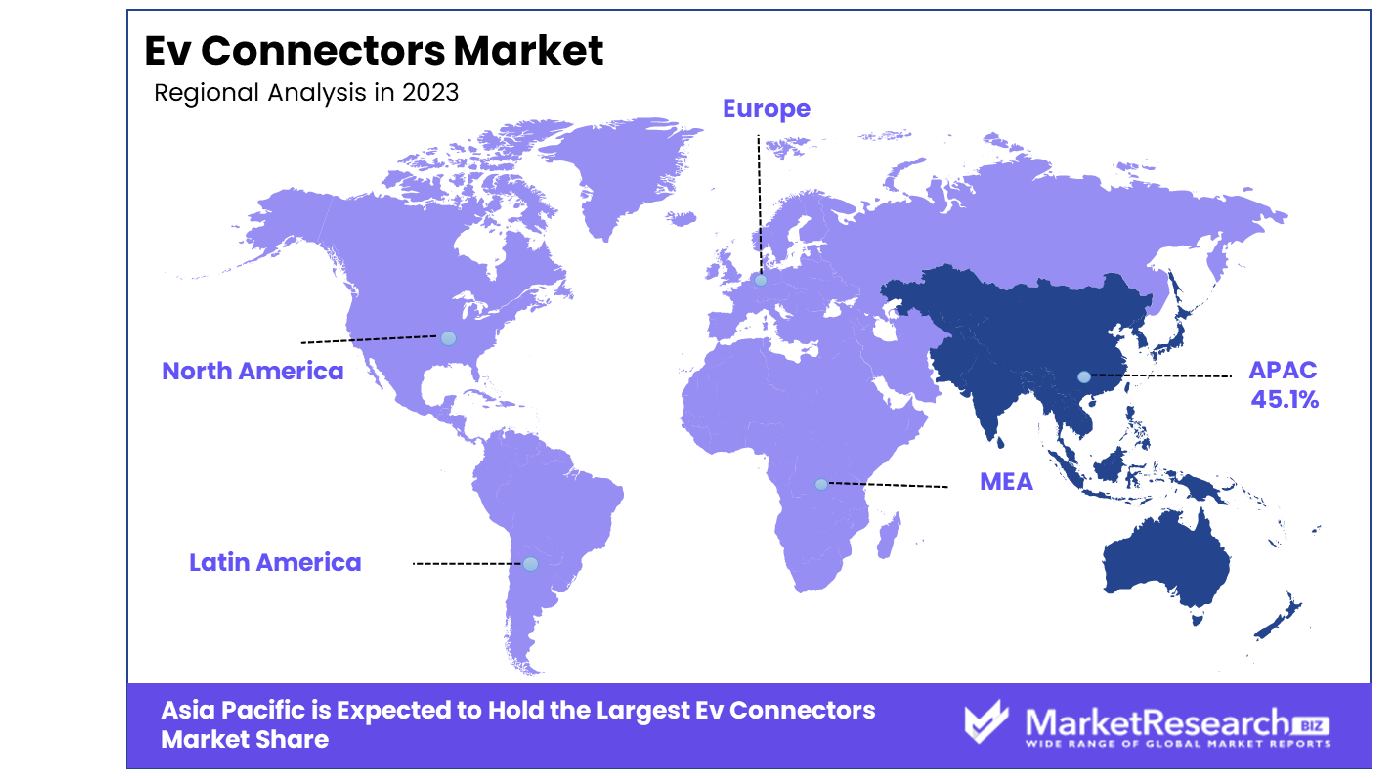

- Regional Dominance: Asia Pacific dominates the EV Connectors Market with a 45.1% share.

- By Type: CCS connectors lead the market by type with 40%.

