Artificial Intelligence In Construction Market By Component (Solutions, Services), By Deployment Type (Cloud, On-premises), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large enterprises), By Applications (Project Management, Risk Management, Schedule Management, Supply Chain Management), By End-User (Residential, Public Infrastructure, Heavy Construction)

-

45916

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Component Analysis

- By Deployment Type Analysis

- By Organization Size Analysis

- By Applications Analysis

- By End-User Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

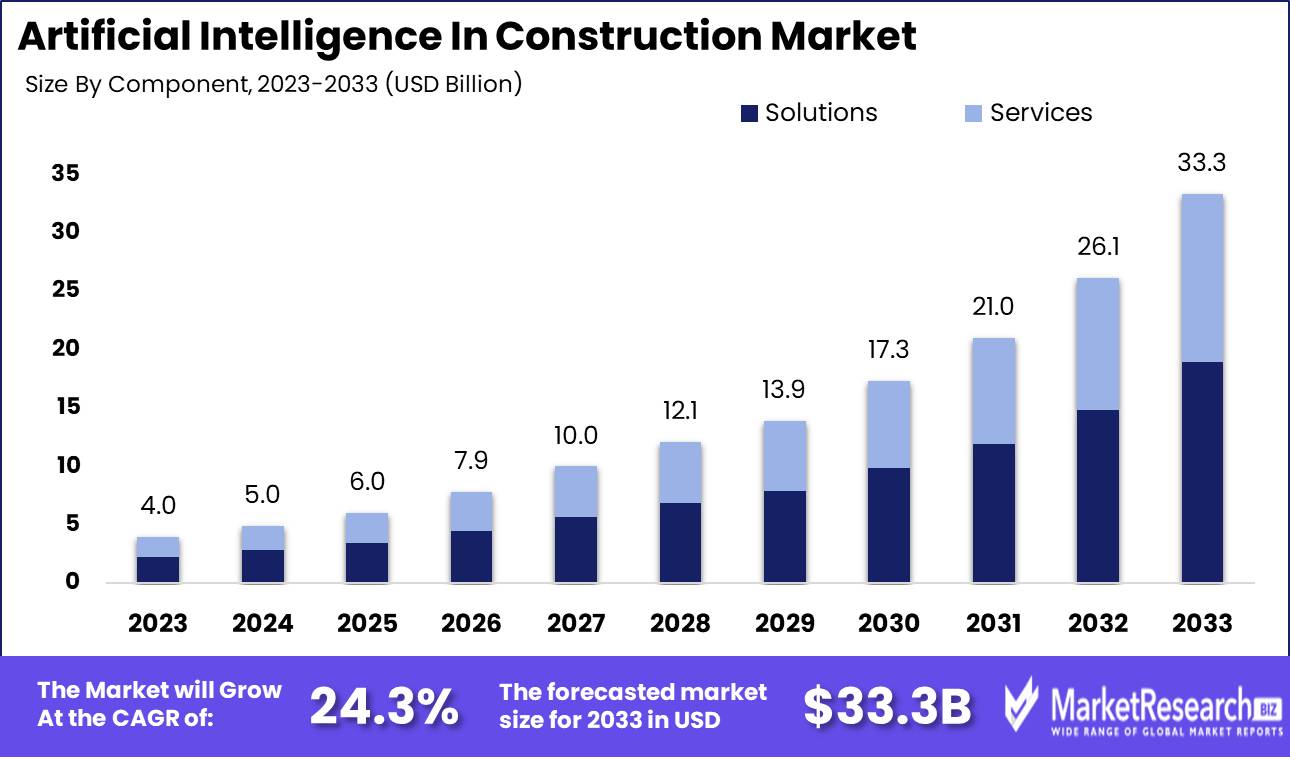

The Artificial Intelligence in Construction Market size is estimated at USD 4.0 billion in 2023 and is expected to reach USD 33.3 billion by 2033, growing at a CAGR of 24.31% during the forecast period 2024-2033.

