Electrical Appliances Market By Product(Refrigerator, Entertainment Appliances, Cooking Appliances, Washing Appliances), By Operation(Automatic, Semi-Automatic), By Distribution Channel(Online, Specialty Stores, Multi-Branded Stores), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

13911

-

April 2024

-

166

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

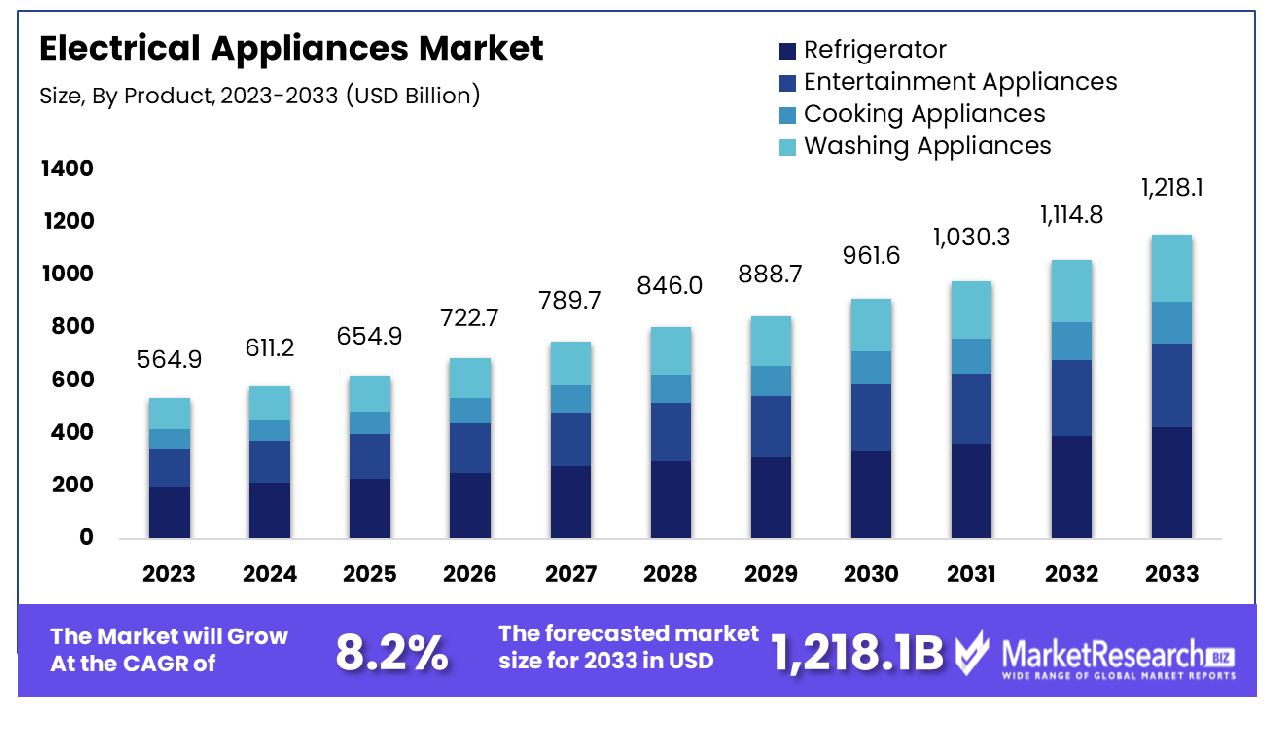

The Global Electrical Appliances Market was valued at USD 564.9 billion in 2023. It is expected to reach USD 1,218.1 billion by 2033, with a CAGR of 8.2% during the forecast period from 2024 to 2033. The surge in demand for new product innovations and the rise in consumer preference for many valued added feature products are key driving factors for electrical appliances.

Electrical appliances are defined as devices powered by electricity and built to perform particular tasks for domestic, industrial, and commercial uses. They include a range of products that comprises kitchen appliances such as refrigerators, stoves, and microwaves as well as household essentials like washing machines, heaters, and vacuum cleaners. Moreover, electrical appliances range from entertainment gadgets such as televisions, gaming consoles, and audio systems.