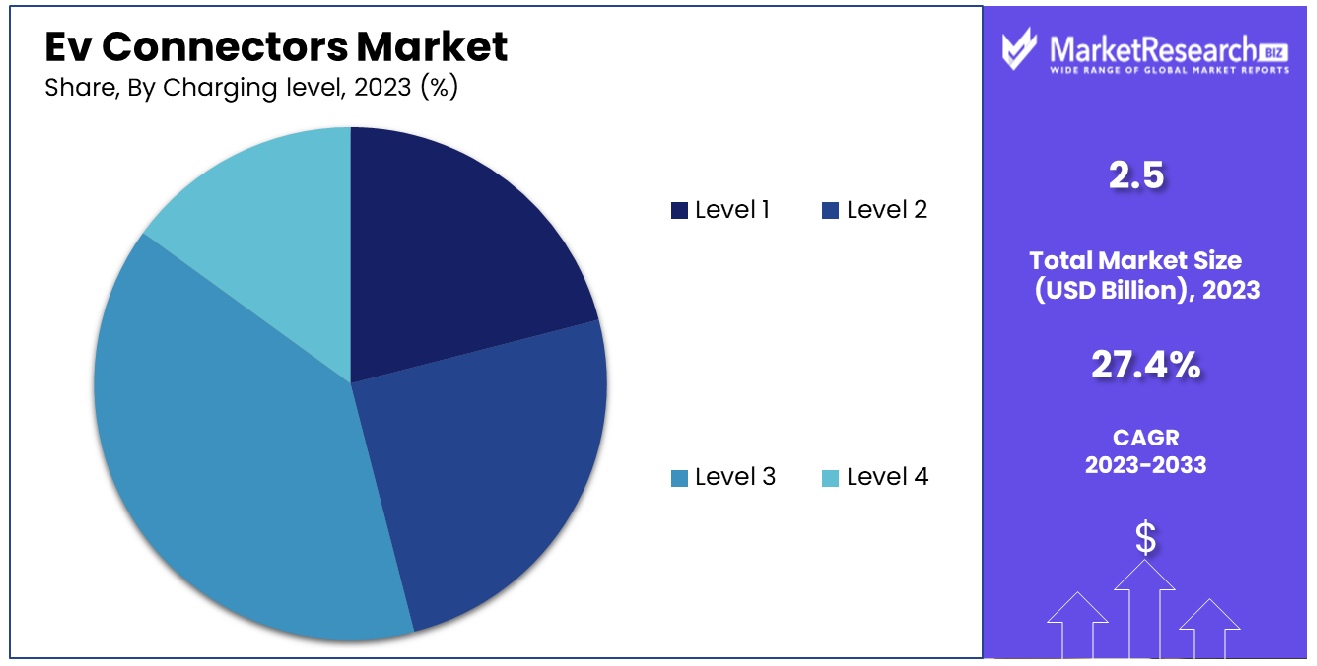

- By Charging level: Level 3 charging dominates levels, capturing 50% of the market.

- By Charging speed: Fast charging speed is dominant, holding 70% market share.

- By Voltage: DC voltage predominates, accounting for 60% of the market.

- By Application: Commercial applications lead, constituting 60% of the market use.

Driving factors

Increasing Adoption of Electric Vehicles (EVs)

The surge in electric vehicle (EV) adoption is a primary catalyst driving the expansion of the EV Connectors Market. As more consumers and enterprises transition towards sustainable transportation options, the demand for robust and efficient charging infrastructure escalates.

This uptrend in EV sales, fueled by heightened environmental awareness and the proliferation of more affordable EV models, necessitates a parallel growth in charging facilities, including advanced connectors that ensure compatibility and safety. The correlation between the number of EVs on the road and the requirement for more charging points directly boosts the market for EV connectors.

Government Incentives and Subsidies for EV Infrastructure

Government policies play a pivotal role in shaping the EV Connectors Market. Incentives and subsidies designed to bolster EV adoption also extend to supporting infrastructure development. Governments worldwide are not only encouraging EV purchases through rebates and tax benefits but are also investing in the establishment of public charging networks.

Such policies lower the financial barriers for new charging stations, promoting the deployment of both standard and fast-charging connectors. This governmental push significantly lowers entry barriers for new market entrants and accelerates the build-out of necessary charging infrastructure, thereby driving demand for innovative connector solutions.

Advancements in Fast Charging Technology

The evolution of fast charging technology is revolutionizing the EV Connectors Market. As fast chargers become more efficient, offering substantial charges in minimal time, they address one of the critical pain points for EV adoption—charging duration. Modern fast chargers, capable of delivering speeds up to 200 km per hour, reduce EV downtime drastically, appealing to both private and commercial users.

