Recombinant Proteins Market Product & Services Segmentation(Product Types, Production Services), Application Segmentation(Drug Discovery & Development, Therapeutics, Biologics, Vaccines, Cell & Gene Therapies, Others, Research, Others), End-user Segmentation(Pharma & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42989

-

Jan 2022

-

176

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Recombinant Proteins Market Size, Share, Trends Analysis

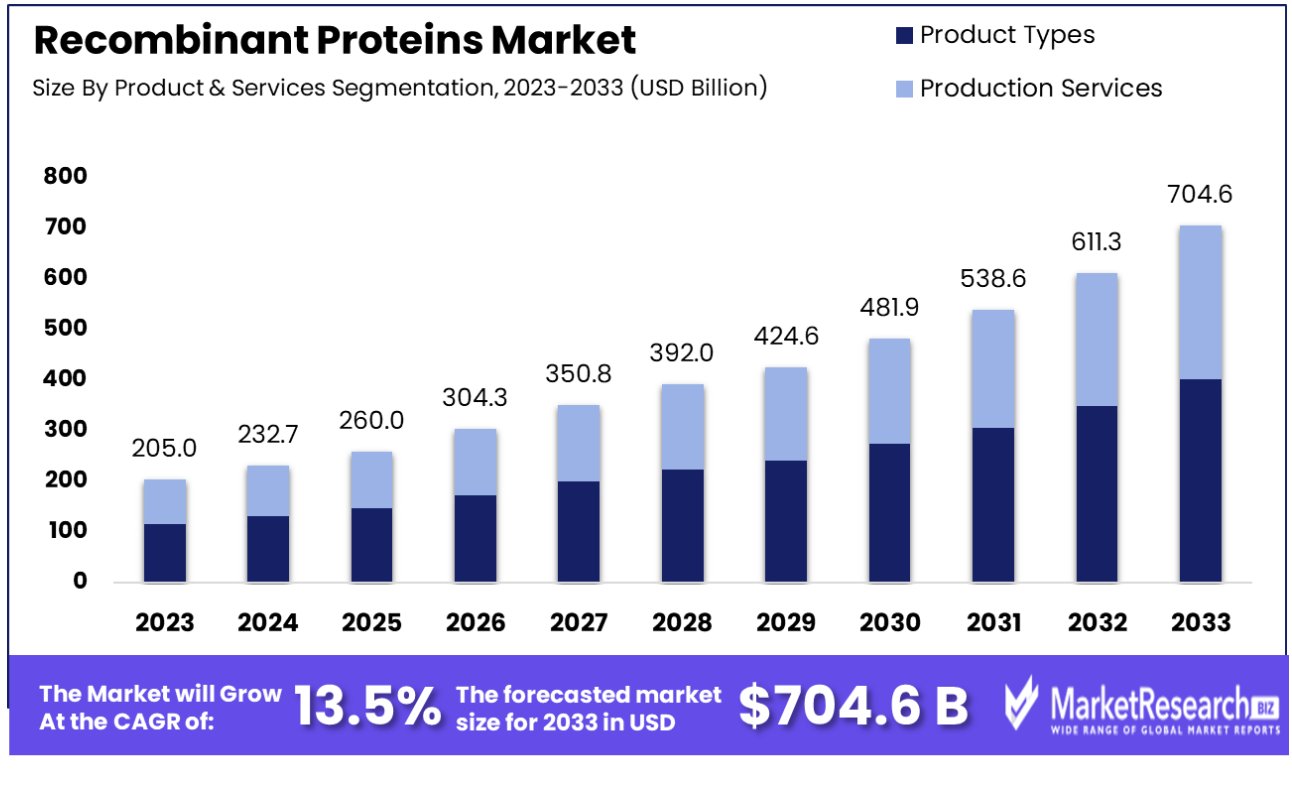

The recombinant proteins market was valued at USD 205.8 billion in 2023. It is expected to reach USD 704.6 billion by 2033, with a CAGR of 13.5% during the forecast period from 2024 to 2033.

