Disposable Cutlery Market By Type(Spoon, Fork, Knife), By Material(Plastic, Wood), By End Use(Households, Commercial), By Distribution Channel(Supermarkets and Hypermarkets, B2B, Online Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

8900

-

Feb 2024

-

153

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

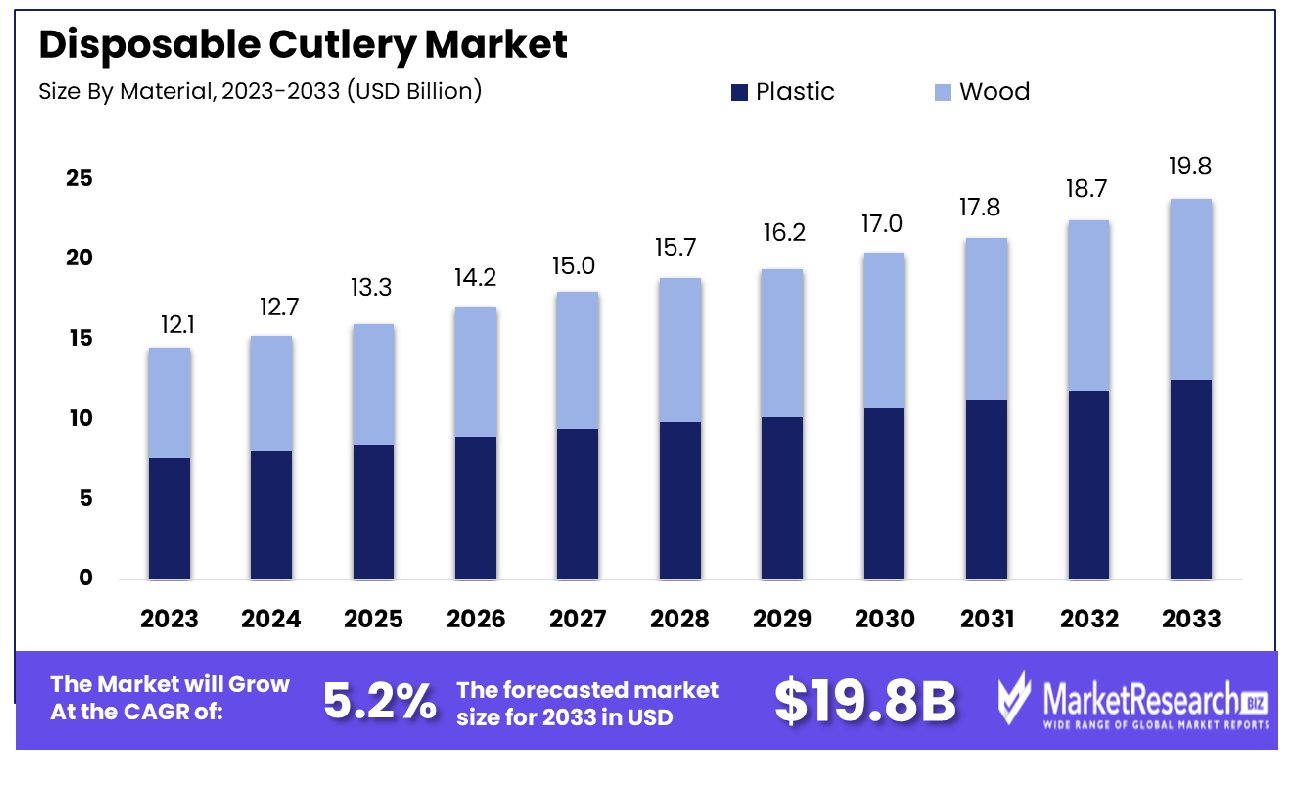

The global Disposable Cutlery Market was valued at USD 12.1 billion in 2023. It is expected to reach USD 19.8 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Disposable Cutlery Market refers to the segment within the food service industry focused on single-use utensils made from materials like plastic, wood, or compostable materials. This market encompasses a wide range of products including spoons, forks, knives, and stirrers designed for one-time use, offering convenience and hygiene benefits for consumers and businesses alike.

With growing concerns about sustainability and environmental impact, the market is witnessing a shift towards eco-friendly alternatives. Key players in this market often innovate to meet evolving consumer preferences while addressing regulatory standards. Understanding trends and consumer behavior is crucial for stakeholders to capitalize on emerging opportunities.

