Global Biscuits Market By product(Sweet Biscuits, Savory, Crackers, Filled/Coated, Wafers, Others), By source(Wheat, Oats, Millets, Others), By distribution channel(Supermarket/Hypermarket, Convenience Store, Specialty Store, Online Retail), By flavor(Plain, Chocolate, Sour Cream, Cheese, and Spiced, Fruits and Nuts, Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

3845

-

May 2023

-

180

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

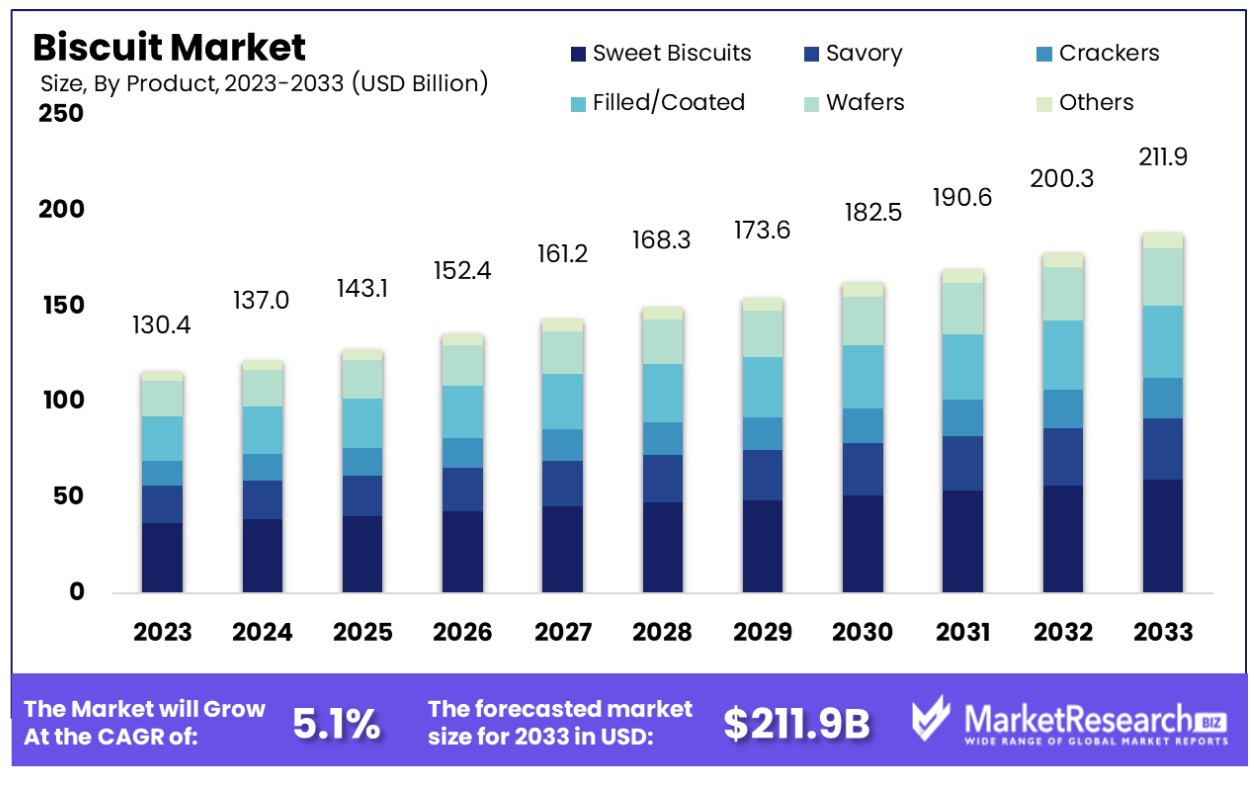

The biscuits market was valued at USD 130.4 billion in 2023. It is expected to reach USD 211.9 billion by 2033, with a CAGR of 5.11% during the forecast period from 2024 to 2033. The surge in demand for online retail stores, various flavors, and customer preferences are some of the main key driving factors for the biscuit market.

