Carbon Offset Market By Type(Compliance Market, Voluntary Market), By Project Type(Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-use(Energy, Aviation, Transportation, Industrial Buildings, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42699

-

Jan 2024

-

174

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Carbon Offset Market Size, Share, Trends Analysis

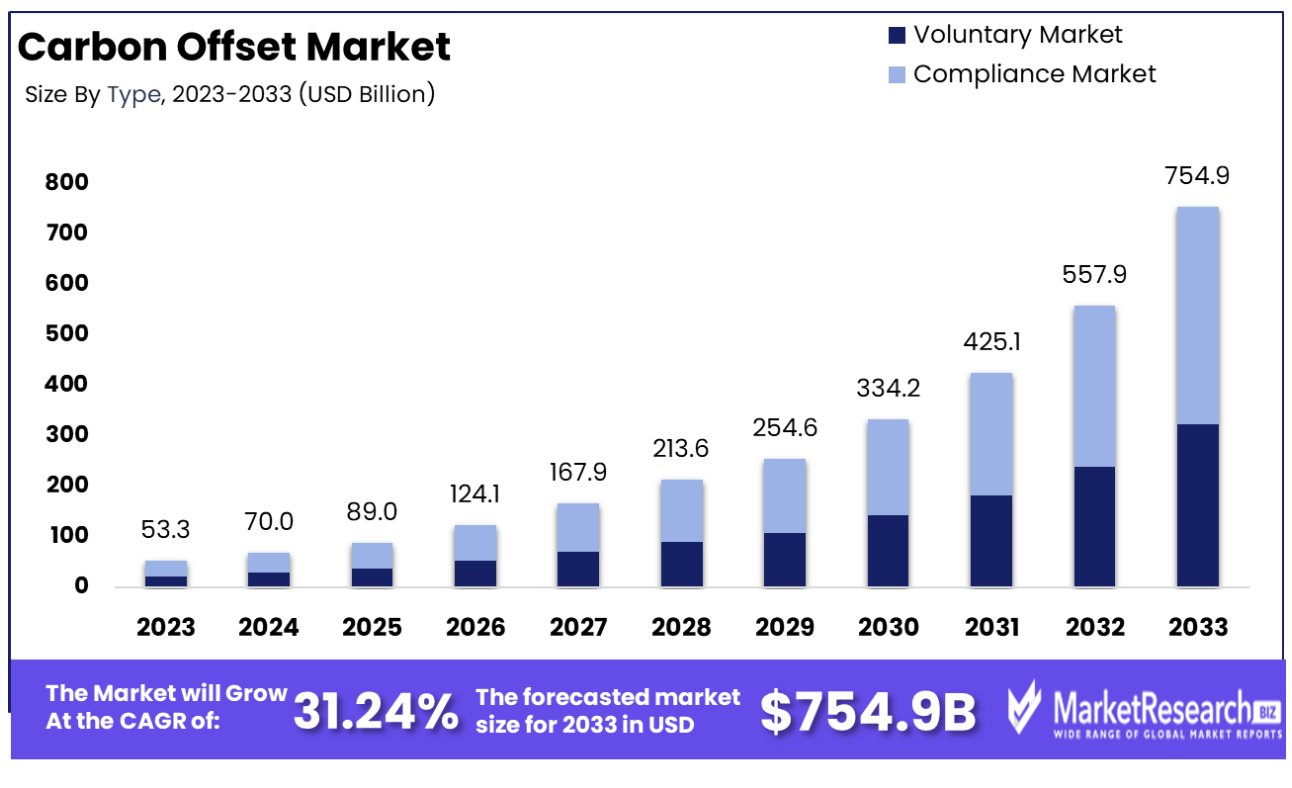

Carbon Offset Market size is estimated to reach USD 754.9 Bn by 2033, an increase from its USD 53.3 Bn estimate by 2023. Growth projections estimate an annual compound compound annual growth rate of (CAGR) 31.24% during 2024-2033.

