Bakers Yeast Market By Application(Bread, Cakes, Pastries, Biscuits, Others), By Form(Liquid/Cream, Solid, Dry or Powdered, Other Form), By Product(Active Dry Yeast, Inactive Dry Yeast), By End Users(Bakery, Food, Feed, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

38055

-

March 2024

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

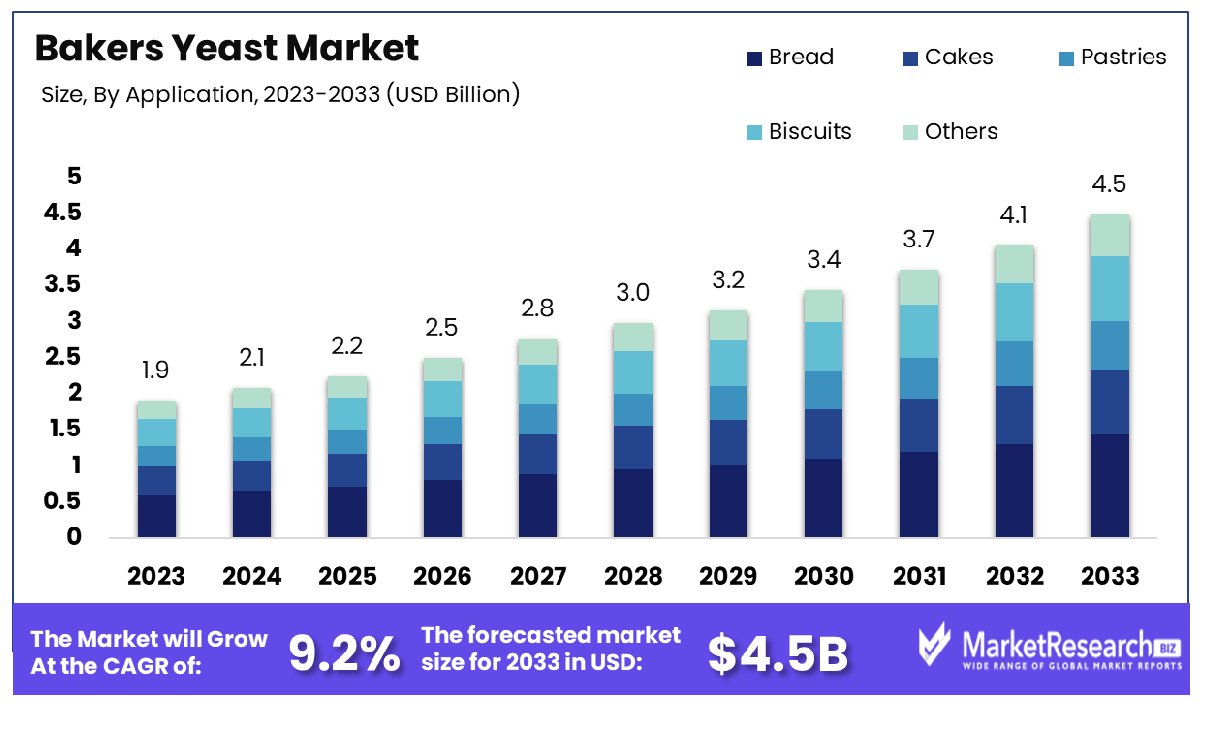

The global Bakers Yeast Market was valued at USD 1.9 billion in 2023. It is expected to reach USD 4.5 billion by 2033, with a CAGR of 9.2% during the forecast period from 2024 to 2033. The surge in demand for confectionary foods, the rise in online distribution channels, and health awareness are some of the main key driving factors for the baker’s yeast market.

The baker’s yeast is scientifically called Saccharomyces cerevisiae which is a single-celled fungus used in baking and brewing processes. These are broadly employed in the culinary which acts as a leavening agent by changing sugars into carbon dioxide and ethanol through fermentation. This generates gas bubbles that cause the dough to rise in lightning and airy baked products goods such as bread, dough, cake, and pastries.

These yeast are quite rich in terms of proteins, minerals, and vitamin B contributing to the nutritional value of the final products. Several types of stains of Saccharomyces cerevisiae are also used in the manufacture of alcoholic beverages like beer and wine. With its main role in fermentation, baker’s yeast has become a vital component in the food sector by influencing the texture and flavors of different types of baked products goods, and fermented beverages consumed globally. Additionally, baker’s yeast has several health benefits as well as it is used in the research and development process.

