Global Automated Material Handling Market By Type(Automated Storage & Retrieval System, Automated Conveyor & Sorting System, Automated Guided Vehicle), By System Load(Unit Load, Bulk Load), By Application(Assembly, Distribution, Transportation, Packaging, Others (Sorting)), By Industry(E-Commerce, Automotive, Food & Beverages, Pharmaceutical, Aviation, Semiconductors & Electronics, Others (Chemicals)), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46098

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

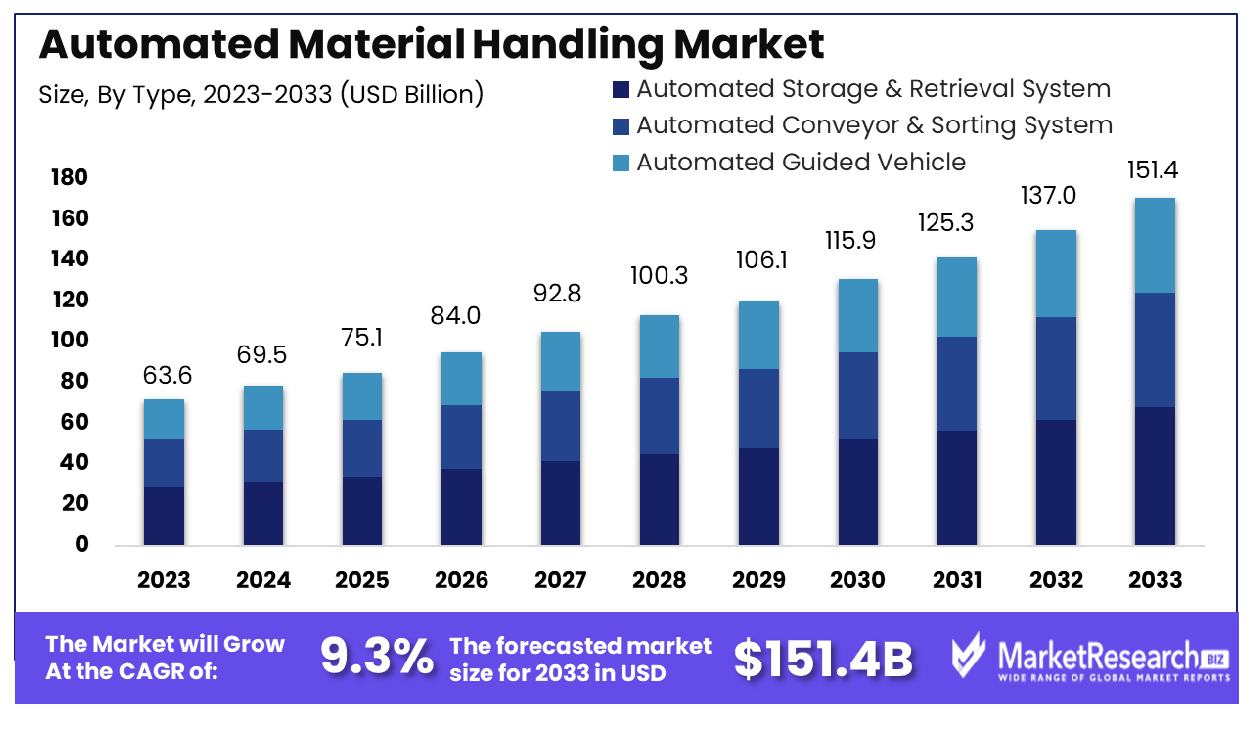

The Global Automated Material Handling Market was valued at USD 63.6 billion in 2023. It is expected to reach USD 151.4 billion by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

The Automated Material Handling Market encompasses a dynamic sector focused on the implementation of advanced technologies to streamline and optimize the movement, storage, and control of materials within manufacturing, logistics, and distribution facilities. This market segment revolves around the deployment of automated systems such as robotics, conveyors, and warehouse management software to enhance operational efficiency, minimize manual intervention, and reduce costs.

As industries increasingly embrace automation to meet growing demands for productivity and accuracy, the Automated Material Handling Market offers strategic opportunities for product managers to stay competitive by integrating cutting-edge solutions into their supply chain operations.

