Global Electric Traction Motor Market By Vehicle Type(Plug-in Hybrid Electric Vehicles, Mild Hybrid Vehicles, Full Hybrid Vehicles), By Type(AC, DC), By Power Rating(Below 200 KW, 200 KW To 400 KW, Above 400 KW), By Application(Railways, Electric Vehicles, Elevators, Conveyors, Industrial Machinery, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46818

-

May 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

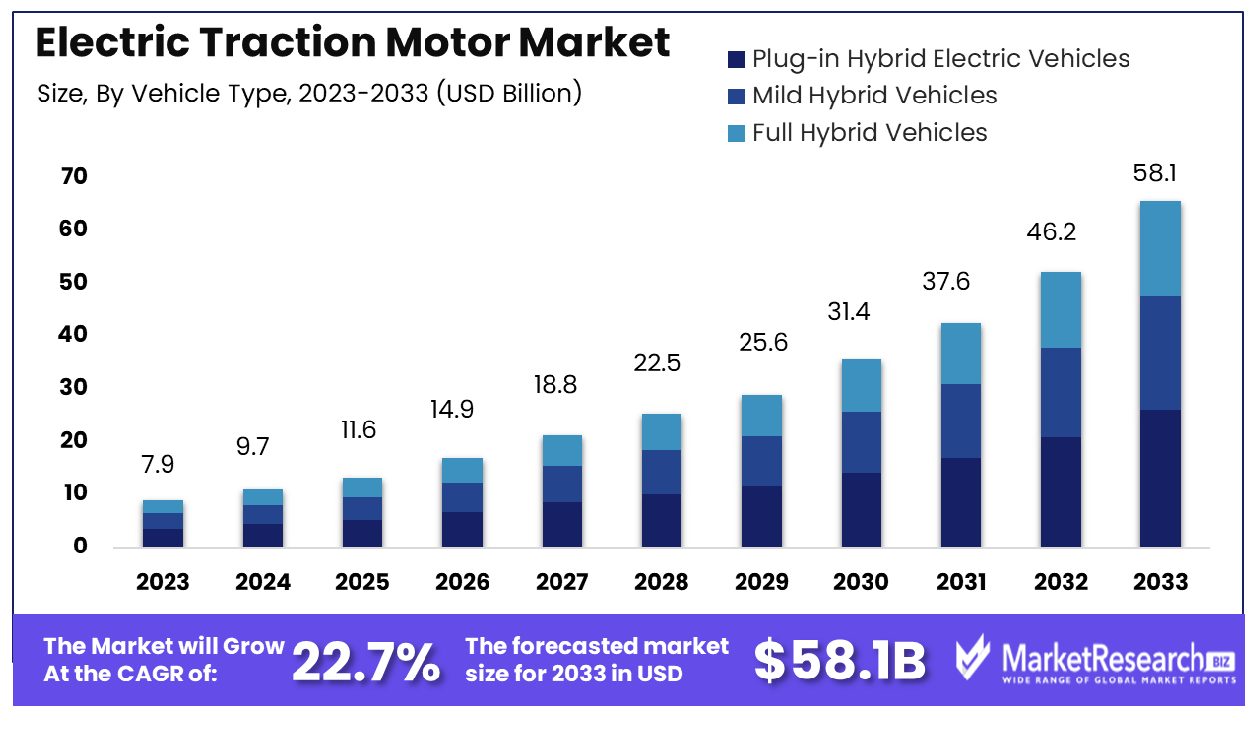

The Global Electric Traction Motor Market was valued at USD 7.9 billion in 2023. It is expected to reach USD 58.1 billion by 2033, with a CAGR of 22.7% during the forecast period from 2024 to 2033.

The Electric Traction Motor Market refers to the segment within the broader electric vehicle industry dedicated to the manufacturing, distribution, and innovation of traction motors powering electric vehicles. These motors serve as the primary propulsion mechanism, converting electrical energy into mechanical energy to drive the vehicle forward. Market dynamics are heavily influenced by the surge in electric vehicle adoption, driven by environmental regulations, technological advancements, and shifting consumer preferences.