The development of such technologies not only enhances user convenience but also amplifies the operational feasibility of EVs for longer journeys, thus expanding the overall market for high-performance EV connectors. This technological trajectory is anticipated to continue, propelling the market forward with innovations that meet the fast-evolving standards of the automotive industry.

Restraining Factors

High Installation Cost of Charging Stations

The substantial initial investment required for the installation of charging stations is a significant restraining factor in the growth of the EV Connectors Market. Establishing a network of reliable and accessible EV charging stations involves high costs associated with infrastructure, such as electrical upgrades and real estate, along with the actual hardware of the stations and connectors.

These expenses can be prohibitive for new market entrants and may slow the expansion rate of charging networks, particularly in regions lacking governmental or financial incentives. This financial barrier not only restricts the deployment of new charging points but also influences the pace at which existing stations are upgraded with advanced connector technologies, ultimately impacting the overall market expansion.

Compatibility Issues Between Different Connector Types

Compatibility remains a critical challenge within the EV Connectors Market. As different automakers design and implement proprietary connectors for their EV models, the lack of standardization across the industry leads to significant usability issues. This fragmentation forces consumers to seek specific charging stations that match their vehicle’s connector type, reducing the convenience and perceived benefit of EVs.

Furthermore, compatibility issues can deter new users from transitioning to electric vehicles, as the uncertainty about charging options adds a layer of complexity to EV ownership. Addressing these compatibility challenges is crucial for market growth, as greater standardization would not only enhance user convenience but also streamline the manufacturing and distribution of EV connectors, potentially reducing costs and accelerating market expansion.

By Type Analysis

The CCS type significantly dominated the market, holding a robust 40% share in 2023.

In 2023, CCS (Combined Charging System) held a dominant market position in the "By Type" segment of the EV Connectors Market, capturing more than a 40% share. This substantial market penetration is attributed to the widespread adoption of CCS standards by leading automotive manufacturers in Europe and North America, which have prioritized interoperability and fast-charging capabilities. The CCS technology facilitates rapid charging, a crucial factor driving consumer preference amidst growing electric vehicle adoption.

CHAdeMO, initially leading in Japan, secured a smaller portion of the global market, reflecting regional preferences and the gradual pivot of Japanese automakers towards CCS standards. Its market presence underscores the technological diversity within the EV connectors landscape and highlights the ongoing competition between global charging standards.

The GB/T connector, predominant in the Chinese market, has demonstrated significant influence within Asia. The standard benefits from state-backed initiatives aimed at promoting electric vehicles in China, the largest EV market globally. The integration of GB/T standards into local infrastructure projects and domestic vehicle designs emphasizes its critical role in shaping the regional EV ecosystem.

Tesla’s proprietary connector maintains a niche but noteworthy segment, particularly in the United States, where Tesla continues to expand its dedicated Supercharger network. Although it represents a smaller share compared to CCS, Tesla’s innovation in charging technology and infrastructure development remains pivotal in advancing EV adoption and influencing market trends.

By Charging level Analysis

Level 3 charging, designed for rapid energy delivery, captured a commanding 50% of the market.

In 2023, Level 3 held a dominant market position in the "By Charging Level" segment of the EV Connectors Market, capturing more than a 50% share. This substantial market control can be attributed to the increasing adoption of rapid charging technologies, which are integral to supporting the high throughput needs of contemporary electric vehicles. Level 3 connectors, commonly referred to as DC fast chargers, offer the advantage of significantly reduced charging times compared to their Level 1 and Level 2 counterparts, which primarily provide AC charging solutions.

Level 1 connectors, typically utilized for residential charging, accounted for the smallest market share, as they offer the slowest charging speeds. On the other hand, Level 2 connectors, which are used both in residential and commercial settings, held a moderate market share. These connectors support a more extensive range of applications than Level 1 and are favored for overnight charging or at workplaces.

Level 4 charging technology, which is still in the nascent stages of development and deployment, represented a minimal portion of the market in 2023. This segment is expected to grow as technological advancements pave the way for ultra-fast charging solutions that could revolutionize how energy is delivered to electric vehicles.