The Automated Material Handling Market stands as a pivotal arena in modern industry, emblematic of the transformative power of automation. With relentless technological advancements, this market segment is witnessing exponential growth, driven by the imperative for enhanced efficiency, accuracy, and cost-effectiveness in material handling operations.

The integration of robotics, artificial intelligence, and advanced software solutions has revolutionized traditional warehouse and logistics paradigms, offering unprecedented levels of optimization and scalability. Furthermore, the escalating demand for seamless supply chain management in the face of burgeoning e-commerce and global trade has propelled the Automated Material Handling Market into a position of paramount importance.

As forecasted, the warehouse automation market is poised to soar, potentially breaching the USD 30 billion mark by 2026, underpinning the robust trajectory of automation adoption across industries. Concurrently, the bulk material handling equipment sector is projected to reach USD 10.84 billion by the same year, attesting to the substantial investments pouring into modernizing material handling infrastructure worldwide.

In essence, the Automated Material Handling Market represents not only a convergence of cutting-edge technologies but also a strategic imperative for businesses seeking to fortify their competitive edge in an era defined by agility and efficiency.

Key Takeaways

- Market Growth: The Global Automated Material Handling Market was valued at USD 63.6 billion in 2023. It is expected to reach USD 151.4 billion by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

- By Type: Automated Conveyor & Sorting System dominated the market with a 43% share.

- By System Load: Unit Load was the leading system load category in the market.

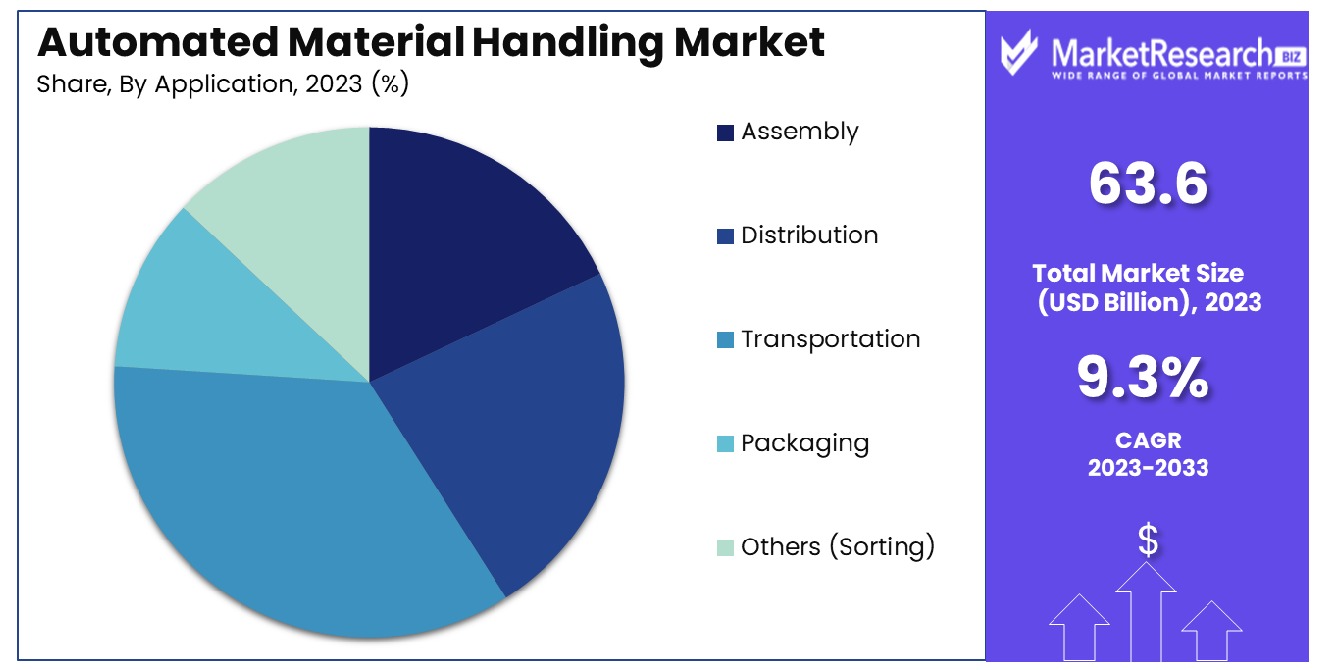

- By Application: Distribution applications led the market, dominating the application segment.