Artificial Intelligence in Construction Market refers to the strategic integration of AI technologies within the construction sector to enhance operational efficiency, improve safety, and reduce costs. This market encompasses a range of applications from automated equipment and robotics to predictive analytics and intelligent project management solutions. AI-driven tools assist in optimizing resource allocation, monitoring project timelines, and foreseeing potential delays through data-driven insights. As the construction industry seeks to address complex challenges such as labor shortages and stringent regulatory demands, AI serves as a transformative force, propelling productivity and innovation, thereby offering a competitive edge in a rapidly evolving market landscape.

Artificial intelligence is revolutionizing the construction industry by enhancing efficiency, safety, and decision-making processes. AI technologies, including machine learning, natural language processing, and robotics, are increasingly integrated into various construction phases, from pre-construction risk assessment to on-site execution. This integration facilitates precise planning, real-time problem-solving, and predictive maintenance, thereby reducing costs and project delays while improving compliance and safety standards.

One significant application is Building Information Modeling (BIM), which utilizes AI algorithms to create 3D models, enabling stakeholders to visualize projects comprehensively. AI-driven predictive analytics assist in project scheduling, resource allocation, and risk assessment, thereby reducing delays and cost overruns. Drones and autonomous vehicles equipped with AI navigate construction sites for surveying, inspection, and data collection, expediting once time-consuming tasks.

Safety also receives a boost through AI with the ability to analyze data to predict potential hazards and ensure compliance with safety protocols. Quality control benefits from AI-powered image recognition systems that identify defects in real time. Additionally, AI-driven energy management systems optimize resource usage in buildings, fostering sustainability.

Market projections indicate sustained growth as construction companies increasingly recognize AI's potential to streamline operations and minimize errors. However, challenges such as data privacy, integration complexities, and the need for upskilling the workforce persist. As AI continues to evolve, the construction industry stands to gain enhanced productivity, reduced costs, and safer work environments.

Key Takeaways

- Market Growth: The Artificial Intelligence in Construction Market size is estimated at USD 4.0 billion in 2023 and is expected to reach USD 33.3 billion by 2033, growing at a CAGR of 24.31% during the forecast period 2024-2033.

- By Component: AI solutions lead in construction, enhancing efficiency and reducing costs.

- By Deployment Type: Cloud deployment dominates AI in construction for efficiency and scalability.

- By Organization Size: Small and Medium-sized Enterprises (SMEs) dominate AI adoption in construction, enhancing efficiency and innovation.

- By Application: AI in project management optimizes construction efficiency and reduces costs.

- By End-User: Public Infrastructure dominates AI-enhanced efficiency in the 2023 Construction Market.

- Regional Dominance: North America leads global AI in the construction market with 48.5%.

- Growth Opportunity: AI in construction boosts efficiency and competitiveness through enhanced project management and predictive maintenance in 2024.

Driving factors

Growing Demand for AI Applications: Catalyzing Efficiency and Innovation

The construction industry has historically been characterized by high costs and significant inefficiencies. Artificial Intelligence (AI) is increasingly viewed as a transformative solution to these challenges. The demand for AI applications in construction is driven by the need to enhance project planning, management, and execution. AI-powered tools can analyze vast amounts of data from past projects to predict timelines, budget requirements, and potential project risks more accurately.

Moreover, AI is instrumental in automating routine tasks such as scheduling, resource allocation, and compliance monitoring, freeing human resources to focus on more complex aspects of project management. This growing demand for AI applications is underpinned by the recognition of these tools' potential to significantly boost productivity and streamline operations, thereby accelerating market growth. For instance, the use of machine learning algorithms and data analytics helps in creating more precise and efficient building designs, reducing material wastage, and optimizing the supply chain.

Reducing Production Costs: Enhancing Profit Margins Through AI Integration

AI's role in reducing production costs in construction intertwines closely with its applications for enhancing operational efficiencies. By leveraging AI for tasks such as predictive maintenance, automated machinery operations, and optimal resource utilization, construction projects can see a reduction in downtime and lower labor costs. AI technologies also contribute to cost reduction by minimizing errors in the construction process, which typically lead to expensive corrections and delays.

Statistically, AI adoption can lead to a reduction in project costs by as much as 20%, according to industry studies. This substantial decrease in production costs not only boosts profitability for construction firms but also makes large-scale projects more financially viable, thus driving further investment and development in the sector.