November 2023, highlights that science researchers have developed baker’s yeast with more than 50% synthetic DNA. Moreover, an international team comprising UK researchers has integrated more than 7 synthetic chromosomes that have packages of DNA into single cells which are found to survive and imitate normal yeast cells. Moreover, an article published by Angel yeast in September 2022, highlights that Angel yeast has introduced a premium dry yeast segment that serves the whole value chain for the bakery and confectionary market.

Baker’s yeasts have gained much attention beyond its old baking and brewing applications. The role of baker’s yeast widens to sustainable practices where yeast is used for biofuel production by contributing to eco-friendly energy solutions. Moreover, the ongoing research explores yeasts' potential in medical and pharmaceutical, and as a protein source in substitute foods. This versatile microorganism with its multiple applications holds promise for identifying contemporary risks in renewable energy, sustainable nutrition, and medicines. The demand for baker’s yeast will increase due to its requirement in the medical and food sectors which will help in the market expansion in the coming years.

Key Takeaways

- Market Growth: Bakers Yeast Market was valued at USD 1.9 billion in 2023. It is expected to reach USD 4.5 billion by 2033, with a CAGR of 9.2% during the forecast period from 2024 to 2033.

- By Application: In bread applications, dominance is evident, with bread being the prevalent choice.

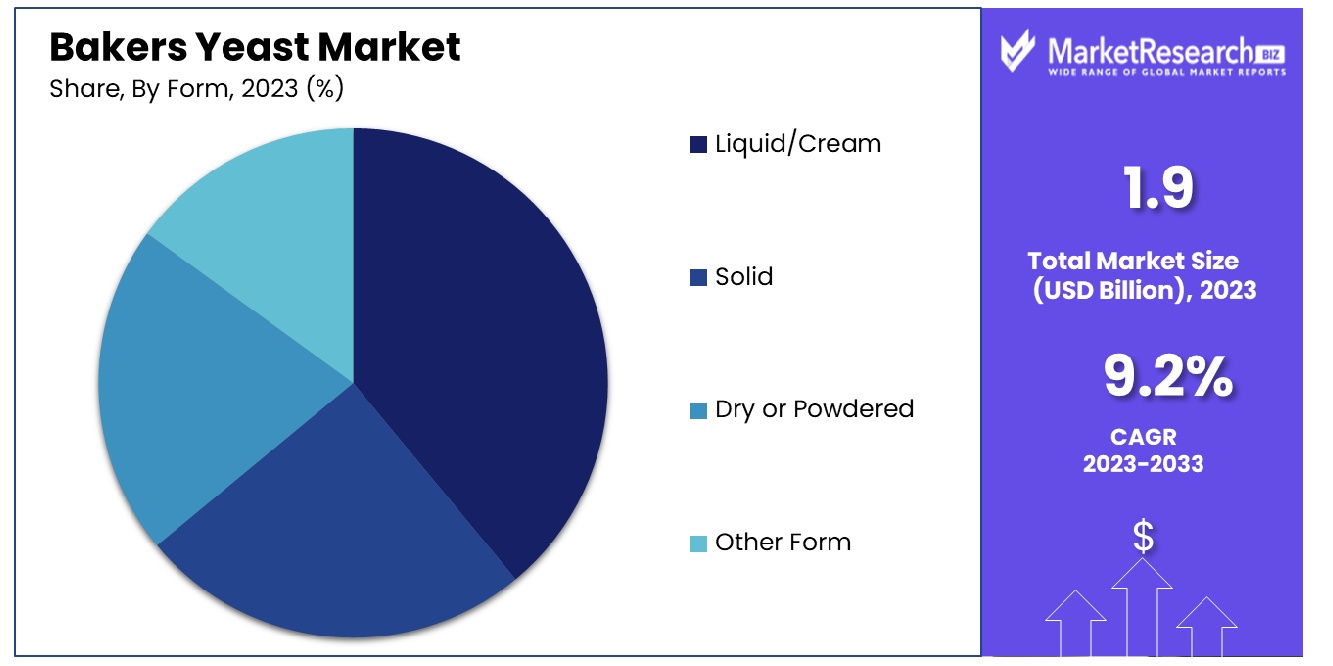

- By Form: Liquid/cream forms prevail, asserting dominance in product formulation across various applications.

