Global Aquaculture Vaccines Marke By Product(Inactivated Vaccines, Attenuated Live Vaccines, Subunit Vaccines, DNA Vaccines, Recombinant Vaccines), By Route Of Administration(Injected, Oral, Immersion & Spray), By Application(Bacterial, Viral, Parasitic), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46002

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

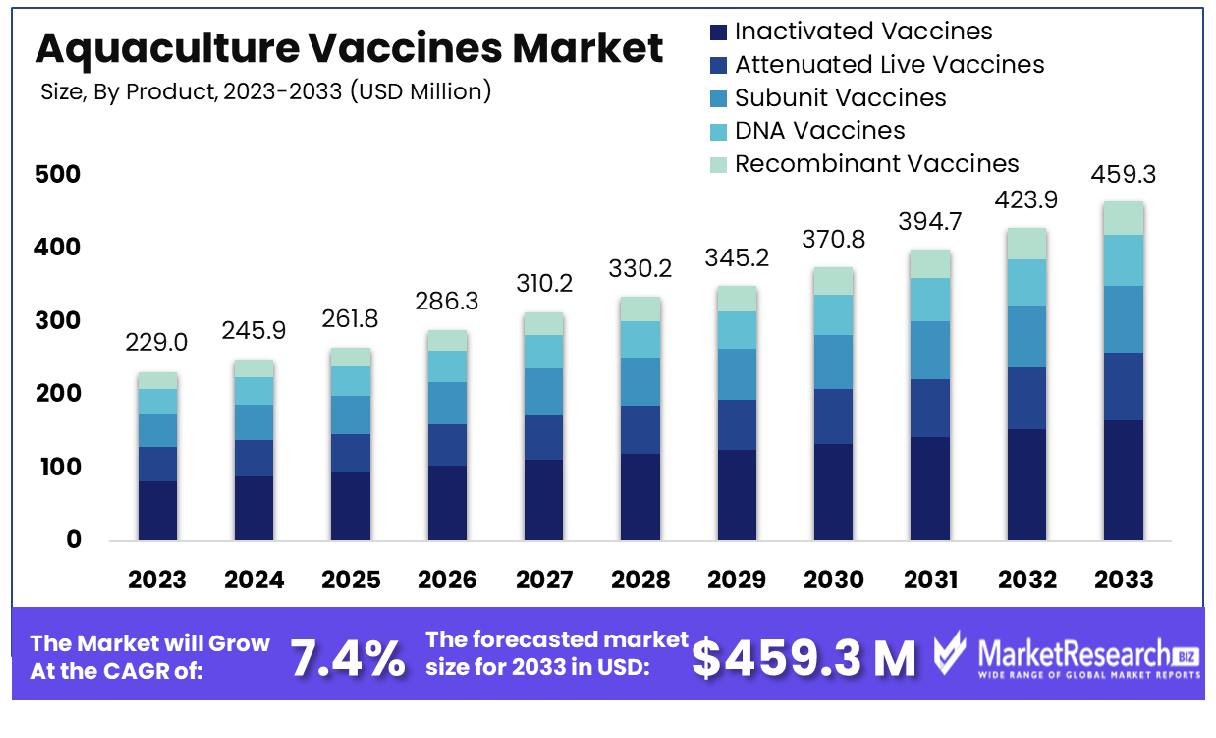

The Global Aquaculture Vaccines Market was valued at USD 229.0 million in 2023. It is expected to reach USD 459.3 million by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

The Aquaculture Vaccines Market refers to the segment within the biopharmaceutical industry dedicated to developing, manufacturing, and distributing vaccines specifically designed for aquatic species. These vaccines aim to prevent and control diseases prevalent in fish and other aquatic organisms raised in aquaculture settings, ensuring the health and sustainability of farmed populations.

With the global demand for seafood on the rise, aquaculture plays a crucial role in meeting this need. Consequently, the Aquaculture Vaccines Market offers innovative solutions to mitigate disease outbreaks, enhance productivity, and support the expansion of sustainable aquaculture operations worldwide.

The Aquaculture Vaccines Market stands as a pivotal segment within the broader spectrum of animal health and welfare. As of 2020, the global landscape witnessed the approval of over 140 aquatic vaccines, a testament to the growing recognition of the significance of disease control in aquaculture. However, despite this notable advancement, the market still grapples with challenges stemming from the limited range and quantity of approved vaccines. This deficiency leaves critical gaps in disease prevention strategies, hindering optimal production outcomes.