Increasing Demand for Enhanced Safety Measures: AI as a Safety Innovator

The construction sector is one of the most hazardous industries, with high risks of accidents and fatalities. There is an increasing demand for enhanced safety measures, where AI plays a crucial role. By integrating AI with IoT (Internet of Things) devices, construction sites can be monitored in real-time to identify potential safety hazards, such as personnel in unsafe zones or malfunctioning equipment.

AI-driven analytics can predict and prevent incidents before they occur by analyzing historical accident data and real-time inputs from sensors on machinery and equipment. This proactive approach to safety not only helps in reducing the incidence of workplace accidents but also significantly lowers associated costs, such as insurance, litigation, and downtime. Enhancing safety measures through AI not only fosters a safer working environment but also enhances compliance with increasingly stringent regulatory standards, further driving market growth.

Restraining Factors

Lack of Research and Development: Stifling Innovation and Competitive Advancement

Artificial Intelligence in the Construction market is particularly sensitive to innovations and technological advancements that drive efficiency, safety, and cost reductions in projects. However, a primary restraining factor is the lack of substantial investment in research and development (R&D). This deficiency hinders the progression of AI technologies tailored specifically for construction needs, limiting the introduction of groundbreaking solutions that could otherwise streamline complex construction processes.

Statistically, sectors with robust R&D frameworks often experience accelerated growth rates due to continuous improvements and innovations. For instance, industries like pharmaceuticals and technology allocate a significant portion of their revenue towards R&D often upward of 15%. In contrast, the construction sector traditionally invests a meager 1% of revenue in R&D, reflecting a stark disparity in innovation drive compared to other sectors.

Technical Expertise Shortage: A Barrier to AI Integration and Utilization

Another significant challenge impeding the growth of AI in the construction market is the shortage of technical expertise. AI technologies require specialized knowledge not only for development but also for effective implementation and maintenance. The construction industry, traditionally slower in digital adoption, faces difficulties in attracting skilled professionals adept in AI, data science, and machine learning, essential for leveraging AI capabilities.

The shortage of technical experts can be partially attributed to the broader global talent crunch in tech-oriented skills, with many industries vying for the same pool of candidates. This competition makes it particularly challenging for the construction sector, which may not be seen as the most attractive or innovative field by tech professionals.

By Component Analysis

AI solutions lead in construction, enhancing efficiency and reducing costs.

In 2023, Solutions held a dominant market position in the "By Component" segment of the Artificial Intelligence in Construction Market. This prominence can be attributed to the critical role these AI-driven solutions play in enhancing operational efficiencies and reducing costs across various construction stages. AI-based solutions in construction include automated design tools, project management software, and real-time data analytics systems. These advanced technologies have significantly advanced the capabilities of predictive analytics, risk management, and resource allocation, ensuring projects are completed on time and within budget.

Conversely, Services also form an essential part of AI in the construction landscape, though they have not matched the market dominance of solutions. These services typically encompass the implementation, support, and maintenance of AI technologies. The growth in this sub-segment is driven by the increasing need for specialized expertise to integrate AI tools effectively within existing infrastructure. Moreover, as construction firms become more familiar with the benefits of AI, demand for consulting and customization services is expected to rise, further supporting the growth of this segment.

By Deployment Type Analysis

Cloud deployment dominates AI in construction for efficiency and scalability.

In 2023, Cloud deployment held a dominant market position in the "By Deployment Type" segment of the Artificial Intelligence in Construction Market. This prominence can be attributed to several compelling advantages that cloud-based AI solutions offer to the construction industry. Primarily, the cloud enables scalable computing power and vast data storage capabilities, essential for handling the large datasets typical in AI applications. It also facilitates enhanced collaboration across various stakeholders, as data and tools can be accessed remotely and in real-time, a critical feature for the geographically dispersed nature of construction projects.

On-premises deployment, while less dominant, remains relevant, particularly for organizations prioritizing data control and security. This method allows firms to manage AI applications and data on local servers, reducing reliance on internet connectivity and enhancing data security, which is crucial for sensitive projects.