The Disposable Cutlery Market exhibits a resilient trajectory amidst fluctuating economic landscapes, a testament to its inherent adaptability and consumer demand dynamics. As global economic forces, notably lumber prices, undergo fluctuations, the market maintains its course with an unwavering presence.

Lumber prices, a crucial determinant in production costs, have witnessed a noteworthy decrease of USD 7/1000 board feet since the commencement of 2024, presently settling at $564.50 per unit. This decline, albeit modest, alleviates cost pressures within the disposable cutlery supply chain, potentially fostering improved profit margins for market participants.

In tandem, insights from the US market underscore the sector's robustness. Sawn hardwood production in the US surged to 17.64 million m3 in 2022, marking an impressive 11% uptick from the preceding year. Despite this encouraging growth, pulpwood production witnessed a marginal decline of 1.6% in 2022 compared to 2021, indicative of nuanced shifts within the forestry sector. Such data illuminates the intricate interplay between raw material availability and market dynamics, guiding strategic decision-making within the disposable cutlery landscape.

Key Takeaways

- Market Growth: Disposable Cutlery Market was valued at USD 12.1 billion in 2023, It is expected to reach USD 19.8 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

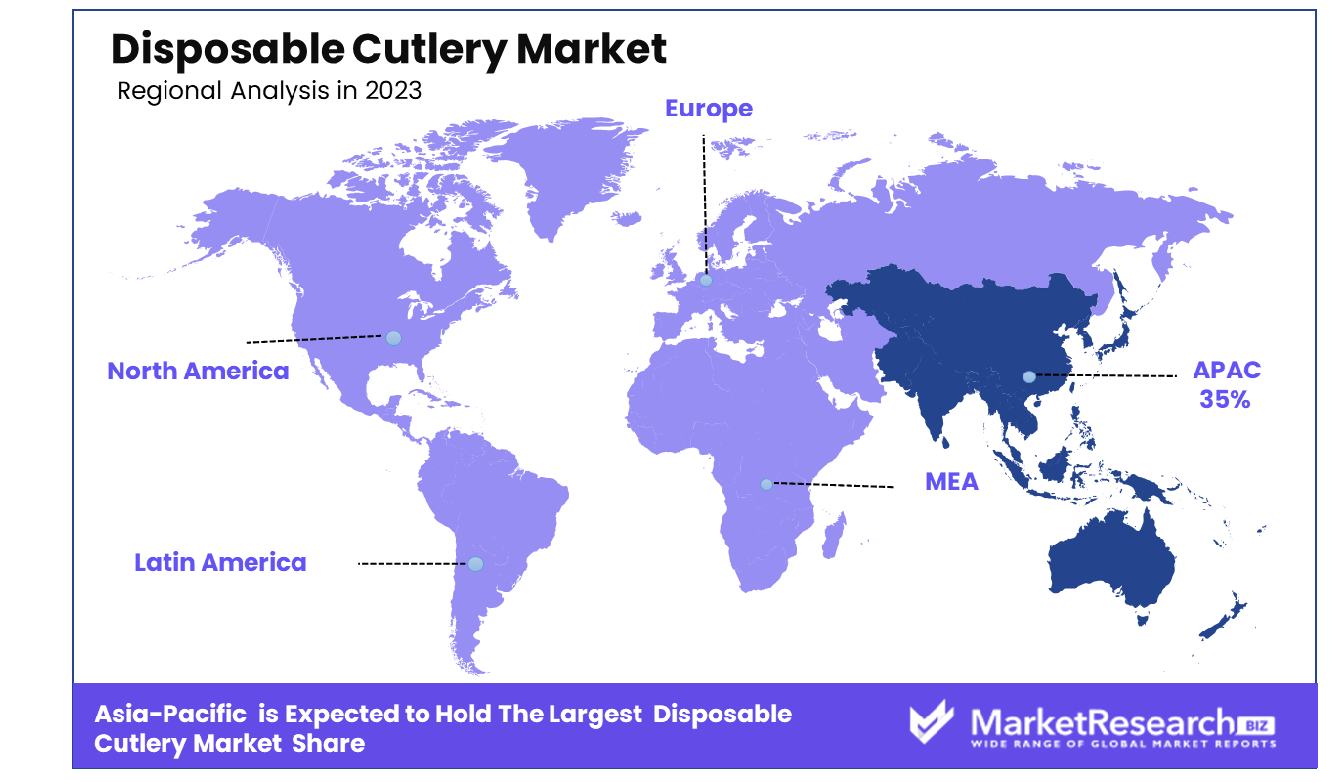

- Regional Dominance: The Asia-Pacific region holds a significant 35% market share in disposable cutlery.

