Global Dental Wax Market Report By Type (Pattern Wax, Processing Wax, Impression Wax, Orthodontic Wax, Baseplate Wax, Others), By Application (Dental Laboratories, Dental Clinics, Orthodontic Clinics, Others), By Formulation (Natural Waxes, Synthetic Waxes, Combination Waxes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47490

-

June 2024

-

325

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

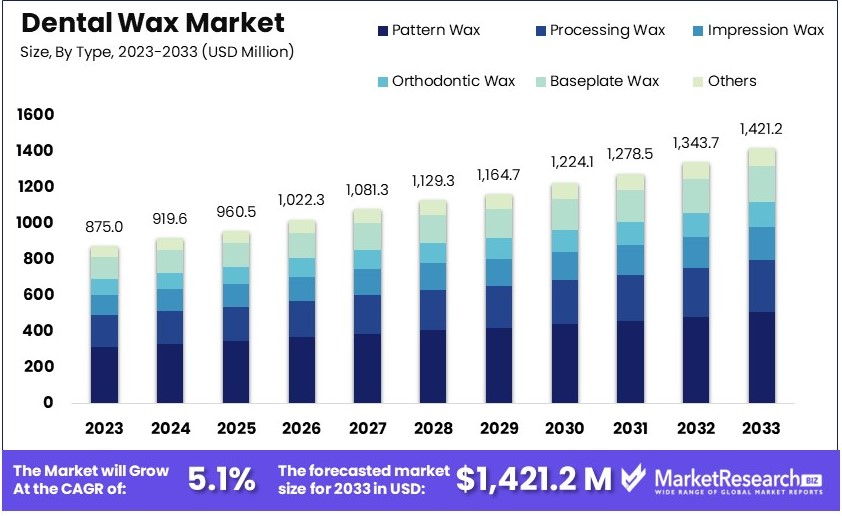

The Global Dental Wax Market size is expected to be worth around USD 1,421.2 Million by 2033, from USD 875 Million in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The Dental Wax Market refers to the sector focused on the production and distribution of dental wax, a crucial material used in dentistry for fabricating impressions, casting models, and forming dental prosthetics. This market caters to dental professionals and laboratories requiring high-quality, malleable waxes for precision work.

Key products include utility waxes, bite registration waxes, and boxing waxes, each serving specific functions in dental procedures. As dental healthcare standards rise globally, the demand for these specialized waxes grows, presenting significant opportunities for industry stakeholders, including manufacturers and distributors. This market is essential for maintaining and advancing dental treatment quality and efficiency.

The Dental Wax Market is poised for significant growth, driven by an increasing global demand for dental services, a direct consequence of the rising prevalence of oral diseases. According to the World Health Organization, approximately 3.5 billion people worldwide are affected by oral health issues. This surge in oral health complications is amplifying the need for effective dental solutions, where dental wax plays a critical role.

In emerging economies such as India, there has been a noticeable increase in the utilization of dental care services. Between 2011 and 2016, dental service utilization among adults stood at 20.27%, which escalated to 27.10% in the period from 2017 to 2022. This uptrend underscores a broader acceptance and accessibility of dental health services, subsequently boosting the market for dental wax. Dental wax is essential in various dental procedures, particularly in the fabrication of dentures, orthodontic appliances, and other dental prosthetics, which are fundamental in treating a wide array of dental issues.

From an industry standpoint, the escalating demand for dental wax is fostering innovations and expansions by key market players. Manufacturers are increasingly focusing on developing advanced wax compositions to enhance the quality and efficiency of dental treatments. This innovation drive is not only enhancing product quality but also expanding the application scope of dental waxes in the dental sector.

Observing the alignment of rising oral health awareness with the expansion of dental service infrastructure suggests robust market growth prospects. Stakeholders in the dental wax market should consider these dynamics when planning for future investments or expanding their market presence. The ongoing trends and data indicate a favorable growth environment for the Dental Wax Market, making it a key area for strategic developments in the dental industry.

Key Takeaways

- Market Value: The Global Dental Wax Market was valued at USD 875 Million in 2023 and is projected to reach USD 1,421.2 Million by 2033, with a CAGR of 5.1%.

- Type Analysis: Pattern Wax dominates, being critical for dental restorations and modeling due to its essential use in producing detailed metal castings and prosthetics.

