Global 3D Printing in Prosthetics Market Size, Share, Growth, And Industry Analysis By Technology (Fused Deposition Modeling, Stereolithography, Others), Material Type (Thermoplastic, Titanium Alloys, Other Metals), Prosthetic Type (Upper Limb Prosthetics, Lower Limb Prosthetics, Other), And By Region Forecast - 2023-2032

-

41171

-

Sep 2023

-

160

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

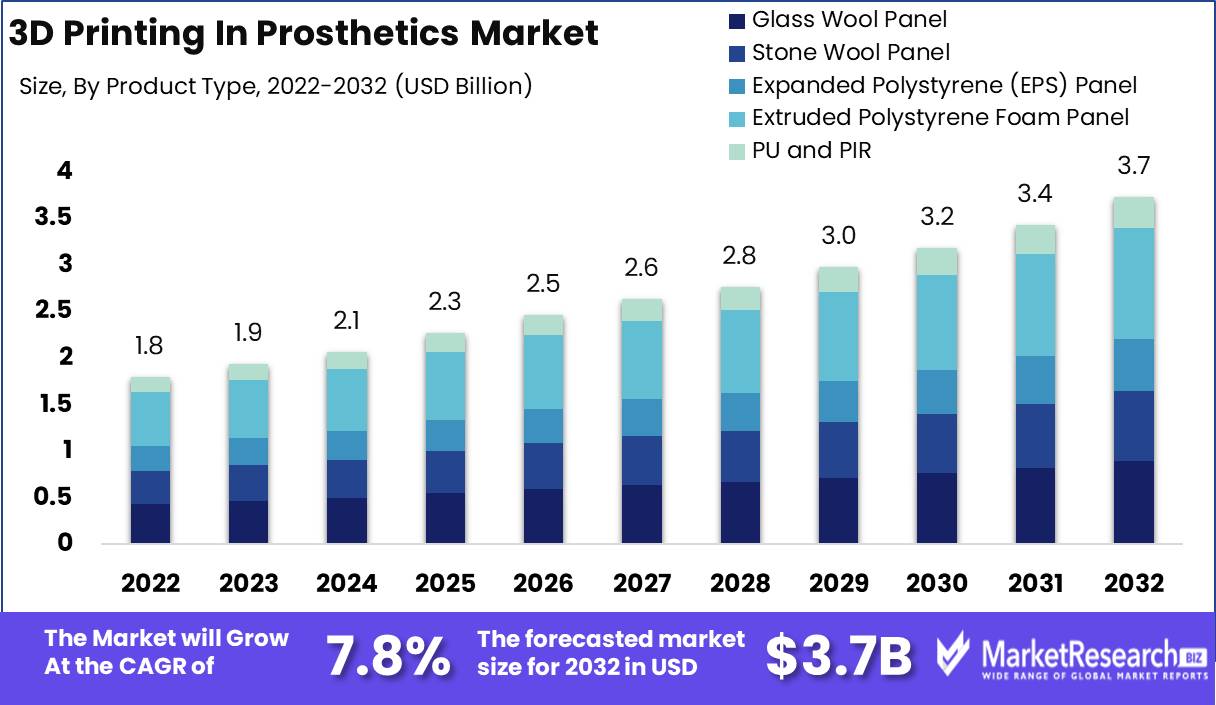

Global 3D Printing in Prosthetics Market size is expected to be worth around USD 3.7 Bn by 2032 from USD 1.8 Bn in 2022, growing at a CAGR of 7.8% during the forecast period from 2023 to 2032.

Key Takeaways

- The global 3D printing in prosthetics market is expected to reach a market size of approximately USD 3.7 Billion by 2032 and register a revenue CAGR of 7.8% over the forecast period

- It is estimated that there were approximately 40 million individuals worldwide in need of prosthetic limbs and orthopedic devices due to various causes, including congenital conditions, accidents, diseases, and conflict-related injuries.

