Next Generation Cancer Diagnostics Market By Technology(Next-generation Sequencing, Lab-on-a-chip (LOAC) & Reverse Transcriptase-PCR (RT-PCR)), By Application(Biomarker Development, Proteomic Analysis, CTC Analysis), By Cancer Type(Breast Cancer , Lung Cancer, Others), By Function(Therapeutic Monitoring, Prognostics, Companion Diagnostics), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42347

-

Dec 2022

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Next Generation Cancer Diagnostics Market Size, Share, Trends Analysis

- Next Generation Cancer Diagnostics Market Dynamics

- Next Generation Cancer Diagnostics Market Segmentation Analysis

- Next Generation Cancer Diagnostics Industry Segments

- Next Generation Cancer Diagnostics Market Growth Opportunity

- Next Generation Cancer Diagnostics Market Regional Analysis

- Next Generation Cancer Diagnostics Industry By Region

- Next Generation Cancer Diagnostics Market Share Analysis

- Next Generation Cancer Diagnostics Industry Key Players

- Next Generation Cancer Diagnostics Market Recent Development

- Report Scope

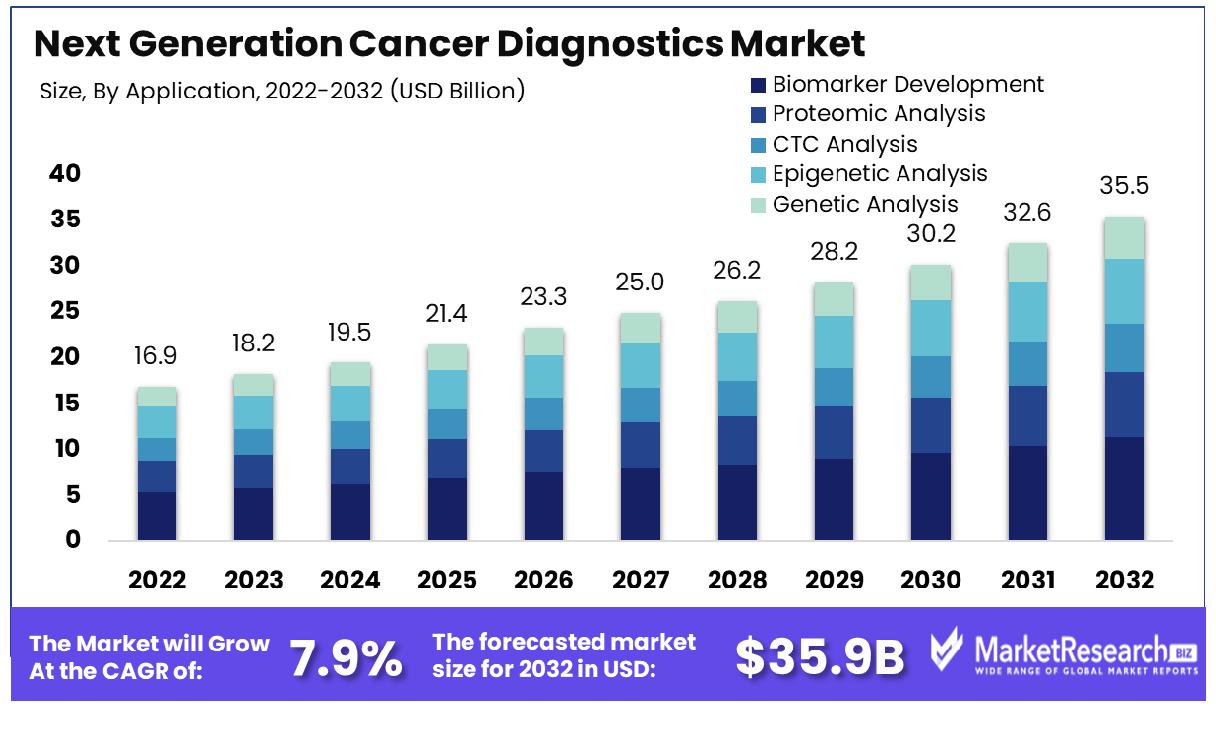

Next Generation Cancer Diagnostics Market size is predicted to reach approximately USD 35.5 Bn by 2032, from a valuation of USD 16.9 Bn in 2022, growing at a CAGR of 7.9% during the forecast period from 2023 to 2032.

