Bulk Container Packaging Market By Product (Flexitanks, Drums, Pails, Bulk Containers, Pallets), By Material (Plastic, Metals, Fiber, Wood, Others), By End Use (Chemicals, Pharmaceutical, Food and Beverages, Petroleum and Lubricants, Inks, Paints, and Dyes, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47309

-

June 2024

-

136

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

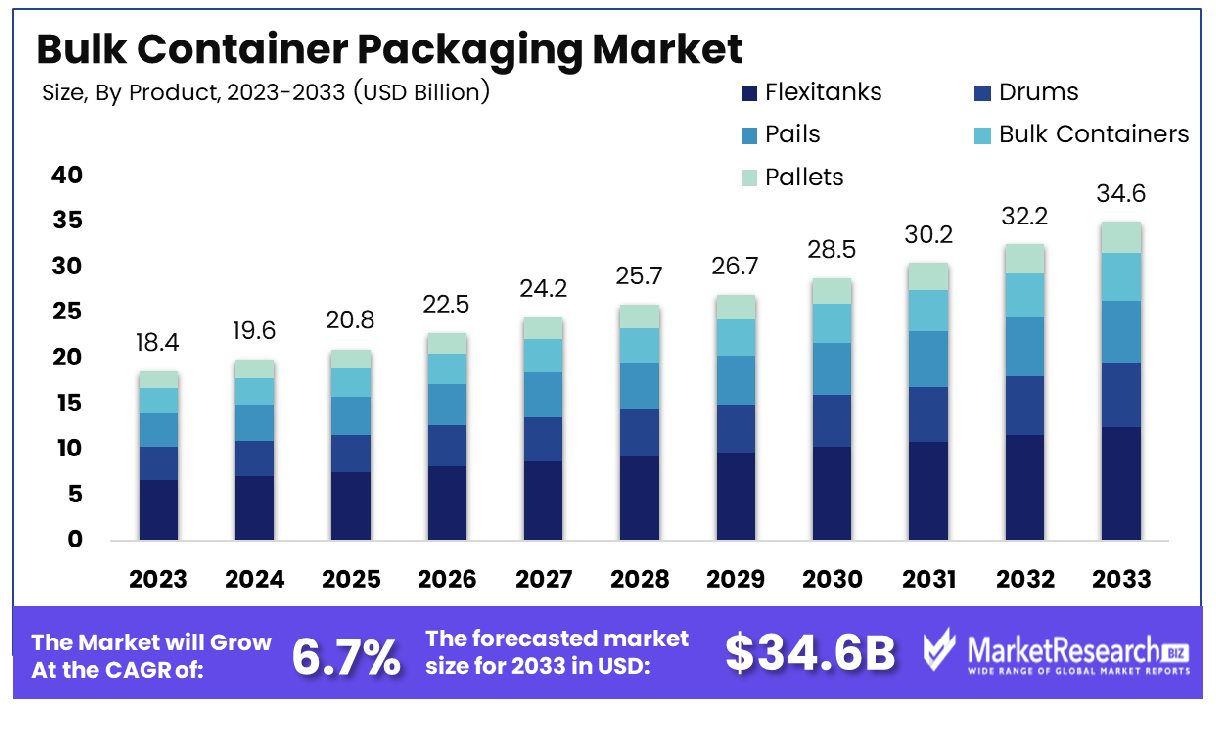

The Global Bulk Container Packaging Market was valued at USD 18.4 Bn in 2023. It is expected to reach USD 34.6 Bn by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

The Bulk Container Packaging Market encompasses the global industry dedicated to the production and distribution of large-scale containers used for the storage and transportation of goods. This market primarily includes products such as drums, pails, bulk boxes, and intermediate bulk containers (IBCs). These containers are designed to handle substantial volumes of dry and liquid materials, ensuring safe, efficient, and cost-effective logistics. Industries such as chemicals, food and beverage, pharmaceuticals, and agriculture rely heavily on bulk container packaging to streamline operations, reduce waste, and enhance supply chain management.

The Bulk Container Packaging Market is poised for substantial growth, driven by advancements in logistics, materials technology, and increasing global trade. Analysts project significant expansion due to the rising demand from key industries such as chemicals, food and beverage, pharmaceuticals, and agriculture. These sectors require robust and efficient packaging solutions to handle large volumes of products, ensuring their safe storage and transportation. The market's growth is also propelled by the shift towards sustainable practices, with companies increasingly opting for reusable and recyclable packaging materials to reduce environmental impact.