By Organization Size Analysis

Small and Medium-sized Enterprises SMEs dominate AI adoption in construction, enhancing efficiency and innovation.

In 2023, Small and Medium-sized Enterprises (SMEs) held a dominant market position in the "By Organization Size" segment of the Artificial Intelligence in Construction Market. This trend underscores the increasing reliance of SMEs on AI technologies to enhance operational efficiencies and competitive advantage. SMEs in the construction sector have been particularly adept at integrating AI to streamline project management, optimize resource allocation, and improve cost estimation and risk management. The agility of SMEs allows for quicker adoption and adaptation of AI tools compared to their larger counterparts, enabling more personalized and responsive project management approaches.

Large enterprises, while also integrating AI, often face longer implementation cycles due to the complexity of their operations and the scale of integration required. However, these organizations benefit significantly from AI in terms of predictive analytics, large-scale automation, and advanced data analytics for strategic decision-making. The investment in AI by large enterprises typically aims at long-term transformations with robust integrations across global operations. Both segments recognize AI as a critical driver for innovation and efficiency in the evolving landscape of the construction industry.

By Applications Analysis

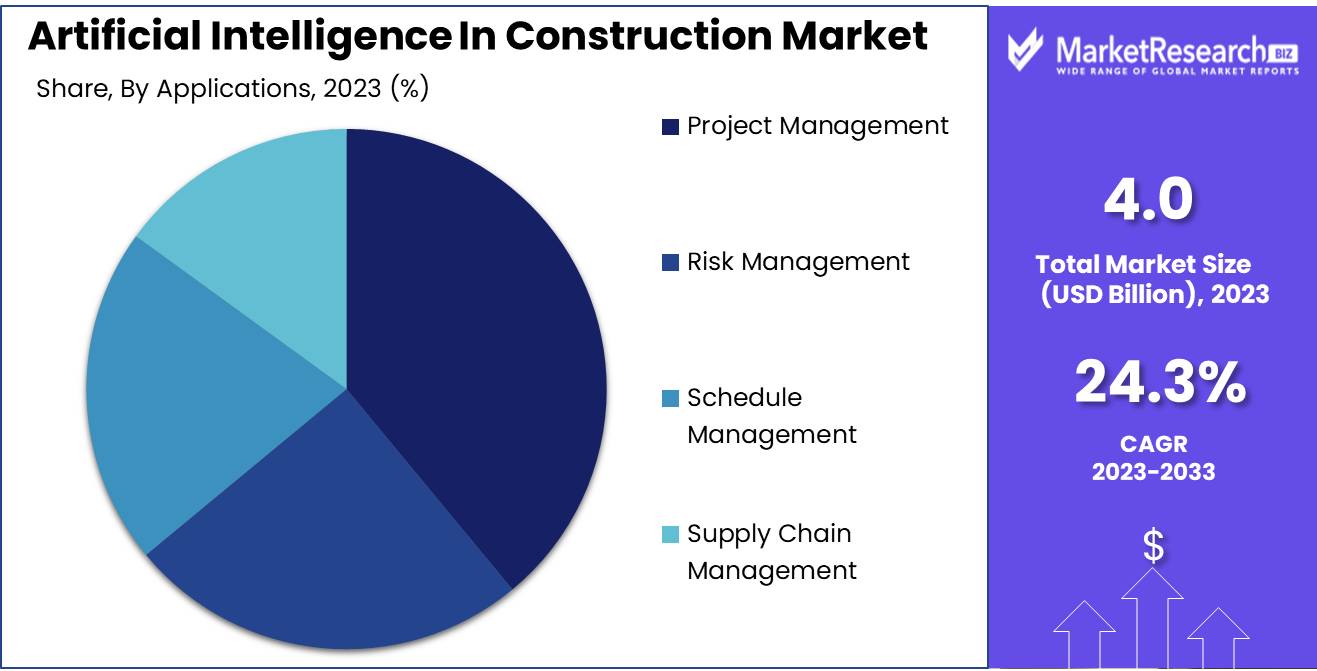

AI in project management optimizes construction efficiency and reduces costs.

