Plastic Packaging Market By Product(Rigid, Flexible), By Technology(Injection Molding, Extrusion, Other), By Application(Food & Beverages, Industrial Packaging, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5695

-

Aug 2023

-

190

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

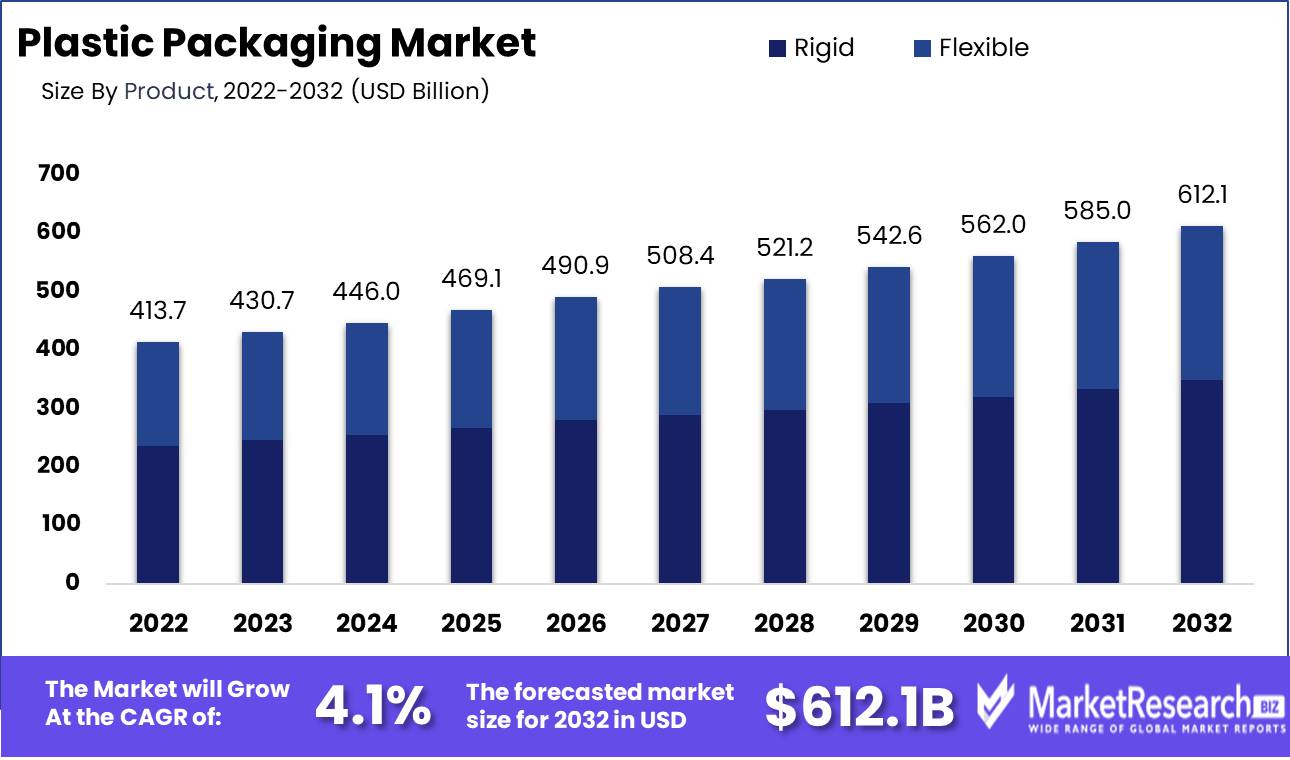

Plastic Packaging Market size is expected to be worth around USD 612.1 Bn by 2032 from USD 413.7 Bn in 2022, growing at a CAGR of 4.1% during the forecast period from 2023 to 2032.

The primary purpose of plastic packaging is to contain and safeguard products in a safe and efficient manner. It protects the quality and integrity of the packaged goods from contaminants, moisture, and other external factors. Plastic packaging ensures that products reach consumers in pristine condition, extending their storage life and minimizing the possibility of spoilage.

