Epigenetics Market By Product(Kits & Reagents, Instruments, Enzymes), By Method(DNA Methylation, Histone Modifications, Other), By Technique(NGS, PCR & qPCR, Other), By Application(Cardiovascular Diseases, Oncology, Metabolic Diseases,Other), By End User(Academic and Research Institutes, Pharmaceutical and Biotechnology Companies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

3529

-

May 2023

-

182

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

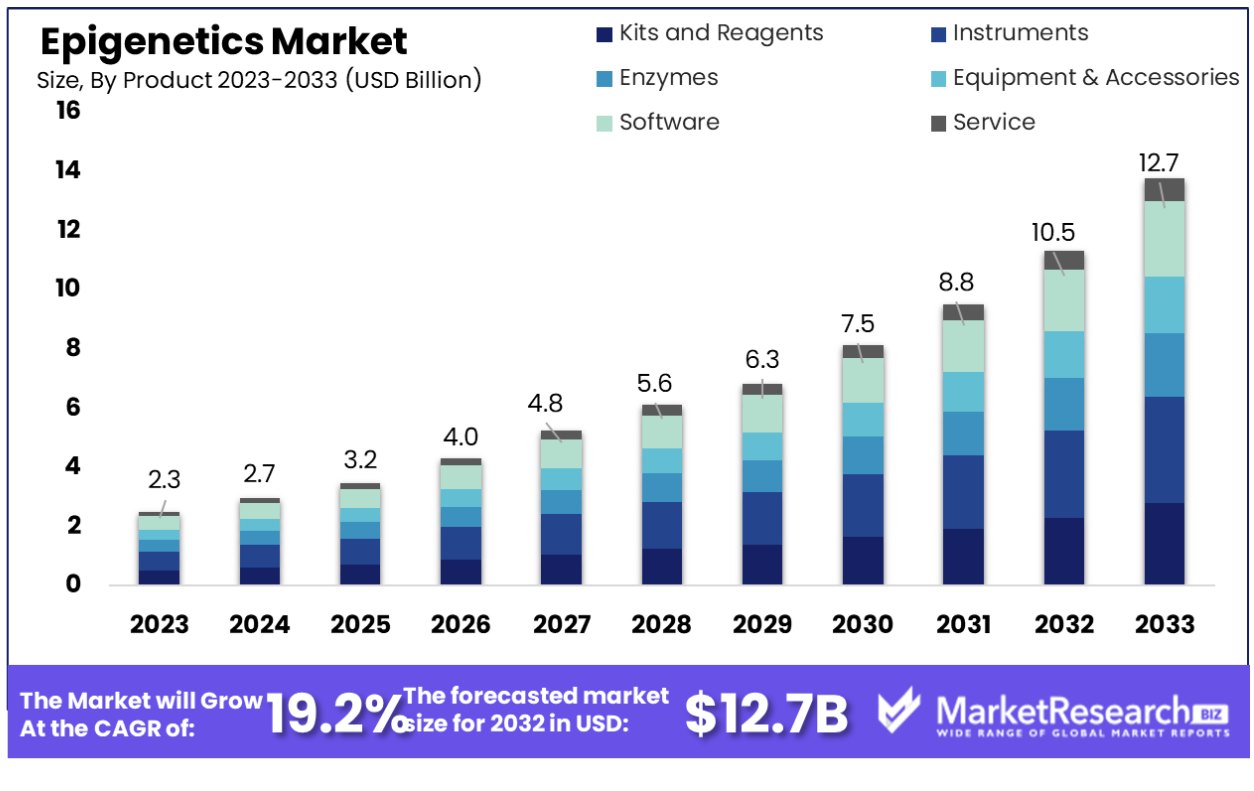

Epigenetics Market size is expected to be worth around USD 12.7 Bn by 2033 from USD 2.3 Bn in 2023, growing at a CAGR of 19.2% during the forecast period from 2024 to 2033.

The graph offers a CAGR-based forecast until 2032. Actual market dynamics, influenced by economic and industry-specific factors, may lead to different outcomes. Comprehensive analysis available in the full report.

The surge in demand for advanced technology related to epigenetics and the growing prevalence of cancer and AIDS all across the world are some of the key factors driving the epigenetics market. Epigenetics has displayed its potential in non-oncology conditions, creating great opportunities for market expansion.

