Global Contract Manufacturing Market By Product(Medical Device Manufacturing, Pharmaceutical Products Manufacturing), By End User(Biotechnology Companies, Pharmaceutical Companies , Medical Device Companies, Biopharma Companies, Other End-Users), By Distribution Channel(Retail Sales, Direct Tender, Other Distribution Channels), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

39671

-

August 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

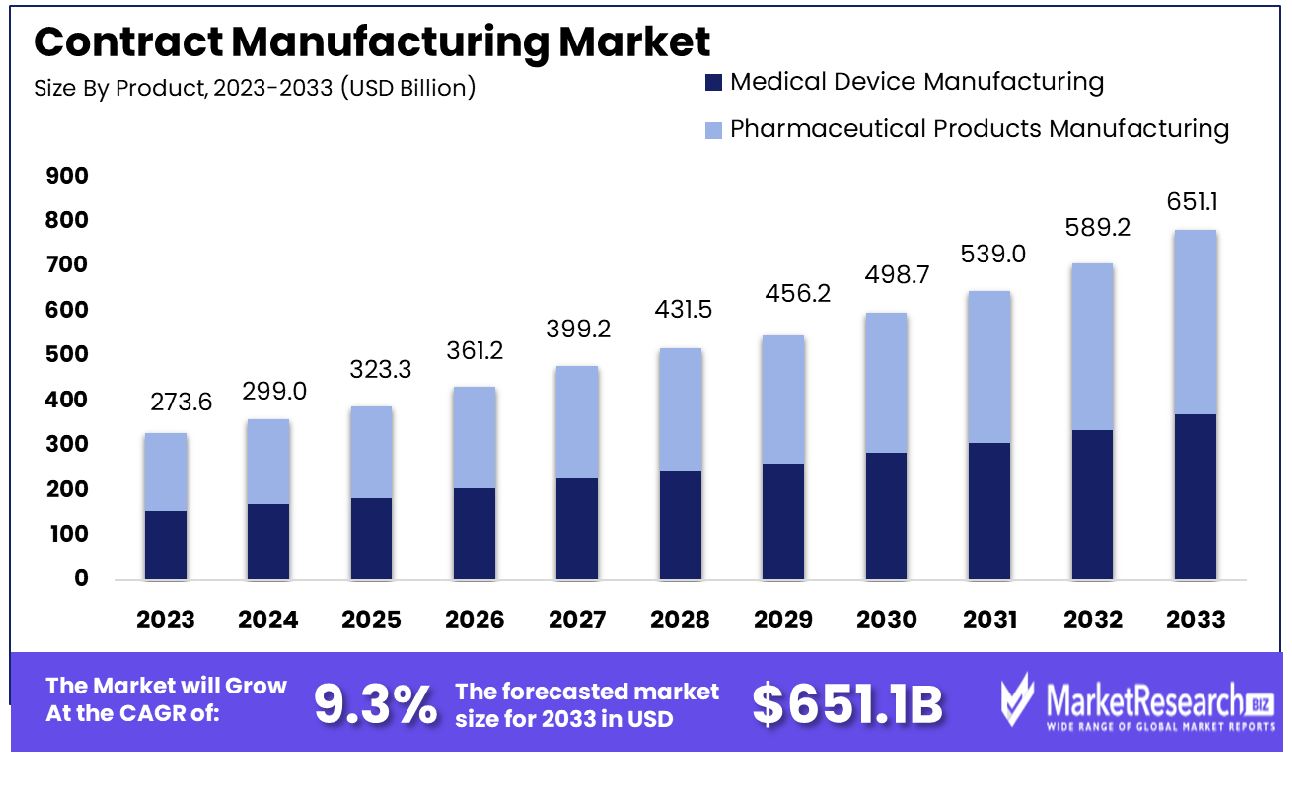

The Global Contract Manufacturing Market was valued at USD 273.6 billion in 2023. It is expected to reach USD 651.1 billion by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

The contract manufacturing market refers to the sector in which firms outsource production processes to third-party entities. This model allows companies to focus on core competencies such as research and development, branding, and market expansion while leveraging the manufacturing expertise of specialized firms. Predominantly utilized in industries such as electronics, pharmaceuticals, and consumer goods, contract manufacturing offers cost efficiencies and quicker time-to-market for products.

