Global Home Healthcare Equipment Market By Product(Therapeutic Products, Testing, Screening, and Monitoring Products, Mobility Care Products), By Service(Skilled Nursing, Rehabilitation Therapy, Hospice & Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy, Pregnancy Care), By Indication(Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases & Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Other Indications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Sc

-

46255

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

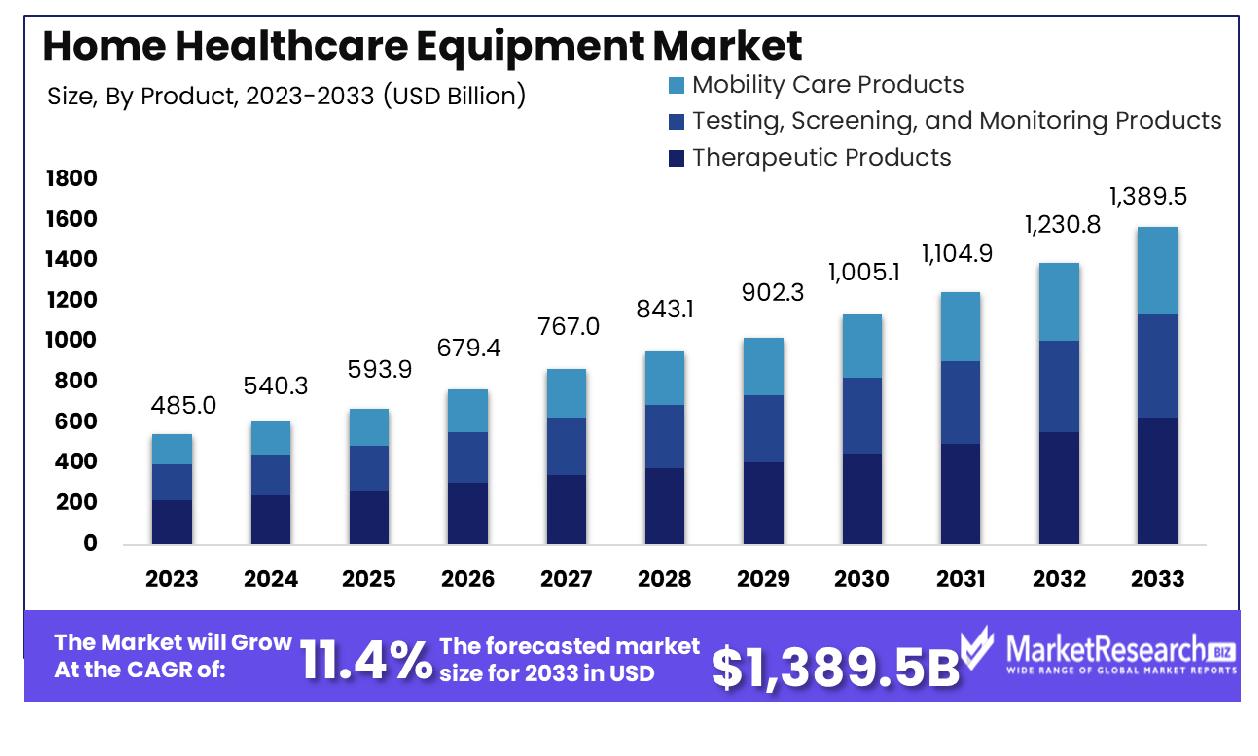

The Global Home Healthcare Equipment Market was valued at USD 485.0 billion in 2023. It is expected to reach USD 1,389.5 billion by 2033, with a CAGR of 11.4% during the forecast period from 2024 to 2033.

The Home Healthcare Equipment Market encompasses a broad range of medical devices and products designed for patient care in a residential setting. This market serves to support individuals who require ongoing medical care but prefer to receive it in the comfort and privacy of their own homes. Key segments include therapeutic devices, diagnostic and monitoring equipment, and mobility assist products.

