Contract Manufacturing Market By Product (Medical Device Manufacturing, Pharmaceutical Products Manufacturing), By Distribution Channel (Retail Sales, Direct Tender, Other Distribution Channels), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

39671

-

July 2023

-

186

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

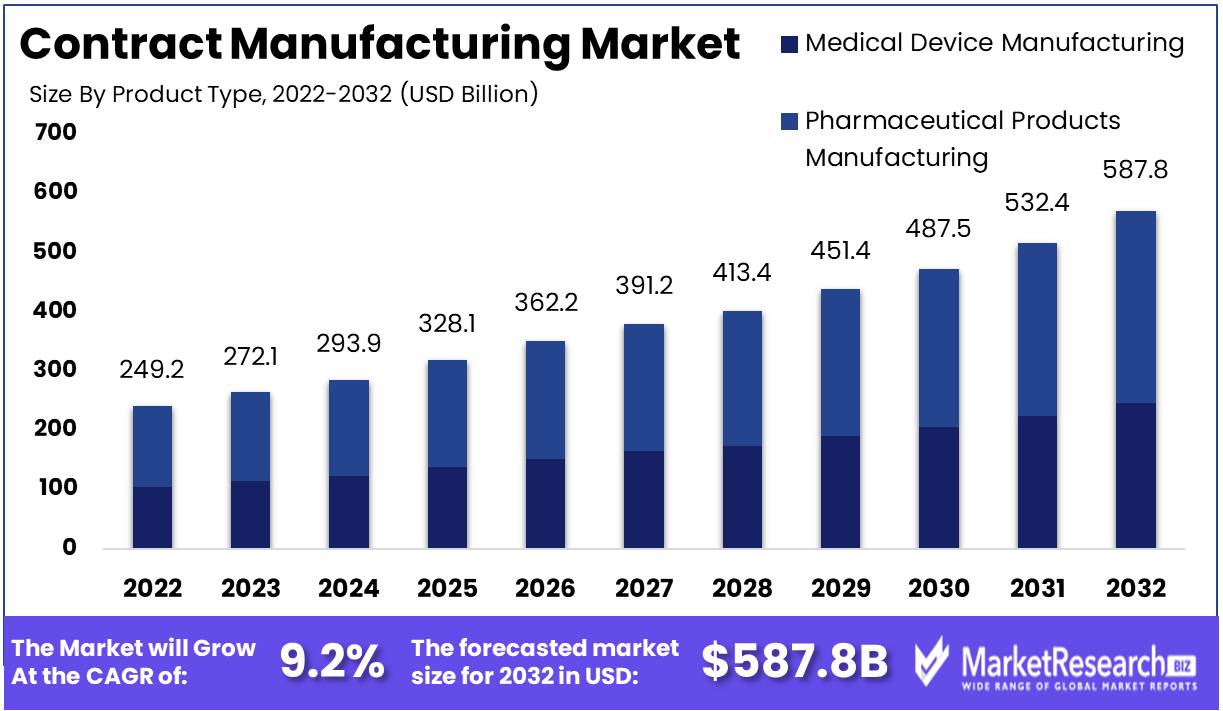

Contract Manufacturing Market size is expected to be worth around USD 587.8 Bn by 2032 from USD 249.2 Bn in 2022, growing at a CAGR of 9.2% during the forecast period from 2023 to 2032.

The necessity of the contract manufacturing market appears as a true game-changer, an irreplaceable catalyst propelling organizations to the pinnacle of success, in the current hyper-competitive and dynamically shifting business scene. With its seductive attraction, it tempts businesses to join in on a big symphony of resources and skills, an opulent masquerade without the burden of colossal capital investments in infrastructure, equipment, and employees. Oh, the sweet dance of outsourcing production a waltz into the world of specialized knowledge, cutting-edge technology, and economies of scale a crescendo of benefits reverberating through the halls of business.

Look at that! The big arena of contract manufacturing is where the spectacle of significant investments and their assimilation into goods and services begin. Multinational corporations come to the contract manufacturing market as though touched by the divine hand of opportunity, their eyes fixated on the horizon of enlarged operations, widened market reach, and the embrace of specialist manufacturers' sagacity. Electronics, medicines, autos, and consumer products are all enthralled by the magnificent display of this marvelous spectacle as it unfolds across several industries.

In a captivating dance of supply and demand, the industries, seduced by the seductive song of contract manufacturing, set off on their own epic voyages of investment. Watch how the contract manufacturing market generously satisfies the electronics industry's deepest demand for electrical components and devices. Oh, how the pharmaceutical sector seeks comfort in the capable hands of contract manufacturers for drug development, packaging, and delivery. Even the auto sector falls prey to the seduction, having been seduced by the appeal of increased operational effectiveness and the search of innovation.

Cost reduction stands out in the stunning symphony of forces advancing the contract manufacturing market, a ringing crescendo of financial wisdom. As businesses skillfully direct their resources toward other crucial areas, their hearts are eased by the freedom from financial burdens. Watch the amazing symphony of reduced labor and manufacturing costs. Flexibility emerges as a new virtuoso, giving businesses the power to magically increase their manufacturing capacities at whim, dancing in unison with consumer demand and protecting them from the turbulent storms of excess inventory and unused capacity.

A chorus of conscience is calling out among this expansive tapestry of industrial opera, touching the contract manufacturing market's heartstrings with ethical considerations and responsible behavior. Ah, the siren call of social responsibility and sustainability, asking businesses to incorporate their ethical standards into the very foundation of their dealings with their contract manufacturers. They expect that the production processes be conducted in an environmentally friendly manner and with fair labor policies. So responsible contract manufacturing advances, embracing accountability, traceability, and transparent supply chains as part of a commitment to uphold the fundamental core of moral sourcing for materials and components.