The dominance of Level 3 in the market underscores the trend towards optimizing charging time, which is a critical factor in the consumer adoption of electric vehicles. As infrastructure expands and technology improves, the dynamics within this segment are anticipated to evolve, potentially increasing the competitive pressure on Level 3 while opening new opportunities for Levels 1, 2, and 4.

By Charging Speed Analysis

Fast charging speeds prevailed, constituting 70% of the market, appealing to consumers seeking convenience.

In 2023, Fast chargers held a dominant market position in the "By Charging Speed" segment of the EV Connectors Market, capturing more than a 70% share. This commanding presence is primarily driven by the increasing demand for reduced charging times and enhanced convenience among electric vehicle users. Fast chargers, which significantly shorten the charging process compared to their slow counterparts, have become increasingly vital in commercial settings and public charging stations, where time efficiency is a critical factor.

The slow charging segment, typically utilized for overnight residential charging or at locations where vehicles remain parked for extended periods, retained a smaller share of the market. These chargers are often perceived as more economical due to lower installation and maintenance costs, but their lengthy charging times limit their appeal for users needing quicker turnaround.

The overwhelming preference for fast chargers underscores the market's shift towards supporting a lifestyle that aligns more closely with the traditional fueling experience—quick and convenient. This trend is facilitated by technological advancements that allow fast chargers to provide substantial charge in short durations, making electric vehicles more appealing to the general public and fleet operators.

Looking forward, the fast-charging segment is expected to maintain its dominance as infrastructure development continues to focus on expanding the availability of quick-charging stations. This expansion is anticipated to further propel the adoption of electric vehicles, affirming the pivotal role of fast-charging technology in the growth of the global EV market.

By Voltage Analysis

DC voltage, known for its efficiency in fast charging, dominated with a 60% market share.

In 2023, DC connectors held a dominant market position in the "By Voltage" segment of the EV Connectors Market, capturing more than a 60% share. This predominance is largely due to the rapid charging capabilities that DC connectors offer, which significantly reduces charging time compared to AC connectors. The preference for DC connectors is especially pronounced in commercial and public charging settings, where the need for speed is paramount to accommodate the high turnover of vehicles requiring quick energy replenishment.

AC connectors, which are typically used for residential charging due to their slower charging speeds, occupy a lesser share of the market. These connectors remain popular for home use because they align well with overnight charging habits and are compatible with the existing residential electrical infrastructure. However, their slower charging rates make them less ideal for drivers who require a quick charge on the go.

The market's tilt toward DC charging underscores a broader trend in the electric vehicle industry toward enhancing user convenience and reducing downtime, which is crucial for broader EV adoption. As electric vehicle ownership increases, the demand for faster, more efficient charging solutions is expected to rise, potentially increasing the market share for DC connectors even further.

Future advancements in technology and reductions in the cost of DC charging equipment could further consolidate its dominance in the market, while also potentially expanding its use in residential settings as consumers seek more efficient home charging solutions.

By Application Analysis

The commercial application led, occupying 60% of the market, driven by business and fleet usage.

In 2023, the Commercial segment held a dominant market position in the "By Application" segment of the EV Connectors Market, capturing more than a 60% share. This significant market presence reflects the growing installation of EV charging stations in commercial venues such as shopping centers, public parking spaces, and business complexes. The push for commercial charging infrastructure is largely driven by governmental policies and incentives aimed at promoting electric vehicle adoption, alongside growing consumer demand for accessible and rapid charging options outside of the home.

Conversely, the Residential segment, which encompasses home-based charging solutions, accounted for a smaller portion of the market. Despite the convenience of home charging, the growth in this segment has been somewhat tempered by the slower adoption rate of individual charging equipment and the continuing need for infrastructure improvements in residential settings.

The predominance of commercial applications highlights the strategic focus on developing EV charging as a service, which not only supports the existing population of electric vehicle owners but also entices potential buyers by alleviating range anxiety. The expansion of commercial charging facilities is expected to continue, driven by investments from both public and private sectors.