As global supply chains become more integrated and the demand for specialized production capabilities increases, the contract manufacturing market is positioned for significant growth, presenting strategic opportunities for businesses aiming to optimize operations and enhance competitive advantage.

The global contract manufacturing market is positioned for significant growth, influenced by an array of socio-economic factors and industry-specific dynamics. Notably, the increasing aging population worldwide, particularly in developed economies, catalyzes expanded market opportunities. As of 2024, projections indicate that over 2 billion individuals globally will be aged 60 years and above. This demographic shift underscores a rising demand for pharmaceuticals, medical devices, and healthcare services, sectors heavily reliant on contract manufacturing for scalability and efficiency.

In the UK, the situation is particularly pronounced, with expectations that by 2050, a quarter of the population will be 65 years or older. This demographic trend necessitates robust healthcare solutions, subsequently driving the demand for contract manufacturing services in the medical and pharmaceutical sectors. Additionally, consumer preferences have evolved, emphasizing the importance of daily health management, which aligns with the increasing reliance on contract-manufactured products that support healthcare regimes.

Market accessibility varies, highlighted by the pricing strategy for industry reports, which significantly impacts market understanding and strategy development. The disparity in report access between members and non-members, with members accessing at no cost versus a $995 fee for non-members, potentially influences strategic decisions made by various stakeholders in the market.

This demographic and economic context presents contract manufacturers with substantial growth opportunities, contingent upon their ability to innovate and scale operations effectively. The evolving market demands a strategic approach that prioritizes operational excellence and strategic partnerships to capitalize on the burgeoning needs of an aging global population.

Key Takeaways

- Market Growth: The Global Contract Manufacturing Market was valued at USD 273.6 billion in 2023. It is expected to reach USD 651.1 billion by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