Driving Factors

Accentuate core competencies and areas of expertise

Companies are realizing the value of concentrating on their core strengths in a global environment that is continually changing. Outsourcing non-core activities is frequently a necessary step in streamlining operations and maximizing resources in order to maintain a competitive edge. Businesses can outsource tasks like production, packaging, and distribution through a partnership with Contract Manufacturers Market, freeing up their time to focus on R&D, marketing, and branding.

Increase in Contract Manufacturing across a Range of Industries

Pharma, electronics, food and beverage, and other industries have all seen considerable development in contract manufacturing. Due to the strict regulatory environment and the necessity for cost savings, outsourcing manufacturing processes has become a standard practice in the pharmaceutical industry. Pharmaceutical businesses may concentrate on medication development, clinical trials, and marketing because contract manufacturers' Market is compliant with industry laws and have state-of-the-art facilities to satisfy the highest quality requirements.

Advancements in Manufacturing Technologies

The expansion of the contract manufacturing market is significantly influenced by improvements in manufacturing technology. Automation, robots, and artificial intelligence have altered the way that products are made, increasing productivity, accuracy, and efficiency. These technologies are embraced by contract manufacturers in the market, allowing them to provide premium goods and services at affordable costs.

Expansion of Global Supply Chains

Global supply chains have many advantages, such as lower production costs, quicker lead times, and access to a wider range of markets. Contract producers Market places their buildings in a strategic way to benefit from economies of scale, take full advantage of local advantages, and build robust supply networks. Companies can improve operational efficiency while retaining a competitive edge in the market thanks to this international growth.

Restraining Factors

Challenges in Quality Control for Contract Manufacturing

Ensuring that stringent quality control standards are met for contract-manufactured products is one of the greatest challenges in the contract manufacturing industry. To accomplish this, rigorous testing and inspection procedures must be implemented throughout the production process. However, the level of complexity increases when contract manufacturers market their services to multiple clients with varying quality and regulatory standards. In addition, the variety of products and variations in manufacturing processes further complicate quality control efforts.

Navigating Regulatory Compliance in Contract Manufacturing

The term "contractor" refers to a company that provides goods and services to the general public. Authorities such as the Food and Drug Administration (FDA) or the International Organization for Standardization (ISO) establish regulations and standards that must be followed by contract manufacturers. This can be difficult, particularly when operating in multiple jurisdictions with different regulatory frameworks. Compliance requires continuous monitoring, documentation, and reporting, resulting in higher overhead expenses and administrative burdens.

Balancing Control and Outsourcing in Contract Manufacturing

When outsourcing to third parties, the potential loss of control over production processes is a concern for the contract manufacturers market. Original manufacturers depend on contract manufacturers for production and assembly, introducing risks. It is possible that the contract manufacturer lacks the same expertise or commitment to quality as the original manufacturer. In addition, limited visibility and control over the production schedule can hinder the ability to meet customer demand and deliver products on time.

Overcoming Dependency Challenges in Contract Manufacturing

In order to meet production needs, contract manufacturers market rely on a network of subcontractors or suppliers. Nonetheless, this reliance can result in hazards such as capacity constraints, quality issues, and supplier dependability. If a contract manufacturer extensively relies on particular subcontractors or suppliers, any disruption or failure in their operations can cause delays and customer dissatisfaction throughout the entire manufacturing process.

Product Analysis

In the contract manufacturing market, the pharmaceutical products manufacturing segment has become dominant. This segment has experienced significant growth in recent years as a result of technological advances and rising demand for pharmaceutical products. The manufacturing of pharmaceutical products entails the mass production of medicines and other healthcare products.

Emerging economies' economic growth has played a crucial role in propelling the adoption of the pharmaceutical products manufacturing segment. Rapid industrialization and urbanization have led to an increase in demand for high-quality healthcare products in these nations. In turn, this has created favorable conditions for the expansion of the pharmaceutical products manufacturing sector.

In addition to consumer trends and behavior, the pharmaceutical products manufacturing segment's dominance in the contract manufacturing market is a result of its dominance in this sector. Consumers are pursuing high-quality products that can meet their healthcare needs as they become more health conscious. With its emphasis on innovation and research, the pharmaceutical products manufacturing segment has successfully captured the attention of these consumers.

End User Analysis

The pharmaceutical companies segment dominates the contract manufacturing market. The development, production, and distribution of pharmaceutical products rely heavily on pharmaceutical companies. They work with contract manufacturers to satisfy the growing demand for pharmaceuticals and healthcare products.

Similar to the product analysis, economic development in emerging nations has been a key driver of the pharmaceutical companies segment's adoption in the contract manufacturing market. These economies are experiencing accelerated expansion and have become desirable investment destinations for pharmaceutical companies. Consequently, pharmaceutical companies are extending their operations in these regions, fueling the expansion of this market segment.

The dominance of the pharmaceutical companies segment is also heavily impacted by consumer behavior and trends. Consumers have faith in pharmaceutical companies with a history of producing safe and effective medications. This confidence motivates them to choose pharmaceutical products, resulting in pharmaceutical companies' market dominance.

