Automotive Underbody Coatings Market Report By Type (Bitumen, Resin, Steel, Aluminum, Magnesium, Other Materials), By Material Type (Solvent-borne, Water-borne, Powder), By Application (Underbody Protection, Corrosion Protection, Noise Reduction, Heat Management, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48348

-

July 2024

-

325

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

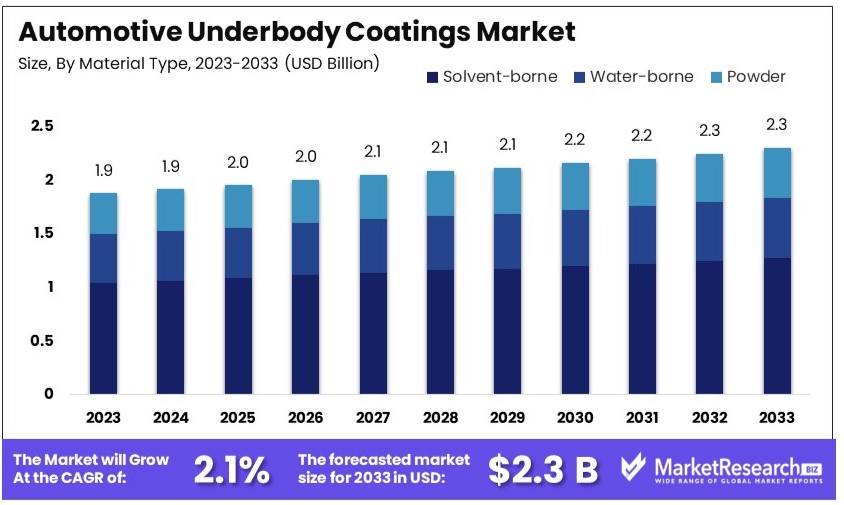

The Global Automotive Underbody Coatings Market size is expected to be worth around USD 2.3 Billion by 2033, from USD 1.9 Billion in 2023, growing at a CAGR of 2.1% during the forecast period from 2024 to 2033.

The Automotive Underbody Coatings Market deals with products used to protect the underbody parts of vehicles from corrosion, chips, and chemical abrasion. These coatings are crucial for enhancing vehicle longevity and performance. The market includes solutions like rubber-based and wax-based coatings, tailored to withstand various environmental conditions.

Driven by advancements in coating technology and increasing standards for vehicle maintenance and durability, this market serves automotive manufacturers and aftermarket services, providing essential protection solutions that meet rigorous industry standards.

The automotive underbody coatings market is experiencing significant growth, propelled by a series of strategic factors and industrial advancements. A notable driver of this market expansion is the surge in vehicle production, with a marked emphasis on electric vehicles (EVs).

These vehicles require advanced underbody coatings to ensure protection against corrosion and to extend vehicle longevity. In response to these demands, industry leaders like PPG have reported a robust increase in sales, with a 10% uptick in 2023, primarily fueled by enhanced pricing strategies and volume growth in key markets such as the U.S. and Latin America.

Investments and strategic partnerships within the private sector are further catalyzing market growth. A prime example is PPG's inauguration of a $30-million Battery Pack Application Center in Tianjin, China. This facility is dedicated to advancing coating solutions for the burgeoning EV battery market, showcasing the industry’s commitment to innovation and to meeting the rapidly evolving needs of the market.

Geographically, China continues to lead as the world’s largest vehicle producer, with production expected to reach 26.4 million units in 2024, marking a 4.2% increase year-over-year. Meanwhile, the European market is also showing signs of robust growth, with vehicle production projected to rise by 2.9% to approximately 15.1 million units in 2024. This growth is attributed to the recovery of vehicle production capacities and improvements in delivery times.

The automotive underbody coatings market is set for substantial growth, driven by increased vehicle production, innovative developments in EV technologies, and strategic global expansions. These dynamics are expected to continue driving the market forward, offering significant opportunities for stakeholders across the automotive industry.

Key Takeaways

- Market Value: The Automotive Underbody Coatings Market was valued at USD 1.9 billion in 2023 and is expected to reach USD 2.3 billion by 2033, with a CAGR of 2.1%.

- Type Analysis: Aluminum dominates with 40%, due to its lightweight properties.

- Material Type Analysis: Water-borne coatings lead with 55%, driven by environmental regulations.