- By Industry: The E-commerce industry held the dominant position in the market.

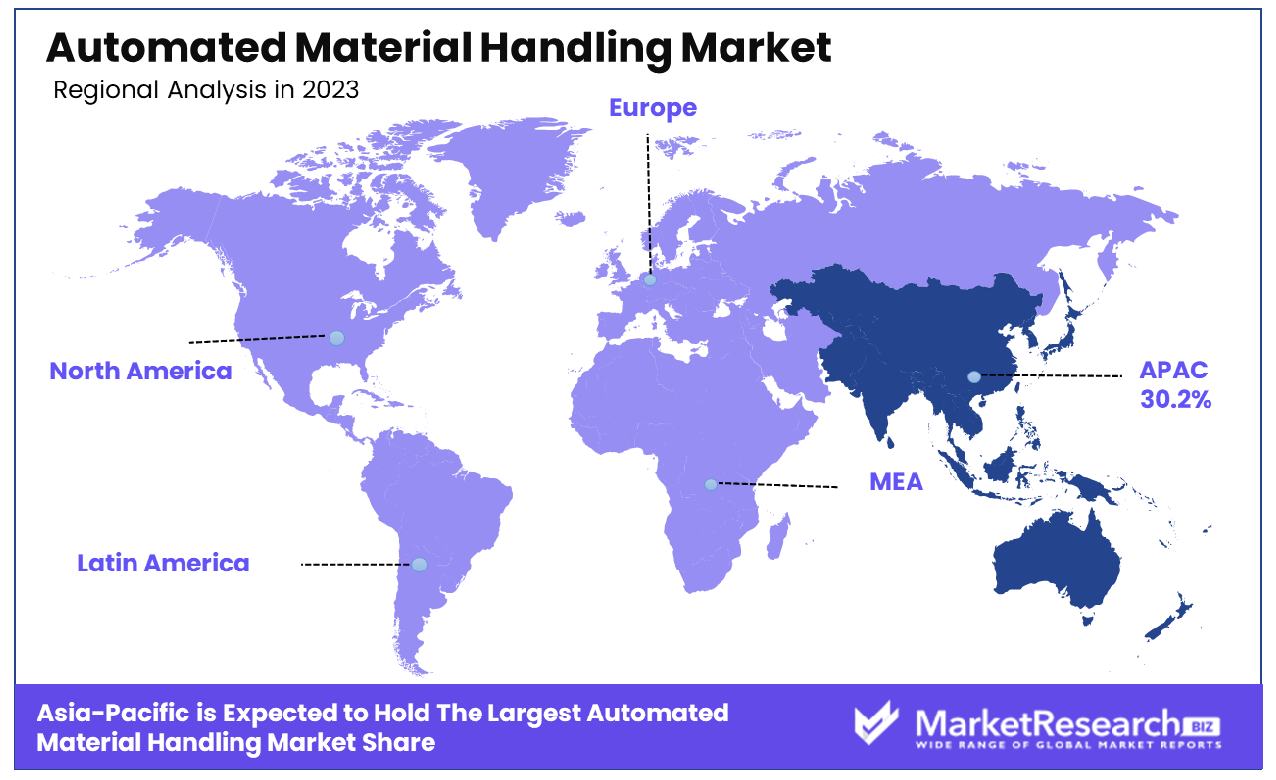

- Regional Dominance: The Automated Material Handling market in Asia Pacific holds a significant share of 30.2%.

- Growth Opportunity: The 2023 growth of the global Automated Material Handling market is driven by the expansion of automotive assembly lines and advancements in robotics and AI, enhancing efficiency, precision, and operational agility.

Driving factors

Technological Advancements in Automation and Material Handling Systems

The Automated Material Handling (AMH) Market is significantly driven by technological advancements in automation and material handling systems. Innovations such as robotic systems, automated guided vehicles (AGVs), and sophisticated software solutions enhance the efficiency and accuracy of material handling processes.