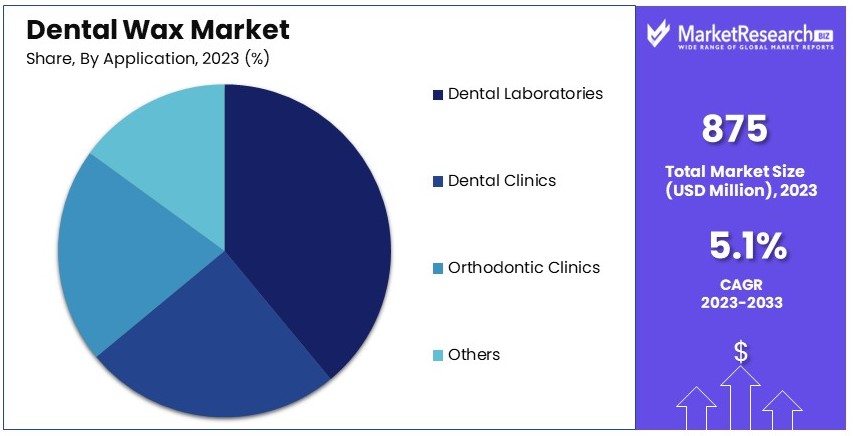

- Application Analysis: Dental Laboratories dominate with their central role in fabricating various dental prosthetics, driving the demand for dental waxes.

- Formulation Analysis: Synthetic Waxes lead due to their superior properties like consistency and adaptability, enhancing their usability in dental applications.

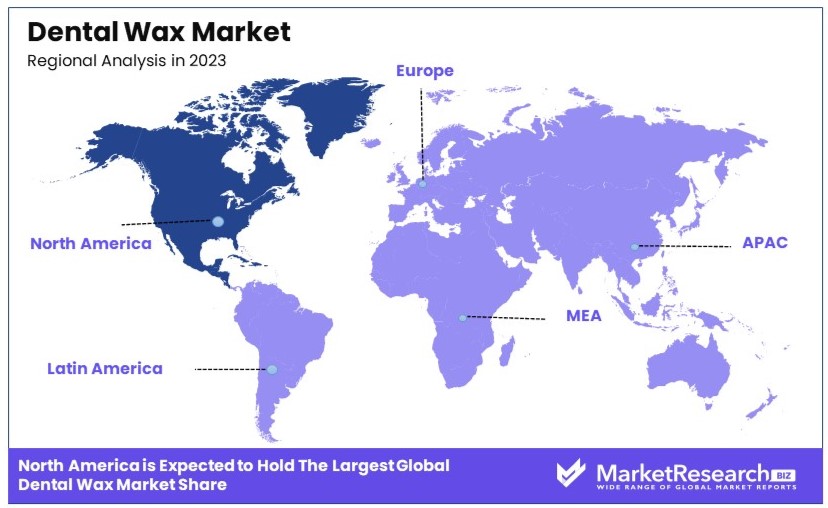

- Dominant Region: North America holds a dominant 40% market share, underscoring its leading role in dental wax innovations and consumption.

- High Growth Region: Europe follows with a 30% share, indicating robust market activity and potential growth in dental industries.

- Analyst Viewpoint: The market shows moderate competition and saturation, with significant growth potential through technological innovations in wax formulations and applications.

- Growth Opportunities: Key players can capitalize on the rising demand for advanced dental prosthetics and the ongoing developments in synthetic wax formulations to distinguish themselves in the market.

Driving Factors

Increasing Demand for Dental Procedures and Treatments Drives Market Growth

The escalating demand for dental wax correlates significantly with the increase in dental procedures and treatments worldwide. This growth is fueled by a rising global population, particularly within the aging demographic, which typically experiences more dental issues requiring restorative procedures. Additionally, heightened awareness about oral hygiene and the expanding popularity of cosmetic dentistry are key contributors. Procedures such as crown and bridge installations, orthodontic treatments, and denture fittings rely heavily on dental wax for impression-taking and temporary restorations. The precision offered by dental loupes enhances the application of dental wax in intricate dental procedures.

Statistics indicate that the cosmetic dentistry market alone is projected to grow at a CAGR of approximately 6.6% from 2023 to 2033, reflecting a broader trend that supports the increased consumption of dental wax. The surge in these specialized dental treatments has not only amplified the use of traditional waxes but also spurred demand for advanced formulations that offer superior performance and aesthetic results, underlining the direct relationship between dental healthcare trends and dental wax market dynamics.