Epigenetic pathways are interconnected with a variety of cancers, cardiovascular diseases, reproductive health issues, and other ailments and disorders that impact cognitive functions. Epigenetics-based assays are beneficial in comparison to old microarrays, by getting benefits such as low concentration of the sample and absence of experimental basis in micrassays. Many researchers have now aimed at creating advanced epigenetic instruments and genome sequencing.

There has been a rise in cancer incidence in the past few decades. Drugs derived from epigenetic research efficiently work on some of the specific types of cancers, which makes sure to decrease treatment costs and provide treatment at reasonable prices all across the globe.

According to the American Cancer Society in 2023, 1,958,310 new cancer cases have been discovered and among that 609,820 cancer deaths are being noted. Moreover, The Institute of Cancer Research, Human Technopole, and Queen Mary University of London collaboratively researched the importance of epigenetics in the advancement of bowel cancer. Epigenetics includes changes in the physical structure of DNA without changing the genetic code, impelling gene accessibility and expressions.

Epigenetic influences on colorectal cancer growth factor independently of DNA mutations. Researchers also noticed that epigenetic changes have a significant control over cancer’s ability to grow. Thus, the upsurge in global cases of cancers is projected to substantially drive the epigenetic market expansion.

The epigenetic market has observed substantial growth in technology that has changed the view of gene regulation and inheritance. For example, next-generation sequencing (NGS) helps researchers to know DNA methylation order, histone changes, and other epigenetic identifications on the genome-wide scale with extraordinary accuracy and effectiveness.

Additionally, the new advanced CRISPR-based technology has appeared that allows the targeted manipulation of epigenetic identification marks to study their functionality and potential therapeutic application. Moreover, governments from different nations are planning to aim for investments in healthcare research to ensure good quality standards and meet the requirements of the patients for better and advanced technologies.

Driving factors

Rising Prevalence of Cancers Drives Epigenetics Market Growth

An estimated 20 million new cases of cancer and 10 million deaths from cancer occurred globally in 2023. Epigenetics research is becoming a vital aspect of cancer research as more cases emerge globally, amplifying the need to understand its underlying mechanisms. Epigenetics plays an integral part in cancer research as modifications in epigenetic processes may activate oncogenes while simultaneously silencing tumor suppressor genes.

As cancer becomes an increasing burden, more investment in epigenetic research aimed at creating targeted therapies and personalized medicine approaches is being made. Over time, as the cancer burden increases further, epigenetics is projected to play an even more prominent role, propelling sustained market growth for this market segment.

Technological Innovations Drive Epigenetics Market

The epigenetics market is experiencing significant growth, propelled by advancements in technologies like CRISPR-based gene editing and single-cell epigenomics. These cutting-edge tools are revolutionizing the field, enabling deeper and more comprehensive studies. The launch of Bioinformatics Services by FOXO Technologies in July 2023 exemplifies this trend, offering a platform specifically tailored for rapid and accurate epigenetic data analysis. This technological leap is critical in fostering new discoveries in biology, biotechnology, and healthcare, significantly expanding the scope and potential of epigenetics research.

Diagnostic Applications Fuel Market Expansion

The utilization of epigenetic biomarkers for early disease detection, particularly in cancer diagnostics, marks a pivotal shift in the epigenetics market. Methods like liquid biopsies using methylation markers, as exemplified by Cardio Diagnostics Holdings Inc's PrecisionCHD™ for Coronary Heart Disease detection, represent a less invasive and more efficient approach to disease diagnosis. This innovation in diagnostics is not only enhancing early disease detection but also shaping the future of personalized medicine, thereby contributing significantly to the growth of the epigenetics market.

Increased Funding Catalyzes Epigenetics Research

The influx of investments and funding from governments and private organizations into epigenetics research is a key driver of market growth. Significant initiatives like the NIH Roadmap Epigenomics Project, which received a budget of approximately $200 million USD, are testament to this trend. This project alone has produced 111 reference maps of epigenomic modifications across a wide range of cell types and tissues. Additionally, the approval of agents targeting DNMT, HDAC, and EZH2 for clinical trials underscores the growing interest and potential of epigenetic therapies. This heightened investment and focus on understanding the epigenome's role in health and disease are crucial in advancing the field and driving market expansion.

