Global Bitumen Market Report By Product (Paving Grade, Hard Grade, and Others), and By Application (Road Construction, Waterproofing, and Other), and By End-User (Non-Residential, Residential and Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

3030

-

May 2023

-

159

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

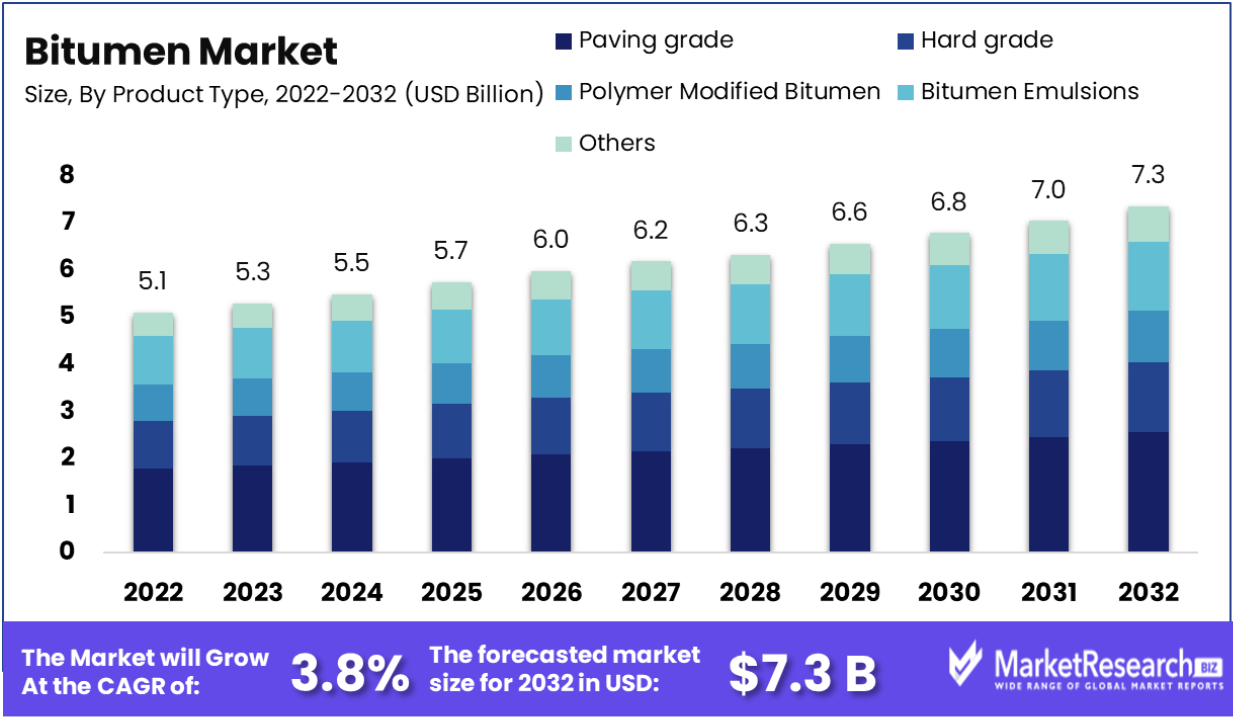

Bitumen Market size is expected to be worth around USD 7.3 Bn by 2032 from USD 5.1 Bn in 2022, growing at a CAGR of 3.8% during the forecast period from 2023 to 2032.

Bitumen is primarily used to create asphalt, which is then used in road building. It creates a strong bond with the rock particles, giving the finished asphalt strength and stability. Depending on the precise type of bitumen used or the makeup of the mixture, this adaptable material enables the modification of asphalt roads to fit diverse climatic conditions and operational requirements.

Asphalt is typically used in the construction of vital infrastructure such airport runways, parking garages, and port working spaces. The construction of roads, along with infrastructure like parking garages and airport runways, has a substantial impact on a country's economic development. These networks play a crucial role in facilitating commerce and movement, which boosts economic activity. As a result, significant investments are required for the renovation and maintenance of these vital infrastructures.

Increased government spending and policies intended to expand roads and infrastructure, particularly via the use of Public-Private Partnership models, are poised to direct the trajectory of the bitumen market. These programs support the use of bituminous materials in the maintenance and road building sectors, particularly in developing nations where the rapid growth of infrastructure and the construction of new industrial facilities drive up product demand.

However, the market's expansion is constrained by the growing preference for cement over other materials for building roads, which is being prompted by growing environmental worries and the expensive maintenance costs of bitumen-based roads. Increased Purchase Power Parity (PPP) in emerging nations has led to an increase in global vehicle traffic, which calls for a larger road network with more lanes to handle peak-hour congestion.

