Global Refurbished Computers And Laptops Market By Type(Laptops, Computers, PCs, Workstations, Notebooks, Ultrabooks), By Distribution Channel(Online, OEMs, Distributors), By End User(Enterprises, Small and Medium, Large, Educational Institutes, Government, Personal), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

22678

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

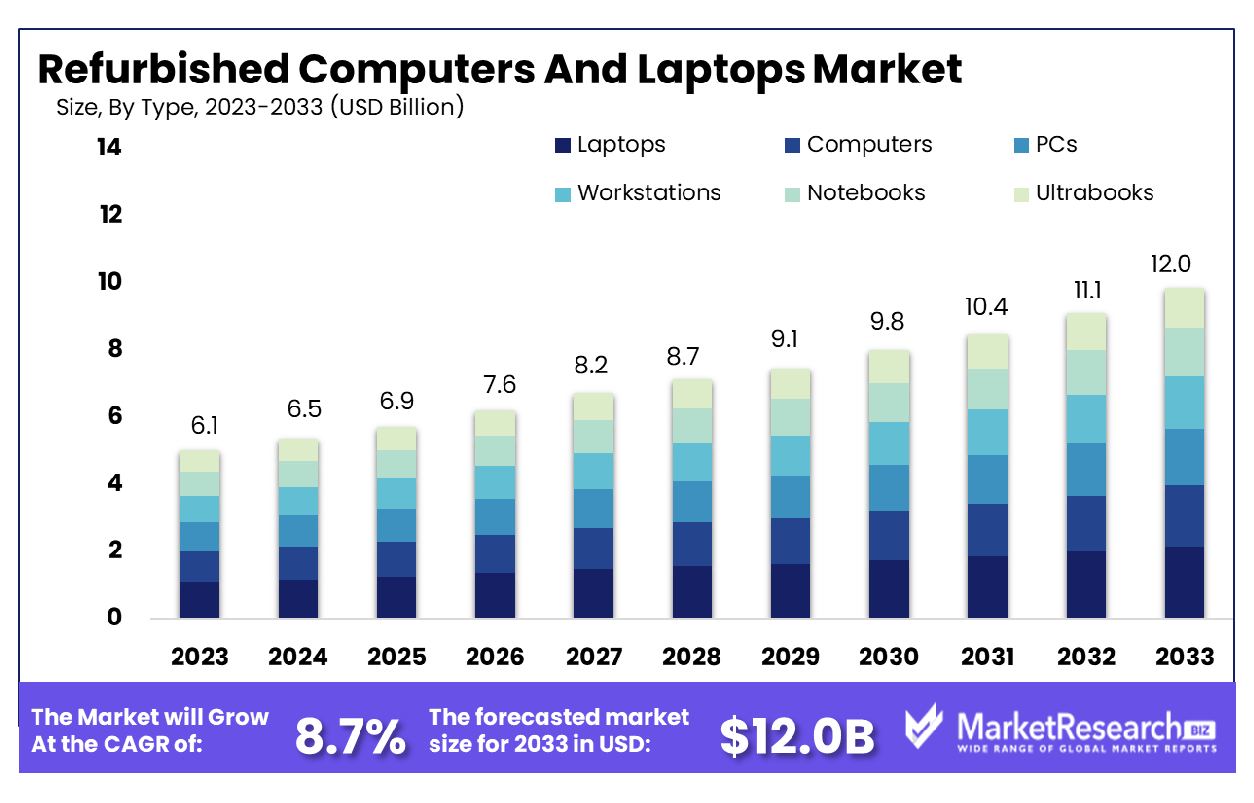

The Global Refurbished Computers And Laptops Market was valued at USD 6.1 billion in 2023. It is expected to reach USD 12.0 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

The Refurbished Computers and Laptops Market refers to the sector encompassing renewed computing devices that have undergone rigorous testing, repair, and restoration processes to meet stringent quality standards for resale. This market segment caters to cost-conscious consumers and environmentally conscious businesses seeking high-quality, reliable computing solutions at reduced prices.

It thrives on the principles of sustainability, affordability, and performance, offering a compelling alternative to new devices. Key players in this market include manufacturers, refurbishers, retailers, and online platforms. As technology evolves, this market demonstrates exponential growth potential, driven by its capacity to offer value-driven, eco-friendly computing solutions.