Traditional approaches to aquatic vaccination predominantly revolve around inactivated whole organisms, supplemented by select live-attenuated or subunit protein vaccines. These conventional methodologies, administered through injection or immersion, have demonstrated efficacy in bolstering aquaculture productivity while concurrently mitigating reliance on antibiotics, thus aligning with evolving industry standards and sustainability imperatives.

Nevertheless, the overarching narrative underscores a pressing need for innovation and expansion within the aquaculture vaccine domain. The inadequacy of available vaccine varieties coupled with protracted development timelines underscores the imperative for concerted efforts aimed at bolstering research and development initiatives. Such endeavors are pivotal in fortifying the industry's resilience against emergent disease threats and fostering sustainable growth trajectories.

In navigating the complexities of the Aquaculture vaccine market, stakeholders must adopt a forward-thinking approach, characterized by strategic collaborations, investment in research and development, and a steadfast commitment to advancing animal health and welfare standards. By embracing innovation and fostering cross-sectoral partnerships, the industry can surmount existing challenges and chart a course toward enhanced sustainability and resilience.

Key Takeaways

- Market Growth: The Global Aquaculture Vaccines Market was valued at USD 229.0 million in 2023. It is expected to reach USD 459.3 million by 2033, with a CAGR of 7.4% during the forecast period from 2024 to 2033.

- By Product: Inactivated Vaccines dominate with a commanding 35.2% market share.

- By Route of Administration:, Injection prevails, accounting for 37.3% of usage.

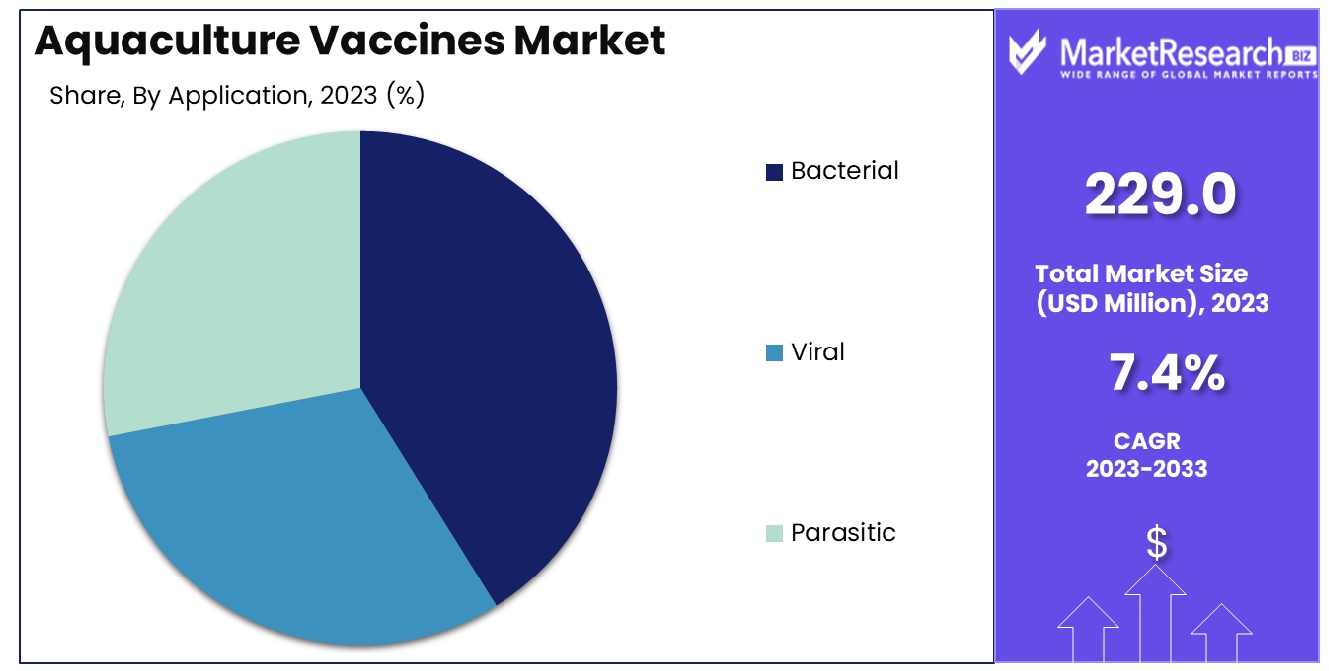

- By Application: Bacterial control dominates, capturing a significant 44.2%.