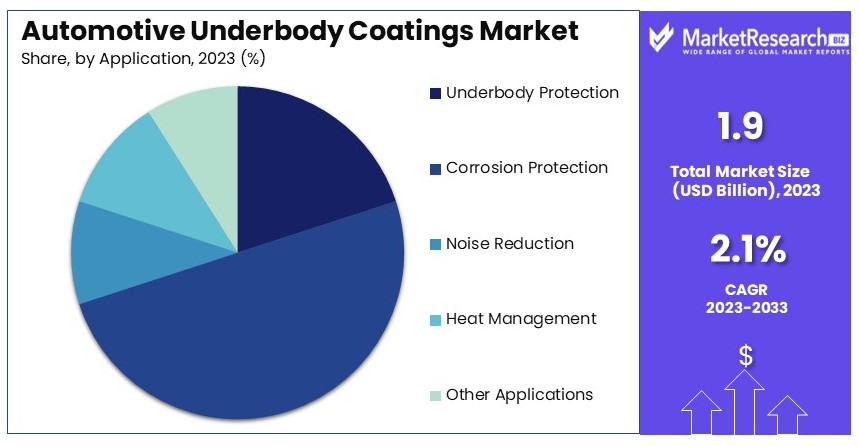

- Application Analysis: Corrosion Protection dominates with 50%, essential for vehicle durability.

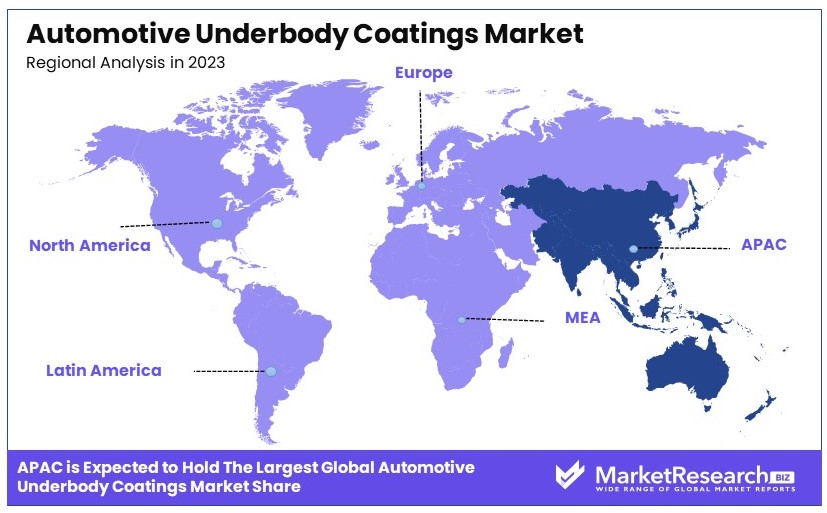

- Dominant Region: Asia Pacific leads with 44%, due to its automotive manufacturing base.

- Analyst Viewpoint: The market shows low saturation with steady competition, expected to grow with advancements in coating technologies.

- Growth Opportunities: Key players can capitalize on eco-friendly coatings and technological innovations to enhance market position.

Driving Factors

Increasing Demand for Vehicle Corrosion Protection Drives Market Growth

The automotive underbody coatings market is primarily driven by the need for effective corrosion protection. Underbody coatings serve as a shield against environmental elements like road salt, moisture, and debris, which are known to accelerate rusting. This need is especially pronounced in regions with severe winter conditions where road salts are commonly used.

As a result, both automobile manufacturers and owners are increasingly investing in underbody coatings to extend the longevity and maintain the value of vehicles. This growing demand significantly propels the market forward, as durable and efficient coatings become a critical requirement for vehicle maintenance and protection.

Stringent Environmental Regulations Drive Market Growth

The imposition of rigorous environmental regulations globally is a significant catalyst for the automotive underbody coatings market. These regulations demand the use of coatings that have minimal environmental impact, specifically those with low volatile organic compound (VOC) emissions.

The European Union’s End-of-Life Vehicles (ELV) Directive, for example, compels manufacturers to utilize environmentally friendly coatings. This regulatory pressure has accelerated the adoption of sustainable and compliant products, leading to innovation and expanded market opportunities in eco-friendly coatings, thereby driving market growth.

Technological Advancements Drive Market Growth

Technological innovations in the field of automotive coatings have greatly influenced the underbody coatings market. The development of coatings with superior durability, enhanced adhesion, and better corrosion resistance meets the evolving demands of the automotive industry for high-performance products.

Notably, the shift towards waterborne underbody coatings, recognized for their reduced environmental impact and superior performance characteristics compared to traditional solvent-based options, aligns with the increasing environmental concerns and regulatory standards. These advancements not only improve product offerings but also stimulate market growth by meeting both consumer preferences and regulatory requirements.

