Petroleum Coke Market By Product Type (Fuel grade coke, Calcined coke) By End-Use (Calcining, Power plants, Cement kilns, Blast furnace) and By Region - Global Forecast To 2026

-

611

-

March 2023

-

89

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Global Petroleum Coke Market Overview:

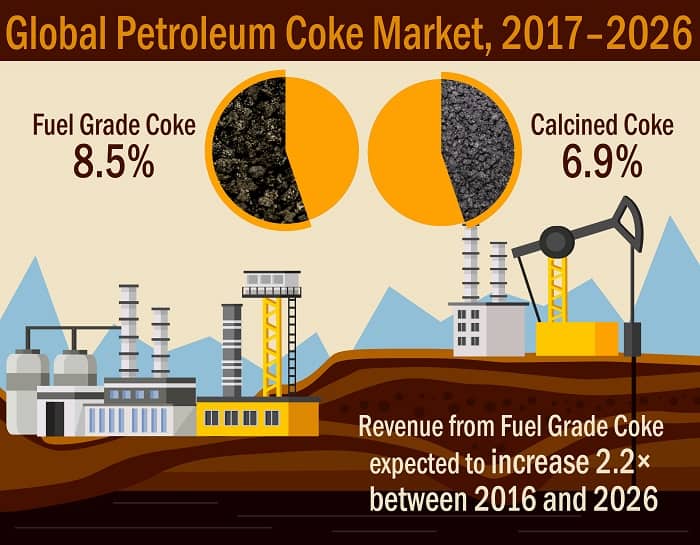

The global petroleum coke market was valued at US$ 17,980.6 million in 2017 and is expected to register a CAGR of over 8%.

Petroleum Coke (Petcoke) is a byproduct of the oil refining process. The chemical and physical properties of petcoke are a function of the crude oil and refining technology used by the refinery. It is a carbon-rich product, that is derived from a final cracking process, which is a thermo-based chemical engineering process that splits long chain hydrocarbons of petroleum into shorter chains.

There are four basic petroleum coke types: needle coke, honeycomb coke, sponge coke, and shot coke. Owing to its physical properties, it is largely used in energy applications and other industrial applications. The fuel-grade petcoke is the largest consumed product type due to its wider energy applications in blast furnaces and power plants.

Global Petroleum Coke Market Dynamics:

The global petroleum coke market is driven by factors such as, growing usage of petcoke as a cost effective fuel in cements and energy industries, growth in production of aluminum and steel, and, advanced technologies aiding the surge in production of crude oil. Growing demand from several end use industries such as cement, railways, automobiles, transportation sector, and power generation industries is drive the global petroleum coke market over the forecast period.

Rising population and increasing urbanization are fueling the growth of the construction, electricity and power generation globally. Increasing demand for clean fuel along with strict government regulations to reduce carbon emissions will drive the global petroleum coke market. Pet coke is fuel for developing countries owing to the high carbon contents, after combustion it release 10% more CO2 per unit of energy that normal coal the energy effectiveness of pet coke is mainly the driving factor the global petroleum coke market. These sectors are anticipated to drive the demand for pet coke.

The pet coke is residue of manufacturing process of transportation fuel. Pet coke is refined by a process known as coking. The process is low cost, as the manufacturing process is low cost the cost of pet coke is also low. The low cost of fuel is driving the petroleum coke market as it is cost effective to the emerging economies.

However, the adverse effect on respiratory process will lead to restraining the growth global petroleum coke market. After combustion of the petroleum coal emits small amount of hazardous gases such as sulfur which can make harm to the operating person this will lead to the restrain the growth of the global market health and environmental effects of the petcoke is likely to act as restraining factor affecting the global petroleum coke market over the forecast period.

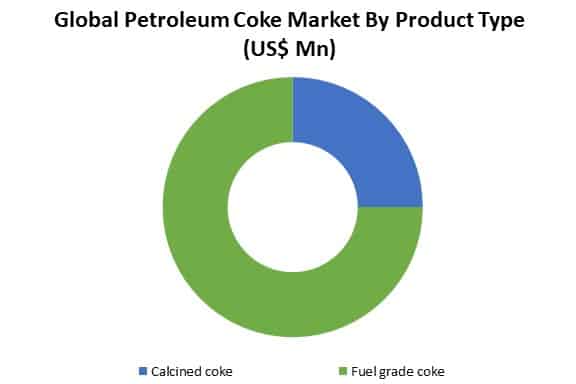

Market Analysis of Global Petroleum Coke by Product Type:

Based on type segmentation, the fuel grade coke segment in the global petroleum coke market holds the major revenue share of over 70.0% in 2017, as it can be used as an alternative to steam coal in various power plants, and its high heat and low ash content makes it an ideal fuel for power generation. Increasing demand from cement kilns, and electric power plants for fuel grade coke is a key driver for growth of the global petroleum coke product segment.