Technological Advancements in Dental Materials and Techniques Drive Market Growth

Technological innovations in dental materials and techniques significantly propel the dental wax market forward. Recent advancements have introduced novel dental wax formulations that enhance handling, dimensional stability, and compatibility with other dental materials. The shift towards thermoplastic wax alternatives exemplifies this trend, offering better flow characteristics and ease of removal, which streamline dental procedures.

These innovations respond to the demands of modern dental practices for more efficient and adaptable materials, reflecting broader industry trends towards high-performance, customizable solutions. Market analysis reveals that the adoption of advanced dental waxes is increasing, as they crucially improve the outcomes of dental restorations and prosthetics. This factor not only supports market growth through direct application but also by fostering a competitive landscape where continuous improvement becomes a market standard, driving ongoing research and product development.

Rising Dental Tourism and Increasing Healthcare Expenditure Drive Market Growth

Dental tourism has emerged as a significant factor driving the dental wax market, particularly in countries known for cost-effective and high-quality dental care like Thailand, Hungary, and Mexico. This trend is coupled with rising global healthcare expenditures, which in many regions include increased investments in dental services. For instance, countries with burgeoning dental tourism markets are seeing heightened demand for dental materials, including dental wax, as they cater to international patients seeking affordable care.

The growth in healthcare expenditure, which includes dental services, further supports this market expansion. In developed countries, healthcare spending has been increasing steadily, with dental care constituting a significant portion of this expenditure. Dental insurance typically covers preventive care items like dental wax, emphasizing the importance of patient comfort. This increased financial outlay on dental health directly contributes to the growth of the dental wax market, as well-funded dental systems are better equipped to offer a range of treatments, thus boosting the demand for essential dental supplies like wax.

Restraining Factors

Availability of Alternative Materials and Techniques Restrains Market Growth

The adoption of new materials and digital dentistry technologies significantly challenges the dental wax market. Innovative methods like intraoral scanning and 3D printing are becoming more prevalent, reducing reliance on traditional impression materials such as dental wax.

Simultaneously, advancements in composite resins and ceramics are offering durable and aesthetically pleasing alternatives for dental restorations, further displacing dental wax. The digital dentistry market, which encompasses these technologies, is expected to grow at a CAGR of approximately 9.5% from 2020 to 2027, underscoring a shift towards these new techniques that diminish the traditional roles of dental wax in clinical settings.

Environmental Concerns and Sustainability Issues Restrains Market Growth

Environmental and sustainability concerns associated with petroleum-based dental waxes are increasingly affecting market dynamics. As global awareness of the environmental impacts of medical supplies grows, both consumers and regulatory bodies are pushing for more sustainable alternatives.

This shift is encouraging the development and adoption of eco-friendly materials that do not rely on petroleum, which traditionally forms the base for many dental waxes. This trend is poised to restrict the growth of the conventional dental wax market as practitioners and manufacturers pivot towards greener practices and materials to align with evolving regulatory policies and market preferences.

Type Names Analysis

Pattern Wax dominates with a significant percentage due to its critical role in dental restorations and modeling.

Pattern wax is the dominant sub-segment within the dental wax market, primarily because of its essential use in dental restorations and modeling. This type of wax is primarily used in the creation of metal castings and prosthetics, making it indispensable in dental laboratories. The accuracy and detail required in dental prosthetics heavily rely on the quality and properties of the pattern wax used, which has driven its widespread adoption. As dental aesthetics continue to gain importance globally, the demand for high-quality dental prosthetics is increasing, thereby boosting the market for pattern wax.

On the other hand, other types of dental waxes like processing wax, impression wax, orthodontic wax, and baseplate wax also contribute to the market but in different capacities. Processing wax aids in the processing of dental appliances, impression wax is crucial for taking accurate dental impressions, orthodontic wax provides comfort for brace wearers by preventing irritation, and baseplate wax is used in the initial stages of denture creation. Each of these types plays a specific role, catering to varied procedural needs in dentistry, thus supporting the overall growth of the dental wax market.

Application Analysis

Dental Laboratories dominate with a significant percentage due to their central role in fabricating various dental prosthetics.

Dental laboratories are the primary application segment for dental waxes, as these facilities are central to the fabrication of dental prosthetics such as crowns, bridges, dentures, and other dental restorations. The extensive use of various types of dental waxes in these processes makes this segment a significant contributor to market growth. The demand for customized dental prosthetics is rising, driven by increasing awareness of dental health and aesthetics, which in turn fuels the expansion of dental laboratories using dental waxes.