Major contractors have started interacting directly with refineries as a result of market volatility brought on by the drop in oil prices and the ensuing scarcity of raw materials. Additionally, among stringent regulatory measures, such REACH laws, that control the business, the development of bio-based bitumen is being investigated as a viable path for expansion.

In the future, the bitumen market will have to comply with strict environmental rules that control its applications and production procedures. The observance of occupational exposure limits, which have been established in nations like Australia, China, Belgium, and France, will be crucial in determining how the industry operates. Price changes for oil and petrochemicals will continue to have an impact on market price dynamics.

Key Takeaways

- Bitumen market initially declined due to COVID-19 disruptions, with major construction projects halted.

- Near-term growth expected from increased road construction activities, demand in building sector for filler, adhesive, and sealant applications.

- Environmental concerns over bitumen's emissions pose a significant market expansion challenge.

- High-performance bitumen products like Shell Cariphalte and Shell Mexphalte hold promise for future market growth.

Driving Factors

Increasing Government Infrastructure Investments

Governments around the world are investing heavily on infrastructure development, particularly road construction activities. This increased investment is a major growth driver for the bitumen sector. The growth and modernisation of roads, bridges, and airports are directly driving up demand for bitumen, which is a critical component in asphalt and improves road resilience and lifetime.

Rising need for Sustainable Construction Materials

As environmental awareness grows, so does the need for eco-friendly building materials. Bitumen, particularly polymer-modified forms, improves the sustainability and endurance of road surfaces. This growing inclination for environmentally friendly solutions positions bitumen as a viable option, fuelling market expansion.

Rapid Development and Population Growth

Rapid urbanization, particularly in emerging economies, necessitates more infrastructure development. Roads, apartment complexes, and commercial places are all included. Bitumen, a critical component in many building applications, is in high demand, particularly in places experiencing rapid urbanization.

Restraining Factors

Competing Materials, such as Cement

Different materials, particularly cement, compete in the road construction industry. Cement is preferred because it has a longer lifespan and requires less maintenance. The bitumen market has to address this issue by emphasizing its distinct advantages and constantly innovating to increase competitiveness.

Price Volatility as a Result of Raw Material Dependence

The bitumen market is driven by fluctuations in crude oil prices, which are a main raw material. This fluctuation has an impact on production costs, resulting in market instability. To mitigate this, industry participants must investigate cost-effective procurement options as well as different supplies or production methods.

By Product Type

e Bitumen Market encompasses various product types, with paving grade being a dominant sector. Bitumen serves as a vital binding agent in asphalt concrete for roads, national highways, and runways. Additionally, it's crucial in producing industrial goods like roofing materials and adhesives.

Paving grade bitumen, prized for its durability and traffic resistance, is extensively used in construction, driven by infrastructure needs in emerging economies. Moreover, Bitumen emulsion is rising due to eco-friendly construction methods, while polymer modified bitumen meets demand for durable road surfaces, notably in North America and Europe.

