Global Botanicals Market By Form (Fresh, Extracts), By Source (Roots, Fruits, Flowers, Leaves, Herbs, Spices, Others), By Application( Pharmaceuticals, Food and Beverage (Alcoholic Beverages, Sauces and Dressings, Bakery and Confectionery, Non-alcoholic Beverages, Others), Dietary Supplements (Tablets, Capsules, Soft Gels, Powders, Gummies, Liquids, Others). Personal Care and Cosmetics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51522

-

March 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

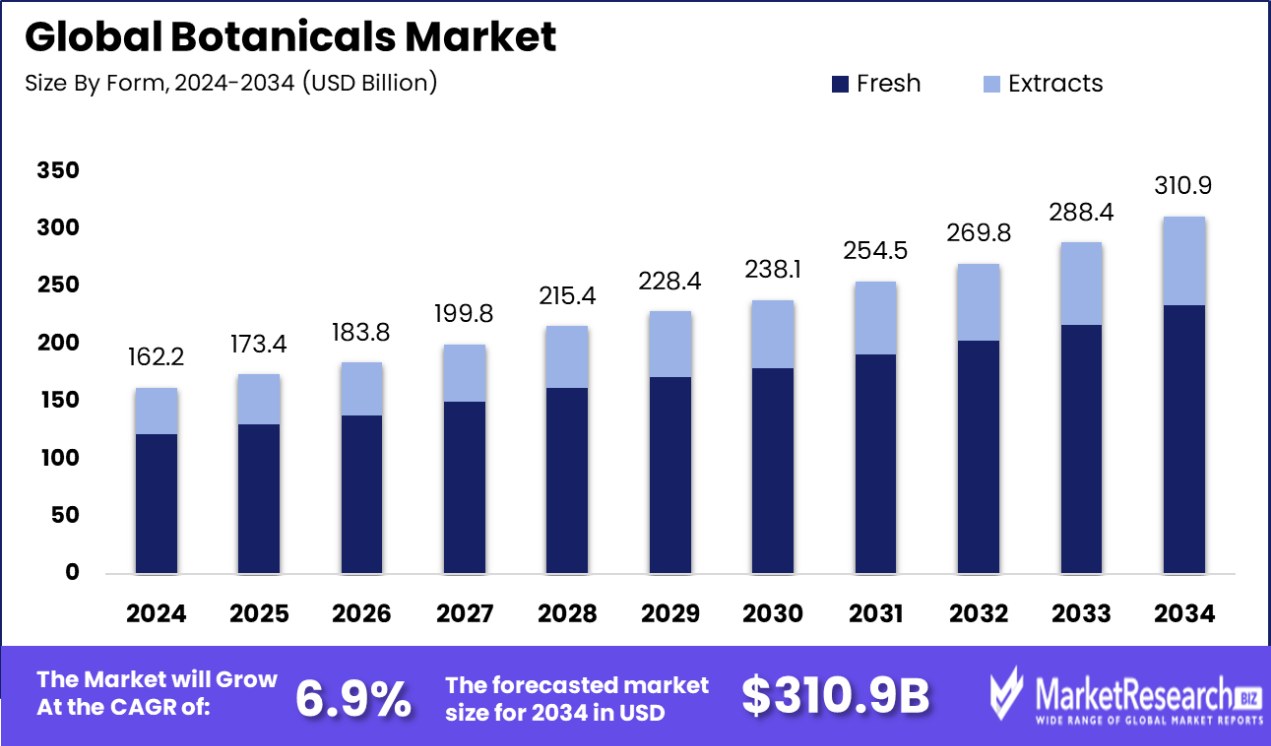

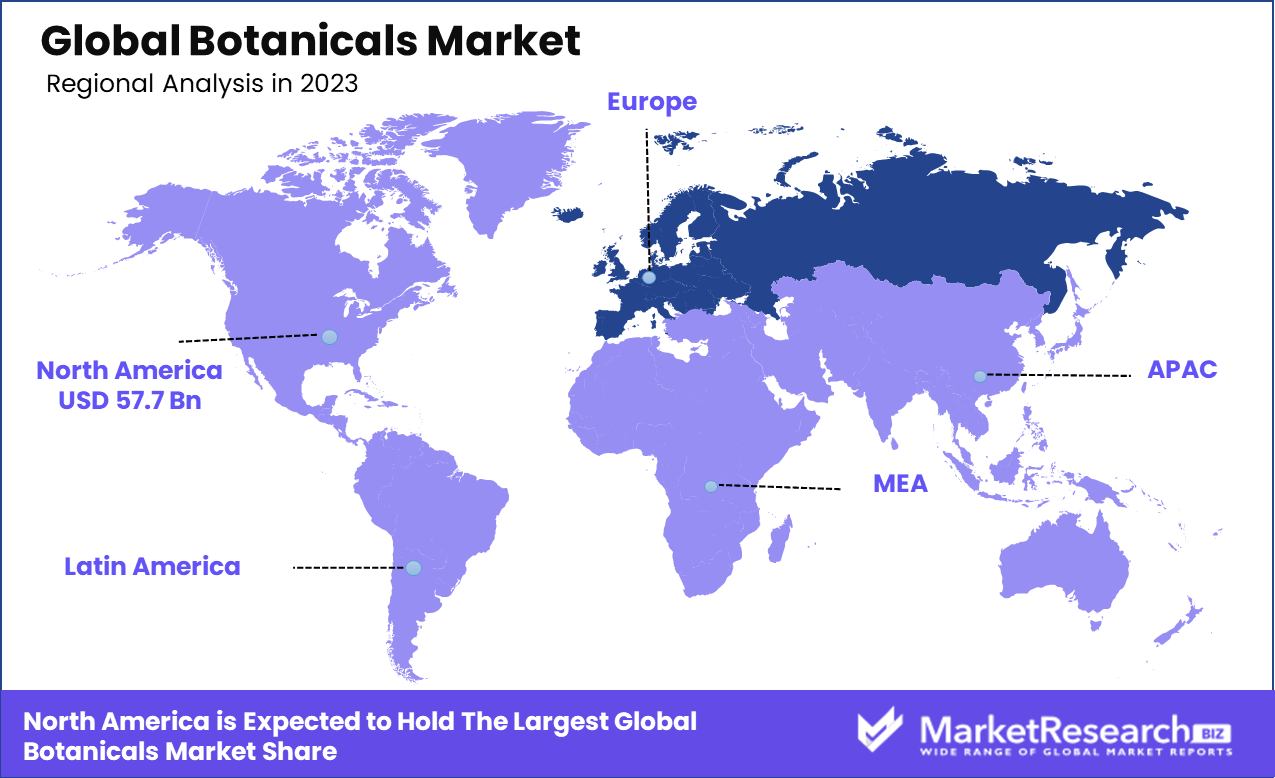

Global Botanicals Market was valued at USD 162.2 billion in 2024. It is expected to reach USD 310.9 billion by 2034, with a CAGR of 6.9% during the forecast period from 2025 to 2034. With a 35.6% market share, Europe's botanicals market was valued at USD 57.7 billion in 2024, leading globally.

Botanicals refer to plant-derived substances used for their medicinal, therapeutic, or flavoring properties in food, beverages, cosmetics, and pharmaceuticals. These natural ingredients, sourced from herbs, roots, flowers, and leaves, have been traditionally used in wellness applications, with growing consumer interest in their health benefits.

From chamomile and turmeric to ginseng and echinacea, botanicals are widely incorporated into functional foods, dietary supplements, and skincare formulations. Their increasing adoption is fueled by the rising preference for organic, plant-based, and chemical-free products across industries.

The botanicals market is expanding as consumers prioritize natural and holistic health solutions. With the surge in demand for herbal remedies, plant-based cosmetics, and botanical-infused beverages, manufacturers are innovating with clean-label, sustainable, and organic formulations.

The market spans segments like dietary supplements, personal care, pharmaceuticals, and food & beverages, each witnessing strong growth. The expansion of herbal medicine, backed by scientific research on botanical efficacy, further supports market expansion.

One major growth factor is the increasing awareness of health and wellness. Consumers are actively seeking plant-based alternatives to synthetic ingredients, driving demand for botanical supplements and functional foods. The shift toward preventive healthcare and immune-boosting solutions further propels botanical ingredient adoption.