Biscuits are defined as baked food items that are small and flat treats that have gained attention and versatile snacks globally. It is made from a mixture of flour, fat like butter, sugar, and other leavening agents such as baking powder, and biscuits that come in different shapes, flavors, and sizes. The dough is generally rolled and dropped onto a baking sheet and it is baked until it turns golden brown. They can be crisp, soft, and variations that comprise savory biscuits that contain cheese or maybe herbs. It has served multiple purposes. In some cultures, they accompany meals as a dish and are enjoyed with tea and coffee. Sweet biscuits generally have extra ingredients such as chocolate chips, nuts, and dried fruits that improve their taste and texture.

The definition of “biscuit” can change in meaning as in the US, it is referred to as a soft, leavened bread roll, whereas in the UK, the “biscuits” basically signify what Americans call a “cookie”. The versatility and minimalism of biscuits make them a popular, beloved, and accessible treat all across the world.

An article published by MSN in February 2024, highlights that Mars has launched a new version of the confectionary, Twix biscuits. These Twix secret center biscuits are available at-home bargains and will set you back at £1.69. Moreover, an article published by ARSUMMARY in October 2023, highlights that MBFSL is an important player in the premium and mid-premium biscuit segments under the “Mrs. Bector’s Cremica” brand. It is one of the country’s largest biscuit exporters that exports to 69 nations in 6 continents.

The firm is a contract manufacturer of select biscuits, Oreo, and Choco bakes for Mondelez. The outcome of the firm for the year is a record turnover and net profit of Rs 1,362.1 crores and Rs. 90.1 Crore respectively, up by 37.8% and 83 basis points as compared to 2021 to 2022. Additionally, the total revenue share of the biscuit segment in FY 2023 is 59.25%.

Biscuits provides convenient and portable snacks that can carried anywhere and anytime. They offer instant energy, come in different flavors and forms, and are ready to eat. The fortified biscuits with extra nutrients contribute to dietary diversity. This availability makes them an ideal choice for on-the-go individuals searching for an easy and tasty snack alternative. The demand for biscuits will increase due to its high requirement for snacks and customers’ preferences that will help in the market segment in the coming years.

Key Takeaways

- Market Growth: Biscuits Market was valued at USD 130.4 Billion in 2023 and is expected to reach USD 211.9 Billion in 2033, at a CAGR of 5.11%