For instance, the integration of the Internet of Things (IoT) and Artificial Intelligence (AI) has led to the development of intelligent systems capable of real-time decision-making and predictive maintenance. These advancements reduce downtime, optimize workflow, and increase overall operational efficiency, making them highly attractive to industries looking to streamline their supply chains.

Rising Labor Costs and Safety Concerns Driving the Need for Automation

Rising labor costs and increasing safety concerns are pivotal factors propelling the demand for automation in material handling. The global increase in wages, coupled with stringent labor regulations, has made manual labor more expensive and less feasible for many industries.

Moreover, the focus on workplace safety has intensified, prompting businesses to adopt automated systems that minimize human intervention in hazardous environments. Automation not only reduces labor costs but also enhances safety by mitigating the risk of workplace injuries.

Growing Efficiency and Productivity of Manufacturing and Warehouse Operations

The pursuit of greater efficiency and productivity in manufacturing and warehouse operations is a crucial driver of the AMH market. Automated systems facilitate faster and more accurate handling of materials, leading to streamlined operations and improved throughput.

The use of automated storage and retrieval systems (AS/RS), for example, can double the speed of material handling processes compared to manual methods. This boost in efficiency translates into higher productivity, enabling companies to meet increasing demand without proportionate increases in labor or operational costs.

Restraining Factors

High Initial Investment Required

The high initial investment required for the implementation of Automated Material Handling (AMH) systems is a significant restraining factor for market growth. The costs associated with purchasing, installing, and integrating these advanced systems can be substantial, posing a barrier for many small and medium-sized enterprises (SMEs). For instance, the initial capital expenditure for automated systems, such as robotic arms, automated guided vehicles (AGVs), and advanced software, can range from hundreds of thousands to millions of dollars, depending on the complexity and scale of the operations.

This financial burden can deter businesses from adopting AMH solutions, especially in industries with tight budget constraints. Despite the long-term benefits and cost savings associated with automation, the upfront investment remains a critical hurdle. Research indicates that nearly 40% of potential adopters cite high costs as the primary reason for delaying or avoiding investment in AMH systems, thereby limiting the market's growth potential.

Lack of Skilled Labor to Operate and Maintain Systems

The shortage of skilled labor to operate and maintain automated material handling systems further restrains market growth. As automation technology becomes more sophisticated, the demand for workers with specialized skills in robotics, software programming, and system maintenance increases. However, there is a notable gap in the availability of such skilled labor, making it challenging for companies to effectively deploy and manage AMH systems.

This lack of expertise can lead to operational inefficiencies, increased downtime, and higher maintenance costs, thereby reducing the overall attractiveness of automation investments. For example, it is estimated that the demand for skilled technicians in the automation sector will grow by 15% annually, yet the supply of qualified individuals is not keeping pace, creating a bottleneck for market expansion.

By Type Analysis

The Automated Conveyor & Sorting System dominated the market, accounting for 43% of the share.

In 2023, Automated Conveyor & Sorting Systems held a dominant market position in the "By Type" segment of the Automated Material Handling Market, capturing more than a 43% share. This segment was characterized by its significant contribution to streamlining logistics and warehouse operations. The increasing adoption of e-commerce and the need for efficient order fulfillment processes have driven the demand for these systems. They offer enhanced speed, accuracy, and cost-effectiveness, making them indispensable in modern warehousing and distribution centers.

Automated Storage & Retrieval Systems (AS/RS) also held a substantial market share, driven by the need for optimized storage solutions. AS/RS systems are increasingly adopted for their ability to enhance space utilization, reduce labor costs, and improve inventory management. These systems are particularly favored in industries requiring high-density storage and rapid retrieval of goods, such as manufacturing, pharmaceuticals, and food & beverage sectors. The growing emphasis on automation and the rising trend of smart warehouses have further fueled the adoption of AS/RS, contributing significantly to the market's overall growth.