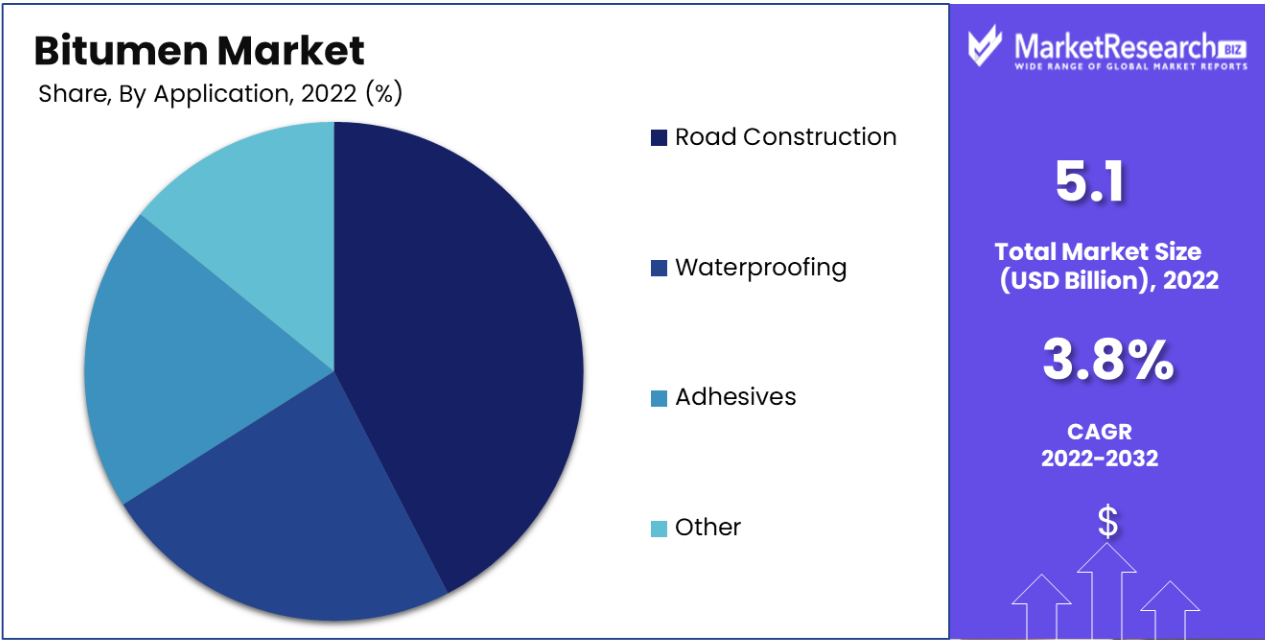

By Application Type

The road construction sector emerged as the dominant application type in the global market in 2022, and it is expected to grow at a stable rate of 4.2% throughout the forecast period. Government investment in infrastructure projects such as roads, bridges, and tunnels has increased demand in this sector.

The Indian government has prioritized infrastructure development as a main driver of economic growth. Creating a competent and well-connected road network is critical for increasing connectivity, enabling trade, and deepening regional integration. Notable government efforts, such as the Bharatmala Pariyojana and the Pradhan Mantri Gram Sadak Yojana, are aimed squarely at expanding and modernizing the nation's road infrastructure, assuring long-term growth in this arena.

Waterproofing is the second-largest global use, with bitumen being used to protect structures such as roofs, basements, and building foundations. Demand in this area is being driven by a growing emphasis on eco-friendly and energy-efficient structures, as well as increased construction activity in emerging nations. Bitumen-based adhesives are seeing significant growth, particularly in the construction industry for fastening insulation, flooring, and roofing felt. They are highly favoured because to their tremendous adhesive strength and water resistance.

By End-User Type

In the dynamic landscape of the bitumen market, the non-residential segment stands as a dominant force. This sector encompasses a wide array of applications, including commercial infrastructure, industrial facilities, transportation networks, and public works projects. The dominance of the non-residential segment can be attributed to the continuous expansion of urban centers and the increasing demand for robust and durable construction materials.

However, the residential segment is also poised for growth in the bitumen market. As more individuals and families seek housing solutions, especially in urban areas, the demand for durable and aesthetically appealing residential infrastructure has increased. Bitumen's versatility and durability make it an ideal choice for residential applications like driveways, roofing, and decorative surfaces.

Key Market Segments

By Product Type

- Paving grade

- Hard grade

- Polymer Modified Bitumen

- Bitumen Emulsions

- Others

By Application Type

- Road Construction

- Waterproofing

- Adhesives

- Other

By End User Type

- Non-Residential

- Residential

- Other

Growth Opportunities

Bitumen Production Technological Advancements

Ongoing research and development in bitumen production processes, particularly bio-based bitumen, presents a substantial opportunity. These advancements have the potential to lead to more sustainable and cost-effective solutions, hence enhancing the market's potential.

Asia-Pacific and African Emerging Markets

Rapid economic expansion in places such as Asia-Pacific and Africa is driving massive infrastructure construction. This increase in construction activity presents a significant potential for the bitumen business to expand its footprint in these high-growth markets.

Higher Demand for Polymer-Modified Bitumen

Due to its improved qualities, polymer-modified bitumen is in great demand, particularly in applications requiring higher performance standards. The market can capitalize on this trend by focusing on R&D to provide specialized goods that cater to certain construction demands.

Strategic Partnerships and Collaborations

Partnerships between bitumen manufacturers, contractors, and governments can lead to innovation and enhanced infrastructure solutions. PPPs can also provide a platform for long-term market expansion.

Latest Trends

Sustainable and environmentally friendly solutions

Growing environmental consciousness is fuelling demand for long-lasting bitumen products. Greener alternatives include the development of bio-based bitumen and recycling activities for spent bitumen. This shift in demand is not only for economic reasons but also because it aligns with the global efforts to reduce the carbon footprint of construction and infrastructure projects.

Advances in Bitumen Production Technology

Continuous advancements in bitumen production technology, such as the incorporation of polymer-modified bitumen, have revolutionized the industry. These innovations enhance product quality and performance, making bitumen more versatile and adaptable for various applications. Furthermore, advanced refining processes have led to the creation of customized bitumen grades tailored to meet the specific requirements of different construction and infrastructure projects.