A carbon offset represents a reduction in greenhouse gas emissions, quantified in metric tons of carbon dioxide equivalent (CO2e), which is used to compensate for emissions occurring elsewhere.

Typically, one carbon offset equals one ton of CO2e either reduced or removed from the atmosphere. These offsets are generated through various activities, such as reforestation, renewable energy projects, or energy efficiency upgrades. They play a crucial role in climate change mitigation strategies, allowing businesses and individuals to 'offset' their emissions by investing in environmental projects.

Aligning with stringent regulatory frameworks, such as the EU's ambitious target to reduce emissions by over 55% by 2030, presents a lucrative opportunity. This alignment ensures that carbon offset projects are not only compliant but also contribute significantly to national and international climate goals. Recent trends indicate a surge in regulatory initiatives globally, mandating corporations to adopt greener energy.

The proliferation of net-zero targets among leading global companies creates a burgeoning market for carbon offsets. In 2023, Carbon Brief identified 37.8 million carbon offsets used by 34 of the top 50 businesses, which equates to approximately 5% of the credits on the voluntary market over three years.

As these corporations seek to meet their climate goals, the demand for credible and effective carbon offsets escalates. This trend offers a significant opportunity for companies in the carbon offset market to expand their offerings.

By providing solutions that assist in achieving these net-zero ambitions, companies can not only grow their client base but also establish themselves as key players in the global effort to mitigate climate change, aligning their growth strategy with the prevailing corporate sustainability narrative.

The emergence of new carbon-trading networks, tailored to localized and niche climate actions, opens new avenues for collaboration and investment. These networks respond to the growing demand for customized solutions in carbon offsetting, presenting a ripe opportunity for market expansion.

A new law in Paraguay has now been approved. It aims to improve the carbon credit market. The law establishes a registry for carbon credit projects within the National Directorate of Climate Change, ensuring organized and transparent tracking.

Moreover, integrating carbon offsets into consumer purchasing decisions taps into a rapidly growing market segment. The trend towards conscious consumerism is accelerating, driven by a heightened awareness of climate change impacts.

Companies that embed carbon offset options into their consumer-facing platforms can attract a broader, more environmentally conscious customer base, thereby driving growth and reinforcing their commitment to sustainability. For Instance, By integrating solar panels directly into building materials, Building-Integrated Photovoltaics not only generates renewable energy but also contributes to carbon offset goals by reducing reliance on conventional, emissions-intensive power sources

Driving Factors

Carbon Capture Investments Boost carbon offset market

Investment in CCS has more than doubled since last year to hit a record high of $6.4 billion, with the US leading the pack with 45% of global investment. Additionally, the amount of CO2 captured by CCS facilities worldwide currently accounts for just 0.12 percent of annual global emissions. As businesses and governments invest more in carbon capture and storage (CCS) technologies, the capacity to offset larger volumes of carbon emissions expands. This investment is a response to the growing demand for effective solutions to mitigate the impact of climate change.

Carbon capture technologies play a critical role in reducing atmospheric CO2, and their advancement directly increases the availability and efficacy of carbon offset projects. The ongoing investment in these technologies suggests a future where carbon offsets become an integral part of global climate strategies, indicating sustained growth in the market driven by technological advancements in carbon capture.

Corporate Carbon Goals Propel Offsets Demand

According to the United Nations, more than 9,000 companies, over 1,000 cities, more than 1,000 educational institutions, and over 600 investors have committed to achieving a solution to net-zero emissions by 2050. As more companies commit to reducing their carbon footprint, the demand for carbon offsets as a tool to achieve these goals increases. Businesses are utilizing carbon offsets to compensate for emissions they cannot eliminate through direct actions.

This trend reflects a broader shift in corporate responsibility, where environmental sustainability is becoming a core aspect of business strategy. The commitment to carbon neutrality and net zero targets by a growing number of corporations suggests a continued expansion of the carbon offset market, underpinned by corporate efforts to address climate change.

