Kitchen Tools Market By Product(Cookware, Bakeware, Others), By Distribution Channel(Offline, Online), By End User(Residential Kitchen, Commercial Kitchen), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42280

-

Dec 2023

-

169

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Kitchen Tools Market Size, Share, Trends Analysis

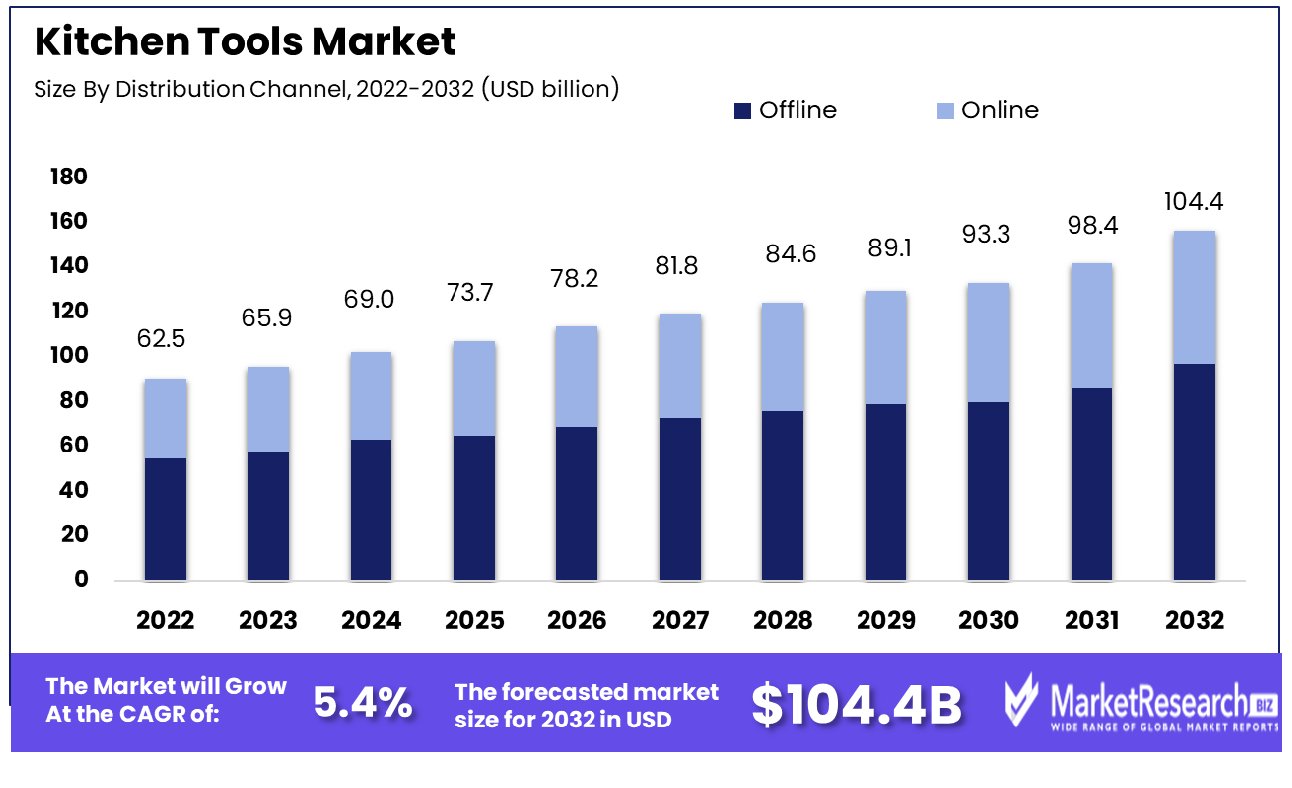

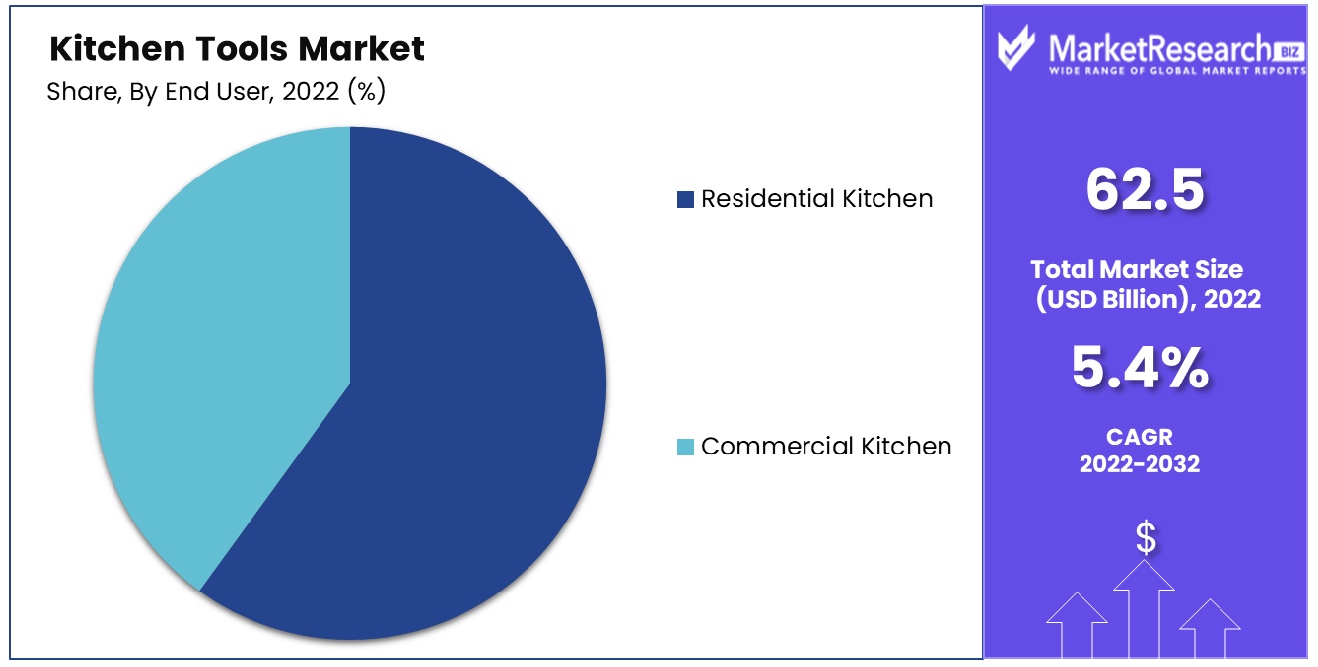

The kitchen tool market was valued at USD 62.5 billion in 2022. It is expected to reach USD 104.4 billion by 2032, with a CAGR of 5.4% during the forecast period from 2023 to 2032.

The sudden shift in consumer preferences and demand for easy and quick cooking applications are some of the main driving factors for the kitchen tool market expansion. Every kitchen tool has its significance and functionality.

Using the right tool will make things more efficient and safe in the smart kitchen appliances market. Proper kitchen cooking tools help to increase the speed of the cooking process. The right advanced home appliances product makes the process of food making better and at the same time, it maintains hygiene and keeps the kitchen clean.

As consumers are investing more in home renovation, they are getting more inclined towards advanced technologies that can make the cooking experience easier. Many cooking appliances have been introduced in kitchen manufacturing. For example, ovens aim to use as little water as possible.

The kitchen is among the rooms that have to be furnished with the appropriate tools. The tools must be used correctly to prevent any injury. Tools for the kitchen, such as a meat thermometer can be employed to gauge the internal temperature of cooked meat so that you can be able to determine whether the meat is safe to consume.

As per the Times of Malta article, more than 780 individuals were impacted by food poisoning in 2019, and nearly 300 people were reported in pre-pandemic years, according to some of the official statistics. A total of 781 food poisoning cases have been reported to the higher authorities of the health department in the year 2022, but there was a major surge from the 486 registered in 2019. The usage of the meat thermometer will help in preventing food poisoning by killing the bacteria.

Manufacturers are expanding their reach to different types of distribution platforms. Consumers are more inclined towards online shopping as they get a variety of options regarding kitchen tools that might not be available in offline stores. Many kitchen tools are also not available in the stores but consumers can get them easily on the online platform.