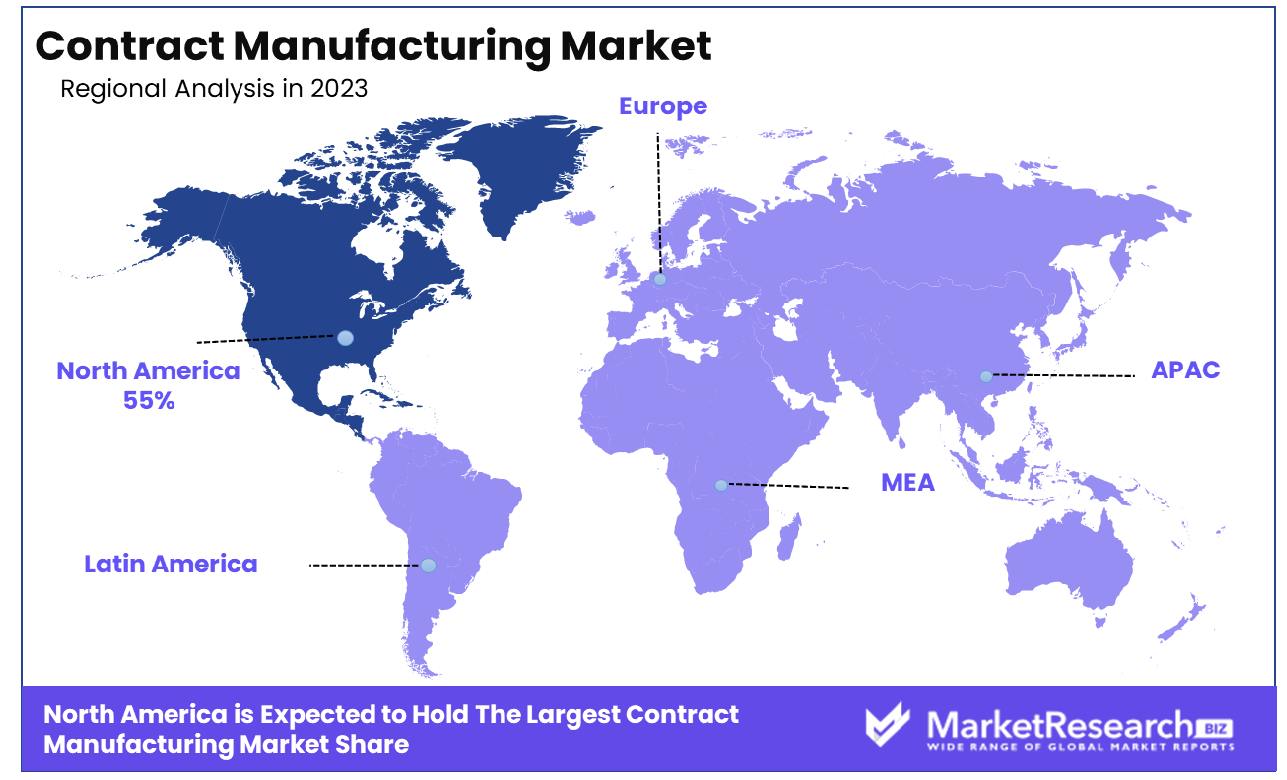

- Regional Dominance: North America holds 55% of the global contract manufacturing market.

- By Product: Pharmaceutical product manufacturing leads, dominating 55% of the market.

- By End User: Pharmaceutical companies are major end-users, holding 48% dominance.

- By Distribution Channel: Direct tender is the main distribution channel at 60%.

Driving factors

Increased Outsourcing by Pharmaceutical and Biotech Companies

The contract manufacturing market is significantly bolstered by the increased outsourcing activities of pharmaceutical and biotech companies. This trend is driven by the desire to streamline operations and focus on core competencies such as R&D and drug discovery, while delegating manufacturing processes to external partners. This shift allows these companies to scale their production capabilities without the substantial capital investment required for new facilities, thus accelerating time-to-market for new therapies.

With an aging global population projected to exceed 2 billion individuals by 2024, the demand for pharmaceutical products is set to rise, further enhancing the growth prospects for contract manufacturers who can provide the needed capacity and specialized services.

Rising Demand for Generic Medicines and Biosimilars

The escalating demand for generic medicines and biosimilars acts as a pivotal growth lever within the contract manufacturing sector. As patents on many blockbuster drugs expire, there is a surge in the demand for generics and biosimilars which offer a cost-effective alternative to branded medications.

This demand is further amplified by global healthcare initiatives to reduce drug costs and increase accessibility, particularly in emerging markets. Contract manufacturers, with their established production facilities and regulatory expertise, are ideally positioned to capitalize on this trend, providing essential services to companies racing to launch generic versions and biosimilars.

Cost Reduction and Efficiency Improvement Needs

Cost reduction and efficiency improvements are central to the competitive strategy of pharmaceutical and biotech companies, driving the expansion of the contract manufacturing market. By outsourcing to contract manufacturers, these companies can achieve significant cost efficiencies through reduced labor costs, optimized resource utilization, and access to advanced technologies without direct investment.

The economic benefit is particularly compelling given the high importance placed on healthcare efficiency, underscored by studies emphasizing the significance of daily health management. This efficiency drive, coupled with strategic outsourcing and the demand for generics, creates a robust environment for growth in the contract manufacturing sector, aligning operational goals with market needs.

Restraining Factors

Stringent Regulatory Requirements for Product Approval

Stringent regulatory requirements pose significant challenges for the contract manufacturing market, particularly in the pharmaceutical and biotech sectors. The process for product approval is often complex and varies by region, requiring manufacturers to adhere to rigorous standards for quality and safety. This complexity can lead to delays in getting products to market and increase the costs associated with compliance.

For contract manufacturers, the necessity to continuously update and maintain compliance with these evolving regulations demands substantial investment in both technology and expert personnel. While this factor restrains growth by raising barriers to entry and operational costs, it also ensures that only the most capable and reliable contract manufacturers thrive, potentially leading to a market composed of highly competent providers.

Intellectual Property Concerns Among Original Manufacturers

Intellectual property (IP) concerns significantly influence the dynamics within the contract manufacturing market. Original manufacturers often hesitate to outsource their manufacturing processes due to fears of IP theft or misuse, particularly in regions with less stringent IP protection laws.

