DNA Diagnostics Market By Product Type(Instruments, Reagents, Other) By Technology Analysis (PCR-based Diagnostics, Microarrays-based Diagnostics, Others), By End-user Analysis(Hospitals, Independent Laboratories, Other), By Application, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

41681

-

Oct 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

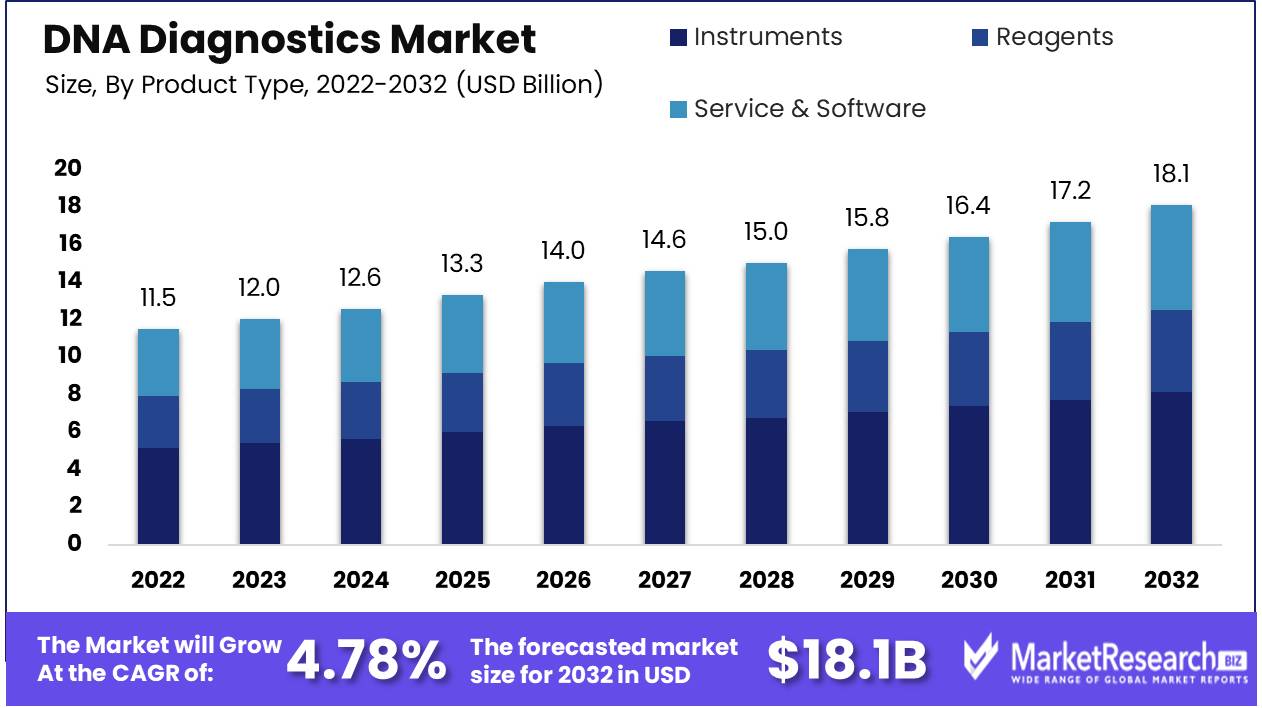

DNA Diagnostics Market size is expected to be worth around USD 18.1 Bn by 2032 from USD 11.5 Bn in 2022, growing at a CAGR of 4.78% during the forecast period from 2023 to 2032.

The DNA Diagnostics Market can be recognized by various factors including rising rates of infectious, genetic, and chronic illnesses as well as decreasing costs for Next-Generation Sequencing (NGS) and Polymerase Chain Reaction (PCR), all contributing to its rapid expansion.

Genetic diagnostics is an exciting development that is revolutionizing how medical conditions are diagnosed. Health professionals and doctors can now recognize genetic conditions earlier, which improves outcomes for patients while increasing effectiveness. DNA diagnostics is used widely for cancer detection, infectious disease screening, personalized medicine research projects and research purposes as well as personalized medicine uses and research. With rapid genome sequencing technology now readily available to us all, personalized medicine could soon become even more possible and thus expand diagnosis opportunities even more rapidly than ever.