Versatility is one of the primary advantages of plastic packaging. In terms of shape, size, and design, plastic materials provide a vast array of possibilities. This enables companies to create packaging solutions tailored to their specific needs, thereby increasing brand visibility and consumer appeal. In addition, plastic packaging is lightweight, which makes transportation economical and reduces the carbon footprint associated with logistics.

There have been notable innovations in the plastic packaging market in recent years. Constant efforts are made by businesses to develop more eco-friendly packaging options with minimal environmental impact. The introduction of biodegradable and compostable plastics, for instance, has gained momentum. These materials biodegrade over time, reducing plastic waste and promoting a circular economy.

The plastic packaging market has also been the recipient of significant investments and incorporation into a variety of products and services. Companies recognize the importance of packaging as a marketing tool and are investing in attractive, high-quality designs. Custom plastic packaging has become an essential element of branding and product differentiation, as it creates a memorable and aesthetically pleasing experience for consumers.

Population growth, urbanization, and shifting consumer lifestyles are major market drivers for plastic packaging. As population and urbanization have increased, so has the demand for packaged goods. Plastic packaging provides convenience, portability, and usability to meet the requirements of contemporary consumers. In addition, the growth of e-commerce has increased the demand for protective packaging for transportation and delivery.

Driving factors

Demand for Packaged Consumer Goods is Growing

Due to the rising demand for packaged consumer products, the plastic packaging market has witnessed a significant rise in demand. As a result of the introduction of modern packaging techniques, consumers are now acclimated to the convenience and advantages of plastic packaging. Plastic is a popular option for packaging a variety of consumer goods because of its ability to shield products from external factors such as moisture, dust, and contamination.

Specifically, the food and beverage industry has played a significant role in fueling the demand for plastic packaging. The demand for ready-to-eat meals, convenience foods, and on-the-go beverages has skyrocketed as people's lifestyles have become hectic. Plastic packaging provides the necessary protection and preservation for these products, ensuring that consumers have access to safe, high-quality goods.

Industry Expansion in the Food and Beverage Sector

Globally, the food and beverage industry has experienced substantial expansion, resulting in an increase in demand for plastic packaging. This industry has expanded due to factors such as population growth, urbanization, shifting consumer preferences, and the emergence of e-commerce. As a result, manufacturers are constantly seeking innovative packaging solutions to satisfy consumers' changing demands.

In recent years, plastic packaging materials and technologies have witnessed remarkable advancements. This has enabled manufacturers to create packaging solutions that are both aesthetically appealing and functionally superior. The introduction of high-tech plastics, such as biodegradable and recyclable materials, has mitigated environmental concerns and increased the packaging industry's overall sustainability.

Materials and technological developments in plastic packaging

The industry has been revolutionized by the constant advancements in materials and technologies that the plastic packaging market has witnessed. Due to their durability, versatility, and affordability, packaging materials such as polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) have gained widespread acceptance. These materials enable manufacturers to construct packaging solutions that can withstand a variety of transport and storage conditions.

Technological advancements have also played an important role in the development of plastic packaging. Automated systems have enabled manufacturers to increase production efficiency, decrease expenses, and enhance quality control.

Restraining Factors

Environmental Concerns and Waste Management Issues

Due to potential environmental concerns and waste management issues, the plastic packaging market is under increasing scrutiny. As the world confronts the challenges of plastic pollution and its impact on our planet, both consumers and businesses are becoming increasingly aware of the need for sustainable packaging solutions.

Although plastic packaging is widely used due to its convenience and affordability, its disposal and recycling present significant challenges. Plastic waste accumulation in landfills and oceans has increased demands for stricter regulations and initiatives to reduce plastic waste.