Next Generation Cancer Diagnostics refers to emerging techniques that allow for earlier and more precise cancer detection compared to traditional diagnostic methods. These innovative technologies include liquid biopsies, which analyze blood samples for traces of circulating tumor DNA, and genomic sequencing.

This enables customized treatment plans tailored to a patient's genetic makeup. Advanced imaging modalities like MRIs and PET scans with higher resolution; as well as machine learning algorithms designed to identify cancerous tissues more precisely are part of this revolution in care. Together these technologies promise to revolutionize treatment by providing noninvasive screening, targeted therapies, and effective monitoring of treatment effectiveness.

The Next Generation Cancer Diagnostics Market is being propelled forward by factors including rising prevalence rates, advances in genomics and proteomics research, as well as increases in funding for research. Key innovations like next-gen sequencing technologies, lab-on-a-chip devices, and liquid biopsies are driving next-generation cancer diagnostics size market expansion. This is because they offer noninvasive yet accurate testing services that offer timely results.

The American Cancer Society estimates 1,958,310 new cancer cases and 609,820 cancer deaths projected for 2023 in the US. Lung and bronchus are expected to account for 21% of deaths while breast cancer could account for 15%. This poses a substantial burden on healthcare systems.

Companies in the next-generation cancer diagnostics space have significant opportunities for expansion into emerging markets, where increasing health awareness and improving health infrastructure are driving the adoption of advanced oncology testing services. There is also ample room for growth in the developing Next Generation Cancer Diagnostics market, where demand is growing for early and highly specific screening tests.

Strategic mergers and acquisitions are also providing growth avenues for key companies looking to expand their product portfolios with innovative diagnostics platforms.

For Instance, In May 2023, Thermo Fisher Scientific and Pfizer are collaborating to expand access to next-generation sequencing (NGS) testing for breast and lung cancer patients in over 30 countries in Latin America, Africa, the Middle East, and Asia. Thermo Fisher will identify and support local labs using its NGS technology, ensuring infrastructure and quality control, while Pfizer aims to make NGS testing financially accessible for patients in these regions.

In June 2023, Exact Sciences Corporation partnered with the Broad Institute and Baylor Scott & White to advance technologies. The collaboration with the Broad Institute includes a 5-year research agreement and an exclusive license for MAESTRO, a next-gen circulating tumor DNA tech, enabling highly sensitive detection of residual disease for enhanced scalability.

Advances in genomics, proteomics, metabolomics, and other omics technologies are enabling the development of highly sensitive and specific next-generation cancer diagnostics. Substantial investments into R&D to identify new cancer biomarkers and create innovative platforms like liquid biopsies and multiplexing assays are fueling rapid market growth and allowing earlier detection and more precise diagnosis.

Researchers at the Perelman School of Medicine (University of Pennsylvania) introduced Direct Methylation Sequencing (DM-Seq), a novel DNA sequencing method targeting 5-methylcytosine (5mC) markings crucial for gene expression and implicated in health conditions, including cancer. This advancement holds promise for more accurate and efficient testing, especially in early detection via liquid biopsies.

The Next Generation Cancer Diagnostics Market is poised for remarkable growth, driven by advancements in technology, increased emphasis on personalized medicine, and rising demand for early and accurate detection.

Next Generation Cancer Diagnostics Market Dynamics

Cancer Prevalence and Aging Population Drive Diagnostic Advances

The increasing prevalence of cancer and the rising aging population are significant drivers of the Next Generation Cancer Diagnostics Market. As the world's population ages and incidence grows, it calls for more efficient methods of diagnosis. Prompt and precise detection of cancer is vital for effective treatment. As the rate of cancer rises, so do the requirements for more sophisticated diagnostic methods. This is crucial in the case of cancers that are age-related as the method of detection is crucial to the treatment.

The increasing rate of cancer across the globe isn't just an everyday health issue and a chance to keep improving and progressing regarding the treatment of cancer type. The market is expected to grow in the coming years because of the need to fight the increasing prevalence of cancer, specifically among people over the age of. This could mean the development of new diagnostic techniques that will be vital in the treatment. They can provide faster and more certainty in the diagnosis.

