Cancer Diagnostics Market By method (Laboratory Tests, Imaging, Genetic Tests, Biopsy, Others), By application (Breast Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4287

-

May 2023

-

173

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

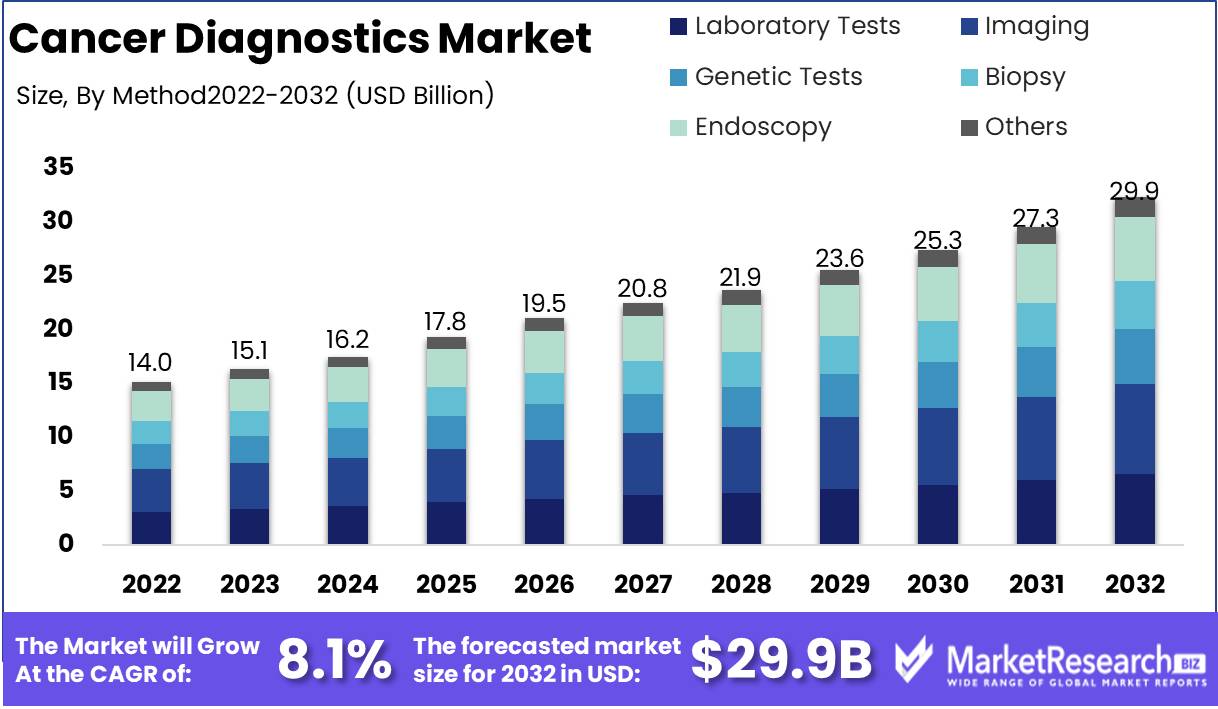

Cancer Diagnostics Market size is expected to be worth around USD 29.9 Bn by 2032 from USD 14.0 Bn in 2022, growing at a CAGR of 8.1% during the forecast period from 2023 to 2032.

Cancer Diagnosis is the process of detecting various types of cancer using a variety of diagnostic tests and procedures. It encompasses imaging, genomics, proteomics, as well as other technologies. The primary objective of cancer diagnostics is to detect the disease at an early stage, which increases the likelihood of effective treatment. Since cancer is one of the primary causes of mortality worldwide, the market is crucial. According to the World Health Organization, cancer causes 9.6 million fatalities annually.

The significance of cancer diagnostics cannot be emphasized enough. Early cancer detection can enhance patient outcomes and increase survival rates. Accurate diagnosis also enables oncologists to select the most suitable treatment options for each patient based on his or her particular requirements. This individualized approach can result in improved outcomes and fewer adverse effects.