Automated Guided Vehicles (AGVs) accounted for a notable portion of the market as well. AGVs are pivotal in facilitating material transport within facilities, offering flexibility and efficiency in handling repetitive tasks. Their usage spans various industries, including automotive, healthcare, and retail, where they support just-in-time (JIT) production systems and enhance operational efficiency. The increasing integration of advanced technologies, such as artificial intelligence and machine learning, into AGVs is expected to drive their adoption, enabling more intelligent navigation and decision-making capabilities.

The Automated Material Handling Market's growth can be attributed to technological advancements, increasing labor costs, and the need for enhanced productivity and safety in material handling processes. These systems not only streamline operations but also provide a competitive edge by reducing operational costs and improving overall efficiency. As industries continue to prioritize automation and digital transformation, the market for automated material handling systems is poised for substantial growth in the coming years.

By System Load Analysis

The Unit Load system load category dominated, capturing the majority of the market share.

In 2023, Unit Load held a dominant market position in the "By System Load" segment of the Automated Material Handling Market, capturing a significant share. This segment's prominence can be attributed to its widespread use in various industries, including automotive, electronics, and retail. Unit load systems are designed to handle large, palletized loads, making them ideal for industries where heavy or bulky items are common. These systems enhance operational efficiency by facilitating the smooth movement of goods within warehouses and distribution centers, thus reducing labor costs and minimizing manual handling.

The adoption of unit load systems has been driven by the growing need for efficient storage and retrieval solutions. With the rise of e-commerce and the increasing demand for rapid order fulfillment, companies are investing in automated solutions that can handle high volumes of goods with precision and speed. Unit load systems, including automated storage and retrieval systems (AS/RS) and automated guided vehicles (AGVs), provide the necessary capabilities to meet these demands, contributing to their market dominance.

Bulk Load systems, although holding a smaller share compared to unit load systems, play a crucial role in industries where handling loose materials, such as grains, chemicals, and minerals, is essential. Bulk load systems are designed to transport large quantities of materials efficiently, ensuring smooth operations in industries such as agriculture, mining, and construction. The need for automation in these sectors to improve safety, reduce labor costs, and increase productivity has led to a steady adoption of bulk load systems.

The Automated Material Handling Market's growth is fueled by the increasing focus on automation, technological advancements, and the need for improved operational efficiency across various industries. Both unit load and bulk load systems offer significant benefits, and their adoption is expected to rise as industries continue to seek solutions that enhance productivity and reduce operational costs. The market is poised for substantial growth, driven by the ongoing trend toward automation and the digital transformation of material handling processes.

By Application Analysis

The Distribution application dominated the market, reflecting its critical role in logistics operations.

In 2023, Distribution held a dominant market position in the "By Application" segment of the Automated Material Handling Market, capturing a substantial share. This segment's leading position can be attributed to the increasing demand for efficient and rapid logistics operations driven by the exponential growth of e-commerce and the need for timely delivery of goods. Automated systems in distribution centers significantly enhance throughput, accuracy, and overall efficiency, making them indispensable for modern logistics operations.

Distribution applications leverage automated storage and retrieval systems (AS/RS), automated guided vehicles (AGVs), and conveyor systems to streamline processes such as order picking, sorting, and shipping. These systems reduce manual labor, minimize errors, and increase the speed of order fulfillment, addressing the critical needs of retailers and e-commerce giants striving to meet consumer expectations for fast delivery.

Assembly applications also held a significant market share, particularly in the automotive and electronics industries. Automated material handling systems in assembly lines ensure precision, consistency, and efficiency, facilitating the production of complex products with high quality and minimal downtime. These systems support just-in-time (JIT) manufacturing processes and enhance overall productivity by integrating seamlessly with production lines.

Transportation applications, encompassing the movement of goods within facilities and between different production stages, saw considerable adoption. Automated transport systems such as AGVs and conveyors improve operational efficiency and reduce the risk of damage during transport. They are crucial in sectors requiring the continuous flow of materials, including manufacturing and warehousing.

Packaging applications, driven by the need for high-speed, accurate, and flexible packaging solutions, also contributed significantly to the market. Automated packaging systems reduce labor costs, enhance packaging precision, and accommodate various packaging formats and sizes, meeting the diverse needs of industries such as food and beverage, pharmaceuticals, and consumer goods.