In commercial and industrial settings, they comprise devices such as computers, power tools, printers, and manufacturing machinery. Contemporary electrical appliances generally implement advanced technologies and smart features by improving efficacy, convenience, and connectivity. Such devices play an important role in everyday life, streamlining tasks, enhancing productivity, and improving comfort. However, their use also raises considerations for saving energy, environmental effects, and safety, by promoting current ongoing innovations in energy efficacy design and eco-friendly materials to alleviate their footprints on resources and ecosystems.

According to Business Standard in March 2024, highlights that Havells India launched a foray into the domestic kitchen appliances segment such as cooktops, hobs, chimneys, and other built-in appliances. The company also projects a new venture to bring advantages of synergies of business with its existing range of small domestic appliances.

Havells also focuses on being one of the top 3 market players over the next 3 years from the start of operations. The whole range of products will be outsourced and serve the domestic market. The estimated date of the new launch of the above category of products is May 2024. The corporation's amalgamated net profit surged 1.55% to Rs 287.91 crore on a 6.94% upturn in revenue from operations to Rs 4,413.86 crore in Q3 FY24 over Q3 FY23.

Contemporary electrical appliances provide exceptional accessibility and efficacy, simplifying tasks and saving time in everyday life. They improve productivity, enhance comfort, and make better organization and management of household chores. Many appliances feature energy-saving technologies that reduce environmental effects and minimize utility expense costs for users. The demand for electrical appliances will increase due to their requirement in the everyday lifestyle of the customers which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Global Electrical Appliances Market was valued at USD 564.9 billion in 2023. It is expected to reach USD 1,218.1 billion by 2033, with a CAGR of 8.2% during the forecast period from 2024 to 2033.

- By Product: Refrigerators, a household staple, come in various models, catering to diverse preferences and needs.

- By Operation: Automatic refrigerators ensure convenience, regulating temperatures and preserving food without manual intervention.

- By Distribution Channel: Online distribution channels offer a convenient platform for consumers to explore and purchase automatic refrigerators.