The expansion of this market is driven by factors such as an aging population, the rising prevalence of chronic diseases, and advancements in healthcare technology. Product Managers are particularly interested in this market for its potential to deliver cost-effective, patient-centered healthcare solutions.

The Home Healthcare Equipment Market is poised for significant growth, propelled by an increasing global demand for in-home medical care. This trend is largely driven by the aging global population, technological advancements in healthcare, and a shift towards more cost-effective treatment options outside of traditional hospital settings. Particularly in India, the market is experiencing a surge due to a combination of demographic shifts and policy enhancements.

With a growing elderly population and a rising prevalence of chronic conditions, there is an escalating need for continuous healthcare services that can be managed from the comfort of one's home. This need is further magnified by the urban shift towards nuclear family structures, where fewer in-house caretakers are available to address the health needs of aging relatives.

In response to these trends, the telemedicine segment within the home healthcare market is experiencing rapid expansion. From a valuation of approximately USD 830 million in 2019, it is expected to soar to around USD 5.5 billion by 2025, charting a robust CAGR of 31% during the 2020-25 period.

The acceleration in telemedicine is also supported by significant policy reforms in India. The Telemedicine Practice Guidelines, introduced by the Ministry of Health and Family Welfare (MoHFW) and NITI Aayog in March 2020, have played a pivotal role. These guidelines leverage advanced communication technologies to facilitate the diagnosis, treatment, and management of diseases remotely.

By December 2020, the e-Sanjeevani platform had already facilitated over 1 million tele-consultations across 550 districts, underscoring the vast potential and rapid adoption of telehealth in the region. These factors collectively signal a promising growth trajectory for the Home Healthcare Equipment Market, presenting substantial opportunities for stakeholders across the healthcare ecosystem.

Key Takeaways

- Market Growth: The Global Home Healthcare Equipment Market was valued at USD 485.0 billion in 2023. It is expected to reach USD 1,389.5 billion by 2033, with a CAGR of 11.4% during the forecast period from 2024 to 2033.

- By Product: Therapeutic Products led by 32% in the product category.