- By Product Analysis: Sweet Biscuits held a dominant market position

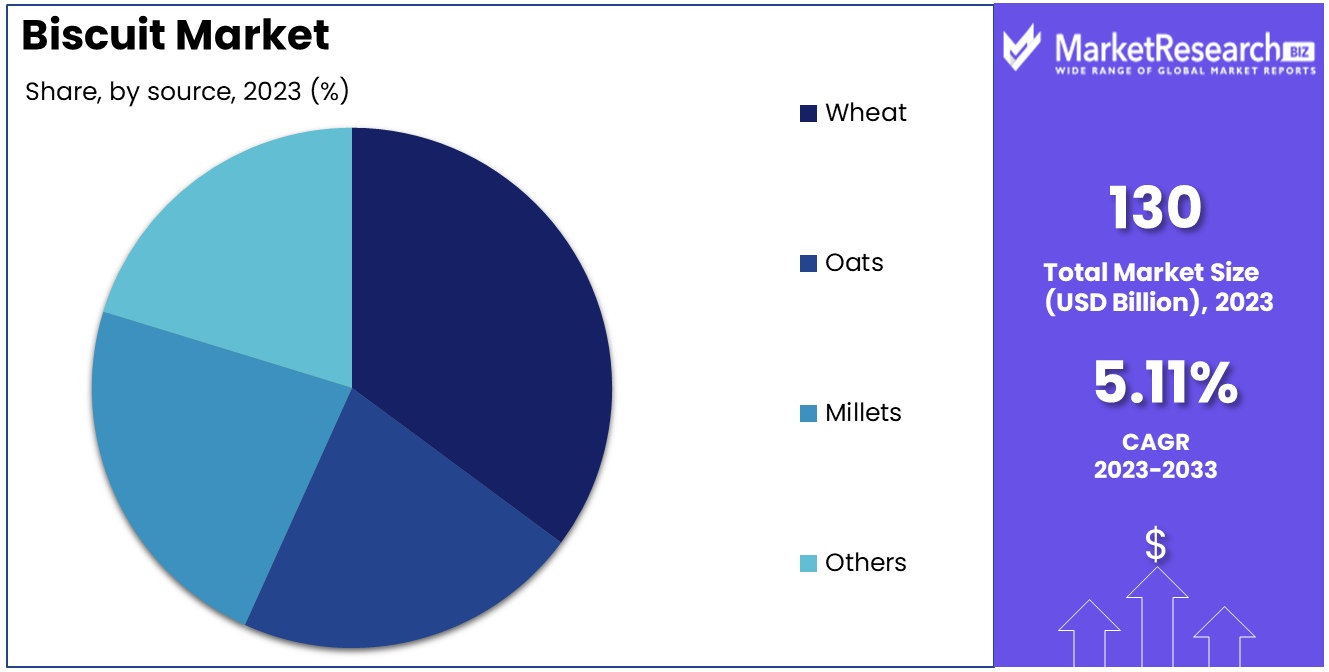

- By Source Analysis: Wheat held a dominant market position within the Source segment

- By Distribution Channel Analysis: Supermarket/Hypermarket establishments held a dominant market position

- By Flavor Analysis: Plain biscuits held a dominant market position within the flavor segments

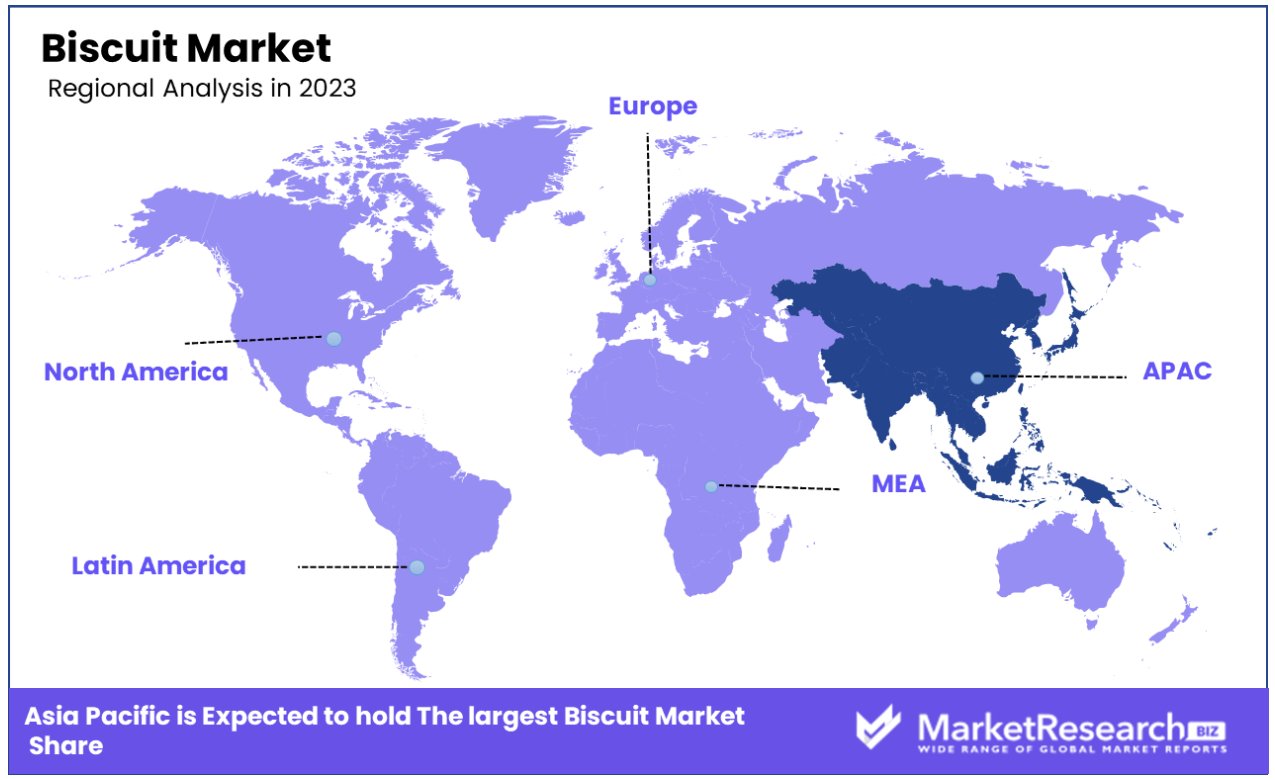

- Regional Dominance: Asia Pacific: With a dominating share of 32.68% of the global Biscuits Market

Driving factors

Product Innovations Drive Market Expansion

Innovative product offerings such as digestive crackers and sugar-free biscuits fortified with grains spearhead growth within the Biscuits Market. These advancements cater to evolving consumer preferences for healthier snack options while simultaneously tapping into the broader health and wellness trend. According to recent market data, sales of these specialized variants have surged, with a notable increase in demand for products promoting digestive health and reduced sugar content. As manufacturers continue to invest in research and development, introducing novel flavors, textures, and formulations, they position themselves strategically to capitalize on emerging consumer trends and drive market expansion.