Rising demand is evident in natural skincare and cosmetics. The clean beauty movement, emphasizing non-toxic and sustainable formulations, has fueled the incorporation of botanicals like aloe vera, green tea, and rose extracts. This trend aligns with consumer preference for eco-friendly and cruelty-free personal care products.

Opportunities lie in expanding scientific research and innovation. Advancements in botanical extraction, bioavailability, and formulation techniques are unlocking new applications. The integration of botanicals in pharmaceuticals, nutraceuticals, and functional beverages presents lucrative growth avenues for market players.

Key Takeaways

- Global Botanicals Market was valued at USD 162.2 billion in 2024. It is expected to reach USD 310.9 billion by 2034, with a CAGR of 6.9% during the forecast period from 2025 to 2034.

- Fresh botanicals dominate with a 75.2% share, driven by consumer preference for raw, unprocessed, and nutrient-rich ingredients.

- Roots contribute 27.4% to the botanicals market, widely used for medicinal formulations, herbal supplements, and functional beverages.

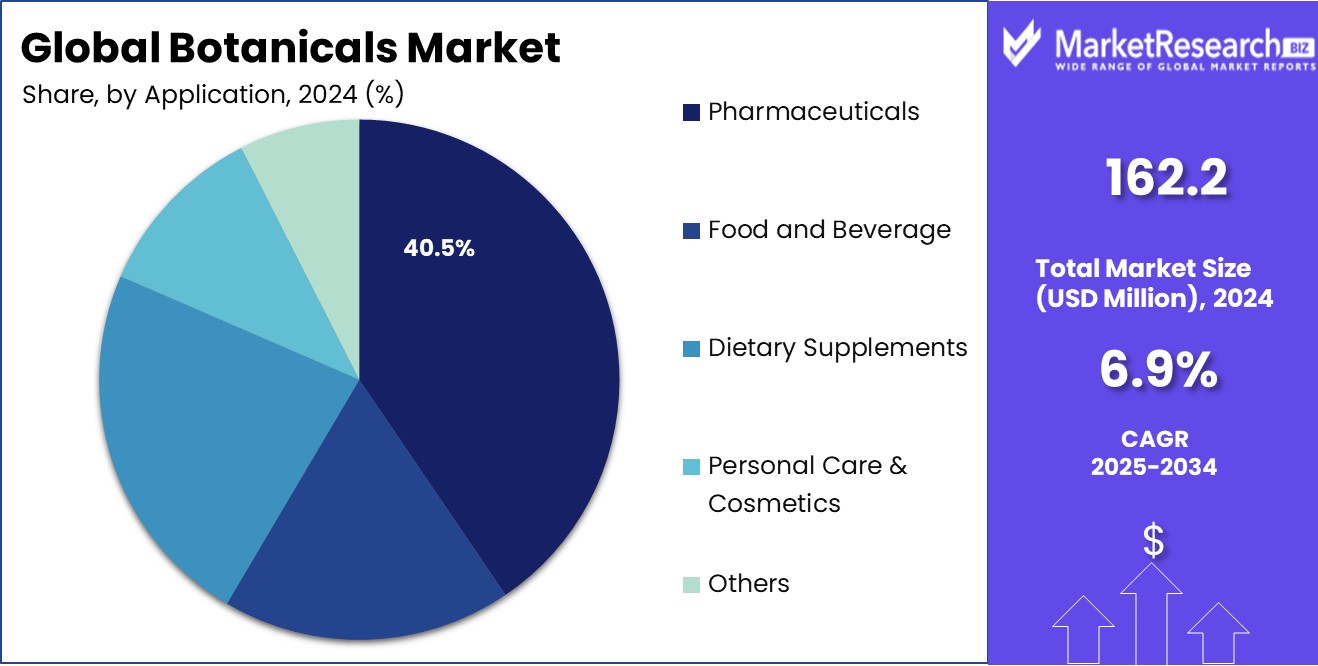

- Pharmaceuticals account for 40.5% of the botanicals market, leveraging plant-based compounds for therapeutic, preventive, and wellness applications.