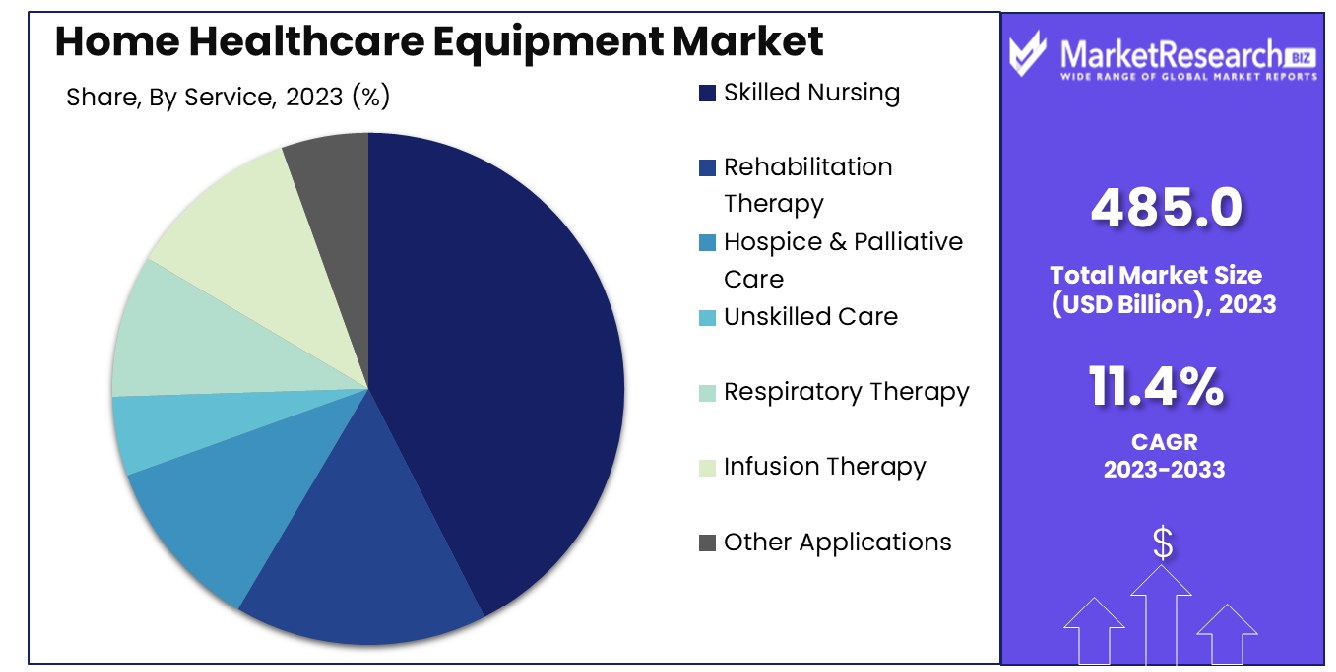

- By Service: Skilled Nursing held a 35% share in services provided.

- By Indication: Diabetes was the dominant indication at 31.4% market share.

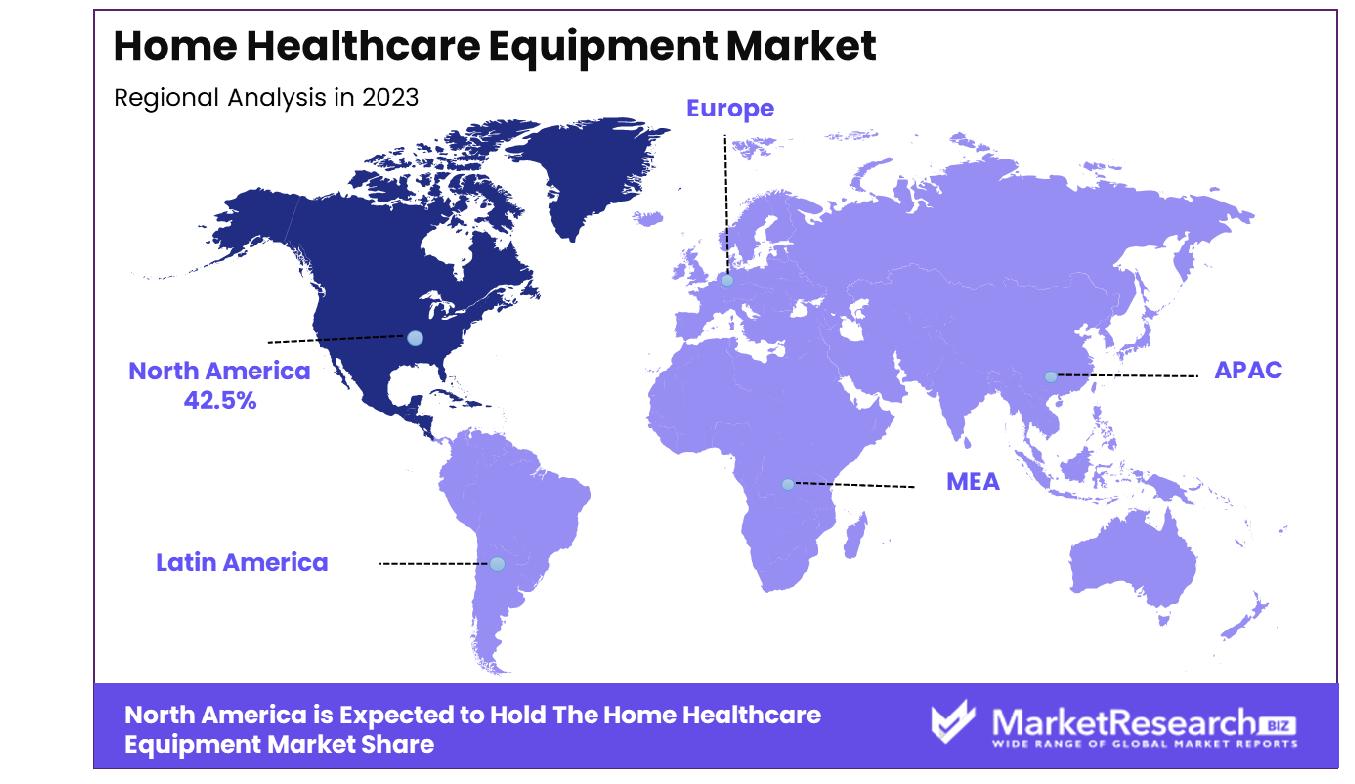

- Regional Dominance: The North American home healthcare equipment market holds a 42.5% share.