This apprehension can limit the scope of outsourcing engagements and influence the choice of contract manufacturing partners, favoring those in countries with robust legal frameworks for IP protection. Consequently, while IP concerns can restrict market expansion by dampening the enthusiasm for outsourcing, they also encourage contract manufacturers to enhance their reputations for reliability and security, potentially leading to deeper, more trusting relationships with clients.

By Product Analysis

Pharmaceutical product manufacturing dominated the market, accounting for 55% of contract manufacturing activities.

In 2023, Pharmaceutical Products Manufacturing held a dominant market position in the by-product segment of the Contract Manufacturing Market, capturing more than a 55% share. This segment significantly outperformed Medical Device Manufacturing, which held a smaller portion of the market.

The robust performance of Pharmaceutical Products Manufacturing can be attributed to several key factors. Firstly, the rising global demand for pharmaceuticals driven by an aging population and the increasing prevalence of chronic diseases has significantly fueled the sector's growth. Additionally, the expansion of generic drug production, coupled with advancements in biopharmaceuticals, has propelled pharmaceutical manufacturers to invest heavily in contract manufacturing organizations (CMOs) to leverage their expertise and capacity.

The strategic partnerships between pharmaceutical companies and CMOs are increasingly critical, as they allow for enhanced scalability and flexibility in production. These collaborations are crucial in an environment where speed to market is a significant competitive advantage. Moreover, regulatory support for drug development and manufacturing in regions such as North America and Europe continues to provide a conducive environment for the growth of this segment.

Meanwhile, Smart Medical Device Manufacturing in the contract manufacturing market also showed growth, though it was more moderate compared to Pharmaceutical Products Manufacturing. This segment benefits from the technological innovations in medical devices, including wearable health devices and surgical instruments, which have expanded the market scope for contract manufacturers in the medical device sector.

Overall, the Contract Manufacturing Market is witnessing a significant shift with pharmaceutical products manufacturing taking the lead, driven by comprehensive service offerings from CMOs that include advanced drug development capabilities and manufacturing excellence. This trend is expected to continue as pharmaceutical companies increasingly rely on contract manufacturers to meet the rising global demand for healthcare solutions.