Moving forward, the market is likely to witness even greater growth in the commercial sector as new business models emerge around EV charging services, including subscription plans and integrated vehicle-to-grid systems, further cementing the importance of commercial applications in the EV connectors market.

Key Market Segments

By Type

- CCS

- Chademo

- GB/T

- Tesla

By Charging level

- Level 1

- Level 2

- Level 3

- Level 4

By Charging speed

- Slow

- Fast

By Voltage

- AC

- DC

By Application

- Residential

- Commercial

Growth Opportunity

Expansion into Developing Markets

The year 2023 presents significant opportunities for the global EV Connectors Market, particularly through expansion into developing markets. As countries in regions such as Asia, Africa, and Latin America increase their focus on sustainable development, the demand for electric vehicle infrastructure is expected to rise sharply. These markets offer a vast new consumer base and are often supported by government policies aimed at reducing carbon emissions and enhancing energy efficiency.

The expansion into these areas not only opens up new revenue streams for companies in the EV Connectors Market but also diversifies the geographical risk and dependency on more mature markets. Moreover, developing markets frequently leapfrog older technologies directly to newer solutions, providing a ripe environment for the adoption of advanced EV technologies and infrastructure.

Innovations in Wireless Charging Technologies

Innovations in wireless charging technologies are set to redefine the landscape of the EV Connectors Market in 2023. Wireless EV charging systems, which allow for the automatic charging of electric vehicles without the need for physical connectors, represent a breakthrough in convenience and functionality. These systems can drastically simplify the charging process, reducing wear and tear on traditional connectors and potentially increasing the adoption of EVs due to the enhanced user experience.

The development and refinement of such technologies are likely to attract investment and research, driving the market forward. Companies that pioneer these innovations could establish strong competitive advantages, setting the stage for leadership in a rapidly evolving industry. As these technologies mature, they could become a key differentiator in the EV infrastructure, catalyzing further growth in the global EV Connectors Market.

Latest Trends

Emergence of Ultra-Fast Charging Stations

The emergence of ultra-fast charging stations is a definitive trend shaping the EV Connectors Market in 2023. As the electric vehicle market grows, so does the demand for reduced charging times, driving significant investment in ultra-fast charging technologies. These stations can dramatically accelerate the charging process, offering rates that can replenish significant portions of an EV’s battery in just minutes, compared to the hours required by earlier models.

This capability is not only more convenient for consumers but also critical for the feasibility of electric vehicles in commercial and heavy-duty applications, where downtime for charging is a major operational concern. The deployment of ultra-fast charging stations is expected to bolster the appeal of electric vehicles, enhancing their viability as a replacement for traditional combustion engines and pushing the boundaries of what's possible within the EV charging infrastructure.

Integration of Smart Features in EV Connectors

Another trend gaining momentum in 2023 is the integration of smart features into EV connectors. Smart connectors enhance the user experience by providing features such as real-time charging data, remote control via smartphone apps, and enhanced security measures to prevent unauthorized usage. Furthermore, these intelligent systems can optimize power consumption based on grid demand, contributing to more efficient energy use and supporting grid stability.

The sophistication of these smart connectors aligns with broader trends toward IoT (Internet of Things) and home automation technologies, creating a more interconnected and user-friendly charging ecosystem. As consumers become increasingly tech-savvy, the demand for these advanced features is expected to grow, thereby driving further innovations and developments in the EV Connectors Market.

Regional Analysis

The Asia Pacific region leads the EV Connectors Market, holding a dominant share of 45.1%.

The EV Connectors Market is segmented into diverse regional landscapes, each with its own unique growth dynamics and market penetration levels. Among these, the Asia Pacific region dominates the market with a substantial 45.1% share, driven by aggressive electric vehicle adoption rates in countries such as China, Japan, and South Korea. These countries are not only leading in terms of EV sales but also the development and deployment of EV charging infrastructure. Government incentives, robust manufacturing capabilities, and the presence of major automotive players contribute significantly to this dominance.

In contrast, Europe follows closely with strong regulatory support promoting eco-friendly vehicles, particularly in nations like Germany, the UK, and the Netherlands. The European market benefits from well-established automotive industries and stringent environmental regulations, which drive the demand for EV connectors as part of the broader push towards green mobility.