The surge in demand for protein engineering and advanced treatment techniques are some of the main key driving factors for the recombinant protein market. Recombinant proteins are produced artificially by integrating genetic materials from various sources. Recombinant signifies joining genetic substances to develop a new combination that does not prevail naturally. To build a recombinant protein, many scientists are implementing engineering methodology to put a particular gene that can encrypt an anticipated protein into the genome of a host organism like bacteria or yeasts. The host organism then assists as a factory for generating the protein desired using its cellular machinery.

The increasing incidence of chronic diseases represents another significant driving factor for the recombinant proteins market. According to a report published by the American Cancer Society in January 2023, there have been more than 1,958,310 new cancer cases reported and among that 609,820 deaths have been registered in the US. Moreover, according to PubMed Central report in March 2023, there were approx. 14,61,427 cancer cases were reported in India for the year 2022. In India, 1 out of 9 individuals are likely to get affected with cancer in their lifespan. Lung and breast cancers are the main sites of cancer in males and females respectively. Among childhood from 0 to 14 years cancer prevails, lymphoid leukemia affects 29.2% of boys and 24.2% of girls. The occurrence of cancer cases is projected to rise by 12.8% in 2025.

Recombinant proteins have a broad range of applications in medicines and industry. In medicines, recombinant proteins are utilized as therapeutics to heal diseases like cancer and other autoimmune illnesses. These proteins are used to enhance crop yields and pesticides in agriculture. Whereas, these proteins are used in generating enzymes, biofuels, and other products in the industrial sector. Recombinant protein has also played an important role in the growth of vaccines. This protein is also used as an antigens to arouse the immune system and improve immunity against particular diseases. For example, the hepatitis B vaccine is generated by implementing recombinant DNA technology to get the hepatitis B surface antigen. This technology is also utilized to create vaccines for other diseases like HPV and shingles. The demand for recombinant proteins will increase due to its requirement in medical and therapeutic fields which will help in market expansion in the coming years.

Driving Factors

Chronic Disease Prevalence Boosts Recombinant Proteins Market

The growing incidence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, is a pivotal driver for the recombinant proteins market. With 51.8% of U.S. adults having at least one chronic condition, there's an escalating demand for innovative biologic drugs, predominantly comprising recombinant proteins. For instance, Humira, a recombinant protein-based drug for autoimmune diseases, has emerged as the world's top-selling drug. This increasing prevalence necessitates advanced treatment options, thereby propelling the market for recombinant proteins.

Advances in Recombinant DNA Technology Propel Production

Technological advancements in recombinant DNA techniques are critical to the market's growth, enhancing the efficiency and cost-effectiveness of producing complex recombinant proteins. The optimization of CHO cell expression systems for higher yields is a notable example. Such improvements in production methodologies not only increase scalability but also make these biologics more accessible.

Biotech Collaborations Expand Recombinant Protein Production

The active licensing and partnerships among biotech firms for recombinant technology are pivotal in market expansion. By sharing development costs and expertise in biologics manufacturing, these collaborations significantly increase production capacity. This collaborative approach helps in the development of novel treatments based on recombinant proteins, which contributes to the growth of the market.

Rising Demand in Diagnostics and Research Catalyzes Growth

The demand for recombinant antibodies and proteins in diagnostics and research is on an upward trajectory, bolstered by advancements in immuno-oncology and precision medicine. As these fields evolve, the need for specific and high-quality recombinant proteins intensifies, further driving the market's expansion. The growing reliance on these proteins for accurate diagnostics and research applications underscores their importance in modern medicine.

Restraining Factors

High Production Costs Impede Accessibility in Recombinant Proteins Market

The high costs associated with the production of recombinant proteins significantly limit their market growth. Manufacturing biologics, particularly complex proteins, demands substantial capital investments in advanced technology and facilities. This requirement leads to elevated production costs, which are often passed on to the end-users, thereby limiting access and uptake. The expense associated with producing these proteins makes them less accessible, especially in cost-sensitive markets, and can be a deterrent for smaller companies or startups from entering the market. This financial barrier restricts the widespread availability and adoption of recombinant protein products.