Several online platforms such as Amazon, Flipkart, and others provide huge discounts on kitchen tools and equipment items. Online shopping has become one of the major retail channels for all household consumption. The demand for kitchen tools will increase as consumers opt to have an easy cooking experience which will contribute to the kitchen tool expansion in the forecast period.

Kitchen Tools Market Dynamics

Economic Growth and Urbanization Elevate Kitchen Tools Market

Economic expansion in emerging countries coupled with rising urbanization is a key driver for the kitchen tools market's growth. As economies grow, increasing disposable incomes and urban lifestyles lead to an enhanced focus on home improvement, including kitchen upgrades.

Consumers in these rapidly developing regions are investing more in their living spaces, with a particular interest in the modernization rate in their kitchens. This trend, reflective of broader economic and demographic shifts, indicates a sustained market expansion as more individuals seek to enhance their kitchen spaces with various tools and gadgets.

Demand for Modular Kitchen Equipment Spurs Market Innovation

The growing demand for modular and cutting-edge kitchen equipment is reshaping the kitchen tools market. As homes become more compact and aesthetically driven, there's a rising preference for kitchen tools that are both functional and stylish.

This demand drives innovation in design and functionality, with manufacturers introducing products that align with contemporary kitchen layouts and consumer lifestyles. The long-term implication is a market increasingly focused on innovative, space-saving, and visually appealing kitchen tools, catering to the evolving preferences of modern consumers.

Natural Products Preference Shapes Kitchen Tools Market

Rising consumer awareness and preference for natural products a notable factors in the growth of the kitchen tools market. This trend stems from a broader shift towards health and wellness, where consumers are more mindful of the materials and products they use in their homes, including a focus on renewable energy and solar energy in kitchen tool manufacturing.

As a result, there's an increasing demand for kitchen tools made from natural, non-toxic materials. This preference is likely to drive market innovation, with a growing range of products catering to health-conscious consumers, suggesting a market evolution towards healthier, safer kitchen tools.

Economic Constraints in Emerging Countries Restrain Kitchen Tools Market Growth

The growth of the kitchen tools market is notably hindered by economic constraints in emerging countries. In these regions, limited disposable incomes often lead consumers to prioritize necessities over non-essential purchases such as premium kitchen tools.

The affordability factor plays a crucial role in consumer decision-making, pushing a significant portion of the market towards more economical alternatives. This economic dynamic restrains the market’s potential, particularly for higher-end kitchen tool brands, and poses a challenge for companies trying to expand their footprint in these rapidly growing but price-sensitive markets.

High Competition from Established Brands Leads to Intense Competition in the Kitchenware Market

Intense competition from established brands significantly impacts the growth of the kitchen tools market. Well-known brands with long-standing reputations dominate the market, benefiting from consumer loyalty, extensive distribution networks, and substantial marketing budgets. This dominance creates a challenging environment for new entrants and smaller brands, who struggle to gain visibility and market share.

The competition is particularly fierce in segments like premium kitchenware, where brand perception is critical in consumer choice. For new market players, differentiating their products and building brand recognition in the face of this established competition is a formidable barrier to market entry and growth.

Kitchen Tools Market Segmentation Analysis

By Product Analysis

The cookware segment, comprising pots, pans, and cooking vessels, is the cornerstone of the kitchen tools industry. This segment's dominance is driven by the universal need for cooking essentials in both residential and commercial kitchens. The current trend of health-conscious kitchenware that is attractive and healthy has resulted in innovations in cookware products like non-stick surfaces and induction-compatible materials. The rising popularity of cooking as a pastime and the emergence of cooking shows have also resulted in a higher demand for top-quality.

Bakeware caters to a specific but growing market segment, particularly with the rising interest in home baking. The 'Others' category, including cutlery, knife accessories, kitchen appliances, and small gadgets, is integral to the kitchen tools market. These segments contribute to industry growth by offering specialized tools and appliances that cater to diverse cooking needs and preferences, from basic utensils to advanced gadgets.

By Distribution Channel Analysis

Offline segment channels, including department stores, specialty stores, and supermarkets, are the primary distribution channels for kitchen tools. The ability to physically inspect and compare products is a key factor in consumers' preference for offline segment shopping. These channels benefit from established customer trust and the shopping experience they offer, such as live demonstrations and in-store assistance.

