Smart Homes Systems Market By Application (New Construction and Retrofit), By Product (Light Control, Security And Access Control, HVAC Control, Entertainment Control, Smart Speaker, Home Healthcare, Smart Kitchen, Home Appliance, Home Furniture), By Sales Channel (Direct and Indirect), By Protocol (Wired, Wireless, Hybrid), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47841

-

June 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

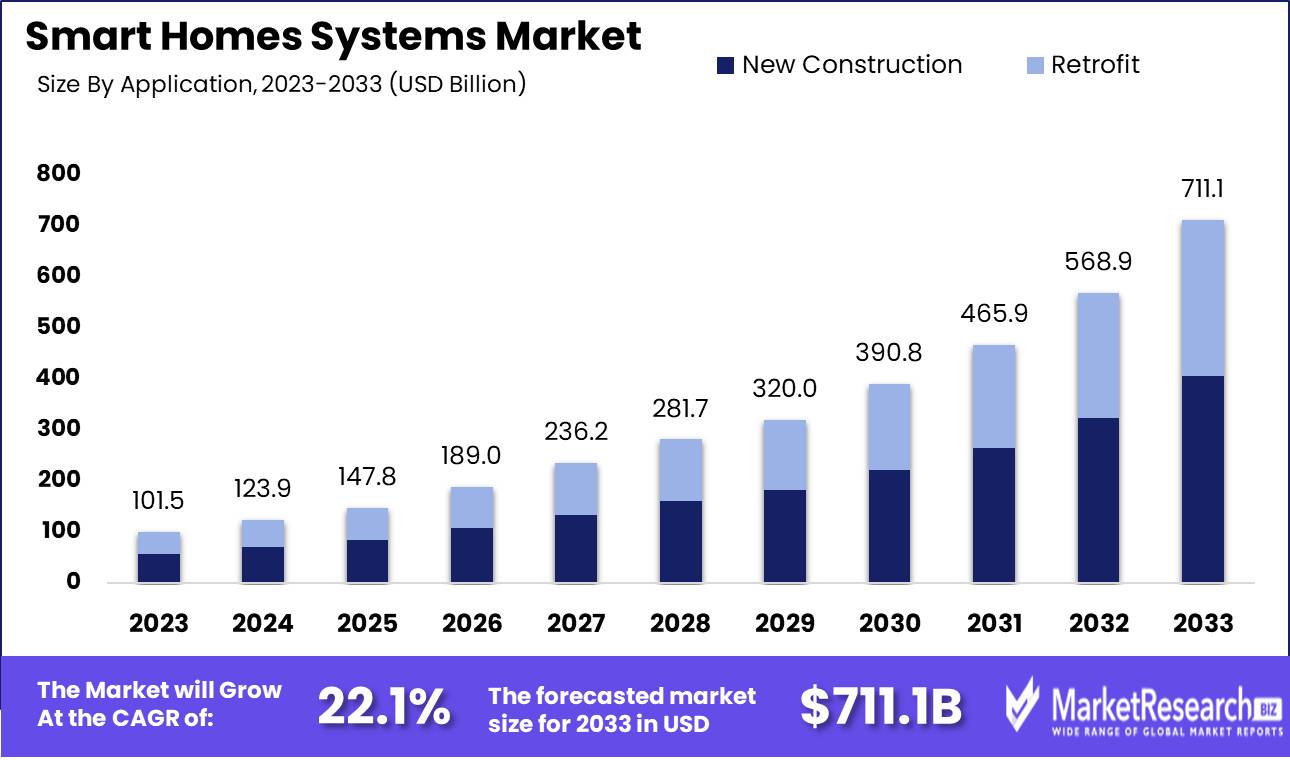

The Smart Homes Systems Market was valued at USD 101.5 billion in 2023. It is expected to reach USD 711.1 billion by 2033, with a CAGR of 22.1% during the forecast period from 2024 to 2033.

The Smart Home Systems Market encompasses integrated home automation solutions that enable the centralized control and remote management of home functions such as lighting, climate, security, entertainment, and appliances. Leveraging technologies like the Internet of Things (IoT), artificial intelligence (AI), and voice assistants, these systems enhance convenience, energy efficiency, and security. Key market drivers include the increasing adoption of connected devices, rising consumer demand for energy-efficient solutions, and advancements in wireless communication technologies.

