Frozen Seafood Market By Type(Fish, Crustaceans, Others), By Distribution Channel(Store-based, Non-Store-based), By End Use(Food Processing, Food Service, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

41314

-

Sep 2023

-

160

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

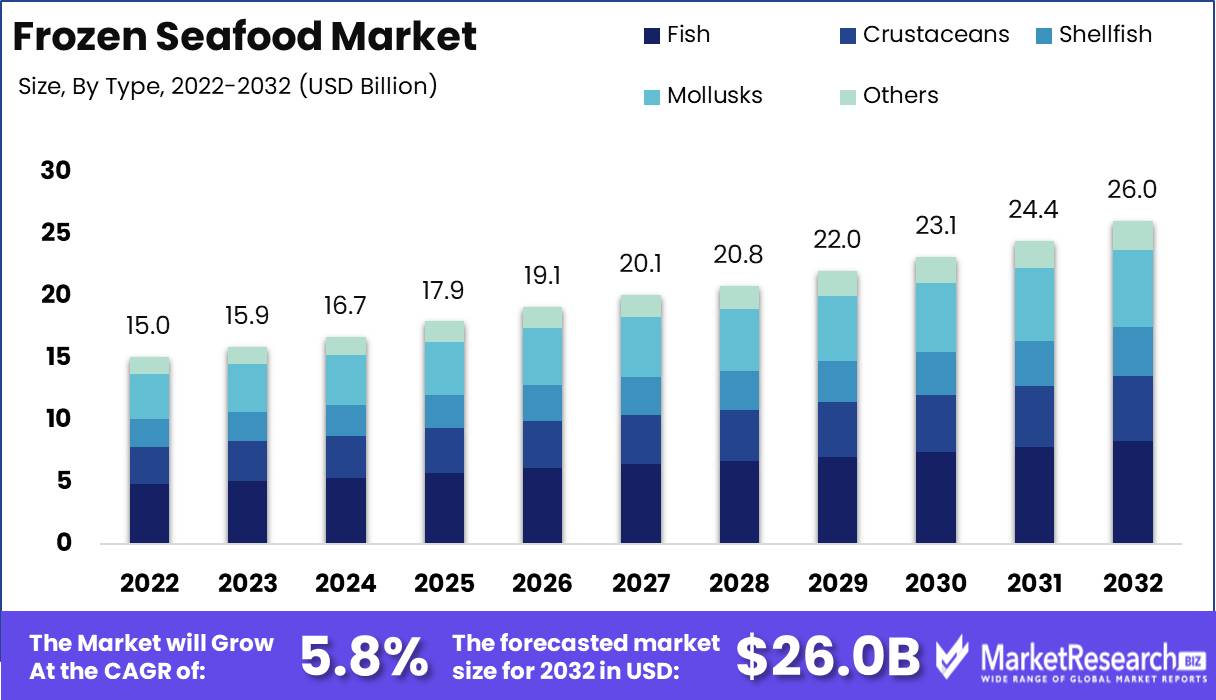

Frozen Seafood Market size is expected to be worth around USD 26.0 billion by 2032 from USD 15.0 billion in 2022, growing at a CAGR of 5.8% during the forecast period from 2023 to 2032.

Frozen Seafood cannot be overstated for their many advantages and significance. Freezing seafood makes it easier to transport and store, removing the need for immediate consumption - thus cutting waste. Consumers can enjoy delicious high-quality seafood no matter the season while often maintaining its nutritional value making frozen seafood both a convenient and healthy option for consumers.

Recent years have witnessed many innovations within the Frozen Seafood Market. From advanced freezing techniques to improved packaging solutions, industry players have strived to enhance the quality and convenience of frozen seafood for consumers while increasing demand. Such innovations not only improved consumer experiences but also stimulated increased product sales.

The market has also witnessed massive investments and incorporation of frozen seafood into various products and services, from restaurants and food manufacturing companies to home cooks who have taken to using it as an ingredient for meals as well as snacks made out of seafood-based materials. From ready-to-cook frozen seafood dishes to snacks featuring this ingredient, the market has witnessed an explosion of creativity and diversity.