Regulatory Policies Catalyze Market Expansion

Governments worldwide are implementing policies that require or encourage carbon offsetting as part of broader climate change and sustainability initiatives. These regulations often include mechanisms like cap-and-trade systems or carbon taxes that incentivize or mandate the use of carbon offsets.

As these regulatory frameworks become more widespread and stringent, the demand for carbon offsets is expected to increase. This regulatory environment not only promotes the growth of the carbon offset market but also ensures its integration into national and international climate strategies.

Restraining Factors

Lack of Standardization and Verification Restrains Carbon Offset Market Growth

The carbon offset market faces significant growth challenges due to the lack of standardization and verification of carbon offset projects. Without universally accepted standards, it's difficult to ensure the quality and effectiveness of offset projects. This lack of standardization can lead to skepticism among buyers about the true environmental impact of their investments, potentially undermining the market's credibility.

Moreover, inadequate verification processes can result in issues like double counting of emissions reductions or investments in projects that do not deliver the promised carbon sequestration. These factors limit market growth by reducing buyer confidence and participation in the carbon offset market.

Lack of Preparation for New Market Mechanisms Limits carbon offset Market Expansion

Establishing a carbon market requires a complex framework involving regulatory structures, trading platforms, and participant readiness. Many regions and organizations are unprepared for this transition, lacking the necessary infrastructure, legal frameworks, or technical expertise.

This unpreparedness can delay the establishment and efficient functioning of carbon markets, limiting the ability to scale up and attract broader participation. But this can be seen changing as Generative AI in energy emerges as a transformative solution to address the challenges posed by the lack of preparation for new market mechanisms within the carbon offset landscape. By leveraging advanced algorithms and predictive models, generative AI can play a crucial role in streamlining and optimizing the intricate processes involved in carbon trading.

Carbon Offset Market Segmentation Analysis

By Type

The compliance market, representing 54% of the carbon offset market, is driven by regulatory mandates requiring companies to offset their carbon emissions. This segment's dominance is underpinned by government-imposed carbon reduction targets and cap-and-trade schemes, where entities must purchase carbon credits to comply with emission caps. For Instance, The Federal Government has set a goal of achieving net-zero emissions by 2050, including a 65% reduction by 2030.

The compliance market is critical in industries like energy, manufacturing, and transportation, where emissions are traditionally high. This market is characterized by a more formal and regulated structure, offering standardized and verified carbon credits.

The voluntary market, while smaller than the compliance market, is significant and growing rapidly. It caters to entities that voluntarily choose to offset their carbon footprint as part of their sustainability initiatives or corporate social responsibility goals.

By Project Type

Avoidance or reduction projects, which account for 56% of the market, focus on preventing carbon emissions or reducing existing emissions. These projects include renewable energy initiatives, energy efficiency improvements, and methane capture. The popularity of these projects lies in their immediate impact on reducing emissions and their alignment with sustainable development goals.

Removal or sequestration projects involve the capture and storage of carbon dioxide from the atmosphere. These include reforestation, afforestation, and carbon capture and storage (CCS) technologies. While they currently have a smaller market share, interest in these projects is increasing due to their long-term benefits for climate change mitigation.