Potential Sustainability and Regulatory Requirements

Global regulatory agencies are tightening their grasp on plastic packaging by imposing more stringent sustainability requirements and regulations. These regulations frequently emphasize the reduction of single-use plastics, the promotion of recyclable materials, and the encouragement of the adoption of more environmentally responsible alternatives.

To meet these sustainability requirements, plastic packaging manufacturers must adapt to changing regulatory environments and invest in research and development. Failure to comply with these regulations may result in hefty penalties and reputational harm to the brand.

Product Analysis

Rigid Segment dominance in the plastic packaging market has been significant. With its robust and long-lasting characteristics, the Rigid Segment has become the packaging material of preference in numerous industries. This segment provides superior protection and ensures the preservation of products throughout their entire lifecycle. From pharmaceuticals to electronics, the Rigid Segment has demonstrated its adaptability and efficacy in protecting products.

Rapid economic development has driven the adoption of rigid segments in emerging economies. These economies are experiencing a rapid increase in industrialization and urbanization, resulting in a greater demand for dependable packaging solutions. The Rigid Segment satisfies these specifications by offering a robust packaging option for the transportation and storage of products.

The consumer trend and behavior with respect to the Rigid Segment have been positive. Consumers are pursuing products that are packaged sustainably and securely. The Rigid Segment provides a solution by decreasing the risk of product injury during transportation and increasing shelf life. Additionally, consumers value the convenience and usability provided by rigid packaging.

Technology Analysis

In the plastic packaging market, the Extrusion Segment has emerged as the dominant force. This segment employs extrusion techniques to produce a vast array of packaging options. Extrusion technology enables the production of malleable and adaptable packaging that can be tailored to the needs of a variety of industries.

Similar to the Rigid Segment, economic development drives the adoption of the Extrusion Segment in emerging economies. As these economies undergo accelerated urbanization and industrial development, the demand for flexible packaging solutions increases. The Extrusion Segment satisfies this demand by providing packaging options that are adaptable to various shapes and sizes.

The consumer trend and behavior toward the Extrusion Segment reflect the shifting packaging preferences. In terms of resealable options and portion control, consumers are pursuing convenience in packaging more frequently. The Extrusion Segment offers flexible packaging that is simple to open and close, ensuring the freshness and durability of products. In addition, the adaptability of extrusion-based packaging allows manufacturers to meet specific consumer demands.