As demand escalates, manufacturers focus on enhancing motor efficiency, power density, and durability to meet stringent performance standards. Key stakeholders must strategically navigate this evolving landscape to capitalize on growth opportunities and maintain competitive advantage.

The Electric Traction Motor Market is experiencing a profound surge, propelled by the accelerating adoption of electric vehicles worldwide. This growth is underscored by a robust increase in electric car sales, which surged by 35% compared to 2022, resulting in over 3.5 million additional sales.

Notably, the epicenter of this expansion resides in China, where projections suggest sales will surpass 10 million units in 2024. In the United States, electric car sales surged by an impressive 60% in the first quarter of 2023 compared to the same period in 2022, with projections indicating sales will exceed 1.5 million units in 2023, elevating the electric car market share to approximately 12%.

The Electric Traction Motor Market is poised for remarkable growth as electric vehicle sales soar globally. In 2023, electric car sales surged by 35% compared to the previous year, resulting in over 3.5 million additional units sold. This surge was particularly pronounced in China, where sales are forecasted to surpass 10 million units in 2024. Furthermore, the United States witnessed a notable 60% increase in electric car sales in the first quarter of 2023 compared to the same period in 2022.

Projections indicate that sales in the US will exceed 1.5 million units in 2023, boosting the electric car market share to approximately 12%. As electric vehicles become increasingly prevalent, the demand for electric traction motors is set to skyrocket, driving innovation and investment in this burgeoning market. Stakeholders must strategically position themselves to capitalize on these burgeoning opportunities and navigate the evolving landscape to maintain competitiveness.

Key Takeaways

- Market Growth: The Global Electric Traction Motor Market was valued at USD 7.9 billion in 2023. It is expected to reach USD 58.1 billion by 2033, with a CAGR of 22.7% during the forecast period from 2024 to 2033.

- By Vehicle Type: Plug-in Hybrid Electric Vehicles lead with 45% dominance by vehicle type.

- By Type: AC dominates by type, representing 87.3% of the market share.