There have been a number of noteworthy innovations on the Cancer Diagnostics Market. These include liquid biopsy, the analysis of a patient's blood sample to detect cancer cells or DNA fragments. The development of AI-based diagnostic tools that use machine learning algorithms to analyze medical images and identify tumor characteristics is an additional innovation. These innovations have the potential to transform the diagnosis and treatment of cancer.

Driving factors

Cancer Prevalence

The escalating incidence of cancer around the world is the major factor behind this remarkable growth. As cancer becomes one of the primary causes of death on a global scale, the market receives a substantial boost from the rising popularity of cancer screening programs. In addition, advances in technology for diagnosis improve early detection capabilities, thereby amplifying the market's positive impact. Growing recognition of the importance of early cancer detection is a crucial factor in achieving effective treatment outcomes and reduced mortality rate.

Government Support Creates a Path

Government initiatives devoted to cancer diagnosis and treatment are crucial to the growth of the Cancer Diagnostics industry as it advances. The unwavering support of governing bodies is bolstered by favorable reimbursement policies for cancer diagnostic procedures, like tumor biopsy, thereby generating a market expansion-friendly environment. This government and healthcare stakeholder collaboration significantly contributes to the creation of an efficient and accessible cancer diagnostics landscape.

Aging Population Galvanizes Demand

The increasing geriatric population arises as a significant factor that positively influences the Cancer Diagnostics Market. Given the increased susceptibility of the geriatric to cancer, the demand for personalized medicine is growing. Advancements in genomic and proteomic technologies serve as enablers, thereby facilitating individualized diagnostic approaches. This convergence of an aging population and innovative diagnostic techniques propels the market forward, thereby improving the quality of treatment and prognosis for geriatric cancer patients.

Restraining Factors

Diagnostics for cancer are Expensive

The exorbitant cost associated with developing and implementing cancer testing technologies is one of the greatest obstacles to cancer diagnostics. In the majority of instances, these expenses are passed on to patients, who frequently struggle to cover them. This factor can result in a delay in diagnosis, which can negatively impact patient outcomes.

Strict Regulatory Structure

The global regulatory framework, which is stringent and complex, is another factor that can hinder the expansion of the market for cancer diagnostics. This framework is intended to protect the health and safety of patients, but it can be difficult for businesses to navigate. This factor can impede the introduction of new diagnostic technologies to the market, limiting their accessibility to patients in need.

Insufficient Qualified Professionals

Lack of qualified professionals is another significant factor that can hinder the expansion of the market for cancer diagnostics. Due to the increasing demand for cancer diagnostics, there is a need for qualified and experienced professionals who are able to comprehend and implement the most recent technologies. However, the lack of trained professionals can substantially hinder the development, accessibility, and precision of cancer diagnostic tests.

Radiation Exposure Risks Associated

While early detection is essential for cancer management, some diagnostic procedures (such as CT scans and X-rays) entail the use of ionizing radiation, which can increase the risk of cancer in patients. Despite the fact that the benefits of these diagnostic tests frequently outweigh the risks, it is essential to minimize their use and inform patients about the risks involved.

Method Analysis

The field of cancer diagnostics is currently dominated by the Imaging Segment, which is expected to grow exponentially in the forecast period. The imaging segment involves the use of various imaging techniques, such as MRI, CT scans, X-rays, and ultrasound, to detect and diagnose cancerous tumors in the body. This segment holds a significant advantage over other cancer diagnostic methods as it is non-invasive and provides a detailed view of the affected area, thus reducing the risk of complications.

The growth of the Imaging Segment in the cancer diagnostics market can be attributed to several key factors, such as the increasing incidence of cancer worldwide, the growing demand for non-invasive diagnostic techniques, and technological advancements in imaging modalities. There has been a shift in consumer trend and behavior towards Imaging Segment in recent years. Consumers are now more willing to opt for non-invasive diagnostic methods such as imaging, as it provides a detailed and accurate diagnosis of cancerous tumors.