- Asia-Pacific currently accounts for comparatively smaller revenue share (34.3%) in the global market than North America and Europe, but this is expected to increase steadily over the forecast period

- Europe 3D printing in prosthetics market accounted for a revenue share of around USD 1.2 billion in 2022, and is expected to register a CAGR of 7.4% over the forecast period

- Among the prosthetic type segments, the upper limb segment is expected to account for a robust 33.7% revenue share due to high demand for prosthetics among individuals with loss of upper body limbs and parts in various countries worldwide

Market Overview

The global 3D printing in prosthetics market has been registering significantly robust revenue growth, driven by rising demand for personalized and affordable prosthetic solutions. This factor is a major revenue driver an increasing number of patients and individuals are opting for more personalized fits and features in requirements, and 3D printing enables the production of customized, patient-specific devices. In addition, consumption trends indicate a shift towards additive manufacturing methods, with increased adoption across healthcare institutions and prosthetic clinics.

Advancements in 3D printing technologies, such as biocompatible materials and multi-material printing, are enhancing device functionality and comfort. Initiatives promoting research and development in this sector are driving rapid innovation, and advantages such as reduced costs, faster production, and improved patient outcomes are expected to drive further growth and evolution in the market.

3D printing has revolutionized the field of prosthetics, offering customizable, cost-effective, and efficient solutions to create more efficient, advanced, and convenient prosthetics for a varying range of applications and uses. Emergence of new and more advanced technologies, machinery, materials, and services are enabling companies to meet unmet demands and requirements over the recent past. Emergence of cutting-edge software and printing equipment currently allows for more precise design and digital modeling, ensuring a perfect fit for individual patients, and also enables production of more cost-effective end-products.

Also, availability of a range of services and organizations offering design, scanning, and printing services for prosthetic devices, makes this technology even more accessible to a wider consumer base. More widely used 3D printing methods for prosthetics include Fused Deposition Modeling (FDM), Stereolithography (SLA), and Selective Laser Sintering (SLS)m and these technologies enable the creation of intricate and patient-specific limb and joint replacements.

However, some restraints to adoption among a sizable potential consumer pool include service disparity, body impactors, consequences of ill-fit, prosthesis irritants, and limitations of practice.

Driving Factors

Customization and Personalization

3D printing of prosthetic devices enables creation of solutions and products that are specifically tailored to an individual patients' needs. Customization ensures proper fit and length and weight features and thereby enhances patient comfort and functionality. The increasing number of individuals opting for more advanced prosthetic devices and acceptance of the fact that it is not taboo to have such products, coupled with awareness about the functionalities and benefits such products offer are leading to increased demand and preference.Comfort and Lightweight Materials and Design

Light-weighting is a crucial factor as individuals who require prosthetics and implants are invariably facing the challenge of bone and muscle limitation or partial loss due to the removal or damage of a limb or part. Weight plays an important role with regard to comfort, ability to function, mobility, and overall experience. 3D printing has been very positive in this regard and devices and prosthetics printed using this technology are generally much lighter than those traditionally manufactured.Wide Range of Application Areas

3D printing in prosthetics is not limited to limbs; and this technology is also being used for creating cranial implants, dental implants, and other medical devices. The versatility of 3D printing technology has expanded its application beyond traditional prosthetic limbs, and with new technologies, materials, and techniques being rapidly developed, demand and preference are expected to expand steadily over the forecast period. Revolutionizing the 3D printing in prosthetics market, the 3D Optical Profiler ensures meticulous detailing for personalized and functional prosthetic solutions.Cost Efficiency

3D printing entails reduced production costs as compared to production using other conventional methods and materials. This is a key factor that makes 3-D printed prosthetic devices more affordable for a broader range of individuals currently.Technological Advancements

Ongoing advancements in 3D printing technology, including improved materials and printing techniques, result in production of prosthetic devices that are more durable and functionally superior. These innovations attract patients with need for such products and an increasing number of healthcare providers are also encouraging adoption and this is contributing significantly to overall market revenue growth.Healthcare Accessibility