Restraining Factors

Volatility in Raw Material Prices Restrains Automotive Underbody Coatings Market Growth

Volatility in raw material prices significantly affects the automotive underbody coatings market. Key materials like resins, pigments, and additives see frequent price changes. For example, resin costs can spike with rising crude oil prices. These fluctuations increase production costs for manufacturers.

Higher costs are often passed on to consumers, making the final product more expensive. This can reduce demand for underbody coatings. Manufacturers struggle with budgeting and planning due to unpredictable material costs. The financial uncertainty can deter investment in new technologies and expansion efforts, slowing market growth.

Stringent Environmental Regulations Restrain Automotive Underbody Coatings Market Growth

Stringent environmental regulations pose challenges to the automotive underbody coatings market. Regulations like VOC emission limits and hazardous material restrictions are becoming stricter. For instance, the REACH regulation in the European Union restricts certain chemicals used in coatings.

Manufacturers must invest in developing eco-friendly alternatives to comply. This compliance can be costly and time-consuming. Failure to meet regulations can lead to penalties or market exclusion. The need to continuously adapt to changing regulations adds operational complexity. This regulatory pressure can slow innovation and production, limiting market growth.

Type Analysis

Aluminum dominates with 40% due to its lightweight properties and corrosion resistance.

In the automotive underbody coatings market, different materials such as bitumen, resin, steel, aluminum, magnesium, and other materials are used. Aluminum stands out as the leading sub-segment due to its lightweight nature and excellent corrosion resistance, which are crucial in enhancing fuel efficiency and vehicle longevity. This makes aluminum coatings particularly appealing in an industry increasingly focused on sustainability and performance.

Steel, traditionally favored for its strength and durability, remains significant but is gradually being overshadowed by aluminum billets due to weight considerations. Resin coatings are also essential, offering flexibility and protection against various environmental factors, though they are typically more prevalent in combination with other materials like aluminum for enhanced properties.

Magnesium and other innovative materials are emerging in the market, providing unique properties such as even greater weight reduction and advanced thermal management. These segments, though smaller in scale, are crucial for the development of next-generation automotive coatings.

The role of these remaining sub-segments in magnesium and innovative materials is particularly important in the growth of the market as they offer manufacturers new ways to meet stringent environmental regulations and consumer demands for higher performance and sustainability.

Material Type Analysis

Water-borne dominates with 55% due to its environmental friendliness and compliance with stringent regulations.

Material types in the automotive underbody coatings market include solvent-borne, water-borne, and powder. Water-borne coatings hold the dominant position in this segment, driven by increasing regulatory pressures worldwide to reduce volatile organic compound (VOC) emissions and their lower environmental impact. Water-borne technologies are advancing rapidly, offering comparable durability and protection as solvent-borne coatings but with a significantly reduced environmental footprint.

Solvent-borne coatings, although effective, are facing declining usage due to their higher VOC content and the stringent environmental regulations being enacted globally. However, they continue to be used in regions with less strict environmental standards or in applications where their performance advantages are indispensable.

Powder coatings are growing in popularity due to their advantages in terms of waste reduction and absence of VOC emissions. They are particularly favored in applications requiring a thick, durable finish, contributing to market growth by meeting specific performance criteria that liquid coatings might not fulfill.

The expansion of the powder segment demonstrates the industry's shift towards more sustainable and technologically advanced coating solutions, which will play a significant role in the overall market growth by offering enhanced properties such as durability and environmental sustainability.

Application Analysis

Corrosion Protection dominates with 50% due to its critical role in vehicle longevity and safety.

Applications of automotive underbody coatings are categorized into underbody protection, corrosion protection, noise reduction, heat management, and other applications. Corrosion protection is the most crucial, as it directly impacts the vehicle's durability and safety. The dominance of this segment is supported by the global rise in vehicle quality standards and consumer expectations for vehicle longevity, particularly in harsh weather regions.

Underbody protection also holds a significant share, providing a barrier against physical damage from rough terrains and road debris. This application is vital for off-road and utility vehicles, emphasizing the importance of robust protective coatings.

Noise reduction coatings are increasingly being applied as consumer demand for quieter vehicle interiors grows. These coatings are applied to reduce the noise from road contact, enhancing the comfort of vehicle interiors.

Heat management coatings are vital for maintaining optimal operating temperatures and protecting sensitive vehicle components from excessive heat. This segment is becoming increasingly important with the rise of electric vehicles, which require more sophisticated thermal management solutions.

The "other applications" category includes specialized coatings designed for specific purposes such as aesthetic enhancements or additional protective features. While smaller in market size, these applications are essential for addressing niche market needs and contributing to the innovation and diversification of the underbody coatings market.