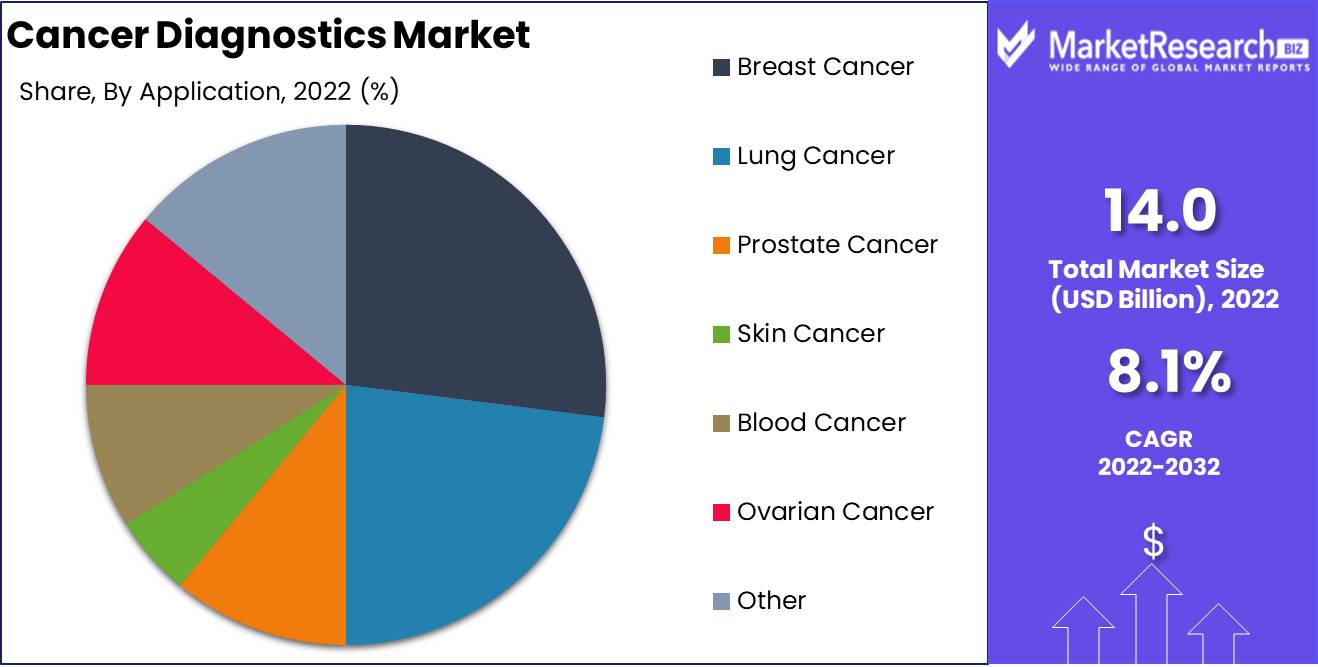

Application Analysis

Among the various types of cancer, breast cancer holds a dominant position in the Cancer Diagnostics Market. The Breast Cancer Segment is expected to grow at an unprecedented rate in the coming years. This dominance is attributable to the higher prevalence of breast cancer among women worldwide.

There has been a significant shift in consumer trend and behaviour towards the Breast Cancer Segment in recent years. Women are now more willing to undergo screenings for breast cancer as part of their routine healthcare checkups. The Breast Cancer Segment is also gaining popularity due to its non-invasiveness, high accuracy, and detailed visualization, which makes it an attractive option for women. The colorectal cancer and lung cancer segment are also expected to grow at a significant rate.

Key Market Segments

By Method

- Laboratory Tests

- Imaging

- Genetic Tests

- Biopsy

- Endoscopy

- Others (microarray, barium enema, serological method etc.)