- By Type: The dominant segment in Type is Spoon.

- By Material: Plastic emerges as the dominant material segment.

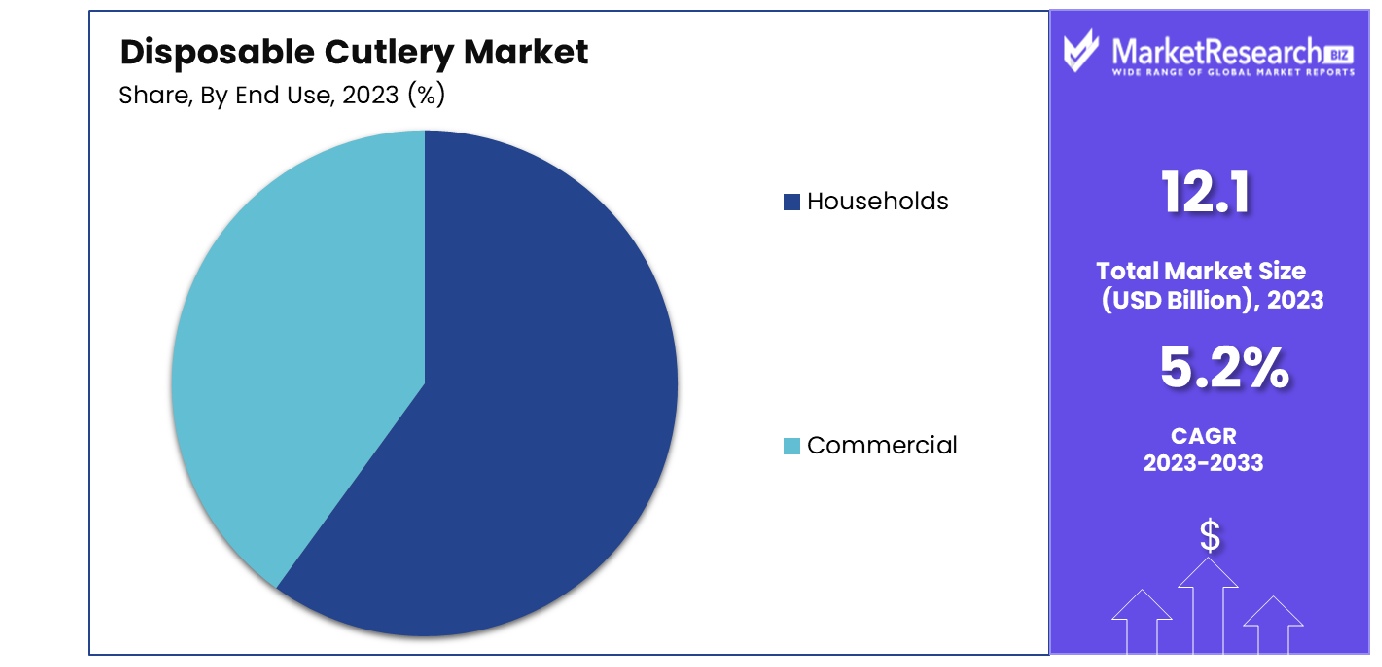

- By End Use: Households represent the dominant end-use category.

- By Distribution Channel: Supermarkets and Hypermarkets dominate the distribution channel segment.

- Growth Opportunity: Growing environmental consciousness drives demand for sustainable alternatives in the disposable cutlery market, with technological innovations enhancing functionality and sustainability.

Driving factors

Environmental Concerns Drive Demand for Eco-Friendly Alternatives

The surge in environmental awareness prompts consumers and businesses alike to seek sustainable solutions, including biodegradable and compostable disposable cutlery. The adverse impacts of traditional plastic cutlery on ecosystems, particularly marine life, have led to widespread calls for eco-friendly alternatives. Government regulations and initiatives banning single-use plastics further amplify the shift towards environmentally responsible products.

