Alcoholic Beverages Market By Type(Beer, Wine, Spirits), By Alcoholic Content(High, Medium, Low), By Category(Mass, Premium), By Packaging(Plastic Bottles, Glass Bottles, Tins), By Distribution Channel(Supermarkets, Specialty Stores, Liquor Stores), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

5602

-

Feb 2024

-

176

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

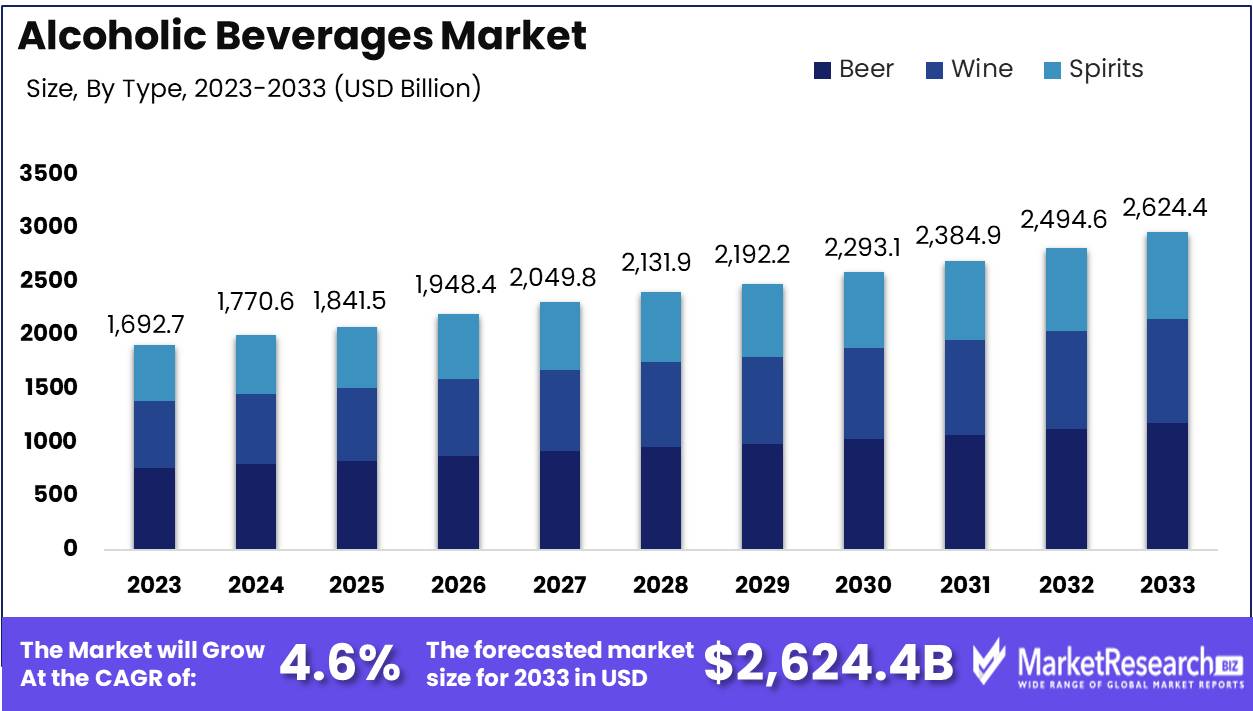

The alcoholic beverages market was valued at USD 1,692.7 billion in 2023, It is expected to reach USD 2,624.4 billion by 2033, with a CAGR of 4.6% during the forecast period from 2024 to 2033. The surge in demand for hybrid alcoholic beverages and changes in customer preferences are some of the main key driving factors for the alcoholic beverage market.

Alcoholic beverages are defined as drinks containing ethanol, a type of alcohol that is made through the fermentation of sugars by yeast. It has many categories that consist of different types of beverages like wine, beer, cocktails, and spirits. Meanwhile, beer is made from fermented grains, spirits are made up from distilled fermented products, and wine is developed from fermented grapes.

The alcohol content changes, with beer commonly having a lower alcohol content by volume than wine or spirits. This has been an important part of human social, and recreational activities for centuries, religious, playing roles in rituals, celebrations, and cooking traditions globally. The consumption of alcoholic beverages is often related to social enjoyment, more drinking can lead to health issues and societal issues, highlighting the prominence of responsible alcohol consumption.