The "Others" category, including sorting applications, plays a vital role in industries requiring precise sorting of products, such as logistics and postal services. Automated sorting systems enhance accuracy and speed, ensuring efficient processing of high volumes of goods.

The growth of the Automated Material Handling Market is driven by the increasing adoption of automation technologies, rising labor costs, and the need for improved efficiency and productivity across various applications. As industries continue to prioritize automation and digital transformation, the market for automated material handling systems is expected to expand significantly in the coming years.

By Industry Analysis

The E-Commerce industry led the market, driven by increasing online shopping and fulfillment needs.

In 2023, E-Commerce held a dominant market position in the "By Industry" segment of the Automated Material Handling Market, capturing a substantial share. The e-commerce sector's leading position can be attributed to the explosive growth in online shopping, which has necessitated the adoption of advanced automated material handling systems to manage the high volume of orders, streamline logistics, and ensure timely deliveries. These systems, including automated storage and retrieval systems (AS/RS), automated guided vehicles (AGVs), and conveyor systems, enhance operational efficiency by speeding up order processing, improving accuracy, and reducing labor costs.

The automotive industry also accounted for a significant market share, driven by the need for automation in manufacturing and assembly processes. Automated material handling systems in the automotive sector ensure precise handling of components, streamline production lines, and support just-in-time (JIT) manufacturing, leading to increased productivity and reduced operational costs. The integration of robotics and automated systems in automotive manufacturing plants has become essential to maintain competitiveness and meet the high demand for vehicles.

The food & beverages sector has increasingly adopted automated material handling systems to enhance efficiency, maintain hygiene standards, and comply with stringent regulatory requirements. These systems facilitate the handling, storage, and transportation of perishable goods, ensuring product quality and safety.

In the pharmaceutical industry, the adoption of automated material handling systems is driven by the need for precision, accuracy, and compliance with regulatory standards. These systems ensure the efficient handling and storage of sensitive products, improve inventory management and enhance overall operational efficiency.

The aviation industry utilizes automated material handling systems to manage baggage handling, cargo logistics, and maintenance operations. These systems improve operational efficiency, reduce turnaround times, and enhance passenger satisfaction.

The semiconductors & electronics sector relies on automated material handling systems to manage the complex and precise handling of components. These systems support high-volume production, ensure product quality, and improve manufacturing efficiency.

The "Others" category, including the chemicals industry, also saw significant adoption of automated material handling systems. These systems enhance safety, improve handling efficiency, and reduce the risk of contamination in handling hazardous materials.

The growth of the Automated Material Handling Market across these industries is driven by the increasing focus on automation, technological advancements, and the need for enhanced efficiency and productivity. As industries continue to prioritize automation and digital transformation, the market for automated material handling systems is expected to witness substantial growth in the coming years.

Key Market Segments

By Type

- Automated Storage & Retrieval System

- Automated Conveyor & Sorting System

- Automated Guided Vehicle

By System Load

- Unit Load

- Bulk Load

By Application

- Assembly

- Distribution

- Transportation

- Packaging

- Others (Sorting)

By Industry

- E-Commerce

- Automotive

- Food & Beverages

- Pharmaceutical

- Aviation

- Semiconductors & Electronics

- Others (Chemicals)

Growth Opportunity

Expansion of Automotive Assembly Lines

The expansion of automotive assembly lines is a significant growth driver for the global automated material handling (AMH) market in 2023. The automotive industry, characterized by its high production volumes and stringent quality standards, increasingly relies on automated systems to enhance efficiency and reduce errors.

As automotive manufacturers scale up operations to meet rising consumer demand and introduce new models, the adoption of AMH systems, including automated guided vehicles (AGVs), conveyor systems, and robotic arms, has become imperative. These systems facilitate the seamless movement of parts and components through various stages of production, ensuring precision and speed.

Additionally, the integration of AMH solutions in automotive assembly lines helps minimize downtime, optimize labor costs, and maintain consistent product quality. This trend is particularly evident in regions with strong automotive manufacturing bases, such as North America, Europe, and Asia-Pacific, where investments in automation are driving substantial market growth.