Extended Development Timelines and Complexities Slow Recombinant Protein Drug Market Growth

The lengthy timelines and complexities involved in developing recombinant protein drugs are major factors restraining market growth. Typically, it can take 10-15 years to bring a new recombinant protein drug to market. This extended period is due to the intricate process of development, including extensive research, process optimization, and rigorous clinical trials to ensure efficacy and safety. These prolonged development phases not only delay the introduction of new products into the market but also significantly increase the costs associated with research and development. Such factors collectively hinder the rapid growth and innovation within the recombinant proteins market.

Recombinant Proteins Market Segmentation Analysis

Product & Services Segmentation :

Product Types (Cytokines & Growth Factors, Antibodies, Recombinant Regulatory proteins)

represent the dominant segment in the recombinant proteins market. This segment's dominance is attributed to the wide range of applications these proteins have in both therapeutic and research settings. Cytokines and growth factors are crucial for cell signaling and have significant applications in cell culture, immunology, and regenerative medicine. Antibodies, particularly monoclonal antibodies, are vital in treatments for various diseases, including cancer and autoimmune disorders. Recombinant regulatory proteins play a critical role in understanding cellular mechanisms and drug discovery processes.

Production Services, which involve the custom production of recombinant proteins, are also significant but are secondary to the demand for the product types mentioned above.

Application Segmentation:

The largest application segment in the recombinant protein market is therapeutics. The substantial use of recombinant proteins in therapeutic applications, such as vaccines, biologics, and cell and gene therapies, serves as a major driving force for this market. The proteins revolutionized treatment for various diseases, providing targeted and effective treatment options.Recombinant proteins have become an integral part of the treatment of diseases such as diabetes, autoimmune diseases as well as various types of cancer.Their role in the development of vaccines is particularly evident during the development of COVID-19 vaccines.

Drug Discovery & Development, Research, and Others also significantly impact the industry, with recombinant protein being an essential tool in the development and research of new therapies and drugs.