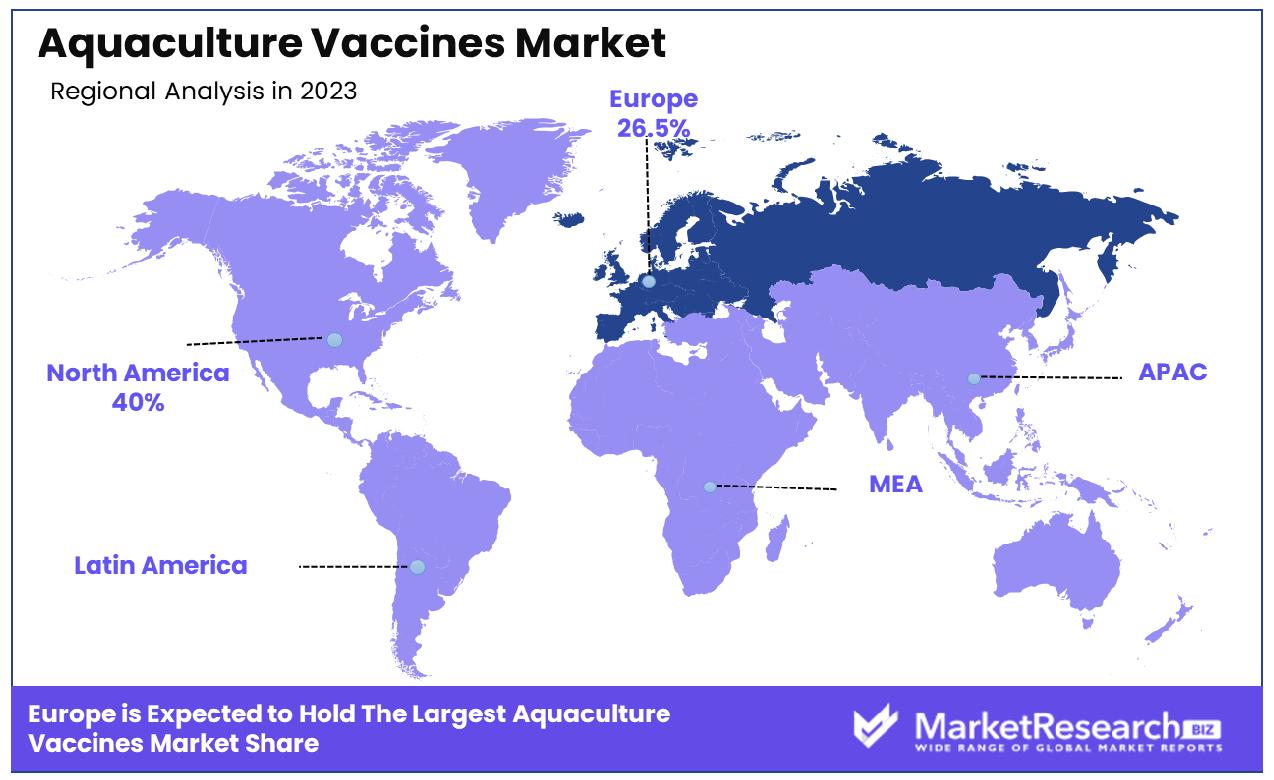

- Regional Dominance: In Europe, the aquaculture vaccines market surged by 26.5%.

- Growth Opportunity: In 2023, the global aquaculture vaccines market saw robust growth driven by government initiatives promoting health management and rising consumer demand for safe seafood products.

Driving factors

Growing Aquaculture Industry and Surging Demand for Aquatic Animal-Derived Food Products

The burgeoning aquaculture industry stands as a pivotal driver behind the escalating demand for aquaculture vaccines. As the global population burgeons and dietary preferences evolve, there is an amplified inclination towards aquatic animal-derived food products. This surge is notably pronounced in regions witnessing rapid urbanization and income growth, where dietary patterns are shifting towards protein-rich sources.

With aquaculture serving as a significant contributor to meeting this escalating demand, the necessity to safeguard aquatic populations against diseases becomes paramount. Aquaculture vaccines emerge as indispensable tools in this endeavor, facilitating disease prevention and ensuring the sustainable growth of aquaculture operations.