R&D Investments Propel Diagnostic Solutions

Rising investments in research and development for advanced diagnostic solutions are fueling the growth of the Market. Significant funding is allocated to developing new technologies that can detect more accurately and at earlier stages. This investment is a reaction to the demand for better diagnosis and is a testament to the potential of new techniques to transform treatment.

The research and development effort is focusing on developing more sensitive more effective, less invasive, and quicker diagnostic tools. These advancements promise to improve patient outcomes significantly by enabling earlier intervention. The continuous flow of investments into R&D indicates a market that is evolving rapidly, with potential breakthroughs on the horizon. This trend is expected to continue, driving the market towards more advanced, efficient diagnostics, and effective diagnostic solutions.

Precision Medicine Enhances Early and Accurate Diagnosis

The emphasis on precision medicine and the need for accurate and early diagnosis are reshaping the market. Precision medicine aims to tailor treatment to the individual characteristics of each patient, and accurate diagnosis is key to this approach. The latest diagnostic technology provides detailed insight into the molecular and genetic aspects of, allowing more precise and customized treatment strategies.

The emphasis on precision medicine is a reflection of the shift in the healthcare industry toward more individualized treatment, which is based on a better comprehension of diseases on a molecular level. The market is anticipated to expand as the use of precision medicine increases due to the demand for diagnostic tools that offer the exact information required to create targeted treatment strategies. The long-term impact is the healthcare environment where the next generation of diagnostics is essential to the treatment of, providing more precise and efficient treatment options.

Personalized Medicine and Targeted Therapies Demand Specific Diagnostics

The growing demand for personalized medicine and targeted therapies for specific types is significantly influencing the Next Generation Cancer Diagnostics Market. The concept of personalized medicine is to tailor treatments to each patient's specific genetic profile, and targeted therapies are developed to treat specific kinds of cells that are cancerous. These strategies require precise diagnostic tests that determine the specific characteristics of each and make next-generation diagnostics crucial.

The market is growing as more targeted treatments are created, each requiring specific tests for diagnosis. This suggests the future of treatment that is becoming more personalized and diagnostic tests play an important role in determining the best treatment option for every patient. The need for specific therapies and tailored medicine is predicted to continue driving expansion in the market and a major focus is on developing tests that help with these individual treatment strategies.

High Cost and Stringent Regulatory Framework Restrain Next Generation Cancer Diagnostics Market Growth

The expansion of the market for next-generation cancer diagnostics is severely limited by the cost of these diagnostics which are highly advanced and have an extremely strict regulatory framework. Implementing and developing new-generation diagnostics, like liquid biopsies and genomic sequencing are substantial research and development costs and can result in increased costs for patients.

Additionally, the complex and strict regulatory landscape for approval of new diagnostic technologies further adds to the time and expense. These factors make such diagnostics less accessible, particularly in resource-limited settings, and can slow down their entry into the market, thereby limiting the market's overall growth potential.

Data Privacy and Security Concerns Limit Next-Generation Cancer Diagnostics Market Growth

Security and privacy concerns regarding data pose significant obstacles in the expansion of the market for next-generation cancer diagnostics. The most advanced diagnostic techniques usually require the gathering and analysis of huge amounts of patient information that is sensitive to unauthorized access. The risk of data breaches and the potential misuse of personal health information raise considerable concerns among patients and healthcare providers.

Adherence to data protection regulations, such as HIPAA in the United States, is crucial but also complex. These privacy and security challenges can lead to reluctance to adopt these new technologies, impeding market growth as ensuring patient data safety is paramount in healthcare.

Next Generation Cancer Diagnostics Market Segmentation Analysis

By Technology Analysis

Next-generation Sequencing (NGS) leads the technology segment in next-generation cancer diagnostics. Its dominance is due to its comprehensive genomic profiling abilities, enabling the identification of multiple cancer types and biomarkers from a single test. NGS technology has revolutionized diagnostics by providing high throughput, scalability, and speed, facilitating personalized treatment plans. Advancements in NGS, such as improved accuracy and reduced sequencing costs, have further propelled its adoption in clinical settings.