Other application areas such as dental clinics, orthodontic clinics, and other sectors also utilize dental waxes but to a lesser extent. Dental clinics use waxes mainly for basic impression taking and temporary restorations, orthodontic clinics use orthodontic waxes to ease discomfort for patients with braces, and other sectors might use dental waxes for specific, niche applications. While these segments contribute to the market, their impact is not as pronounced as that of dental laboratories.

Formulation Analysis

Synthetic Waxes dominate with a notable percentage due to their enhanced properties and versatility in applications.

Synthetic waxes have taken a leading position in the dental wax market, primarily due to their superior characteristics such as consistency, meltability, and adaptability to various dental applications. These waxes are engineered to provide specific properties that are beneficial in dental applications, such as improved dimensional stability and minimal shrinkage, which are critical for accurate dental work. The ability to tailor the properties of synthetic waxes to meet the precise needs of dental practitioners has made them a preferred choice over natural waxes.

Natural waxes and combination waxes also play significant roles in the market. Natural waxes are valued for their traditional use and biocompatibility, making them suitable for patients with allergies or sensitivities to synthetic materials. Combination waxes leverage the benefits of both natural and synthetic waxes, providing a balance of performance and natural properties. These alternative formulations support market diversity and provide options for various dental applications, contributing to the overall growth of the dental wax market.

Key Market Segments

By Type Names

- Pattern Wax

- Processing Wax

- Impression Wax

- Orthodontic Wax

- Baseplate Wax

- Others

By Application

- Dental Laboratories

- Dental Clinics

- Orthodontic Clinics

- Others

By Formulation

- Natural Waxes

- Synthetic Waxes

- Combination Waxes

Growth Opportunities

Development of Eco-Friendly and Sustainable Dental Wax Products Offers Growth Opportunity

The push towards sustainability is creating substantial growth opportunities within the dental wax market. With environmental awareness on the rise, there is a growing demand for dental materials that minimize ecological impact. Manufacturers are responding by researching and developing dental waxes made from plant-based or bio-based materials.

These eco-friendly alternatives not only comply with increasing regulatory demands for sustainable products but also appeal to a consumer base that values environmental responsibility. This shift towards greener materials is expected to open new markets and expand the customer base for dental wax products, as more dental professionals seek to align their practices with sustainable standards.

Expansion in Emerging Markets and Developing Economies Offers Growth Opportunity

Emerging markets and developing economies present significant expansion opportunities for the dental wax market. As these regions experience economic growth, improvements in healthcare infrastructure and increased spending power are enabling more consumers to access dental services. This development is driving the demand for dental materials, including dental waxes.

By entering these markets, manufacturers have the chance to establish a presence in areas where dental services are becoming more prevalent and essential, thus broadening their market reach and enhancing growth prospects.

Trending Factors

Incorporation of Advanced Materials and Technologies Offers Growth Opportunity

Incorporating advanced materials and technologies into dental wax products offers a clear pathway for market expansion. The integration of nanotechnology into dental wax formulations, for instance, enhances their properties such as strength and dimensional stability, making them more appealing to dental professionals.

Furthermore, the adoption of 3D printing in prosthetics allows for the precise creation of customized dental wax patterns, which can significantly improve the efficiency and accuracy of dental restorations. These advancements not only cater to the current needs of the dental industry but also position dental wax products at the forefront of technological innovation, attracting new customers and markets.

Regional Analysis

North America Dominates with 40% Market Share

North America's dominance in the dental wax market is primarily driven by its advanced healthcare infrastructure and high rate of dental procedures. The region's emphasis on cosmetic dentistry and orthodontic treatments, coupled with high healthcare expenditure, significantly contributes to the large market share. Moreover, the presence of leading dental product manufacturers and robust R&D activities in dental technologies further strengthen this position.

The regional market benefits from a well-established healthcare system and high patient awareness about dental care. The adoption of new technologies such as digital dentistry and eco-friendly materials also plays a crucial role in shaping the market landscape in North America.

Looking ahead, North America is expected to maintain its market leadership due to ongoing innovations in dental materials and a growing focus on personalized dental solutions. Continued investments in healthcare and dental aesthetics are likely to further drive the market growth.

Regional Market Shares and Growth Rates

- Europe: Holding a market share of 30%, Europe follows North America closely. The region's strong dental healthcare policies and the increasing demand for dental aesthetics fuel this substantial market share. The presence of numerous well-established dental clinics and laboratories across Europe supports continuous market growth.

- Asia Pacific: Asia Pacific is rapidly growing with a market share of 20%. This growth is driven by increasing disposable incomes, improvements in healthcare infrastructure, and rising awareness about oral health in emerging economies such as China and India.