Strict Regulatory Policies for Vaccine Approval and High Vaccine Costs

While stringent regulatory policies for vaccine approval and high costs pose challenges, they also catalyze market growth through quality assurance and innovation. Regulatory frameworks necessitate rigorous testing and evaluation processes, to ensure the safety and efficacy of aquaculture vaccines. Consequently, approved vaccines garner trust among stakeholders, fostering market credibility and sustainability.

Moreover, the high costs associated with vaccine development and compliance incentivize manufacturers to invest in research and development, driving technological advancements and the introduction of more efficacious vaccines. Thus, while regulatory hurdles may impede market entry, they ultimately contribute to elevating industry standards and enhancing product efficacy.

Rising Global Consumption of Aquatic Foods

The escalating global consumption of aquatic foods serves as a formidable catalyst propelling the aquaculture vaccines market forward. With seafood constituting a vital component of diverse culinary traditions and dietary habits worldwide, the demand for aquaculture products continues to soar. As consumers become increasingly health-conscious and environmentally aware, the perceived benefits of seafood consumption further fuel this trend.

However, this surge in demand also amplifies the susceptibility of aquaculture populations to diseases, necessitating proactive disease management strategies. Consequently, the uptake of aquaculture vaccines surges, driven by the imperative to sustainably meet the escalating demand for aquatic foods while mitigating disease-related risks.

Restraining Factors

Limited Access to Aquaculture Vaccines in Certain Regions

The constrained access to aquaculture vaccines in specific regions poses a significant impediment to market expansion. Regions with underdeveloped aquaculture infrastructure or inadequate distribution networks often struggle to procure essential vaccines, hindering disease management efforts. Consequently, aquaculture productivity in these regions may suffer from heightened susceptibility to diseases, resulting in diminished yields and economic losses.

Additionally, limited access to vaccines exacerbates disparities in aquaculture development, widening the gap between regions with robust vaccination programs and those lacking adequate support. Addressing this challenge necessitates concerted efforts to enhance vaccine accessibility through initiatives such as capacity building, technology transfer, and strategic partnerships.

Complicated Vaccine Production Processes and High Vaccination Costs

The complexity of vaccine production processes and elevated vaccination costs present formidable barriers to market expansion. Developing aquaculture vaccines entails intricate research and development endeavors, involving the identification of antigenic targets, formulation optimization, and efficacy testing. These complexities contribute to prolonged development timelines and escalated production costs, rendering vaccines financially inaccessible for some aquaculture operators.

Moreover, the high costs associated with vaccination procedures, including labor, equipment, and administration, further compound economic burdens. Consequently, aquaculture enterprises may perceive vaccination as a prohibitively expensive endeavor, opting for alternative disease management strategies or forgoing preventive measures altogether.

Addressing this challenge requires streamlining vaccine production processes, leveraging technological innovations to reduce costs, and implementing cost-sharing mechanisms to alleviate financial burdens on stakeholders. By overcoming these obstacles, the aquaculture vaccines market can realize its full potential in safeguarding global aquaculture sustainability and food security.

By Product Analysis

Inactivated vaccines accounted for 35.2% of the market share, emphasizing their widespread acceptance and usage.

In 2023, Inactivated Vaccines held a dominant market position in the By Product segment of the Aquaculture Vaccines Market, capturing more than a 35.2% share. This robust presence underscores the industry's reliance on inactivated vaccines, which are prepared from pathogens that have been killed through physical or chemical processes, thereby retaining their immunogenicity without causing disease.

Following closely behind, Attenuated Live Vaccines claimed a notable share of the market, demonstrating their efficacy in stimulating robust immune responses while offering the advantage of single-dose administration. Subunit Vaccines also emerged as a significant contender, leveraging specific protein subunits of pathogens to trigger immune responses without the risk of causing disease, thus aligning with the industry's focus on safety and efficacy.

DNA Vaccines, characterized by their utilization of genetically engineered DNA to induce protective immune responses, showcased promising potential within the Aquaculture Vaccines Market. Similarly, Recombinant Vaccines, which utilize genetically modified organisms to express antigens, presented innovative solutions for disease prevention in aquaculture settings.

The dominance of Inactivated Vaccines underscores the industry's preference for established and proven vaccination methods. However, the notable presence of emerging vaccine types such as DNA Vaccines and Recombinant Vaccines suggests a growing trend towards advanced biotechnological solutions in aquaculture disease management.