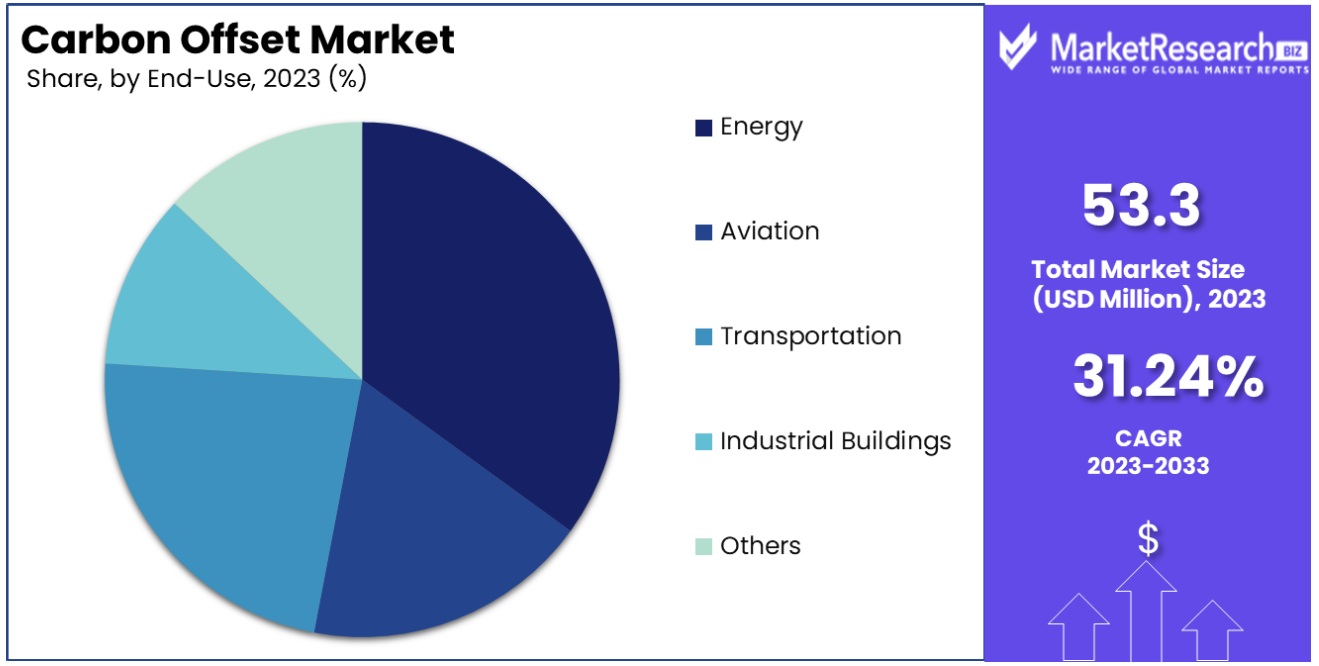

By End-use

The energy sector, comprising 37% of the carbon offset market, is the largest end-user. Carbon offset projects in this sector include transitioning to renewable energy, improving energy efficiency, and implementing carbon capture and storage solutions.

The aviation industry is increasingly investing in carbon offsets to mitigate its environmental impact. The transportation sector is focusing on offsets through cleaner fuel initiatives and efficiency improvements. Industrial buildings are adopting energy-efficient practices and renewable energy management. Other sectors, including agriculture and waste management, also contribute to the carbon offset market with specific projects tailored to their emission profiles.