The online segment is witnessing significant growth, driven by the convenience of home shopping, the broader selection of products, and competitive pricing. E-commerce platforms are increasingly becoming popular for kitchen tools, offering detailed product information, customer reviews, and easy return policies.

By End User Analysis

Residential kitchens represent the largest end-user segment in the kitchen tools industry. This dominance is attributed to the growing interest in home cooking, driven by health and wellness trends and the desire for homemade meals. The increasing number of households and the rise in home renovation projects focusing on kitchen upgrades are also significant drivers of this segment.

Commercial kitchens, including those in restaurants, hotels, and catering services, require a wide range of kitchen tools for diverse culinary operations. While this commercial segment is smaller compared to residential kitchens, it plays a vital role in the market, particularly for high-end and specialized kitchen tools.

Kitchen Tools Industry Segments

By Product

- Cookware

- Bakeware

- Others

By Distribution Channel

- Offline

- Online

By End User

- Residential Kitchen

- Commercial Kitchen

Kitchen Tools Market Growth Opportunity

Increasing Demand in Emerging Markets Offers Growth Opportunity in Kitchen Tools Market

The burgeoning demand for kitchen tools in emerging markets is a significant factor driving market growth. As these markets experience economic growth, there is an increase in disposable income, leading to more spending on household items, including kitchen tools. Consumers in these regions are showing a growing interest in cooking and are investing in better-quality kitchenware.

Recent data reflects a notable surge in kitchen tool sales in these markets, driven by urbanization, increasing culinary awareness, and the influence of global food trends. This presents a vast market opportunity for expansion, both in terms of volume and the diversity of products offered, with the hospitality industry and commercial sector also contributing to the fastest growth.

Increasing Demand for Eco-Friendly Kitchen Tools Stimulates Market Growth

The rising demand for eco-friendly kitchen tools stimulates significant growth in the market. Sustainability and environmental concerns influence the purchasing decisions of consumers which leads to the preference of kitchen equipment that is made of sustainable, non-toxic, and biodegradable substances. This trend is evident in the increasing popularity of bamboo cookware, silicone utensils, and many other eco-friendly options.

Current market trends show a steady increase in demand for these sustainable options, reflecting a broader movement towards environmentally responsible consumerism. This trend not only broadens the market for eco-friendly kitchen tools but also drives innovation and development in sustainable product design, especially within the residential sector.