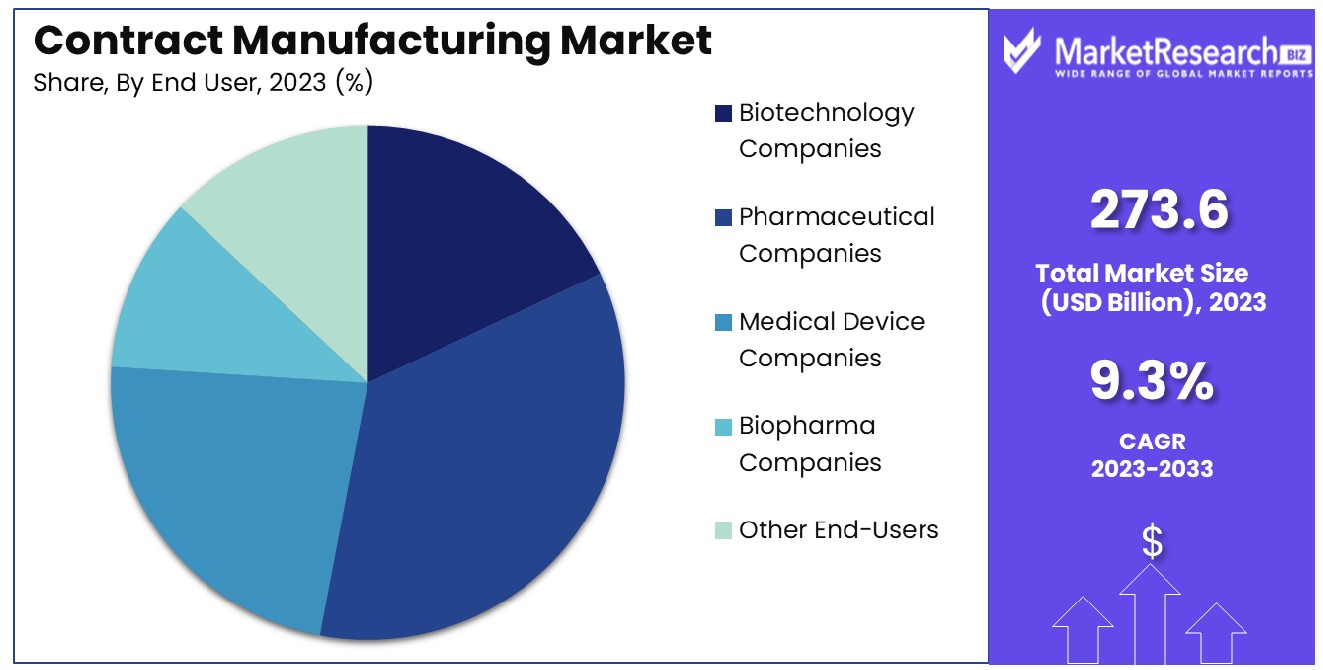

By End User Analysis

Pharmaceutical companies were the primary end users, representing 48% of the total market demand.

In 2023, Pharmaceutical Companies held a dominant market position in the By End User segment of the Contract Manufacturing Market, capturing more than a 48% share. This was followed by Biopharma Companies, Medical Device Companies, Biotechnology Companies, and Other End-Users, each contributing to the market's dynamics with varying shares.

Pharmaceutical Companies' leading position can be primarily attributed to their increasing reliance on contract manufacturing organizations (CMOs) to mitigate the risks associated with drug production, reduce costs, and improve time efficiencies in bringing products to market. The surge in demand for pharmaceutical products, driven by an aging global population and a higher prevalence of chronic diseases, has underscored the need for enhanced production capacities that CMOs can provide.

Biopharma Companies also constituted a significant portion of the market, leveraging CMOs for their specialized manufacturing capabilities, particularly in the production of biologics. This includes advanced therapies such as monoclonal antibodies and recombinant proteins, which require specialized production facilities and expertise that are often more cost effective to outsource.

Medical Device Companies and Biotechnology Companies further contributed to the market share, focusing on outsourcing to manage complex manufacturing processes and regulatory requirements more efficiently. These segments are increasingly turning to CMOs to navigate the fast-evolving technological landscape and stringent quality standards.

Other End-Users, including startups and niche healthcare companies, also engaged CMOs to access specialized manufacturing technologies and regulatory expertise without the overhead of maintaining in-house production facilities.

Overall, the robust engagement of pharmaceutical and biopharma companies with contract manufacturers is indicative of a strategic shift towards outsourcing in the healthcare sector, driven by the imperative to accelerate innovation and manage costs effectively. This trend is projected to continue, further enhancing the growth and diversification of the Contract Manufacturing Market.

By Distribution Channel Analysis

Direct tender was the leading distribution channel, holding a significant 60% of market transactions.

In 2023, Direct Tender held a dominant market position in the By Distribution Channel segment of the Contract Manufacturing Market, capturing more than a 60% share. This was significantly higher than the contributions from Retail Sales and Other Distribution Channels, which filled out the remainder of the market landscape.

The predominance of Direct Tender as a distribution channel can be attributed to its direct engagement between manufacturers and large purchasing organizations, such as hospitals, government entities, and large pharmacy chains. This method is favored for its efficiency and cost-effectiveness, allowing for bulk purchasing at negotiated prices, which significantly reduces the overall cost of procurement and enhances supply chain predictability.

Retail Sales, while substantial, accounted for a lesser share compared to Direct Tender. Retail channels typically involve distribution through pharmacies and online platforms where end consumers can purchase directly. This segment has seen growth driven by the increased accessibility of medical products and the rising trend of self-medication among consumers. However, the complexities and costs associated with retail distribution, such as inventory management and broader logistic networks, have somewhat curtailed its expansion.

Other Distribution Channels, including e-commerce and distributor partnerships, also played a role but were less dominant. These channels are evolving, with digital platforms gaining ground by offering manufacturers the ability to reach wider markets with reduced overhead costs.