The Refurbished Computers and Laptops Market continues to demonstrate resilience and adaptability amidst fluctuating trends within the broader PC market. The global landscape of refurbished technology witnessed notable dynamics influenced by both economic and consumer behavior shifts. In 2022, the PC market experienced a significant downturn, with worldwide shipments plummeting by 16.5% compared to the previous year. This decline, indicative of evolving consumer preferences and economic uncertainties, posed challenges to the refurbished segment.

However, amidst these challenges, the refurbished sector remained robust, demonstrating its capacity to navigate market volatility. In 2023, despite an overall decrease of 14.8% in PC shipments for the year, there emerged a slight resurgence in the fourth quarter, with a modest 0.3% increase. Notably, HP maintained its market leadership, albeit experiencing a marginal decline of 2.5% in shipped units, while Dell faced a substantial decline of 24.5%.

Moreover, regional nuances in market performance further underscore the complex landscape of refurbished technology. In India, while the PC market experienced a decline of 6.6% in 2023, the desktop category exhibited growth of 6.7% year-on-year, juxtaposed against declines in notebooks and workstations by 11.1% and 14% respectively. HP's dominance in the Indian market with a 31.5% share reflects its strategic positioning amidst evolving consumer demands.

These data points illuminate the market's resilience and potential for growth despite prevailing challenges. As consumer behaviors evolve and economic landscapes fluctuate, the refurbished computers and laptops market stands poised to capitalize on emerging opportunities, leveraging its adaptability and cost-effectiveness to meet evolving consumer needs.

Key Takeaways

- Market Growth: The Global Refurbished Computers And Laptops Market was valued at USD 6.1 billion in 2023. It is expected to reach USD 12.0 billion by 2033, with a CAGR of 8.7% during the forecast period from 2024 to 2033.

- By Type: Laptops command a dominant market share of 35% across various computing types.

- By Distribution Channel: Online channels assert dominance with a commanding 60% share of distribution.

- By End User: Enterprises hold sway with a substantial 35% share among end users.