- By Product: Active dry yeast dominates the product segment, indicating its widespread usage and preference.

- By End Users: Bakery end-users hold sway, emerging as the dominant sector for yeast food product consumption.

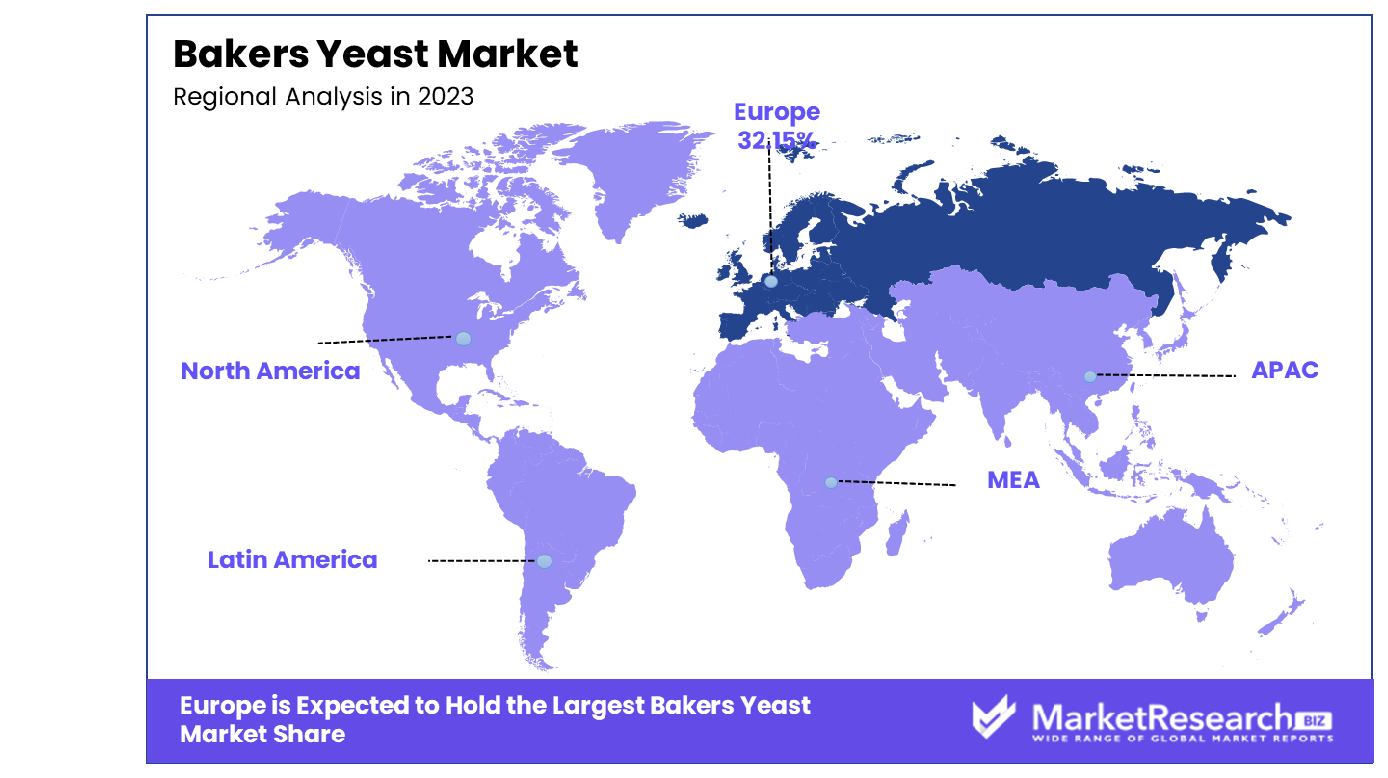

- Regional Dominance: In Europe, the baker's yeast market has seen a significant growth of 32.15%.

- Growth Opportunity: The 2023 bakers yeast market saw significant growth driven by increasing demand for bakery products worldwide, fueled by consumer preferences, innovation, and stringent quality control measures.

Driving factors

Innovative Yeast Strains Drive the Bakers Yeast Market

The continuous development and introduction of innovative yeast strains play a pivotal role in propelling the growth of the baker yeast Market. These strains are meticulously engineered to offer enhanced fermentation capabilities, improved flavor profiles, and heightened resistance to environmental stresses.