Technological Advancements in Robotics and AI

Technological advancements in robotics and artificial intelligence (AI) are pivotal in propelling the global AMH market forward in 2023. Innovations in AI and machine learning have significantly enhanced the capabilities of AMH systems, enabling them to perform complex tasks with higher accuracy and efficiency.

Advanced robotics, equipped with AI-driven vision systems and sensors, can now handle a diverse range of materials, adapt to dynamic environments, and make real-time decisions, thereby improving operational agility. These technological improvements are particularly beneficial in warehousing and logistics, where precision and speed are crucial.

The adoption of AI-powered robotics facilitates better inventory management, faster order fulfillment, and reduced operational costs. As companies across various sectors recognize the benefits of these advanced systems, the demand for AMH solutions is expected to rise, contributing to the market's robust growth trajectory.

Latest Trends

Expansion of Automated Guided Vehicles (AGVs) in Manufacturing and Distribution

The expansion of automated guided vehicles (AGVs) is a key trend shaping the global automated material handling (AMH) market in 2023. AGVs, which include various types such as tow vehicles, unit load carriers, and assembly line vehicles, are increasingly being deployed in manufacturing and distribution environments due to their flexibility and efficiency.

In manufacturing, AGVs enhance productivity by automating the transportation of materials and components between workstations, reducing the reliance on manual labor and minimizing production downtime. In distribution centers, AGVs streamline warehouse operations by optimizing the movement of goods, improving inventory accuracy, and accelerating order fulfillment processes.

The integration of AGVs with warehouse management systems (WMS) and enterprise resource planning (ERP) systems further enhances their utility, allowing for seamless coordination and real-time data tracking. As companies seek to improve operational efficiency and reduce costs, the adoption of AGVs is expected to rise, contributing to the growth of the AMH market.

Focus on Sustainability with Energy-Efficient Automated Systems

A growing focus on sustainability and energy efficiency is another prominent trend in the 2023 AMH market. Companies are increasingly prioritizing the implementation of energy-efficient automated systems to reduce their carbon footprint and comply with stringent environmental regulations.

Innovations in energy-efficient technologies, such as regenerative drives and low-power consumption motors, are being incorporated into AMH solutions, enabling significant energy savings. Additionally, the development of solar-powered AGVs and automated systems utilizing renewable energy sources is gaining traction.

These advancements not only support environmental sustainability but also result in substantial cost savings over the long term. The emphasis on sustainability is driving manufacturers and logistics providers to invest in green automation technologies, thereby fostering the growth of the global AMH market. As environmental concerns continue to rise, the trend toward energy-efficient and sustainable automated systems is expected to become increasingly significant.

Regional Analysis

The Automated Material Handling market in Asia Pacific holds a significant share of 30.2%.

The automated material handling market exhibits significant regional variations, driven by distinct economic activities, industrial automation adoption rates, and technological advancements. In North America, the market is propelled by the robust presence of key industries such as automotive, e-commerce, and manufacturing, supported by high investments in automation technologies.

The region accounted for a substantial share of the global market, with the United States being a major contributor due to its advanced technological infrastructure and substantial R&D investments. In 2023, North America's market share was approximately 28.5%, reflecting steady growth driven by the need for efficient supply chain solutions.

Europe follows closely, characterized by strong industrial bases in countries like Germany, France, and the UK. The region's emphasis on Industry 4.0 and smart manufacturing has spurred the adoption of automated material handling systems. Europe held a significant market share of 27.1% in 2023, with Germany leading the charge owing to its advanced manufacturing sector and early adoption of automation technologies.

Asia Pacific emerges as the dominant region, capturing the largest market share at 30.2%. The rapid industrialization, burgeoning e-commerce sector, and substantial investments in infrastructure development in countries like China, Japan, and India drive this growth. China, in particular, plays a pivotal role due to its massive manufacturing base and strategic initiatives to enhance industrial automation.

In the Middle East & Africa, the market is witnessing gradual growth, primarily driven by the expanding logistics sector and increased investments in automation to enhance operational efficiencies. The region's market share stood at 8.5% in 2023, with the UAE and Saudi Arabia being key contributors.