Global focus on improving healthcare accessibility is driving an incline in the adoption of 3D-printed prosthetics. These devices can be manufactured locally, thus reducing the reliance on centralized production facilities and improving access in areas with unmet demands.Regulatory Support

Regulatory agencies are increasingly recognizing the convenience, safety, and effectiveness of 3D-printed prosthetic devices. As regulations become more accommodating, it becomes easier for manufacturers to enter the market and scale their operations, and this is having positive impacting on revenue.Restraining Factors

Limited Reimbursement Policies

Reimbursement policies for 3D-printed prosthetic devices are limited or nonexistent in a number of countries and regions. This is a key factor that can deter potential patients who rely on insurance coverage to afford prosthetics.Material Quality and Biocompatibility Concerns

Ensuring that 3D-printed prosthetics meet stringent quality and biocompatibility standards can be challenging. Concerns about material safety and durability may restrain adoption if patients and healthcare providers remain skeptical, and this will lead to a negative impact on revenue.Technological Barriers

Despite various advancements, 3D printing technology continues to have certain limitations, such as speed of production and scalability for mass adoption. These technological barriers can slow market growth and hinder revenue potential as manufacturers work to overcome these challenges.Opportunities

Customization Services

Companies can capitalize on rising demand for personalized prosthetics by offering advanced customization services and increasing the visibility of options that can be accommodated. Developing user-friendly software and conducting 3D scans for precise measurements and charging premiums for such tailored solutions can open up lucrative revenue streams.Material Development

Investing in research and development of biocompatible and durable 3D printing materials can open up significant opportunities. Companies can supply specialized filaments or resins that meet healthcare standards, catering to some of the more unique material requirements in the prosthetics market.Training and Certification

Offering healthcare professionals training programs and certification in the use of 3D printing technology for prosthetics can create an additional revenue stream. The market is expanding and this is driving need for skilled practitioners who can harness the full potential of 3D printing in prosthetics. Securing certifications and undergoing training also opens up lucrative opportunities in the healthcare sector.Segment Analysis

By Technology

Among the technology segments, the Fused Deposition Modeling (FDM) segment accounted for the majority of revenue share in 2022. FDM is a significantly prominent technology in the 3D printing in prosthetics market, and further revenue growth can be attributed to cost-effectiveness and versatility. FDM technology allows for the production of prosthetic devices at a relatively lower cost compared to traditional manufacturing methods, making it an attractive option for both patients and healthcare providers. Also, the versatility of FDM enables the creation of prosthetic devices with various materials, including thermoplastics and biocompatible options, ensuring these meet the specific needs of patients.

By Prosthetic Type

Among the prosthetic type segments, the upper limb prosthetics segment accounted for the majority revenue share contribution in 2022. Advancements in design and increased adoption among pediatric patients are some key factors attributable to robust demand and revenue growth. In addition, innovations in upper limb prosthetic design have resulted in more functional and aesthetically pleasing devices, attracting a wider patient base.

Moreover, the rising incidence of congenital upper limb deficiencies among pediatric patients has led to increased demand for 3D-printed upper limb prosthetics, as these offer a customizable and cost-effective solution for children as they grow.