The smart home systems market is poised for significant growth, driven by continuous innovations in the Internet of Things (IoT) and artificial intelligence (AI). These advancements have led to the development of more sophisticated and user-friendly smart home devices, enhancing their appeal to a broader consumer base. Integrating AI and machine learning into smart home systems is particularly transformative, as it enables devices to become more intuitive and efficient. For instance, smart thermostats can learn a household's temperature preferences and adjust settings automatically, while AI-powered security systems can differentiate between routine and suspicious activities, providing enhanced safety.

Despite these technological advancements, the high cost of smart home devices and their installation remains a substantial barrier to widespread adoption. This cost factor is particularly pronounced in emerging markets, where disposable incomes are lower, and price sensitivity is higher. However, as technology advances and economies of scale are achieved, it is anticipated that prices will decrease, making these systems more accessible to a larger demographic.

From a strategic standpoint, companies operating in the smart home systems market must navigate these challenges and opportunities with a nuanced approach. Investment in research and development to foster further innovations in AI and IoT will be critical for maintaining competitive advantage. Additionally, partnerships with financial institutions to offer affordable financing options or with governments for subsidies could mitigate the cost barrier. Market players should also focus on consumer education to highlight the long-term cost savings and enhanced quality of life offered by smart home systems. In this evolving landscape, those companies that can balance innovation with cost-effectiveness will likely lead the market, tapping into the growing consumer demand for smart, connected living environments.

Key Takeaways

- Market Growth: The Smart Homes Systems Market was valued at USD 101.5 billion in 2023. It is expected to reach USD 711.1 billion by 2033, with a CAGR of 22.1% during the forecast period from 2024 to 2033.

- By Application: New Construction dominated Smart Home Systems over Retrofit.

- By Product: Light Control dominated the Smart Homes Systems Market segments.

- By Sales Channel: Direct Sales dominated the Smart Homes Systems market.

- By Protocol: Wired Systems dominated smart homes for stability and security.

- Regional Dominance: North America dominates the Smart Home Systems Market with a 35% share.

- Growth Opportunity: The convergence of next-generation voice assistants and AR-powered smart devices will significantly reshape and drive growth in the smart home systems market.

Driving factors

Stay-at-Home Mandates and Work From Home: Catalysts for Smart Home Adoption

The global shift towards remote work and stay-at-home mandates, primarily driven by the COVID-19 pandemic, has significantly accelerated the adoption of smart home systems. With increased time spent at home, consumers are investing more in their living environments to enhance comfort, productivity, and security. According to recent industry reports, the smart home systems market witnessed a surge of approximately 20% in sales during the pandemic, underlining this trend.

The demand for smart home technologies such as automated lighting, climate control, and enhanced security systems has risen as individuals seek to create multifunctional living spaces that accommodate personal and professional needs. This shift has also led to the integration of advanced communication tools and smart office setups within homes, driving the market forward. Consequently, the stay-at-home mandates and work-from-home arrangements have not only boosted immediate sales but are also fostering long-term consumer interest in maintaining a smart, efficient home environment.

Convenience: Unified Control Enhances User Experience and Market Appeal

The convenience offered by smart home systems, allowing control of multiple devices from a single location, is a significant driver of market growth. This unified control is often facilitated through centralized platforms or apps, which streamline the management of home functions such as lighting, security, HVAC systems, and entertainment. The ability to operate these systems effortlessly enhances the user experience, making smart home technologies more appealing to a broader consumer base.

For instance, smart home hubs and voice-controlled assistants like Amazon Echo and Google Home have seen widespread adoption due to their ability to integrate various devices seamlessly. Market research indicates that homes equipped with smart hubs have a higher likelihood of expanding their smart device ecosystems, contributing to a compound annual growth rate (CAGR) of over 25% in the smart home market. The convenience factor not only simplifies daily routines but also offers a compelling value proposition that drives market penetration and consumer loyalty.