By addressing specific challenges encountered in baking processes, such as dough consistency and rising time, innovative yeast strains cater to the evolving needs of bakers and food industry manufacturers. Statistics reveal that the adoption of novel yeast strains has led to a notable increase in product quality and efficiency within the baking industry, driving market expansion.

Versatility Fuels Bakers Yeast Market Growth

The versatility of bakers yeast serves as a significant catalyst for market growth. This single-celled organism is utilized across a diverse array of baking applications, ranging from traditional bread making to the production of pastries, cake segments, and even alcoholic beverages. Its ability to ferment various sugars and produce carbon dioxide and ethanol makes it indispensable in creating light and fluffy baked goods with desirable texture and flavor.

Bakers yeast's versatility extends far beyond conventional baking; it has applications in bioethanol production as well as pharmaceutical production. This multifaceted utility enhances the market's resilience and fosters sustained growth, as demand remains buoyant across multiple sectors.

Impact of Innovations on Bakers Yeast Market

The collective impact of innovations, including advanced yeast strains and technological advancements in fermentation processes, profoundly influences the dynamics of the baker yeast Market. These innovations drive efficiency gains, reduce production costs, and expand the scope of applications for bakers yeast.

Additionally, advancements in biotechnology enable the customization of yeast strains to meet specific requirements, further amplifying market potential. As a result, the market experiences a positive feedback loop, where ongoing innovations fuel demand, prompting further research and development initiatives. This cycle of continuous improvement sustains market momentum and fosters a climate of innovation, positioning the bakers yeast market for robust growth in the foreseeable future.

Restraining Factors

Price and Rivalry Restrain Bakers Yeast Market

The dynamic interplay between pricing strategies and market competition significantly shapes the trajectory of the Bakers Yeast Market. Pricing pressures stemming from intense rivalry among market players often lead to competitive pricing strategies aimed at capturing market share. While this fosters affordability for consumers, it constrains revenue growth for individual suppliers.

Market analysts reveal that this rivalry-driven pricing phenomenon has resulted in a moderate decline in average selling prices of bakers yeast products over the past few years, affecting profit margins within the industry. Despite this restraint, the cumulative effect of competitive pricing has fueled market penetration, expanding the consumer base and driving overall market growth.

Health Concerns Impact the Bakery Yeast Market

Heightened consumer awareness of health and wellness concerns has cast a significant influence on the Bakery Yeast Market. As individuals increasingly prioritize healthier dietary choices, there has been a perceptible shift towards organic and natural products. This shift is driven by mounting concerns over the adverse health effects associated with synthetic additives and preservatives commonly found in the processed food segment, including certain types of yeast industry used in baking. Consequently, market demand has witnessed a notable uptick in favor of clean-label, natural yeast alternatives.

Market research data corroborates this trend, indicating a steady increase in consumer preference for organic and non-GMO bakery yeast products. This evolving consumer preference aligns with broader key market trends toward clean eating and sustainable lifestyles. Despite the initial challenges posed by this shift, savvy market major players have seized the opportunity to innovate and diversify their product offerings, thereby capitalizing on the burgeoning demand for health-conscious bakery yeast products. As a result, the market has experienced sustained growth, propelled by the convergence of health-conscious consumer preferences and industry innovation initiatives.

By Application Analysis

Bread dominated the market by application due to its widespread consumption and versatile usage.

Bread held the top spot in 2023 in terms of Bakers Yeast Market by Application segment. Being consumed across various demographics worldwide, its widespread consumption has had an immense influence in driving its market growth rate and stability. Bread's popularity as both a dietary staple and versatile application option further propelled its demand within bakers yeast market; an effect further amplified by its growing use in modern lifestyles as a convenient nutritional alternative.

Cakes also emerged as a prominent application within the segment, driven by the rising demand for confectionery products and the celebration culture prevalent in many societies. The versatility of bakers yeast in cake production, facilitating the leavening process and imparting desirable texture and flavor characteristics, has further fueled its utilization in this segment.

Pastries constitute another significant application area within the bakers yeast market. The indulgence in pastries as a snack or dessert option has gained traction, particularly among urban populations seeking convenient and indulgent food options. The incorporation of bakers yeast in pastry formulations enhances the dough fermentation process, resulting in a light and airy texture, thus contributing to the overall sensory appeal of pastries.