Overall, the strong position of Direct Tender underscores a market preference for streamlined, cost-effective distribution practices that can handle large-volume transactions typical in the contract manufacturing sector. This trend is expected to persist as institutions continue to seek efficient and scalable purchasing solutions in a bid to manage healthcare expenditure effectively.

Key Market Segments

By Product

- Medical Device Manufacturing

- Pharmaceutical Products Manufacturing

By End User

- Biotechnology Companies

- Pharmaceutical Companies

- Medical Device Companies

- Biopharma Companies

- Other End-Users

By Distribution Channel

- Retail Sales

- Direct Tender

- Other Distribution Channels

Growth Opportunity

Emergence of Niche Therapeutic Areas Requiring Specialized Manufacturing Capabilities

The emergence of niche therapeutic areas, such as personalized medicine and advanced biologics, presents significant growth opportunities for the global contract manufacturing market in 2023. These specialized sectors require distinct manufacturing capabilities, often involving complex production processes and stringent quality controls that are not universally available in-house for many pharmaceutical and biotech companies.

Contract manufacturers with the ability to invest in and develop these specialized capabilities are well-positioned to capture a substantial market share. This trend is particularly driven by the increasing focus on targeted therapies and precision medicine, which demand bespoke production setups capable of handling small-scale, high-value production runs. The ability to meet these specific requirements not only attracts more clients but also allows contract manufacturers to command premium pricing for their specialized services.

Expansion into Emerging Markets with Growing Healthcare Needs

The expansion into emerging markets represents a critical growth avenue for contract manufacturers in 2023. These regions exhibit rapidly growing healthcare needs due to increasing population, rising economic power, and governmental efforts to enhance healthcare infrastructure. Emerging markets offer a fertile ground for the introduction of both generic and innovative pharmaceutical products, fueled by the rising prevalence of chronic diseases and a growing middle class.

For contract manufacturers, these markets provide a dual opportunity: to serve global pharmaceutical companies seeking to extend their geographic reach and to partner with local companies needing to scale production without substantial capital expenditure. This strategic expansion not only diversifies the client base but also mitigates risks associated with reliance on more developed markets, thereby driving sustained growth in the global contract manufacturing landscape.

Latest Trends

Adoption of Continuous Manufacturing Processes

In 2023, one of the transformative trends in the global contract manufacturing market is the widespread adoption of continuous manufacturing processes. This shift from traditional batch manufacturing to continuous operations is reshaping production dynamics by enhancing efficiency, reducing waste, and minimizing the time required to manufacture pharmaceutical products. Continuous manufacturing allows for a more streamlined, controlled process that can significantly reduce production costs and improve product quality through consistent conditions throughout the manufacturing cycle.

As regulatory bodies like the FDA encourage the adoption of these practices for their potential to improve drug quality and manufacturing reliability, contract manufacturers embracing this technology are better positioned to meet the evolving demands of the pharmaceutical industry, providing them with a competitive edge in both capacity and innovation.

Increasing Collaboration between Contract Manufacturers and Big Pharma Companies

Another prominent trend in 2023 is the increasing collaboration between contract manufacturers and big pharma companies. As pharmaceutical giants continue to focus on core competencies like drug discovery and development, there is a growing reliance on contract manufacturers for production capabilities, especially for complex biologics and generics. These collaborations are becoming more strategic rather than transactional, with partnerships often including shared risks and co-investment in technology and processes.

Such deep integrations facilitate a more responsive supply chain and faster go-to-market times for new drugs. Additionally, through these partnerships, contract manufacturers gain insights into product development early in the cycle, enabling better preparation and alignment of manufacturing strategies to meet specific drug needs. This trend not only enhances operational efficiencies but also strengthens the overall ecosystem of pharmaceutical manufacturing.

Regional Analysis

North America leads the contract manufacturing market, holding a dominant 55% share of the global industry.

The global contract manufacturing market exhibits significant regional diversities, with North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America each presenting unique characteristics and opportunities. North America dominates the market, accounting for 55% of the global share, bolstered by advanced manufacturing infrastructures, robust regulatory frameworks, and the presence of major pharmaceutical companies that drive demand for contract manufacturing services. The region's leadership in biotechnology innovations further strengthens its market position.