Innovations in automation and robotics are playing a critical role in enhancing the efficiency and hygiene of bulk container packaging operations. The introduction of robotic picking platforms (RPPs) is revolutionizing the industry. A basic robotic RPP configuration, comprising two delta robots, can achieve up to 120 picks per robot per minute. This high-performance capability significantly boosts operational efficiency, reducing manual labor and increasing throughput. Furthermore, the RPP platform's stainless steel, self-draining, and IP65-compliant construction ensures hygienic operations, meeting stringent industry standards for cleanliness and safety, particularly in the food and pharmaceutical sectors.

These technological advancements not only streamline processes but also enhance the overall reliability and safety of bulk container packaging. As companies continue to invest in innovative solutions, the market is expected to witness accelerated growth. This trend underscores the critical importance of adopting advanced packaging technologies to maintain competitive advantage and meet the evolving demands of global supply chains.

Key Takeaways

- Market Value: The Global Bulk Container Packaging Market was valued at USD 18.4 Bn in 2023. It is expected to reach USD 34.6 Bn by 2033, with a CAGR of 6.7% during the forecast period from 2024 to 2033.

- By Product: Flexitanks dominate the bulk container packaging market with 35% share, favored for their cost-effectiveness and efficiency in transporting large volumes of liquids.

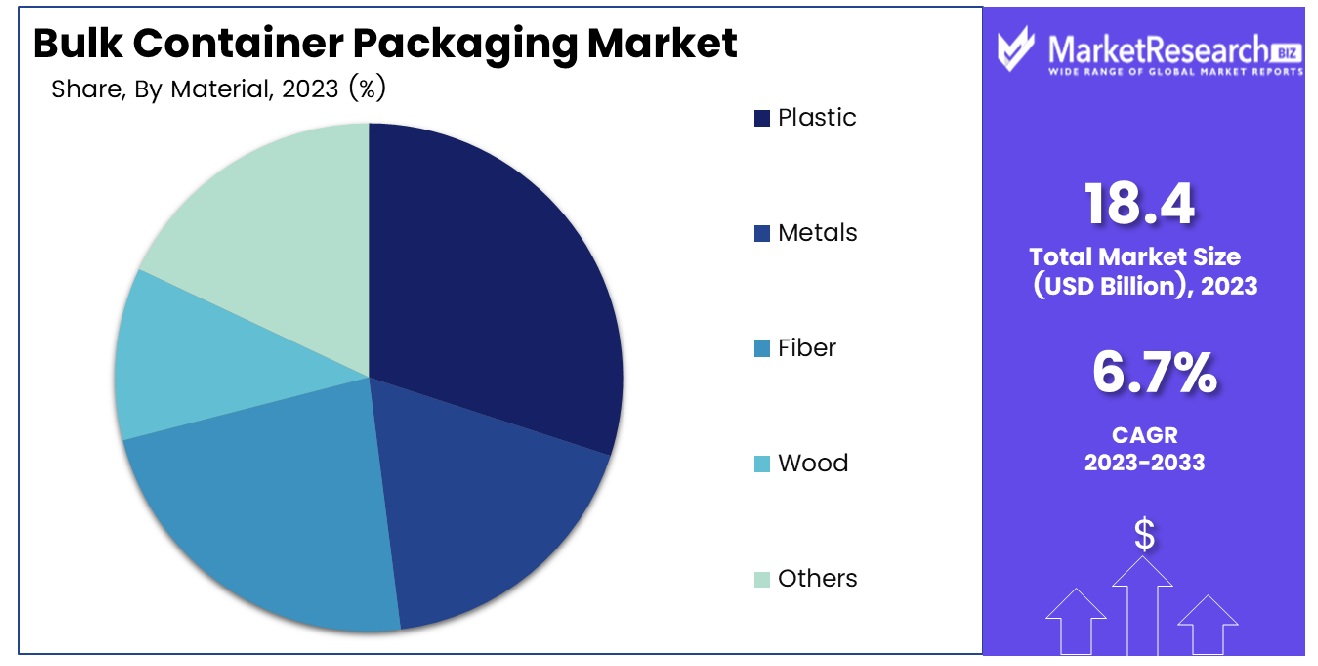

- By Material: Plastic leads with 40% market share, due to its versatility, durability, and widespread use in packaging solutions.