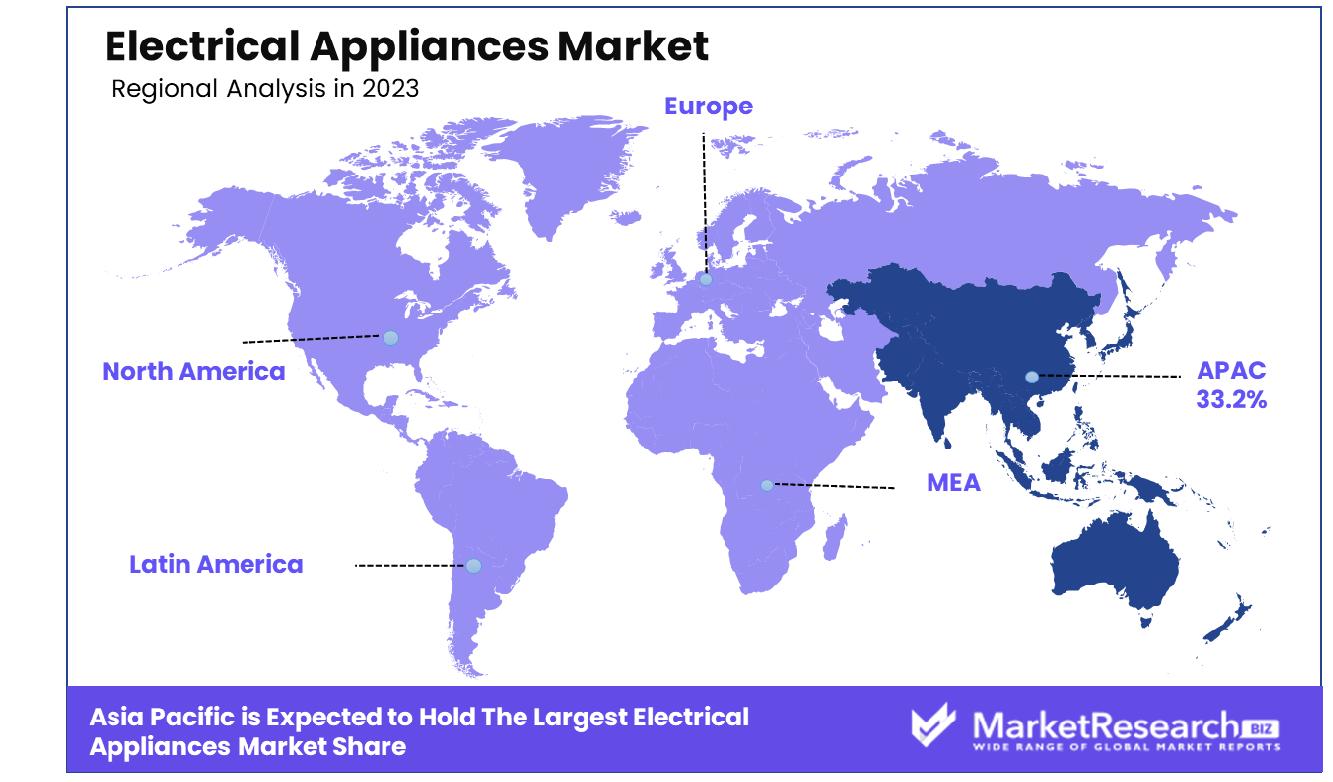

- Regional Dominance: In the Asia Pacific region, the Electrical Appliances Market holds a significant share of 33.2%.

- Growth Opportunity: The global Electrical Appliances Market in 2023 offers opportunities through smart technology integration, energy-efficient product expansion, and innovative design, driving consumer satisfaction and market competitiveness.

Driving factors

Urbanization and Improved Living Standards Propel Demand for Electrical Appliances

The growth of the Electrical Appliances Market can be attributed to the rising demand for comfort in household chores, spurred by rapid urbanization and improved living standards. As urbanization accelerates globally, more individuals are migrating to cities in search of better opportunities, leading to an increased demand for convenient solutions to streamline daily tasks. Furthermore, improved living standards have heightened consumer expectations regarding comfort and convenience in household activities.

Statistics indicate a significant correlation between urbanization rates and the sales of electrical appliances. In urban areas, where space constraints and busy lifestyles are prevalent, consumers seek efficient appliances to ease their domestic responsibilities. This major trends is further fueled by the availability of a wide range of innovative products designed to simplify tasks such as cooking, cleaning, and laundry.

Eco-Friendly and Energy-Efficient Appliances Cater to Consumer Preferences

Consumer inclination toward eco-friendly and energy-efficient appliances is a key driver of market strong growth in the Electrical Appliances industry. With growing environmental awareness and concerns about energy consumption, consumers prioritize sustainability when making purchasing decisions. Manufacturers have responded by developing products that minimize energy usage and reduce environmental impact, aligning with consumer values and regulatory standards.

The shift toward eco-friendly appliances is reinforced by government initiatives and regulations promoting energy efficiency. These policies encourage manufacturers to invest in research and development to create innovative, environmentally sustainable solutions. As a result, consumers are increasingly choosing appliances with high energy efficiency ratings, driving market demand for eco-conscious products.

Nuclear Family Dynamics Boost Demand for Household Devices

The increasing prevalence of nuclear families contributes to the strong growth of the Electrical Appliances Market by heightening dependence on household devices. In nuclear family setups, where households consist of parents and children without extended family members, there is a greater need for appliances to manage domestic tasks efficiently.

Statistics reveal a direct correlation between the rise of nuclear families and the demand for electrical appliances, particularly in categories such as cooking appliances, refrigerators, and laundry equipment. As nuclear families prioritize convenience and time-saving solutions, they drive market demand for advanced appliances that streamline daily routines. Additionally, demographic shifts toward smaller household sizes amplify the impact of this trend, further boosting market growth.