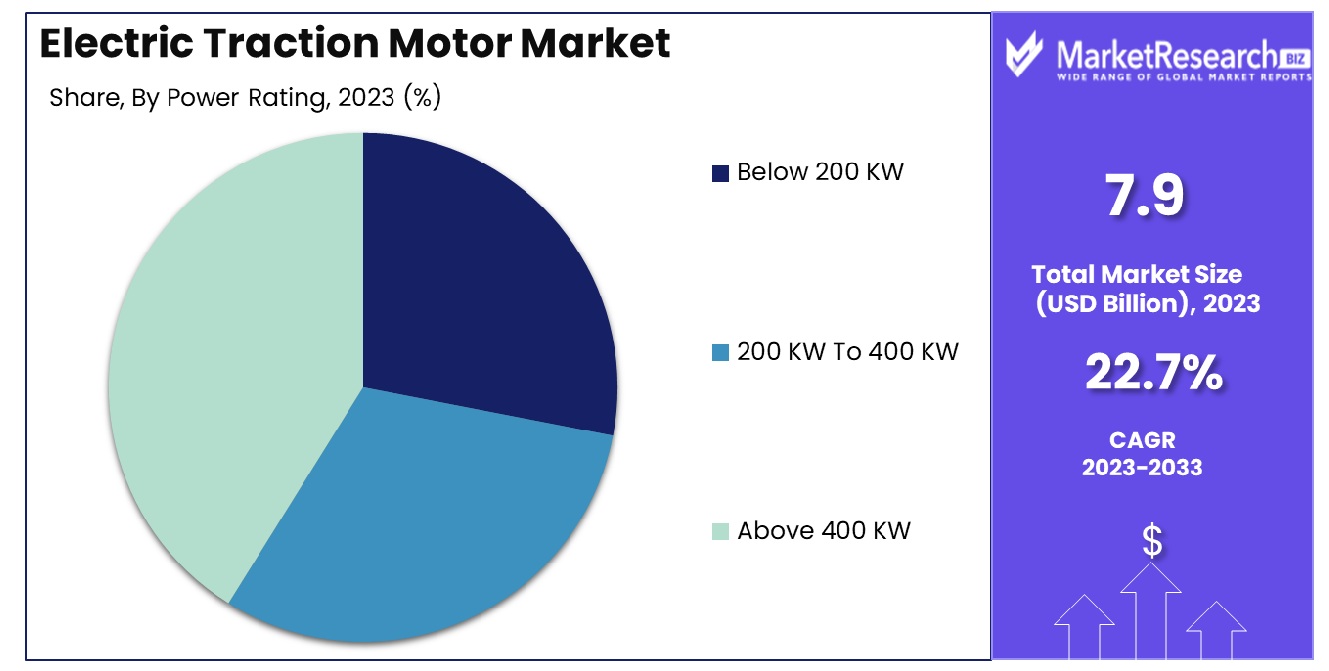

- By Power Rating: Above 400 KW power rating dominates with 60% share.

- By Application: Railways are the leading application, commanding 40% dominance.