By Type

- Compliance Market

- Voluntary Market

By Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

By End-Use

- Energy

- Aviation

- Transportation

- Industrial Buildings

- Others

Carbon Offset Market Regional Analysis

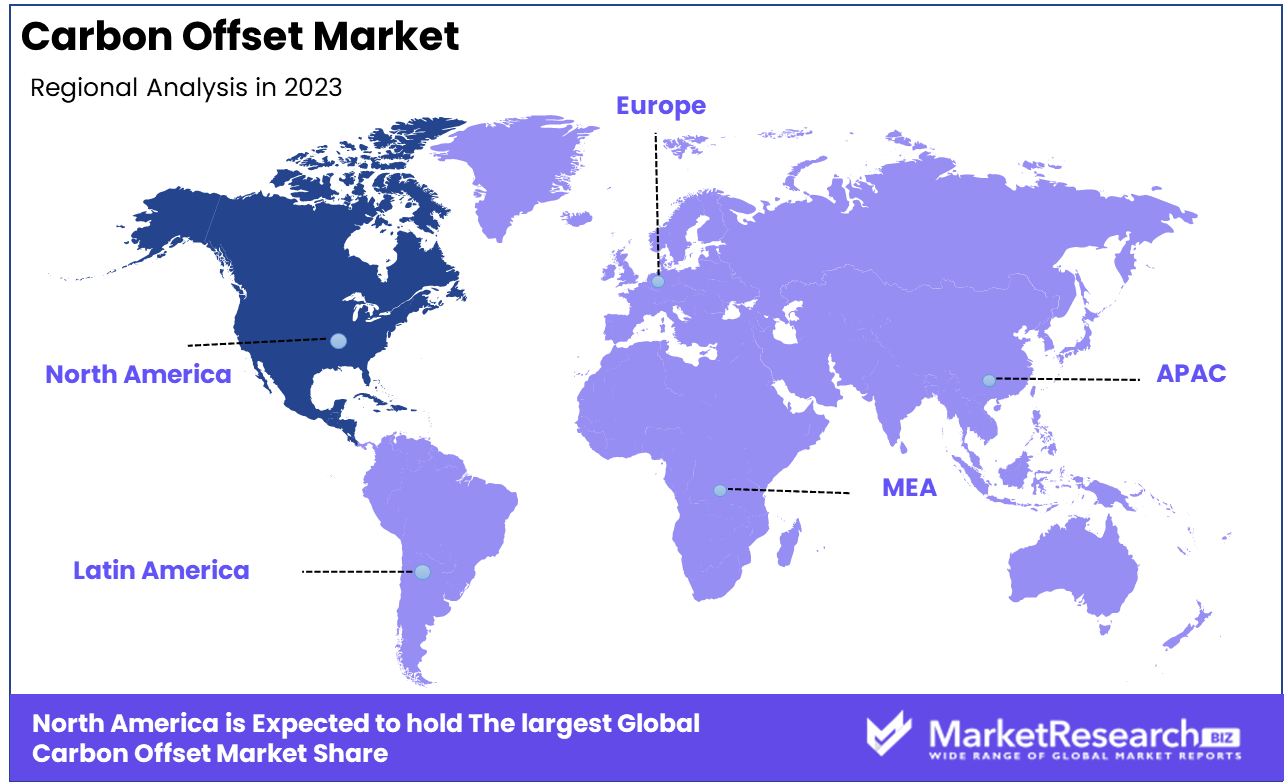

North America Dominates with 31% Market Share

North America’s significant 31% share of the global carbon offset market is driven by the region's strong commitment to addressing climate change and reducing greenhouse gas emissions. This commitment is reflected in both policy initiatives and corporate responsibility strategies. The United States and Canada have several regulations and incentives in place that encourage businesses and individuals to invest in carbon offset projects. Additionally, there is a growing awareness and demand from consumers for sustainable practices, which pushes companies to offset their carbon footprint.

The market dynamics in North America are influenced by a well-established framework for carbon trading and a variety of projects eligible for carbon offsets, such as renewable energy, reforestation, and methane capture. Moreover, the corporate sector in North America is increasingly recognizing carbon offsets as a tool for achieving sustainability goals, further boosting the market.

Europe Is Pioneering in Climate Action and Carbon Market

Europe's carbon offset market is driven by its pioneering role in climate action and the establishment of the European Union Emissions Trading System (EU ETS). The region's stringent climate policies and the commitment to the Paris Agreement underpin the market's growth. European companies are actively participating in carbon offsetting as part of their comprehensive climate strategies.

Asia-Pacific Is An Emerging Market with Growing Environmental Consciousness

In Asia-Pacific, the carbon offset market is emerging, fueled by the region's growing environmental consciousness and efforts to combat climate change. Countries like China and India are increasingly investing in renewable energy and other sustainable projects that offer carbon offset opportunities. The region's rapid economic growth and industrialization present significant potential for the expansion of the carbon offset market.