- By End Use: Food and beverages hold the largest share at 30%, driven by the significant demand for safe and efficient bulk packaging in the food and beverage industry.

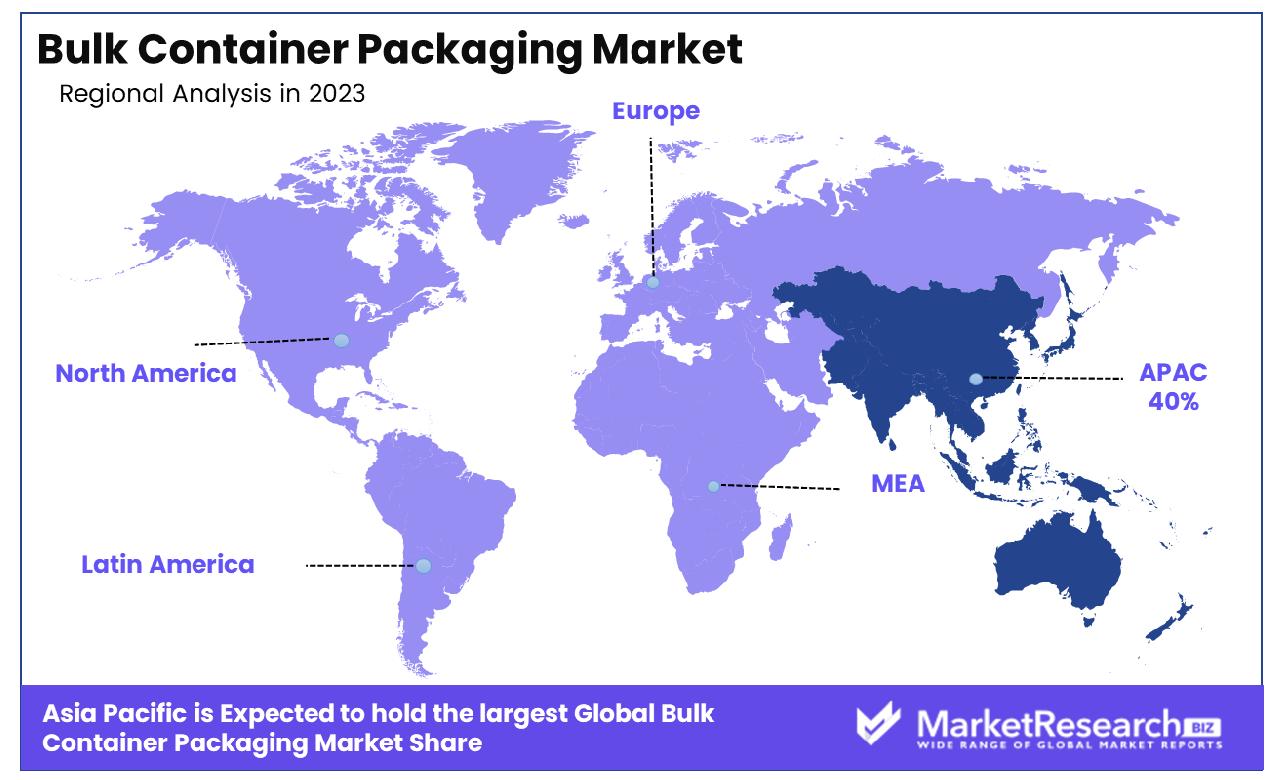

- Regional Dominance: Asia-Pacific leads the bulk container packaging market with 40% share, driven by the region's booming industrial and manufacturing sectors.

- Growth Opportunity: Innovations in sustainable packaging materials offer a promising growth opportunity for the bulk container packaging market, meeting the increasing consumer and regulatory demands for eco-friendly packaging solutions.

Driving factors

Rise in Industrial Chemicals and Food & Beverage Industry

The surge in industrial chemicals and food & beverage industries stands as a cornerstone driving force behind the expansion of the bulk container packaging market. These sectors are pivotal consumers of bulk containers due to the nature of their products, necessitating efficient, secure, and cost-effective packaging solutions.

In the industrial chemicals sector, heightened production levels, driven by industrialization and globalization, have propelled the demand for bulk container packaging. Chemical substances require specialized handling and secure containment to ensure safety during transportation and storage. Bulk containers offer the ideal solution, providing durability, chemical resistance, and containment capabilities essential for hazardous substances.