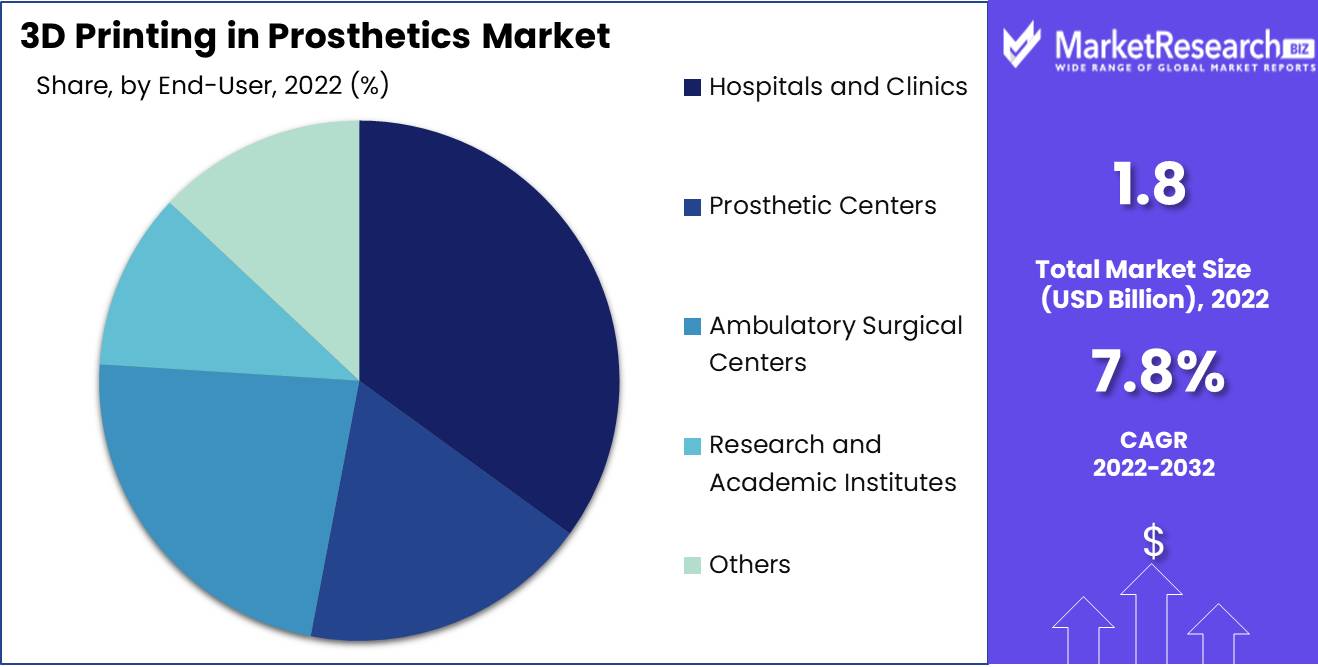

By End-User

The hospitals and clinics segment among the end-user segments accounted for a significantly large revenue share contribution to the global 3D printing in prosthetics market in 2022. Some key factors driving revenue growth are increased collaborations and technological support from various private and governmental entities and 3-D printing companies seeking to further the goals of 3-D printing in healthcare applications and end-uses.

Hospitals and clinics are increasingly collaborating with 3D printing companies to explore offerings of customized prosthetic solutions to their patients, and this is serving to enhance accessibility of these devices. Also, technological support from 3D printing companies, including training and certifications, helps healthcare professionals in hospitals and clinics adopt and integrate 3D-printed prosthetics effectively, and this is further driving revenue growth of this segment.

Market Segmentation

By Technology

- Fused Deposition Modeling (FDM)