- The botanicals market in Europe accounted for 35.6%, generating a USD 57.7 billion revenue, driven by herbal product demand.

By Form Analysis

The botanicals market's fresh form dominates, holding a substantial 75.2% market share globally.

In 2024, Fresh held a dominant market position in the By Form segment of the Botanicals Market, with a 75.2% share. The high demand for fresh botanicals is driven by their superior bioactive content, minimal processing requirements, and consumer preference for natural ingredients. Fresh botanicals are widely utilized in herbal supplements, pharmaceuticals, and functional foods due to their perceived health benefits and potency. The growing trend of clean-label products and the shift toward plant-based diets further support the segment’s expansion.

Meanwhile, the dried form accounts for the remaining market share, with applications in teas, nutraceuticals, and extracts. The longer shelf life and ease of transportation make dried botanicals a preferred choice for manufacturers in industries with global supply chains. However, the dominance of fresh botanicals highlights the increasing emphasis on organic and minimally processed ingredients.

Regionally, North America and Europe exhibit a strong demand for fresh botanicals due to stringent regulations favoring natural products and increasing consumer awareness. The Asia-Pacific region also contributes significantly, with rising usage in traditional medicine and functional foods. As consumer preference for natural and unprocessed botanical ingredients strengthens, the Fresh segment is expected to maintain its leading position in the coming years.

By Source Analysis

Roots contribute 27.4% to the botanicals market, showcasing their importance in herbal formulations.

In 2024, Roots held a dominant market position in the By Source segment of the Botanicals Market, with a 27.4% share. The strong demand for root-based botanicals is driven by their extensive use in herbal medicine, dietary supplements, and functional beverages. Roots such as ginger, turmeric, and ginseng are widely recognized for their anti-inflammatory, adaptogenic, and immune-boosting properties, making them essential ingredients in natural health products.

The dominance of the Roots segment is also attributed to its application in pharmaceuticals, where extracts from botanicals like ashwagandha and licorice are integrated into formulations targeting stress relief and digestive health. The food and beverage industry has also embraced root-derived botanicals, particularly in herbal teas and fortified drinks, due to their growing acceptance in preventive healthcare trends.

Regionally, North America and Europe exhibit strong consumption of root-based botanicals, driven by the rising popularity of organic supplements and herbal therapeutics. Meanwhile, Asia-Pacific remains a significant market, supported by the deep-rooted presence of Ayurveda and Traditional Chinese Medicine (TCM).

By Application Analysis

Pharmaceutical applications drive 40.5% of the botanicals market, highlighting growing medicinal demand worldwide.

In 2024, Pharmaceuticals held a dominant market position in the By Application segment of the Botanicals Market, with a 40.5% share. The increasing reliance on plant-based medicines and herbal formulations has driven demand for botanical ingredients in pharmaceutical applications.

Traditional medicinal systems, including Ayurveda, Traditional Chinese Medicine (TCM), and herbal therapeutics, have contributed significantly to this growth. Botanicals such as ginseng, echinacea, and turmeric are widely used in pharmaceutical formulations for their anti-inflammatory, antioxidant, and immune-supporting properties.

Regulatory approvals and scientific advancements in botanical drug formulations have further strengthened the segment’s market presence. Pharmaceutical companies are increasingly incorporating botanical extracts in prescription drugs and over-the-counter (OTC) medications due to rising consumer preference for natural alternatives. Additionally, botanical-based pharmaceuticals play a crucial role in treating lifestyle-related disorders such as stress, digestive issues, and cardiovascular diseases.

North America and Europe remain key markets for pharmaceutical applications of botanicals, driven by stringent regulatory frameworks and growing acceptance of plant-derived medicines. Meanwhile, the Asia-Pacific region continues to be a major supplier and consumer, benefiting from strong cultural integration of herbal medicine. The Pharmaceuticals segment is expected to sustain its leadership as demand for natural therapeutics continues to rise globally.