Restraining Factors

Limited Applications of Epigenomic Data in Toxicology Restrains Market Growth

Epigenomic data applications in toxicology impede market expansion for epigenetics. Epigenetics has immense potential in understanding the effects of toxic substances on gene expression, yet current application is limited due to complex epigenetic mechanisms and difficulties interpreting vast amounts of data. As a result, its potential usage for toxicological studies and environmental health research remains limited, restricting market expansion as its scope remains narrow.

High Cost of Instruments Restrains Epigenetics Market Growth

Epigenetic research can be hindered by its high cost. Equipment used for epigenetic analysis such as next-generation sequencing (NGS) and mass spectrometry are expensive investments that often prevent many research institutions with limited funds or in developing regions from purchasing these technologies. Due to affordability concerns, access is restricted thus restricting market expansion beyond well-funded organizations limiting democratization of epigenetic research applications.

Segmentation Analysis of Epigenetics Market

By Product Analysis

Kits and reagents form the core of the epigenetics market due to their widespread application across various epigenetic experiments and procedures. These products are essential in DNA methylation studies, histone modification analysis, chromatin immunoprecipitation (ChIP) assays, etc. The growth of this segment is driven by increased research volume as well as advancements of kits and reagents tailored specifically for specific applications as well and rising demand for epigenetics high-throughput techniques. The Kite segment exhibits the largest share in epigenetics, contributing significantly to overall segment growth.

Instruments such as sequencers and mass spectrometers are critical tools for epigenetic analysis, while enzymes play an essential role in changing DNA and histones. Equipment, accessories, software packages, as well as services offering sequencing and analysis services for researchers lacking their capabilities, are indispensable for accurate experiments.

By Method Analysis

DNA methylation is a leading method in epigenetics research. It's fundamental in understanding gene expression and regulation and is implicated in various diseases. This method's dominance is attributed to its established role in epigenetics and the increasing interest in its role in cancer and other diseases.

Histone modifications are also crucial in understanding chromatin structure and function. Other methods include chromatin remodeling and non-coding RNA analysis.

By Technique Analysis

NGS is the dominant technique in epigenetics due to its ability to provide comprehensive genomic data, including epigenetic modifications across the genome. The scalability and decreasing cost of NGS contribute to its widespread adoption.

PCR & qPCR are essential for quantifying epigenetic changes. Mass spectrometry is used in protein modification analysis. Sonication is a technique used in ChIP assays.