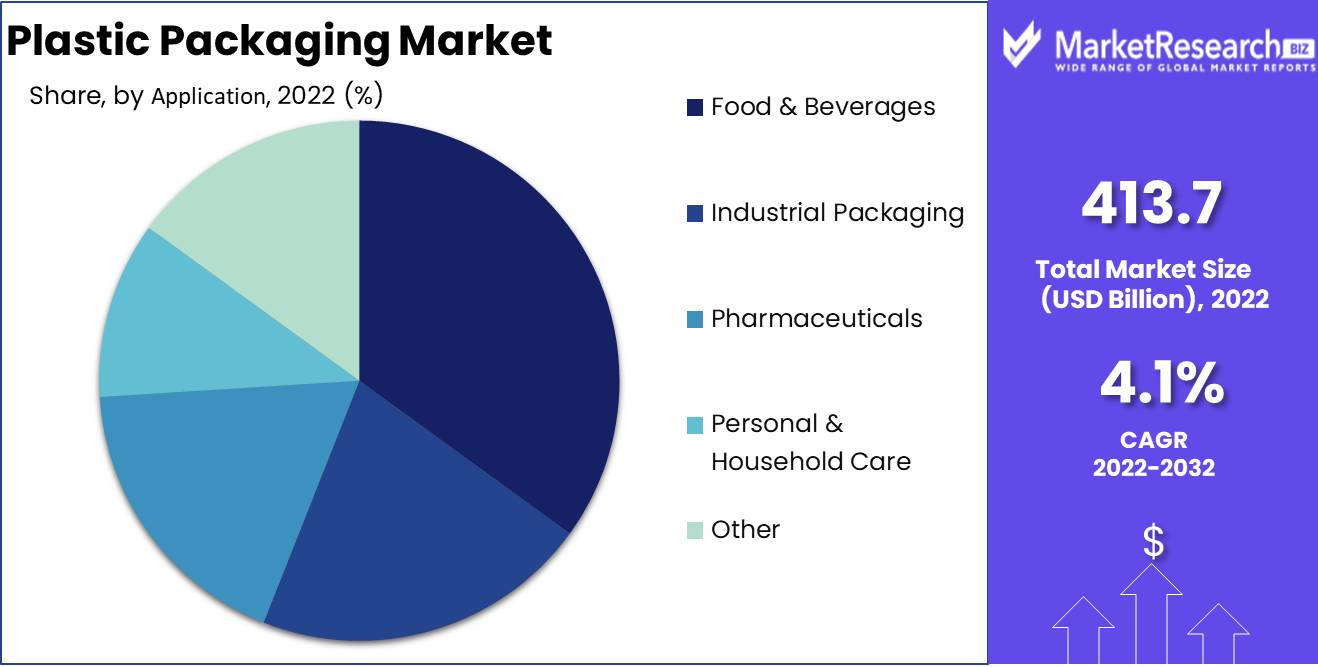

Application Analysis

Food & Beverage dominates the plastic packaging market. The demand for packaged food and beverages has grown significantly, driven by urbanization, rising disposable incomes, and changing lifestyles. In order to cater to the diverse requirements of the industry, the Food & Beverages Segment offers a wide variety of packaging options, including bottles, cans, cartons, and pouches.

Food & Beverage Segment plastic packaging adoption is significantly influenced by the economic growth of emerging economies. As purchasing power increases in these economies, consumers increasingly prefer packaged food and beverages for their convenience, safety, and extended shelf life. The Food & Beverage Segment offers the necessary preservation and protection to meet these demands.

The Food & Beverages Segment is characterized by convenience-oriented consumer trends and behavior. Consumers desire packaging that is user-friendly, resealable, and ensures the freshness of the products. The Food & Beverages Segment provides a variety of packaging options that cater to these preferences, facilitating the consumption and storage of food and beverages.

Key Market Segments

By Product

- Rigid

- Flexible

By Technology

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Other

By Application

- Food & Beverages

- Industrial Packaging

- Pharmaceuticals

- Personal & Household Care

- Other

Growth Opportunity

Incorporation of Eco-friendly Materials

Given the global drive for sustainability and environmental awareness, there is a growing demand for environmentally friendly packaging options. With the development of recyclable, biodegradable, and compostable materials, the plastic packaging market is on the verge of a revolution. By utilizing these sustainable materials, packaging manufacturers and brand proprietors can demonstrate their commitment to environmental responsibility, thereby catering to the growing consumer demand for eco-friendly products.

Integrating sustainable materials not only aids in the reduction of plastic waste but also offers market participants lucrative opportunities. Brands can obtain a competitive advantage by differentiating themselves as environmentally conscious and catering to the expanding eco-conscious consumer segment.

Increasing Packaging Technology

As the world becomes increasingly digitalized, there has been a transition in the plastic packaging market toward the incorporation of intelligent and interactive features. Brands can revolutionize how consumers interact with their products by fusing traditional packaging functions with cutting-edge technologies such as NFC (Near Field Communication) tags, QR codes, and augmented reality. These technological advances not only improve the consumer experience but also provide valuable insights to brands, enabling targeted marketing and personalized communication strategies.

Intelligent packaging characteristics facilitate real-time inventory management, supply chain tracking, and product authentication, thereby promoting efficiency in a variety of industries. In the food industry, for instance, temperature-sensitive packaging endowed with intelligent sensors can ensure that perishable products maintain optimal conditions during transport, thereby reducing food waste and enhancing food safety.