Genetic testing regulations can be complex and ever-evolving, with each country or region having its own set of rules, in addition to legal and ethical considerations to take into account when performing tests. Both patients and healthcare professionals alike may find it challenging to navigate this maze of regulations to ensure genetic tests are carried out safely and ethically; by 2023 Thermo Fisher Scientific had acquired GenMark Diagnostics; an expert provider of molecular diagnostics products.

As personalized medicine and genetic disorders become more popular and DNA testing becomes a part of everyday healthcare, its growth should only accelerate further over time. DNA Prototyping plays an integral part in prenatal diagnosis as well as disease diagnosis within healthcare facilities - fuelling innovations in DNA diagnosis technology.

Driving factors

Increasing Prevalence Of Genetic Disorders

The Myogenic disorder has risen rapidly across the world. DNA diagnostics provide aid in the earlier diagnosis as well as treatment for illnesses by determining their genetic causes.

Growing Incidence Of Chronic Disorders

Chronic diseases, such as cardiovascular diseases, cancer, and diabetes are rising making the diagnosis and treatment for these conditions increasingly complicated and expensive. DNA diagnostics play an essential function in this regard. For instance, polymerase chain reaction (PCR) tests help to detect cancerous cells in the early stages before the disease becomes more severe.

Rising Prevalence Of Infectious Diseases

As diseases such as COVID-19 have spread across the globe DNA diagnostics have experienced the demand for them increase. DNA diagnostics are used to identify bacteria and viruses within the body. This aids in the diagnosis and treatment of diseases such as COVID-19.

Increasing Geriatric Population

Populations of the elderly are growing steadily which is causing an increase in age-related ailments. DNA diagnostics can be used to detect warning signs of these ailments, so that prompt treatment and management is given to speed up recovery of the disease. In the DNA Diagnostics Market, Next Generation Cancer Diagnostics introduces groundbreaking techniques for identifying genetic markers in cancer more accurately.

Restraining Factors

Privacy Concerns Impacting the DNA Diagnostics Market

DNA diagnostics hold great promise, yet several key issues impede their expansion. One such challenge stems from patients' fear of sharing data related to their genetics (DNA) with healthcare providers due to security fears relating to this data; this fear is amplified in countries without adequate laws in place that protect the confidentiality of this type of patient information.

High Costs Challenge DNA Diagnostics Growth

Cost can also pose an obstacle to expanding the DNA testing business. Though prices have decreased significantly over time, genetic tests remain very expensive compared to other forms of diagnostic tests - something which may put off those unable to pay out-of-pocket and health professionals planning costs for other tests.

Standardization Hurdles in Genetic Testing

Lack of standardization processes is one of the main obstacles to the advancement of DNA diagnostics. There are various kinds of genetic tests, and their methods and interpretation could produce different results, leading to confusion for healthcare providers as well as patients, thus decreasing their utility in clinical settings.

Navigating Complex Regulatory Landscape for Genetic Testing

The regulatory framework regarding genetic tests is ever evolving and evolving, with different countries having specific laws regulating this industry. There are ethical and legal aspects of conducting genetic tests that must be considered when doing them safely and responsibly by both health professionals and patients alike.

By Product Type Analysis

DNA diagnostic instruments represent an array of technologies and equipment essential for DNA analysis. Such instruments include PCR machines, DNA sequencers, and microarray scanners among many others - their success can be attributed to various major key factors within their industry.

Advances in DNA sequencing technology have enabled high-throughput sequencing platforms that make genetic analysis more cost-effective and efficient, processing large volumes of samples simultaneously to revolutionize both research and clinical applications.

As personalized medicine and genomics research become more popular, DNA diagnostic instrument segments have become more widely utilized by both academic researchers and healthcare industry providers alike. Researchers rely on them to analyze individual genetic makeup - enabling the identification of disease susceptibility, treatment response rates, drug development potential as well as many other attributions.

Instruments remain the focus of the DNA diagnostics industry due to their vital role in furthering genetic research and personalized medicine. With ongoing technological innovations and rising global demand for genetic analysis services, this segment will likely remain domineering over time - shaping healthcare and genetics alike for years to come.

By Technology Analysis

The PCR segment led the industry with over 40% industry share. PCR technology is widely utilized for DNA diagnostics as it amplifies small amounts of DNA into millions of copies that are easy to detect and analyze, making detection and analysis simpler than ever. With global industry demand growing for tests utilizing this technique for infectious disease diagnosis, genetic disorders diagnosis, and cancer diagnostics this sector continues to thrive.