Key Market Segments

By Form

- Fresh

- Extracts

By Source

- Roots

- Fruits

- Flowers

- Leaves

- Herbs

- Spices

- Others

By Application

- Pharmaceuticals

- Food and Beverage

- Alcoholic Beverages

- Sauces and Dressings

- Bakery and Confectionery

- Non-alcoholic Beverages

- Others

- Dietary Supplements

- Tablets

- Capsules

- Soft Gels

- Powders

- Gummies

- Liquids

- Others

- Personal Care & Cosmetics

- Others

Driving Factors

Rising Demand for Natural and Herbal Products

The increasing preference for natural and herbal products is a major driver of the botanicals market. Consumers are shifting away from synthetic ingredients and chemical-based products, favoring plant-based alternatives due to health and wellness concerns.

Botanical ingredients are widely used in pharmaceuticals, food, beverages, and cosmetics because they offer functional benefits with minimal side effects. Growing awareness of traditional medicine systems such as Ayurveda, Traditional Chinese Medicine (TCM), and naturopathy further boosts market demand.

Additionally, the clean-label trend is pushing brands to incorporate botanical extracts into their products. Rising disposable incomes and urbanization also play a role, as people are willing to spend more on high-quality, plant-based supplements and personal care products. This trend is expected to sustain strong market growth.

Restraining Factors

Quality and Standardization Issues in Botanicals

One major challenge in the botanicals market is maintaining consistent quality and standardization. Botanical ingredients vary in composition due to differences in growing conditions, harvesting methods, and processing techniques.

This variability makes it difficult for manufacturers to ensure uniform potency and effectiveness in final products. Regulatory agencies impose strict quality standards, but compliance remains a hurdle for many small and medium-sized suppliers.

Adulteration and contamination risks further raise concerns about product safety, leading to recalls and loss of consumer trust. Additionally, the lack of globally harmonized regulations complicates international trade, making market expansion challenging.

Addressing these issues requires better quality control, transparent sourcing practices, and advancements in testing technologies to ensure consistency and reliability in botanical products.

Growth Opportunity

Expansion of Botanical-Based Functional Foods Market

The growing demand for functional foods presents a significant opportunity for the botanicals market. Consumers are increasingly looking for food and beverages that offer health benefits beyond basic nutrition.

Botanical ingredients such as turmeric, ginger, ashwagandha, and ginseng are being widely incorporated into energy drinks, herbal teas, and fortified snacks. The rise of plant-based diets and clean-label trends is further driving innovation in this segment.

Food manufacturers are investing in botanical formulations to meet the demand for natural immune boosters, stress relievers, and digestive health enhancers. Additionally, the growing popularity of personalized nutrition is encouraging companies to develop botanical-infused products targeting specific health needs.

Latest Trends

Rising Popularity of Adaptogenic Botanical Ingredients

A key trend in the botanicals market is the increasing use of adaptogenic ingredients. Adaptogens are plant-based compounds that help the body manage stress and restore balance.

Botanicals like ashwagandha, rhodiola, ginseng, and holy basil are gaining traction in supplements, beverages, and functional foods. Consumers are becoming more aware of mental health and wellness, leading to a surge in demand for stress-relief and energy-boosting botanical products.

The shift toward holistic health solutions is also driving innovation in adaptogen-infused teas, smoothies, and nootropic formulations. Additionally, social media and digital health influencers are promoting adaptogens as natural alternatives to synthetic stress relievers. This trend is expected to drive growth in the botanicals industry, especially in premium health and wellness markets.

Regional Analysis

In 2024, Europe dominated the botanicals market with a 35.6% share, reaching a market value of USD 57.7 billion.

In 2024, Europe dominated the global botanicals market, holding a 35.6% share, valued at USD 57.7 billion. The strong market position is driven by high consumer demand for plant-based products, stringent regulatory support for natural ingredients, and a well-established herbal medicine industry. Countries like Germany, France, and the United Kingdom are leading contributors, with a significant presence of botanical-based pharmaceuticals and functional foods.

North America follows as a key market, driven by increasing consumer awareness of herbal supplements and the rising demand for botanical-infused functional beverages. The region benefits from a strong retail network and investment in plant-based wellness products.

Asia Pacific is experiencing rapid growth, supported by a rich tradition of herbal medicine, particularly in China, India, and Japan. The expansion of Ayurveda and Traditional Chinese Medicine (TCM) in global markets is further fueling demand. The rising middle-class population and increasing disposable incomes are also driving market expansion.