Easy Upgrades: Adaptability Drives Continuous Market Expansion

The adaptability and ease of upgrading smart home technologies play a pivotal role in sustaining market growth. Smart home systems are designed to be flexible, allowing for the integration of new devices and technologies without significant overhauls. This modular approach ensures that consumers can continuously enhance and expand their smart home capabilities, fostering an ongoing market demand.

For example, the ability to add new smart sensors, cameras, or lighting solutions without replacing existing systems lowers the barrier for consumers to invest in upgrades. This adaptability also aligns with the rapid technological advancements in the Internet of Things (IoT) sector, ensuring that smart home systems remain relevant and capable of incorporating the latest innovations. Industry forecasts suggest that the ease of upgrades will contribute to a sustained growth rate, with projections indicating a market size expansion to over $150 billion by 2025.

Restraining Factors

High Initial Cost of Installation and Setup: A Major Barrier to Adoption

The high initial cost of installation and setup is a significant restraining factor for the growth of the Smart Home Systems Market. This includes the expense of purchasing smart devices, professional installation fees, and the potential need for infrastructure upgrades in older homes. According to market data, the average cost of setting up a comprehensive smart home system can range from $1,000 to $5,000, depending on the number of devices and the level of integration required. This financial barrier is particularly pronounced in emerging markets and among middle-income households, which are less able to absorb these upfront costs.

High costs deter potential customers, slowing market penetration rates and limiting the customer base to higher-income segments. This restricts overall market growth, as the widespread adoption necessary to drive significant revenue expansion is hindered. Additionally, the perceived return on investment for these systems can be unclear to consumers, who may not see immediate or substantial savings on energy bills or significant improvements in quality of life to justify the expense.

Complexity of Use and Technical Know-How Required: Impeding User Adoption and Satisfaction

The complexity of use and the technical know-how required to operate smart home systems represent another critical restraining factor. Many consumers find the setup and daily operation of smart home devices to be challenging, particularly when dealing with advanced configurations or integrating multiple devices from different manufacturers. This complexity can lead to user frustration and dissatisfaction, reducing the likelihood of positive word-of-mouth recommendations and repeat purchases.

Technical challenges also increase the reliance on professional services for installation and troubleshooting, further raising the total cost of ownership. For instance, the need for ongoing technical support and the difficulty in resolving issues independently can discourage less tech-savvy consumers from adopting smart home technologies. A survey by Parks Associates indicates that 31% of smart home device owners have experienced technical problems, underscoring the prevalence of these issues.

By Application Analysis

In 2023, New Construction dominated Smart Home Systems over Retrofit.

In 2023, New Construction held a dominant market position in the By Application segment of the Smart Homes Systems Market. The integration of advanced smart technologies during the construction phase offers significant advantages, such as seamless incorporation of energy management systems, security solutions, and home automation features. This early-stage integration leads to cost efficiencies and ensures a cohesive smart home infrastructure, driving preference among homeowners and developers alike. The increasing demand for sustainable and energy-efficient homes further propels this segment, as new constructions can more readily adopt green building standards and smart energy solutions from the ground up.

Retrofit, while significant, lags behind due to the complexities and higher costs associated with upgrading existing infrastructures. However, it remains a crucial segment, particularly in mature markets with extensive older housing stocks. Retrofitting allows homeowners to modernize their homes with the latest smart technologies, enhancing convenience and energy efficiency. Despite its challenges, the retrofit segment is expected to grow steadily, supported by rising consumer awareness and government incentives aimed at promoting smart home upgrades. Both segments are vital for the overall growth and diversification of the Smart Homes Systems Market.

By Product Analysis

In 2023, Light Control dominated the Smart Homes Systems Market segments.

In 2023, Light Control held a dominant market position in the Smart Homes Systems Market's By Product segment. This preeminence is attributed to the increasing adoption of energy-efficient solutions and the growing consumer inclination towards automated lighting systems. As a critical component of smart home technology, Light Control systems integrate with voice-activated assistants and mobile applications, offering users enhanced convenience and energy savings.

Security and Access Control systems follow closely, driven by rising security concerns and technological advancements in smart locks and surveillance systems. HVAC Control systems are gaining traction due to their potential for optimizing energy usage and improving home comfort. Entertainment Control, encompassing smart TVs and home theaters, continues to expand, fueled by the rising demand for seamless, high-quality home entertainment experiences.