The sequencing segment is projected to experience significant growth over the forecast period due to increased acceptance of next-generation sequencing (NGS) technologies in clinical diagnostics. NGS technologies facilitate high-throughput DNA sample sequencing for disease detection and identification of genetic variations or mutations associated with specific diseases. Furthermore, the DNA diagnostics industry is expanding at an unparalleled rate globally. Demand for DNA tests drives their rapid expansion while accurate demand forecasting assists both diagnostics and treatment categories.

Microarray technology has seen impressive gains in DNA diagnostics due to its ability to concurrently examine multiple genes. Microarray technology enables personalized medicine and targeted therapy, and increased adoption of microarray-based tests for cancer diagnosis and drug development drives growth within this segment.

ISH technology is used for the detection and localization of specific DNA sequences within tissue samples, with steady growth expected over the forecast period due to rising demand for cancer diagnosis tests that utilize in situ hybridization technology as well as research applications that utilize this type of detection and localization technique.

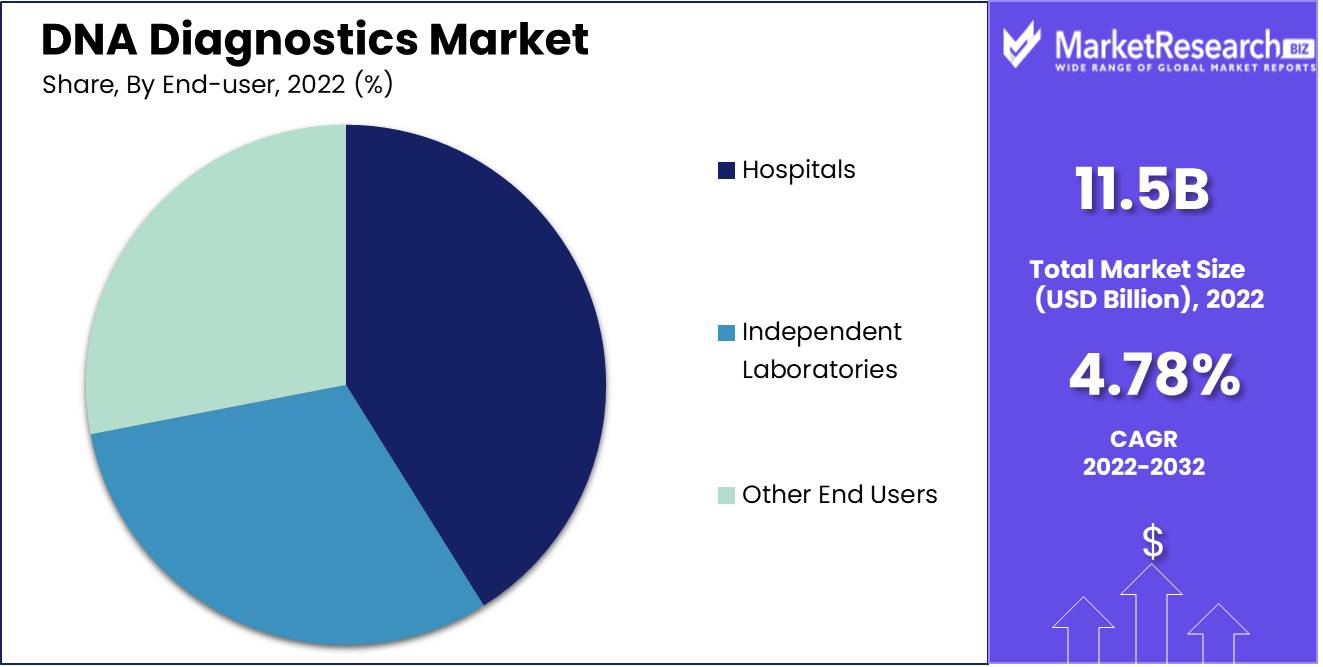

By End-user Analysis

End-users of DNA diagnostics include hospitals and independent laboratories, with hospitals being among the primary end users due to increased patient demand for DNA tests in hospitals. Independent laboratories also play an essential of providing DNA diagnostic testing options to their patient base.

Hospital industry growth will likely be propelled by the rising prevalence of genetic disorders and increasing demand for personalized medicine. Hospitals are investing in advanced DNA diagnostic technologies to provide timely results to patients, which should increase demand for DNA diagnostic tests at hospitals.