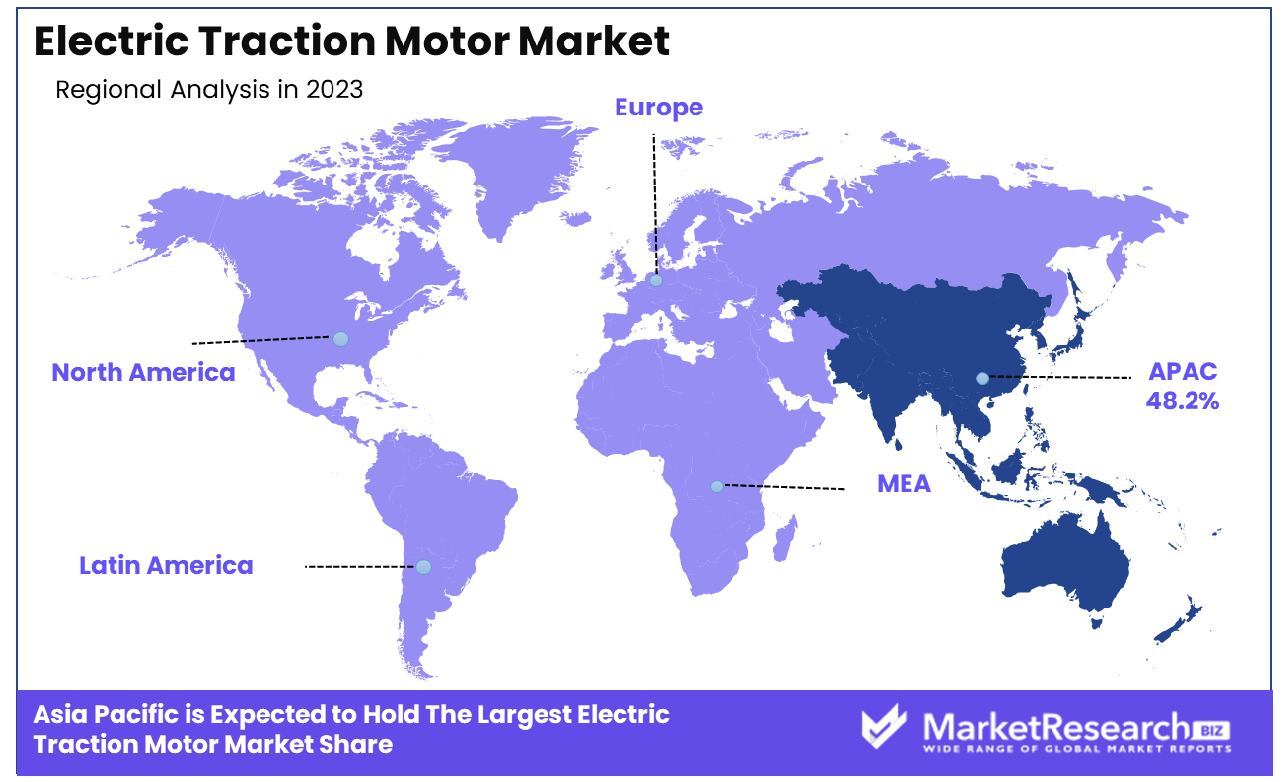

- Regional Dominance: In the Asia Pacific region, the Electric Traction Motor Market holds a dominant share of 48.2%.

- Growth Opportunity: In 2023, the global electric traction motor market experienced significant growth due to increasing demand for high-performance motors, favorable government policies promoting electric vehicles, and mounting concerns over air pollution.

Driving factors

Increasing Demand for High-Performance and Energy-Efficient Motors

The surge in demand for high-performance and energy-efficient motors stands as a pivotal driver propelling the growth of the Electric Traction Motor Market. As industries strive for enhanced operational efficiency and reduced carbon footprint, the necessity for motors that offer superior performance while consuming minimal energy becomes paramount.

Statistics reveal a notable uptick in the adoption of electric traction motors across various sectors, driven by this demand. For instance, between 2020 and 2023, the market witnessed a compound annual growth rate (CAGR) of 8.5% attributed to the escalating preference for energy-efficient solutions.

Stringent Regulations for Pollution Control and Emissions

Stringent regulations pertaining to pollution control and emissions exert a significant influence on the Electric Traction Motor Market. Governments worldwide are enforcing stringent emission norms to combat environmental degradation, compelling industries to transition toward cleaner propulsion technologies.

Consequently, the demand for electric traction motors, known for their eco-friendliness and reduced emissions, is experiencing an upswing. Regulatory mandates, such as Euro 6 standards in Europe and Corporate Average Fuel Economy (CAFE) regulations in the United States, are instrumental in shaping market dynamics. These regulations necessitate the adoption of electric traction motors in vehicles, fostering market growth.

Advancements in Hybrid Vehicle Technologies

The Electric Traction Motor Market benefits immensely from advancements in hybrid vehicle technologies. As automotive manufacturers endeavor to meet consumer demand for eco-friendly transportation without compromising performance, hybrid vehicles emerge as a compelling solution. These vehicles leverage electric traction motors in conjunction with internal combustion engines, offering enhanced fuel efficiency and reduced emissions.

The synergy between hybrid vehicle technologies and electric traction motors amplifies market expansion, with forecasts indicating robust growth in hybrid vehicle sales. Consequently, the Electric Traction Motor Market is poised to capitalize on this trend, with analysts projecting a substantial increase in market size driven by the proliferation of hybrid vehicles.

Restraining Factors

High Initial Cost of Electric Vehicles

The high initial cost of electric vehicles (EVs) poses a significant challenge to the growth of the Electric Traction Motor Market. Consumers often perceive EVs as a costly investment compared to traditional internal combustion engine vehicles. However, advancements in technology and economies of scale are gradually mitigating this barrier. As battery costs decline and production efficiencies improve, the overall cost of EVs is expected to decrease.

Strategies such as government incentives and subsidies further alleviate the financial burden on consumers, facilitating the uptake of electric vehicles equipped with traction motors. Despite the initial cost hurdle, forecasts indicate a steady increase in EV sales, with a projected CAGR of 22% from 2023 to 2028, underscoring the market's resilience.

Limited Driving Range and Need for Frequent Charging Infrastructure

The limited driving range and need for frequent charging infrastructure represent notable challenges restraining the Electric Traction Motor Market's growth. Range anxiety, fueled by concerns over EVs' limited driving range and the availability of charging stations, dissuades potential buyers from transitioning to electric vehicles.