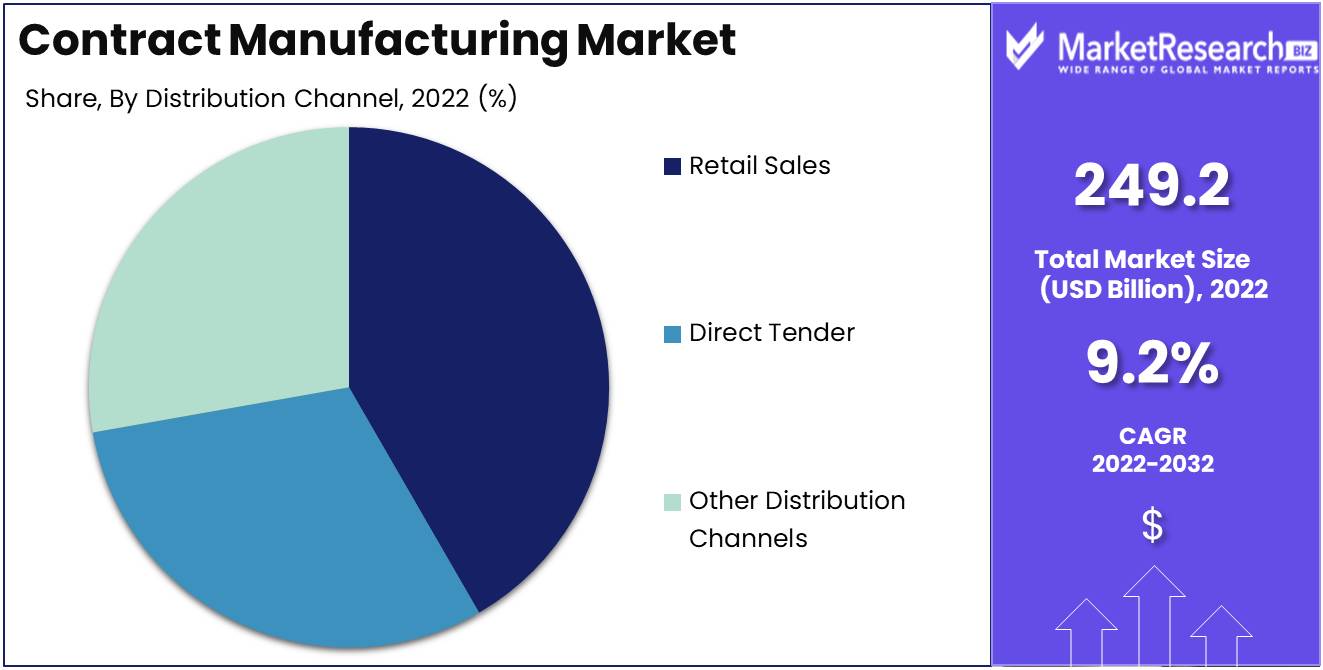

Distribution Channel Analysis

In the contract manufacturing market, the retail sales segment has emerged as the dominant distribution channel. Retail sales entail selling pharmaceutical products directly to consumers through pharmacies, drugstores, and other retail outlets. This market has acquired prominence due to its extensive reach and consumer-friendliness.

Economic growth in developing nations has fueled the expansion of the retail sales segment of the contract manufacturing market. As disposable incomes and living standards rise, consumers have increased access to retail establishments. This has increased the demand for pharmaceutical products sold via retail channels.

Consumer trends and behavior also significantly impact the retail sales segment's dominance. Direct purchases of pharmaceutical products from retail outlets are preferred by consumers due to their accessibility. In addition, consumers frequently rely on the knowledge of pharmacists and other healthcare professionals present in these retail locations for guidance on medication use and potential interactions.

Key Market Segments

By Product

- Medical Device Manufacturing

- Pharmaceutical Products Manufacturing

By End User

- Biotechnology Companies

- Pharmaceutical Companies

- Medical Device Companies

- Biopharma Companies

- Other End-Users

By Distribution Channel

- Retail Sales

- Direct Tender

- Other Distribution Channels

Growth Opportunity

Leveraging Technological Advancements for Streamlined Operations

There are ample opportunities for companies to leverage technological advances and optimize their operations in the contract manufacturing market. Manufacturing processes have become increasingly connected and digitized with the advent of Industry 4.0 and the Internet of Things (IoT). This connectivity allows businesses to acquire real-time insights into production processes, enabling them to quickly identify bottlenecks and inefficiencies. By adopting intelligent manufacturing technologies such as robotics, artificial intelligence (AI), and big data analytics, businesses can increase output, reduce expenses, and enhance quality control.

Leveraging Additive Manufacturing for Customized Products

3D printing, also known as additive manufacturing, has revolutionized the design and production of products. Additive manufacturing enables contract manufacturers to offer highly customized products to their consumers. Using 3D printing technology, businesses can create intricate and complex designs that were previously difficult or expensive to produce. Not only does the contract manufacturing market permit greater design flexibility, but it also reduces lead times and eliminates the need for costly tooling. Contract manufacturers can attract customers who value personalized and unique products by implementing additive manufacturing techniques in their production processes.

Investing in Employee Training and Development

Investing in employee training and development represents a critical growth opportunity for the contract manufacturing market. As technology continues to transform the industry, it is crucial for companies to equip their personnel with the skills and knowledge required to adapt to shifting manufacturing trends. By providing regular training programs, businesses can ensure that their employees are abreast of the most recent developments in manufacturing technologies and procedures. Moreover, investing in employee development fosters a culture of continuous refinement and innovation, which can assist contract manufacturers in gaining a market advantage.

Exploring Niche Markets and Diversification

Exploring niche markets and diversifying their offerings is another growth opportunity for contract manufacturers. Instead of focusing solely on mass production, businesses can identify niche markets where they can leverage their expertise and resources. By catering to niche markets, contract manufacturers are able to offer distinctive value propositions that distinguish them from their rivals. Moreover, diversifying into new product categories or industries can provide contract manufacturers with additional revenue sources and reduce their reliance on a single market segment.