Concentration on High-Performance Bitumen Products

Growing demand for specialty bitumen variations such as Shell Cariphalte and Shell Mexphalte, which are known for their improved characteristics and performance in demanding applications. The construction and infrastructure sectors are increasingly relying on such high-quality bitumen to ensure the longevity and durability of their projects.

Digital Technology Integration in the Bitumen Supply Chain

Digital systems for procurement, logistics, and inventory management improve supply chain efficiency. Moreover, the adoption of Internet of Things (IoT) applications allows real-time monitoring of bitumen storage conditions, ensuring product quality is maintained throughout its lifecycle. This technological integration not only enhances efficiency but also provides valuable data for decision-making and quality control within the industry.

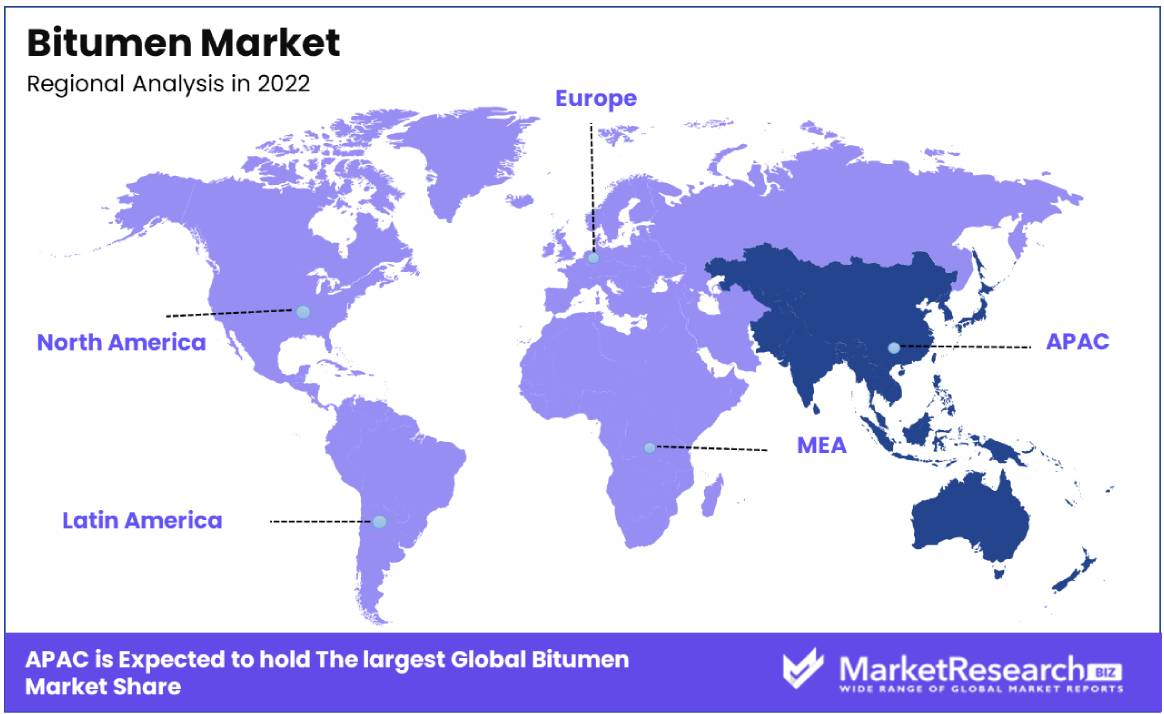

Regional Analysis

In terms of regional analysis, the Global Bitumen Market is divided into North America, Europe, Asia Pacific, and the Rest of the World. Notably, the Asia-Pacific region has the greatest market share worldwide. This significance is largely owed to China, which has the region's largest economy. While China's economic development continues healthy, there is a perceptible shift taking place as the population ages and the economy shifts from investment to consumption, manufacturing to services, and external to internal demand.

The Asia-Pacific area, driven by China and India, is seeing a population boom as well as an increase in living standards. This rise in traffic has resulted in higher traffic demands around the world, necessitating the construction of strong infrastructure such as flyovers and heavy-duty roadways. To fulfil these demands, there is also a rising emphasis on extending existing highways.

Furthermore, both North America and Europe are seeing an increase in the number of property rehabilitation projects and the use of innovative construction methods, particularly those employing waterproofed flat roofs. This trend is projected to boost demand for bitumen products in these locations significantly.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

The global bitumen market is highly consolidated, with a few important players controlling a sizable portion of the revenue. These businesses are gaining a competitive advantage and expanding their market presence through diverse methods such as mergers and acquisitions, joint ventures, partnerships, and product launches.