Independent laboratories are projected to experience steady expansion over the forecast period due to growing demand for DNA diagnostic tests and increasing numbers of independent labs offering them. Independent laboratories are investing in cutting-edge DNA technologies to provide accurate results at a fast rate for convalescence.

By Application Analysis

The DNA diagnostics industry can be divided into research and development, diagnostics, and other approaches. Of these areas of focus, diagnostics is expected to hold the highest market share due to rising genetic disorder prevalence rates and growing interest in personalized medicine treatments.

Research and development will experience tremendous growth over the forecast period due to an increasing focus on creating therapies and drugs using genetic information. Other applications of genomic testing include forensics, paternity testing, and ancestry testing; while DNA diagnostics utilizes genomic analysis for early disease detection as well as prevention; this has proven valuable for providing personalized healthcare and personalized insights into cancer disease.

Diagnostics is expected to lead the industry during its forecast period due to growing global demand for genetic testing for various diseases - such as cancer diagnostics industry, cardiovascular disorders, and neurological conditions - while research and development is projected to see substantial expansion due to an emphasis on creating therapies and drugs using genetic information.

The other major segment is projected to experience rapid expansion due to the increased adoption of DNA diagnostic testing for forensic applications, paternity testing, and ancestry testing. With growing awareness regarding its benefits as well as direct-to-consumer kits available directly, direct genetic testing kits should fuel its expansion. The DNA diagnostics market, driven by an annual compounded growth rate, addresses cancer incidence rates while within it the breast cancer segment provides treatment and diagnostic testing solutions, decreasing prevalence levels.

Key Market Segments

By Product Type

- Instruments

- Reagents

- Service & Software

By Technology Analysis

- PCR-based Diagnostics

- Microarrays-based Diagnostics

- In-situ Hybridization Diagnostics

- NGS DNA Diagnosis

By End-user Analysis

- Hospitals

- Independent Laboratories

- Other End Users

By Application Analysis

- Oncology

- Prostate Cancer

- Breast Cancer

- Colorectal Cancer

- Others

- Infectious Disease

- Hepatitis B Virus

- Hepatitis C Virus

- HIV

- TB

- Chlamydia Trachomatic and Neisseria Gonorrhea (CT/NG)

- HPV

- Methiciline Resistant Staphylococcus Aureus (MRSA)

- Others

- Myogenic Disorder

- Clinical Diagnostic Confirmation

- Prenatal Diagnostics

- Pre-implantation Diagnostics

- Others

Growth Opportunity

Lack of Standardization

A major obstacle facing the DNA diagnostics industry is its lack of similarity. There are currently no established protocols for DNA testing, leading to differences between the results of different DNA tests - this can become particularly complicated when DNA results are used for critical medical diagnoses. To address this challenge, efforts are currently being made to develop quality protocols for DNA testing.

High Cost

A major key factor of DNA diagnostics industry's growth is its relatively expensive testing method. While DNA test costs have reduced significantly over time, they remain costly compared to other diagnostic tests; this may prevent some patients from accessing DNA testing due to limited insurance coverage for such tests. To address this issue, efforts are currently being undertaken to develop more cost-efficient DNA testing methods.

Personalized Medicine

While the DNA diagnostics industry presents challenges, there are also numerous opportunities. One such opportunity lies within personalized medicine - as genomic research advances further, DNA testing has become an indispensable tool for converting treatment plans based on an individual's genetic makeup. This trend should spur significant growth within this segment over the coming years.

Direct-to-Consumer (DTC) Genetic Testing

A major growth opportunity in the DNA diagnostics industry lies with direct-to-consumer (DTC) genetic testing, which allows consumers to gain access to information about their genetic makeup without going through traditional healthcare providers. As costs for DTC testing decrease significantly over time, this trend should drive significant expansion within the industry for DNA diagnostics products and services.

Latest Trends

Personalized Medicine

Advances in genomics and bioinformatics have become key drivers of growth within the DNA diagnostics industry, enabling personalized treatments tailored specifically to an individual's genetic makeup. As such, personalized treatments will increase demand for DNA diagnostic tests that offer accurate information about an individual patient's genetic profile.

Increased Use of Next-Generation Sequencing (NGS)

NGS technology has rapidly gained in popularity within the DNA diagnostics market. NGS allows for fast sequencing of large amounts of DNA quickly, making it ideal for clinical settings. As NGS costs decrease further, its popularity will likely expand even more within this field of medical science.