In 2023, Project Management held a dominant market position in the "By Applications" segment of Artificial Intelligence in the Construction Market. This prominence can be attributed to the increasing complexity and scale of construction projects which demand enhanced efficiency and precision that AI-driven project management tools provide. These tools leverage machine learning algorithms and big data analytics to optimize the planning, execution, and monitoring of construction projects.

AI in project management aids in real-time decision-making, forecasting potential delays, and allocating resources efficiently. Furthermore, risk management is significantly bolstered through predictive analytics, identifying potential safety hazards and financial risks before they become problematic. In terms of schedule management, AI enables more accurate time estimations, helping to streamline workflows and reduce downtime. Lastly, AI's role in supply chain management transforms traditional practices by improving logistics coordination, material sourcing, and inventory management, thereby minimizing waste and reducing costs. Collectively, these applications underscore the transformative impact of AI on enhancing project outcomes, reducing costs, and improving safety in the construction industry.

By End-User Analysis

Public Infrastructure dominates AI-enhanced efficiency in the 2023 Construction Market.

In 2023, Public Infrastructure held a dominant market position in the By End-User segment of Artificial Intelligence in the Construction Market. This dominance is largely attributable to significant investments in smart city projects and infrastructure upgrades, which require advanced AI solutions for planning, construction management, and operational efficiency. AI technologies, including machine learning models and AI-driven project management tools, have been pivotal in optimizing the allocation of resources, enhancing safety measures, and minimizing project delays in public infrastructure projects. These technologies facilitate real-time data analysis, predictive maintenance, and efficient logistics planning, contributing to more resilient and sustainable infrastructure development.

The residential sector also significantly integrates AI to streamline design and construction processes. AI applications in this segment focus on improving cost efficiency, personalizing designs to consumer preferences, and enhancing energy efficiency in homes. The use of AI-enabled tools for automated design adjustments and virtual reality walkthroughs helps in better decision-making and customer satisfaction.

Heavy Construction has seen an uptick in AI adoption for handling complex projects like highways and industrial facilities. AI's role in this sub-segment includes optimizing supply chain operations, predictive analytics for equipment maintenance, and safety monitoring. The data-driven insights provided by AI help reduce downtime, ensure compliance with safety standards, and streamline the overall construction process, leading to timely and under-budget project completions. This strategic incorporation of AI not only mitigates risks but also drives efficiency across operations.

Key Market Segments

By Component

- Solutions

- Services

By Deployment Type

- Cloud

- On-premises

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Applications

- Project Management

- Risk Management

- Schedule Management

- Supply Chain Management

By End-User

- Residential

- Public Infrastructure

- Heavy Construction

Growth Opportunity

Enhancement of Project Management Through AI-Powered Tools

One of the primary growth drivers in the AI construction market is the increasing adoption of AI-powered project management tools. These tools are revolutionizing how projects are planned, monitored, and executed. AI enables real-time data analytics and decision-making, optimizing resource allocation and minimizing delays. By employing sophisticated algorithms, AI tools can predict project bottlenecks and suggest optimal solutions, thereby ensuring projects are completed on time and within budget. This capability not only improves operational efficiency but also enhances profitability for construction firms, making it an indispensable asset in today’s competitive market.

Predictive Maintenance: Transforming Equipment Management in Construction

The AI in construction market is the application of AI in the predictive maintenance of construction equipment. Traditional maintenance schedules are often based on estimated usage and time intervals. However, AI introduces a more precise approach by analyzing data from equipment sensors to predict potential failures before they occur. This predictive capability allows for maintenance to be scheduled at optimal times, reducing downtime and extending the lifespan of valuable machinery. The financial benefits include lower repair costs and increased availability of equipment, crucial for meeting tight project timelines.

Latest Trends

Regenerative Design and Optimization

The global Artificial Intelligence (AI) in Construction Market is set to increasingly leverage AI-driven regenerative design and optimization. This trend signifies a shift towards more sustainable and efficient construction methodologies, using AI to minimize environmental impact while maximizing resource efficiency. Regenerative design uses algorithms to create building plans that not only aim to reduce waste but also positively impact the environment by restoring or improving the natural resources and ecosystems that surround them. This approach not only supports sustainability goals but also aligns with global regulatory pressures and the growing demand from stakeholders for greener construction practices. By integrating AI, firms can optimize material usage and site logistics, leading to significant cost reductions and enhanced project outcomes.