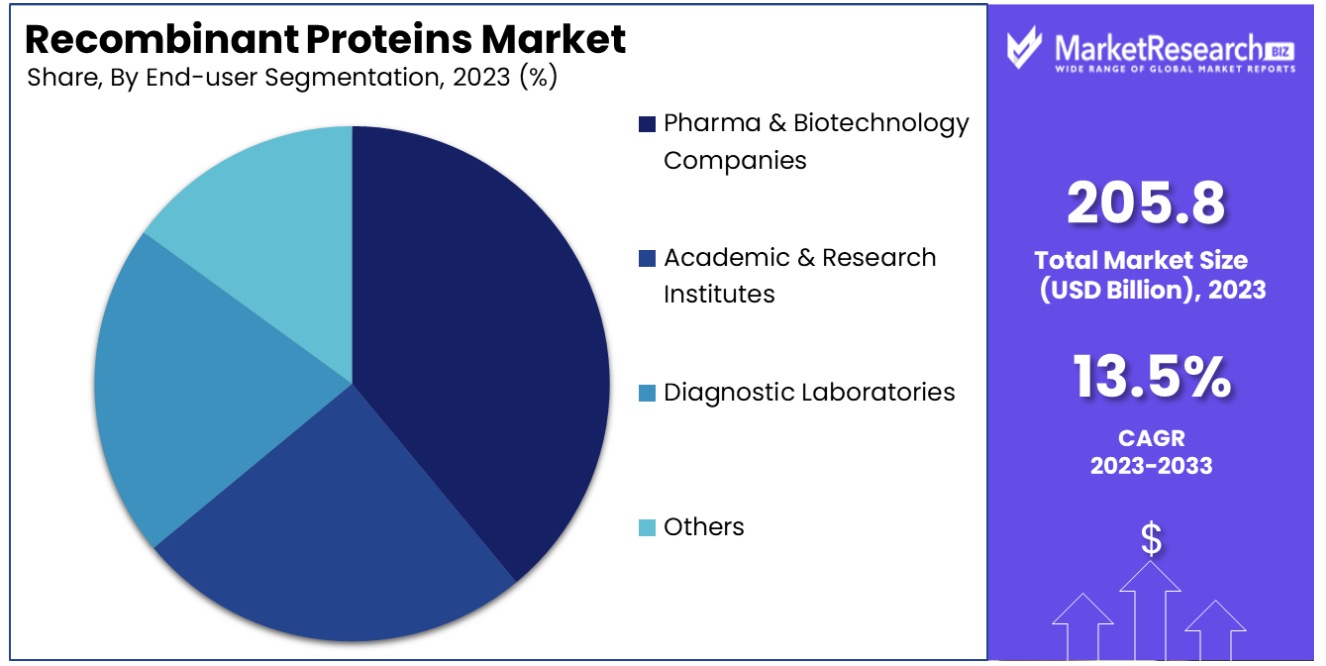

End-user Segmentation:

Pharmaceutical and biotechnology companies stand out as primary end-users in the recombinant proteins market. These companies harness recombinant proteins for various purposes, including drug development, biologics production, and therapeutic applications. Their market dominance is fortified by substantial investments and the ongoing development of products focused on recombinant proteins. While academic and research institutes, diagnostic laboratories, and other entities also employ recombinant proteins, particularly for research and diagnostic endeavors, the scale and impact of their utilization by pharmaceutical and biotech companies remain unparalleled.

Host Cell Segmentation:

Mammalian systems serve as the predominant host cells in the recombinant proteins market. Mammalian cell systems are preferred due to their ability to produce proteins with proper folding, post-translational modifications, and functional activity. This is particularly important for therapeutic proteins, where correct glycosylation patterns are critical for efficacy and reduced immunogenicity.

Insect Cells, Yeast & Fungi, Bacterial Cells, and Others also play roles in recombinant protein production. Each system has its advantages, such as cost-effectiveness in bacterial cells or specific post-translational modifications in yeast. The market is dominated by proteins produced in mammalian systems, primarily due to their superior quality, particularly in the context of therapeutic applications.

Recombinant Proteins Industry Segments

Product & Services Segmentation:

- Product Types

- Production Services

Application Segmentation:

- Drug Discovery & Development

- Therapeutics

- Biologics

- Vaccines

- Cell & Gene Therapies

- Others

- Research

- Others

End-user Segmentation:

- Pharma & Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Laboratories

- Others

Host Cell Segmentation:

- Mammalian Systems

- Insect Cells

- Yeast & Fungi

- Bacterial Cells

- Others

Growth Opportunities

Novel Delivery Mechanisms Enhance Efficacy and Convenience in Recombinant Proteins Market

The development of novel delivery mechanisms for recombinant protein drugs, such as PEGylation, nanoparticle carriers, and pulmonary delivery, presents a significant opportunity for growth in the recombinant proteins market. Many recombinant protein drugs face bioavailability challenges, and these advanced technologies offer solutions to improve drug delivery, patient convenience, and treatment outcomes. By enhancing the efficacy and ease of use of these drugs, these innovative delivery methods can lead to increased adoption and patient preference, subsequently driving market growth and potentially transforming patient care in various therapeutic areas.

Alternative Production Systems Drive Cost Efficiency in Recombinant Proteins Market

Utilizing alternative production systems, such as transgenic animals, plants, and microbes, for manufacturing recombinant proteins opens up substantial growth opportunities in the market. These systems can provide a more cost-effective method of production compared to traditional mammalian cultures. The reduction in manufacturing costs can translate into lower pricing and improved access to these therapies, making them more available to a broader patient base. This shift in production methods not only benefits consumers in terms of cost but also encourages more widespread use and acceptance of recombinant protein therapies, thereby catalyzing market expansion.