Latest Trends

Growth of Contract Manufacturing in Pharmaceutical and Nutraceutical Industries

The pharmaceutical and nutraceutical industries are experiencing a substantial increase in demand as a result of the growing global population and a greater emphasis on health and wellness. As a result, many businesses in these industries are turning to contract manufacturing to efficiently satisfy the growing market demands. Contract manufacturers provide expertise in manufacturing processes, quality control, and regulatory compliance, allowing pharmaceutical and nutraceutical companies to concentrate on their primary competencies, including research and development, marketing, and sales.

Utilization of Contract Manufacturing for Electronics and Semiconductor Components

Contract manufacturers play a crucial role in the production of electronic and semiconductor components by providing state-of-the-art infrastructure, expert labor, and cutting-edge technologies. By partnering with contract manufacturers, businesses are able to remain competitive, scale production quickly, and mitigate the risk associated with substantial capital investments in manufacturing facilities. In addition, the contract manufacturing market allows them to concentrate on innovation and product development while outsourcing complex manufacturing processes to specialized professionals.

The rise of Contract Manufacturing in Food and Beverage Segments

The food and beverage contract manufacturing market offers a variety of services, including product development, ingredient procurement, formulation, packaging, and labeling. By leveraging the expertise and infrastructure of contract manufacturers, businesses can bring new products to market faster, adapt to shifting consumer demands, and increase operational efficiency. Additionally, contract manufacturing enables food and beverage companies to adhere to stringent quality and regulatory standards.

Focus on Value-Added Services Like Packaging and Labeling

Packaging and labeling play an essential function in product differentiation, brand visibility, and regulatory compliance. Companies in the contract manufacturing market with expertise in these areas offer custom packaging solutions, innovative designs, and compliance with labeling regulations. Companies can optimize their supply chain, reduce costs, and ensure consistent and compliant packaging and labeling practices by outsourcing these services to contract manufacturers.

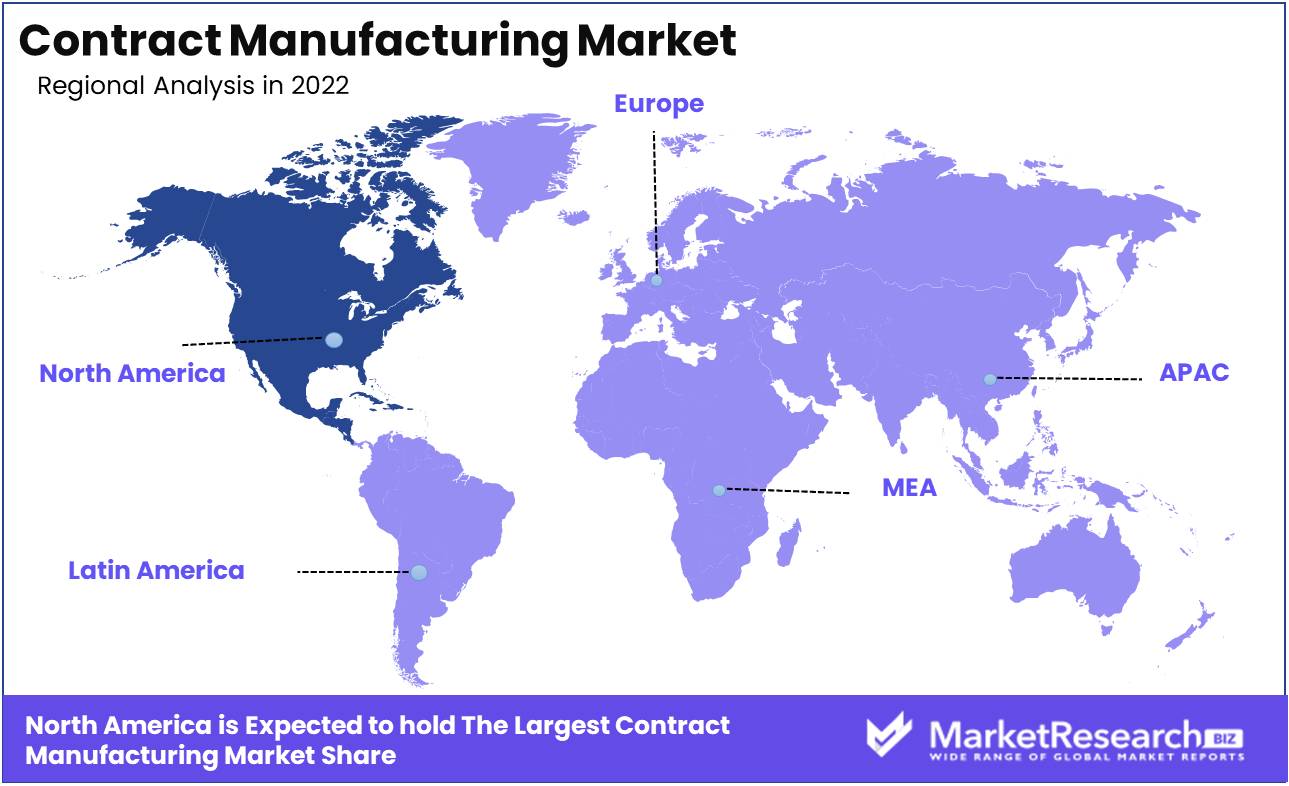

Regional Analysis

The United States of America is the largest market for the sale of used cars. In the global contract manufacturing landscape, North America stands out as a dominant force. With its unparalleled capabilities, cutting-edge technologies, and highly qualified labor force, North America has solidified its position as the world's leading hub for contract manufacturing services. This article seeks to illuminate the causes for North America's market dominance and its effect on the global supply chain.