As the aquaculture industry continues to expand and diversify, the market for aquaculture vaccines is expected to witness further evolution, with advancements in vaccine technology driving innovation and addressing emerging challenges in disease prevention and control.

By Route Of Administration Analysis

Injected administration prevailed with a dominance of 37.3%, reflecting its efficacy and preferred application.

In 2023, Injected held a dominant market position in the "By Route of Administration" segment of the Aquaculture Vaccines Market, capturing more than a 37.3% share. The segmental breakdown of aquaculture vaccines by route of administration is critical in understanding the preferences and trends within the industry. Aquaculture, being a vital sector for global food security, demands efficient and effective vaccination methods to ensure the health and productivity of aquatic species.

Injected vaccines have emerged as the preferred choice among aquaculture producers due to their precise delivery and efficacy in stimulating immune responses in fish populations. This dominance can be attributed to several factors, including the ability of injected vaccines to provide targeted and controlled dosing, thereby minimizing wastage and ensuring optimal protection against prevalent diseases. Furthermore, the convenience of administration and the compatibility of injected vaccines with various species and sizes of fish contribute to their widespread adoption across different aquaculture operations.

Following Injected, the Oral route of administration commands a significant portion of the market share, reflecting the growing demand for convenient and stress-free vaccination methods. Oral vaccines offer advantages such as ease of administration, reduced handling stress on aquatic species, and the potential for mass vaccination in large-scale aquaculture facilities. Moreover, advancements in vaccine formulations and delivery technologies have enhanced the efficacy and reliability of oral vaccines, further driving their adoption among aquaculture producers worldwide.

The Immersion & Spray route of administration, although holding a smaller market share compared to Injected and Oral methods, remains an essential segment in the aquaculture vaccines market. This method is particularly suitable for smaller aquatic species and larval stages, where individual vaccination may be impractical. Additionally, immersion and spray vaccines offer the advantage of uniform coverage and rapid distribution, ensuring consistent protection across entire populations.

In summary, the segmental analysis of aquaculture vaccines by route of administration highlights the dominance of Injected vaccines, followed by Oral alternatives, and the continued relevance of Immersion & Spray methods in addressing the diverse needs of the aquaculture industry. As the market evolves, innovations in vaccine technologies and strategic partnerships within the aquaculture value chain are expected to drive further growth and development in this critical sector.

By Application Analysis

Bacterial applications led with a 44.2% market share, underscoring the importance of combating bacterial pathogens.

In 2023, Bacterial held a dominant market position in the "By Application" segment of the Aquaculture Vaccines Market, capturing more than a 44.2% share. This segmental breakdown by application type provides crucial insights into the prevalence of specific diseases and the corresponding demand for vaccines within the aquaculture industry.

Bacterial vaccines are essential in combating prevalent bacterial infections that pose significant threats to aquaculture productivity and sustainability. The dominance of Bacterial vaccines underscores the prevalence of bacterial diseases such as Aeromoniasis, Enteric Redmouth Disease (ERM), and Streptococcosis, which affect various aquatic species worldwide. Aquaculture producers prioritize bacterial vaccines due to their effectiveness in preventing and controlling these economically damaging diseases, thereby safeguarding fish health and farm profitability.

Following Bacterial vaccines, the Viral segment commands a substantial portion of the market share, reflecting the significant impact of viral diseases on aquaculture operations. Viral pathogens such as Infectious Pancreatic Necrosis Virus (IPNV), Infectious Salmon Anemia Virus (ISAV), and Viral Hemorrhagic Septicemia Virus (VHSV) pose considerable challenges to the aquaculture industry due to their ability to cause widespread outbreaks and high mortality rates. As a result, the demand for viral vaccines remains robust as aquaculture producers seek effective strategies to mitigate viral disease risks and ensure the sustainable growth of their operations.

The Parasitic segment, while holding a smaller market share compared to Bacterial and Viral applications, addresses the threat posed by parasitic infections in aquaculture. Parasites such as sea lice, protozoa, and monogeneans can compromise fish health and welfare, leading to reduced growth rates and increased susceptibility to secondary infections. Parasitic vaccines offer a preventive approach to managing parasitic infestations, contributing to the overall health and performance of farmed aquatic species.