Restraining Factors

Economic Slowdowns Temper Consumer Spending on Electrical Appliances

Economic slowdowns pose a significant restraint on the strong growth of the Electrical Appliances Market by impacting consumer spending patterns. During periods of economic uncertainty or recession, consumers tend to tighten their budgets and prioritize essential expenses over discretionary purchases, including household appliances. This behavior is particularly pronounced in segments with higher price sensitivity, such as large appliances like refrigerators and washing machines.

Statistics indicate a negative correlation between economic indicators, such as GDP growth rates and consumer confidence levels, and the sales performance of electrical appliances. As disposable incomes shrink and unemployment rates rise during economic downturns, households postpone or downsize appliance purchases, leading to a slowdown in market growth. Moreover, reduced access to credit and financing options further dampens consumer sentiment and constrains spending in the appliance sector.

Intensifying Competition from Online Retailers Challenges Traditional Market Players

The increasing competition from online retailers presents a formidable challenge to traditional brick-and-mortar stores in the Electrical Appliances Market. With the proliferation of e-commerce platforms, consumers have greater access to a wide array of products at competitive prices, often accompanied by convenience factors such as doorstep delivery and hassle-free returns.

Statistics reveal a steady shift in consumer shopping preferences toward online channels, with a notable increase in online purchases of electrical appliances. This trend is driven by major factors such as convenience, extensive product choices, and attractive promotional offers available through online platforms. As a result, traditional retailers face pressure to adapt their business models to compete effectively in the digital marketplace.

By Product Analysis

Refrigerators, classified by product type, encompass a wide array of models catering to diverse needs.

In 2023, Refrigerators maintained a dominant market position in the by-product segment of the Electrical Appliances Market. This segment encompasses various categories, including Refrigerators, Entertainment Appliances, Cooking Appliances, and Washing Appliances, each playing a crucial role in household functionality and consumer lifestyle. However, within this landscape, Refrigerators stood out as a cornerstone product, reflecting sustained demand and market preference.

The dominance of Refrigerators can be attributed to several factors. Firstly, the evolving consumer lifestyles and increasing disposable incomes have fueled the demand for advanced refrigeration solutions. Consumers are seeking appliances that offer not only basic functionalities but also advanced features such as energy efficiency, smart connectivity, and eco-friendly attributes. Refrigerator manufacturers have responded to these demands by innovating their product lines to meet the evolving needs of consumers, thereby solidifying their market presence.

Additionally, technological advancements, such as the integration of IoT (Internet of Things) capabilities and innovative designs, have further propelled the growth of the Refrigerator segment. These advancements have enhanced user experience, convenience, and efficiency, thereby driving consumer adoption and market penetration.

Moreover, the global emphasis on sustainability and energy efficiency has also influenced consumer preferences towards eco-friendly appliances, including refrigerators. Manufacturers are increasingly incorporating sustainable materials and energy-efficient technologies into their product offerings to align with environmental regulations and consumer expectations.

By Operation Analysis

Automatic operation simplifies user experience, offering convenience and efficiency in refrigeration technology.