Smart Speakers, serving as hubs for home automation, show significant growth due to their multifunctionality. Home Healthcare systems are increasingly popular, catering to the aging population and the demand for remote health monitoring. The Smart Kitchen segment, featuring intelligent appliances, is expanding as consumers seek convenience and efficiency in cooking. Home Appliances and Home Furniture segments are also evolving, integrating smart technology to enhance functionality and user experience. Each of these segments collectively drives the growth and diversification of the smart home systems market, reflecting the increasing consumer demand for interconnected and efficient home environments.

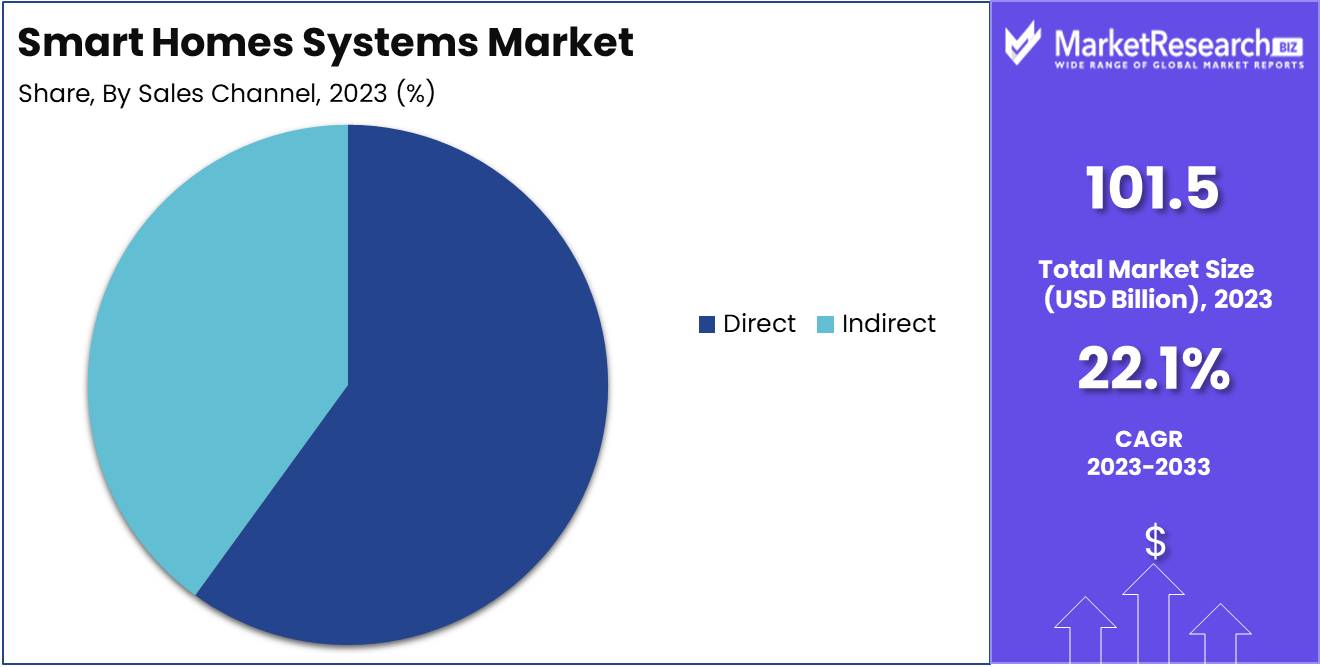

By Sales Channel Analysis

In 2023, Direct Sales dominated the Smart home systems market.

In 2023, The Direct Sales Channel held a dominant market position in the By Sales Channel segment of the Smart Homes Systems Market. The direct sales channel, encompassing e-commerce platforms, company-owned websites, and direct-to-consumer sales, captured the majority share due to its ability to offer personalized customer experiences and competitive pricing. Consumers increasingly prefer purchasing smart home systems directly from manufacturers, benefiting from comprehensive product information, after-sales services, and customization options. This channel also enables companies to maintain better control over branding and customer relationships, which enhances trust and loyalty. Moreover, the rise of online shopping and digital transformation has bolstered the growth of direct sales, as consumers seek the convenience and assurance of purchasing from official sources.