An article published by CNBC in February 2024, highlights that US spirits has maintained its market share strength in 2023 and shattered out beer industry and wine for the second year. In the US, supplier sales grew in 2023 to USD 37.7 billion. Although the alcoholic beverages industry has gained slight total revenue, it has overtaken beer and wine sales by 0.4% and 26.1% respectively. Moreover, the pre-mixed cocktails were up the spirits category last year by rising 26.7% to USD 2.8 billion in sales revenue.

Alcoholic beverages like red wines have been connected to more health advantages when consumed in moderation, with some of the studies suggesting that it has some positive outcomes on cardiovascular health. It is important to know that more amount of alcohol consumptions have some serious health risks and some societal challenges that comprise accidents, addictions, and several public health challenges. Maintaining a balance among social, cultural, and economic aspects with responsible alcoholic consumption practices are main to appreciate the prominence of alcoholic beverages in a well-rounded context. The demand for alcoholic beverages will increase due to its high requirement in food and beverages industries which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Alcoholic Beverages Market was valued at USD 1,692.7 billion in 2023, It is expected to reach USD 2,624.4 billion by 2033, with a CAGR of 4.6% during the forecast period from 2024 to 2033.

- By Type: Beer dominates, while wine and spirits also hold significant market shares.

- By Alcoholic Content: High, medium, and low alcoholic content options cater to diverse preferences.

- By Category: Mass category dominates, while the premium category experiences rapid growth trends.

- By Packaging: Plastic bottles, glass bottles, and tins are common packaging options.

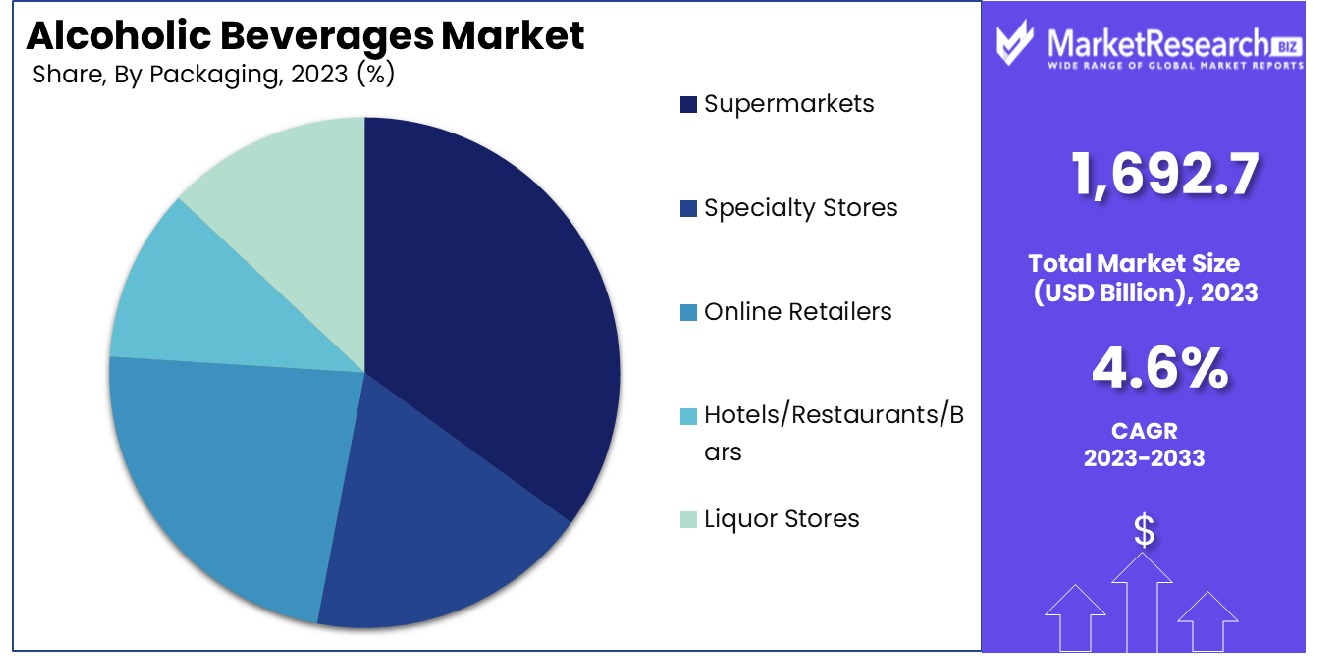

- By Distribution Channel: Supermarkets dominate the alcoholic beverages market distribution channel significantly.