By Application

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Blood Cancer

- Ovarian Cancer

- Other (Liver Cancer, Kidney Cancer, Colorectal Cancer, Brain Cancer, etc.)

Growth Opportunity

Novel Biomarker Development for Cancer Diagnosis

The development of novel biomarkers for cancer diagnosis has received considerable attention in recent years. Biomarkers are molecules detected in bodily fluids like blood or urine that can indicate the presence of a specific disease or condition. The development of biomarkers that can provide more accurate and earlier detection of certain forms of cancer is the focus of current research. For instance, a recently developed blood test for pancreatic cancer can detect the disease at an early stage with remarkable accuracy.

Cancer Screening Program Expansion in Emerging Markets

According to estimates, in the forecast period, emerging markets represent a substantial opportunity for cancer diagnostics companies. It has been demonstrated that cancer screening programs are effective at detecting cancer at an early stage, when it is simpler and less expensive to treat. Various diagnostic procedures, such as mammography, colonoscopy, and HPV testing, may be incorporated into cancer screening programs. These programs have been effective in developed nations, and now the emphasis is on expanding them in emerging markets, where the cancer burden is greater.

Adoption of Liquid Biopsy for Detecting Cancer

The noninvasive diagnostic test liquid biopsy detects circulating tumor DNA (ctDNA) in the blood. This test can be used to detect cancer, monitor the progression of the disease, and assess the efficacy of treatment. Liquid biopsy is less invasive than conventional biopsy techniques and can yield quicker results. Several companies currently offer liquid biopsy tests, and we expect this trend to continue as additional companies enter the market.

Key Trends

Non-Invasive Diagnostic Techniques

The cancer diagnostics market experiences a paradigm shift as the industry embraces non-invasive diagnostic techniques, revolutionizing the patient experience. Traditional invasive screening methods are being replaced by innovative approaches such as liquid biopsy, breath tests, urine tests, and saliva tests. By eliminating the need for invasive procedures, these non-invasive diagnostic tools offer greater comfort to patients while enhancing the accuracy of cancer detection, enabling early intervention and improved treatment outcomes.

Precision Medicine

The rise of precision medicine heralds a transformative era in the cancer diagnostics market, empowering clinicians to deliver personalized treatment regimens tailored to individual patients' unique characteristics. Leveraging advancements in genomic sequencing technologies, precision medicine enables the identification of specific genetic mutations driving tumor growth. Armed with this knowledge, clinicians can develop targeted therapies that precisely attack cancer cells, minimizing harm to healthy cells, and fostering enhanced patient outcomes while optimizing healthcare resource allocation.

Early Cancer Detection

The cancer diagnostics market witnesses an intensified emphasis on early cancer detection, recognizing its pivotal role in improving patient prognosis and reducing the overall burden of the disease. Leveraging advanced imaging and molecular diagnostic technologies, healthcare professionals can detect cancer at its nascent stages when intervention is most effective. In alignment with this focus, governments and healthcare organizations invest in high-risk population screening programs and awareness campaigns to promote the importance of early cancer detection.