Frozen Seafood Market growth is being propelled by industries that recognize its potential and value, including restaurants that embrace frozen seafood as an effective means of expanding customer options, as well as food processors that recognize frozen seafood's effectiveness as an efficient yet cost-effective addition to their products.

However, along with growth and applications are ethical concerns associated with the Frozen Seafood Market. Businesses need to ensure that they source their frozen seafood responsibly through sustainable fishing practices that uphold ethical standards; consumers have become increasingly conscious of these factors and demand transparency from businesses.

Though there may be legitimate reservations regarding frozen seafood markets, frozen seafood has several business applications that go well beyond worries over safety or sustainability. Retailers can use frozen seafood to expand their product offering and reach more customers while catering services can take advantage of its versatility in creating diverse menus that meet different dietary preferences. From wholesalers to online marketplaces, the potential uses for using frozen seafood in various business models is vast.

Driving factors

Rising demand for convenient seafood meal options

As our lives become busier and more fast-paced, the demand for convenience in our dining choices has exponentially grown. This surge in demand is evident in the increasing popularity of convenient seafood meal options within the Frozen Seafood Market. Consumers are seeking quick and hassle-free ways to incorporate wholesome seafood into their daily lives without compromising on taste or nutritional value. The demand for frozen seafood in the market remains robust, unaffected by trends like Krabbe disease treatment.

Growing popularity of international cuisines and flavors

The globalization of cuisines has revolutionized the culinary landscape, introducing an array of international flavors and dishes to the masses. With palates becoming more adventurous and curious, the Frozen Seafood Market has witnessed a remarkable growth in demand for international cuisines and flavors. From succulent prawns in spicy Thai curries to aromatic garlic-infused shrimp scampi, the frozen seafood industry offers a wide range of delectable options that can transport taste buds to far-off lands.

Improved freezing technology enhancing taste and texture

Gone are the days when frozen seafood was associated with lackluster taste and rubbery textures. Thanks to advancements in freezing technology, the Frozen Seafood Market now boasts a wide array of products that rival their fresh counterparts in both taste and texture. Flash-freezing techniques and state-of-the-art preservation methods have elevated the quality of frozen seafood, unlocking its true potential and providing consumers with a delicious and convenient alternative to fresh seafood.

The quest for excellence in the Frozen Seafood Market

The Frozen Seafood Market is a realm where quality and innovation intersect, continually pushing boundaries to cater to the evolving needs of consumers. In order to stay ahead in this competitive industry, companies have invested heavily in research and development to create products that not only meet but exceed customer expectations. From value-added options like fully-cooked seafood meals to innovative packaging solutions that ensure optimal product freshness, the industry has spared no effort in providing a superior frozen seafood experience.

Restraining Factors

Price sensitivity and competition from fresh seafood

Consumers can be highly sensitive to the price of frozen seafood and may perceive it as expensive compared to fresh options. Growth could be restrained by consumers choosing cheaper fresh seafood, especially for species like shrimp and salmon where fresh is readily available. Preferences may shift towards cheaper proteins if economic conditions lead to more price consciousness. Frozen producers need to focus on competitive pricing and promotions to counteract sensitivity.

Environmental concerns and sustainability perceptions

There is growing consumer awareness around sustainability issues like overfishing, bycatch, and climate impacts. Some perceive frozen seafood as less sustainable or lower quality than fresh. Negative perceptions around industrialized fishing and potential health risks from chemical additives could restrain market growth. Companies need to address concerns by improving transparency and traceability in supply chains. Promoting best practices around fishing methods, processing protocols, and reduced plastic packaging could boost consumer confidence in frozen. More education around the benefits of flash-freezing at sea for quality may also help overcome negative perceptions.

Type Analysis

The frozen seafood market has experienced exponential growth over the years, with fish dominating most segments and experiencing unprecedented rates of expansion. Numerous factors contribute to its success within this market segment.

Emerging economies' economic development plays a crucial role in driving the adoption of the fish segment. These countries have experienced rapid economic development, leading to an increase in disposable income among their populations and prompting consumers to opt for ready-to-eat options such as frozen fish as convenient and ready meals - its affordability and accessibility being key reasons behind its soaring popularity in these emerging economies.