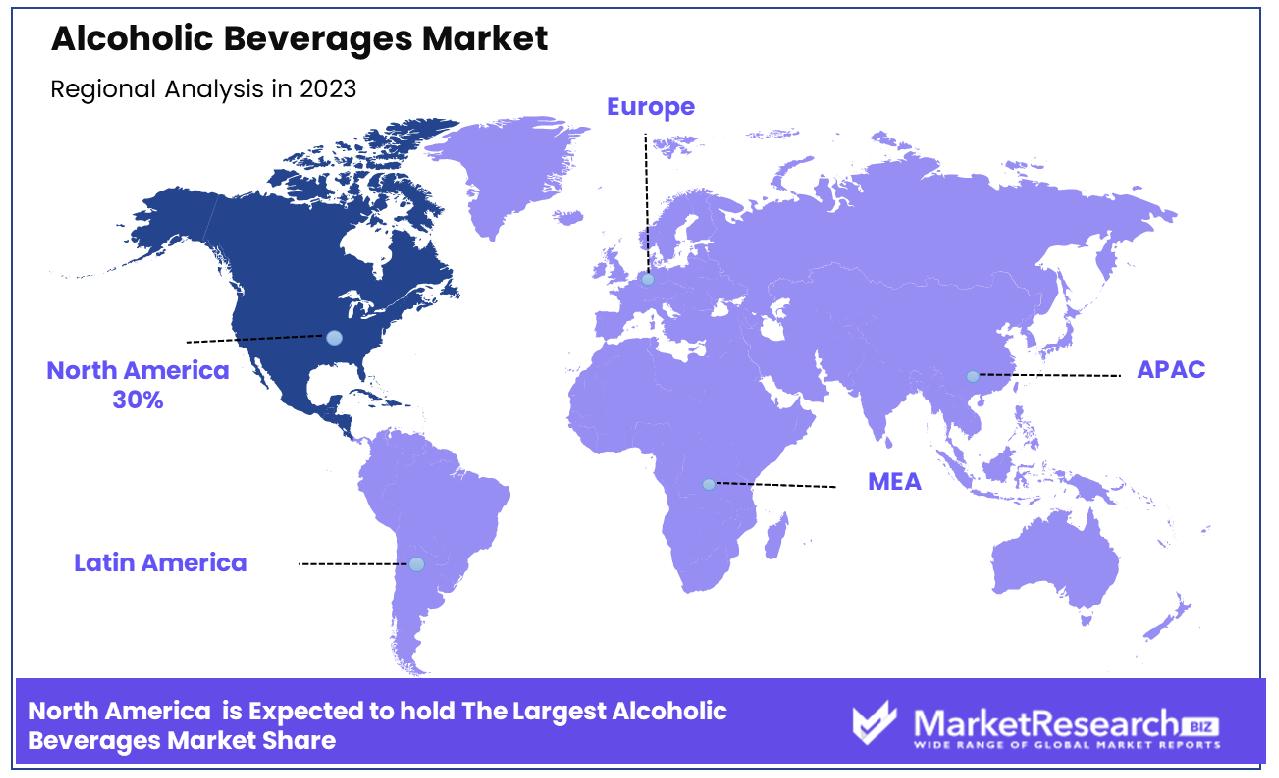

- Regional Dominance: North America Dominates with 30% Market Share in the Alcoholic Beverages Market

- Growth Opportunity: Craft and micro-distilleries offer personalized experiences, while direct-to-consumer sales empower brands, reshaping the alcoholic beverages market landscape.

Driving factors

Premiumization Drives Market Growth

The premiumization trend has significantly impacted the alcoholic beverages market, encouraging consumers to opt for higher-quality, often artisanal, products. This shift has enabled companies to command higher prices, thereby increasing revenues. According to IWSR, growth in consumer spending, with 33% of Americans spending over $50 on a single bottle of alcohol in 2022, up from 24% in 2021, underscores the value placed on quality over quantity.

This trend not only elevates consumer expectations but also spurs innovation among producers, who are motivated to craft distinguished products that stand out in a competitive market. The ripple effect of premiumization extends to enhancing brand perception and loyalty, potentially leading to sustained market growth as consumers continue to seek out premium experiences.

New Product Development Propels Market Expansion

Innovation in product development, characterized by the introduction of new flavors, packaging, and formats such as ready-to-drink cocktails and hard seltzers, has been a pivotal growth driver for the alcoholic beverages market. The surge in hard seltzer sales in the US exemplifies consumer demand for novel, convenient, and lower-calorie options. This continuous innovation not only caters to evolving consumer preferences but also opens new avenues for market expansion.