Key Market Segments

Type

- Bitumen

- Resin

- Steel

- Aluminum

- Magnesium

- Other Materials

Material Type

- Solvent-borne

- Water-borne

- Powder

Application

- Underbody Protection

- Corrosion Protection

- Noise Reduction

- Heat Management

- Other Applications

Growth Opportunities

Development of Multi-functional Coatings Offers Growth Opportunity

The trend towards multi-functional underbody coatings offers significant growth opportunities. These advanced coatings provide additional benefits such as sound dampening, vibration control, and thermal insulation, beyond just corrosion protection.

For example, sound-dampening properties can improve the driving experience by reducing road noise inside the vehicle cabin. By integrating these multiple functions, manufacturers can offer enhanced products that meet diverse consumer needs. Investing in the development of such multi-functional coatings can help companies stand out in the competitive automotive market and drive growth.

Adoption of Sustainable and Bio-based Coatings Offers Growth Opportunity

The push for sustainability in the automotive industry opens growth opportunities for bio-based and sustainable underbody coatings. These coatings, derived from renewable sources like plant-based materials, provide an eco-friendly alternative to traditional coatings.

With increasing environmental concerns and stricter regulations, the demand for sustainable solutions is rising. Manufacturers investing in research and development of these eco-friendly coatings can tap into a growing market segment. By offering products that align with sustainability goals, companies can attract environmentally conscious consumers and expand their market share.

Trending Factors

Waterborne Underbody Coatings Are Trending Factors

Waterborne underbody coatings are becoming increasingly popular due to their low VOC emissions and eco-friendly nature. These coatings use water as the primary solvent, making them more environmentally sustainable compared to traditional solvent-based coatings.

As environmental regulations tighten, the demand for waterborne coatings is expected to rise. This trend highlights the industry's shift towards greener practices. By adopting waterborne coatings, manufacturers can meet regulatory requirements and cater to the growing consumer preference for sustainable products.

Automated Application Processes Are Trending Factors

The adoption of automated application processes for underbody coatings is a key trend in the automotive industry. Automated methods, such as robotic spraying, enhance efficiency, consistency, and cost-effectiveness.

These processes ensure uniform coverage and minimize material waste, which is particularly important in high-volume production facilities. By implementing automated application systems, manufacturers can improve production quality and reduce operational costs. This trend underscores the industry's focus on innovation and efficiency, driving overall market growth and competitiveness.

Regional Analysis

Asia Pacific Dominates with 44% Market Share in the Automotive Underbody Coatings Market

Asia Pacific's 44% share of the global automotive underbody coatings market is significantly influenced by its large automotive manufacturing base. Major automotive production countries like China, Japan, and South Korea contribute extensively to this dominance. The region's capacity for high-volume manufacturing, combined with lower production costs and abundant availability of raw materials, supports its leading position. Additionally, growing consumer demand for durable and high-quality vehicles in these populous nations further drives the market.

The automotive underbody coatings market in Asia Pacific is bolstered by rapid industrialization and increasing investments in automotive technologies. The region's emphasis on exporting automobiles to international markets also plays a crucial role. Furthermore, stringent regulations regarding vehicle safety and emissions standards in Asia Pacific countries push for advancements in coating technologies, enhancing overall market growth.

Regional Market Shares and Dynamics:

North America: North America accounts for about 25% of the market, driven by technological advancements and stringent regulations on vehicle protection and emissions. The presence of major automotive manufacturers and a focus on innovation in protective coatings support steady growth in this region.

Europe: Europe holds approximately 20% of the market share, with a strong emphasis on environmental sustainability influencing coating technologies. High standards for vehicle manufacturing and maintenance, along with a focus on luxury and performance vehicles, sustain its market position.

Middle East & Africa: This region captures around 6% of the market. Despite being smaller, there is potential growth due to increasing vehicle sales and industrial investments in countries like Saudi Arabia and the UAE.

Latin America: Latin America maintains about 5% of the market share. Growth is influenced by rising automotive production in countries like Brazil and Argentina and a growing demand for vehicle longevity and maintenance.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Automotive Underbody Coatings Market is shaped by several influential companies. BASF SE and PPG Industries, Inc. are leaders with their extensive product lines and innovative solutions. Their strong R&D capabilities and global presence give them a strategic advantage.

Axalta Coating Systems Ltd. and Akzo Nobel N.V. are notable for their advanced coating technologies and sustainable practices. They focus on providing high-performance coatings that meet environmental regulations.

Henkel AG & Co. KGaA and The Sherwin-Williams Company have a significant market influence due to their comprehensive product offerings and strong customer relationships. Their strategies include continuous innovation and expanding their market reach.

3M Company and Dow Inc. are known for their technological advancements and high-quality products. They leverage their expertise in materials science to offer durable and effective coatings.