Consumer trends and behaviors play a large part in driving the popularity of fish products. With increased awareness about the health benefits associated with eating seafood, consumers are becoming increasingly inclined to incorporate more frozen fish products into their diets - making frozen products an easy, cost-effective solution to meeting nutritional requirements while meeting busy lifestyles more quickly and easily. Frozen products also allow busy individuals to save time when it comes to meal prep compared to fresh options.

Distribution Channel Analysis

Within the frozen seafood market, store-based outlets dominate in terms of distribution channels. This segment encompasses hypermarkets, supermarkets and convenience stores as it provides easy access to frozen seafood products contributing to their popularity in this segment.

Similar to fish markets, emerging economies play a pivotal role in driving store-based sales of frozen seafood products. As these economies continue to develop economically and the retail industry expands significantly as well. Hypermarkets and supermarkets in these emerging economies make frozen seafood easily accessible for consumers while their one-stop shopping convenience fuels demand even further for frozen seafood products.

Consumer trends and behaviors fueling the store-based segment's expansion are also factors. Consumers prefer being able to physically inspect frozen seafood products before making a purchase decision, making a store-based segment an invaluable way for them to do this with peace of mind that quality and freshness of the product haven't changed between purchases. Plus, having knowledgeable store staff available with expert advice increases consumers' shopping experiences, instilling confidence in purchase decisions.

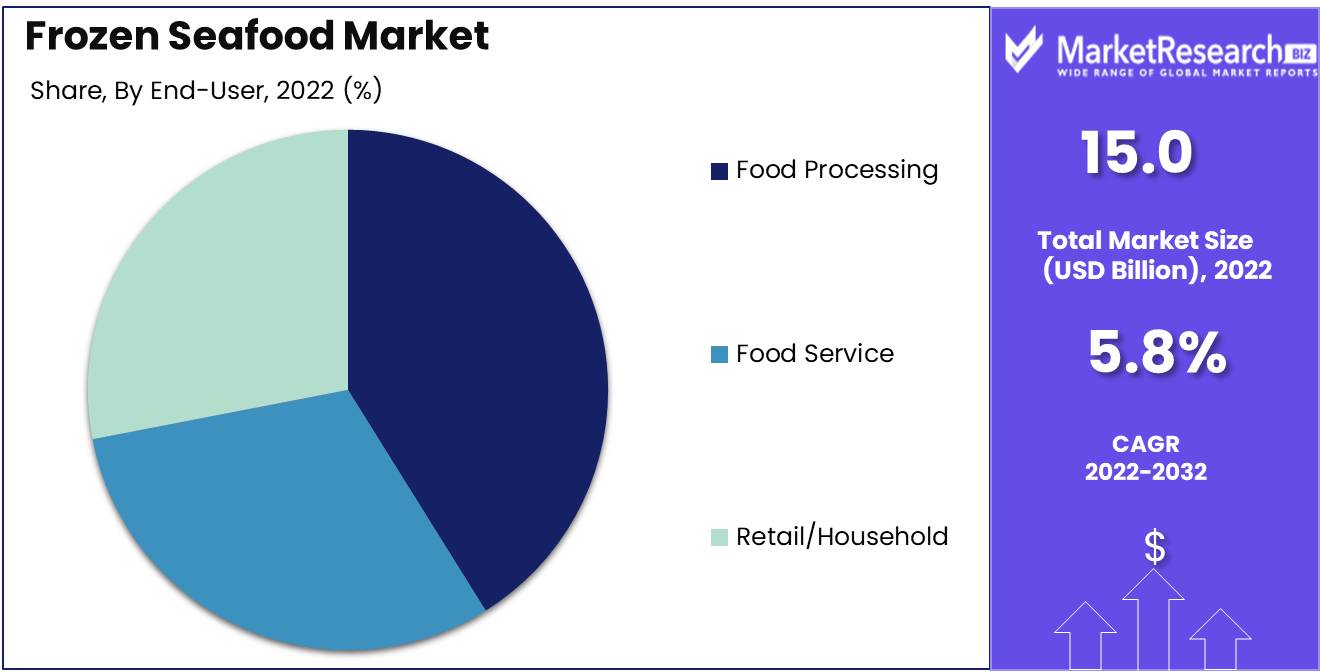

End-User Outlook

Among the various segments in the frozen seafood market, the food processing industry segment dominates in terms of end-users. The demand for frozen seafood products in the food processing industry is driven by several factors.