Health-Conscious Consumers Fuel Demand for Nutritious Options

The surge in demand for healthy snacks, including plain sweet biscuits, reflects a fundamental shift in consumer behavior towards wellness-oriented lifestyles. Health-conscious individuals increasingly prioritize nutritional value when making snack choices, leading to a rise in consumption of biscuits perceived as healthier alternatives. Market statistics indicate a significant uptick in sales of plain sweet biscuits globally, underscoring the growing preference for indulgent yet nutritious options. Manufacturers responding to this trend by reformulating recipes to reduce sugar content and fortify products with natural ingredients capitalize on the expanding market segment, driving sustained growth in the Biscuits Market.

Market Expansion Driven by Innovation in Specialty Products

The Biscuits Market experiences notable growth propelled by the introduction of innovative products catering to niche dietary preferences, including vegan, gluten-free, and sugar-free biscuits. As awareness of dietary restrictions and lifestyle choices increases, consumers seek products aligned with their specific needs and values. Market analysis reveals a substantial uptick in demand for specialty biscuits, with sales of vegan and gluten-free variants witnessing particularly robust growth rates. By diversifying their product portfolios to accommodate these evolving preferences, manufacturers capitalize on untapped market segments, driving overall market expansion and bolstering their competitive positioning.

Convenience Drives Growth Amidst Busy Lifestyles

The Biscuits Market benefits from increased consumer preference for convenient snacking solutions, driven by hectic modern lifestyles. Busy schedules and on-the-go lifestyles prompt individuals to seek quick and portable snack options that offer both convenience and satisfaction. Market trends indicate a notable surge in demand for biscuits as a convenient snacking choice, with sales soaring across various demographics. Manufacturers leveraging packaging innovations and portion-controlled formats to enhance convenience further fuel market growth. As consumer lifestyles continue to prioritize convenience, the Biscuits Market remains poised for sustained expansion, propelled by the enduring appeal of convenient snacking options.

Restraining Factors

Escalating Raw Material Costs and Tax Burdens Impede Market Growth

The Biscuits Market faces significant challenges stemming from high raw material costs and escalating tax burdens, exerting pressure on profit margins and operational efficiency. Mounting expenses associated with essential ingredients such as flour, sugar, and oils directly impact production costs, constraining profitability for manufacturers. Moreover, stringent regulatory frameworks and rising tax levies further exacerbate the financial strain on industry players, limiting their capacity for investment and expansion. Market data indicates a steady increase in production costs, with raw material prices outpacing revenue growth in recent years. To mitigate these challenges, stakeholders must prioritize cost optimization strategies and advocate for policy reforms aimed at alleviating tax burdens, thereby fostering sustainable growth within the Biscuits Market.

Strategic Decision-Making Vital Amidst Market Complexity

In the face of evolving market dynamics and intensifying competition, effective decision-making becomes paramount for sustained growth within the Biscuits Market. Manufacturers must navigate complex considerations related to selling, packaging, and pricing strategies to remain competitive and capture market share. Comprehensive market analysis and strategic planning are essential to identify emerging consumer trends, anticipate competitive threats, and capitalize on untapped opportunities. Leveraging data-driven insights and adopting agile decision-making processes enable companies to adapt swiftly to changing market conditions and consumer preferences. By prioritizing strategic decision-making, industry stakeholders can overcome market challenges and position themselves for long-term success amidst dynamic industry landscapes.