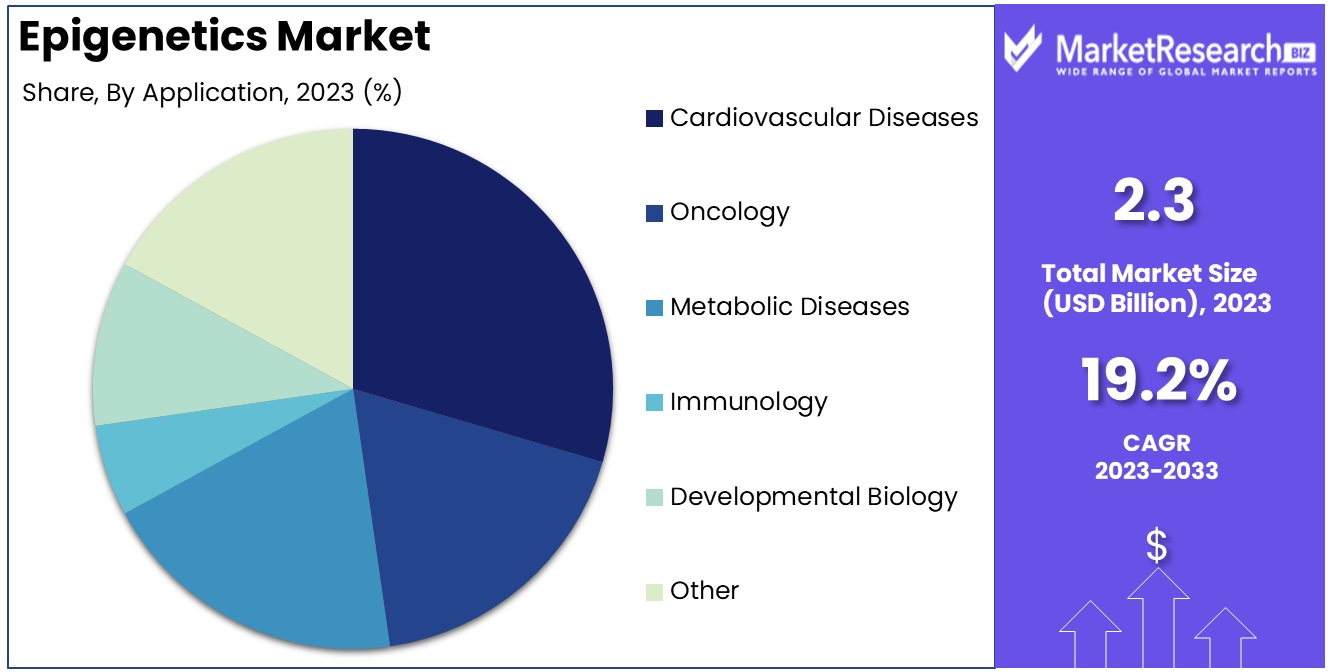

By Application Analysis

Epigenetics in cardiovascular diseases is gaining attention due to the increasing prevalence of these conditions and the recognition of epigenetic factors in their development. This application is driving significant research and funding. The Epigenetics industry trends experiences steady annual growth rates in addressing Cardiovascular disorder, Neurological disorder, and Metabolic disorders.

Oncology is a key application area, with epigenetics providing insights into cancer development and potential treatments. Metabolic diseases, immunology, and developmental biology are also important fields of study.

By End User Analysis

These institutes are the primary end-users in the epigenetics market. They drive basic research and advancements in epigenetics, often collaborating with pharmaceutical companies for translational research.

Pharmaceutical and biotech companies are increasingly investing in epigenetic research for drug development. CROs provide essential services for both academic research and industry projects.

The epigenetics market is driven by the growing understanding of epigenetic mechanisms in disease and the development of technologies such as NGS. Kits and reagents lead the product segment, essential for a range of research applications. DNA methylation remains a key method, with cardiovascular diseases emerging as a leading application area. Academic and research institutes are the main end-users, spearheading basic research and collaborations for clinical applications. The market is expected to grow as epigenetic research continues to unveil critical insights into gene regulation and disease pathogenesis.

Key Market Segments

By Product

- Kits and Reagents

- Instruments

- Enzymes

- Equipment & Accessories

- Software

- Service

By Method

- DNA Methylation

- Histone Modifications

- Other

By Technique

- NGS

- PCR & qPCR

- Mass Spectrometry

- Sonication

- Other

By Application

- Cardiovascular Diseases

- Oncology

- Metabolic Diseases

- Immunology

- Developmental Biology

- Other

By End User

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

Growth Opportunity

Increasing Investments in Healthcare Research Amplify Epigenetics Market Potential

The surge in investments in healthcare research presents substantial growth opportunities for the epigenetics market. Increased funding facilitates the exploration of novel epigenetic applications in disease diagnosis and treatment. For instance, the rise in healthcare spending, especially in R&D, which reached over $200 billion globally, accelerates the development of epigenetic technologies. These investments enable deeper investigation into genetic modifications, fostering advancements in personalized medicine and targeted therapies, pivotal areas within epigenetics.

Continuous Technological Advancements Drive Epigenetics Market Expansion

Continuous technological innovations are at the core of driving epigenetics market growth. Innovations in sequencing technologies, bioinformatics, and epigenetic analysis methods play a key role in improving efficiency and accuracy in epigenetic research. NGS technologies in particular are providing researchers with unprecedented insight into epigenetic mechanisms at reduced costs and time, propelling further epigenetic studies for diagnostics and therapeutics that expand market size.

Increasing Prevalence of Chronic Diseases Catalyzes Epigenetics Market Development

Epigenetics market growth has been fuelled by an increasing global prevalence of chronic diseases like cancer, heart diseases, and diabetes, all of which contain epigenetic components. According to World Health Organization reports on chronic disease prevalence estimates; due to this significant surge, advanced diagnostic and treatment methods must be put in place as soon as possible - epigenetic research plays an essential part in understanding disease mechanisms which opens doors for novel therapeutic approaches and expands epigenetic market size exponentially.