Predictive Analytics for Risk Assessment

Predictive analytics in the AI Construction Market is evolving as a crucial tool for risk assessment. This application of AI analyzes data from numerous sources, including real-time site data, weather forecasts, and historical project performance, to forecast potential project risks before they manifest. The ability to predict issues such as scheduling delays, budget overruns, and safety incidents allows project managers to proactively implement mitigation strategies, thereby saving resources and reducing downtime. In 2024, as the construction industry faces increasingly complex projects and tighter margins, predictive analytics will become an essential component for companies aiming to maintain competitive advantage and ensure project success through enhanced decision-making processes.

Regional Analysis

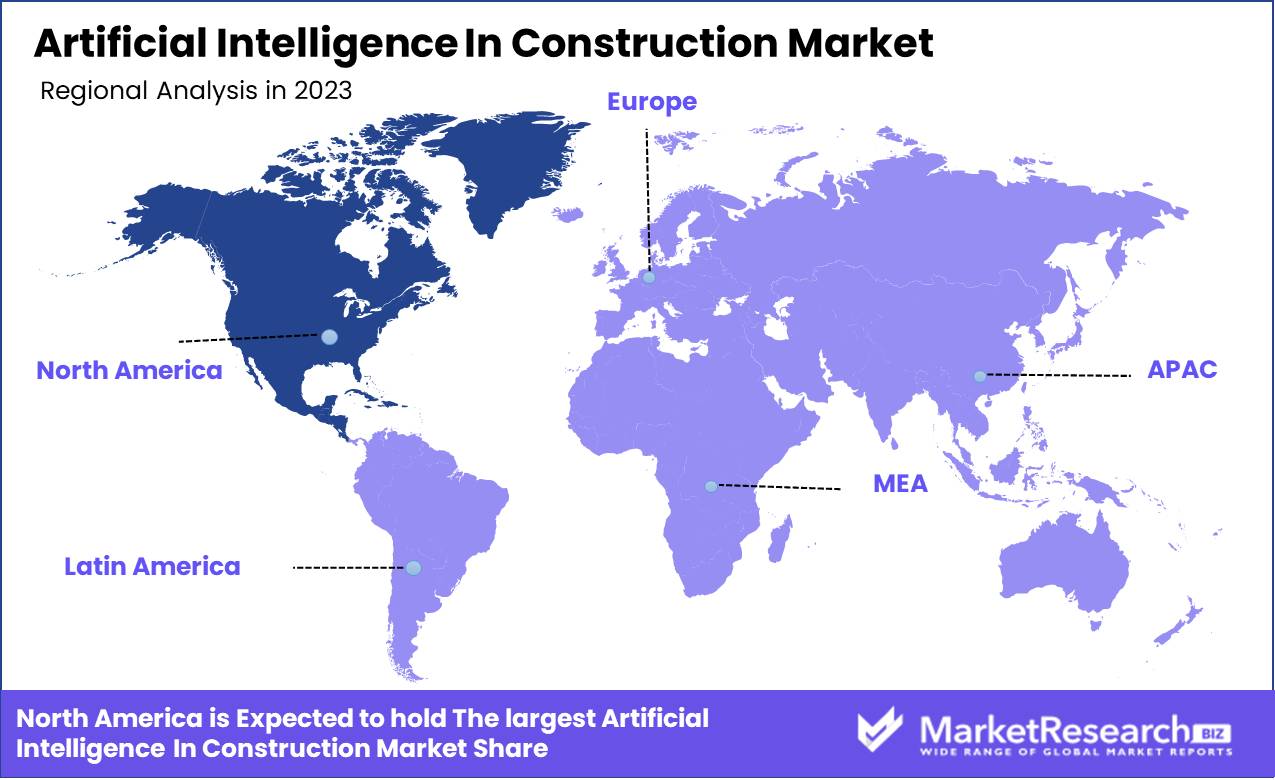

North America leads global AI in the construction market with 48.5%.