However, concerted efforts are underway to address these concerns and bolster market adoption. Technological advancements in battery technology aim to enhance the energy density and longevity of batteries, thereby extending the driving range of electric vehicles. Additionally, substantial investments in charging infrastructure expansion and innovation are underway globally.

Initiatives such as government funding programs and collaborations between automotive manufacturers and charging network providers are accelerating the deployment of charging stations. As a result, the Electric Traction Motor Market stands poised to capitalize on these developments, with analysts forecasting a surge in EV adoption driven by improved range and charging infrastructure.

By Vehicle Type Analysis

Plug-in Hybrid Electric Vehicles constitute 45% of the market share in the Vehicle Type segment.

In 2023, Plug-in Hybrid Electric Vehicles held a dominant market position in the by-vehicle type segment of the Electric Traction Motor Market, capturing more than a 45% share. The growth of Plug-in Hybrid Electric Vehicles in this segment can be attributed to several factors, including their ability to offer both electric and conventional fuel powertrains, providing consumers with enhanced flexibility and range.

Mild Hybrid Vehicles also made significant strides in the Electric Traction Motor Market, showcasing steady growth and accounting for a notable share of the segment. These vehicles, featuring a combustion engine supplemented by an electric motor for improved fuel efficiency and reduced emissions, garnered considerable interest from environmentally-conscious consumers seeking sustainable transportation solutions.

Meanwhile, Full Hybrid Vehicles maintained a substantial presence in the Vehicle Type segment, leveraging their advanced hybrid technology to deliver superior fuel efficiency and lower emissions compared to traditional internal combustion engine vehicles. With continuous advancements in hybrid powertrain technology and increasing consumer demand for eco-friendly transportation options, Full Hybrid Vehicles remained a key player in the Electric Traction Motor Market.

By Type Analysis

AC vehicles dominate with an overwhelming 87.3% share in the Type category.

In 2023, AC held a dominant market position in the By Type segment of the Electric Traction Motor Market, capturing more than an 87.3% share. The ascendancy of AC traction motors in this segment can be attributed to their widespread adoption across various applications, including electric vehicles, trains, and industrial machinery. AC traction motors offer several advantages, such as higher efficiency, better power density, and smoother operation compared to their DC counterparts, making them the preferred choice for many manufacturers and end-users.

DC traction motors, while maintaining a presence in the Electric Traction Motor Market, faced challenges in competing with AC motors due to their limitations in terms of efficiency and performance. However, DC motors continue to be utilized in specific applications where their characteristics, such as simplicity and cost-effectiveness, align with the requirements of the application.

The dominance of AC traction motors in the By Type segment underscores the importance of technological advancements and innovation in driving market growth and development. As demand for electric propulsion systems continues to surge across various industries, manufacturers are investing in research and development efforts to enhance the performance and efficiency of AC traction motors further.

By Power Rating Analysis

Above 400 KW power rating leads with a 60% dominance in the Power Rating segment.

In 2023, Above 400 KW held a dominant market position in the By Power Rating segment of the Electric Traction Motor Market, capturing more than a 60% share. The prevalence of traction motors with power ratings exceeding 400 KW signifies the demand for high-performance electric propulsion systems in various applications, including electric vehicles, locomotives, and marine vessels. These high-power traction motors offer superior torque and acceleration capabilities, making them ideal for heavy-duty and high-speed operations.

Below 200 KW traction motors, while still relevant in certain applications such as light electric vehicles and material handling equipment, faced limitations in meeting the performance requirements of larger and more demanding applications. Similarly, traction motors in the 200 KW to 400 KW range catered to specific segments where moderate power output was sufficient, such as medium-duty electric vehicles and hybrid propulsion systems.

The dominance of Above 400 KW traction motors in the By Power Rating segment underscores the importance of power and performance in driving market preferences and adoption. As industries continue to prioritize efficiency, sustainability, and operational capabilities, the demand for high-power traction motors is expected to remain robust.