By diversifying their product portfolios, companies can reach broader audiences, including health-conscious consumers and millennials seeking variety and convenience. The dynamic nature of product development fosters a competitive environment that encourages brands to remain at the forefront of industry trends, ultimately contributing to the industry's overall growth.

E-commerce and Delivery Accelerate Market Dynamics

The proliferation of online sales and delivery services has revolutionized the alcoholic beverages market, making purchases more convenient and accessible. China's emergence as the world's largest market for online alcohol sales, with annual growth rates of 10%-20%, highlights the significant impact of e-commerce on industry dynamics. This digital transformation enables consumers to make impulsive buying decisions and access a wider range of products than available in traditional retail settings.

The convenience of e-commerce, coupled with the expansion of delivery services, not only broadens the customer base but also stimulates frequent purchases. As this trend continues, it is expected to further integrate the alcoholic beverages market into the digital economy, fostering growth through increased accessibility and consumer engagement.

Restraining Factors

Health Consciousness Curbs Alcohol Consumption

The growing trend of health consciousness among consumers significantly impacts the alcoholic beverages market. With a better understanding of alcohol's health risks and calorie content, many individuals are opting to reduce their alcohol intake or switch to alternatives perceived as healthier, such as hard seltzers, which offer lower calorie content.

This shift is evidenced by a notable decline in per capita alcohol consumption over the past decade in mature markets such as the United States and the United Kingdom, reflecting a broader trend towards wellness and moderation in consumption habits.

Regulatory Environment Tightens, Impacting Alcohol Market Dynamics

Regulatory measures, including restrictions on alcohol availability, sales hours, minimum legal drinking ages, stringent advertising regulations, and elevated taxes, significantly constrain the alcoholic beverages market's growth. For example, Scandinavian countries impose high excise taxes on alcoholic products, effectively limiting consumption levels.

Similarly, the implementation of minimum unit pricing for alcohol in Scotland in 2018 has been shown to reduce alcohol purchases. These regulations aim to mitigate alcohol-related harms but also present considerable challenges for the industry, affecting everything from market access to consumer pricing and overall demand.

By Type Analysis

Beer stands out as the dominant segment within the alcoholic beverages market. Among its sub-segments, Lager is particularly prominent, favored worldwide for its crisp and refreshing taste, making it a staple at social gatherings and sporting events. However, other sub-segments like Ale, Stout, and Craft beers play crucial roles in market growth. Craft and specialty beers, in particular, have seen a surge in popularity, as consumers increasingly seek unique flavors and artisanal brewing techniques. This trend towards diversification has encouraged innovation within the beer segment, expanding its appeal and driving growth.

Wine is another key segment, with Red Wine leading in popularity. Red wine is celebrated for its rich flavors and potential health benefits, attracting a broad consumer base. Other wine varieties, such as White, Rosé, Sparkling, and Fortified wines, contribute to the segment's diversity, catering to varying consumer preferences for different occasions. Spirits encompass a wide range of products, with Vodka and Whiskey among the most popular. Vodka's versatility in cocktails and its smooth profile appeal to a wide audience, while Whiskey — including Scotch, Bourbon, and Rye — attracts connoisseurs and casual drinkers alike with its complexity and heritage.

By Alcoholic Content Analysis

The market is segmented into High, Medium, and Low alcoholic content categories. High-alcohol beverages, often spirits, cater to consumers looking for intensity and depth in flavor. Medium and low-alcohol options, including many beers and wines, appeal to a broader audience seeking lighter, more sessionable drinking experiences. This segmentation allows brands to target specific consumer preferences and occasions, from casual social drinking to more formal celebrations.

By Category Analysis

The Mass category dominates the market, driven by widespread availability and affordability. However, the Premium segment is experiencing rapid growth, fueled by consumers' increasing willingness to pay more for higher quality, artisanal, and specialty beverages. This shift towards premiumization reflects a broader trend across consumer goods, with individuals seeking products that offer superior taste, exclusivity, and a more authentic drinking experience.

By Packaging Analysis

Packaging options like Plastic Bottles, Glass Bottles, and Tins serve different consumer needs and preferences. Glass bottles are preferred for premium products due to their ability to preserve the quality and flavor of the beverage. Plastic bottles and tins, offering convenience and portability, cater to the casual, on-the-go consumption market. The choice of packaging plays a significant role in branding and environmental sustainability, influencing consumer purchasing decisions.