Covestro AG and RPM International Inc. excel in specialty coatings, focusing on customized solutions for specific automotive needs. Their strategic positioning includes partnerships and collaborations to enhance their market presence.

Kansai Paint Co., Ltd. and Nippon Paint Holdings Co., Ltd. are significant players in the Asian market, leveraging their regional strengths and expanding globally. Sika AG and LORD Corporation focus on innovative bonding solutions and protective coatings, enhancing vehicle durability.

Wacker Chemie AG is noted for its silicone-based coatings, providing unique benefits in the market. The market features a blend of global leaders and specialized firms, each contributing to the market’s growth through innovation, sustainability, and strategic partnerships.

Market Key Players

- BASF SE

- PPG Industries, Inc.

- Axalta Coating Systems Ltd.

- Akzo Nobel N.V.

- Henkel AG & Co. KGaA

- The Sherwin-Williams Company

- 3M Company

- Dow Inc.

- Covestro AG

- RPM International Inc.

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Sika AG

- LORD Corporation

- Wacker Chemie AG

Recent Developments

- 2024: BASF has been actively involved in developing lightweight composite materials for automotive applications. Their new composite engine mounts and cross members offer a 50% weight reduction compared to traditional aluminum parts, enhancing vehicle efficiency and reducing front axle load.

- 2024: PPG Industries introduced a range of Corashield underbody coatings designed for exceptional protection against stones, road debris, and other elements. These coatings are formulated to provide long-term protection from corrosion and rust, tailored to meet the specific needs of various OEM production environments.

Report Scope

Report Features Description Market Value (2023) USD 1.9 Billion Forecast Revenue (2033) USD 2.3 Billion CAGR (2024-2033) 2.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bitumen, Resin, Steel, Aluminum, Magnesium, Other Materials), By Material Type (Solvent-borne, Water-borne, Powder), By Application (Underbody Protection, Corrosion Protection, Noise Reduction, Heat Management, Other Applications) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, PPG Industries, Inc., Axalta Coating Systems Ltd., Akzo Nobel N.V., Henkel AG & Co. KGaA, The Sherwin-Williams Company, 3M Company, Dow Inc., Covestro AG, RPM International Inc., Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Sika AG, LORD Corporation, Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Automotive Underbody Coatings Market Overview

- 2.1. Automotive Underbody Coatings Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Automotive Underbody Coatings Market Dynamics

- 3. Global Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Automotive Underbody Coatings Market Analysis, 2016-2021

- 3.2. Global Automotive Underbody Coatings Market Opportunity and Forecast, 2023-2032

- 3.3. Global Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 3.3.1. Global Automotive Underbody Coatings Market Analysis by Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 3.3.3. Bitumen

- 3.3.4. Resin

- 3.3.5. Steel

- 3.3.6. Aluminum

- 3.3.7. Magnesium

- 3.3.8. Other Materials

- 3.4. Global Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Material Type, 2016-2032

- 3.4.1. Global Automotive Underbody Coatings Market Analysis by Material Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type, 2016-2032

- 3.4.3. Solvent-borne

- 3.4.4. Water-borne

- 3.4.5. Powder

- 3.5. Global Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.5.1. Global Automotive Underbody Coatings Market Analysis by Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.5.3. Underbody Protection

- 3.5.4. Corrosion Protection

- 3.5.5. Noise Reduction

- 3.5.6. Heat Management

- 3.5.7. Other Applications

- 4. North America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Automotive Underbody Coatings Market Analysis, 2016-2021

- 4.2. North America Automotive Underbody Coatings Market Opportunity and Forecast, 2023-2032

- 4.3. North America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 4.3.1. North America Automotive Underbody Coatings Market Analysis by Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 4.3.3. Bitumen

- 4.3.4. Resin

- 4.3.5. Steel

- 4.3.6. Aluminum

- 4.3.7. Magnesium

- 4.3.8. Other Materials

- 4.4. North America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Material Type, 2016-2032

- 4.4.1. North America Automotive Underbody Coatings Market Analysis by Material Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type, 2016-2032

- 4.4.3. Solvent-borne

- 4.4.4. Water-borne

- 4.4.5. Powder

- 4.5. North America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.5.1. North America Automotive Underbody Coatings Market Analysis by Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.5.3. Underbody Protection

- 4.5.4. Corrosion Protection

- 4.5.5. Noise Reduction

- 4.5.6. Heat Management

- 4.5.7. Other Applications

- 4.6. North America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Automotive Underbody Coatings Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Automotive Underbody Coatings Market Analysis, 2016-2021

- 5.2. Western Europe Automotive Underbody Coatings Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 5.3.1. Western Europe Automotive Underbody Coatings Market Analysis by Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 5.3.3. Bitumen