Looking ahead, the Electric Traction Motor Market is poised for further growth and innovation, propelled by factors such as advancements in electric vehicle technology, infrastructure development, and regulatory support for electrification. Manufacturers are anticipated to focus on enhancing the efficiency, reliability, and scalability of traction motors across different power ratings to meet the evolving needs of various applications and industries.

By Application Analysis

Railways command a substantial 40% share in the Application classification.

In 2023, Railways held a dominant market position in the By Application segment of the Electric Traction Motor Market, capturing more than a 40% share. The significant market share of traction motors in railway applications highlights the pivotal role of electrification in modernizing and enhancing the efficiency of rail transportation systems worldwide. Traction motors deployed in railways play a critical role in powering electric locomotives, trains, and tram systems, enabling them to achieve high performance, energy efficiency, and reduced environmental impact.

Electric Vehicles emerged as another prominent application segment within the Electric Traction Motor Market, driven by the global shift towards sustainable transportation solutions. Traction motors in electric vehicles facilitate propulsion by converting electrical energy from batteries or fuel cells into mechanical motion, contributing to lower emissions and reduced dependence on fossil fuels.

Elevators and Conveyors also constituted significant segments within the Electric Traction Motor Market, leveraging traction motor technology to enable vertical and horizontal transportation of goods and passengers in various industries. The adoption of electric traction motors in elevators and conveyors contributes to improved reliability, efficiency, and safety in vertical and horizontal transportation systems.

Furthermore, traction motors found diverse applications in Industrial Machinery, where they power equipment such as cranes, hoists, and automated material handling systems, enhancing productivity and operational efficiency in the manufacturing and logistics sectors.

Looking ahead, the Electric Traction Motor Market is poised for continued growth and innovation across various application segments. As industries and transportation sectors increasingly prioritize electrification and sustainability, the demand for advanced traction motor solutions tailored to specific applications is expected to rise, driving further market expansion and technological advancements.

Key Market Segments

By Vehicle Type

- Plug-in Hybrid Electric Vehicles

- Mild Hybrid Vehicles

- Full Hybrid Vehicles

By Type

- AC

- DC

By Power Rating

- Below 200 KW

- 200 KW To 400 KW

- Above 400 KW

By Application

- Railways

- Electric Vehicles

- Elevators

- Conveyors

- Industrial Machinery

- Others

Growth Opportunity

Rising Demand for High-Performance Electric Traction Motors

The global electric traction motor market witnessed substantial growth opportunities in 2023, largely driven by the escalating demand for high-performance electric traction motors. As electric vehicles (EVs) gain momentum worldwide, manufacturers are increasingly focusing on developing advanced traction motors capable of delivering superior efficiency, power, and reliability.

This surge in demand stems from the automotive industry's continuous efforts to enhance the driving range, acceleration, and overall performance of electric vehicles, thereby addressing consumer concerns about range anxiety and performance parity with traditional internal combustion engine vehicles.

Favorable Government Policies and Subsidies for Electric Vehicles

In 2023, the global electric traction motor market also benefited significantly from favorable government policies and subsidies aimed at promoting electric vehicle adoption. Governments across various regions implemented robust regulatory frameworks, incentivizing consumers and automakers to transition towards cleaner transportation alternatives.

Substantial financial incentives, tax credits, and rebates for electric vehicle purchases incentivized consumers to opt for electric vehicles, thereby driving the demand for electric traction motors. Moreover, supportive infrastructure investments, including the expansion of charging networks, further bolstered market growth by alleviating range anxiety and enhancing the practicality of electric vehicles.

Growing Concerns Regarding Air Pollution Leading to Targets for Electric Vehicle Adoption

Furthermore, growing concerns regarding air pollution and its adverse environmental impacts propelled governments and regulatory bodies to set ambitious targets for electric vehicle adoption. In response to escalating pollution levels and the imperative to mitigate climate change, policymakers implemented stringent emission regulations and carbon reduction targets, thereby accelerating the transition towards electric mobility.