By Distribution Channel Analysis

Supermarkets are the dominant distribution channel for alcoholic beverages, offering a wide selection and convenience. However, Specialty Stores, Online Retailers, Hotels/Restaurants/Bars, and Liquor Stores also play essential roles. The growth of online retail has been particularly noteworthy, expanding the market's reach and making it easier for consumers to explore and purchase a wider variety of alcoholic beverages.

Key Market Segments

By Type

Beer:

- Lager

- Ale

- Stout

- Others (Craft beer, specialty beers)

Wine:

- Red wine

- White wine

- Rosé wine

- Sparkling wine

- Fortified wine (e.g., Port, Sherry)

Spirits:

- Vodka

- Whiskey (Scotch, Bourbon, Rye, etc.)

- Rum

- Gin

- Tequila

- Brandy/Cognac

- Liqueurs

- Others (e.g., Absinthe, Akvavit)

By Alcoholic Content

- High

- Medium

- Low

By Category

- Mass

- Premium

By Packaging

- Plastic Bottles

- Glass Bottles

- Tins

By Distribution Channel

- Supermarkets

- Specialty Stores

- Online Retailers

- Hotels/Restaurants/Bars

- Liquor Stores

Growth Opportunity

Customization: A Tailored Approach Elevates the Alcoholic Beverages Market

The surge in popularity of craft and micro-distilleries underscores a burgeoning market trend towards customization in the alcoholic beverage industry sector. Consumers' growing desire for personalized experiences is met by establishments offering custom spirits and beers, which not only cater to individual preferences but also foster a sense of connection with local brands.

This shift towards small-batch, tailored offerings represents a significant departure from the traditional mass-produced alcohol industry, positioning customization as a key driver of growth. Such initiatives enable brands to differentiate themselves in a crowded market, offering a unique value proposition that appeals to a discerning clientele.

Direct-to-Consumer Sales: Redefining the Alcoholic Beverages Landscape

The adoption of direct-to-consumer (DTC) sales models by small distilleries and breweries presents a formidable opportunity within the alcoholic beverages market. By leveraging owned e-commerce platforms, producers can bypass traditional retail channels, enhancing profit margins and gaining direct insights into consumer preferences. This strategy not only facilitates a deeper understanding of market dynamics but also enables rapid product innovation in response to feedback.

The growth of DTC sales is a testament to changing consumer behaviors, with an increasing number of buyers appreciating the convenience and personalized experience of purchasing directly from producers. As such, the expansion of DTC channels is poised to reshape the alcoholic beverages market, offering a pathway for small brands to achieve significant growth.

Latest Trends

Rise of Craft Cocktails

Craft cocktails are surging in popularity, driven by consumer demand for unique, artisanal experiences. This trend emphasizes quality ingredients, innovative flavors, and skilled mixology, appealing to discerning drinkers seeking authenticity and sophistication.

Demand for Low- and No-Alcohol Options

Health-conscious consumers are driving the growth of low- and no-alcohol alternatives in the alcoholic beverages market. This trend reflects a shift towards moderation and wellness, with consumers seeking flavorful options that offer social enjoyment without the effects of traditional alcohol. The market responds with a range of innovative products, including non-alcoholic beverages spirits, beers, and wines, catering to diverse preferences and lifestyles.

Regional Analysis

North America Dominates with 30% Market Share in the Alcoholic Beverages Market

North America's substantial 30% hold on the global alcoholic beverages market is largely attributed to its vast consumer base with a high disposable income and a culturally ingrained tradition of alcohol consumption. The region's market is propelled by a diverse demographic profile, leading to a wide array of preferences that drive innovation and variety in product offerings. The United States, in particular, has a vibrant craft beer and spirits scene, which has significantly contributed to market growth. Additionally, stringent regulations ensure product quality and safety, fostering consumer trust and further driving consumption.

The North American market is characterized by a strong distribution network that spans retail and online channels, making alcoholic beverages readily accessible to consumers. The rise of e-commerce in alcohol sales, particularly during the COVID-19 pandemic, has opened new avenues for market expansion. Furthermore, the region's commitment to marketing and promotional strategies has effectively tapped into various consumer segments, from millennials seeking craft and artisanal options to older generations preferring traditional brands.

Europe: A Tradition-Steeped Market with Premium Products

Europe commands a significant share of the global alcoholic beverages market, buoyed by its rich brewing and distilling heritage and the prevalence of alcohol consumption as a cultural norm. The region excels in producing premium wines, beers, and spirits, with a strong emphasis on quality and tradition. European countries also benefit from geographical indications that protect and enhance the value of regional products. Moving forward, the market is expected to grow, albeit at a slower pace, with sustainability and innovation in packaging and product offerings driving consumer interest.