- 5.3.4. Resin

- 5.3.5. Steel

- 5.3.6. Aluminum

- 5.3.7. Magnesium

- 5.3.8. Other Materials

- 5.4. Western Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Material Type, 2016-2032

- 5.4.1. Western Europe Automotive Underbody Coatings Market Analysis by Material Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type, 2016-2032

- 5.4.3. Solvent-borne

- 5.4.4. Water-borne

- 5.4.5. Powder

- 5.5. Western Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.5.1. Western Europe Automotive Underbody Coatings Market Analysis by Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.5.3. Underbody Protection

- 5.5.4. Corrosion Protection

- 5.5.5. Noise Reduction

- 5.5.6. Heat Management

- 5.5.7. Other Applications

- 5.6. Western Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Automotive Underbody Coatings Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Automotive Underbody Coatings Market Analysis, 2016-2021

- 6.2. Eastern Europe Automotive Underbody Coatings Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 6.3.1. Eastern Europe Automotive Underbody Coatings Market Analysis by Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 6.3.3. Bitumen

- 6.3.4. Resin

- 6.3.5. Steel

- 6.3.6. Aluminum

- 6.3.7. Magnesium

- 6.3.8. Other Materials

- 6.4. Eastern Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Material Type, 2016-2032

- 6.4.1. Eastern Europe Automotive Underbody Coatings Market Analysis by Material Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type, 2016-2032

- 6.4.3. Solvent-borne

- 6.4.4. Water-borne

- 6.4.5. Powder

- 6.5. Eastern Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.5.1. Eastern Europe Automotive Underbody Coatings Market Analysis by Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.5.3. Underbody Protection

- 6.5.4. Corrosion Protection

- 6.5.5. Noise Reduction

- 6.5.6. Heat Management

- 6.5.7. Other Applications

- 6.6. Eastern Europe Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Automotive Underbody Coatings Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Automotive Underbody Coatings Market Analysis, 2016-2021

- 7.2. APAC Automotive Underbody Coatings Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 7.3.1. APAC Automotive Underbody Coatings Market Analysis by Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 7.3.3. Bitumen

- 7.3.4. Resin

- 7.3.5. Steel

- 7.3.6. Aluminum

- 7.3.7. Magnesium

- 7.3.8. Other Materials

- 7.4. APAC Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Material Type, 2016-2032

- 7.4.1. APAC Automotive Underbody Coatings Market Analysis by Material Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type, 2016-2032

- 7.4.3. Solvent-borne

- 7.4.4. Water-borne

- 7.4.5. Powder

- 7.5. APAC Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.5.1. APAC Automotive Underbody Coatings Market Analysis by Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.5.3. Underbody Protection

- 7.5.4. Corrosion Protection

- 7.5.5. Noise Reduction

- 7.5.6. Heat Management

- 7.5.7. Other Applications

- 7.6. APAC Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Automotive Underbody Coatings Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Automotive Underbody Coatings Market Analysis, 2016-2021

- 8.2. Latin America Automotive Underbody Coatings Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 8.3.1. Latin America Automotive Underbody Coatings Market Analysis by Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 8.3.3. Bitumen

- 8.3.4. Resin

- 8.3.5. Steel

- 8.3.6. Aluminum

- 8.3.7. Magnesium

- 8.3.8. Other Materials

- 8.4. Latin America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Material Type, 2016-2032

- 8.4.1. Latin America Automotive Underbody Coatings Market Analysis by Material Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type, 2016-2032

- 8.4.3. Solvent-borne

- 8.4.4. Water-borne

- 8.4.5. Powder

- 8.5. Latin America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.5.1. Latin America Automotive Underbody Coatings Market Analysis by Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.5.3. Underbody Protection

- 8.5.4. Corrosion Protection

- 8.5.5. Noise Reduction

- 8.5.6. Heat Management

- 8.5.7. Other Applications

- 8.6. Latin America Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Automotive Underbody Coatings Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Automotive Underbody Coatings Market Analysis, 2016-2021

- 9.2. Middle East & Africa Automotive Underbody Coatings Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Type, 2016-2032

- 9.3.1. Middle East & Africa Automotive Underbody Coatings Market Analysis by Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Type, 2016-2032

- 9.3.3. Bitumen

- 9.3.4. Resin

- 9.3.5. Steel

- 9.3.6. Aluminum

- 9.3.7. Magnesium

- 9.3.8. Other Materials

- 9.4. Middle East & Africa Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Material Type, 2016-2032

- 9.4.1. Middle East & Africa Automotive Underbody Coatings Market Analysis by Material Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Material Type, 2016-2032