Enhancing Packaging Design

Packaging design is crucial to the success of a product because it serves as a potent marketing instrument and reflects brand values. As consumer interests and preferences continue to evolve, manufacturers must perpetually innovate their packaging design in order to attract attention and drive sales. Brands can create an emotive connection with consumers and increase brand loyalty by utilizing modern design trends, distinctive visual elements, and captivating storytelling.

Latest Trends

The expansion of flexible plastic packaging

Flexible plastic packaging has emerged as an industry-altering innovation. This lightweight and adaptable material offers numerous advantages, including increased convenience, a longer shelf life, and lower transportation costs. It also permits inventive designs and shapes, which attract consumers' attention and stand out on crowded shelves.

Diverse industries, such as food and beverage, personal care, and pharmaceuticals, are experiencing a rise in demand for flexible plastic packaging. Its adaptability to various product sizes, shapes, and volumes makes it a popular option for businesses seeking cost-effective and functional packaging solutions.

Demand for Single-Serve and Portion-Controlled Packaging is Increasing

Consumers seek convenience and portion-controlled options more and more in today's fast-paced world. Consequently, the demand for single-serve and portion-controlled plastic packaging has increased. Whether it's individually wrapped snacks, single-use personal care products, or pre-portioned food items, this packaging format is designed to meet the requirements of busy individuals seeking on-the-go solutions.

Single-serve and portion-controlled packaging not only provides convenience but also reduces food waste. It promotes sustainability and cost-effectiveness by minimizing the risk of overconsumption or deterioration by providing consumers with precisely measured quantities.

Use of Resealable and Convenience Functions in Plastic Packaging

For consumers, convenience features in plastic packaging have become paramount. No longer are cumbersome and difficult-to-handle packaging acceptable. Consumers these days favor packaging that is simple to open, secure, and store.

Consumers can easily access and preserve the contents of resealable plastic packaging, which has grown in popularity. This function guarantees product freshness, reduces waste, and improves the user experience. Whether it's a resealable zipper or a snap-on closure, these innovative packaging solutions meet the demands of modern consumers.