As a result, manufacturers are investing in research and development to innovate biodegradable materials derived from renewable sources such as corn starch, sugarcane fiber, or bamboo. The growth of the market can be attributed to the escalating demand for disposable cutlery options that minimize ecological footprints, aligning with sustainability goals across various industries.

Convenience and Hygiene Fuel Adoption in the Food Service Sector

In the food service industry, convenience and hygiene are paramount considerations driving the adoption of disposable cutlery. Quick-service restaurants, catering businesses, and event organizers prefer single-use utensils for their practicality, reducing the need for washing and sanitization. Moreover, amid the global pandemic, heightened hygiene standards have accelerated the transition towards disposable cutlery as a safer option for food handling and consumption.

The versatility of disposable cutlery, available in various designs and materials, offers flexibility to cater to diverse culinary preferences and occasions. Consequently, the market witnesses robust growth fueled by the convenience and hygiene benefits that disposable cutlery provides, particularly in the food service sector.

Rising Urbanization and On-the-Go Lifestyles Spur Market Expansion

Urbanization trends and evolving consumer lifestyles contribute significantly to the expansion of the disposable cutlery market. As urban populations burgeon worldwide, there is a corresponding increase in on-the-go dining habits, fueled by busy schedules and urban mobility. Disposable cutlery emerges as a convenient solution for individuals seeking hassle-free meal options while commuting, working, or socializing.

Furthermore, the proliferation of food delivery services and takeaway culture further augments the demand for disposable utensils, catering to the growing preference for convenient dining experiences. The market capitalizes on the convenience-driven behaviors of urban consumers, positioning disposable cutlery as an indispensable accompaniment to modern on-the-go lifestyles.

Restraining Factors

Sustainability Concerns Impacting Disposable Cutlery Market Growth

Within the disposable cutlery market, sustainability concerns act as significant restraining factors. Environmental consciousness among consumers increasingly influences purchasing decisions, favoring reusable or biodegradable alternatives. This shift reflects a growing aversion to single-use plastics, driving regulatory measures and consumer preferences toward eco-friendly options.

The demand for sustainable alternatives imposes challenges on traditional disposable cutlery manufacturers to adapt their production processes and materials. Consequently, major companies face increased costs associated with sourcing environmentally friendly materials and implementing eco-conscious practices. As sustainability remains a paramount concern globally, failure to address these issues could lead to declining market share and diminished profitability for manufacturers in the disposable cutlery sector.

Regulatory Pressures Constricting Disposable Cutlery Market Expansion

Regulatory pressures represent formidable restraining factors within the disposable cutlery market. Governments worldwide are enacting stringent regulations to curb plastic pollution, targeting single-use plastic products including cutlery. Compliance with these regulations necessitates costly adjustments in manufacturing processes and materials sourcing for disposable cutlery producers. Moreover, regulatory uncertainties pose challenges in long-term planning and investment decisions for industry players.

Adherence to evolving environmental standards requires continuous innovation and adaptation, placing additional strain on major companies' resources and profitability. Failure to comply with regulations risks reputational damage and legal repercussions, further impeding market growth. Consequently, navigating the complex regulatory landscape presents a formidable obstacle to the expansion of the disposable cutlery market, constraining opportunities for industry players.

By Type Analysis

The spoon segment dominates due to its versatility and widespread usage in households.

In 2023, Spoon held a dominant market position in the By Type segment of the Disposable Cutlery Market. The prevalence of Spoon within this segment can be attributed to its widespread usage across various dining settings, including households, restaurants, and catering services. Its ergonomic design and versatility make it a preferred choice among consumers for consuming a wide range of food items, from soups and desserts to main courses. Additionally, the convenience factor associated with disposable spoons, particularly in fast-paced environments and on-the-go consumption scenarios, further contributes to its market dominance.

Following Spoons, Forks, and Knife also maintained substantial shares in the By Type segment of the Disposable Cutlery Market. Forks are favored for their utility in consuming salads, pasta, and other fork-friendly dishes, while knives cater to the need for cutting and slicing food items. Although Spoon leads the segment, Fork and Knife continues to command a significant market presence, driven by their indispensable roles in dining experiences.