The food & beverage industry's growth is intrinsically linked to the demand for bulk container packaging. As global population rises and consumer preferences evolve, there's a concurrent increase in food production, processing, and distribution. Bulk containers, such as flexitanks, intermediate bulk containers (IBCs), and drums, accommodate large quantities of liquids and solids, facilitating efficient transportation and storage throughout the supply chain.

Growing Demand for Flexitanks

Within the spectrum of bulk container packaging, flexitanks have emerged as a game-changer, revolutionizing the logistics landscape. The growing demand for flexitanks stems from their versatility, cost-effectiveness, and sustainability advantages over traditional packaging methods.

Flexitanks offer significant advantages in terms of transportation efficiency, allowing for the shipping of non-hazardous liquids in bulk quantities. Compared to drums or intermediate bulk containers (IBCs), flexitanks can significantly increase shipment capacity, thereby reducing shipping costs per unit volume.

The growing preference for flexitanks is further fueled by their ease of installation and removal, minimizing turnaround times and operational disruptions. This aspect is particularly crucial in industries characterized by rapid production cycles and tight schedules, such as the food & beverage and chemical sectors.

Restraining Factors

High Initial Investments

The presence of high initial investments presents a significant challenge in the bulk container packaging market, yet it also serves as a catalyst for growth and innovation. While the upfront costs may deter some potential adopters initially, they signify the market's potential for long-term returns and advancements.

Investments in bulk container packaging encompass various aspects, including the procurement of specialized equipment, development of customized packaging solutions, and implementation of infrastructure for handling and transportation. These investments are particularly pronounced in industries such as chemicals and food & beverage, where stringent quality and safety standards dictate the need for sophisticated packaging solutions.

Low Awareness in Underdeveloped Areas

The low awareness of bulk container packaging in underdeveloped areas presents both a challenge and an opportunity for market growth. While these regions may lag behind in terms of adoption due to limited exposure and resources, they offer untapped potential for expansion as awareness increases and infrastructure develops. In underdeveloped areas, traditional packaging methods may still prevail due to entrenched practices and lack of exposure to modern packaging solutions.

Education and outreach initiatives play a crucial role in addressing low awareness levels. Market players can collaborate with industry associations, governmental organizations, and local communities to provide training, seminars, and demonstrations highlighting the benefits of bulk container packaging. By showcasing the advantages in terms of cost savings, product safety, and environmental sustainability, these initiatives can gradually shift perceptions and encourage adoption.

By Product Analysis

Flexitanks dominate with 35% market share.

In 2023, Flexitanks established a commanding presence in the By Product segment of the Bulk Container Packaging Market, seizing over 35% of the market share. This significant market dominance underscores the versatility and efficiency of flexitanks as a preferred solution for transporting bulk liquids across various industries.

Flexitanks, renowned for their flexibility, cost-effectiveness, and ease of use, emerged as the preferred choice for packaging and transporting bulk liquids, including chemicals, food products, and pharmaceuticals. The lightweight nature of flexitanks, coupled with their ability to maximize container space utilization, enables companies to achieve significant cost savings and operational efficiencies in their supply chain logistics.

Drums, Pails, Bulk Containers, and Pallets, while offering alternative packaging solutions for bulk materials, faced formidable competition from the dominant position held by Flexitanks in the market. The unique advantages offered by flexitanks, such as reduced transportation costs, lower carbon footprint, and simplified handling processes, positioned them as the preferred choice for companies seeking to streamline their bulk liquid logistics operations.

By Material Analysis

Plastic leads with 40% market share.

In 2023, Plastic emerged as the dominant force in the By Material segment of the Bulk Container Packaging Market, securing over 40% of the market share. This substantial market presence underscores the versatility, durability, and cost-effectiveness of plastic as a preferred material for bulk container packaging across diverse industries.

Plastic packaging containers, renowned for their lightweight nature, corrosion resistance, and ability to accommodate various shapes and sizes, have emerged as the go-to choice for packaging a wide range of bulk materials, including chemicals, food products, and consumer goods. The inherent properties of plastic, such as moldability and barrier protection, make it an ideal solution for preserving product integrity and ensuring safe transportation throughout the supply chain.