This can be attributed to preference of fuel grade coke by end users, coupled with low cost of fuel grade coke as compared to calcined coke. The fuel grade coke segment accounted for the highest revenue share of the product segment, and is expected to continue its dominance over the forecast period. Year-on-Year growth of the calcined coke segment is expected to increase steadily over the forecast period, owing to advancements in calcined petroleum coke, coupled with steady growth of the aluminum and steel industries.

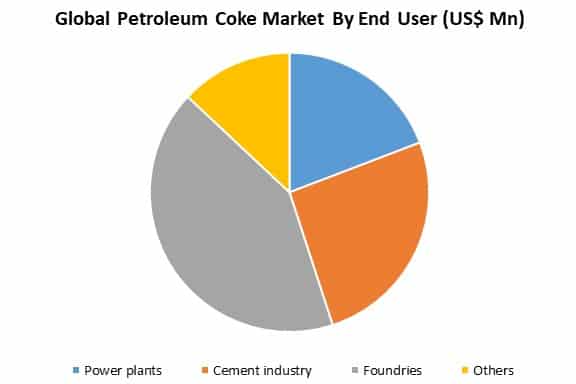

Market Analysis of Global Petroleum Coke by End-user:

On the basis of type segmentation, the foundries segment in the global petroleum coke market holds the major revenue share of over 40.0% in 2017, owing to factors such as rising industrialization developments in developing economies including the Asia Pacific region.

The cement industry segment accounted for a significant market revenue share in 2017, and is projected to decline to 25% in 2026, owing to declining demand for petroleum coke from cement industries due to environmental concerns. The growth of the petroleum coke in the cement industry can be attributed to high demand for petroleum coke from cement industries in the Asia Pacific region, due to increasing infrastructure developments, and cost-effectiveness as compared to other fuels.

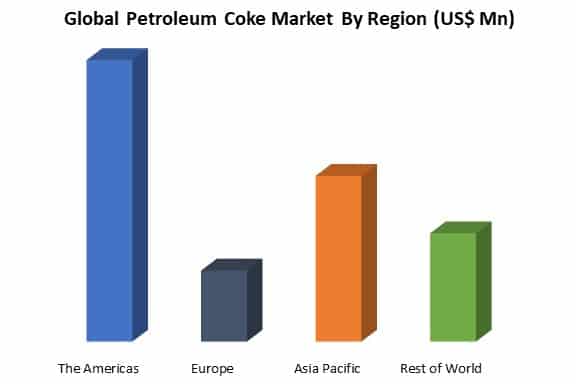

Market Analysis by Global Petroleum Coke by Region:

Geographically, the Americas accounts for the largest share in 2017 and is expected to witness CAGR of over 8% during the forecast period, owing to factors such as growing usage of petcoke as a cost effective tool in cements and energy industries. Increasing exports of petroleum coke from US, due to its lower prices than international petroleum coke prices is key factor expected to drive growth of the petroleum coke market in this region.

However, increasing use of coal and natural gas which are more economical fuel than petroleum coke for use in power generation and mechanical application expected to restrict growth of the petroleum coke market in this region. In addition, increasing use of waste derived fuel in power and cement industries to increase energy efficiency and to avoid environmental concerns expected to restrict growth of the petroleum coke market in this region.

The market in Europe for petroleum coke is expected to witness a steady growth, attributed to increasing use in steel and cement industry and increasing number of power generating station, owing to low ash and high heat content which makes petroleum coke descent solid fuel for generating power and increasing use of Calcined Petroleum Coke (CPC) to manufacture anodes for steel and aluminum industry expected to fuel growth of the petroleum coke market.

Asia Pacific holds the second largest market for petroleum coke in 2017, with countries such as the China, Japan, and India holding the major markets in terms of revenue. This can be attributed to small and private companies in China shifting their preference from coal to petroleum coke due to its lower price is expected to drive growth of the petroleum coke market in this region. In India, consumption of petroleum coke is increasing due to increasing infrastructure development, rising demand for automotive, cement, and steel consumption is key factor expected to drive growth of the petroleum coke market in this region.

Global Petroleum Coke Market Segmentation:

Segmentation by product type:

- Calcined coke

- Fuel Grade coke

Segmentation by end-user:

- Power plants

- Cement Industry

- Foundries

- Others

Segmentation by region:

- The Americas

- Europe

- Asia Pacific

- Rest of the World

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Chevron Corporation

- BP Plc

- Essar Oil Limited

- Royal Dutch Shell Plc

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- Reliance Industries Limited

- Saudi Arabian Oil Co.

- HPCL Mittal Energy Limited

- Valero Energy Corporation