In the first place, North America is home to a vast network of contract manufacturing companies that serve a variety of industries. These businesses offer expertise in numerous fields, including electronics, pharmaceuticals, automotive, and aerospace. Contract Manufacturing. The region's prominence on the market can be attributed to its ability to meet the diverse requirements of various industries. North America's exceptional capabilities attract industries that rely significantly on manufacturing solutions of the highest quality.

In addition, North America is home to cutting-edge technologies and cutting-edge facilities. These innovations have transformed the manufacturing process, enabling greater efficiency, precision, and customization. North American companies in the Contract Manufacturing Market leverage these technologies to deliver superior products and services, giving them a competitive edge in the market. Utilizing cutting-edge technologies also allows them to adapt rapidly to shifting client demands and market trends.

North America's highly competent labor force is a distinguishing characteristic. The region's talent pool is comprised of highly educated and trained engineers, technicians, and professionals with expertise in various disciplines. These experienced individuals contribute to the continuous innovation and growth of the North American contract manufacturing industry. Their expertise and experience enable businesses to deliver products of superior quality and satisfy stringent client requirements.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The contract manufacturing market is intensely competitive, and these key players have carved out a niche for themselves by capitalizing on their distinctive strengths and competencies. In this swiftly evolving industry, Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH, and Catalent continue to promote innovation, efficiency, and customer satisfaction. With a strong emphasis on quality, advanced technologies, and customer-centric approaches, these companies dominate the contract manufacturing market and shape the future of pharmaceutical and biotechnology production.

Aenova Group is an internationally renowned contract manufacturer specializing in pharmaceuticals, nutritional supplements, and veterinary products. Aenova is committed to utilizing cutting-edge technology and expertise to ensure the highest quality and safety standards by placing a strong emphasis on research and development. They provide a vast array of services, including formulation development, production, packaging, and quality control. Aenova is a key participant in the contract manufacturing market due to their dedication to customer satisfaction and commitment to continuous improvement.

Thermo Fisher Scientific Inc. is a prominent contract manufacturing company that caters to a variety of industries, including pharmaceuticals, biotechnology, and healthcare. Thermo Fisher Scientific provides end-to-end solutions, from drug discovery and development to manufacturing and commercialization, through its extensive portfolio of services. Their proficiency in global supply chain management, advanced manufacturing technologies, and regulatory compliance has positioned them as a reliable partner for businesses seeking efficient and trustworthy contract manufacturing services.

EVONIK INDUSTRIES AG is a major participant in the contract manufacturing market, providing a vast array of services across numerous industries, including pharmaceuticals, medical devices, and cosmetics. Their strategic concentration on specialty chemicals and advanced materials enables them to provide clients with solutions tailored to their particular requirements. With a strong emphasis on innovation, sustainability, and collaborative partnerships, EVONIK INDUSTRIES AG is a top choice for businesses seeking eco-friendly contract manufacturing solutions.

Lonza is a world leader in contract manufacturing, especially in the biopharmaceutical industry. Lonza utilizes its state-of-the-art facilities and exceptional technical expertise to ensure the successful delivery of complex biologics for a wide range of services, including cell and gene therapies, antibodies, and viral vectors. Their dedication to quality, dependability, and regulatory compliance has earned them a solid standing in the contract manufacturing market.

Focusing on biopharmaceuticals and biotechnology, Boehringer Ingelheim Biopharmaceuticals GmbH is a major participant in the contract manufacturing market. Boehringer Ingelheim Biopharmaceuticals GmbH offers contract manufacturing services for a wide variety of biologics, including monoclonal antibodies and recombinant proteins. The company has a long history of innovation and pioneering therapies. Their cutting-edge facilities, stringent quality control measures, and dedication to advancing patient care through biotechnology distinguish them in the industry.

Top Key Players in Contract Manufacturing Market

- Aenova Group

- Thermo Fisher Scientific Inc.

- EVONIK INDUSTRIES AG

- Lonza

- Boehringer Ingelheim Biopharmaceuticals GmbH.

- Catalent Inc.

Recent Development

- In 2023, Catalent, a prominent contract manufacturing organization (CMO), announced its intention to establish a state-of-the-art manufacturing facility in India. This shift is intended to capitalize on India's emerging market potential and its abundant talent pool. Catalent's strategic expansion demonstrates its dedication to meeting the region's rising demand for contract manufacturing market services.

- In 2021, DSM, a prominent science-based company, and Pfizer, a renowned pharmaceutical behemoth, formed a remarkable partnership. DSM engaged in a significant agreement with Pfizer to provide contract manufacturing market services for Pfizer's vaccine production. This strategic alliance leverages the expertise of both companies to guarantee the efficient and large-scale production of vital vaccines, thereby contributing to initiatives to improve global health.

- In 2020, Jubilant Life Sciences, a diversified global pharmaceutical company, successfully acquired GSK's contract manufacturing operation in India in a landmark transaction. With this acquisition, Jubilant Life Sciences strengthened its position as a leading player in the contract manufacturing market, substantially expanding its capabilities and client base. This action aligns with the company's growth strategy to enhance its market presence and provide global partners with comprehensive manufacturing solutions.