Rising Demand for Non-Invasive Prenatal Testing (NIPT)

NIPT (noninvasive prenatal testing) is an in-utero diagnostics technology that detects chromosomal abnormalities without the need for invasive procedures, making this technology increasingly popular with pregnant women as it offers less risk and greater accuracy compared with traditional prenatal testing methods.

Demand for Companion Diagnostics Is Rising

Companion diagnostics are tests designed to identify patients most likely to benefit from specific treatments, and are becoming an integral component of targeted therapies for cancer and other diseases. With more targeted therapies being created, companion diagnostics demand should only continue to rise globally.

Advances in Bioinformatics.

Bioinformatics is the study of biological data combined with computer science and statistics for analysis and interpretation. Bioinformatics advancements are predicted to play an integral part in shaping the DNA diagnostics industry's future, especially given that more data will be generated through DNA sequencing tests or other means and will need to be interpreted correctly to be useful.

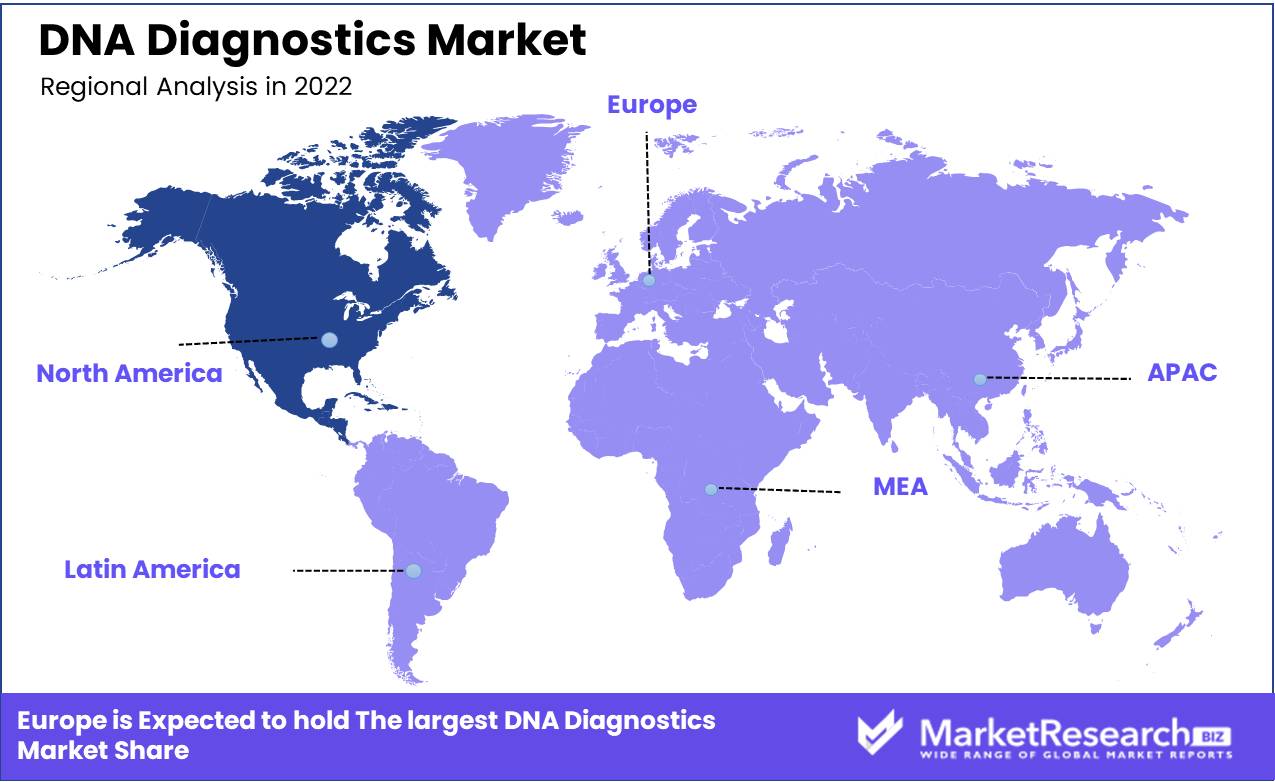

Regional Analysis

North America dominated the DNA diagnostics marke and is projected to experience tremendous growth over time due to an increase in genetic, infectious, and chronic diseases.This section covers regional demand across North America, Europe, and Asia-Pacific for DNA diagnostic products. North America is projected to hold a large industry share of the DNA diagnostics market due to the large presence of industry players and adoption of advanced technologies.