Metals, Fiber, Wood, and Other materials, while offering alternative packaging options for bulk containers, faced formidable competition from the dominant position held by Plastic in the market. While each material offers unique advantages, such as strength, recyclability, or aesthetics, the widespread availability, cost-effectiveness, and adaptability of plastic containers have positioned them as the preferred choice for companies seeking efficient and reliable packaging solutions.

By End Use Analysis

Food and beverages hold the largest share at 30%.

In 2023, Food and Beverages emerged as the leading sector in the By End Use segment of the Bulk Container Packaging Market, commanding over 30% of the market share. This substantial market dominance underscores the crucial role played by bulk container packaging solutions in facilitating the storage, transportation, and distribution of food and beverage products across the supply chain.

Within the Food and Beverages sector, bulk container packaging solutions are extensively utilized for packaging various products, including liquids, powders, and granules. The versatility and reliability of bulk containers in preserving product quality, ensuring hygiene standards, and optimizing storage and transportation logistics have positioned them as indispensable assets for food and beverage manufacturers and distributors.

Chemicals, Pharmaceutical, Petroleum coke and mining Lubricants, Inks, Paints, and Dyes, and Other sectors, while representing significant segments within the bulk container packaging market, faced stiff competition from the dominant position held by Food and Beverages. While each sector has unique packaging requirements and regulatory considerations, the criticality of maintaining product integrity, safety, and compliance aligns closely with the capabilities offered by bulk container packaging solutions, particularly in the food and beverage industry.

Key Market Segments

By Product

- Flexitanks

- Drums

- Pails

- Bulk Containers

- Pallets

By Material

- Plastic

- Metals

- Fiber

- Wood

- Others

By End Use

- Chemicals

- Pharmaceutical

- Food and Beverages

- Petroleum and Lubricants

- Inks, Paints, and Dyes

- Others

Growth Opportunity

Flexible Intermediate Bulk Containers (FIBCs)

Flexible Intermediate Bulk Containers (FIBCs), commonly known as bulk bags or super sacks, are poised to play a pivotal role in shaping the future of the bulk container packaging market. These versatile containers offer significant advantages in terms of efficiency, cost-effectiveness, and sustainability, making them increasingly popular across various industries. With a growing emphasis on reducing packaging waste and optimizing logistics operations, the demand for FIBCs is expected to surge in 2024 and beyond.

Strategic Initiatives

Strategic initiatives undertaken by key players in the bulk container packaging market are poised to unlock new growth opportunities in 2024. These initiatives encompass a wide range of activities, including mergers and acquisitions, product innovations, and geographic expansions. By leveraging strategic partnerships and investing in research and development, market leaders aim to enhance their competitive positioning and capture a larger share of the market.

Recent strategic initiatives include the launch of eco-friendly packaging solutions, expansion into emerging markets, and collaborations with technology providers to optimize supply chain efficiency.

Latest Trends

Reuse and Recycling

In response to increasing environmental concerns and regulatory pressures, reuse and recycling have emerged as prominent trends shaping the bulk container packaging market. Companies are increasingly prioritizing sustainability in their packaging practices, opting for materials that are recyclable, biodegradable, or reusable. This shift towards sustainable packaging solutions aligns with growing consumer expectations for eco-friendly products and demonstrates a commitment to corporate social responsibility.

The demand for bulk containers designed for reuse and recycling is on the rise, with manufacturers investing in innovative materials and designs to meet this demand. Moreover, governments and industry associations are implementing policies and initiatives to promote recycling and incentivize sustainable packaging practices, further driving the adoption of environmentally friendly bulk container packaging solutions.

Digitalization and Automation

Digitalization and automation are revolutionizing the bulk container packaging industry, enhancing efficiency, transparency, and traceability throughout the supply chain. Advancements in technology, such as Internet of Things (IoT) sensors, blockchain, and artificial intelligence, enable real-time monitoring of container conditions, optimizing inventory management, and ensuring product integrity during transportation and storage.

Automated packaging processes streamline operations, reduce human error, and improve productivity, leading to cost savings and competitive advantages for businesses. Digitalization facilitates data-driven decision-making, allowing companies to analyze performance metrics and identify areas for optimization and improvement. As digitalization and automation continue to evolve, they will play an increasingly integral role in shaping the future of the bulk container packaging market, driving innovation and enhancing competitiveness across the industry.

Regional Analysis

Asia-Pacific leads bulk container packaging with 40%.