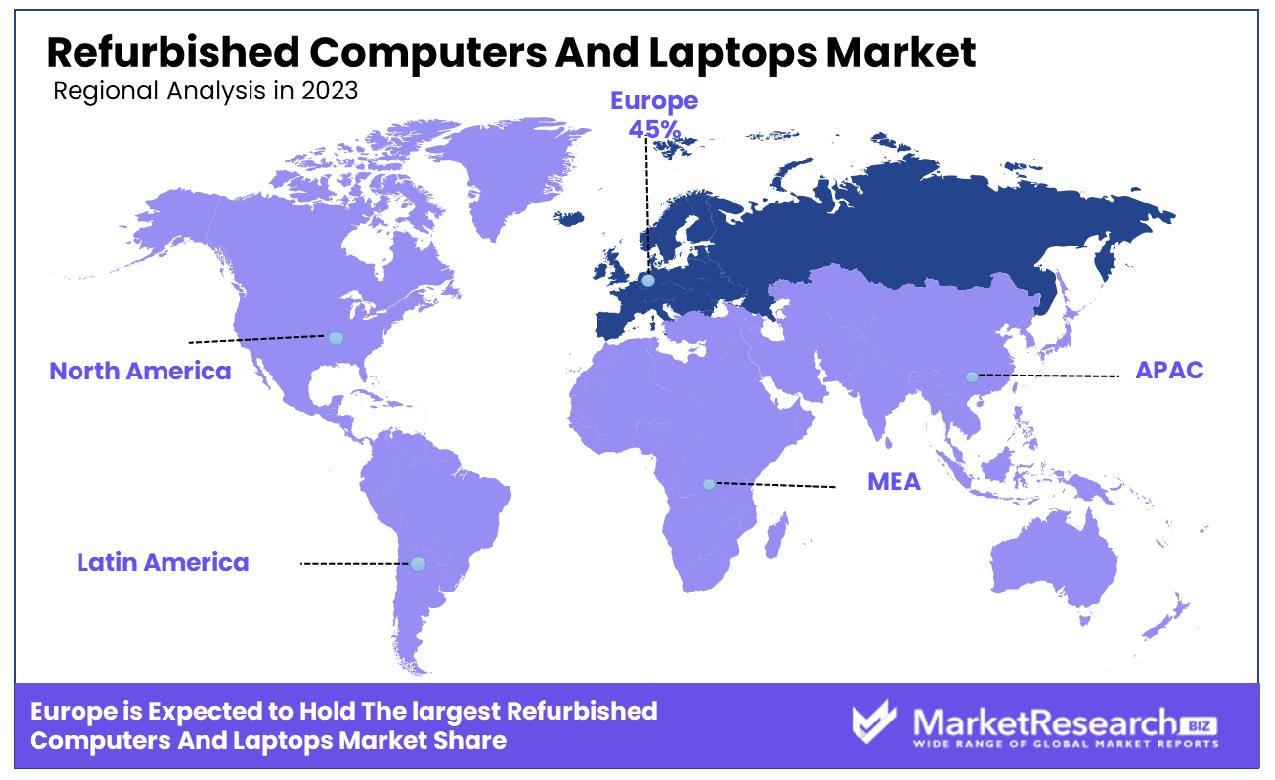

- Regional Dominance: In Europe, the refurbished computers and laptops market comprises 45% of total sales.

- Growth Opportunity: In 2023, the global refurbished computers and laptops market saw growth driven by increased adoption in educational institutions and the expanding small and medium-sized business sector, presenting significant opportunities for vendors.

Driving factors

Availability of High-Performance Components Fuels Refurbished Computers and Laptops Market Growth

The accessibility of high-performance components significantly drives the expansion of the refurbished computers and laptops market. As technological advancements continue to evolve at a rapid pace, consumers seek upgraded systems with enhanced features. The availability of these components allows refurbishers to revamp older devices, infusing them with modern capabilities and functionalities. This not only extends the lifespan of the products but also meets the demand for cost-effective yet powerful computing solutions.

Furthermore, the proliferation of high-performance components contributes to the attractiveness of refurbished devices among budget-conscious consumers and businesses alike. With refurbished options offering comparable performance to new counterparts at a fraction of the cost, the market experiences heightened demand. According to recent statistics, the availability of high-performance components has led to a notable increase in the sales volume of refurbished computers and laptops, driving overall market growth.

Increased Product Lifespan Sustains Refurbished Computers and Laptops Market Expansion

The extended lifespan of refurbished computers and laptops serves as a fundamental driver behind market growth. As consumers prioritize sustainability and longevity in their purchasing decisions, refurbished devices emerge as viable alternatives to new ones. The refurbishment process involves thorough testing, repairs, and upgrades, ensuring that these products remain functional and reliable for an extended period.

Additionally, the perception of refurbished devices has shifted positively, with many consumers recognizing their value and reliability. With advancements in refurbishment techniques and quality assurance measures, refurbished products now offer comparable durability to their new counterparts. This increased lifespan not only reduces the environmental impact of electronic waste but also contributes to the sustainability goals of both individuals and organizations.

Reduced Electronic Waste Drives Refurbished Computers and Laptops Market Growth

The imperative to reduce electronic waste propels the growth of the refurbished computers and laptops market. With the global volume of electronic waste reaching alarming levels, consumers and governments alike seek sustainable solutions to mitigate environmental impact. Refurbishing older devices instead of disposing of them not only prevents them from ending up in landfills but also conserves valuable resources used in manufacturing.

Moreover, the reduced electronic waste aligns with corporate sustainability initiatives, driving businesses to adopt refurbished devices in their operations. By choosing refurbished computers and laptops, organizations demonstrate their commitment to environmental stewardship while benefiting from cost savings. Recent statistics indicate a significant increase in the adoption of refurbished devices by environmentally conscious consumers and businesses, further fueling market growth.

Restraining Factors

Less Consumer Awareness Hinders Refurbished Computers and Laptops Market Growth

The limited awareness among consumers regarding refurbished goods constitutes a significant restraining factor in the growth trajectory of the Refurbished Computers and Laptops Market. Despite the evident benefits such as cost-effectiveness and reduced environmental impact, many potential buyers remain unaware or hesitant to purchase refurbished products due to concerns about quality, reliability, and warranty coverage. According to recent surveys, only a minority of consumers actively consider refurbished options when shopping for electronics, indicating a substantial gap in market understanding.