The Middle East & Africa and Latin America are emerging markets with growing interest in botanical-based cosmetics, nutraceuticals, and pharmaceuticals. Latin America benefits from diverse plant biodiversity, particularly in Brazil, while the Middle East is witnessing rising demand for herbal medicine and wellness solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players in the global botanicals market leveraged innovation, acquisitions, and product diversification to strengthen their positions. The Archer-Daniels-Midland Company (ADM) expanded its portfolio with botanical extracts targeting functional foods and beverages, capitalizing on the rising demand for clean-label and plant-based products. Its strong supply chain and sustainability initiatives further reinforced its market leadership.

International Flavors & Fragrances, Inc. (IFF) focused on botanical-infused flavor solutions, enhancing its footprint in the nutraceutical and functional beverage sectors. The company’s advanced extraction technologies ensure superior ingredient quality, catering to premium wellness trends.

Koninklijke DSM N.V. played a crucial role in botanical-based dietary supplements, emphasizing research-driven solutions for immunity and gut health. DSM’s commitment to science-backed botanical formulations positioned it as a preferred supplier in the pharmaceutical and nutrition industries.

Givaudan capitalized on the natural fragrance and flavor trend, integrating botanicals into cosmetic and personal care applications. The company’s investments in sustainable sourcing and AI-driven formulation techniques helped expand its clean-label botanical offerings.

Carbery Group strengthened its botanicals segment with plant-derived bioactives for sports nutrition and functional foods, catering to consumer demand for plant-based proteins and wellness products.

Sidomuncul, a leading herbal player in Asia, expanded its influence in global markets by promoting traditional botanical medicines. The company’s expertise in herbal supplements, particularly in Traditional Indonesian Medicine, positioned it as a strong regional contender.

Top Key Players in the Market

- The Archer-Daniels-Midland Company

- International Flavors& Fragrances, Inc.

- Koninklijke DSM N.V.

- Givaudan

- Carbery Group

- Sidomuncul

- Martin Bauer GmbH & Co. KG

- Bell Flavors & Fragrances

- Lipoid-Kosmetik

- Prakruti Products

- Eu Yan Sang

- Herbanext Laboratories, Inc.

- Ransom Naturals Ltd

- Blue Sky Botanics

- Indesso

- Other Manufacturers

Recent Developments

- In July 2024, Givaudan completed the acquisition of the remaining 75% of b.kolormakeup & skincare's share.

- In June 2024, Lipoid Kosmetik introduced a new product line called Herbasol Pro, bridging the gap between plant-derived actives and botanical extracts.

Report Scope

Report Features Description Market Value (2024) USD 162.2 Billion Forecast Revenue (2034) USD 310.9 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Fresh, Extracts), By Source (Roots, Fruits, Flowers, Leaves, Herbs, Spices, Others), By Application( Pharmaceuticals, Food and Beverage (Alcoholic Beverages, Sauces and Dressings, Bakery and Confectionery, Non-alcoholic Beverages, Others), Dietary Supplements (Tablets, Capsules, Soft Gels, Powders, Gummies, Liquids, Others). Personal Care & Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Archer-Daniels-Midland Company, International Flavors& Fragrances, Inc., Koninklijke DSM N.V., Givaudan, Carbery Group, Sidomuncul, Martin Bauer GmbH & Co. KG, Bell Flavors & Fragrances, Lipoid-Kosmetik, Prakruti Products, Eu Yan Sang, Herbanext Laboratories, Inc., Ransom Naturals Ltd, Blue Sky Botanics, Indesso, Other Manufacturers Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- The Archer-Daniels-Midland Company

- International Flavors& Fragrances, Inc.

- Koninklijke DSM N.V.

- Givaudan

- Carbery Group

- Sidomuncul

- Martin Bauer GmbH & Co. KG

- Bell Flavors & Fragrances

- Lipoid-Kosmetik

- Prakruti Products

- Eu Yan Sang

- Herbanext Laboratories, Inc.

- Ransom Naturals Ltd

- Blue Sky Botanics

- Indesso

- Other Manufacturers