- Growth Opportunity: In 2023, the global Home Healthcare Equipment Market will experience significant growth due to increased demand for therapeutic, testing, and monitoring products, alongside expanding opportunities in various home healthcare services.

Driving factors

Technological Advances in Home Care Medical Equipment

The home healthcare equipment market is significantly driven by technological advancements that enhance the functionality and user-friendliness of medical devices. Innovations such as wearable technology, remote monitoring tools, and telehealth services not only expand the scope of home care possibilities but also improve patient outcomes by facilitating continuous monitoring and real-time data collection.

These technological enhancements allow for early diagnosis and intervention, reducing the need for frequent hospital visits and thereby lowering healthcare costs. The integration of smart technologies like AI and IoT in medical devices is expected to boost market growth further by improving the accuracy and efficiency of healthcare delivery in home settings.

Increase in Demand for Home Healthcare Services

A substantial increase in demand for home healthcare services is another pivotal factor propelling the market forward. This surge is primarily fueled by the growing global elderly population, which is projected to reach nearly 2 billion by 2050, and an increasing preference among these demographics to age in the comfort of their own homes.

Chronic diseases, which require ongoing management and are prevalent in aging populations, also contribute to the rising demand. As patients seek convenient and cost-effective solutions that home healthcare offers, the market for home healthcare equipment continues to expand, supporting a broader range of healthcare needs at home.

Shortage of Skilled/Trained Workforce

The shortage of skilled healthcare professionals has a dual impact on the home healthcare equipment market. On one hand, it poses challenges by limiting the availability of trained personnel needed to provide complex medical care at home. On the other, it serves as a catalyst for market growth by increasing the reliance on advanced home healthcare equipment that can compensate for human resource constraints.

Devices that are designed for ease of use by laypersons or that incorporate automated functions to deliver care with minimal professional oversight are particularly in demand. This trend is pushing manufacturers to innovate and develop more sophisticated, user-friendly equipment that can perform a variety of functions with little to no professional assistance needed.

Restraining Factors

High Costs Associated with Technologically Advanced Equipment and Devices

The proliferation of technologically advanced home healthcare equipment, while beneficial in enhancing care quality and patient autonomy, poses a significant barrier due to high costs. These innovative devices often incorporate cutting-edge technologies such as IoT, AI, and remote monitoring capabilities, which substantially increase their price points. For many patients and healthcare providers, especially in lower-income regions or underinsured populations, the cost of acquiring and maintaining such equipment can be prohibitively expensive.

This financial hurdle restricts the accessibility of advanced home healthcare solutions, limiting market growth to a demographic that can afford these premium products. Consequently, while the demand for high-tech home healthcare equipment is on the rise, its market expansion is curtailed by affordability challenges, affecting overall growth rates.

Vulnerability to Fraud, Waste, and Abuse by Home Health Service Providers

The home healthcare sector is particularly susceptible to issues of fraud, waste, and abuse, which undermine the market's integrity and growth. Incidents where services are overbilled, equipment is unnecessarily replaced, or care is not provided as claimed, can lead to significant financial losses and erode trust in home healthcare services. These malpractices not only result in direct economic losses to government healthcare programs and private insurers but also deter potential new entrants and investors wary of the sector's regulatory risks.

The fear of fraudulent activities and the potential for financial and reputational damage compel stricter regulations and increased scrutiny, which can stifle innovation and delay the introduction of new technologies into the market. This environment creates a cautious investment atmosphere, slowing down the growth and expansion of the home healthcare equipment market.