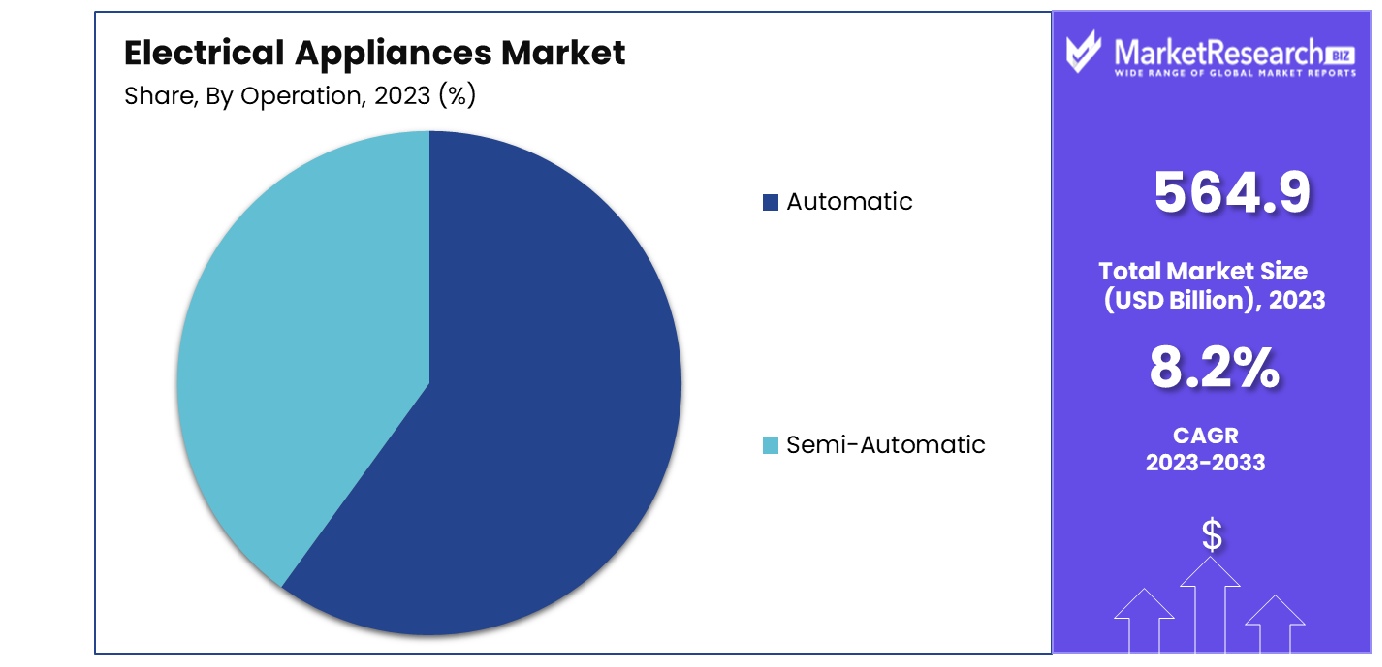

In 2023, Automatic appliances maintained a dominant market position in the By Operation segment of the Electrical Appliances Market. This segment encompasses two main categories: Automatic and Semi-Automatic appliances. Within this landscape, Automatic appliances emerged as the preferred choice for consumers, reflecting a significant shift towards convenience, efficiency, and technological advancement.

The dominance of Automatic appliances can be attributed to several factors. Firstly, the rising adoption of smart technologies and automation has reshaped consumer preferences, driving demand for appliances that offer seamless operation and minimal manual intervention. Automatic appliances, equipped with advanced sensors, programmable settings, and automated functions, cater to the modern consumer's need for convenience and time-saving solutions.

Furthermore, the proliferation of IoT (Internet of Things) and connectivity features has enhanced the appeal of Automatic appliances, allowing users to remotely control and monitor their devices through smartphone apps or voice commands. This connectivity not only adds convenience but also enables users to optimize energy usage and improve overall efficiency.

Additionally, the increasing pace of urbanization and hectic lifestyles have fueled the demand for appliances that streamline household chores and tasks. Automatic appliances, such as automatic washing machines, dishwashers, and coffee makers, offer time-saving solutions, allowing consumers to focus on other priorities while their appliances handle routine tasks efficiently.

By Distribution Channel Analysis

Online distribution channels facilitate seamless accessibility, providing consumers with a convenient purchasing avenue.

In 2023, the Online distribution channel held a dominant market position in the By Distribution Channel segment of the Electrical Appliances Market. This segment encompasses three primary channels: Online, Specialty Stores, and Multi-Branded Stores. Among these, Online distribution emerged as the preferred choice for consumers, marking a significant shift in shopping behavior and retail dynamics.

The dominance of the Online distribution channel can be attributed to several key factors. Firstly, the growing prevalence of e-commerce platforms and digitalization has revolutionized the retail landscape, offering consumers unparalleled convenience, accessibility, and a wide range of product choices. Online platforms provide consumers with the flexibility to browse and purchase electrical appliances from the comfort of their homes, at any time of the day or night, thereby eliminating geographical constraints and time limitations associated with traditional brick-and-mortar stores.