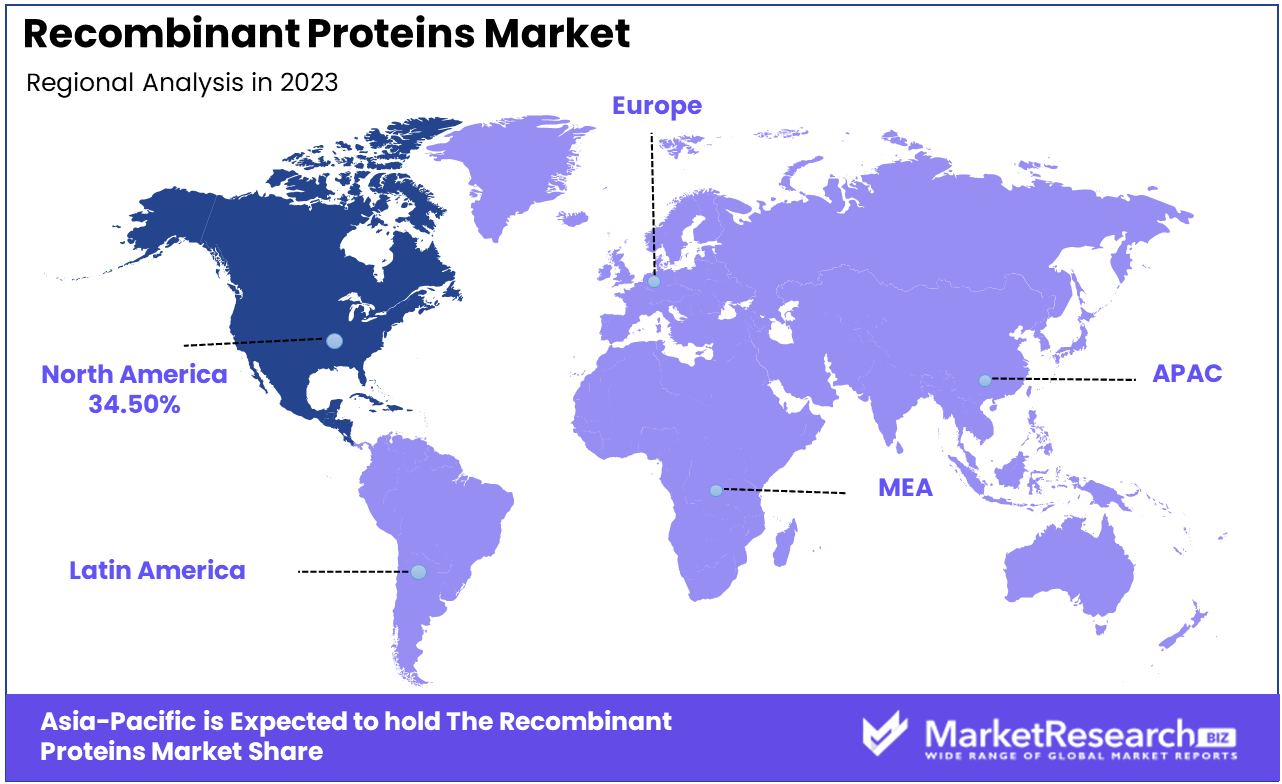

Recombinant Proteins Market Regional Analysis

North America Dominates with 34.50% Market Share in Recombinant Proteins Market

The substantial 34.50% share of the global recombinant proteins market held by North America is propelled by the region's advanced biotechnology sector and substantial investments in research and development. The United States, a key player in this market, is home to some of the world's foremost biotech and pharmaceutical companies, including influential players like Amgen and Genentech. These companies hold a crucial role in the research, development, and production of recombinant proteins. Contributing factors to the region's prominent market share include elevated healthcare spending, a sophisticated healthcare infrastructure, and a strong emphasis on drug development and personalized medicine.

The market dynamics in North America are characterized by cutting-edge technological advancements in bioprocessing and genetic engineering. The growing focus on therapeutic applications of recombinant proteins in treating various diseases, including cancer and autoimmune disorders, drives market growth. Additionally, strategic collaborations between academic institutions, research organizations, and biotech companies facilitate innovation and development in the field. The region's stringent regulatory environment, ensuring safety and efficacy, also plays a crucial role in market development.

Europe: Strong Research Infrastructure and Growing Biotech Sector

Europe’s recombinant proteins market benefits from its strong research infrastructure and growing biotech sector. Countries like Germany, the UK, and Switzerland play pivotal roles, with companies like Roche and Novartis leading in biopharmaceutical innovation. The European market is also driven by supportive government policies for biotechnology research and a well-established regulatory framework.