Regional Analysis

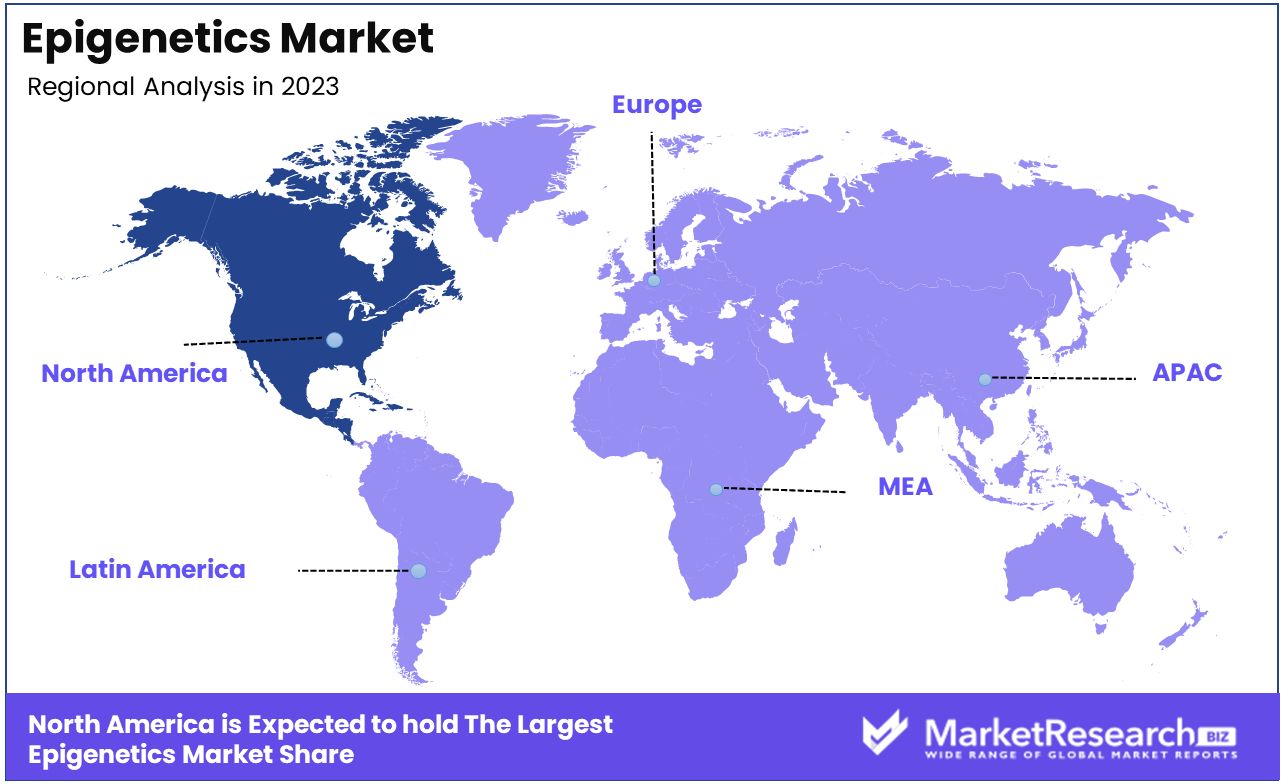

North America Dominates with 35% Market Share in the Epigenetics Market

North America currently accounts for 35% of the global epigenetics market, thanks to its advanced research infrastructure, substantial funding for biomedical research, and leading pharmaceutical and biotechnology companies. North America's share can also be explained by active research conducted in areas like cancer, cardiovascular diseases, and genetic disorders where epigenetic mechanisms play a critical role.

North America's market dynamics are heavily influenced by collaboration among academic institutions, research organizations, and biotech industries - creating a fertile ground for innovation and development of epigenetic therapies and DNA diagnostics. Furthermore, its well-established healthcare system and regulatory environment that facilitate the adoption of new therapies enhance its market position even further.

Forecast projections project that North America will remain a global leader in the epigenetics market due to ongoing investments in genomics and personalized medicine, coupled with rising chronic disease prevalence requiring new therapeutic approaches. Targeted therapies and precision medicine should foster further advancement and growth within the epigenetics field.

Europe:

Europe holds an advantageous place in the epigenetics market, supported by strong research initiatives, funding from government and private sources, and numerous major pharmaceutical and biotech key market players in both sectors. Market growth is propelled by active research into disease pathogenesis such as oncology and genetic disorders.

The European market is expected to experience sustained expansion, propelled by increasing collaborations among research institutions, advances in epigenetic research, and government policies that promote healthcare innovation.