This regulatory push towards cleaner transportation solutions created a conducive environment for the electric traction motor market, fostering increased investments in research, development, and production of innovative electric propulsion technologies. Consequently, the electric traction motor market witnessed unprecedented growth opportunities in 2023, driven by the imperative to combat air pollution and achieve sustainability goals on a global scale.

Latest Trends

Implementation of Stringent Emission Regulations

In 2023, the global electric traction motor market witnessed a notable trend driven by the implementation of stringent emission regulations worldwide. With growing concerns over environmental degradation and climate change, governments and regulatory bodies intensified their efforts to combat air pollution by imposing stringent emission standards on vehicles.

As a result, automotive manufacturers were compelled to accelerate the adoption of electric vehicles (EVs) equipped with electric traction motors to meet the stringent regulatory requirements. This regulatory push acted as a catalyst for market growth, stimulating increased investments in electric propulsion technologies and encouraging innovation in motor design and efficiency.

Rising Demand for Lightweight and Compact Motors

Another prominent trend observed in the 2023 electric traction motor market was the escalating demand for lightweight and compact motors. As the automotive industry pivoted towards electric mobility, there was a growing emphasis on optimizing vehicle design to maximize energy efficiency and driving range. In response to this demand, electric traction motor manufacturers focused on developing compact and lightweight motors without compromising on performance.

These advancements in motor design not only facilitated the integration of electric propulsion systems into a wider range of vehicle models but also contributed to improving overall vehicle dynamics and handling. Moreover, lightweight motors offered advantages in terms of reduced energy consumption and enhanced vehicle efficiency, further driving their adoption in the electric vehicle market.

Regional Analysis

In the Asia Pacific region, the electric traction motor market commands a significant market share of 48.2%.

The global electric traction motor market is experiencing robust growth, with various regions contributing significantly to its expansion. In North America, the market is characterized by a steady adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), driven by stringent emission regulations and increasing consumer awareness regarding environmental sustainability. According to recent data from the International Energy Agency (IEA), North America accounted for approximately 25% of global EV sales in 2023, indicating a burgeoning market for electric traction motors.

In Europe, stringent emissions standards and government incentives are propelling the transition towards electric mobility. The European Union's commitment to achieving carbon neutrality by 2050 has led to ambitious targets for reducing greenhouse gas emissions from the transportation sector. As a result, the electric traction motor market in Europe is witnessing significant growth, with countries like Germany and Norway leading the way in EV adoption.

The Asia Pacific region emerges as the dominating force in the global electric traction motor market, capturing a substantial share of approximately 48.2%. Rapid urbanization, increasing disposable income, and supportive government policies promoting electric vehicle adoption are driving the market's growth in this region. Countries like China, Japan, and South Korea are at the forefront of electric mobility, with robust manufacturing ecosystems and a growing infrastructure for electric vehicles.

In the Middle East & Africa and Latin America, the electric traction motor market is nascent but promising. While the adoption of electric vehicles is relatively slower compared to other regions, initiatives aimed at reducing dependence on fossil fuels and mitigating air pollution are expected to drive market growth in these regions in the coming years. Overall, Asia Pacific remains the dominating region in the global electric traction motor market, with a commanding share of 48.2%, followed by Europe and North America.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Electric Traction Motor Market witnessed significant activity, with several key players vying for dominance and innovation within the industry. Among these players, several stood out for their strategic moves, technological advancements, and market positioning.

Schneider Electric SE demonstrated noteworthy growth, leveraging its expertise in energy management and automation solutions to offer efficient traction motor systems. Its focus on sustainability and digitalization aligned well with the industry's evolving needs.

The Curtiss-Wright Corporation made strides in developing compact and high-performance traction motors, catering to various applications such as rail transportation and industrial automation. Its emphasis on reliability and ruggedness resonated with customers seeking durable solutions.

Prodrive Technologies emerged as a dynamic player, disrupting the market with its innovative motor designs and integration capabilities. Its agility in customizing solutions to meet specific customer requirements contributed to its growing prominence.