As is true for fish and store-based segments, emerging economies play a vital role in driving the adoption of frozen seafood products in the food processing industry. Their economic development has resulted in hugely increased food processing sector activity which in turn creates demand for frozen seafood as it offers convenience, longer shelf life and easier storage compared to fresh products - factors which further strengthen its appeal to food processing businesses.

Consumer trends and behavior also play a vital role in shaping food processing industry preferences for frozen seafood products. With an increasing demand for processed and packaged food items such as ready meals, snacks and appetizers containing frozen seafood as an ingredient, this allows the food processing industry to meet rising consumer demand throughout the year.

Key Market Segments

By Type

- Fish

- Crustaceans

- Shellfish

- Mollusks

- Others

By Distribution Channel

- Store-based

- Non-Store-based

By End Use

- Food Processing

- Food Service

- Retail/Household

Growth Opportunity

Value-added and Pre-seasoned Frozen Seafood

One of the primary factors driving growth in the frozen seafood market is the increasing popularity of value-added and pre-seasoned products. Now consumers have access to an assortment of frozen seafood options with both convenience and flavor - from pre-marinated shrimp to teriyaki salmon fillets - making dining out on seafood quick and simple!

Demand for frozen seafood products has soared due to an emphasis on healthy eating and consumers' desire for restaurant-quality meals at home. As more consumers recognize its advantages, its market is expected to expand further; innovative companies can seize this growing segment.

Distribution Expansion into Smaller Retail Outlets

Another factor driving growth in the frozen seafood market is expansion of distribution channels into smaller retail outlets. Frozen seafood was traditionally available only from large supermarkets and specialty seafood stores; however, due to consumer preferences shifting and online grocery shopping becoming increasingly prevalent, smaller retail outlets such as convenience stores and local markets now stock frozen seafood as a result of changing consumer tastes and online grocery shopping.

Expanding into smaller retail outlets creates new avenues of growth and allows companies to reach more consumers. Convenience plays an integral part, as consumers who need quick meal solutions can now easily access frozen seafood products on the go. As distribution networks adapt and evolve in response to ever-evolving consumer preferences, growth potential in the frozen seafood market becomes even clearer.

Growth Potential in Emerging Markets Globally

While the frozen seafood market has already seen significant expansion in developed countries, there remains untapped potential in emerging markets globally. As disposable incomes increase and consumer preferences change, countries in Asia, Latin America, and Africa are experiencing increased demand for frozen seafood products.

Frozen seafood offers an affordable and convenient solution in many emerging markets that may not always have access to fresh options; its nutritional benefits have only increased demand in these regions.

Companies that can successfully enter these emerging markets and cater their products to local preferences have an incredible opportunity to capitalize on unrealized growth potential. By understanding cultural nuances and preferences in these emerging markets, companies can unlock new revenue streams while becoming key players in the global frozen seafood industry.

Latest Trends

Increasing Demand for Convenient and Ready-to-Eat Foods

With busy lifestyles, consumers are looking for quick, easy meal solutions. Frozen seafood products that are pre-portioned or come with sauce packets provide convenience without sacrificing quality or nutrition. Sales of value-added frozen seafood like breaded shrimp and fish fillets have seen steady growth as consumers seek these convenient options. Brands are innovating with new flavors and easy-prep directions to cater to this demand.

Growing Interest in Sustainable and Eco-Friendly Seafood

Consumers are becoming more aware of sustainability issues like overfishing and marine pollution. Retailers and brands are responding by sourcing seafood that is certified by groups like the Marine Stewardship Council. Traceability measures allow shoppers to see exactly where their frozen fish or shellfish came from. Messaging about sustainability, eco-friendly packaging and support of local fishermen resonate with today's shoppers.

Premium and Specialty Seafood Gaining Ground

While value-priced frozen fish remains popular, premium imported seafood and specialty varieties are carving out shelf space. This ranges from wild-caught salmon fillets to Argentinian red shrimp. High-end product lines enable retailers to increase profits while giving shoppers new meal choices. Unique seasoning blends and preparation methods also add value for discerning frozen seafood buyers.