Latin America, with a market share of 5.7%, is experiencing growth fueled by the expanding automotive and e-commerce sectors, particularly in Brazil and Mexico. The adoption of automated material handling solutions in these countries is driven by the need to improve supply chain efficiency and reduce operational costs.

Overall, the Asia Pacific region dominates the global automated material handling market, accounting for 30.2% of the market share, reflecting its leading position in industrial automation and manufacturing advancements.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The automated material handling (AMH) market has seen significant advancements in 2023, driven by key players such as Daifuku, Kion, SSI Schaefer, Honeywell International, Toyota Material Handling, Hyster-Yale Material Handling, Jungheinrich, Hanwha, JBT, and KUKA.

Daifuku has maintained its leadership position through continuous innovation in warehouse automation solutions, enhancing efficiency and reducing operational costs for clients globally. Kion has expanded its market share by leveraging its robust portfolio of automated guided vehicles (AGVs) and warehouse management systems, catering to the rising demand for streamlined supply chain operations.

SSI Schaefer has focused on modular and scalable AMH solutions, making it a preferred choice for companies seeking flexibility and future-proofing capabilities. Honeywell International's investments in advanced robotics and AI-driven systems have solidified its presence in the market, particularly in the e-commerce and logistics sectors where speed and accuracy are paramount.

Toyota Material Handling has strengthened its foothold with its comprehensive range of automated forklifts and integrated solutions, addressing diverse material handling needs across industries. Hyster-Yale Material Handling has emphasized reliability and durability in its AMH offerings, appealing to heavy-duty industries requiring robust automation.

Jungheinrich's expertise in intralogistics and intelligent automation solutions has positioned it as a key player in optimizing warehouse efficiency. Hanwha has made strides in integrating smart technologies into its AMH products, enhancing operational intelligence and decision-making capabilities.

JBT has expanded its market presence through innovative automated systems designed for the food and beverage industry, ensuring high standards of safety and hygiene. KUKA's advanced robotics and flexible automation solutions have continued to drive growth, particularly in the automotive and manufacturing sectors.

In summary, the competitive landscape of the AMH market in 2023 is characterized by innovation, strategic investments, and a focus on meeting the evolving needs of various industries. The leading companies have leveraged their technological capabilities to enhance efficiency, flexibility, and sustainability in material handling operations.

Market Key Players

- Daifuku

- Kion

- SSI Schaefer

- Honeywell International

- Toyota Material Handling

- Hyster-Yale Material Handling

- Jungheinrich

- Hanwha

- JBT

- KUKA

Recent Development

- In April 2024, Recent developments in material handling systems for pet food processing emphasize flexibility, data management, and automation. Companies like Sterling Systems & Controls and NorthWind Technical Services lead innovations in this sector.

- In April 2024, ESCATEC enhances operational efficiency by deploying PUDU Robotics material handling robots in Malaysian factories, optimizing routes and reducing manpower. CEO Charles-Alexandre Albin emphasizes commitment to manufacturing innovation.

- In February 2024, Dorner introduces material handling innovations at Pack Expo East 2024, including ERT150 for cleanroom assembly, FlexMove Wedge Conveyors, AquaGard GT for food lines, and AGLP conveyor for tight spaces. Partnering with Garvey.

Report Scope

Report Features Description Market Value (2023) USD 63.6 Billion Forecast Revenue (2033) USD 151.4 Billion CAGR (2024-2032) 9.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Automated Storage & Retrieval System, Automated Conveyor & Sorting System, Automated Guided Vehicle), By System Load(Unit Load, Bulk Load), By Application(Assembly, Distribution, Transportation, Packaging, Others (Sorting)), By Industry(E-Commerce, Automotive, Food & Beverages, Pharmaceutical, Aviation, Semiconductors & Electronics, Others (Chemicals)) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Daifuku, Kion, SSI Schaefer, Honeywell International, Toyota Material Handling, Hyster-Yale Material Handling, Jungheinrich, Hanwha, JBT, KUKA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Daifuku

- Kion

- SSI Schaefer

- Honeywell International

- Toyota Material Handling

- Hyster-Yale Material Handling

- Jungheinrich

- Hanwha

- JBT

- KUKA