Report Scope

Report Features Description Market Value (2022) USD 249.2 Bn Forecast Revenue (2032) USD 587.8 Bn CAGR (2023-2032) 9.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Medical Device Manufacturing, Pharmaceutical Products Manufacturing)

By End Users (Biotechnology Companies, Pharmaceutical Companies, Medical Device Companies, Biopharma Companies, Other End-Users)

By Distribution Channel (Retail Sales, Direct Tender, Other Distribution Channels)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH. , Catalent Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Contract Manufacturing Market Overview

- 2.1. Contract Manufacturing Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Contract Manufacturing Market Dynamics

- 3. Global Contract Manufacturing Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Contract Manufacturing Market Analysis, 2016-2021

- 3.2. Global Contract Manufacturing Market Opportunity and Forecast, 2023-2032

- 3.3. Global Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 3.3.1. Global Contract Manufacturing Market Analysis By Product: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 3.3.3. Medical Device Manufacturing

- 3.3.4. Pharmaceutical Products Manufacturing

- 3.4. Global Contract Manufacturing Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 3.4.1. Global Contract Manufacturing Market Analysis By End User: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 3.4.3. Biotechnology Companies

- 3.4.4. Pharmaceutical Companies

- 3.4.5. Medical Device Companies

- 3.4.6. Biopharma Companies

- 3.5. Global Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 3.5.1. Global Contract Manufacturing Market Analysis By Distribution Channel: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 3.5.3. Retail Sales

- 3.5.4. Direct Tender

- 3.5.5. Other Distribution Channels

- 4. North America Contract Manufacturing Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Contract Manufacturing Market Analysis, 2016-2021

- 4.2. North America Contract Manufacturing Market Opportunity and Forecast, 2023-2032

- 4.3. North America Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 4.3.1. North America Contract Manufacturing Market Analysis By Product: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 4.3.3. Medical Device Manufacturing

- 4.3.4. Pharmaceutical Products Manufacturing

- 4.4. North America Contract Manufacturing Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 4.4.1. North America Contract Manufacturing Market Analysis By End User: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 4.4.3. Biotechnology Companies

- 4.4.4. Pharmaceutical Companies

- 4.4.5. Medical Device Companies

- 4.4.6. Biopharma Companies

- 4.5. North America Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 4.5.1. North America Contract Manufacturing Market Analysis By Distribution Channel: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 4.5.3. Retail Sales

- 4.5.4. Direct Tender

- 4.5.5. Other Distribution Channels

- 4.6. North America Contract Manufacturing Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 4.6.1. North America Contract Manufacturing Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Contract Manufacturing Market Analysis, 2016-2021

- 5.2. Western Europe Contract Manufacturing Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 5.3.1. Western Europe Contract Manufacturing Market Analysis By Product: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 5.3.3. Medical Device Manufacturing

- 5.3.4. Pharmaceutical Products Manufacturing

- 5.4. Western Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 5.4.1. Western Europe Contract Manufacturing Market Analysis By End User: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 5.4.3. Biotechnology Companies

- 5.4.4. Pharmaceutical Companies

- 5.4.5. Medical Device Companies

- 5.4.6. Biopharma Companies

- 5.5. Western Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 5.5.1. Western Europe Contract Manufacturing Market Analysis By Distribution Channel: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 5.5.3. Retail Sales

- 5.5.4. Direct Tender

- 5.5.5. Other Distribution Channels

- 5.6. Western Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 5.6.1. Western Europe Contract Manufacturing Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Contract Manufacturing Market Analysis, 2016-2021

- 6.2. Eastern Europe Contract Manufacturing Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 6.3.1. Eastern Europe Contract Manufacturing Market Analysis By Product: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 6.3.3. Medical Device Manufacturing

- 6.3.4. Pharmaceutical Products Manufacturing

- 6.4. Eastern Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 6.4.1. Eastern Europe Contract Manufacturing Market Analysis By End User: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 6.4.3. Biotechnology Companies

- 6.4.4. Pharmaceutical Companies

- 6.4.5. Medical Device Companies

- 6.4.6. Biopharma Companies

- 6.5. Eastern Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 6.5.1. Eastern Europe Contract Manufacturing Market Analysis By Distribution Channel: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 6.5.3. Retail Sales

- 6.5.4. Direct Tender

- 6.5.5. Other Distribution Channels

- 6.6. Eastern Europe Contract Manufacturing Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 6.6.1. Eastern Europe Contract Manufacturing Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Contract Manufacturing Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Contract Manufacturing Market Analysis, 2016-2021

- 7.2. APAC Contract Manufacturing Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 7.3.1. APAC Contract Manufacturing Market Analysis By Product: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 7.3.3. Medical Device Manufacturing

- 7.3.4. Pharmaceutical Products Manufacturing

- 7.4. APAC Contract Manufacturing Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 7.4.1. APAC Contract Manufacturing Market Analysis By End User: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 7.4.3. Biotechnology Companies

- 7.4.4. Pharmaceutical Companies

- 7.4.5. Medical Device Companies

- 7.4.6. Biopharma Companies

- 7.5. APAC Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 7.5.1. APAC Contract Manufacturing Market Analysis By Distribution Channel: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 7.5.3. Retail Sales

- 7.5.4. Direct Tender

- 7.5.5. Other Distribution Channels

- 7.6. APAC Contract Manufacturing Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 7.6.1. APAC Contract Manufacturing Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Contract Manufacturing Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Contract Manufacturing Market Analysis, 2016-2021

- 8.2. Latin America Contract Manufacturing Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 8.3.1. Latin America Contract Manufacturing Market Analysis By Product: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 8.3.3. Medical Device Manufacturing

- 8.3.4. Pharmaceutical Products Manufacturing

- 8.4. Latin America Contract Manufacturing Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 8.4.1. Latin America Contract Manufacturing Market Analysis By End User: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 8.4.3. Biotechnology Companies

- 8.4.4. Pharmaceutical Companies

- 8.4.5. Medical Device Companies

- 8.4.6. Biopharma Companies

- 8.5. Latin America Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 8.5.1. Latin America Contract Manufacturing Market Analysis By Distribution Channel: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 8.5.3. Retail Sales

- 8.5.4. Direct Tender

- 8.5.5. Other Distribution Channels

- 8.6. Latin America Contract Manufacturing Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 8.6.1. Latin America Contract Manufacturing Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Contract Manufacturing Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Contract Manufacturing Market Analysis, 2016-2021