Lab-on-a-chip and RT-PCR technologies are pivotal for rapid, on-site testing. qPCR and multiplexing offer high sensitivity and specificity for detecting specific cancer-type markers. Protein and DNA microarrays are essential for analyzing the expression of numerous genes or proteins simultaneously, contributing to understanding biology and developing targeted therapies.

By Application Analysis

Biomarker development is the leading application in next-generation cancer diagnostics. The focus on identifying specific biomarkers for different cancer types facilitates early detection, prognosis, and the customization of treatment strategies. Biomarkers play a crucial role in the development of targeted therapies and monitoring treatment response, driving the demand for advanced diagnostic technologies.

Proteomic analysis provides insights into protein expressions related to cancer type. Circulating Tumor Cell (CTC) analysis aids in assessing metastasis and treatment efficacy. Epigenetic analysis reveals modifications in gene expression, while genetic analysis identifies hereditary risks and mutations. These applications are integral to comprehensive cancer-type diagnosis and management.

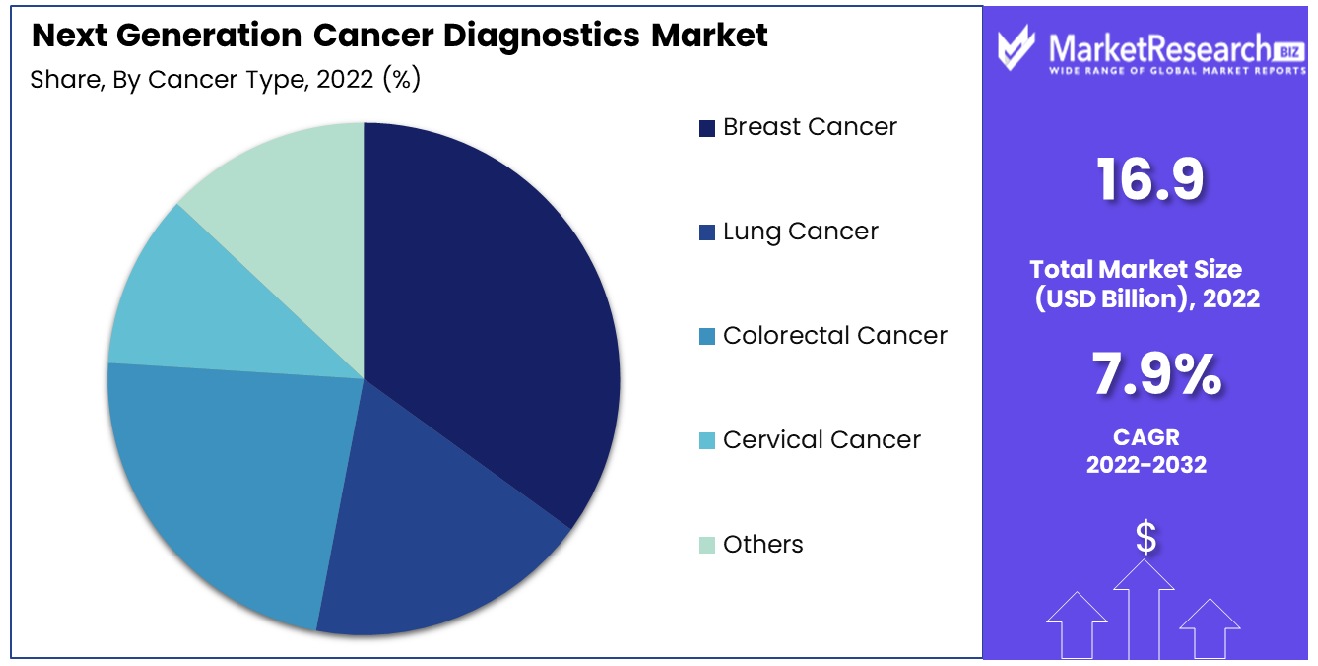

By Cancer Type Analysis

Breast cancer diagnostics is the most significant segment, driven by the high prevalence of the disease and the need for early detection. Advances in diagnostics, such as genomic profiling and liquid biopsies, have enhanced breast cancer detection and treatment personalization. The use of genomic profiling for breast cancer diagnosis allows healthcare professionals to customize treatment plans based on the specific genetic profile of each patient's tumor and improve the therapeutic results.