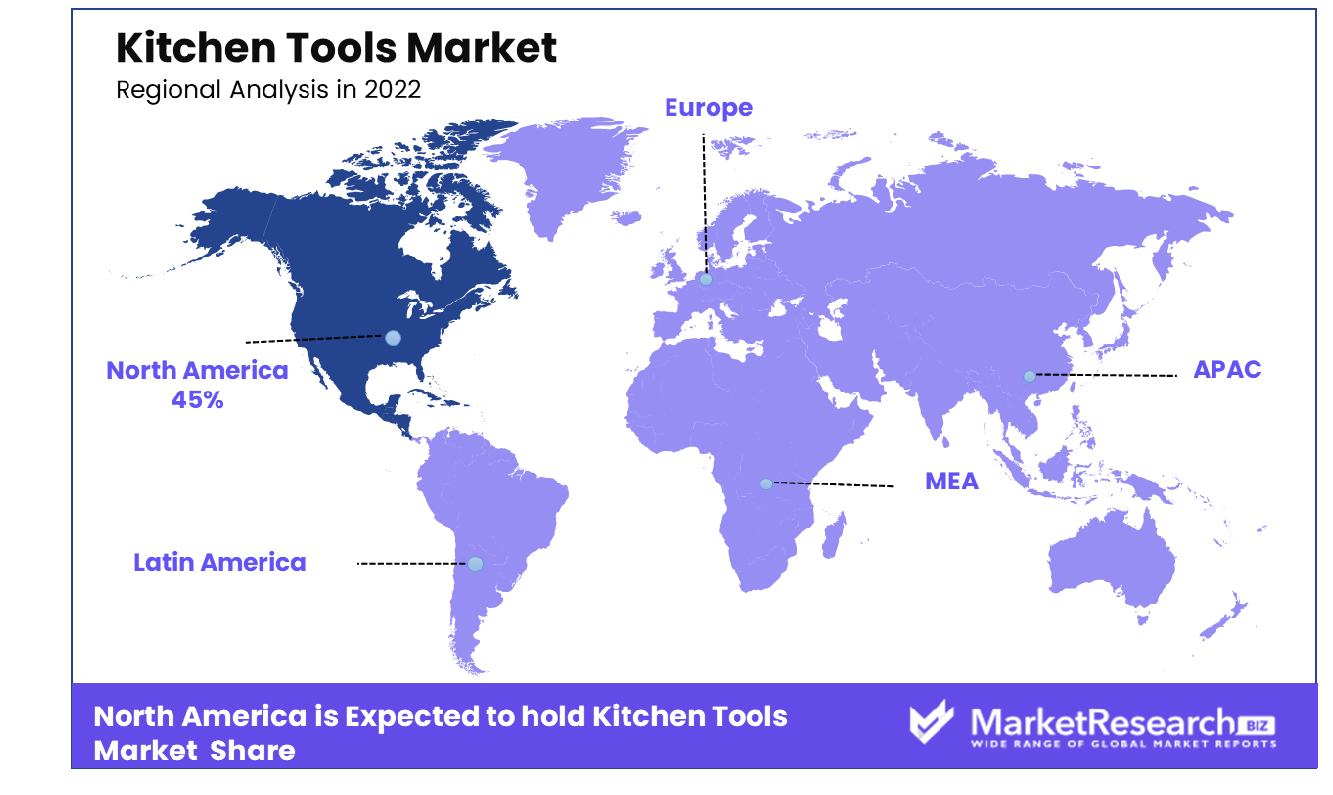

Kitchen Tools Market Regional Analysis

North America Dominates with 45% Share Market Share

North America's substantial 45% share in the regional market for the kitchen tools market is anchored by its large consumer base with high spending power and a strong culture of home cooking and baked foods. The region's emphasis on quality and innovation in kitchenware, coupled with a growing trend towards gourmet home cooking, drives this significant market share.

Furthermore, the existence of a variety of major kitchen equipment makers and retailers in this region, well-known for their varied and ingenuous product ranges, is a good fit for the various preferences and tastes of North American consumers including those in the hospitality sector

The dynamic of the kitchen equipment market within North America is influenced by the advanced retail infrastructure of the region which includes brick-and-mortar shops and online shopping platforms. This allows many different products to be easily accessible to consumers. The region’s focus on sustainable and ergonomically designed products also resonates well with environmentally conscious consumers.

Looking ahead, the kitchen tools market in North America is poised for continued growth. Factors such as rising interest in home cooking, especially post-pandemic, and the ongoing innovation in smart appliances and multifunctional kitchen gadgets are likely to propel this market further. Additionally, the growing awareness of healthy eating and the trend towards home-prepared meals are expected to sustain market demand for high-quality kitchen tools.

Europe is A Blend of Tradition and Modernity

Europe's kitchen tools market is characterized by a blend of traditional craftsmanship and modern design. The region's strong culinary heritage, combined with an increasing focus on modern, efficient kitchenware, drives market growth. European consumers' preference for durable and aesthetically pleasing kitchen tools, often made from eco-friendly materials, contributes to the market's vitality.

Asia-Pacific's Rapid Growth Driven by Economic Expansion

The kitchen tools market in Asia-Pacific is experiencing rapid growth, driven by the region's expanding middle class and increasing urbanization. Countries like China and India are witnessing a surge in demand for kitchen tools, fueled by growing household count and the proliferation of western cooking The region's diverse culinary traditions also create a unique market for specialized kitchen tools, catering to local cooking practices.

Kitchen Tools Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Kitchen Tools Market Share Analysis

In the kitchen tools market, the collective influence and strategic positioning of the listed key companies highlight a diverse and competitive landscape. Tupperware and Pampered Chef, renowned for their innovative products for kitchen storage and cooking tools, underscore the market's emphasis on convenience and home cooking trends. Meyer Corporation and KitchenAid, with their focus on high-quality cookware and appliances, reflect the consumer demand for durability and functionality in kitchen tools.

Cuisinart and Hobart Corporation, known for their diverse and advanced kitchen appliances industry, illustrate the industry's shift towards multifunctional and technologically sophisticated products. LG Electronics Inc. and Samsung Electronics Co Ltd., as major market leaders in the consumer electronics market, demonstrate the growing integration of smart technology in the kitchen appliances industry, catering to the modern, connected home.