Asia-Pacific emerges as the dominant force in the bulk container packaging market, commanding a substantial share of approximately 40%. This dominance can be attributed to the region's robust industrial growth, particularly in sectors such as chemicals, agriculture, and food & beverages. Countries like China, India, and Japan are witnessing significant demand for bulk container packaging due to rapid urbanization, increasing population, and expanding e-commerce activities.

North America follows closely, presenting a mature yet lucrative market for bulk container packaging. The region benefits from well-established logistics infrastructure, stringent regulations promoting sustainable packaging solutions, and a thriving manufacturing sector.

Europe also holds a significant share in the bulk container packaging market, fueled by the region's emphasis on sustainable packaging solutions and strict environmental regulations. Countries like Germany, the UK, and France are witnessing increasing adoption of bulk containers in industries such as chemicals, pharmaceuticals, and automotive.

Middle East & Africa and Latin America are emerging as promising markets for bulk container packaging, driven by factors such as increasing industrialization, expanding retail sector, and rising investments in infrastructure development. In the Middle East, countries like the United Arab Emirates and Saudi Arabia are witnessing significant demand for bulk containers, particularly in the oil & gas and construction sectors.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Bulk Container Packaging Market in 2024, key players such as Greif Inc., Winpak Ltd, Bemis Company Inc., Berry Global, Inc., DS Smith Plc, TechnipFMC, Braid Logistics, National Bulk Equipment, Signode Industrial Group, Mauser Group B.V, Mondi Group, Bermis Company Inc., and Hoover Ferguson Group are at the forefront, driving market trends and innovation.

Greif Inc. stands out as a leading player, leveraging its extensive product portfolio and global presence to cater to diverse packaging needs across industries. Winpak Ltd and Bemis Company Inc. excel in providing high-quality, innovative packaging solutions, meeting the stringent requirements of various end-users.

Berry Global, Inc. and DS Smith Plc are notable for their commitment to sustainability, offering eco-friendly bulk container packaging options that resonate with environmentally-conscious consumers and businesses. TechnipFMC, with its expertise in engineering and manufacturing, contributes advanced solutions for specialized bulk packaging requirements.

Braid Logistics and National Bulk Equipment play vital roles in logistics and equipment supply, ensuring efficient handling and transportation of bulk containers. Signode Industrial Group and Mauser Group B.V focus on providing robust and reliable packaging solutions, critical for safeguarding products during transit and storage.

Mondi Group, Bermis Company Inc., and Hoover Ferguson Group are also significant players, driving innovation and market growth through their diversified product offerings and strategic initiatives.

Market Key Players

- Greif Inc.

- Winpak Ltd

- Bemis Company Inc.

- Berry Global, Inc.

- DS Smith Plc

- TechnipFMC

- Braid Logistics

- National Bulk Equipment

- Signode Industrial Group

- Mauser Group B.V

- Mondi Group

- Bermis Company Inc.

- Hoover Ferguson Group

Recent Development

- In June 2024, Greif, Inc. raises fiscal year earnings guidance amid mixed Q2 results. Operational launch of Dallas sheetfeeder and expansion plans in Asia-Pacific. Emphasis on debt reduction and future growth strategies.

- In May 2024, Yardbarker on MSN provides 20 eco-friendly swaps for everyday living, from reusable cloths instead of paper towels to silicone bags instead of plastic, promoting sustainability and cost-saving measures

Report Scope

Report Features Description Market Value (2023) USD 18.4 Bn Forecast Revenue (2033) USD 34.6 Bn CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Flexitanks, Drums, Pails, Bulk Containers, Pallets), By Material (Plastic, Metals, Fiber, Wood, Others), By End Use (Chemicals, Pharmaceutical, Food and Beverages, Petroleum and Lubricants, Inks, Paints, and Dyes, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Greif Inc., Winpak Ltd, Bemis Company Inc., Berry Global, Inc., DS Smith Plc, TechnipFMC, Braid Logistics, National Bulk Equipment, Signode Industrial Group, Mauser Group B.V, Mondi Group, Bermis Company Inc., Hoover Ferguson Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Greif Inc.

- Winpak Ltd

- Bemis Company Inc.

- Berry Global, Inc.

- DS Smith Plc

- TechnipFMC

- Braid Logistics

- National Bulk Equipment

- Signode Industrial Group

- Mauser Group B.V

- Mondi Group

- Bermis Company Inc.

- Hoover Ferguson Group