Chronic diseases, including cancer diagnostics, are driving global industry demand for DNA diagnostics in this region; complex healthcare infrastructure, strong government initiatives, proactive funding for testing research projects, and high prevalence are other significant contributors to market expansion in this region.

North America has seen widespread adoption of genetic testing for various purposes, such as disease risk assessment, pharmacogenomics research, prenatal screening, and ancestry testing. Advanced laboratory facilities, favorable healthcare reimbursement policies, and an expanding population base all help North America lead the DNA diagnostic industry.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The DNA diagnostics industry is highly competitive with several key players competing to stay atop its development. These players include Sysmex Corporation, GE HealthCare, Sansure Biotech Inc., Illumina Inc., and Thermo Fisher Scientific - just to name a few - among many others. Each player uses product launches, partnerships, collaborations, and acquisitions as a means of expanding market presence and maintaining their edge against their rivals.

Thermo Fisher Scientific announced its acquisition of PPD, a leading global contract research organization (CRO), for $17.4 billion. This will strengthen Thermo Fisher's capabilities within clinical research and drug development areas.

Illumina, Inc. - an industry leader in DNA sequencing - today announced their acquisition of GRAIL Healthcare Limited, an early detection specialist committed to lifesaving early diagnosis of multiple cancers. This move should strengthen their position within the sequencing services market.

Sysmex Corporation recently announced that they have agreed with Oxford University to create a rapid and highly sensitive diagnostic test for COVID-19.

GE Healthcare recently unveiled the Ready Gene Oncology Test, an advanced next-generation sequencing (NGS) test that provides a broad overview of cancer-related gene mutations and alterations.

Top Key Players in DNA Diagnostics Market

- F. Hoffmann-La Roche AG

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Sysmex Corporation

- Bio-Rad Laboratories, Inc.

- Myriad Genetics, Inc.

- GE Healthcare

- Abbott Laboratories

- Beckman Coulter Inc.

- Cephide.Inc

- Hologic, Inc.

- Siemens HealthcareGmbH

- Agilent Technologies Inc.

Recent Development

- In August 2023, The US Food and Drug Administration (FDA) approved a new DNA diagnostic test for cystic fibrosis developed by Vertex Pharmaceuticals. The test uses next-generation sequencing technology to detect mutations in the CFTR gene, which causes cystic fibrosis.

- In June 2023, Qiagen, a global provider of sample and assay technologies, launched a new sample-to-result workflow for DNA and RNA sequencing. The workflow is called QIAseq 2S.

- In March 2023, Thermo Fisher Scientific, a global leader in DNA sequencing and analysis, announced the acquisition of GenMark Diagnostics, a company specializing in molecular diagnostics.

- In January 2023, Illumina, a leading DNA sequencing company, launched a new sequencing platform called NovaSeq X. Allowing researchers to sequence large volumes of DNA quickly and cost-effectively.

- In September 2022, a team of researchers from the University of California, San Francisco, and the University of Michigan developed a new blood test that can detect over 50 types of cancer.

Report Scope

Report Features Description Market Value (2022) USD 11.5 Bn Forecast Revenue (2032) USD 18.1 Bn CAGR (2023-2032) 4.78% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology Analysis(PCR-based Diagnostics, Microarrays-based Diagnostics, In-situ Hybridization Diagnostics, NGS DNA Diagnosis, Others), By End-user Analysis(Hospitals , Independent Laboratories, Other End Users), By Application Analysis(Cancer Genetics Tests, Cardiovascular Diseases, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape F. Hoffmann-La Roche AG, Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., Sysmex Corporation, Bio-Rad Laboratories, Inc., Myriad Genetics, Inc., GE Healthcare, Abbott Laboratories, Beckman Coulter Inc., Cephide Inc, Hologic, Inc., Siemens HealthcareGmbH, Agilent Technologies Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- F. Hoffmann-La Roche AG

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Sysmex Corporation

- Bio-Rad Laboratories, Inc.

- Myriad Genetics, Inc.

- GE Healthcare

- Abbott Laboratories

- Beckman Coulter Inc.

- Cephide.Inc

- Hologic, Inc.

- Siemens HealthcareGmbH

- Agilent Technologies Inc.