Moreover, Biscuits have witnessed notable traction in the bakers yeast market's application landscape. The demand for biscuits as on-the-go snacks or accompaniments to beverages has surged, driven by changing consumer preferences and lifestyle patterns. Bakers yeast plays a crucial role in achieving the desired texture and volume in biscuit formulations, thereby influencing consumer acceptance and brand loyalty.

By Form Analysis

Liquid/Cream was the predominant form favored, likely for its convenience and ease of incorporation.

Liquid/Cream held the top market position for Bakers Yeast Market By Form in 2023. Liquid/Cream yeast's advantages in improving dough properties and fermentation processes helped propel it to this position, with its versatile use across different baking applications combined with ease of incorporation into recipes leading to its widespread adoption across bakery industries.

Solid form trailed closely behind Liquid/Cream, demonstrating considerable market presence due to its stability and convenience in storage and transportation. The Solid form of bakers yeast found favor among manufacturers seeking efficient handling and prolonged shelf life of yeast products. Additionally, its suitability for specific baking processes and applications further bolstered its market position.

Dry or Powdered yeast emerged as another prominent segment within the By Form category, witnessing steady growth driven by its long shelf life, easy handling, and suitability for automated production systems. The Dry or Powdered form of bakers yeast appealed to manufacturers seeking cost-effective solutions and extended product shelf stability, particularly in the context of global supply chain dynamics.

By Product Analysis

Active Dry Yeast emerged as the leading product, likely due to its stability and long shelf life.

Active Dry Yeast held a strong market position in 2023 in the Bakers Yeast Market By Product segment. Alongside Inactive Dry Yeast, active dry yeast made up an overwhelming share of the overall market share within this segment. This could be attributed to several factors including its wide adoption for both home baking and commercial baking applications; longer shelf life compared with fresh yeast; and its ease of handling and storage.

Active Dry Yeast, characterized by its granulated form and dormant state, activates upon rehydration, providing consistent and reliable fermentation in baking processes. Its popularity stems from its ease of use, versatility across various baked goods, and extended shelf life, making it a preferred choice among bakers and food manufacturers worldwide.

Inactive Dry Yeast, while holding a smaller market share compared to its active counterpart, still plays a significant role in certain niche applications within the baking industry. Often utilized for its nutritional benefits, such as being a rich source of protein, vitamins, and minerals, inactive dry yeast is commonly incorporated into health-focused and specialty baked goods.

Looking ahead, the By Product segment of the Bakers Yeast Market is poised for steady growth, driven by increasing consumer demand for bakery products, advancements in baking technologies, and the rising trend of home baking. Moreover, with a growing emphasis on natural and clean-label ingredients, both active and inactive dry yeast are expected to maintain their prominence in the market, catering to the evolving preferences of consumers seeking high-quality baked goods.

By End Users Analysis

Bakery stood out among end users, likely due to the integral role of yeast in baking processes.

Bakery held the dominant market position in 2023 for Bakers Yeast Market By End Users segment. This success can be attributed to several factors, such as the widespread consumption of bakery products globally as well as the increasing demand for high-quality yeast to meet consumer preferences for fresh, flavorful baked goods.

Bakeries remain at the heart of Bakers Yeast Market with their dynamic innovation and technological advances in baking processes, driving the adoption of specific yeast strains tailored to specific bakery applications. Furthermore, the rising consumer inclination towards healthier and artisanal bakery products has propelled the demand for premium yeast variants, further consolidating the Bakery segment's market position.

Moreover, the Bakery segment's dominance is bolstered by the expanding bakery industry, fueled by changing consumer lifestyles, urbanization, and increasing disposable incomes. As consumers seek convenience and indulgence in bakery products, manufacturers are leveraging advanced yeast formulations to meet evolving taste preferences and dietary requirements, thus augmenting the Bakery segment's market share.

Looking ahead, the Bakery segment is poised to maintain its leading position in the Bakers Yeast Market, supported by sustained investments in research and development, product diversification, and expanding distribution networks. Additionally, collaborations between yeast manufacturers and bakery industry players are anticipated to drive innovation and product differentiation, further strengthening the Bakery segment's foothold in the market.