Indirect sales channels, including third-party retailers, distributors, and installers, also played a significant role, particularly in regions with a high prevalence of traditional retail infrastructure. These channels benefit from established networks and customer bases, providing accessibility to a broad audience. However, the indirect segment faced challenges such as lower profit margins and less control over customer interactions, which impacted its market share relative to direct sales. Despite these hurdles, indirect channels remain essential for market penetration, especially in emerging markets and among customers who prefer in-person assistance and demonstrations before purchasing smart home systems.

By Protocol Analysis

In 2023, Wired Systems dominated smart homes for stability and security.

In 2023, The Wired Segment held a dominant market position in the By Protocol segment of the Smart Homes Systems Market. Wired systems are highly favored for their stability and security, making them a preferred choice for consumers who prioritize reliable performance and uninterrupted connectivity. These systems, typically involving Ethernet cables and other physical connections, offer robust data transfer rates and minimal latency, critical for home automation and advanced smart devices.

Conversely, the Wireless segment is gaining traction due to its convenience and ease of installation. Wireless protocols such as Wi-Fi, Zigbee, and Z-Wave eliminate the need for extensive cabling, making it an attractive option for retrofitting existing homes with smart technology. These systems cater to a growing demographic of tech-savvy users seeking flexibility and scalability in their home automation solutions.

The Hybrid segment, combining both wired and wireless technologies, is emerging as a significant trend. It leverages the strengths of both protocols, providing the reliability of wired connections for essential functions and the versatility of wireless systems for non-critical applications. This approach addresses diverse consumer needs, offering a balanced solution for comprehensive smart home integration.

Key Market Segments

By Application

- New Construction

- Retrofit

By Product

- Light Control

- Security And Access Control

- HVAC Control

- Entertainment Control

- Smart Speaker

- Home Healthcare

- Smart Kitchen

- Home Appliances

- Home Furniture

By Sales Channel

- Direct

- Indirect

By Protocol

- Wired

- Wireless

- Hybrid

Growth Opportunity

Next-Generation Voice Assistants to Deliver Personalized User Experience

The global Smart Homes Systems market is poised to witness substantial growth, driven by the evolution of next-generation voice assistants. These advanced voice-controlled systems are set to revolutionize user interactions by offering highly personalized experiences. Integrating artificial intelligence and machine learning, these voice assistants can learn user preferences, predict needs, and seamlessly integrate with other smart home devices. This enhancement not only elevates user satisfaction but also fosters greater adoption of smart home technologies. Companies investing in these intelligent systems are likely to capture significant market share as consumers increasingly prioritize convenience and customized solutions.

AR-Powered Smart Devices to Drive an Immersive Connected Home Experience

Augmented Reality (AR) technology is set to transform the smart home landscape, providing an immersive and interactive user experience. AR-powered smart devices, such as interactive mirrors and smart glasses, enable users to visualize and control their home environments in real-time. This technological advancement offers a more engaging way to manage home automation systems, enhancing user engagement and driving the adoption of smart home solutions. As AR technology becomes more mainstream, its integration into smart home systems presents a lucrative growth opportunity for market players. Companies that pioneer AR innovations will likely lead the market, appealing to tech-savvy consumers seeking cutting-edge home automation solutions.

Latest Trends

Growing Demand for Smart Home Services

The smart home systems market is witnessing a significant surge in demand for smart home services. This trend is driven by an increasing consumer inclination towards convenience, security, and energy efficiency. With more homeowners seeking seamless integration of various smart devices, services such as home automation, remote monitoring, and smart maintenance are gaining traction. Companies are capitalizing on this trend by offering subscription-based models that provide continuous updates, maintenance, and customer support, thereby ensuring a steady revenue stream. Additionally, the expansion of 5G technology is enhancing the reliability and responsiveness of these services, further accelerating their adoption.