Europe follows as a significant player, with its market propelled by stringent regulatory standards which ensure high-quality production and attract companies seeking compliance with these standards. The presence of numerous big pharma companies, particularly in Western Europe, also fuels the demand for contract manufacturing organizations (CMOs).

Asia Pacific is witnessing the fastest growth among the regions, driven by cost advantages in manufacturing and an expanding base of skilled labor. Countries like China and India are becoming increasingly pivotal due to their improved regulatory environments and investments in biotechnology and pharmaceutical manufacturing capabilities.

The Middle East & Africa, though a smaller market, is gradually expanding. Investments in healthcare infrastructure and increasing economic diversification efforts are creating opportunities for contract manufacturing organizations, particularly in pharmaceuticals.

Latin America, while still emerging in this sector, shows potential due to its growing pharmaceutical industry and favorable trade agreements that facilitate exports of manufactured goods, including pharmaceuticals.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global contract manufacturing market is significantly shaped by the activities and strategies of key players, including Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH, and Catalent Inc. Each company brings unique capabilities and strategic focuses that collectively drive the industry forward.

Aenova Group excels in providing comprehensive services from development to packaging, catering especially to the pharmaceutical and healthcare sectors. Their commitment to high manufacturing standards and extensive global footprint allows them to serve a wide array of client needs in various therapeutic areas.

Thermo Fisher Scientific Inc. leverages its broad expertise in scientific research and development to offer superior contract manufacturing services, particularly in the field of precision medicine and clinical trials logistics. Their investment in cutting-edge technologies and facilities strengthens their competitive edge and appeal to a diverse client base.

EVONIK INDUSTRIES AG focuses on specialty chemicals and has carved out a niche in the advanced drug delivery systems market. Their ability to innovate in biodegradable polymers positions them as a key partner for pharmaceutical companies looking to develop more effective and sustainable drug formulations.

Lonza is a standout in biologics, offering custom manufacturing solutions that support the burgeoning demand for biopharmaceuticals. Their capacity to handle large-scale productions and their advanced modalities support make them indispensable to big pharma and biotech firms.

Boehringer Ingelheim Biopharmaceuticals GmbH specializes in the production of biopharmaceuticals, investing heavily in technology and capacity expansion to meet the rising demand for outsourced manufacturing.

Catalent Inc. is notable for its innovative drug delivery technologies and clinical supply services. Their leadership in oral, biologic, and respiratory products, combined with robust global operations, makes them a preferred partner for many pharmaceutical firms seeking flexibility and scalability.

Market Key Players

- Aenova Group

- Thermo Fisher Scientific Inc.

- EVONIK INDUSTRIES AG

- Lonza

- Boehringer Ingelheim Biopharmaceuticals GmbH.

- Catalent Inc.

Recent Development

- In June 2023, Lonza completed a merger with a leading biotech firm, aiming to enhance its capabilities in high-potency active pharmaceutical ingredients (APIs). This merger is expected to increase Lonza's production capacities by 25%, strengthening its position in the global contract manufacturing market.

- In January 2023, Thermo Fisher Scientific announced in January 2023 the launch of a new, state-of-the-art facility dedicated to the manufacture of biologics and pharmaceuticals. This facility increases their production output by 30%, demonstrating a significant boost in their contract manufacturing operations.

- In March 2022, Aenova Group significantly expanded its capabilities through the acquisition of a smaller competitor, enhancing its production capacity by 40%. This strategic move aimed to broaden their service offerings in pharmaceutical and healthcare product manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 273.6 Billion Forecast Revenue (2033) USD 651.1 Billion CAGR (2024-2032) 9.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Medical Device Manufacturing, Pharmaceutical Products Manufacturing), By End User(Biotechnology Companies, Pharmaceutical Companies , Medical Device Companies, Biopharma Companies, Other End-Users), By Distribution Channel(Retail Sales, Direct Tender, Other Distribution Channels) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH., Catalent Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Aenova Group

- Thermo Fisher Scientific Inc.

- EVONIK INDUSTRIES AG

- Lonza

- Boehringer Ingelheim Biopharmaceuticals GmbH.

- Catalent Inc.