Key Market Segments

By Application

- Bread

- Cakes

- Pastries

- Biscuits

- Others

By Form

- Liquid/Cream

- Solid

- Dry or Powdered

- Other Form

By Product

- Active Dry Yeast

- Inactive Dry Yeast

By End Users

- Bakery

- Food

- Feed

- Other

Growth Opportunity

Increasing Demand Drives the Expansion of the Bakers Yeast Market

The global bakers yeast market witnessed significant growth opportunities in 2023, primarily fueled by the increasing demand for bakery products worldwide. Factors such as changing consumer preferences, rising disposable incomes and urbanization have contributed to the expansion of this market. With consumers seeking convenient and ready-to-eat options, the demand for bakery products, including bread, pastries, and demand for cakes, has surged, consequently driving the need for bakers yeast.

Innovation in the Bakery Is Driven by Unique Yeast

Innovation remains a key driver in the bakery industry, with bakers continually exploring novel ingredients and techniques to differentiate their products. In 2023, the focus on unique yeast strains emerged as a notable current trend shaping the market landscape. Specialty yeast variants offer distinct flavors, textures, and nutritional profiles, providing bakeries with the opportunity to cater to diverse consumer preferences and dietary requirements. This emphasis on innovation not only enhances product offerings but also contributes to the overall growth and competitiveness of the bakers yeast market.

Controlled Quality Ensures Authentic Baker's Yeast

The assurance of controlled quality standards is paramount in the bakers yeast market to ensure the authenticity and effectiveness of the product. In 2023, stringent quality control measures remained a priority for manufacturers and suppliers alike. Adherence to strict quality protocols throughout the production process guarantees the consistency, purity, and functionality of bakers yeast. This commitment to quality not only instills confidence among bakery producers but also reinforces consumer trust, driving sustained demand for authentic and reliable bakers yeast products.

Latest Trends

Developing Future Global Bakers Yeast Trends

The global bakers yeast market continues to evolve, driven by several key trends that are shaping its trajectory in 2023 and beyond. One prominent trend is the increasing demand for natural and clean-label ingredients, fueled by growing consumer awareness of health and wellness. As consumers seek healthier alternatives, bakers are turning towards natural yeast options, such as sourdough and wild yeast, to meet this demand. This shift towards natural products aligns with the broader clean-label movement, driving the adoption of bakers yeast derived from natural sources.

Furthermore, technological advancements in yeast production are also influencing the market landscape. Innovations in biotechnology have led to the development of genetically modified yeast strains with enhanced functionality and performance characteristics. These customized formulations offer bakers greater flexibility and control over their production processes, leading to improved product quality and consistency.

Customized Formulations Influence Bakers Yeast

Customized formulations are increasingly influencing the bakers yeast market, providing tailored solutions to meet the diverse needs of bakers and food manufacturers. These formulations allow for the optimization of yeast performance in specific applications, such as breadmaking, pastry production, and brewing. By fine-tuning yeast strains and adjusting fermentation parameters, bakers can achieve desired outcomes, such as improved dough rheology, enhanced flavor profiles, and extended shelf life.

Moreover, the rising demand for specialty and artisanal baked goods is driving the adoption of premium yeast formulations. Artisan bakers are seeking high-quality yeast products that deliver superior results, allowing them to differentiate their offerings in a competitive market landscape. As a result, manufacturers are investing in research and development to create innovative yeast solutions that cater to the evolving needs of the industry, positioning themselves for success in the dynamic global bakers yeast market.

Regional Analysis

In Europe, the bakers yeast market experienced significant growth, reaching a remarkable 32.15% increase in sales.

The global market for baker's yeast demonstrates a dynamic landscape, with regional variations shaping the industry's trajectory. In North America, the market exhibits steady growth driven by the burgeoning demand for bakery products. The region's thriving food and beverage industry, coupled with increasing consumer preference for convenience foods, propels the market forward. According to recent data, North America commands a significant share, accounting for approximately 28% of the global market.

In Europe, the baker's yeast market holds a dominant position, capturing a substantial share of approximately 32.15%. The region's rich culinary heritage, coupled with the rising trend of artisanal bakeries and premium baked goods, fuels the demand for high-quality yeast products. Moreover, stringent food safety regulations and emphasis on natural ingredients bolster the adoption of baker's yeast in Europe.

Meanwhile, the Asia Pacific region emerges as a promising market, fueled by rapid urbanization, changing dietary habits, and increasing disposable incomes. Growing awareness regarding the nutritional benefits of baked goods and expanding bakery chains contribute to the region's market growth. With an increasing share of global bakery consumption, Asia Pacific presents lucrative opportunities for market players.