- 9.4.3. Solvent-borne

- 9.4.4. Water-borne

- 9.4.5. Powder

- 9.5. Middle East & Africa Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.5.1. Middle East & Africa Automotive Underbody Coatings Market Analysis by Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.5.3. Underbody Protection

- 9.5.4. Corrosion Protection

- 9.5.5. Noise Reduction

- 9.5.6. Heat Management

- 9.5.7. Other Applications

- 9.6. Middle East & Africa Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Automotive Underbody Coatings Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Automotive Underbody Coatings Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Automotive Underbody Coatings Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Automotive Underbody Coatings Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. BASF SE

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. PPG Industries, Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Axalta Coating Systems Ltd.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Akzo Nobel N.V.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Henkel AG & Co. KGaA

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. The Sherwin-Williams Company

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. 3M Company

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Dow Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Covestro AG

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. RPM International Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Kansai Paint Co., Ltd.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Sika AG

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. LORD Corporation

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Wacker Chemie AG

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Type in 2022

- Figure 2: Global Automotive Underbody Coatings Market Attractiveness Analysis by Type, 2016-2032

- Figure 3: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Material Typein 2022

- Figure 4: Global Automotive Underbody Coatings Market Attractiveness Analysis by Material Type, 2016-2032

- Figure 5: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 6: Global Automotive Underbody Coatings Market Attractiveness Analysis by Application, 2016-2032

- Figure 7: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Automotive Underbody Coatings Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 12: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Figure 13: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 14: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 16: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Figure 17: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 18: Global Automotive Underbody Coatings Market Share Comparison by Region (2016-2032)

- Figure 19: Global Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Figure 20: Global Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Figure 21: Global Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Figure 22: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 23: North America Automotive Underbody Coatings Market Attractiveness Analysis by Type, 2016-2032

- Figure 24: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Material Typein 2022

- Figure 25: North America Automotive Underbody Coatings Market Attractiveness Analysis by Material Type, 2016-2032

- Figure 26: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 27: North America Automotive Underbody Coatings Market Attractiveness Analysis by Application, 2016-2032

- Figure 28: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Automotive Underbody Coatings Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 33: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Figure 34: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 35: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 37: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Figure 38: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 39: North America Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Figure 40: North America Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Figure 41: North America Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Figure 42: North America Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Figure 43: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 44: Western Europe Automotive Underbody Coatings Market Attractiveness Analysis by Type, 2016-2032

- Figure 45: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Material Typein 2022

- Figure 46: Western Europe Automotive Underbody Coatings Market Attractiveness Analysis by Material Type, 2016-2032

- Figure 47: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 48: Western Europe Automotive Underbody Coatings Market Attractiveness Analysis by Application, 2016-2032

- Figure 49: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Automotive Underbody Coatings Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 54: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Figure 55: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 56: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 58: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Figure 59: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 60: Western Europe Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Figure 62: Western Europe Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Figure 63: Western Europe Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Figure 64: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 65: Eastern Europe Automotive Underbody Coatings Market Attractiveness Analysis by Type, 2016-2032

- Figure 66: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Material Typein 2022

- Figure 67: Eastern Europe Automotive Underbody Coatings Market Attractiveness Analysis by Material Type, 2016-2032

- Figure 68: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 69: Eastern Europe Automotive Underbody Coatings Market Attractiveness Analysis by Application, 2016-2032

- Figure 70: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Automotive Underbody Coatings Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 75: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Figure 76: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 77: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 79: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Figure 80: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 81: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Figure 83: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Figure 84: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Figure 85: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 86: APAC Automotive Underbody Coatings Market Attractiveness Analysis by Type, 2016-2032

- Figure 87: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Material Typein 2022

- Figure 88: APAC Automotive Underbody Coatings Market Attractiveness Analysis by Material Type, 2016-2032

- Figure 89: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 90: APAC Automotive Underbody Coatings Market Attractiveness Analysis by Application, 2016-2032

- Figure 91: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Automotive Underbody Coatings Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 96: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Figure 97: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 98: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 100: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Figure 101: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 102: APAC Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Figure 104: APAC Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Figure 105: APAC Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Figure 106: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 107: Latin America Automotive Underbody Coatings Market Attractiveness Analysis by Type, 2016-2032

- Figure 108: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Material Typein 2022

- Figure 109: Latin America Automotive Underbody Coatings Market Attractiveness Analysis by Material Type, 2016-2032

- Figure 110: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 111: Latin America Automotive Underbody Coatings Market Attractiveness Analysis by Application, 2016-2032

- Figure 112: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Automotive Underbody Coatings Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 117: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Figure 118: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 119: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 121: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Figure 122: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 123: Latin America Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Figure 125: Latin America Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Figure 126: Latin America Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Figure 127: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Typein 2022