Furthermore, the increasing penetration of smartphones, tablets, and other internet-enabled devices has facilitated the rise of online shopping, enabling consumers to compare prices, read reviews, and make informed purchasing decisions with ease. This accessibility to information empowers consumers, allowing them to make well-informed choices and select products that best suit their needs and preferences.

Moreover, the convenience of doorstep delivery, coupled with hassle-free return policies and secure payment options, has bolstered consumer confidence in online shopping for electrical appliances. Additionally, the emergence of online marketplaces and aggregator platforms has further expanded product visibility and market reach for both manufacturers and retailers, driving sales and revenue growth in the Online distribution channel.

Key Market Segments

By Product

- Refrigerator

- Entertainment Appliances

- Cooking Appliances

- Washing Appliances

By Operation

- Automatic

- Semi-Automatic

By Distribution Channel

- Online

- Specialty Stores

- Multi-Branded Stores

Growth Opportunity

Integration of Smart Technology and IoT Capabilities

The global Electrical Appliances Market in 2023 presents an array of promising opportunities, notably driven by the integration of smart technology and Internet of Things (IoT) capabilities. With the pervasive influence of digitization across industries, manufacturers are capitalizing on this major trend to enhance user experience and operational efficiency. Through IoT integration, appliances are becoming interconnected, offering consumers unprecedented levels of control and automation. From smart refrigerators that manage inventory to intelligent thermostats that optimize energy consumption, the market is witnessing a paradigm shift towards interconnected ecosystems.

Expansion of Product Portfolios for Energy Efficiency

Another notable opportunity lies in the expansion of product portfolios to incorporate energy-efficient appliances. With growing environmental concerns and regulatory mandates, consumers are increasingly inclined toward sustainable solutions. Manufacturers are responding by investing in research and development to engineer appliances that consume less energy without compromising performance. This shift towards energy efficiency not only aligns with consumer preferences but also positions major companies favorably in an evolving regulatory landscape.

Focus on Product Differentiation and Innovative Design

Moreover, the market landscape is ripe with opportunities for major companies to differentiate their offerings through innovative design and features. In a highly competitive market, product differentiation is essential for capturing consumer attention and fostering brand loyalty. By investing in research and design, prominent companies can develop appliances that not only meet functional requirements but also resonate with consumers on an aesthetic and experiential level.

Latest Trends

Technological Advancements Driving Energy Efficiency and Smart Appliances

The latest key trends in the global Electrical Appliances Market for 2023 are characterized by significant technological advancements, particularly in the realm of energy efficiency and smart capabilities. Manufacturers are leveraging cutting-edge technologies to develop major appliances that not only consume less energy but also offer enhanced functionality through connectivity and automation. This major trend is reshaping the industry landscape, with consumers increasingly prioritizing eco-friendly solutions and seamless integration with smart home ecosystems.

Rising Demand Fueled by Disposable Income and Urbanization

Furthermore, the appliance market is experiencing a surge in demand fueled by increasing disposable income and rapid urbanization, particularly in emerging markets. As populations migrate to urban centers and lifestyles evolve, there is a growing preference for modern smart home appliances that offer convenience, efficiency, and improved quality of life. This demographic shift is driving manufacturers to tailor their product offerings to meet the evolving needs and preferences of urban consumers, presenting lucrative opportunities for expansion and market penetration.

Regional Analysis

In the Asia Pacific region, the Electrical Appliances Market holds a substantial market share of 33.2%.

The global Electrical Appliances Market exhibits notable regional variations, with distinct major trends and dynamics shaping each segment. In North America, the market is characterized by a strong emphasis on technological innovation and energy efficiency. With a robust economy and high consumer purchasing power, North America accounts for a significant portion of global sales. According to recent data, the region holds a prominent market share, with key players driving growth through product differentiation and advanced features.

Similarly, in Europe, stringent regulations regarding energy efficiency and environmental sustainability drive the adoption of eco-friendly appliances. The market is witnessing steady growth, fueled by a rising demand for smart appliances and home automation solutions. With a focus on quality and performance, European manufacturers remain competitive on the global stage, capturing a considerable market share.