North America, particularly the United States, shows significant growth potential due to increasing environmental awareness, state-level incentives for EVs, and initiatives to expand charging infrastructure. This region's market is characterized by a quick adoption of innovative technologies, including high-speed and smart charging solutions.

Meanwhile, the Middle East & Africa and Latin America regions are emerging markets in the EV connectors space. These regions present untapped opportunities due to increasing urbanization and industrialization, paired with a growing governmental focus on reducing reliance on fossil fuels. However, the growth in these regions is gradual, with infrastructural and economic challenges influencing the pace of adoption compared to other regions. Collectively, these regional markets contribute to a dynamic global landscape, with Asia Pacific leading the charge in shaping future trends and technology adoption in the EV connectors sector.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global EV Connectors Market will be significantly shaped by the activities and innovations of key players. Each of these companies contributes distinct technological advancements and strategic expansions that bolster the market's overall dynamics.

Yazaki and Fujikura from Japan are notable for their pioneering efforts in high-reliability connectors that suit varying climates and demanding usage conditions, a critical factor for markets with diverse geographical and environmental challenges. Their continued innovation in durability and efficiency plays a crucial role in maintaining Japan's leading position in automotive technologies.

Schneider Electric from France and Siemens AG from Germany emphasize the integration of smart technology into their EV charging solutions. Their focus on IoT-enabled connectors allows for more efficient energy management and aligns with Europe’s stringent energy regulations and digital transformation goals.

Tesla in the U.S., renowned for its disruption in the electric vehicle industry, also innovates in connector technologies that support its rapid charging network and superchargers, enhancing the convenience and practicality of EV ownership.

Bosch and Siemens AG, with their roots in industrial engineering, have been pivotal in driving forward the technology for fast and ultra-fast charging stations, supporting quicker adoption rates in both commercial and residential segments.

ABB in China leverages its global presence and expertise in heavy electrical equipment to lead developments in robust and high-capacity charging systems, especially catering to China’s expansive and rapidly growing EV market.

Amphenol, Huber+Suhner, and Sumitomo provide specialized connector solutions that support the diverse needs of global automotive manufacturers, enhancing the interoperability and efficiency of EV charging across different vehicle types.

Market Key Players

- Yazaki (Japan)

- Schneider Electric (France)

- Tesla (U.S.)

- Bosch (Germany)

- ABB (China)

- Siemens AG (Germany)

- Fujikura (Japan)

- Amphenol (U.S.)

- Huber+Suhner (Switzerland)

- Sumitomo (Japan)

- others

Recent Development

- In June 2024, Yazaki launched a new line of ultra-fast EV connectors designed to reduce charging time by 25%. This innovation aims to cater to the growing demand for faster charging solutions in the electric vehicle market.

- In May 2024, ABB launched a global initiative in May 2024 to install 10,000 new EV charging stations equipped with their latest high-efficiency connectors. This initiative is expected to expand ABB’s global footprint in the EV charging infrastructure market by 25% over the next two years.

- In April 2024, Bosch secured a $40 million investment to develop a new generation of EV connectors that are more durable and weather-resistant. This funding will enable Bosch to potentially reduce manufacturing costs by 15% while maintaining high-quality standards.

Report Scope

Report Features Description Market Value (2023) USD 2.5 Billion Forecast Revenue (2033) USD 26.5 Billion CAGR (2024-2032) 27.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(CCS, Chademo, GB/T, Tesla), By Charging level(Level 1, Level 2, Level 3 , Level 4), By Charging speed(Slow, Fast), By Voltage(AC, DC), By Application(Residential, Commercial) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Yazaki (Japan), Schneider Electric (France), Tesla (U.S.), Bosch (Germany), ABB (China), Siemens AG (Germany), Fujikura (Japan), Amphenol (U.S.), Huber+Suhner (Switzerland), Sumitomo (Japan), others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Yazaki (Japan)

- Schneider Electric (France)

- Tesla (U.S.)

- Bosch (Germany)

- ABB (China)

- Siemens AG (Germany)

- Fujikura (Japan)

- Amphenol (U.S.)

- Huber+Suhner (Switzerland)

- Sumitomo (Japan)

- others