Colorectal and lung cancer diagnoses are vital because of their high incidence and mortality rates. Cervical diagnostics benefit from advancements in HPV testing. Other cancer types, including prostate and ovarian cancer types, are also significant, contributing to the market's diversity.

By Function Analysis

Therapeutic monitoring is a key function, enabling the assessment of treatment effectiveness and therapy adjustments. This segment's growth is driven by the need for personalized treatment regimens and monitoring drug resistance in therapy. By closely scrutinizing the outcomes of therapeutic measures, healthcare professionals can make informed decisions about modifying or fine-tuning the treatment plan, optimizing the chances of successful outcomes for patients.

Prognostics help in predicting disease outcomes. Companion diagnostics identify patients who would benefit from specific therapies. Cancer-type screening and risk analysis are essential for early detection and prevention strategies. Each function plays a vital role in comprehensive care.

Next Generation Cancer Diagnostics Industry Segments

By Technology

- Next-generation Sequencing

- Lab-on-a-chip (LOAC) & Reverse Transcriptase-PCR (RT-PCR)

- qPCR & Multiplexing

- Protein Microarrays

- DNA Microarrays

By Application

- Biomarker Development

- Proteomic Analysis

- CTC Analysis

- Epigenetic Analysis

- Genetic Analysis

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Cervical Cancer

- Others

By Function

- Therapeutic Monitoring

- Prognostics

- Companion Diagnostics

- Cancer Screening

- Risk Analysis

Next Generation Cancer Diagnostics Market Growth Opportunity

Advancements in Technology Offer Growth Opportunity in Next Generation Cancer Diagnostics Market

The advancement in technology is a crucial reason for the rapid growth of the new generation of diagnosis. Recent advancements in genomics, proteomics, and bioinformatics have led to the development of new precise, more precise, and efficient tools for diagnosing.

Techniques like next-generation sequencing (NGS) and liquid biopsies are revolutionizing the process of diagnosis, allowing doctors to identify earlier and create personalized treatments. The rapid speed of technological advancement in this area indicates the potential for significant growth as these sophisticated diagnostic techniques are made more accessible and essential to the treatment.

Improving Healthcare Infrastructure Fuels Growth in Next Generation Cancer Diagnostics Market

The continuous improvement in healthcare infrastructure globally fuels growth in the next-generation cancer diagnostics market. Investments in healthcare facilities, particularly in developing countries, are increasing access to advanced diagnostic services. This includes the expansion of specialized centers equipped with cutting-edge diagnostic technologies.

The improvement in healthcare systems, combined with growing awareness of the importance of early cancer detection, is driving the demand for next-generation diagnostic tools. The trend towards enhancing healthcare infrastructure, thereby enabling widespread adoption of advanced diagnostics, signifies a substantial growth opportunity in the market