Artificial intelligence (AI) in the construction market is experiencing robust growth across various regions, with distinct characteristics and drivers in each. North America is the dominant region, accounting for approximately 48.5% of the global market. This dominance is primarily due to high technology adoption rates, significant investments in AI and machine learning, and a strong presence of leading AI technology developers. The U.S. leads in the region, driven by increased efficiency and safety needs in construction projects.

Europe follows, where AI adoption is fueled by stringent regulatory requirements regarding building efficiencies and environmental sustainability. Countries like Germany, the UK, and France are at the forefront, integrating AI to enhance project planning and risk management. In the Asia Pacific, the market is growing rapidly, driven by urbanization and infrastructure development, particularly in China and India. These countries are leveraging AI for large-scale projects, focusing on automation and real-time data usage to streamline construction processes and cost management.

The Middle East & Africa show potential with infrastructure projects in the Gulf Cooperation Council (GCC) countries, utilizing AI to optimize resource allocation and project timelines, focusing on smart city developments. Latin America is gradually adopting AI in construction, with Brazil leading the way. The focus here is on improving safety measures and operational efficiencies in public and private construction sectors.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Artificial Intelligence in Construction market in 2024 is significantly influenced by major technology firms like IBM, Microsoft, Oracle, and SAP, as well as specialized entities such as Alice Technologies and Autodesk. These key players are pivotal in driving the integration of AI technologies to enhance efficiency, safety, and decision-making in construction projects.

IBM and Microsoft are leading with robust cloud platforms and AI services that help in data management, analytics, and predictive modeling, making them indispensable for large-scale construction projects. Oracle's expertise in database management and SAP's strong analytics capabilities are also vital for complex project management and logistics in construction.

Specialized players like Alice Technologies and Autodesk are at the forefront of innovation in construction-specific solutions. Alice Technologies leverages AI for optimizing construction scheduling and project management, while Autodesk's AI-infused design and engineering software streamline the planning and execution phases, significantly reducing errors and material wastage.Emerging players such as Built Robotics and Buildots are redefining the construction landscape by introducing AI-driven robotics and advanced data analytics for real-time project tracking and management. These technologies are not only enhancing productivity but also improving the safety standards on construction sites.

Market Key Players

- IBM

- Microsoft

- Oracle

- SAP

- Alice Technologies

- eSUB

- Autodesk

- Built Robotics

- InEight

- Buildouts

- Doxel AI

- ALICE Technologies

- Converge.io

- Others

Recent Development

- In September 2023, Buildots' Expansion and Funding Round - Buildots, which offers AI-driven construction management software, successfully closed a Series C funding round of $30 million. The funds are intended for further development of their AI capabilities and expansion into new markets. This funding underscores the increasing investor interest in AI technologies within the construction industry.

- In June 2023, Trimble's Launch of AI-Powered Solutions - Trimble released a new suite of AI solutions designed to optimize construction project management. These tools leverage machine learning algorithms to provide real-time insights into project costs, timelines, and resource allocation, thereby improving decision-making processes.

- In February 2023, Autodesk's Acquisition of Innovaya - Autodesk, a leader in design and drafting software, announced the acquisition of Innovaya, a technology company known for its AI-powered construction simulation tools. This acquisition aims to enhance Autodesk's capabilities in predictive modeling and project management within the construction sector.

Report Scope

Report Features Description Market Value (2023) USD 4.0 Billion Forecast Revenue (2033) USD 33.3 Billion CAGR (2024-2032) 24.31% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Deployment Type (Cloud, On-premises), By Organization Size (Small and Medium-sized Enterprises (SMEs), Large enterprises), By Applications (Project Management, Risk Management, Schedule Management, Supply Chain Management), By End-User (Residential, Public Infrastructure, Heavy Construction) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM, Microsoft, Oracle, SAP, Alice Technologies, eSUB , Autodesk, Built Robotics, InEight , Buildots, Doxel AI, ALICE Technologies, Converge.io, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM

- Microsoft

- Oracle

- SAP

- Alice Technologies

- eSUB

- Autodesk

- Built Robotics

- InEight

- Buildouts

- Doxel AI ALICE Technologies

- Converge.io

- Others