As consumer preferences evolve towards eco-friendly alternatives, there is a growing demand for disposable cutlery made from sustainable materials. This trend is expected to influence market dynamics in the coming years, with manufacturers focusing on eco-conscious production methods and innovative materials to meet consumer expectations while addressing environmental concerns.

By Material Analysis

Plastic materials prevail for their affordability and convenience.

In 2023, Plastic held a dominant market position in the By Material segment of the Disposable Cutlery Market. Plastic, owing to its widespread availability, cost-effectiveness, and versatility, accounted for a significant share of the market. The convenience offered by plastic cutlery, coupled with its durability and lightweight nature, has solidified its position as the preferred choice among consumers and businesses alike. However, amidst growing environmental concerns and increasing awareness about plastic pollution, there has been a notable surge in demand for eco-friendly alternatives.

Wood, emerging as a sustainable and biodegradable option, has garnered considerable attention within the disposable cutlery market. The inherent eco-friendliness of wood aligns with shifting consumer preferences towards environmentally responsible products. Additionally, wood offers a natural aesthetic appeal, further enhancing its appeal to environmentally conscious consumers and businesses seeking to align with sustainable practices.

Despite the dominance of plastic, the gradual adoption of wood and other eco-friendly materials signifies a notable shift towards more sustainable alternatives within the disposable cutlery market. This trend underscores the importance of sustainability and environmental consciousness in shaping the future trajectory of the industry, as stakeholders strive to balance consumer preferences with ecological considerations.

By End-Use Analysis

Households drive demand, favoring practicality and ease of use.

In 2023, households held a dominant market position in the By End Use segment of the Disposable Cutlery Market. The surge in demand for disposable cutlery within households can be attributed to several factors. Firstly, the growing preference for convenience and time efficiency among consumers has led to increased adoption of disposable cutlery for everyday use, especially in busy households where cooking time is limited. Additionally, the rise in awareness regarding hygiene and sanitation practices has fueled the demand for single-use cutlery items, as they offer a convenient solution to avoid the hassle of cleaning and washing traditional utensils.

Furthermore, the proliferation of online food delivery services and the trend of hosting social gatherings and events at home have bolstered the demand for disposable cutlery among households. With the convenience of ordering meals online and organizing events without the need for extensive cleanup afterward, consumers are increasingly opting for disposable cutlery to cater to their dining needs.

Commercial establishments, on the other hand, have also emerged as significant consumers of disposable cutlery, particularly in the food service industry. Restaurants, cafes, fast-food chains, and catering services rely heavily on disposable cutlery to streamline operations, enhance hygiene standards, and cater to the on-the-go lifestyle of modern consumers. This segment's growth is driven by the increasing number of food outlets, the rising trend of takeaway and delivery services, and stringent regulations about food safety and hygiene standards in commercial kitchens.

By Distribution Channel Analysis

Supermarkets and hypermarkets excel in distribution, ensuring wide accessibility to consumers.

In 2023, Supermarkets and Hypermarkets held a dominant market position in the Distribution Channel segment of the Disposable Cutlery Market. This can be attributed to their extensive reach, offering consumers a wide variety of disposable cutlery options conveniently in one location. Supermarkets and Hypermarkets leverage their large-scale operations to negotiate favorable pricing with suppliers, thereby attracting price-sensitive consumers seeking cost-effective solutions for their disposable cutlery needs.

B2B channels also played a significant role in the distribution of disposable cutlery, particularly in catering services, restaurants, and institutional buyers. These channels prioritize bulk purchases and often establish long-term contracts with suppliers to ensure a steady and reliable supply of disposable cutlery to meet the demands of their clientele.

Online Retail emerged as a rapidly growing distribution channel for disposable cutlery, driven by the increasing preference for e-commerce platforms among consumers seeking convenience and a wide product assortment. The convenience of doorstep delivery and the ability to compare prices and read reviews online further propelled the growth of this segment.

Other distribution channels, including convenience stores, specialty stores, and departmental stores, also contributed to the distribution landscape of disposable cutlery, catering to niche consumer segments and providing additional points of access for consumers seeking specific product variants or brands.