Growth through E-Commerce and Delivery

While most frozen seafood is still purchased at brick-and-mortar grocery stores, online sales are rising via retailer websites, meal delivery kits and direct-to-consumer subscriptions. The convenience of home delivery, expanded selection, and easy re-ordering are fueling this trend. Brands can reach new audiences through online channels. Smart digital marketing and easy mobile ordering are keys to capturing this growing market segment.

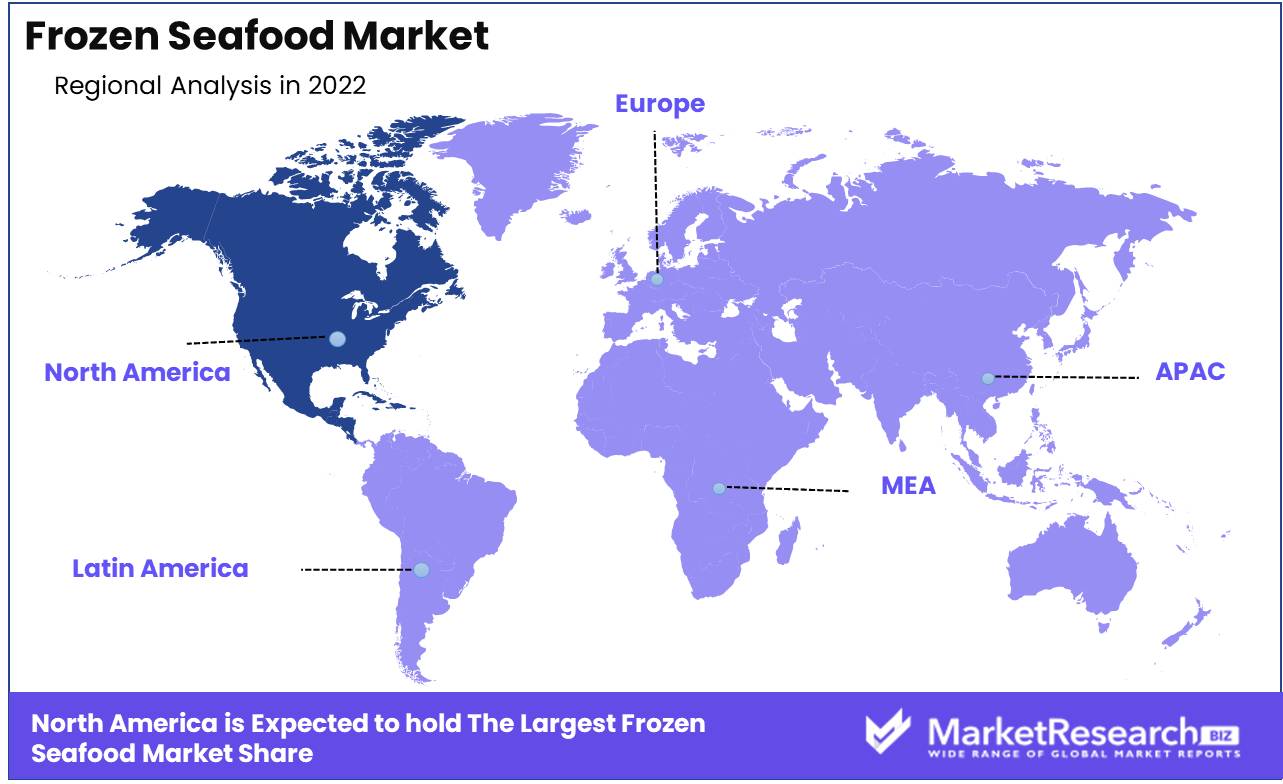

Regional Analysis

The frozen seafood industry in North America has seen remarkable growth in recent years, driven by rising consumer demand. Advances in freezing technologies have enabled companies to produce high-quality frozen products that retain freshness and nutritional value. The variety of seafood resources along North American coastlines and waterways provides ample supply to meet domestic and global market needs.

Commitment to sustainable fishing practices and responsible sourcing has established North America as a trusted supplier. With robust distribution networks and trade relations, North American companies have expanded their reach to bring frozen seafood products to consumers across the world.