- Figure 128: Middle East & Africa Automotive Underbody Coatings Market Attractiveness Analysis by Type, 2016-2032

- Figure 129: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Material Typein 2022

- Figure 130: Middle East & Africa Automotive Underbody Coatings Market Attractiveness Analysis by Material Type, 2016-2032

- Figure 131: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 132: Middle East & Africa Automotive Underbody Coatings Market Attractiveness Analysis by Application, 2016-2032

- Figure 133: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Automotive Underbody Coatings Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Figure 138: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Figure 139: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 140: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Figure 142: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Figure 143: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 144: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Figure 146: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Figure 147: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- List of Tables

- Table 1: Global Automotive Underbody Coatings Market Comparison by Type (2016-2032)

- Table 2: Global Automotive Underbody Coatings Market Comparison by Material Type (2016-2032)

- Table 3: Global Automotive Underbody Coatings Market Comparison by Application (2016-2032)

- Table 4: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 8: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Table 9: Global Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 10: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 12: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Table 13: Global Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 14: Global Automotive Underbody Coatings Market Share Comparison by Region (2016-2032)

- Table 15: Global Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Table 16: Global Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Table 17: Global Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Table 18: North America Automotive Underbody Coatings Market Comparison by Material Type (2016-2032)

- Table 19: North America Automotive Underbody Coatings Market Comparison by Application (2016-2032)

- Table 20: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 24: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Table 25: North America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 26: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 28: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Table 29: North America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 30: North America Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Table 31: North America Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Table 32: North America Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Table 33: North America Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Table 34: Western Europe Automotive Underbody Coatings Market Comparison by Type (2016-2032)

- Table 35: Western Europe Automotive Underbody Coatings Market Comparison by Material Type (2016-2032)

- Table 36: Western Europe Automotive Underbody Coatings Market Comparison by Application (2016-2032)

- Table 37: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 41: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Table 42: Western Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 43: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 45: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Table 46: Western Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 47: Western Europe Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Table 49: Western Europe Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Table 50: Western Europe Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Table 51: Eastern Europe Automotive Underbody Coatings Market Comparison by Type (2016-2032)

- Table 52: Eastern Europe Automotive Underbody Coatings Market Comparison by Material Type (2016-2032)

- Table 53: Eastern Europe Automotive Underbody Coatings Market Comparison by Application (2016-2032)

- Table 54: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 58: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Table 59: Eastern Europe Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 60: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 62: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Table 63: Eastern Europe Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 64: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Table 66: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Table 67: Eastern Europe Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Table 68: APAC Automotive Underbody Coatings Market Comparison by Type (2016-2032)

- Table 69: APAC Automotive Underbody Coatings Market Comparison by Material Type (2016-2032)

- Table 70: APAC Automotive Underbody Coatings Market Comparison by Application (2016-2032)

- Table 71: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 75: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Table 76: APAC Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 77: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 79: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Table 80: APAC Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 81: APAC Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Table 82: APAC Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Table 83: APAC Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Table 84: APAC Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Table 85: Latin America Automotive Underbody Coatings Market Comparison by Type (2016-2032)

- Table 86: Latin America Automotive Underbody Coatings Market Comparison by Material Type (2016-2032)

- Table 87: Latin America Automotive Underbody Coatings Market Comparison by Application (2016-2032)

- Table 88: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 92: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Table 93: Latin America Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 94: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 96: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Table 97: Latin America Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 98: Latin America Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Table 100: Latin America Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Table 101: Latin America Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- Table 102: Middle East & Africa Automotive Underbody Coatings Market Comparison by Type (2016-2032)

- Table 103: Middle East & Africa Automotive Underbody Coatings Market Comparison by Material Type (2016-2032)

- Table 104: Middle East & Africa Automotive Underbody Coatings Market Comparison by Application (2016-2032)

- Table 105: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Type (2016-2032)

- Table 109: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Material Type (2016-2032)

- Table 110: Middle East & Africa Automotive Underbody Coatings Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 111: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Type (2016-2032)

- Table 113: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Material Type (2016-2032)

- Table 114: Middle East & Africa Automotive Underbody Coatings Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 115: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Type (2016-2032)

- Table 117: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Material Type (2016-2032)

- Table 118: Middle East & Africa Automotive Underbody Coatings Market Share Comparison by Application (2016-2032)

- 1. Executive Summary

-

- BASF SE

- PPG Industries, Inc.

- Axalta Coating Systems Ltd.

- Akzo Nobel N.V.

- Henkel AG & Co. KGaA

- The Sherwin-Williams Company

- 3M Company

- Dow Inc.

- Covestro AG

- RPM International Inc.

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Sika AG

- LORD Corporation

- Wacker Chemie AG