Key Market Segments

By Type

- Spoon

- Fork

- Knife

By Material

- Plastic

- Wood

By End Use

- Households

- Commercial

By Distribution Channel

- Supermarkets and Hypermarkets

- B2B

- Online Retail

- Others

Growth Opportunity

Sustainable Alternatives Driving Growth in Disposable Cutlery Market

The surge in environmental consciousness propels the demand for eco-friendly cutlery. Biodegradable materials like bamboo, sugarcane, and cornstarch offer sustainable solutions, aligning with consumer preferences for greener products. Government regulations promoting eco-friendly practices further boost market expansion. Additionally, heightened awareness of single-use plastic's detrimental impact on ecosystems fuels the adoption of biodegradable utensils.

Companies investing in research and development to enhance the durability and affordability of sustainable alternatives stand to gain a competitive edge. Moreover, collaborations with food service providers and event organizers facilitate wider market penetration. With increasing consumer willingness to pay a premium for environmentally friendly options, the disposable cutlery market is poised for substantial growth.

Technological Advancements Revolutionizing Disposable Cutlery Market

Innovations in materials and production processes propel market evolution. Advanced manufacturing techniques, such as injection molding and 3D printing, enable the production of customizable, high-quality disposable utensils. Materials like PLA (polylactic acid) and PHA (polyhydroxyalkanoates) offer enhanced durability and heat resistance, expanding the application scope beyond traditional settings.

Moreover, antimicrobial coatings and barrier technologies ensure hygiene and safety, addressing consumer concerns. The integration of IoT (Internet of Things) sensors in cutlery packaging enables real-time tracking of usage and waste management, optimizing supply chain efficiency. Collaborations between technology firms and packaging manufacturers drive further innovation, fostering a dynamic market landscape. With ongoing technological advancements promising improved functionality and sustainability, the disposable cutlery market presents lucrative growth opportunities.

Latest Trends

Eco-Friendly Innovations Drive Growth in Disposable Cutlery Market

The disposable cutlery market is witnessing a notable surge in demand driven by an increasing preference for eco-friendly alternatives. With rising environmental concerns and growing awareness about plastic pollution, consumers, and businesses alike are gravitating towards sustainable options. Manufacturers are responding to this trend by introducing innovative, biodegradable materials such as plant-based plastics, bamboo, and compostable alternatives.

Additionally, there's a notable shift towards convenient and hygienic solutions, fueled by changing consumer lifestyles and dining habits. Single-use utensils, particularly in the food service and catering industries, are becoming increasingly popular due to their convenience and cost-effectiveness. This trend is further propelled by the ongoing emphasis on health and safety amid the COVID-19 pandemic, driving the adoption of disposable cutlery in various settings.

As sustainability continues to dominate consumer preferences and regulatory agendas worldwide, the disposable cutlery market is poised for robust growth. However, challenges such as cost competitiveness and ensuring the scalability of eco-friendly alternatives remain. Nevertheless, the convergence of sustainability, convenience, and hygiene is reshaping the landscape of disposable cutlery, presenting lucrative opportunities for industry players and stakeholders alike.

Tech Integration and Design Innovation Redefine Disposable Cutlery Landscape

The disposable cutlery market is undergoing a transformation propelled by technological advancements and design innovations. Integration of technology, such as 3D printing and advanced materials, is revolutionizing the manufacturing process, enabling greater customization and efficiency. Moreover, digitalization is streamlining supply chain management, enhancing production agility, and optimizing distribution networks.

In parallel, design innovation is reshaping the aesthetics and functionality of the disposable cutlery industry, catering to diverse consumer preferences and market segments. Sleek, ergonomic designs are gaining traction, offering enhanced user experience and visual appeal. Moreover, emphasis on biodegradable materials and sustainable packaging is driving a paradigm shift towards environmentally conscious designs.

Furthermore, customization options, including branded and personalized cutlery solutions, are gaining prominence, particularly in the hospitality industry and events industry. These trends reflect a broader shift towards experiential dining and brand differentiation. As consumers seek unique and memorable experiences, the customized disposable cutlery industry presents a compelling value proposition for businesses looking to stand out in a crowded market.

Regional Analysis

In the Asia-Pacific region, disposable cutlery holds a significant market share of 35%.

In the disposable cutlery market, regional dynamics play a significant role in shaping consumption patterns and market growth. Across various geographical segments including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, distinct trends and factors influence market expansion.

North America represents a mature market for disposable cutlery, characterized by a high level of adoption owing to convenience-driven lifestyles. According to recent market data, North America accounted for approximately 25% of global consumption, with a steady growth rate projected at 3.5% annually. This region's dominance is attributed to widespread usage in fast-food chains, institutional catering, and household settings.