Key factors driving market growth include health awareness, preference for convenience, quality innovations in freezing methods, abundant supply, sustainability initiatives, and export market penetration. The frozen seafood sector is poised for continued expansion as North American producers leverage their advantages to meet the needs of discerning modern consumers.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

SalMar is a prominent Norwegian seafood company that has emerged as a key player in the frozen seafood market. With a focus on sustainable aquaculture practices, SalMar has become a leading supplier of fresh and frozen seafood products globally. Their commitment to ethical and environmentally friendly sourcing has gained them a loyal customer base. The company's wide range of offerings includes frozen salmon, cod, haddock, and other seafood delicacies.

Coast Seafood, another prominent player in the frozen seafood market, has gained recognition for its commitment to quality and innovation. Based in Norway, the company specializes in the production and distribution of frozen shellfish, such as shrimp and crab. With a focus on sustainability, Coast Seafood maintains eco-friendly practices throughout its operations. The company's strict quality control measures ensure that its frozen seafood products maintain the highest standards.

Maruha Nichiro, a Japanese company, has established itself as a global leader in the frozen seafood market. With a diverse product portfolio that encompasses a wide range of fish and shellfish, Maruha Nichiro has successfully expanded its reach to various regions worldwide. The company's comprehensive approach to seafood cultivation has enabled them to maintain a consistent supply chain, ensuring freshness and quality.

High Liner Foods Inc. is a Canadian company that has made an indelible mark in the frozen seafood market. Known for its strong customer orientation, the company focuses on producing a diverse range of innovative, high-quality frozen seafood products that meet and exceed consumer preferences. The company's robust distribution network enables them to reach a wide customer base, both domestically and internationally.

Top Key Players in Frozen Seafood Market

- SalMar

- Coast Seafood

- Maruha Nichiro

- High Liner Foods Inc.

- Mowi ASA

- Sysco Corporation

- Trident Seafoods

- Thai Union Group

- Sterling Seafood Corp.

- Clifton Seafood Company

- Marine Harvest ASA

- Austevoll Seafood ASA

- Charoen Pokphand Foods

Recent Development

- In 2022, High Liner Foods, a leading seafood company, made waves in the frozen seafood market with its acquisition of Bar Harbor Foods, a renowned processor of frozen seafood entrees and appetizers. This strategic move not only strengthens High Liner Foods' position in the market but also expands its product portfolio to offer consumers a wider range of high-quality frozen seafood options.

- In 2021, AquaStar, a major player in the industry, invested a whopping $35 million to amplify its sustainable salmon farming operations. This significant financial commitment underscores AquaStar's dedication to environmentally friendly practices while meeting the growing demand for responsibly sourced seafood.

- In 2023, Nomad Foods unveiled a new line of frozen seafood under its renowned Birds Eye brand. With its rich history of delivering top-notch frozen food products, Nomad Foods' foray into the frozen seafood market is highly anticipated. This expansion not only diversifies Nomad Foods' product range but also offers seafood aficionados a convenient and accessible way to enjoy delectable frozen seafood from a trusted brand.

- In 2022, SeaPak, a prominent supplier of frozen shrimp products, also caught investors' attention. Securing a remarkable $100 million in new financing, SeaPak is poised for expansion and growth. With the frozen shrimp market gaining momentum, this substantial influx of capital will support SeaPak's ambitious plans to broaden its product offerings and meet the increasing demand for frozen shrimp products across the globe.

Report Scope

Report Features Description Market Value (2022) USD 15.0 Bn Forecast Revenue (2032) USD 26.0 Bn CAGR (2023-2032) 5.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Fish, Crustaceans, Others), By Distribution Channel(Store-based, Non-Store-based), By End Use(Food Processing, Food Service, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SalMar, Coast Seafood, Maruha Nichiro, High Liner Foods Inc., Mowi ASA, Sysco Corporation, Trident Seafoods, Thai Union Group, Sterling Seafood Corp., Clifton Seafood Company, Marine Harvest ASA, Austevoll Seafood ASA, Charoen Pokphand Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- SalMar

- Coast Seafood

- Maruha Nichiro

- High Liner Foods Inc.

- Mowi ASA

- Sysco Corporation

- Trident Seafoods

- Thai Union Group

- Sterling Seafood Corp.

- Clifton Seafood Company

- Marine Harvest ASA

- Austevoll Seafood ASA

- Charoen Pokphand Foods