Asia Pacific: Rapid Growth Fueled by Emerging Economies

The Asia Pacific region is witnessing rapid growth in the alcoholic beverages market, driven by economic development and increasing urbanization in countries like China and India. This growth is characterized by a burgeoning middle class with more disposable income and a growing openness to Western drinking habits. The region's diverse cultures offer unique opportunities for localized and international brands alike. Future growth is expected to be robust, with increasing demand for premium and imported alcoholic beverages. However, market major players need to navigate cultural sensitivities and regulatory environments across different countries.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the vibrant landscape of the global alcoholic beverages market, several key players exert substantial influence through strategic positioning and impactful market initiatives. Anheuser-Busch InBev, the world's leading brewer, dominates with its extensive portfolio of over 500 beer brands, capitalizing on scale, diversity, and global reach to cater to varying consumer tastes and preferences. Diageo follows, commanding a significant presence in the spirits sector with iconic brands across categories, driving growth through innovation and a keen focus on premiumization.

Heineken and Carlsberg, with their global footprint, have successfully penetrated emerging markets, leveraging strong brand identity and expansive distribution networks. Pernod Ricard's strategy of owning an exhaustive portfolio of premium spirits and wines has positioned it as a key player in the luxury segment, enhancing its global standing.

Asahi Group Holdings and Constellation Brands have made strategic acquisitions to broaden their product ranges and enter new markets, signaling a trend toward consolidation in the industry for wider market reach. Brown-Forman, Bacardi, and Rémy Cointreau, with their focus on heritage and craftsmanship, continue to thrive in the premium segment, appealing to consumers seeking authenticity and quality.

Market Key Players

- Anheuser-Busch InBev

- Diageo

- Heineken

- Pernod Ricard

- China Resources Snow Breweries

- Carlsberg

- Molson Coors Beverage Company

- Kirin Holdings

- Asahi Group Holdings

- Thai Beverage

- Constellation Brands

- Brown-Forman

- Suntory Holdings

- Bacardi

- Rémy Cointreau

Recent Development

- In January 2024, Smirnoff vodka launched a new spicy tamarind variety available at ASDA and Tesco in the UK. It aims to offer a bold sweet-meets-spicy flavor experience, capitalizing on the predicted tamarind flavor trend for 2024.

- In January 2024, Mother Earth Brewing in Kinston introduced Kaya, a non-alcoholic beverage containing 3 mg of Delta 9 THC for a calming, present experience. It's aimed at providing an alternative during Dry January and promoting well-being.

- In January 2024, Coca-Cola India enters the Indian alcoholic beverage market with Lemon-Dou, a lime-flavored cocktail, as part of its strategy to diversify its product portfolio and become a total beverage company.

Report Scope

Report Features Description Market Value (2023) USD 1,692.7 Billion Forecast Revenue (2033) USD 2,624.4 Billion CAGR (2024-2032) 4.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type, Beer(Lager, Ale, Stout, Others (Craft beer, specialty beers)), Wine(Red wine, White wine, Rosé wine, Sparkling wine, Fortified wine (e.g., Port, Sherry)), Spirits(Vodka, Whiskey (Scotch, Bourbon, Rye, etc.), Rum, Gin, Tequila, Brandy/Cognac, Liqueurs, Others (e.g., Absinthe, Akvavit))By Alcoholic Content(High, Medium, Low), By Category(Mass, Premium), By Packaging(Plastic Bottles, Glass Bottles, Tins), By Distribution Channel(Supermarkets, Specialty Stores, Online Retailers, Hotels/Restaurants/Bars, Liquor Stores) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Anheuser-Busch InBev, Diageo, Heineken, Pernod Ricard, China Resources Snow Breweries, Carlsberg, Molson Coors Beverage Company, Kirin Holdings, Asahi Group Holdings, Thai Beverage, Constellation Brands, Brown-Forman, Suntory Holdings, Bacardi, Rémy Cointreau Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Anheuser-Busch InBev

- Diageo

- Heineken

- Pernod Ricard

- China Resources Snow Breweries

- Carlsberg

- Molson Coors Beverage Company

- Kirin Holdings

- Asahi Group Holdings

- Thai Beverage

- Constellation Brands

- Brown-Forman

- Suntory Holdings

- Bacardi

- Rémy Cointreau