By Product Analysis

Therapeutic products led the market, holding a dominant share of 32%.

In 2023, Therapeutic Products held a dominant market position in the by-product segment of the Home Healthcare Equipment Market, capturing more than a 32% share. The segment's robust performance can be primarily attributed to the increasing prevalence of chronic diseases and the growing need for long-term therapy management at home. The rising trend towards home-based treatment to reduce hospital visits and associated costs further propelled the demand for these products.

Following Therapeutic Products, the Testing, Screening, and Monitoring Products segment accounted for approximately 29% of the market. This segment's growth is driven by the heightened awareness of preventive care and the continuous advancements in technology which facilitate early detection and management of health conditions from the comfort of one’s home.

Mobility Care Products also made a significant impact, holding around 21% of the market share. The demand in this segment is influenced by the aging population globally, which requires solutions for enhanced mobility and independence. Innovations in product design and functionality, aimed at improving the quality of life for the elderly and physically challenged individuals, are key factors supporting the growth of this segment.

The overall expansion of the Home Healthcare Equipment Market is further supported by government initiatives promoting home healthcare, advancements in healthcare technologies, and a shift in consumer preference towards personalized and convenient care solutions. These dynamics underscore the market's adaptation to evolving healthcare needs, highlighting a trajectory of sustained growth.

By Service Analysis

Skilled nursing claimed the largest segment, accounting for 35% of the market.

In 2023, Skilled Nursing held a dominant market position in the by-service segment of the Home Healthcare Equipment Market, capturing more than a 35% share. This significant market share can be attributed to the rising elderly population, increased prevalence of chronic diseases, and a growing preference for personalized healthcare services at home.

Skilled nursing services are integral in providing comprehensive medical care, including wound care, medication administration, and chronic disease management, which are essential for patients requiring long-term care.

Rehabilitation Therapy followed, accounting for 22% of the market. This segment benefits from the increasing number of patients needing post-operative and stroke recovery therapies, which are more cost-effective when performed at home compared to inpatient settings.

Hospice & Palliative Care also showed notable market presence, holding an 18% share. The demand in this segment is driven by the need for compassionate care for terminally ill patients, focusing on enhancing quality of life and easing end-of-life transition.

Other segments such as Unskilled Care, Respiratory Therapy, Infusion Therapy, and Pregnancy Care collectively contributed to the remaining market share, reflecting a diverse range of services catering to specific patient needs. For instance, Respiratory Therapy and Infusion Therapy are increasingly adopted in home settings to manage conditions such as COPD and administer IV medications respectively.

The continuous growth across these segments is supported by advancements in medical technologies, enabling more complex and effective treatments to be administered at home. This trend is complemented by healthcare policies favoring home-based care, illustrating a shift towards more decentralized, patient-centered care models.

By Indication Analysis

Diabetes was the most prevalent, commanding 31.4% of the market share.

In 2023, Diabetes held a dominant market position in the By Indication segment of the Home Healthcare Equipment Market, capturing more than a 31.4% share. This prominence is largely due to the global increase in diabetes prevalence coupled with the rising adoption of continuous glucose monitoring (CGM) systems and insulin delivery devices in home settings. The convenience and effectiveness of managing diabetes at home have significantly contributed to this segment's growth, enabling real-time monitoring and better control of blood sugar levels, which are crucial for preventing complications associated with diabetes.

Cancer followed as another significant segment, accounting for 21% of the market. Home healthcare for cancer patients focuses on pain management and symptom control, which can greatly improve the quality of life for patients undergoing long-term treatment or palliative care.

Cardiovascular Diseases & Hypertension represented 15% of the market, driven by the need for regular monitoring and management of heart conditions through devices such as blood pressure monitors and portable electrocardiograms.

Other segments, including Respiratory Diseases, Movement Disorders, Pregnancy, Wound Care, Hearing Disorders, and Other Indications collectively contributed to the rest of the market share. Each of these segments addresses specific medical needs that can be effectively managed at home, such as respiratory therapies for COPD, rehabilitation for movement disorders, and prenatal care for expectant mothers.