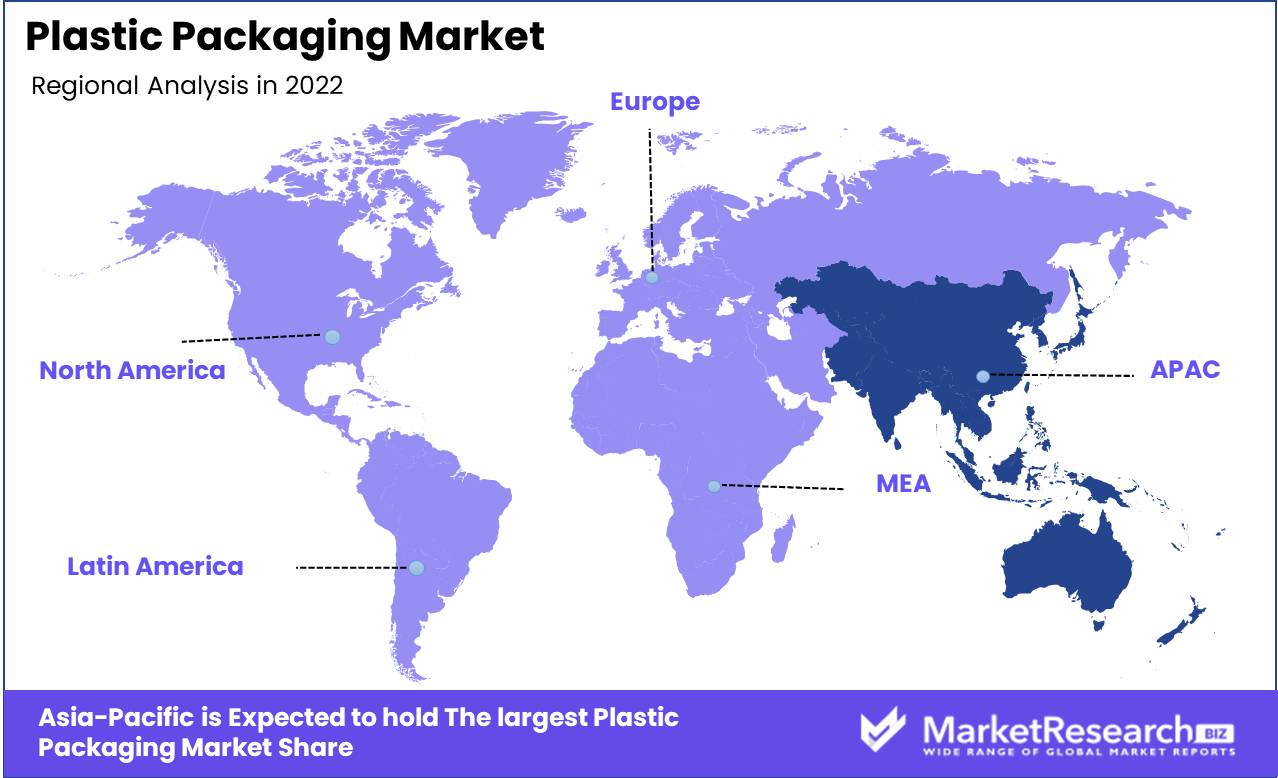

Regional Analysis

Plastic Packaging Market is Predominated by the Asia-Pacific Region

The Asia-Pacific region has played a crucial role in the recent expansion of the plastic packaging market. The region's large population and expanding middle class contribute significantly to its preeminence. The demand for packaging solutions has skyrocketed as a result of a growing consumer base, presenting enormous opportunities for manufacturers.

In addition, the Asia-Pacific region is home to a number of emerging economies that have experienced extraordinary economic development, resulting in increased urbanization and industrialization. This rapid growth has increased the demand for plastic packaging in numerous industries, including the food and beverage, healthcare, personal care, and automotive markets. These industries rely significantly on dependable and effective packaging solutions to ensure the safety and integrity of their products, and the Asia-Pacific region consistently meets their needs.

Particularly China has become a global manufacturing powerhouse. China has become a major participant in the plastic packaging market due to its abundant resources, skilled labor, and advanced production techniques. The nation has the largest population in the globe, resulting in an enormous demand for packaging solutions. In addition, China's industrial sector is expanding swiftly, which increases the demand for innovative packaging materials to serve a variety of industries.

South Korea and Japan contribute significantly to the Asia-Pacific region's plastic packaging market dominance. Both nations are renowned for their technological advances and quality control emphasis. They have established themselves as global leaders in numerous industries, including electronics and automotive, which rely significantly on high-quality packaging to protect their products and guarantee customer satisfaction.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Ireland-based Smurfit Kappa has emerged as a major force in the industry. The company specializes in sustainable packaging solutions and provides innovative products to meet the requirements of a variety of industries. Diverse industries, such as food and beverage, healthcare, personal care, and retail, are served by Smurfit Kappa's extensive range of plastic packaging solutions. Their offerings include flexible packaging, rigid containers, and custom-tailored solutions to satisfy the unique needs of their customers.

The headquarters of Mondi is in the United Kingdom. With a focus on sustainability and a global presence, Mondi has established itself as a dependable and innovative provider of plastic packaging solutions. In their manufacturing processes, they prioritize recyclability, reduced carbon footprint, and minimizing environmental impact. Mondi provides a comprehensive range of plastic packaging solutions, including flexible packaging, rigid containers, and specialty films.

BASF SE, based in Germany, is a prominent chemical company that plays a significant role in the plastic packaging market. They provide a comprehensive selection of high-quality plastic raw materials and additives, which are essential for the production of sustainable and performance-driven packaging solutions. Their proficiency in developing innovative materials guarantees the durability, sturdiness, and adaptability of plastic packaging products.