To address this challenge, industry stakeholders must prioritize educational initiatives and marketing campaigns aimed at raising awareness about the value proposition of refurbished computers and laptops. By disseminating information about the rigorous testing processes, quality assurance measures, and potential cost savings associated with refurbished electronics, companies can gradually overcome consumer skepticism and expand the market's reach.

Shortage of Specific Parts Hampers Refurbishment Timelines, Impeding Market Growth

The shortage of specific parts crucial for refurbishing computers and laptops poses a significant obstacle to market expansion. In a sector heavily reliant on the availability of components for repair and replacement, delays in sourcing essential parts can disrupt refurbishment timelines, leading to inventory bottlenecks and hampering overall market growth. Reports indicate that fluctuations in global supply chains, compounded by increased demand for electronic components, have exacerbated this issue in recent years.

To mitigate the impact of parts shortages, industry players must adopt proactive strategies such as diversifying their supplier base, implementing advanced inventory management systems, and investing in research and development to identify alternative materials or solutions. Additionally, fostering closer collaborations with component manufacturers and distributors can help streamline procurement processes and ensure a steady supply of essential parts, thereby minimizing disruptions to refurbishment operations and supporting sustained market growth.

By Type Analysis

Laptops accounted for a dominating share of 35% in the market by product type.

In 2023, Laptops held a dominant market position in the By Type segment of the Refurbished Computers and Laptops Market, capturing more than a 35% share. This segment encompasses a diverse range of portable computing devices, including Computers, PCs, Workstations, Notebooks, and Ultrabooks.

Laptops, characterized by their portability and convenience, have been the preferred choice for consumers seeking refurbished computing solutions. Their versatile functionality, combined with advancements in technology and design, has sustained their market prominence. Moreover, the growing trend of remote work and increasing demand for portable computing solutions further bolstered the dominance of Laptops within the refurbished segment.

Computers, including desktops and all-in-one systems, also constituted a significant portion of the market share. Despite the shift towards mobile computing, desktop Computers remain essential for specific use cases, such as gaming, content creation, and office setups requiring robust performance and extensive storage capabilities.

PCs, a broad category encompassing both desktops and laptops, maintained a steady presence in the refurbished market. While desktop PCs cater to users with specific computing needs, such as gaming enthusiasts and professionals requiring high processing power, laptops appeal to individuals seeking mobility without compromising performance.

Workstations, noted for their exceptional processing power and graphics capabilities, attracted niche segments like professionals in design, engineering, and scientific fields. The refurbishment of these specialized systems presents cost-effective solutions for businesses and individuals requiring high-performance computing resources.

Notebooks and Ultrabooks, characterized by their slim and lightweight designs, cater to users prioritizing portability and style. The refurbishment of these devices offers budget-friendly alternatives to brand-new models, appealing to students, professionals, and frequent travelers seeking compact yet powerful computing solutions.

By Distribution Channel Analysis

Online channels held a dominant position with a 60% market share in the distribution.

In 2023, Online held a dominant market position in the By Distribution Channel segment of the Refurbished Computers and Laptops Market, capturing more than a 60% share. This segment encompasses various channels through which refurbished computing devices are distributed, including Online platforms, OEMs (Original Equipment Manufacturers), and Distributors.

Online platforms emerged as the preferred distribution channel for refurbished computers and laptops, driven by the convenience, accessibility, and extensive product offerings available to consumers. The proliferation of e-commerce platforms and the ease of browsing, purchasing, and comparing products online contributed significantly to the dominance of this channel. Moreover, the ability to reach a broader audience and the availability of discounts and promotions further incentivized consumers to opt for online purchases.

OEMs, leveraging their expertise in manufacturing and refurbishing processes, also played a significant role in the distribution of refurbished computing devices. These manufacturers often offer direct sales channels through their websites or authorized retailers, providing consumers with refurbished products backed by the assurance of quality and reliability associated with the original brand.

Distributors, comprising retailers, resellers, and specialty stores, contributed to the distribution of refurbished computers and laptops, albeit to a lesser extent compared to online platforms and OEMs. These channels catered to specific market segments, offering personalized services, technical support, and additional value-added services to consumers seeking refurbished computing solutions.