The overall growth of the Home Healthcare Equipment Market in the By Indication segment highlights the increasing shift towards home-based medical care, supported by technological advancements that allow for effective treatment and management of various health conditions outside of traditional hospital environments. This trend is further bolstered by healthcare policies and patient preferences for convenient, cost-effective care.

Key Market Segments

By Product

- Therapeutic Products

- Testing, Screening, and Monitoring Products

- Mobility Care Products

By Service

- Skilled Nursing

- Rehabilitation Therapy

- Hospice & Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

By Indication

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases & Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Other Indications

Growth Opportunity

Rising Demand in Therapeutic Products, Testing, Screening, and Monitoring

The growth trajectory of the global Home Healthcare Equipment Market in 2023 is profoundly influenced by the rising demand for therapeutic products, testing, screening, and monitoring solutions within the home healthcare sector. This surge can be attributed to the increasing prevalence of chronic diseases and the aging population, which necessitate efficient management and monitoring of health conditions in the comfort of one's home.

Therapeutic devices such as insulin pumps, nebulizers, and oxygen therapy equipment are witnessing heightened adoption, driven by the convenience they offer to patients. Similarly, the demand for testing and screening equipment for early disease detection and monitoring is on the rise, reflecting a proactive approach towards healthcare management.

Diverse Opportunities in Home Healthcare Services

In tandem with the demand for equipment, the global Home Healthcare Equipment Market in 2023 presents diverse opportunities across a spectrum of healthcare services. Skilled nursing, rehabilitation therapy, hospice & palliative care, unskilled care, respiratory therapy, infusion therapy, and pregnancy care services constitute key segments poised for significant growth.

The expansion in these sectors is propelled by factors such as increasing healthcare expenditure, advancements in technology facilitating personalized care, and the growing preference for home-based healthcare solutions. This trend not only enhances patient comfort and convenience but also alleviates the burden on traditional healthcare facilities, contributing to the overall efficiency of the healthcare ecosystem.

Latest Trends

Advancements in Battery Technology Enabling Longer Device Runtime

In 2023, the global home healthcare equipment market witnessed significant advancements in battery technology, which have considerably enhanced the runtime of medical devices used at home. This progression can be attributed to innovations in battery composition and efficiency, allowing patients to rely on uninterrupted care and monitoring without frequent recharges.

The extended battery life not only improves the user experience but also enhances the effectiveness of chronic disease management tools, thereby supporting continuous health monitoring in a non-clinical environment. This trend is expected to drive increased adoption rates for portable medical devices, as it aligns with the growing preference for home-based healthcare solutions that offer greater convenience and autonomy to patients.

Emergence of Subscription-Based Models for Home Medical Equipment

The year 2023 also marked the emergence of subscription-based models as a significant trend in the home healthcare equipment sector. These models offer patients and healthcare providers flexible and cost-effective options for accessing the latest medical equipment. By paying a recurring fee, users gain access to a range of medical devices, including upgrades to newer models as they become available.

This approach not only reduces the upfront costs associated with purchasing expensive equipment but also ensures that patients have access to the most current technology, potentially improving clinical outcomes. The subscription model is particularly advantageous in a rapidly evolving technology landscape, where frequent updates and advancements are common, thus providing a sustainable and adaptable solution in home healthcare.

Regional Analysis

In North America, the home healthcare equipment market holds a substantial 42.5% share.

The Home Healthcare Equipment market exhibits notable regional variations in growth dynamics, market penetration, and consumer preferences. In North America, the market is highly developed, holding a dominant share of 42.5%. This region's market expansion can be attributed to an aging population, prevalent chronic diseases, and a well-established healthcare infrastructure promoting advanced home healthcare services. The U.S. is a key contributor, with substantial investments in telehealth and remote patient monitoring systems enhancing market growth.

In contrast, Europe follows closely, driven by increasing healthcare expenditures and supportive government policies aimed at reducing hospital stays and promoting home healthcare services. Countries like Germany and the UK are leading in Europe, with a strong focus on innovation and quality in home healthcare equipment.