Furthermore, product launches and innovation are key drivers of competitiveness in the bitumen market. Major players invest heavily in research and development to create advanced bitumen products that cater to evolving customer demands. They focus on enhancing product quality, durability, and sustainability to meet the stringent requirements of modern construction and infrastructure projects. The ability to offer a diverse range of high-performance bitumen products is a crucial factor in staying competitive.

Key Players in Bitumen Market

- Valero Energy Corporation (US)

- NuStar Energy L.P (US)

- Suncor Energy Inc, (Canada)

- Athabasca Oil Corporation (Canada)

- Imperial Oil Limited (Canada)

- Syncrude Canada Ltd. (Canada)

- Indian Oil Corporation Ltd (India)

- ENEOS Corporation (Japan)

- Exxon Mobil Corporation (US)

- Shell Bitumen (UK)

- Petróleos Mexicanos (Mexico)

- Nynas AB (Sweden)

- Marathon Oil Company (US)

- Bp p.l.c (UK)

- JX Nippon Oil & Energy Corporation

- Royal Dutch Shell plc (UK)

- Total Energy (France)

- Sinopec Corporation (China)

- Chevron Corporation (US)

- Bouygues Groups (France)

- Villas Austria GmbH (Austria)

- Gazprom- Neft (Russia)

- Sasol Ltd.

Recent Development

- On April 2023, Suncor Energy Inc. announced its acquisition of TotalEnergies' stake in the Fort Hills oilsands project for up to $6.1 billion. This deal will give Suncor complete ownership of Fort Hills, further consolidating its presence in Alberta's oilsands. The agreement with Suncor marks the exit of TotalEnergies from the Canadian oilsands.

- On February 2023, Saint-Gobain North America, through CertainTeed Roofing, has acquired the rights to technology from Asphaltica. Saint-Gobain's adoption of this technology supports the Asphalt Roofing Manufacturing Association’s (ARMA) objectives to reduce landfill disposal of asphalt-based roofing materials to 50% by 2035 and approach 0% by 2050.

- On December 2022, Sanmit Infra Ltd. has expanded its business operations by introducing the supply of Bitumen in Drum packaging in the state of Orissa. This move complements their existing bulk bitumen business, providing more packaging options for their customers.

- In 2021, ExxonMobil introduced a new line of bitumen products named the "ExxonMobil Bitumen Advantage" series. These items are intended to improve performance and durability in road construction applications.

Report Scope

Report Features Description Market Value (2022) US$ 5.1 Bn Forecast Revenue (2032) US$ 7.3 Bn CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Paving Grade, Hard Grade, Polymer Modified Bitumen, Bitumen Emulsions and Others), and By Application (Road Construction, Waterproofing, Adhesives and Other), and By End-User (Non-Residential, Residential and Other) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Valero Energy Corporation (US), NuStar Energy L.P (US), Suncor Energy Inc (Canada), Athabasca Oil Corporation (Canada), Imperial Oil Limited (Canada), Syncrude Canada Ltd (Canada), Indian Oil Corporation Ltd (India), ENEOS Corporation (Japan), Exxon Mobil Corporation (US), Shell Bitumen (UK), Petróleos Mexicanos (Mexico), JX Nippon Oil & Energy Corporation, Nynas AB (Sweden), Marathon Oil Company (US), Bp p.l.c (UK), Royal Dutch Shell plc (UK), Total Energy (France), Sinopec Corporation (China), Chevron Corporation (US), Bouygues Groups (France), Villas Austria GmbH (Austria), Gazprom- Neft (Russia), Sasol Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Valero (US)

- NuStar Energy L.P (US)

- Suncor Energy Inc, (Canada)

- Athabasca Oil Corporation (Canada)

- Imperial Oil Limited (Canada)

- Syncrude Canada Ltd. (Canada)

- Indian Oil Corporation Ltd (India)

- ENEOS Corporation (Japan)

- ExxonMobil Corporation (US)

- Shell Bitumen (UK)

- Petróleos Mexicanos (Mexico)

- Nynas AB (Sweden)

- Marathon Oil Company (US)

- Bp p.l.c (UK)

- Royal Dutch Shell plc (UK)

- Total Energy (France)

- Sinopec Corporation (China)

- Chevron Corporation (US)

- Bouygues Groups (France)

- Villas Austria GmbH (Austria)

- Gazprom- Neft (Russia)