Anti Obesity Drugs Market Report By Drug Type (Prescription Drugs, Over-the-Counter (OTC) Drugs), By Mechanism of Action (Appetite Suppressants, Fat Absorption Inhibitors, Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs), GLP-1 Receptor Agonists, Combination Drugs, Others), By Formulation (Tablets, Capsules, Injections, Oral Liquids, Others), By End User (Hospitals, Clinics, Homecare Settings, Weight Loss Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47873

-

June 2024

-

291

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

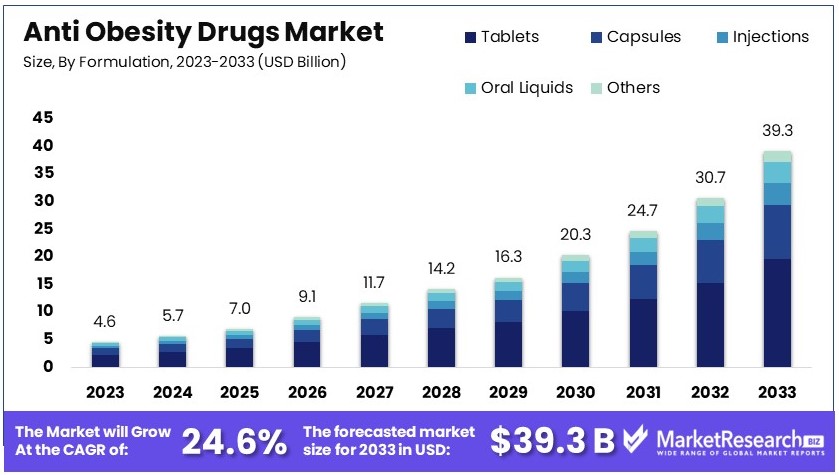

The Global Anti Obesity Drugs Market size is expected to be worth around USD 39.3 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 24.6% during the forecast period from 2024 to 2033.

The Anti-Obesity Drugs Market encompasses pharmaceutical treatments designed to manage and reduce obesity. These medications target various physiological mechanisms to curb appetite, enhance metabolism, or decrease fat absorption. As obesity rates continue to rise globally, the demand for effective anti-obesity drugs escalates, offering significant growth opportunities for pharmaceutical companies.

The market caters to healthcare providers, patients seeking medical interventions for weight loss, and insurance companies covering such treatments. Strategic developments in this sector include innovative drug formulations and combination therapies that aim to improve patient outcomes and minimize side effects.

The Anti-Obesity Drugs Market is poised for significant growth, driven by the escalating global prevalence of obesity. In 2022, the world saw over one billion people, encompassing both adults and children, grappling with obesity.

This includes approximately 880 million adults and 159 million children and adolescents aged 5-19 years. Notably, the incidence of overweight and obesity among this younger demographic has surged from 4% in 1975 to nearly 20% in 2022, underscoring a growing market need for effective therapeutic solutions.

In the United States alone, the situation reflects a substantial market segment. Nearly one in three adults is overweight, with the prevalence slightly higher among men (34.1%) than women (27.5%). This data not only highlights the extensive potential customer base for anti-obesity drugs but also signals an urgent public health issue.

The expanding demographic of individuals affected by obesity translates into a robust demand for innovative and effective pharmaceutical interventions. Pharmaceutical companies are therefore increasingly motivated to invest in R&D to develop new drugs that offer improved efficacy and reduced side effects. Additionally, the market is seeing a trend towards the development of personalized medicine approaches, aimed at enhancing patient outcomes based on genetic and metabolic profiles.

Key Takeaways

- Market Value: The Global Anti-Obesity Drugs Market was valued at USD 4.6 billion in 2023 and is projected to reach USD 39.3 billion by 2033, growing at a CAGR of 24.6%.

- Drug Type Analysis: Prescription drugs dominate with 65%; their clinical efficacy and mandatory medical supervision underscore their market superiority.

- Mechanism of Action Analysis: GLP-1 receptor agonists lead with 40%; their dual role in weight loss and glucose management marks their prominence.