Asia Pacific is identified as the fastest-growing region due to rising healthcare awareness, increasing income levels, and aging populations in countries such as China and Japan. The region benefits from improvements in healthcare infrastructure and a growing preference for personalized healthcare solutions, which are propelling the demand for home healthcare equipment.

Latin America shows a promising growth trajectory in the home healthcare market, supported by gradual improvements in healthcare facilities and a growing burden of chronic diseases. Countries like Brazil and Mexico are increasingly adopting home healthcare solutions to provide cost-effective care to a dispersed population.

Lastly, the Middle East & Africa region is experiencing growth due to the rising prevalence of lifestyle-related health conditions and the expansion of healthcare systems in countries like Saudi Arabia and the UAE. However, the market here is still nascent and faces challenges related to healthcare access and affordability.

Overall, while North America continues to lead the market in terms of revenue and innovation, regions like Asia Pacific are rapidly catching up, indicating a shift towards more decentralized and personalized healthcare solutions globally.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the dynamic landscape of the global Home Healthcare Equipment Market, the year 2023 has seen pivotal contributions from leading companies that have significantly shaped market trends and consumer preferences. Among these key players, several have stood out due to their strategic initiatives, technological advancements, and broad product portfolios.

B. Braun Melsungen AG and Baxter International Inc. have continued to lead with innovative infusion and dialysis technologies that meet the growing demand for home-based treatment solutions. Their commitment to enhancing patient outcomes and ease of use in home settings has reinforced their market positions.

Abbott and Medtronic PLC have been at the forefront of developing portable diagnostic devices and monitoring systems. These advancements have proven crucial in expanding access to healthcare services, especially in remote and underserved areas, thus driving the market forward.

3M Healthcare and Cardinal Health Inc. have excelled in providing essential medical supplies and advanced wound care products, which are integral to home healthcare services. Their consistent quality and reliability have helped them maintain a strong presence in the market.

Koninklijke Philips N.V. and GE Healthcare have pushed the boundaries in home respiratory care and sleep therapy devices. Their focus on user-friendly interfaces and remote monitoring capabilities aligns well with the ongoing shift towards telehealth and connected care.

Lastly, companies like Amedisys, Inc. and Kindred Healthcare, Inc. have underscored the importance of service-based home health providers. Their tailored care programs and integration of telehealth services have enhanced patient engagement and satisfaction, marking significant progress in how healthcare is delivered at home.

These companies collectively demonstrate a robust response to the evolving needs of the healthcare market, emphasizing innovation, patient-centric solutions, and accessibility, which are critical for sustaining growth in the home healthcare sector.

Market Key Players

- B. Braun Melsungen AG

- Abbott

- Sunrise Medical

- 3M Healthcare

- Baxter International Inc.

- Medtronic PLC

- Cardinal Health Inc.

- F. Hoffmann-La Roche AG

- Air Liquide

- Amedisys, Inc.

- NxStage Medical, Inc. (Fresenius Medical Care)

- Arkray, Inc.

- BD

- Omron Healthcare, Inc.

- Drive DeVilbiss Healthcare

- GE Healthcare

- Medline Industries, Inc

- Koninklijke Philips N.V.

- Johnson & Johnson Services, Inc.

- Linde Healthcare

- Acelity (3M)

- Vygon

- Teleflex, Inc.

- Moog Inc.

- Intersurgical Ltd.

- Fresenius Kabi AG.

- Bayer HealthCare

- Comp14

- GF Health Products, Inc.

- Kindred Healthcare, Inc.

- Almost Family, Inc.

- National HealthCare Corporation

- Chubb Fire & Security Pty Ltd

- Gentiva Health Services, Inc.

- Medco Home Healthcare, Inc.

- Addus Homecare

- Brookdale Senior Living Solutions

- Sunrise Carlisle, LP (Sunrise Senior Living, LLC)

- Genesis Healthcare, Inc.