In summary, the segmental analysis of aquaculture vaccines by application type highlights the dominance of Bacterial vaccines in addressing prevalent bacterial diseases, followed by Viral and Parasitic applications. As aquaculture continues to expand to meet global seafood demand, the development and adoption of effective vaccines tailored to specific disease challenges will remain critical for ensuring the long-term sustainability and resilience of the industry.

Key Market Segments

By Product

- Inactivated Vaccines

- Attenuated Live Vaccines

- Subunit Vaccines

- DNA Vaccines

- Recombinant Vaccines

By Route Of Administration

- Injected

- Oral

- Immersion & Spray

By Application

- Bacterial

- Viral

- Parasitic

Growth Opportunity

Government Initiatives Promoting Aquaculture Health Management

In 2023, the global aquaculture vaccines market witnessed significant growth opportunities, propelled by strategic government initiatives aimed at promoting aquaculture health management. Various governments worldwide have recognized the pivotal role of vaccines in maintaining the health and sustainability of aquaculture operations.

Through subsidies, grants, and regulatory support, governments have incentivized aquaculture farmers to adopt vaccination programs as part of their health management strategies. This proactive approach not only enhances the welfare of aquatic species but also safeguards against disease outbreaks, thereby ensuring a stable supply of seafood products to meet growing consumer demands.

Growing Demand for Safe and Quality Seafood Products

Another key driver fueling the growth of the global aquaculture vaccines market in 2023 was the escalating demand for safe and quality seafood products. With increasing health consciousness among consumers, there has been a discernible shift towards responsibly sourced seafood options.

As concerns regarding food safety and antibiotic resistance mount, consumers are actively seeking assurances regarding the safety and sustainability of seafood products. Aquaculture vaccines offer a safe and effective means of disease prevention without relying heavily on antibiotics, aligning with consumer preferences for natural and eco-friendly food production methods.

Consequently, aquaculture producers are investing in vaccination programs to enhance the health and welfare of their aquatic stocks, thereby meeting the burgeoning demand for premium seafood products in the global market.

Latest Trends

Development of Oral and Immersion Vaccines for Aquatic Species

In 2023, the global aquaculture vaccines market witnessed notable trends, including the advancement in the development of oral and immersion vaccines tailored for aquatic species. Traditionally, injectable vaccines dominated the market; however, innovative formulations such as oral vaccines and immersion vaccines have gained traction due to their ease of administration and effectiveness in large-scale aquaculture operations. Oral vaccines, administered through feed or water, offer a convenient and stress-free method of immunization, particularly for species like fish and shrimp.

Similarly, immersion vaccines, applied directly to the aquatic environment, provide broad protection against prevalent diseases, minimizing handling stress and improving overall vaccine uptake. This shift towards alternative vaccination methods reflects the industry's commitment to enhancing animal welfare and production efficiency.

Collaboration Between Research Institutions and Aquaculture Industry

Furthermore, in 2023, a prominent trend in the global aquaculture vaccines market was the increasing collaboration between research institutions and the aquaculture industry. Recognizing the complex challenges associated with aquaculture health management, stakeholders across academia, government, and private sectors have joined forces to drive innovation and knowledge exchange.

Collaborative efforts encompass research and development of novel vaccine formulations, validation studies, and technology transfer initiatives aimed at accelerating the commercialization of effective vaccines. By leveraging collective expertise and resources, these partnerships foster a conducive environment for pioneering advancements in aquaculture vaccination, ultimately benefitting the industry by addressing emerging disease threats and enhancing productivity sustainably.

Regional Analysis

In Europe, the aquaculture vaccines market experienced significant growth, accounting for 26.5% of the market share.

In the burgeoning field of aquaculture vaccines, regional dynamics play a crucial role in shaping market trends and opportunities. Across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, distinct market characteristics emerge, influenced by factors such as regulatory frameworks, technological advancements, and consumer preferences.

North America exhibits a strong presence in the aquaculture vaccines market, driven by robust investment in research and development initiatives and a growing demand for sustainable seafood production. The region is characterized by stringent regulatory standards, fostering the adoption of advanced vaccine technologies. According to industry analysis, North America holds a significant market share, reflecting its progressive approach toward aquaculture sustainability.

In Europe, the market for aquaculture vaccines commands a noteworthy share, with the region accounting for approximately 26.5% of the global market. This dominance is attributed to the presence of key market players, proactive government initiatives promoting aquaculture sustainability, and increasing consumer awareness regarding the benefits of vaccinated seafood products. Europe's commitment to environmental conservation and responsible aquaculture practices further propels market growth, positioning the region as a frontrunner in the global landscape.