Integration of Artificial Intelligence (AI)

The integration of artificial intelligence (AI) into smart home systems is revolutionizing the market. AI-driven technologies are becoming more sophisticated, enabling smarter, more intuitive home environments. AI is enhancing voice assistants, improving their ability to understand and respond to natural language commands, thus offering a more personalized user experience. Moreover, AI algorithms are being employed to analyze usage patterns, optimize energy consumption, and provide predictive maintenance alerts to prevent system failures. This level of intelligence is not only improving the functionality of smart home devices but also driving consumer trust and interest in adopting these technologies. Furthermore, AI integration is facilitating interoperability among various smart devices, creating cohesive ecosystems that offer enhanced convenience and control for users.

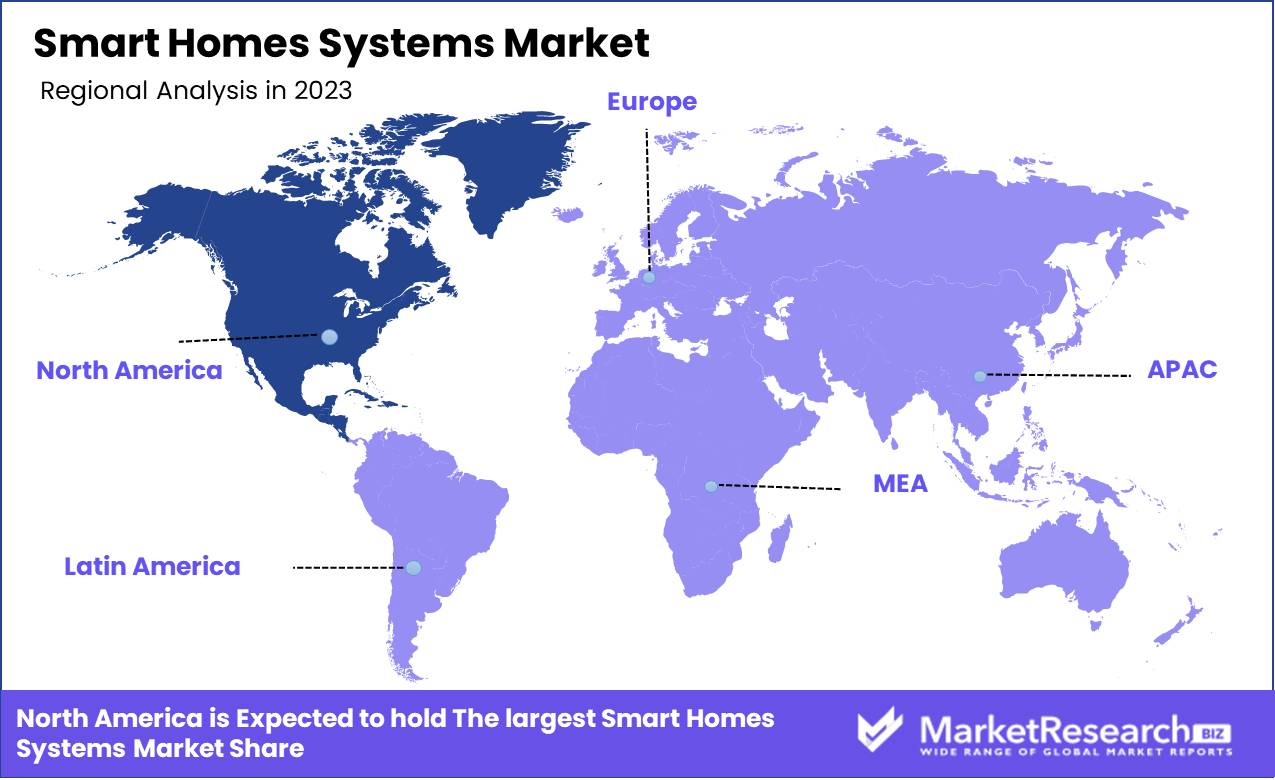

Regional Analysis

North America dominates the Smart Home Systems Market with a 35% share.

The Smart Home Systems Market is witnessing substantial growth across various regions, driven by increasing consumer demand for automated and connected living environments. In North America, the market is highly advanced, propelled by robust technological infrastructure and high disposable income. North America dominates the global market, accounting for approximately 35% of the total market share in 2023, with the United States leading due to the widespread adoption of smart devices and home automation solutions.