Morphy Richards Ltd. and Koninklijke Philips N.V., with their wide range of small appliances, highlight the importance of catering to everyday cooking needs, from convenience to health-conscious cooking. AB Electrolux (publ) and Whirlpool Corporation, with their extensive global presence, underscore the significance of brand reputation and international market reach in the kitchen tools sector.

Pyrex Cookware (Corning Inc.) and Illinois Tools Works Inc., specializing in glassware and industrial kitchen tools respectively, showcase the market's diversity in materials and product range, catering to both consumer and commercial kitchens. Their recent product launch events have further cemented their status as significant industry players.

Together, these companies not only shape the kitchen tools market's growth but also represent a spectrum of strategies, from product innovation to embracing smart technology and maintaining a global brand presence, crucial in navigating this dynamic consumer goods sector.

Kitchen Tools Industry Key Players

- Tupperware

- Pampered Chef

- Meyer Corporation

- KitchenAid

- Cuisinart

- Hobart Corporation

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Morphy Richards Ltd.

- Koninklijke Philips N.V.

- Electrolux AB

- Whirlpool Corporation

- Pyrex Cookware (Corning Inc.)

- Illinois Tools Works Inc.

- Dover Corporation

- Groupe SEB

- Newell Brands

- Williams-Sonoma, Inc.

- IKEA

- Zwilling JA Henckels Türkiye

- Conair LLC

- Lifetime Brands

- China ASD

- Linkfair

- TTK Prestige Ltd.

- Panasonic Corporation

Kitchen Tools Market Recent Development

- In 2023, Singapore-based startup Ai Palette launched 'Concept Genie,' a generative AI tool designed to accelerate the innovation process for food and beverage companies. This tool generates new product concepts based on insights from Ai Palette's trendspotting platform, using data from various sources, including retail e-commerce platforms, menus, recipes, social media posts, and search engines from around the world.

- In 2023, Whataburger introduced its first-ever Digital Kitchen in Bee Cave, Texas. This innovative restaurant model features digital ordering through kiosks and a smartphone app, eliminating the need for traditional drive-thru or cash transactions.

- In 2023, Curefoods, a cloud kitchen aggregator, raised $37 million from Three State Ventures. Bollywood actress Nora Fatehi also invested in the company and became the brand ambassador for its sub-brand CakeZone.

- In May 2022, Country Delight, which sources and delivers milk and other food products, secured $108 million in its Series D funding round. They have experienced significant growth, serving more than 1.5 million customers and delivering over 8 billion orders every month across 11 Indian states.

Report Scope

Report Features Description Market Value (2022) USD 62.5 Bn Forecast Revenue (2032) USD 104.4 Bn CAGR (2023-2032) 5.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Cookware, Bakeware, Others), By Distribution Channel(Offline, Online), By End User(Residential Kitchen, Commercial Kitchen) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Tupperware, Pampered Chef, Meyer Corporation, KitchenAid, Cuisinart, Hobart Corporation, LG Electronics Inc., Samsung Electronics Co. Ltd., Morphy Richards Ltd., Koninklijke Philips N.V., Electrolux AB, Whirlpool Corporation, Pyrex Cookware (Corning Inc.), Illinois tools Works Inc., Dover Corporation, Groupe SEB, Newell Brands, Williams-Sonoma, Inc., IKEA, Zwilling JA Henckels Türkiye, Lifetime Brands, China ASD, Linkfair, TTK Prestige Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Tupperware

- Pampered Chef

- Meyer Corporation

- KitchenAid

- Cuisinart

- Hobart Corporation

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Morphy Richards Ltd.

- Koninklijke Philips N.V.

- Electrolux AB

- Whirlpool Corporation

- Pyrex Cookware (Corning Inc.)

- Illinois Tools Works Inc.

- Dover Corporation

- Groupe SEB

- Newell Brands

- Williams-Sonoma, Inc.

- IKEA

- Zwilling JA Henckels Türkiye

- Conair LLC

- Lifetime Brands

- China ASD

- Linkfair

- TTK Prestige Ltd.

- Panasonic Corporation