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- PolyJet Technology

- Others

Material Type

- Thermoplastic

- Titanium Alloys

- Photopolymer Resins

- Other Metals

- Biocompatible Materials

Prosthetic Type

- Upper Limb Prosthetics

- Lower Limb Prosthetics

- Exoskeletons

- Custom Implants

- Dental Prosthetics

End-User

- Hospitals and Clinics

- Prosthetic Centers

- Ambulatory Surgical Centers

- Research and Academic Institutes

- Others

Application

- Orthopedics

- Cranio-Maxillofacial

- Dental

- Audiology

- Others

Regional Analysis

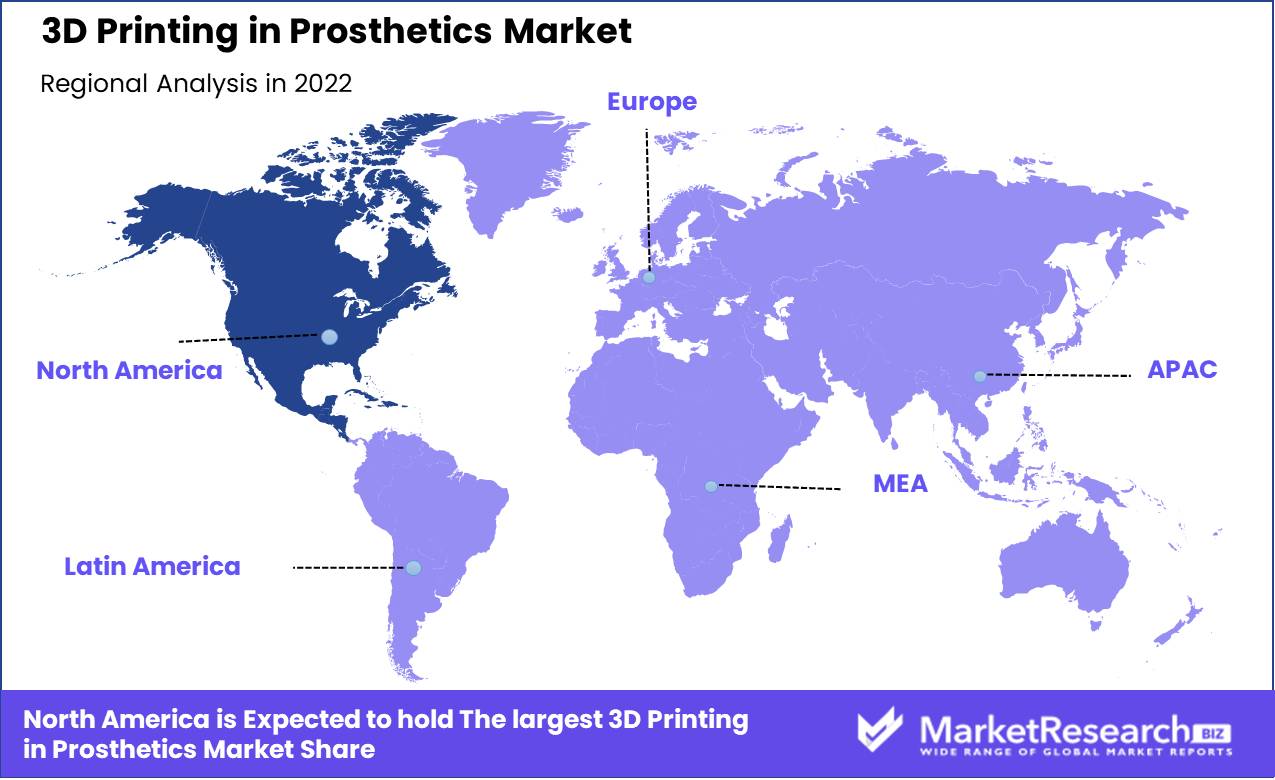

North America

North America accounts for significantly larger revenue share compared to other regional markets in the global 3D printing in prosthetics market. Presence of advanced healthcare infrastructure, high level of awareness about prosthetic solutions, and preference for personalization of such devices, the 3D printing in prosthetics are some key factors driving robust revenue growth of the market in the region. Also, there are over 45,000 American veterans living with limb loss.

Demand for specialized in-home prosthetics care is being met by various organizations and care providers, and development on new and more advanced solutions are quite welcome. In addition, factors such as large aging population, increased funding for research and development, and growing collaborations between healthcare providers and 3D printing companies, supported to a major extent by rapid technological advancements in countries in the region are resulting in design and creation of more sophisticated and durable prosthetic devices.

Furthermore, initiatives supporting revenue growth include partnerships between academic institutions and industry players for innovation, government grants for prosthetic research, and increased insurance coverage for 3D-printed prosthetics are expected to continue to support North America market revenue growth.

Europe

Europe is another major market for 3D printing in prosthetics, and accounts for a robust market share. This can be attributed to well-established healthcare systems and proactive approach to adopting innovative medical technologies in countries in the region. Other key factors include aging population, increasing cases of limb loss, and a focus on patient-centric healthcare in the region.