By End User Analysis

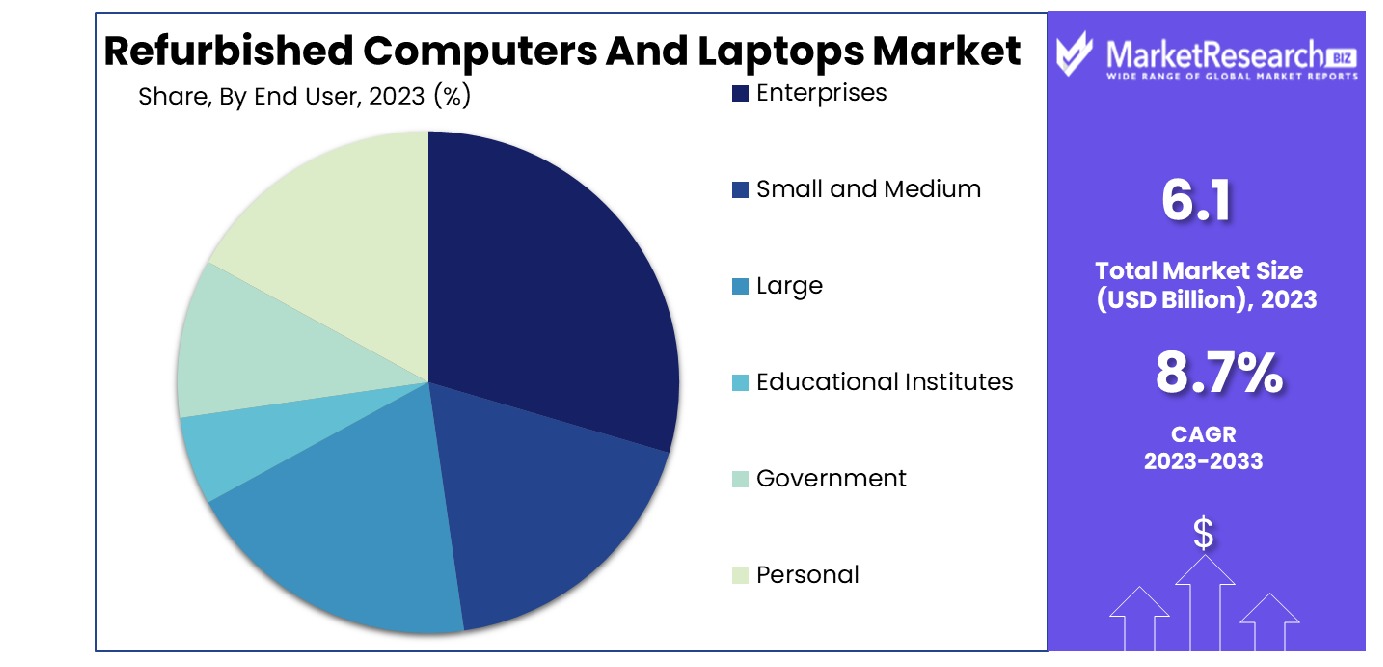

Enterprises emerged as the dominant end-user, capturing 35% of the market share.

In 2023, Enterprises held a dominant market position in the By End User segment of the Refurbished Computers and Laptops Market, capturing more than a 35% share. This segment encompasses various categories of end users, including Enterprises, Small and Medium-sized Businesses (SMBs), Large corporations, Educational Institutes, Government agencies, and Personal consumers.

Enterprises emerged as the leading consumers of refurbished computers and laptops, driven by the need to balance cost-efficiency with reliable computing solutions. Large enterprises, in particular, sought refurbished devices to equip their workforce with cost-effective yet dependable computing resources, enabling seamless business operations without compromising on performance.

Small and Medium-sized Businesses (SMBs) also constituted a significant portion of the market share within the Enterprise segment. These businesses, often operating within budget constraints, turned to refurbished computing devices as a practical solution to meet their technological needs without overspending on brand-new equipment.

Large corporations, characterized by their extensive infrastructure and complex computing requirements, recognized the value proposition offered by refurbished computers and laptops. By investing in refurbished devices, these organizations could optimize their IT budgets while ensuring scalability and performance across their operations.

Educational Institutes, comprising schools, colleges, and universities, represented a notable segment within the Enterprise category. Budgetary constraints and the need to equip classrooms and computer labs with adequate technology drove educational institutions to adopt refurbished devices as a cost-effective solution to meet their student's academic needs.