The WestRock Company is the market leader in sustainable packaging solutions for plastic packaging. They specialize in the design and production of a broad range of packaging materials, including corrugated containers, folding cartons, and plastics. Their emphasis on eco-friendly and lightweight packaging options has earned them customer loyalty.

Top Key Players in Plastic Packaging Market

- Smurfit Kappa (Ireland)

- Mondi (U.K.)

- BASF SE (Germany)

- WestRock Company (U.S.)

- Georgia-Pacific (U.S.)

- Metabolix(U.S.)

- Cereplast(U.S.)

- NatureWorks LLC(U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Biome Bioplastics (U.K.)

- Plantic (Australia)

- BIO-ON (Italy)

- Danimer Scientific (U.S.)

- Novamont S.p.A. (Italy)

- TORAY INDUSTRIES Inc. (Japan)

- Indochine Bio Plastiques (ICBP) Sdn. Bhd (Malaysia)

- TianAn Biologic Materials Co. Ltd. (China)

- Minima Global Ltd. (Switzerland)

- CLONDALKIN GROUP (Netherlands)

- Cargill Incorporated (U.S.)

Recent Development

- In 2023, global leader Amcor plans to launch a new line of sustainable packaging solutions. In response to the urgent demand for eco-friendly alternatives, the company aims to transform how plastic packaging is perceived and utilized. Amcor's upcoming product line will incorporate cutting-edge technologies and materials that substantially lessen the environmental impact of conventional plastic packaging.

- In 2022, Bemis's plans to expand its product portfolio have recently made headlines on the plastic packaging market. In order to satisfy the changing needs of businesses and consumers, the company is about to introduce a range of new and improved plastic packaging options.

- In 2021, Berry Global will launch a new plastic packaging brand, according to a recent announcement. The latest offering from the company aims to combine affordability and sustainability, making high-quality packaging more accessible to all businesses.

Report Scope

Report Features Description Market Value (2022) USD 413.7 Bn Forecast Revenue (2032) USD 612.1 Bn CAGR (2023-2032) 4.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Rigid, Flexible), By Technology(Injection Molding, Extrusion, Other), By Application(Food & Beverages, Industrial Packaging, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smurfit Kappa (Ireland), Mondi (U.K.), BASF SE (Germany), WestRock Company (U.S.), Georgia-Pacific (U.S.), Metabolix(U.S.), Cereplast(U.S.), NatureWorks LLC(U.S.), Mitsubishi Chemical Corporation (Japan), Biome Bioplastics (U.K.), Plantic (Australia), BIO-ON (Italy), Danimer Scientific (U.S.), Novamont S.p.A. (Italy), TORAY INDUSTRIES Inc. (Japan), Indochine Bio Plastiques (ICBP) Sdn. Bhd (Malaysia), TianAn Biologic Materials Co. Ltd. (China), Minima Global Ltd. (Switzerland), CLONDALKIN GROUP (Netherlands), Cargill Incorporated (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Smurfit Kappa (Ireland)

- Mondi (U.K.)

- BASF SE (Germany)

- WestRock Company (U.S.)

- Georgia-Pacific (U.S.)

- Metabolix(U.S.)

- Cereplast(U.S.)

- NatureWorks LLC(U.S.)

- Mitsubishi Chemical Corporation (Japan)

- Biome Bioplastics (U.K.)

- Plantic (Australia)

- BIO-ON (Italy)

- Danimer Scientific (U.S.)

- Novamont S.p.A. (Italy)

- TORAY INDUSTRIES Inc. (Japan)

- Indochine Bio Plastiques (ICBP) Sdn. Bhd (Malaysia)

- TianAn Biologic Materials Co. Ltd. (China)

- Minima Global Ltd. (Switzerland)

- CLONDALKIN GROUP (Netherlands)

- Cargill Incorporated (U.S.)