Also, technological developments in Europe have led to the production of high-quality, biocompatible materials suitable for prosthetics, and this is contributing significantly to innovations in various medical devices, among others. Initiatives such as cross-border collaboration among European Union nations to standardize regulations and promote research in 3D printing for prosthetics are also boosting revenue growth. In addition, private and public investments in healthcare innovation are providing the necessary resources for further growth of the market in Europe.

Asia-Pacific

Asia-Pacific represents immense potential for companies operating in the 3D printing in prosthetics market. While market share is currently smaller compared to North America and Europe, rapid economic development, rising healthcare expenditure, and a large population are some key factors expected to support potential revenue growth of the market over the forecast period.

In addition, factors such as technological advancements in various fields and industries in countries in Asia-Pacific and high focus on the development and production of more cost-effective solutions so as to align with the demand for more affordable healthcare solutions and products are driving innovations across the healthcare sector.

Furthermore, initiatives and collaborations between regional governments and international organizations to improve healthcare infrastructure and accessibility, as well as partnerships with global prosthetic manufacturers to tap into potential arising from steadily growing awareness about 3D printing in prosthetics and modernization of healthcare systems in countries in the region are expected to support revenue growth of the Asia-Pacific market over the forecast period.

Segmentation By Region

North America

- United States

- Canada

Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- Association of Southeast Asian Nations (ASEAN)

- Rest of Asia Pacific

Europe

- Germany

- The U.K.

- France

- Spain

- Italy

- Russia

- Poland

- BENELUX (Belgium, the Netherlands, Luxembourg)

- NORDIC (Norway, Sweden, Finland, Denmark)

- Rest of Europe

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Egypt

- Israel

- Rest of MEA (Middle East & Africa)

Competitive Landscape

The global 3D printing in prosthetics market is characterized by a competitive landscape with several prominent players focusing on leveraging maximum market share. These companies employ various strategies to maintain and strengthen their positions in this rapidly evolving sector and strategic partnerships and collaborations are primary on the list.

Leading players in 3D printing in the prosthetics market often form strategic partnerships and collaborations with healthcare institutions, prosthetic clinics, and medical device manufacturers. These partnerships facilitate the integration of their 3D printing solutions into existing healthcare infrastructure and provide access to valuable patient data for research and development. Such collaborations enhance their market presence and expand their customer base.

Companies are also focused on innovation and research in order to stay at the forefront of technological advancements in this competitive market. Industry leaders invest majorly in R&D to refine their 3D printing technologies. This includes developing more advanced printing materials, improving accuracy in prosthetic design, and expanding the range of prosthetic types that can be produced using 3D printing.

Also, established companies in the global 3D printing in the prosthetics market are focusing on acquiring innovative startups to expand their service offerings and customer reach. These acquisitions help companies enhance their capabilities, access new technologies, and strengthen their market positions. By integrating these startups, larger companies can provide a broader range of solutions to meet diverse customer needs.

In addition, compliance with regulatory standards is paramount in the healthcare sector, and leading players prioritize adherence to stringent regulations such as FDA approvals and CE marking for medical devices. Ensuring that their 3D-printed prosthetics meet the highest quality and safety standards not only builds trust among healthcare providers and patients but also helps such players maintain a strong market presence.

Some major companies operating in the market include Open Bionics, which is known for its advanced 3D-printed bionic hands and arms, including the Hero Arm, which is customizable and affordable; Limbitless Solutions specializes in creating 3D-printed, custom-designed bionic arms for children and focuses keenly on affordability and accessibility; e-NABLE is a global network of volunteers who use 3D printing to create free, open-source prosthetic hands and arms for people in need; PDG specializes in 3D-printed prosthetic limbs, including lower limb prosthetics with advanced features; Nia Technologies focuses on using 3D printing and digital technologies to create affordable prosthetic sockets and components for lower-limb amputees in underserved communities; 3D Systems is a well-known provider of 3D printing solutions, and offers various 3D printing technologies and materials that are used in the production of prosthetic components and devices; Stratasys is another prominent 3D printing company that provides technology and materials used in the creation of custom prosthetic components.