Next Generation Cancer Diagnostics Market Regional Analysis

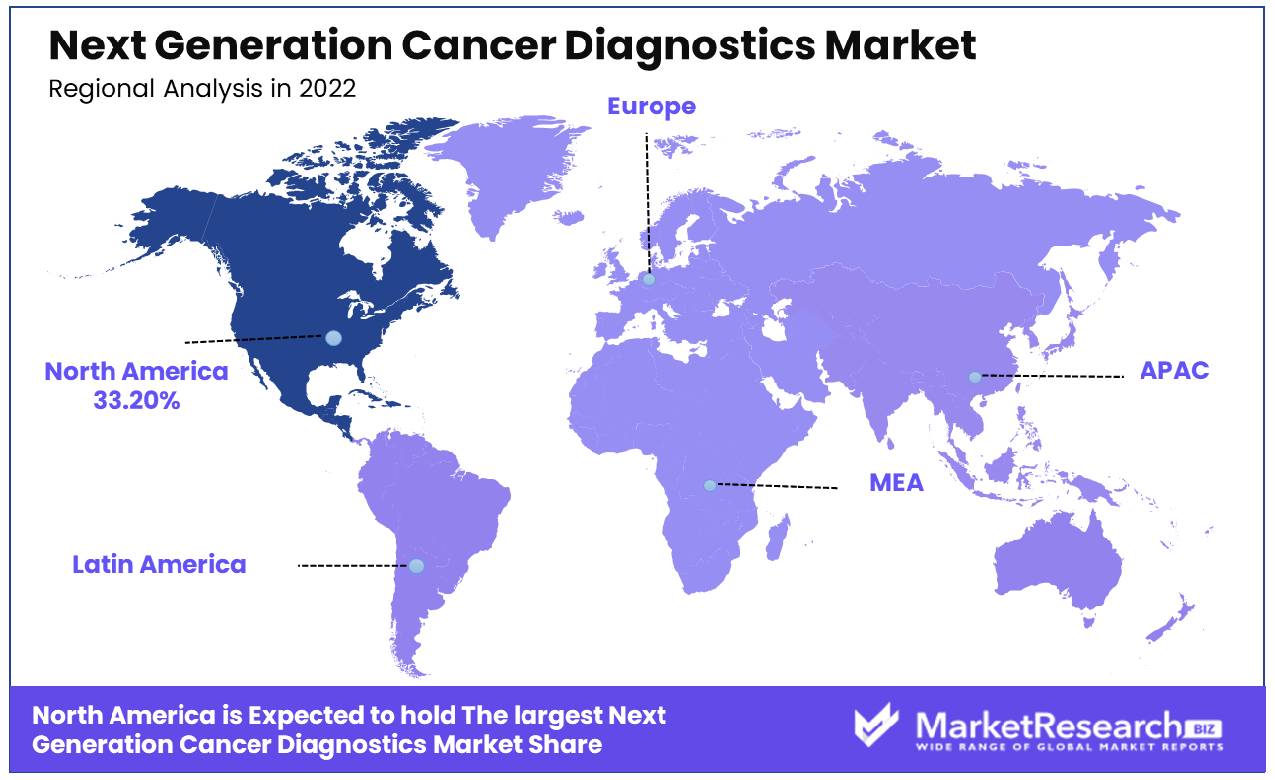

North America Dominates with a 33.20% Market Share

North America’s 33.20% share in the Next Generation Cancer Diagnostics Market is largely attributed to the region's advanced healthcare infrastructure and strong focus on cancer research and personalized medicine. The United States, in particular, hosts some of the world's leading research institutes and biotechnology firms, driving innovation in next-generation diagnostics. High healthcare expenditure and the presence of a sophisticated healthcare technology market also contribute significantly to this market dominance.

The market dynamics in North America are influenced by the increasing incidence of cancer and a growing emphasis on early detection and targeted treatment approaches. The adoption of advanced technologies such as genomic sequencing, liquid biopsies, and molecular imaging in cancer diagnostics is prevalent in the region. Furthermore, supportive government policies and funding for research, along with collaborations between academic institutions and the biotech industry, enhance the development and commercialization of innovative diagnostic methods.

Europe Has A Strong Focus on Innovation and Quality Healthcare

Europe's next-generation cancer diagnostics market is characterized by a strong focus on innovation and quality healthcare. The region benefits from extensive research initiatives, well-established healthcare systems, and stringent regulatory frameworks that ensure high standards in diagnostic technologies. Collaboration between European Union-funded research projects and private companies in the healthcare sector fosters the development of advanced diagnostic solutions.

Asia-Pacific’s Rapid Growth and Technological Advancements

The next-generation cancer diagnostics market in Asia-Pacific is experiencing rapid growth. Factors such as increasing healthcare spending, growing technological capabilities, and rising prevalence contribute to this expansion. Countries like Japan, China, and South Korea are investing in healthcare innovation, including cancer diagnostics, and are fast becoming significant players in the market. The region's focus on adopting cutting-edge technologies and improving healthcare infrastructure positions Asia-Pacific as a key emerging market in next-generation cancer diagnostics.

Next Generation Cancer Diagnostics Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Next Generation Cancer Diagnostics Market is a rapidly evolving market segment of healthcare, the listed companies are pivotal in driving innovation and market growth. Cepheid and F. Hoffmann-La Roche Ltd, with their advanced molecular diagnostic technologies, play crucial roles in the development of precise and rapid cancer diagnostic tools, reflecting the market's focus on early and accurate detection.

Koninklijke Philips N.V. and GE Healthcare, leveraging their expertise in medical imaging and health technology, contribute significantly to the integration of diagnostic imaging with next-generation detection methods. Qiagen and Thermo Fisher Scientific, renowned for their capabilities in genetic and molecular analysis, are instrumental in advancing genomic and proteomic approaches for cancer diagnostics.