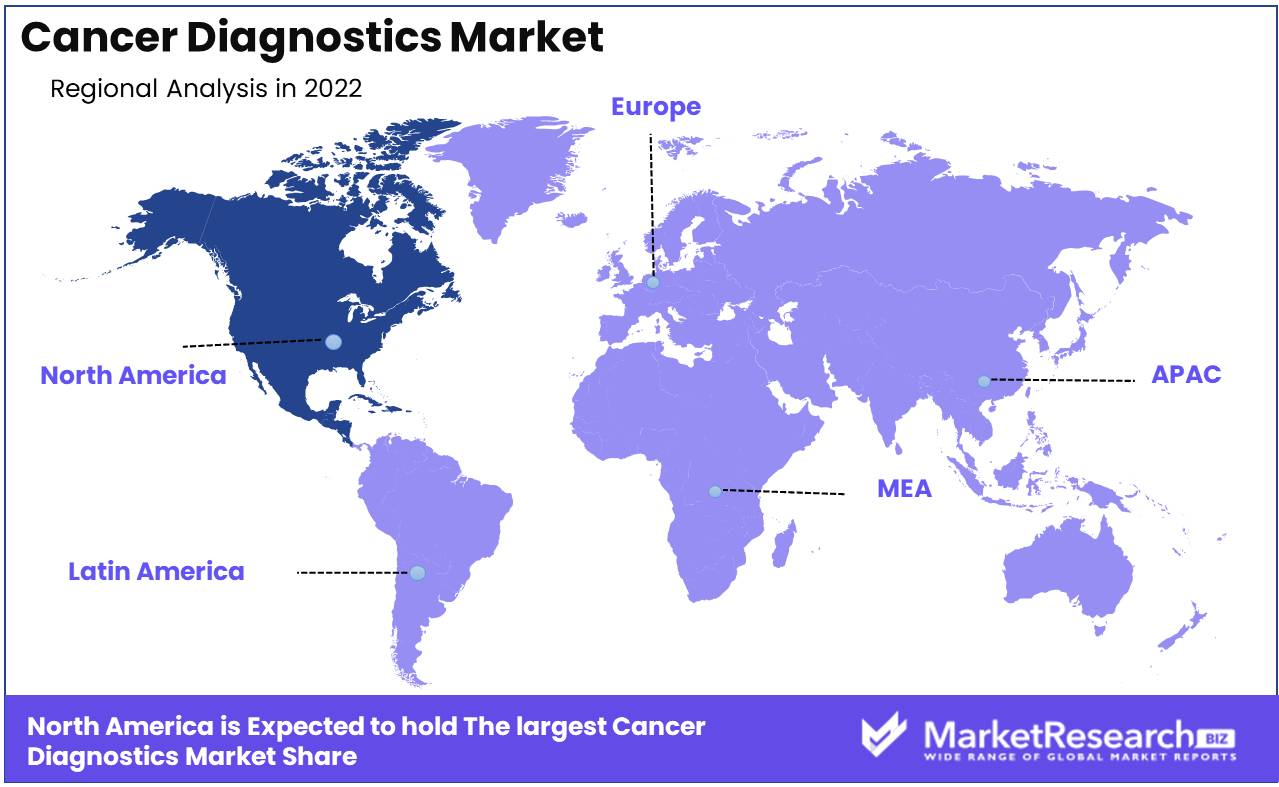

Regional Analysis

Due to the high prevalence of cancer, favorable reimbursement policies, and the rising adoption of technological advances in diagnostic procedures, North America has been identified as the region with the largest market for cancer diagnostics. It is predicted to grow at a rapid during the forecast period.

Globally, cancer is the primary cause of mortality and morbidity. The increase in cancer incidence imposes a significant burden on global cancer care systems, economies, and societies. In developed nations like the United States and Canada, the burden of cancer is primarily felt. According to the World Health Organization (WHO), the prevalence of cancer in North America is higher than in other regions. Cancer has a negative effect on quality of life and creates difficulties for healthcare systems and providers in ensuring timely and accurate diagnosis, treatment, and management.

The high incidence of cancer in North America necessitates the development of innovative cancer detection and diagnosis technologies. Advanced diagnostics, such as molecular diagnostics, have proven to be game-changing in oncology, allowing physicians to efficiently diagnose and treat cancer. Healthcare providers' increasing preference for non-invasive, accurate, and dependable diagnostic techniques has driven the adoption of advanced diagnostic technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global market for cancer diagnostics is intensely competitive, with numerous established and emerging competitors contending for market share. Major players are also expanding their product portfolio by product launches in order to diagnose various types of cancer. Abbott Laboratories, GE Healthcare, Roche Diagnostics, F. Hoffmann-La Roche Ltd, Siemens Healthcare GmbH, and Thermo Fischer Scientific Inc. are some of the major companies participants.