- Extendicare, Inc.

- SONIDA SENIOR LIVING. (CAPITAL SENIOR LIVING CORPORATION)

- Diversicare Healthcare Services, Inc.

- Home Instead, Inc.

- Senior Care Centers of America

- Atria Senior Living, Inc

Recent Development

- In May 2024, Andrew DiMeo Sr., PhD, advocates for mission-driven innovation in medical device development to align quality and value, foreseeing a shift to proactive healthcare and holistic well-being.

- In February 2024, TM Robotics CEO Nigel Smith highlights the role of advanced automation and robotics in supporting medical device innovation, emphasizing efficient production, adherence to regulations, and integration with injection molding machines.

Report Scope

Report Features Description Market Value (2023) USD 485.0 Billion Forecast Revenue (2033) USD 1,389.5 Billion CAGR (2024-2032) 11.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Therapeutic Products, Testing, Screening, and Monitoring Products, Mobility Care Products), By Service(Skilled Nursing, Rehabilitation Therapy, Hospice & Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy, Pregnancy Care), By Indication(Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases & Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Other Indications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape B. Braun Melsungen AG, Abbott, Sunrise Medical, 3M Healthcare, Baxter International Inc., Medtronic PLC, Cardinal Health Inc., F. Hoffmann-La Roche AG, Air Liquide, Amedisys, Inc., NxStage Medical, Inc. (Fresenius Medical Care), Arkray, Inc., BD, Omron Healthcare, Inc., Drive DeVilbiss Healthcare, GE Healthcare, Medline Industries, Inc, Koninklijke Philips N.V., Johnson & Johnson Services, Inc., Linde Healthcare, Acelity (3M), Vygon, Teleflex, Inc., Moog Inc., Intersurgical Ltd., Fresenius Kabi AG., Bayer HealthCare, Comp14, GF Health Products, Inc., Kindred Healthcare, Inc., Almost Family, Inc., National HealthCare Corporation, Chubb Fire & Security Pty Ltd, Gentiva Health Services, Inc., Medco Home Healthcare, Inc., Addus Homecare, Brookdale Senior Living Solutions, Sunrise Carlisle, LP (Sunrise Senior Living, LLC), Genesis Healthcare, Inc., Extendicare, Inc., SONIDA SENIOR LIVING. (CAPITAL SENIOR LIVING CORPORATION), Diversicare Healthcare Services, Inc., Home Instead, Inc., Senior Care Centers of America, Atria Senior Living, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- B. Braun Melsungen AG

- Abbott

- Sunrise Medical

- 3M Healthcare

- Baxter International Inc.

- Medtronic PLC

- Cardinal Health Inc.

- F. Hoffmann-La Roche AG

- Air Liquide

- Amedisys, Inc.

- NxStage Medical, Inc. (Fresenius Medical Care)

- Arkray, Inc.

- BD

- Omron Healthcare, Inc.

- Drive DeVilbiss Healthcare

- GE Healthcare

- Medline Industries, Inc

- Koninklijke Philips N.V.

- Johnson & Johnson Services, Inc.

- Linde Healthcare

- Acelity (3M)

- Vygon

- Teleflex, Inc.

- Moog Inc.

- Intersurgical Ltd.

- Fresenius Kabi AG.

- Bayer HealthCare

- Comp14

- GF Health Products, Inc.

- Kindred Healthcare, Inc.

- Almost Family, Inc.

- National HealthCare Corporation

- Chubb Fire & Security Pty Ltd

- Gentiva Health Services, Inc.

- Medco Home Healthcare, Inc.

- Addus Homecare

- Brookdale Senior Living Solutions

- Sunrise Carlisle, LP (Sunrise Senior Living, LLC)

- Genesis Healthcare, Inc.

- Extendicare, Inc.

- SONIDA SENIOR LIVING. (CAPITAL SENIOR LIVING CORPORATION)

- Diversicare Healthcare Services, Inc.

- Home Instead, Inc.

- Senior Care Centers of America

- Atria Senior Living, Inc