- 9.2. Middle East & Africa Contract Manufacturing Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 9.3.1. Middle East & Africa Contract Manufacturing Market Analysis By Product: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 9.3.3. Medical Device Manufacturing

- 9.3.4. Pharmaceutical Products Manufacturing

- 9.4. Middle East & Africa Contract Manufacturing Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 9.4.1. Middle East & Africa Contract Manufacturing Market Analysis By End User: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 9.4.3. Biotechnology Companies

- 9.4.4. Pharmaceutical Companies

- 9.4.5. Medical Device Companies

- 9.4.6. Biopharma Companies

- 9.5. Middle East & Africa Contract Manufacturing Market Analysis, Opportunity and Forecast, By By Distribution Channel, 2016-2032

- 9.5.1. Middle East & Africa Contract Manufacturing Market Analysis By Distribution Channel: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Distribution Channel, 2016-2032

- 9.5.3. Retail Sales

- 9.5.4. Direct Tender

- 9.5.5. Other Distribution Channels

- 9.6. Middle East & Africa Contract Manufacturing Market Analysis, Opportunity and Forecast, By Country, 2016-2032

- 9.6.1. Middle East & Africa Contract Manufacturing Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country, 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Contract Manufacturing Market Analysis, Opportunity and Forecast, By Region, 2016-2032

- 10.1. Global Contract Manufacturing Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region, 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Contract Manufacturing Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Aenova Group

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Thermo Fisher Scientific Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. EVONIK INDUSTRIES AG

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Lonza

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Boehringer Ingelheim Biopharmaceuticals GmbH.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Catalent Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Contract Manufacturing Market Revenue (US$ Mn) Market Share By Product in 2022

- Figure 2: Global Contract Manufacturing Market Attractiveness Analysis By Product, 2016-2032

- Figure 3: Global Contract Manufacturing Market Revenue (US$ Mn) Market Share By End Userin 2022

- Figure 4: Global Contract Manufacturing Market Attractiveness Analysis By End User, 2016-2032

- Figure 5: Global Contract Manufacturing Market Revenue (US$ Mn) Market Share By Distribution Channelin 2022

- Figure 6: Global Contract Manufacturing Market Attractiveness Analysis By Distribution Channel, 2016-2032

- Figure 7: Global Contract Manufacturing Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Contract Manufacturing Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 12: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Figure 13: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Figure 14: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 16: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Figure 17: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Figure 18: Global Contract Manufacturing Market Share Comparison by Region (2016-2032)

- Figure 19: Global Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Figure 20: Global Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Figure 21: Global Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Figure 22: North America Contract Manufacturing Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 23: North America Contract Manufacturing Market Attractiveness Analysis By Product, 2016-2032

- Figure 24: North America Contract Manufacturing Market Revenue (US$ Mn) Market Share By End Userin 2022

- Figure 25: North America Contract Manufacturing Market Attractiveness Analysis By End User, 2016-2032

- Figure 26: North America Contract Manufacturing Market Revenue (US$ Mn) Market Share By Distribution Channelin 2022

- Figure 27: North America Contract Manufacturing Market Attractiveness Analysis By Distribution Channel, 2016-2032

- Figure 28: North America Contract Manufacturing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Contract Manufacturing Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 33: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Figure 34: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Figure 35: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 37: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Figure 38: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Figure 39: North America Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Figure 40: North America Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Figure 41: North America Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Figure 42: North America Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Figure 43: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 44: Western Europe Contract Manufacturing Market Attractiveness Analysis By Product, 2016-2032

- Figure 45: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share By End Userin 2022

- Figure 46: Western Europe Contract Manufacturing Market Attractiveness Analysis By End User, 2016-2032

- Figure 47: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share By Distribution Channelin 2022

- Figure 48: Western Europe Contract Manufacturing Market Attractiveness Analysis By Distribution Channel, 2016-2032

- Figure 49: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Contract Manufacturing Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 54: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Figure 55: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Figure 56: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 58: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Figure 59: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Figure 60: Western Europe Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Figure 62: Western Europe Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Figure 63: Western Europe Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Figure 64: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 65: Eastern Europe Contract Manufacturing Market Attractiveness Analysis By Product, 2016-2032

- Figure 66: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share By End Userin 2022

- Figure 67: Eastern Europe Contract Manufacturing Market Attractiveness Analysis By End User, 2016-2032

- Figure 68: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share By Distribution Channelin 2022

- Figure 69: Eastern Europe Contract Manufacturing Market Attractiveness Analysis By Distribution Channel, 2016-2032

- Figure 70: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Contract Manufacturing Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 75: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Figure 76: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Figure 77: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 79: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Figure 80: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Figure 81: Eastern Europe Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Figure 83: Eastern Europe Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Figure 84: Eastern Europe Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Figure 85: APAC Contract Manufacturing Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 86: APAC Contract Manufacturing Market Attractiveness Analysis By Product, 2016-2032

- Figure 87: APAC Contract Manufacturing Market Revenue (US$ Mn) Market Share By End Userin 2022

- Figure 88: APAC Contract Manufacturing Market Attractiveness Analysis By End User, 2016-2032

- Figure 89: APAC Contract Manufacturing Market Revenue (US$ Mn) Market Share By Distribution Channelin 2022

- Figure 90: APAC Contract Manufacturing Market Attractiveness Analysis By Distribution Channel, 2016-2032

- Figure 91: APAC Contract Manufacturing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Contract Manufacturing Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 96: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Figure 97: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Figure 98: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 100: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Figure 101: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Figure 102: APAC Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Figure 104: APAC Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Figure 105: APAC Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Figure 106: Latin America Contract Manufacturing Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 107: Latin America Contract Manufacturing Market Attractiveness Analysis By Product, 2016-2032