Adaptive Strategies Essential to Counter Competitive Pressures

Increasing competition and rapid product innovations globally present formidable challenges to growth within the Biscuits Market. As competitors introduce new and innovative products, market dynamics evolve, creating a highly competitive landscape for industry players. Manufacturers must proactively adapt their strategies to differentiate their offerings, enhance brand visibility, and retain consumer loyalty. Market data underscores the intensifying competition within the sector, with established players facing encroachment from both traditional rivals and new market entrants. By investing in research and development, fostering innovation, and cultivating strategic partnerships, companies can navigate competitive pressures and sustain growth within the fiercely contested Biscuits Market.

By Product Analysis

Sweet Biscuits held a dominant market position, supported by a diverse range of product segments catering to varying consumer preferences. Among these segments, Savory biscuits emerged as a notable contender, leveraging innovative flavors and formulations to captivate consumer interest. With a focus on savory profiles and savory-sweet combinations, manufacturers capitalized on changing taste preferences, driving growth within this segment.

Crackers also emerged as a prominent segment within the Biscuits Market, buoyed by their versatility and convenience as a snack option. Market leaders introduced a plethora of flavors and textures, targeting diverse consumer demographics and occasions. Additionally, the health-conscious trend influenced the formulation of crackers, with an emphasis on whole grains, seeds, and natural ingredients to enhance nutritional value and appeal to discerning consumers.

The Filled/Coated segment witnessed steady growth, driven by indulgent offerings that catered to consumers seeking premium experiences. Manufacturers innovated with luxurious fillings such as chocolate, caramel, and fruit preserves, elevating the sensory experience and positioning these biscuits as indulgent treats for special occasions.

Wafers emerged as a segment of interest, characterized by their light and crispy texture, making them a popular choice for consumers seeking lighter snack options. Market players capitalized on this trend by introducing wafers in various flavors and formats, appealing to both traditional and adventurous palates.

The "Others" segment encompassed a diverse array of biscuit products, including specialty items such as gluten-free, vegan, and sugar-free options. With an increasing focus on dietary restrictions and wellness, this segment witnessed significant growth as manufacturers expanded their product offerings to cater to niche consumer preferences.

By Source Analysis

Wheat held a dominant market position within the Source segment, reflecting its widespread consumption and versatile applications across various biscuit categories. However, alternative grains such as Oats emerged as notable contenders, driven by their perceived health benefits and rising consumer awareness of nutritional diversity.

Oats gained traction as a favored ingredient, particularly in the health-conscious segment, owing to their high fiber content and heart-healthy properties. Manufacturers capitalized on this trend by incorporating oats into biscuit formulations, offering consumers a wholesome snacking option without compromising on taste or texture.

Millets, although a smaller segment compared to wheat and oats, witnessed growing interest due to their gluten-free nature and nutritional profile. With increasing consumer demand for alternative grains and dietary diversity, millets found favor among individuals seeking healthier snack alternatives and those with gluten sensitivities.

The "Others" category encompassed a diverse range of grains, including quinoa, barley, and sorghum, among others. While these grains held a relatively smaller market share compared to wheat, oats, and millets, they catered to niche consumer preferences for unique flavors, textures, and nutritional benefits.

By Distribution Channel Analysis

Supermarket/Hypermarket establishments held a dominant market position within the distribution channels segment of the Biscuits Market. These retail giants capitalized on their extensive reach, diverse product offerings, and competitive pricing to attract a wide consumer base seeking convenience and variety in their shopping experiences.

Convenience Store outlets emerged as a notable segment within the distribution landscape, offering consumers quick and accessible options for purchasing biscuits on the go. Despite their smaller footprint compared to supermarkets, convenience stores strategically positioned themselves in high-traffic areas, catering to impulse purchases and immediate snacking needs.

Specialty Store retailers carved out a niche market segment by focusing on curated selections of premium and artisanal biscuit offerings. These establishments appealed to discerning consumers seeking unique flavors, high-quality ingredients, and specialty products not typically found in mainstream retail outlets. By cultivating an atmosphere of exclusivity and expertise, specialty stores fostered consumer loyalty and elevated the overall shopping experience.

The Online Retail segment experienced significant growth, driven by shifting consumer preferences towards e-commerce channels and the convenience of doorstep delivery. Online retailers capitalized on technological advancements and targeted marketing strategies to reach a broad audience of digital-savvy consumers, offering convenience, variety, and competitive pricing in the virtual marketplace.

By Flavor Analysis

Plain biscuits held a dominant market position within the flavor segments of the Biscuits Market, reflecting their timeless appeal and versatility across various consumer preferences and occasions. However, other flavor categories also played significant roles in shaping consumer choices and market dynamics.