Carbon Offset Market Key Player Analysis

In the carbon offset market, an increasingly important segment of the global sustainability effort, the companies listed are key players in addressing climate change through market-driven solutions. South Pole Group and Climate Impact Partners stand out for their extensive portfolios in carbon offset projects, leading the market with innovative and impactful initiatives. Their focus on high-quality carbon credits from diverse projects, including reforestation and renewable energy, highlights the industry's shift towards comprehensive and verifiable carbon offsetting solutions.

3Degrees and EKI Energy Services Ltd., with their expertise in renewable energy credits and carbon management, play pivotal roles in helping businesses reduce their carbon footprint, reflecting the growing corporate demand for credible carbon offsetting strategies. NativeEnergy and CarbonBetter, specializing in custom carbon projects, contribute significantly to the market by catering to businesses seeking tailored sustainability solutions.

Carbon Care Asia Limited and Terrapass, focusing on regional and targeted carbon offset initiatives, demonstrate the market's adaptability in addressing specific environmental challenges and regulatory landscapes. Climetrek Ltd. and Carbon Credit Capital, with their innovative approaches to carbon finance and offsetting, underscore the industry's trend toward integrating technology and finance in climate action.

Collectively, these companies not only drive advancements in the carbon offset market but also represent a spectrum of strategies – from project development and carbon finance to tailored offset solutions – crucial for enhancing global climate action and achieving sustainability goals.

Major Market Players in the Carbon Offset Market

- South Pole Group

- 3Degrees

- EKI Energy Services Ltd.

- NativeEnergy

- CarbonBetter

- Carbon Care Asia Limited

- Terrapass

- Climetrek Ltd.

- Carbon Credit Capital

- Climate Trade

- ForestCarbon

- Moss.Earth

- Bluesource LLC

- Climate Impact Partners

- Carbonfund

- Climeco LLC

Recent Developments

In August 2023, Ora Technology, a software company, is focusing on creating a digital carbon trading platform called Ora Carbon. This platform is designed to revolutionize the voluntary carbon market by enabling users to buy, sell, and retire carbon credits. The primary goal of Ora Carbon is to provide easy access to carbon assets, simplifying the complex processes associated with the carbon industry.

In August 2023, ICVCM released its long-awaited framework as part of its Core Carbon Principles (CCPs), setting higher standards for carbon credits in the voluntary carbon market (VCM).

In 2023, Microsoft's contracted carbon removal increased significantly to almost 5 million metric tons in 2023 due to a substantial purchase from energy provider

In 2022, Google likely continue its efforts to reduce its carbon footprint in 2022, with a strong emphasis on sustainability and green energy. Specific developments for this year might include progress updates on their renewable energy projects and the expansion of their AI-powered energy optimization initiatives.

Report Scope

Report Features Description Market Value (2023) USD 53.3 Bn Forecast Revenue (2033) USD 754.9 Bn CAGR (2024-2033) 31.40% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Compliance Market, Voluntary Market), By Project Type(Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-use(Energy, Aviation, Transportation, Industrial Buildings, Others) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape South Pole Group, 3Degrees, EKI Energy Services Ltd., NativeEnergy, CarbonBetter, Carbon Care Asia Limited, Terrapass, Climetrek Ltd., Carbon Credit Capital, Climate Trade, ForestCarbon, Moss.Earth, Bluesource LLC, Climate Impact Partners, Carbonfund, Climeco LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- South Pole Group

- 3Degrees

- EKI Energy Services Ltd.

- NativeEnergy

- CarbonBetter

- Carbon Care Asia Limited

- Terrapass

- Climetrek Ltd.

- Carbon Credit Capital

- Climate Trade

- ForestCarbon

- Moss.Earth

- Bluesource LLC

- Climate Impact Partners

- Carbonfund

- Climeco LLC