Government agencies, tasked with managing public services and operations, also contributed to the demand for refurbished computers and laptops. These entities leveraged refurbished devices to optimize their IT spending while fulfilling their mandates to deliver efficient and cost-effective services to citizens.

Personal consumers, including individuals seeking affordable computing solutions for personal use, rounded out the End User segment. Refurbished computers and laptops offered an attractive alternative to brand-new devices, enabling individuals to access reliable technology without breaking the bank.

Key Market Segments

By Type

- Laptops

- Computers

- PCs

- Workstations

- Notebooks

- Ultrabooks

By Distribution Channel

- Online

- OEMs

- Distributors

By End User

- Enterprises

- Small and Medium

- Large

- Educational Institutes

- Government

- Personal

Growth Opportunity

Adoption of Refurbished Devices by Educational Institutions

The growth trajectory of the global refurbished computers and laptops market in 2023 was notably influenced by the increasing adoption of these devices by educational institutions worldwide. Educational institutions, particularly in emerging economies, are embracing refurbished devices as a cost-effective solution to equip students with necessary technological tools. This trend stems from budget constraints faced by many educational organizations, compelling them to seek affordable alternatives without compromising on quality.

The shift towards refurbished computers and laptops presents a significant growth opportunity for market players, as it opens up a vast consumer base eager to invest in reliable yet economical technology solutions. Moreover, the focus on sustainability and environmental consciousness among educational institutions further drives the demand for refurbished devices, aligning with the global push towards circular economies and reducing electronic waste.

Expansion of the Small and Medium-Sized Business (SMB) Sector

Another key driver fueling the growth of the global refurbished computers and laptops market in 2023 was the expansion of the small and medium-sized business (SMB) sector. SMBs, often operating within constrained budgets, are increasingly turning to refurbished devices to meet their business needs. These enterprises recognize the value proposition offered by refurbished computers and laptops, allowing them to acquire essential technology at a fraction of the cost of new devices.

Furthermore, as SMBs seek to modernize their operations and enhance productivity, refurbished devices emerge as a pragmatic solution to bridge the digital divide without stretching financial resources. The expanding SMB sector presents a lucrative market segment for refurbished technology vendors, poised to capitalize on the growing demand for affordable yet reliable computing solutions among small and medium-sized enterprises worldwide.

Latest Trends

Increasing Adoption of Circular Economy Practices

In 2023, the global refurbished computers and laptops market experienced a significant shift towards the adoption of circular economy practices. With environmental sustainability becoming a paramount concern across industries, businesses and consumers alike are embracing the concept of circularity in the technology sector.

Refurbished computers and laptops play a pivotal role in this paradigm shift by extending the lifespan of electronic devices, reducing electronic waste, and minimizing the environmental footprint associated with manufacturing new products. This trend reflects a growing recognition of the economic and environmental benefits offered by refurbished technology, driving market growth and fostering a more sustainable approach to consumer electronics consumption.

Rising Awareness of Electronic Waste and Sustainability

Another prominent trend shaping the global refurbished computers and laptops market in 2023 is the escalating awareness of electronic waste and sustainability issues. As consumers become more cognizant of the environmental impact of electronic waste disposal, there is a heightened demand for eco-friendly alternatives to traditional electronics consumption. Refurbished computers and laptops emerge as a compelling solution to address these concerns, offering high-quality, pre-owned devices that undergo rigorous refurbishment processes to ensure performance and reliability.

This heightened awareness of sustainability aligns with broader societal shifts towards conscious consumerism and ethical purchasing behavior, driving the adoption of refurbished technology across diverse consumer segments. As sustainability continues to gain traction as a key driver of purchasing decisions, the global refurbished computers and laptops market is poised for sustained growth, fueled by increasing consumer demand for environmentally responsible products and practices.

Regional Analysis

In Europe, the refurbished computers and laptops market accounted for 45% of total electronic device sales.

In North America, the refurbished computers and laptops market experiences robust growth, fueled by a tech-savvy population and a penchant for adopting the latest gadgets. According to recent market research, North America accounts for approximately 30% of the global refurbished electronics market, with a substantial portion of sales concentrated in the United States and Canada. Factors such as increasing awareness of environmental sustainability and cost-effectiveness drive the demand for refurbished devices in this region.