Chocolate-flavored biscuits emerged as a notable contender within the flavor segment, leveraging the enduring popularity of chocolate as an indulgent treat. With a wide range of offerings, from rich and decadent chocolate cookies to creamy chocolate-filled wafers, manufacturers tapped into consumers' love for chocolate and capitalized on its universal appeal.

Sour Cream, Cheese, and Spiced biscuits represented a unique flavor category, appealing to consumers seeking savory profiles and bold taste experiences. These biscuits offered a departure from traditional sweet options, catering to individuals with more adventurous palates and preferences for savory snack alternatives.

Fruits and Nuts biscuits appealed to health-conscious consumers and those seeking natural flavors and ingredients in their snacks. By incorporating real fruits, nuts, and seeds into biscuit formulations, manufacturers offered consumers a wholesome and satisfying snack option that balanced nutrition with indulgence.

The "Others" category encompassed a diverse array of flavor innovations, including exotic spices, herbs, and regional flavor profiles. These unique offerings catered to niche consumer preferences and culinary trends, providing consumers with novel taste experiences and expanding the overall flavor palette within the Biscuits Market.

Key Market Segments

Segmentation by product:

- Sweet Biscuits

- Savory

- Crackers

- Filled/Coated

- Wafers

- Others

Segmentation by source:

- Wheat

- Oats

- Millets

- Others

Segmentation by distribution channel:

- Supermarket/Hypermarket

- Convenience Store

- Specialty Store

- Online Retail

Segmentation by flavor:

- Plain

- Chocolate

- Sour Cream, Cheese, and Spiced

- Fruits and Nuts

- Others

Growth Opportunity

Rising Demand for Premium Biscuit Products:

The increasing consumer inclination towards premium and indulgent snack options presents significant growth opportunities for the Biscuits Market. Premium biscuit products offer unique flavor profiles, high-quality ingredients, and enhanced sensory experiences, catering to discerning consumers willing to pay a premium for superior quality. Market data indicates a steady rise in sales of premium biscuits, with consumers increasingly valuing taste, texture, and overall product experience.

Expanding Market for Healthy Snacks:

The growing awareness of health and wellness among consumers is driving demand for healthier snack alternatives, including biscuits. Manufacturers are capitalizing on this trend by offering natural, GMO-free products that align with consumer preferences for clean labels and transparent ingredient sourcing. Market statistics reveal a notable uptick in sales of healthy biscuits fortified with whole grains, fiber, and functional ingredients, signaling promising growth prospects for health-focused biscuit offerings.

Focus on Niche Markets for Health Biscuits:

As consumers prioritize digestive health and seek solutions for dietary concerns, there is a growing market for health biscuits targeting specific health needs. Digestive biscuits, in particular, have gained popularity due to their digestive health benefits and low-calorie content. Market research indicates a surge in demand for digestive biscuits, with manufacturers innovating with fiber-rich formulations and natural ingredients to cater to this niche segment effectively.

Latest Trends

Product Innovation Driving Market Expansion:

In 2023, the Biscuits Market presents lucrative growth opportunities fueled by product innovation. Manufacturers are increasingly focusing on developing innovative biscuit variants to cater to evolving consumer preferences and lifestyle trends. Market data reveals a significant correlation between product innovation and market growth, with innovative biscuit offerings capturing consumer attention and driving sales. As manufacturers continue to introduce novel flavors, ingredients, and formats, they position themselves strategically to capitalize on emerging market trends and gain a competitive edge.

Rising Demand for Healthier Options:

The growing emphasis on health and wellness among consumers worldwide is reshaping the Biscuits Market landscape, presenting opportunities for healthier biscuit options. Market research indicates a notable increase in consumer demand for biscuits fortified with functional ingredients, whole grains, and natural sweeteners. As health-conscious consumers seek nutritious snack alternatives without compromising on taste or convenience, manufacturers have an opportunity to innovate and expand their product portfolios to meet this demand. The integration of healthier ingredients and formulations not only satisfies consumer preferences but also drives market growth by tapping into the burgeoning health-conscious market segment.