The Asia Pacific region emerges as a dominant force in the Electrical Appliances Market, boasting a substantial share of 33.2%. Rapid urbanization, increasing disposable income, and a growing population contribute to robust demand in this region. Manufacturers are capitalizing on this opportunity by introducing affordable yet technologically advanced products tailored to local preferences. Moreover, the proliferation of smart technology and IoT connectivity further accelerates market growth in Asia Pacific.

In the Middle East & Africa and Latin America regions, the market exhibits potential for expansion, driven by improving living standards and infrastructure development. While these regions currently account for a smaller share of the global market, increasing urbanization and a rising middle-class population present opportunities for future growth.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global Electrical Appliances Market is influenced significantly by key players such as AB Electrolux, GE Appliances, Haier Group Corporation, Hitachi Appliances Inc., Indesit Company S.p.A, LG Electronics Inc., Miele & CIE KG, Mitsubishi Electric Corporation, Samsung Electronics Co. Ltd., and Whirlpool Corp. These industry giants play pivotal roles in shaping market dynamics and driving innovation across various segments.

AB Electrolux, a renowned Swedish multinational, continues to maintain a strong presence in the market with its diverse portfolio of home appliances known for quality and innovation. Similarly, GE Appliances, a subsidiary of Haier Group Corporation, leverages its extensive expertise to deliver cutting-edge products catering to evolving consumer needs, particularly in North America.

Haier Group Corporation, a global leader headquartered in China, stands out for its strategic focus on smart appliances and IoT integration, positioning itself at the forefront of technological innovation. Meanwhile, Hitachi Appliances Inc., Mitsubishi Electric Corporation, and Samsung Electronics Co. Ltd. are recognized for their commitment to energy efficiency and sustainability, driving the adoption of eco-friendly appliances worldwide.

LG Electronics Inc. and Samsung Electronics Co. Ltd. from South Korea are prominent major players in the global market, renowned for their innovative designs and advanced features. These major companies continually invest in research and development to stay ahead of the competition and meet the growing demand for smart home solutions.

Market Key Players

- AB Electrolux

- GE Appliances

- Haier Group Corporation

- Hitachi Appliances Inc.

- Indesit Company S.p.A

- LG Electronics Inc.

- Miele & CIE KG

- Mitsubishi Electric Corporation

- Samsung Electronics Co. Ltd.

- Whirlpool Corp.

Recent Development

- In March 2024, the FDA proposes a new ban on electrical stimulation devices for self-injurious or aggressive behaviors in people with developmental disabilities. Judge Rotenberg Educational Center plans to fight the proposal.

- In October 2023, Pennsylvania State University researchers developed a new electrical method to control electron flow in quantum materials exhibiting the quantum anomalous Hall effect, potentially advancing future electronic devices and quantum computers.

- In September 2023, Pennsylvania State University researchers developed a novel electrical method to manipulate electron flow in quantum materials, enhancing future electronic devices and quantum computing applications.

Report Scope

Report Features Description Market Value (2023) USD 564.9 Billion Forecast Revenue (2033) USD 1,218.1 Billion CAGR (2024-2032) 8.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Refrigerator, Entertainment Appliances, Cooking Appliances, Washing Appliances), By Operation(Automatic, Semi-Automatic), By Distribution Channel(Online, Specialty Stores, Multi-Branded Stores) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AB Electrolux, GE Appliances, Haier Group Corporation, Hitachi Appliances Inc., Indesit Company S.p.A, LG Electronics Inc., Miele & CIE KG, Mitsubishi Electric Corporation, Samsung Electronics Co. Ltd., Whirlpool Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AB Electrolux

- GE Appliances

- Haier Group Corporation

- Hitachi Appliances Inc.

- Indesit Company S.p.A

- LG Electronics Inc.

- Miele & CIE KG

- Mitsubishi Electric Corporation

- Samsung Electronics Co. Ltd.

- Whirlpool Corp.