In the Middle East & Africa and Latin America regions, the market showcases gradual growth trajectories. Factors such as evolving consumer preferences, urbanization, and the expansion of bakery retail chains drive market expansion. However, challenges related to infrastructure, distribution networks, and economic volatility influence the market dynamics in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global Bakers Yeast Market of 2023, numerous key players exerted substantial influence, each contributing to the market's dynamics in unique ways. Among these, Dun and Bradstreet, Inc. (U.S.) emerged as a notable force, leveraging its established reputation and expansive resources to shape market trends. With a strong presence in the industry, Dun and Bradstreet's strategies likely impacted market strategies and consumer preferences, driving competition and innovation.

Conagra Brands, Inc. (U.S.) also played a pivotal role, harnessing its expertise in food manufacturing to influence product development and distribution channels. Their initiatives likely contributed to the market's expansion and diversification, catering to evolving consumer demands and preferences.

London Dairy Co. Ltd (U.K.) stood out as a key player, possibly introducing innovative yeast-based products and establishing strategic partnerships to enhance market penetration. Their contributions may have stimulated market growth and fostered consumer awareness of yeast-based offerings.

Furthermore, companies like Danone SA (France), ADM (U.S.), and Grupo Bimbo S.A.B.de C.V. (Mexico) likely exerted significant influence, leveraging their global reach and diversified product portfolios to drive market dynamics and capitalize on emerging opportunities.

Market Key Players

- Dun and Bradstreet, Inc (U.S.)

- Conagra Brands, Inc. (U.S.)

- London Dairy Co. Ltd (U.K.)

- Danone SA (France)

- ADM (U.S.)

- Daiya Foods Inc. (Canada)

- Grupo Bimbo S.A.B.de C.V.(Mexico)

- Associated British Foods PLC (U.K.)

- General Mills Inc. (U.S.)

- Lantmännen Unibake (Denmark)

- Aryzta AG (Switzerland)

- Vandemoortele NV (Belgium)

- Europastry S.A. (Spain)

- Cole's Quality Food Inc. (U.S.)

Recent Development

- In March 2024, King Arthur Baking Co. introduces Savory Bread Mix Kits in response to heightened home baking post-pandemic. Offerings include garlic bread, pretzel bites, and more, aiming to inspire culinary creativity.

- In March 2024, MicroBioGen appoints Dr. Heinrich Kroukamp as Deputy Head of Research, bringing expertise in yeast biotechnology. He will lead research on diverse applications, including biofuels, baking, and animal feeds.

- In March 2024, MicroBioGen appoints Dr. Heinrich Kroukamp as deputy head of research, leveraging his expertise in yeast biotechnology. He will lead innovative initiatives in yeast strain development across various sectors, fostering sustainable solutions in biofuels, baking, and more.

Report Scope

Report Features Description Market Value (2023) USD 1.9 Billion Forecast Revenue (2033) USD 4.5 Billion CAGR (2024-2032) 9.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Bread, Cakes, Pastries, Biscuits, Others), By Form(Liquid/Cream, Solid, Dry or Powdered, Other Form), By Product(Active Dry Yeast, Inactive Dry Yeast), By End Users(Bakery, Food, Feed, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Dun and Bradstreet, Inc (U.S.), Conagra Brands, Inc. (U.S.), London Dairy Co. Ltd (U.K.), Danone SA (France), ADM (U.S.), Daiya Foods Inc. (Canada), Grupo Bimbo S.A.B.de C.V.(Mexico), Associated British Foods PLC (U.K.), General Mills Inc. (U.S.), Lantmännen Unibake (Denmark), Aryzta AG (Switzerland), Vandemoortele NV (Belgium), Europastry S.A. (Spain), Cole's Quality Food Inc. (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Dun and Bradstreet, Inc (U.S.)

- Conagra Brands, Inc. (U.S.)

- London Dairy Co. Ltd (U.K.)

- Danone SA (France)

- ADM (U.S.)

- Daiya Foods Inc. (Canada)

- Grupo Bimbo S.A.B.de C.V.(Mexico)

- Associated British Foods PLC (U.K.)

- General Mills Inc. (U.S.)

- Lantmännen Unibake (Denmark)

- Aryzta AG (Switzerland)

- Vandemoortele NV (Belgium)

- Europastry S.A. (Spain)

- Cole's Quality Food Inc. (U.S.)