Meanwhile, Europe emerges as a dominant force in the refurbished computers and laptops market, commanding a significant share of approximately 45%. With stringent regulations promoting the circular economy and encouraging electronic waste reduction, European consumers exhibit a strong inclination towards refurbished electronics. This region boasts a well-established infrastructure for collecting, refurbishing, and redistributing pre-owned devices, supported by a network of certified refurbishers and retailers.

In the Asia Pacific region, rapid urbanization, coupled with expanding access to technology, propels the demand for refurbished computers and laptops. Countries like China, India, and Japan witness a burgeoning market for second-hand electronics, driven by affordability concerns and a growing emphasis on digital inclusion. Despite facing challenges related to counterfeit products and consumer trust, the Asia Pacific region emerges as a lucrative frontier for refurbished electronics manufacturers and retailers.

The Middle East & Africa and Latin America regions also present untapped potential in the refurbished electronics market, albeit with varying degrees of market penetration and consumer awareness. Factors such as rising disposable incomes, coupled with initiatives promoting digital literacy, are expected to drive market growth in these regions in the coming years. However, challenges related to infrastructure development and regulatory frameworks may hinder the pace of expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the dynamic landscape of the global refurbished computers and laptops market, key players such as Apple Inc., IBM Corporation, Samsung Electronics Co. Ltd., Amazon.com, Inc., HP Inc., Acer Inc., and Lenovo play pivotal roles in shaping industry trends and driving market dynamics.

Apple Inc. maintains a strong foothold in the refurbished electronics market, leveraging its brand reputation and loyal customer base to capture significant market share. With a focus on quality assurance and stringent refurbishment processes, Apple sets industry standards for certified pre-owned devices, attracting discerning consumers seeking premium products at competitive prices.

Similarly, IBM Corporation brings decades of expertise in technology solutions and services to the refurbished computers and laptops market. As a trusted provider of enterprise-grade hardware and software solutions, IBM caters to the needs of corporate clients and institutions looking to optimize their IT infrastructure through cost-effective refurbishment options.

Samsung Electronics Co. Ltd., renowned for its innovation and technological prowess, extends its influence into the refurbished electronics sector, offering a diverse portfolio of reconditioned devices across various price segments. With a commitment to sustainability and eco-friendly practices, Samsung emphasizes the value of extending the lifecycle of electronic products through refurbishment and recycling initiatives.

Amazon.com, Inc., with its expansive e-commerce platform and global reach, serves as a key player in facilitating the distribution and sale of refurbished computers and laptops. Through its marketplace model and dedicated refurbished product categories, Amazon caters to a wide range of consumer preferences, providing both convenience and accessibility in purchasing pre-owned electronics.

HP Inc., Acer Inc., and Lenovo, prominent players in the PC and laptop market, capitalize on their manufacturing expertise and distribution networks to offer refurbished products that meet stringent quality standards. By tapping into their existing customer base and leveraging economies of scale, these companies contribute to the growth and competitiveness of the refurbished electronics market.

Market Key Players

- Apple Inc.

- IBM Corporation

- Samsung Electronics Co.ltd.

- Amazon.com, Inc.

- HPINC.

- Acer Inc.

- Lenovo.

Recent Development

- In November 2022, Southern Electrical Recycling in Portsmouth promoted second-hand tech gifts to reduce e-waste and cost of living pressures, refurbishing electronics for both individual and business use.

- In August 2021, eSmart Recycling will focus on recycling IT equipment to fund computer labs globally, enhancing access to technology for underserved communities while promoting environmental sustainability.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Billion Forecast Revenue (2033) USD 12.0 Billion CAGR (2024-2032) 8.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Laptops, Computers, PCs, Workstations, Notebooks, Ultrabooks), By Distribution Channel(Online, OEMs, Distributors), By End User(Enterprises, Small and Medium, Large, Educational Institutes, Government, Personal) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Apple Inc., IBM Corporation, Samsung Electronics Co.ltd., Amazon.com, Inc., HPINC., Acer Inc., Lenovo. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Apple Inc.

- IBM Corporation

- Samsung Electronics Co.ltd.

- Amazon.com, Inc.

- HPINC.

- Acer Inc.

- Lenovo.