Abbott Laboratories is a market leader in cancer diagnostics, renowned for its extensive array of diagnostic tests and oncology-related products. The company offers a variety of point-of-care diagnostic devices, immunoassays, and molecular diagnostics.

GE Healthcare is another major player with a concentration on providing innovative technologies to aid in the early diagnosis of cancer. The company's product line comprises, among others, technologies for molecular imaging, computed tomography (CT), and magnetic resonance imaging (MRI).

Top Key Players in Cancer Diagnostics Market

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd

- bioMérieux SA

- Hologic, Inc.

- Bio-Rad Laboratories

- Dickinson and Company

- Abbott Laboratories

- Agilent Technologies Inc.

- Danaher Corporation

- Siemens Healthineers

- Roche Diagnostics GmbH

- QIAGEN N.V.

- Illumina, Inc.

- Eli Lilly and Co.

- Philips Healthcare Informatics, Inc.

Recent Development

- In September 2023, 3DHISTECH of Hungary and Epredia, a member of PHC Group, have opened the Pathology Innovation Incubator in Budapest. They have a history of collaboration in digital slide scanning technology and are now joining forces to implement scientific ideas practically.

- In June 2023,Researchers at the Perelman School of Medicine at the University of Pennsylvania have developed a groundbreaking method for mapping specific DNA markings called 5-methylcytosine (5mC). It is ideal for blood tests that look for DNA released from tumors or disease tissues.

- In April 2023, MIT engineers have developed a groundbreaking nanoparticle sensor capable of early cancer diagnosis through a simple urine test. This sensor can detect various cancerous proteins, revolutionizing cancer diagnostics. Glympse Bio, a company co-founded by one of the researchers, has conducted phase 1 clinical trials for earlier versions of these urinary diagnostic particles, confirming their safety in patients.

- In August 2023, the FDA unveiled a voluntary pilot program aimed at addressing the risks associated with targeted cancer treatments being approved without companion diagnostic tests (CDx). CDx tests analyze biomarkers in human samples to match patients with specific treatments.

- In June 2022, Karkinos Healthcare has invested in state-of-the-art high-throughput HPV assay equipment, the Cobas 6800, capable of testing over 1200 Human Papilloma Virus (HPV) assays, including high-risk types. This initiative aligns with the World Health Organization's mission to eliminate cervical cancer by 2030.

- In September 2022, the PATHFINDER study, presented at the ESMO Congress 2022, demonstrated the effectiveness of MCED testing. It identified a cancer signal in 1.4% of 6621 individuals aged 50 and over who were not previously diagnosed with cancer. The study found that the false-positive rate was low, and few participants required invasive procedures, alleviating concerns about unnecessary medical interventions.

Report Scope

Report Features Description Market Value (2022) USD 14.0 Bn Forecast Revenue (2032) USD 29.9 Bn CAGR (2023-2032) 8.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By the method (Laboratory Tests, Imaging, Genetic Tests, Biopsy, Endoscopy, Others (microarray, barium enema, serological method etc.))

By application (Breast Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Blood Cancer, Ovarian Cancer, Other (Liver Cancer, Kidney Cancer, Esophageal Cancer, Brain Cancer, etc.)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, bioMérieux SA, Hologic, Inc., Bio-Rad Laboratories, Dickinson and Company, Abbott Laboratories, Agilent Technologies Inc., Danaher Corporation, Siemens Healthineers, Roche Diagnostics GmbH, QIAGEN N.V., Illumina, Inc., Eli Lilly and Co., and Philips Healthcare Informatics, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Becton, Dickinson, and Company

- Agilent Technologies, Inc.

- Roche Diagnostics GmbH

- QIAGEN N.V.

- Illumina, Inc.

- Eli Lilly and Co.

- Philips Healthcare Informatics, Inc.