- Figure 108: Latin America Contract Manufacturing Market Revenue (US$ Mn) Market Share By End Userin 2022

- Figure 109: Latin America Contract Manufacturing Market Attractiveness Analysis By End User, 2016-2032

- Figure 110: Latin America Contract Manufacturing Market Revenue (US$ Mn) Market Share By Distribution Channelin 2022

- Figure 111: Latin America Contract Manufacturing Market Attractiveness Analysis By Distribution Channel, 2016-2032

- Figure 112: Latin America Contract Manufacturing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Contract Manufacturing Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 117: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Figure 118: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Figure 119: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 121: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Figure 122: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Figure 123: Latin America Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Figure 125: Latin America Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Figure 126: Latin America Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Figure 127: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Market Share By Productin 2022

- Figure 128: Middle East & Africa Contract Manufacturing Market Attractiveness Analysis By Product, 2016-2032

- Figure 129: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Market Share By End Userin 2022

- Figure 130: Middle East & Africa Contract Manufacturing Market Attractiveness Analysis By End User, 2016-2032

- Figure 131: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Market Share By Distribution Channelin 2022

- Figure 132: Middle East & Africa Contract Manufacturing Market Attractiveness Analysis By Distribution Channel, 2016-2032

- Figure 133: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Contract Manufacturing Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Figure 138: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Figure 139: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Figure 140: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Figure 142: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Figure 143: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Figure 144: Middle East & Africa Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Figure 146: Middle East & Africa Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Figure 147: Middle East & Africa Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

List of Tables

- Table 1: Global Contract Manufacturing Market Comparison By Product (2016-2032)

- Table 2: Global Contract Manufacturing Market Comparison By End User (2016-2032)

- Table 3: Global Contract Manufacturing Market Comparison By Distribution Channel (2016-2032)

- Table 4: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 8: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Table 9: Global Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Table 10: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 12: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Table 13: Global Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Table 14: Global Contract Manufacturing Market Share Comparison by Region (2016-2032)

- Table 15: Global Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Table 16: Global Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Table 17: Global Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Table 18: North America Contract Manufacturing Market Comparison By End User (2016-2032)

- Table 19: North America Contract Manufacturing Market Comparison By Distribution Channel (2016-2032)

- Table 20: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 24: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Table 25: North America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Table 26: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 28: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Table 29: North America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Table 30: North America Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Table 31: North America Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Table 32: North America Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Table 33: North America Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Table 34: Western Europe Contract Manufacturing Market Comparison By Product (2016-2032)

- Table 35: Western Europe Contract Manufacturing Market Comparison By End User (2016-2032)

- Table 36: Western Europe Contract Manufacturing Market Comparison By Distribution Channel (2016-2032)

- Table 37: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 41: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Table 42: Western Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Table 43: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 45: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Table 46: Western Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Table 47: Western Europe Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Table 49: Western Europe Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Table 50: Western Europe Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Table 51: Eastern Europe Contract Manufacturing Market Comparison By Product (2016-2032)

- Table 52: Eastern Europe Contract Manufacturing Market Comparison By End User (2016-2032)

- Table 53: Eastern Europe Contract Manufacturing Market Comparison By Distribution Channel (2016-2032)

- Table 54: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 58: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Table 59: Eastern Europe Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Table 60: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 62: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Table 63: Eastern Europe Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Table 64: Eastern Europe Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Table 66: Eastern Europe Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Table 67: Eastern Europe Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Table 68: APAC Contract Manufacturing Market Comparison By Product (2016-2032)

- Table 69: APAC Contract Manufacturing Market Comparison By End User (2016-2032)

- Table 70: APAC Contract Manufacturing Market Comparison By Distribution Channel (2016-2032)

- Table 71: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 75: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Table 76: APAC Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Table 77: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 79: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Table 80: APAC Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Table 81: APAC Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Table 82: APAC Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Table 83: APAC Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Table 84: APAC Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Table 85: Latin America Contract Manufacturing Market Comparison By Product (2016-2032)

- Table 86: Latin America Contract Manufacturing Market Comparison By End User (2016-2032)

- Table 87: Latin America Contract Manufacturing Market Comparison By Distribution Channel (2016-2032)

- Table 88: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 92: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Table 93: Latin America Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Table 94: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 96: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Table 97: Latin America Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Table 98: Latin America Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Table 100: Latin America Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Table 101: Latin America Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- Table 102: Middle East & Africa Contract Manufacturing Market Comparison By Product (2016-2032)

- Table 103: Middle East & Africa Contract Manufacturing Market Comparison By End User (2016-2032)

- Table 104: Middle East & Africa Contract Manufacturing Market Comparison By Distribution Channel (2016-2032)

- Table 105: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison By Product (2016-2032)

- Table 109: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison By End User (2016-2032)

- Table 110: Middle East & Africa Contract Manufacturing Market Revenue (US$ Mn) Comparison By Distribution Channel (2016-2032)

- Table 111: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Product (2016-2032)

- Table 113: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison By End User (2016-2032)

- Table 114: Middle East & Africa Contract Manufacturing Market Y-o-Y Growth Rate Comparison By Distribution Channel (2016-2032)

- Table 115: Middle East & Africa Contract Manufacturing Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Contract Manufacturing Market Share Comparison By Product (2016-2032)

- Table 117: Middle East & Africa Contract Manufacturing Market Share Comparison By End User (2016-2032)

- Table 118: Middle East & Africa Contract Manufacturing Market Share Comparison By Distribution Channel (2016-2032)

- 1. Executive Summary

-

- Aenova Group

- Thermo Fisher Scientific Inc.

- EVONIK INDUSTRIES AG

- Lonza

- Boehringer Ingelheim Biopharmaceuticals GmbH.

- Catalent Inc.