Asia-Pacific: Rapid Market Growth and Emerging Biotech Hubs

In Asia-Pacific, the recombinant proteins market is rapidly growing, led by countries like China and India. The region's market growth is driven by increasing investments in the biotech sector, growing healthcare needs, and the emergence of local biotech companies. The increasing government support for biotechnology and healthcare research, coupled with a large patient population, presents significant growth opportunities for the recombinant proteins market in this region.

Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Recombinant Proteins Market Key Player Analysis

Within the Recombinant Proteins Market, a pivotal domain in biotechnology and pharmaceutical research, the listed companies play a crucial role in propelling innovation and providing essential resources.Thermo Fisher Scientific, Inc. and Merck KGaA are global leaders, known for their comprehensive range of high-quality recombinant proteins. Their strategic positioning emphasizes cutting-edge technology and extensive product offerings, significantly influencing research and development in life sciences.

Bio-Techne Corporation and GenScript Biotech Corporation are renowned for their expertise in protein engineering and production, catering to a broad range of applications including drug discovery and diagnostics. Their focus on innovation and quality underscores the market's commitment to advancing scientific research.

Recombinant Proteins Industry Key Players

- Enzo Life Sciences, Inc.

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Thermo Fisher Scientific, Inc.

- ProSpec-Tany TechnoGene Ltd.

- Acrobiosystems

- Sino Biological Inc.

- StressMarq Biosciences Inc.

- Merck KGaA

- RayBiotech, Inc.

- GenScript Biotech Corporation

- Laurus Bio

- Abcam plc

- Bio-Rad Laboratories, Inc.

- STEMCELL Technologies Inc

Recombinant Proteins Market Recent Development

- Jan 2024 Vancouver-based SignalChem Biotech to be Acquired by China's Sino Biological for up to US $48 Million, Newmac Files Legal Action

- In 2023 Canadian startup Future Fields raised $11.2 million in a seed extension round to scale up fruit flies as production vehicles for high-value recombinant proteins.

- In 2023 Bee Partners increased its equity stake, while Toyota Ventures’ investment brings in expertise in large-scale manufacturing, said the startup has raised $13.4 million.

- In 2023 As part of Grifols' investment for future growth, the company designed, built, and validated the $80 million, state-of-the-art, biological manufacturing facility in the San Francisco Bay Area. The new facility has 25,000 square feet of GMP manufacturing space,

- In 2023 FDA gave the green light for the clinical use of over 130 recombinant proteins. However, more than 170 recombinant proteins are produced and utilized worldwide in medical and research fields.

Report Scope

Report Features Description Market Value (2023) USD 205.8 Billion Forecast Revenue (2033) USD 704.6 Billion CAGR (2024-2034) 13.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product & Services Segmentation(Product Types, Production Services), Application Segmentation(Drug Discovery & Development, Therapeutics, Biologics, Vaccines, Cell & Gene Therapies, Others, Research, Others), End-user Segmentation(Pharma & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories, Others), Host Cell Segmentation(Mammalian Systems, Insect Cells, Yeast & Fungi, Bacterial Cells, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Enzo Life Sciences, Inc., Bio-Techne Corporation, Proteintech Group, Inc., Thermo Fisher Scientific, Inc., ProSpec-Tany TechnoGene Ltd., Acrobiosystems, Sino Biological Inc., StressMarq Biosciences Inc., Merck KGaA, RayBiotech, Inc., GenScript Biotech Corporation, Laurus Bio, Abcam plc, Bio-Rad Laboratories, Inc., STEMCELL Technologies Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Enzo Life Sciences, Inc.

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Thermo Fisher Scientific, Inc.

- ProSpec-Tany TechnoGene Ltd.

- Acrobiosystems

- Sino Biological Inc.

- StressMarq Biosciences Inc.

- Merck KGaA

- RayBiotech, Inc.

- GenScript Biotech Corporation

- Laurus Bio

- Abcam plc

- Bio-Rad Laboratories, Inc.

- STEMCELL Technologies Inc