Europe follows closely, representing around 30% of the market share. The region benefits from strong regulatory support and growing consumer awareness about energy efficiency and security, with countries like Germany and the UK at the forefront of adoption. The Asia Pacific region is experiencing rapid growth, driven by urbanization and rising middle-class populations, particularly in China, Japan, and South Korea, contributing to about 25% of the global market.

The Middle East & Africa and Latin America are emerging markets with significant potential, accounting for 5% and 5% respectively. These regions are gradually embracing smart home technologies, spurred by increasing investments in infrastructure and a growing focus on smart city initiatives. The evolving economic landscape and technological advancements in these regions present ample opportunities for market expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Smart Homes Systems market in 2024 is characterized by intense competition and rapid innovation, driven by key players leveraging advanced technologies to enhance home automation, security, and energy efficiency.

Honeywell and Johnson Controls stand out for their extensive experience in building management systems, seamlessly integrating HVAC, security, and lighting controls into smart home ecosystems. Siemens and Schneider Electric bring robust industrial expertise, offering comprehensive smart energy solutions that align with the growing consumer demand for sustainable living.

Amazon and Apple leverage their vast ecosystems and AI capabilities, particularly through Alexa and HomeKit, to dominate the user interface and connectivity aspects of smart home systems. Their extensive product ranges and strong brand loyalty position them as pivotal players in driving market adoption and consumer engagement.

ASSA ABLOY and ADT focus on security, providing state-of-the-art smart locks and security systems that prioritize user safety. Robert Bosch and ABB emphasize engineering excellence, delivering reliable and scalable home automation solutions.

Sony and Samsung Electronics excel in the entertainment segment, integrating smart home functionalities with their premium audio-visual products, enhancing the consumer experience. Crestron Electronics caters to the high-end market with bespoke smart home solutions, reflecting the growing trend towards personalized and luxurious home automation systems.

In summary, the competitive landscape of the Smart Homes Systems market in 2024 is shaped by a blend of technological innovation, strategic partnerships, and a focus on user-centric solutions, driving growth and adoption across diverse consumer segments.

Market Key Players

- Honeywell

- Johnson Controls

- Siemens

- Schneider Electric

- Amazon

- ASSA ABLOY

- ADT

- Apple

- Robert Bosch

- ABB

- Sony

- Crestron Electronics

- Samsung Electronics

Recent Development

- In May 2024, Samsung launched the SmartThings Energy service, a new feature within its SmartThings platform designed to help users monitor and reduce their energy consumption. This service provides real-time energy usage data, insights, and recommendations for energy-saving practices. By leveraging Samsung's extensive ecosystem of connected devices, SmartThings Energy aims to promote sustainable living and reduce household energy costs.

- In March 2024, Google announced the acquisition of ADT, a leading provider of smart home security solutions. This strategic move aims to bolster Google's smart home ecosystem, particularly in the security domain, by integrating ADT's advanced security technologies with Google's existing Nest product line. This acquisition is expected to accelerate innovation in smart home security and provide users with more comprehensive and integrated home protection solutions.

- In February 2024, Amazon introduced a new range of Echo devices featuring enhanced artificial intelligence and machine learning capabilities. The new Echo lineup is designed to provide more intuitive and responsive smart home control, integrating seamlessly with a broader array of third-party smart home products. This development underscores Amazon's commitment to maintaining its leadership position in the smart home market by continuously improving user experience and device interoperability.

Report Scope

Report Features Description Market Value (2023) USD 101.5 Billion Forecast Revenue (2033) USD 711.1 Billion CAGR (2024-2032) 22.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (New Construction and Retrofit), By Product (Light Control, Security And Access Control, HVAC Control, Entertainment Control, Smart Speaker, Home Healthcare, Smart Kitchen, Home Appliance, Home Furniture), By Sales Channel (Direct and Indirect), By Protocol (Wired, Wireless, Hybrid) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Honeywell, Johnson Controls, Siemens, Schneider Electric, Amazon, ASSA ABLOY, ADT, Apple, Robert Bosch, ABB, Sony, Crestron Electronics, Samsung Electronics Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Honeywell

- Johnson Controls

- Siemens

- Schneider Electric

- Amazon

- ASSA ABLOY

- ADT

- Apple

- Robert Bosch

- ABB

- Sony

- Crestron Electronics

- Samsung Electronics