In Europe, stringent regulations promoting sustainable practices have fueled the demand for eco-friendly disposable cutlery alternatives. Despite this, the market is experiencing moderate growth, with a current share of around 20%. The emphasis on biodegradable materials and the reduction of plastic waste continues to shape consumer preferences and industry innovation.

Asia Pacific emerges as the dominating region in the global disposable cutlery market, capturing a substantial share of approximately 35%. The region's robust growth is propelled by rapid urbanization, expanding food service industry, and increasing awareness regarding single-use plastic pollution. Countries like China, India, and Southeast Asian nations are key contributors to this growth, supported by rising disposable incomes and evolving consumer habits.

In contrast, the Middle East & Africa, and Latin America regions exhibit slower growth rates, with respective market shares of 10% and 8%. Factors such as lower disposable incomes, cultural preferences for traditional utensils, and limited infrastructure for waste management contribute to these regions' comparatively smaller market sizes.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global Disposable Cutlery Market of 2023, several key players exerted significant influence, shaping industry dynamics and market trends. Among these, prominent companies such as Koch Industries, Inc., Huhtamaki Oyj, and Dart Container Corporation stood out as pivotal entities driving market growth and innovation.

Koch Industries, Inc., a diversified conglomerate, leveraged its extensive resources and diverse portfolio to establish a strong foothold in the disposable cutlery segment. With a focus on operational efficiency and product quality, Koch Industries played a crucial role in setting industry standards and meeting evolving consumer demands.

Similarly, Huhtamaki Oyj, a global packaging solutions provider, demonstrated robust growth in the disposable cutlery market through strategic acquisitions and product innovation. By investing in sustainable materials and eco-friendly manufacturing processes, Huhtamaki capitalized on the growing consumer preference for environmentally responsible products, thereby enhancing its market position and brand reputation.

Dart Container Corporation emerged as another key player, renowned for its extensive product range and commitment to customer satisfaction. With a focus on product differentiation and customization, Dart Container catered to diverse market segments and forged strong partnerships with key stakeholders.

Furthermore, key companies like Genpak, LLC, Pactiv LLC, and BioPak contributed significantly to market expansion through their relentless pursuit of product excellence and customer-centric approach. By embracing innovation and sustainability, these major companies played instrumental roles in shaping the disposable cutlery landscape and driving industry growth.

Market Key Players

- Koch Industries, Inc.

- Huhtamaki Oyj

- Dart Container Corporation

- Genpak, LLC

- Pactiv LLC

- Gold Plast Spa

- D&W Fine Pack LLC

- BioPak

- Vegware Ltd

- Hotpack Packaging Industries LLC

- Others

Recent Development

- In January 2024, The State Institute of Hotel Management (SIHM) in Indore introduced edible crockery made from millet to combat plastic waste. These crockeries, lasting 30 days, offer an eco-friendly alternative and aim to promote millet consumption. They've been successfully tested for safety.

- In October, England implemented a ban on single-use plastics, including cutlery and polystyrene cups, aiming to reduce pollution. City to Sea highlights delayed implementation compared to the EU, advocating for broader measures.

- In August 2023, WWF supported reuse as a solution to plastic pollution, celebrating innovators at The Reusies 2023. Winners include Re: Dish and Generation Conscious for innovative reuse in food, fashion, and consumer goods.

Report Scope

Report Features Description Market Value (2023) USD 12.1 Billion Forecast Revenue (2033) USD 19.8 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Spoon, Fork, Knife), By Material(Plastic, Wood), By End Use(Households, Commercial), By Distribution Channel(Supermarkets and Hypermarkets, B2B, Online Retail, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Koch Industries, Inc., Huhtamaki Oyj, Dart Container Corporation, Genpak, LLC, Pactiv LLC, Gold Plast Spa, D&W Fine Pack LLC, BioPak, Vegware Ltd, Hotpack Packaging Industries LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Koch Industries, Inc.

- Huhtamaki Oyj

- Dart Container Corporation

- Genpak, LLC

- Pactiv LLC

- Gold Plast Spa

- D&W Fine Pack LLC

- BioPak

- Vegware Ltd

- Hotpack Packaging Industries LLC

- Others