Premiumization Elevating Market Position:

Premiumization emerges as a key driver of growth within the Biscuits Market, as consumers increasingly gravitate towards premium and indulgent biscuit offerings. Market analysis reveals a growing consumer willingness to pay a premium for high-quality biscuit products that offer superior taste, texture, and overall experience. Manufacturers leveraging premiumization strategies by incorporating luxurious ingredients, innovative packaging, and sophisticated branding enhance their market position and command higher price points. By catering to discerning consumer tastes and preferences for premium offerings, manufacturers can capitalize on this trend to drive revenue growth and expand market share in 2023 and beyond.

Regional Analysis

Asia Pacific: With a dominating share of 32.68% of the global Biscuits Market

In North America, the Biscuits Market exhibits steady growth driven by consumer demand for convenient and indulgent snack options. The region's mature market landscape is characterized by a diverse range of biscuit products catering to varying taste preferences and dietary needs. Market data indicates a notable increase in sales of premium and specialty biscuits, reflecting consumer willingness to pay a premium for high-quality products. Additionally, the rising popularity of healthier snack alternatives contributes to the growth of the health biscuit segment in the region. Dominating Region(s): North America accounts for 22.14% of the global Biscuits Market.

Europe: Europe represents a significant market for biscuits, characterized by a rich tradition of biscuit consumption and production. The region's diverse culinary heritage influences biscuit preferences, with consumers favoring a wide range of flavors, textures, and formats. Market analysis reveals a growing demand for premium and artisanal biscuit products, driven by consumer preferences for indulgent treats and gourmet experiences. Moreover, the trend towards healthier snacking options fuels the demand for biscuits fortified with natural ingredients and whole grains. Dominating Region(s): Europe holds a substantial share of the global Biscuits Market at 27.85%.

Asia Pacific: With a dominating share of 32.68% of the global Biscuits Market, the Asia Pacific region emerges as a key driver of market growth. Rapid urbanization, changing consumer lifestyles, and increasing disposable incomes contribute to the region's robust biscuit consumption. Market dynamics vary across countries, with emerging markets such as China and India witnessing significant growth fueled by rising population and expanding middle-class demographics. Manufacturers in the region focus on product innovation, catering to diverse consumer preferences and dietary trends. Additionally, the growing popularity of online retail channels facilitates market expansion, enabling manufacturers to reach a wider audience of digitally savvy consumers.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

- Arnotts Biscuits Holdings Pty Limited

- Mondelez International, Inc.

- Burton's Foods Limited

- United Biscuits (UK) Limited

- Britannia Industries Limited

- Lotus Bakeries NV

- CSC BRANDS, L.P

- Nestlé S.A.

- Kellogg Company

- Dali Foods Group Company Limited

Recent Development

- September 2023 Craze Biscuits unveiled two appealing additions to their line: Choco Rocky, a delicious cookie, and Bourbon, which is the chocolate-filled sandwich biscuit. The delightful flavors are available for purchase on the Internet and in brick-and-mortar shops in the target markets of the company.

- Jan. 2023. Reliance Consumer Products Ltd. has formed a strategic partnership with Maliban Biscuit one of the most prominent participants in Sri Lanka's market for biscuits to offer its products in India. The products are available through a vast range of online and offline stores across the nation.

Report Scope

Report Features Description Market Value (2023) USD 130.4 Billion Forecast Revenue (2033) USD 211.9 Billion CAGR (2024-2032) 5.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By product(Sweet Biscuits, Savory, Crackers, Filled/Coated, Wafers, Others), By source(Wheat, Oats, Millets, Others), By distribution channel(Supermarket/Hypermarket, Convenience Store, Specialty Store, Online Retail), By flavor(Plain, Chocolate, Sour Cream, Cheese, and Spiced, Fruits and Nuts, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Arnotts Biscuits Holdings Pty Limited, Mondelez International, Inc., Burton's Foods Limited, United Biscuits (UK) Limited, Britannia Industries Limited, Lotus Bakeries NV, CSC BRANDS, L.P, Nestlé S.A., Kellogg Company, Dali Foods Group Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Arnotts Biscuits Holdings Pty Limited

- Mondelez International, Inc.

- Burton's Foods Limited

- United Biscuits (UK) Limited

- Britannia Industries Limited

- Lotus Bakeries NV

- CSC BRANDS, L.P

- Nestlé S.A.

- Kellogg Company

- Dali Foods Group Company Limited