Company List

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH Electro Optical Systems

- EnvisionTEC

- Materialise NV

- Formlabs Inc.

- Stryker Corporation

- Limbitless Solutions

- Open Bionics

- UNYQ

- Ottobock

- ProPellor

- Bespoke Innovations

- SHINING 3D Tech Co., Ltd.

- 3D LifePrints

- LayerWise NV (3D Systems)

- The Exo-Prosthetic Center

- Mecuris GmbH

- nTopology Inc.

- PrinterPrezz Inc.

Recent Developments

- In February 2023, Stratasys Ltd., which is a leader in polymer 3D printing, announced the introduction of TrueDent. The material is the first monolithic, full-color 3D printed permanent dentures resin, which enables labs to create permanent, natural-looking gums with accurate tooth structure, shade, and translucency in one continuous print. TrueDent is an FDA-cleared (Class II) dental resin made specifically for the fabrication of dental appliances, including removable dentures.

- On 20 October 2022, SprintRay Inc., which is a leader in digital dentistry and 3D printing solutions, announced the launch of its OnX Tough. This product is a next-generation hybrid ceramic resin designed for 3D printing dental prosthetics and is based on SprintRay's proprietary NanoFusion technology. The new resin material offers high durability and lifelike translucency for high-quality dentures.

- In July 2022, Japan-based Instalimb, which is the world’s first 3D-printed prosthetic legs maker, raised 445 million yen (INR 26 crore) in Series A funding in Japan to enter into the Indian market. The company launched its prosthetic wear solutions in Gurgaon on July 1. Instalimb plans to deliver this technologically advanced prosthesis leg to 48 million individuals who currently lack access to such devices worldwide.

- In May 2022, UNYQ Inc., which is a leader in the 3D-printed prosthetic wear field, announced that it is introducing the new UNYQ FOOT. This enables an innovative approach to producing prosthetic feet for amputees and uses proprietary technology to capture user design preferences and biometrics, involving a process comprising 3D imaging, 3D printing, and design finishing. The product was developed in collaboration with the Department of Veterans Affairs and was showcased at the OTWorld international trade show for advanced prosthetics and orthotics in Leipzig, Germany, in October 2022.

Report Scope

Report Features Description Market Value (2022) USD 1.8 Bn Forecast Revenue (2032) USD 3.7 Bn CAGR (2023-2032) 7.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology(Fused Deposition Modeling (FDM), Stereolithography (SLA), Selective Laser Sintering (SLS), PolyJet Technology, Others), Material Type(Thermoplastic, Titanium Alloys, Photopolymer Resins, Other Metals, Biocompatible Materials), Prosthetic Type(Upper Limb Prosthetics, Lower Limb Prosthetics, Exoskeletons, Custom Implants, Dental Prosthetics), End-User(Hospitals and Clinics, Prosthetic Centers, Ambulatory Surgical Centers, Research and Academic Institutes, Others), Application(Orthopedics, Cranio-Maxillofacial, Dental, Audiology, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Stratasys Ltd., 3D Systems Corporation, EOS GmbH Electro Optical Systems, EnvisionTEC, Materialise NV, Formlabs Inc., Stryker Corporation, Limbitless Solutions, Open Bionics, UNYQ, Ottobock, ProPellor, Bespoke Innovations, SHINING 3D Tech Co., Ltd., 3D LifePrints, LayerWise NV (3D Systems), The Exo-Prosthetic Center, Mecuris GmbH, nTopology Inc., PrinterPrezz Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH Electro Optical Systems

- EnvisionTEC

- Materialise NV

- Formlabs Inc.

- Stryker Corporation

- Limbitless Solutions

- Open Bionics

- UNYQ

- Ottobock

- ProPellor

- Bespoke Innovations

- SHINING 3D Tech Co., Ltd.

- 3D LifePrints

- LayerWise NV (3D Systems)

- The Exo-Prosthetic Center

- Mecuris GmbH

- nTopology Inc.

- PrinterPrezz Inc.