- Middle East & Africa: With a smaller market share of 5%, the Middle East & Africa region is experiencing gradual growth. This is primarily due to increasing investments in healthcare sectors and government initiatives aimed at improving healthcare facilities.

- Latin America: Latin America holds a market share of 5%. The region shows potential for growth owing to rising health awareness and increasing access to healthcare services, which are expected to drive demand for dental services and products like dental wax.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Dental Wax Market, a range of key players contribute significantly to market dynamics through strategic innovation, geographic expansion, and product diversification. Companies such as Kerr Corporation, Dentsply Sirona Inc., and GC Corporation are recognized for their robust market presence and comprehensive product portfolios that cater to diverse dental needs, from impression waxes to utility waxes. These industry leaders leverage their established global distribution networks to ensure widespread accessibility and adoption of their products.

Mid-tier players like Kemdent, METABIOMED Co., Ltd., and Kulzer GmbH also play crucial roles by specializing in niche segments and introducing unique products that meet specific practitioner demands. Their strategic focus on targeted innovations allows them to carve out significant positions within the market.

Emerging entities such as Dental Klinic and Pyrax Polymars are noteworthy for their rapid market penetration. They are quickly gaining traction by offering cost-effective solutions in emerging markets where affordability plays a critical role in customer acquisition.

Companies like Carmel Industries and Solstice T&I distinguish themselves through manufacturing excellence and supply chain agility, which enhance their responsiveness to market changes and customer needs.

Furthermore, specialized players such as Ultradent Products, Inc., Mizzy, Inc. (a division of Keystone Industries), and Dental Creations, Ltd. enhance the market's competitive dynamics through their focused product innovations and marketing strategies. These companies often lead in specific sub-sectors such as orthodontic waxes or environmentally friendly alternatives, pushing the boundaries of what dental waxes can provide.

Overall, the competitive landscape of the Dental Wax Market is marked by a blend of large multinational corporations and dynamic smaller enterprises, each contributing to the market's growth and innovation trajectory. This diverse ecosystem fosters a competitive environment that drives continuous improvements in quality and functionality, benefiting both dental professionals and patients globally.

Market Key Players

- Kerr Corporation

- Dentsply Sirona Inc.

- Dental Klinic

- Carmel Industries

- Solstice T&I

- Pyrax Polymars

- GC Corporation

- Kemdent

- METABIOMED Co., Ltd.

- Yates Motloid

- C.J. Robinson Company, Inc.

- Kulzer GmbH

- Ultradent Products, Inc.

- Mizzy, Inc. (a division of Keystone Industries)

- Dental Creations, Ltd.

- Other Key Players

Recent Developments

- June 2023: B9Creations announces the limited release of its novel dental 3D printing solutions. The new offerings include the B9 Dent XL and the upcoming B9 Dent Lab. These solutions integrate feedback from dental technicians and feature intuitive CAM software alongside high-performance materials, catering to a range of dental applications.

- July 2021: An article discusses the use of additive wax-up and diagnostic mockups as driving tools for minimally invasive veneer preparations. These methods are highlighted for their benefits in reducing the complexity and invasiveness of dental procedures, enhancing precision and patient outcomes.

Report Scope

Report Features Description Market Value (2023) USD 875 Million Forecast Revenue (2033) USD 1,421.2 Million CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pattern Wax, Processing Wax, Impression Wax, Orthodontic Wax, Baseplate Wax, Others), By Application (Dental Laboratories, Dental Clinics, Orthodontic Clinics, Others), By Formulation (Natural Waxes, Synthetic Waxes, Combination Waxes) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kerr Corporation, Dentsply Sirona Inc., Dental Klinic, Carmel Industries, Solstice T&I, Pyrax Polymars, GC Corporation, Kemdent, METABIOMED Co., Ltd., Yates Motloid, C.J. Robinson Company, Inc., Kulzer GmbH, Ultradent Products, Inc., Mizzy, Inc. (a division of Keystone Industries), Dental Creations, Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Kerr Corporation

- Dentsply Sirona Inc.

- Dental Klinic

- Carmel Industries

- Solstice T&I

- Pyrax Polymars

- GC Corporation

- Kemdent

- METABIOMED Co., Ltd.

- Yates Motloid

- C.J. Robinson Company, Inc.

- Kulzer GmbH

- Ultradent Products, Inc.

- Mizzy, Inc. (a division of Keystone Industries)

- Dental Creations, Ltd.

- Other Key Players