Toshiba Corporation remained a stalwart in the market, leveraging its extensive experience in electrical systems to deliver reliable traction motors with advanced control features. Its commitment to research and development ensured a steady stream of innovative products.

General Electric Co. continued to be a major force, with its broad portfolio of traction motors catering to diverse sectors including rail, automotive, and marine. Its focus on efficiency and performance enhancement resonated well with customers seeking sustainable transportation solutions.

CG Power and Industrial Solutions Ltd. differentiated itself through its robust traction motor offerings, characterized by high power density and efficiency. Its global footprint and strong customer support infrastructure further bolstered its position in the market.

These key players, along with others such as Aisin, ABB Ltd., and Alstom S.A., collectively shaped the landscape of the global Electric Traction Motor Market in 2023, driving innovation and competitiveness in the pursuit of sustainable transportation solutions.

Market Key Players

- Schneider Electric SE

- The Curtiss-Wright Corporation

- Prodrive Technologies

- Toshiba Corporation

- General Electric Co.

- CG Power and Industrial Solutions Ltd.

- Aisin

- ABB, Ltd.

- Alstom S.A.

- Siemens AG

- Delphi Automotive LLP

- Voith GmbH

- Mitsubishi Electric Corporation

- Bombardier Inc.

- American Traction Systems

- VEM Group

- Caterpillar Inc.

- TTM Rail - Transtech Melbourne Pty Ltd.

- Kawasaki Heavy Industries Ltd.

- Traktionssysteme Austria GmbH

- Hyundai Rotem Company

- Hitachi, Ltd.

- Ansaldo Signalling

- Magna International

Recent Developement

- In April 2024, Jaguar Land Rover unveils a fully electric Range Rover with innovative traction control, and matching ICE performance. Prototypes were tested in extreme climates. 800V architecture, V8-level performance, promises superior towing and off-road capabilities.

- In March 2024, Energy Efficiency Services Limited (EESL) launched the National Motor Replacement Programme (NMRP), aiming to finance the voluntary replacement of inefficient motors with IE3 motors, fostering energy conservation and efficiency in industries.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Billion Forecast Revenue (2033) USD 58.1 Billion CAGR (2024-2032) 22.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type(Plug-in Hybrid Electric Vehicles, Mild Hybrid Vehicles, Full Hybrid Vehicles), By Type(AC, DC), By Power Rating(Below 200 KW, 200 KW To 400 KW, Above 400 KW), By Application(Railways, Electric Vehicles, Elevators, Conveyors, Industrial Machinery, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Schneider Electric SE, The Curtiss-Wright Corporation, Prodrive Technologies, Toshiba Corporation, General Electric Co., CG Power and Industrial Solutions Ltd., Aisin, ABB, Ltd., Alstom S.A., Siemens AG, Delphi Automotive LLP, Voith GmbH, Mitsubishi Electric Corporation, Bombardier Inc., American Traction Systems, VEM Group, Caterpillar Inc., TTM Rail - Transtech Melbourne Pty Ltd., Kawasaki Heavy Industries Ltd., Traktionssysteme Austria GmbH, Hyundai Rotem Company, Hitachi, Ltd., Ansaldo Signalling, Magna International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Schneider Electric SE

- The Curtiss-Wright Corporation

- Prodrive Technologies

- Toshiba Corporation

- General Electric Co.

- CG Power and Industrial Solutions Ltd.

- Aisin

- ABB, Ltd.

- Alstom S.A.

- Siemens AG

- Delphi Automotive LLP

- Voith GmbH

- Mitsubishi Electric Corporation

- Bombardier Inc.

- American Traction Systems

- VEM Group

- Caterpillar Inc.

- TTM Rail - Transtech Melbourne Pty Ltd.

- Kawasaki Heavy Industries Ltd.

- Traktionssysteme Austria GmbH

- Hyundai Rotem Company

- Hitachi, Ltd.

- Ansaldo Signalling

- Magna International