The Asia Pacific region, propelled by burgeoning aquaculture industries in countries like China, India, and Vietnam, showcases immense growth potential. Rapid urbanization, rising disposable incomes, and evolving dietary preferences drive demand for high-quality seafood, spurring the adoption of aquaculture vaccines to ensure the health and productivity of aquatic species. Asia Pacific emerges as a lucrative market hub, buoyed by favorable government policies and strategic investments in aquaculture infrastructure.

In the Middle East & Africa and Latin America, nascent aquaculture sectors present untapped opportunities for market expansion. While the regions face challenges such as limited infrastructure and regulatory constraints, initiatives promoting sustainable aquaculture practices and increasing investment in healthcare for aquatic species are poised to fuel market growth.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Aquaculture Vaccines Market witnessed robust growth, driven by increasing concerns over aquatic animal health, rising demand for protein-rich seafood, and the implementation of stringent regulations pertaining to food safety. Among the key players in this dynamic landscape, Zoetis emerged as a prominent force, leveraging its extensive experience and comprehensive portfolio to address the evolving needs of the aquaculture industry.

Zoetis, a leading animal health company, demonstrated resilience and innovation in its approach to aquaculture vaccines. With a focus on research and development, Zoetis continually introduces novel vaccine solutions tailored to combat prevalent diseases affecting aquatic species. By investing in advanced technologies and strategic partnerships, Zoetis maintains a competitive edge, ensuring the efficacy and safety of its vaccines across diverse aquaculture settings.

Furthermore, Phibro Animal Health Corporation established itself as a formidable contender in the global Aquaculture Vaccines Market. Leveraging its expertise in veterinary medicine and a deep understanding of aquatic health dynamics, Phibro delivers cutting-edge vaccine solutions aimed at enhancing disease resistance and promoting sustainable aquaculture practices. Through a commitment to product quality and regulatory compliance, Phibro solidifies its position as a trusted partner for aquaculture stakeholders worldwide.

Elanco, Merck & Co., Inc., and other key players such as KBNP, CAVAC, Kyoto Biken Laboratories, Inc., Nisseiken Co., Ltd., Vaxxinova International BV, and HIPRA also contributed significantly to the market landscape. Their collective efforts underscore the industry's commitment to fostering innovation, ensuring food security, and promoting the sustainable growth of the aquaculture sector on a global scale.

Market Key Players

- Zoetis

- Phibro Animal Health Corporation

- Elanco

- Merck & Co., Inc.

- KBNP

- CAVAC

- Kyoto Biken Laboratories, Inc.

- Nisseiken Co., Ltd.

- Vaxxinova International BV

- HIPRA

Recent Development

- In April 2024, A collaborative study by Akvaplan-niva and NIVA investigated an innovative delousing method for salmonids, utilizing liquid medicine pellets with positive buoyancy to reduce EMB pollution in aquaculture sites.

- In April 2024, SAIC funded the University of Stirling's sea lice vaccination research with £50,000, aiming to assess efficacy against adult sea lice. The collaboration includes AQUATRECK Animal Health SL and Moredun Scientific for innovative vaccine technology.

- In March 2024, CATC unveils the Tenacibaculosis Disease Challenge Model to accelerate research into the disease affecting salmonids. Aimed at identifying antibiotic-resistant strains and testing vaccines and feed additives for infection control.

Report Scope

Report Features Description Market Value (2023) USD 229.0 Million Forecast Revenue (2033) USD 459.3 Million CAGR (2024-2032) 7.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Inactivated Vaccines, Attenuated Live Vaccines, Subunit Vaccines, DNA Vaccines, Recombinant Vaccines), By Route Of Administration(Injected, Oral, Immersion & Spray), By Application(Bacterial, Viral, Parasitic) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Zoetis, Phibro Animal Health Corporation, Elanco, Merck & Co., Inc., KBNP, CAVAC, Kyoto Biken Laboratories, Inc., Nisseiken Co., Ltd., Vaxxinova International BV, HIPRA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Zoetis

- Phibro Animal Health Corporation

- Elanco

- Merck & Co., Inc.

- KBNP

- CAVAC

- Kyoto Biken Laboratories, Inc.

- Nisseiken Co., Ltd.

- Vaxxinova International BV

- HIPRA