Asia-Pacific:

Asia-Pacific region has become an emerging epigenetics market due to increasing investments in biomedical research and its growing biotechnology sector, along with rising healthcare needs. China and Japan are leading this movement with substantial investments in genomics research and personalized medicine.

The future of the epigenetics market in Asia-Pacific looks promising, with potential growth driven by increasing public and private investment in healthcare research, a growing focus on personalized medicine, and the expanding capabilities of regional biotech industries. The rising prevalence of chronic diseases in the region is also a key driver for market expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The epigenetics market is shaped by the contributions of numerous key players, each bringing unique technological advancements and strategic focuses. Bio-Rad Laboratories, Inc. and Thermo Fisher Scientific Inc. are industry leaders, known for their extensive range of research tools and reagents. Their significant investment in R&D and global reach position them as an influential major players setting market trends and standards.

Diagenode, QIAGEN, and Abcam Plc. specialize in providing high-quality kits and reagents for epigenetic research, with a strong focus on innovation and user-friendly solutions. Their market influence is evident in their extensive product portfolios that cater to various aspects of epigenetic analysis.

New England Biolabs and Agilent Technologies are recognized for their expertise in genomics and DNA modification analysis, contributing significantly to the advancement of epigenetic research tools. Zymo Research and Active Motif stand out for their dedicated focus on epigenetic research, offering specialized products and services that cater to niche market needs.

PerkinElmer, Inc. and Illumina, Inc. have a strong presence in the market, known for their advanced sequencing and array technologies, which are critical in epigenetic analysis. Their strategic positioning emphasizes their commitment to technological innovation.

Overall, these key players in the epigenetics market drive the industry forward through their emphasis on technological advancement, diverse product offerings, and a focus on addressing the complex needs of epigenetic research, diagnostic applications, and therapeutic development.

Top Key Players in Epigenetics Market

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Diagenode Inc.

- Qiagen NV

- Abcam Plc.

- New England Biolabs

- Agilent Technologies

- Zymo Research

- PerkinElmer, Inc.

- Active Motif

- Illumina Inc.

- Merck KGaA

- Roche Diagnostics

- Perkin Elmer

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Chroma Medicine, Inc

- Promega Corporation

- Hologic Inc.

- AsisChem Inc.

- BioVision Inc.

- PerkinElmer Inc.

Recent Development

- In September 2023, Estée Lauder Companies Inc. shared its latest clinical research findings at the IFSCC Congress in Barcelona, Spain. a keynote address titled "Harnessing Epigenetics: from Anti-Aging to Age Reversal. This presentation highlighted the role of epigenetics in skin aging and the potential to reverse skin aging through understanding epigenetic signals.

- In June 2023, MSK-led research discovered an unexpected link between chromosomal instability and epigenetic alterations, which are both hallmark characteristics of cancer, particularly advanced and drug-resistant forms. This groundbreaking finding has significant implications for both basic science biology research and clinical care.

- In 2023, FOXO Technologies Inc., a leader in commercializing epigenetic biomarker technology, collaborates with DataRobot to leverage the power of artificial intelligence for epigenetic biomarker research in human longevity. This collaboration aims to generate data-driven insights that promote optimal health and longevity.

- In 2022, Yang et al. explored the potential of targeting histone methylation to treat type 2 diabetes mellitus. Their research focused on the development of epigenetic-based therapies for T2D, including drugs that target histone methylations.

Report Scope:

Report Features Description Market Value (2023) USD 2.3 Bn Forecast Revenue (2033) USD 12.7 Bn CAGR (2023-2033) 19.2% Base Year for Estimation 2024 Historic Period 2017-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Kits & Reagents , Instruments, Enzymes, Equipment & Accessories, Software, Service), By Method(DNA Methylation, Histone Modifications, Other), By Technique(NGS, PCR & qPCR, Mass Spectrometry, Sonication, Other), By Application(Cardiovascular Diseases, Oncology, Metabolic Diseases, Immunology, Developmental Biology, Other), By End User(Academic and Research Institutes, Pharmaceutical and Biotechnology Companies, Contract Research Organizations) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Diagenode Inc., Qiagen NV, Abcam Plc., New England Biolabs, Agilent Technologies, Zymo Research, PerkinElmer, Inc., Active Motif, Illumina Inc., Merck KGaA, Roche Diagnostics, Perkin Elmer, Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd, Novartis AG, Promega Corporation, Hologic Inc., AsisChem Inc., BioVision Inc., PerkinElmer Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-