Novartis AG and Abbott, global healthcare key companies with broad portfolios, underscore the importance of comprehensive diagnostic solutions in personalized medicine and targeted therapies. Opko Health and Myriad Genetics, focusing on unique diagnostic tests and genomic profiling, reflect the industry's shift toward personalized and predictive cancer diagnostics.

Agilent Technologies and PerkinElmer, with their extensive range of diagnostic instruments and reagents, play key roles in supporting the laboratory infrastructure necessary for advanced cancer diagnostics. Genomic Health and Illumina, leading in genomic analysis, showcases the growing importance of next-generation sequencing and genomic data in understanding and diagnosing.

Hologic, specializing in women's health diagnostics, highlights the market's emphasis on specific types and the development of targeted diagnostic solutions. Collectively, these major companies not only drive advancements in the Next Generation Diagnostics Market but also represent diverse strategies, from genomic profiling to advanced imaging and molecular diagnostics, crucial for revolutionizing diagnosis and treatment.

Next Generation Cancer Diagnostics Industry Key Players

- Cepheid

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd

- Qiagen

- Novartis AG

- Abbott Laboratories.

- Thermo Fisher Scientific Inc.

- Opko Health

- Myriad Genetics

- Agilent Technologies

- GE Healthcare

- PerkinElmer

- Genomic Health

- Illumina Inc.

- Hologic Inc.

- Sysmex Corporation

- Danaher Corporation

- Johnson & Johnson

- Siemens Healthineers AG

- Bio-Rad Laboratories

Next Generation Cancer Diagnostics Market Recent Development

- In November 2023, Royal Philips announced significant advancements in cancer diagnostics with the introduction of their next-generation ultrasound systems at RSNA23.

- In June 2023, Samiran Dey, European business development manager at Fujifilm Healthcare Europe, emphasized the persistent stigma surrounding lung cancer and the need for early diagnosis to improve patient outcomes. Dey discusses the challenges within the therapy area and upcoming innovations in lung cancer diagnostics.

- In March 2023, French AI biotech unicorn Owkin launched a groundbreaking €33 million AI-powered precision medicine project for cancer diagnosis and treatment named PortrAIt. This initiative received backing from the French Government.

- In March 2023, Proscia announced that PathGroup, one of the largest providers of pathology services in the United States, has chosen Proscia's Concentric Dx platform to advance the standard of diagnosis for diseases. This move aims to provide faster and higher quality results for millions of patients, improving treatment decisions.

Report Scope

Report Features Description Market Value (2022) USD 16.9 Billion Forecast Revenue (2032) USD 35.5 Billion CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology(Next-generation Sequencing, Lab-on-a-chip (LOAC) & Reverse Transcriptase-PCR (RT-PCR), qPCR & Multiplexing, Protein Microarrays, DNA Microarrays), By Application(Biomarker Development, Proteomic Analysis, CTC Analysis, Epigenetic Analysis, Genetic Analysis), By Cancer Type(Breast Cancer , Lung Cancer, Colorectal Cancer, Cervical Cancer, Others), By Function(Therapeutic Monitoring, Prognostics, Companion Diagnostics, Cancer Screening, Risk Analysis) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Cepheid, Koninklijke Philips N.V., F. Hoffmann-La Roche Ltd, Qiagen, Abbott Laboratories., Thermo Fisher Scientific Inc., Myriad Genetics, Agilent Technologies, GE Healthcare, PerkinElmer, Genomic Health, Illumina Inc., Hologic Inc., Sysmex Corporation, Danaher Corporation, Johnson & Johnson, Siemens Healthineers AG, Bio-Rad Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Cepheid

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd

- Qiagen

- Novartis AG

- Abbott Laboratories.

- Thermo Fisher Scientific Inc.

- Opko Health

- Myriad Genetics

- Agilent Technologies

- GE Healthcare

- PerkinElmer

- Genomic Health

- Illumina Inc.

- Hologic Inc.

- Sysmex Corporation

- Danaher Corporation

- Johnson & Johnson

- Siemens Healthineers AG

- Bio-Rad Laboratories