- Formulation Analysis: Tablets hold a 50% market share; their ease of use and manufacturing contribute significantly to their dominance.

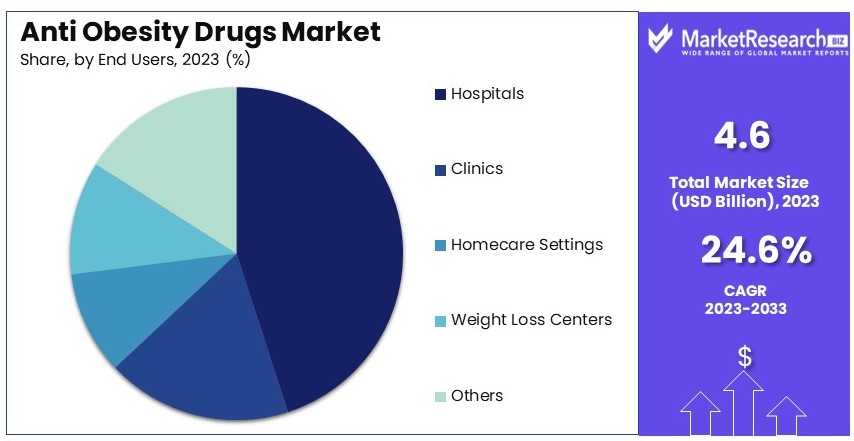

- End User Analysis: Hospitals lead with 45%; their comprehensive care capabilities underscore their primary role in obesity treatment.

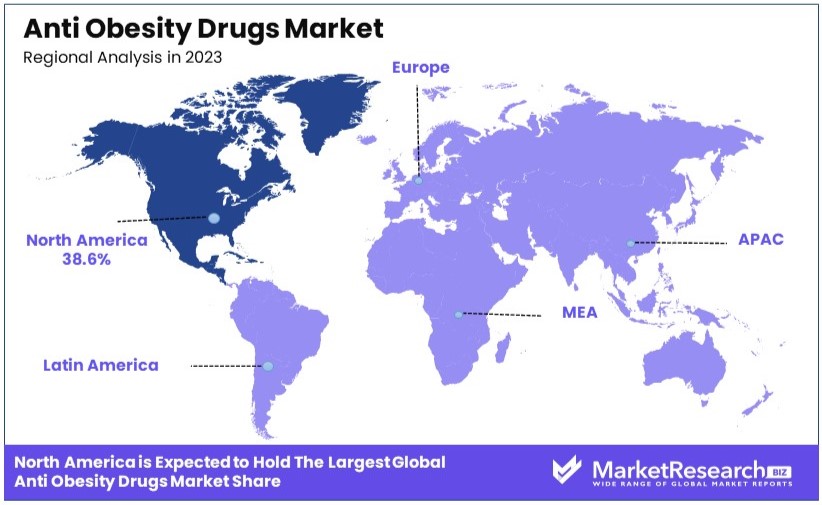

- Dominant Region: North America dominates the market with a 38.6% share; its robust healthcare infrastructure significantly influences this dominance.

- High Growth Region: Europe holds a 27.5% market share; its increasing health awareness and healthcare spending underline its growth potential.

- Analyst Viewpoint: The market is increasingly competitive and still expanding, with significant growth potential despite current penetrations. Innovations in drug development and broader regulatory approvals are anticipated.

- Growth Opportunities: Key players can leverage advancements in personalized medicine and expand into emerging markets to distinguish themselves in the competitive landscape.

Driving Factors

Rising Obesity Rates Drive Market Growth

The increasing prevalence of obesity worldwide significantly drives the growth of the anti-obesity drugs market. According to the World Health Organization (WHO), the number of obese individuals has nearly tripled since 1975, with over 650 million adults classified as obese in 2016. This surge in obesity rates has heightened awareness of the associated health risks, including type 2 diabetes, cardiovascular diseases, and certain types of cancer. As a result, there is a growing demand for effective weight management solutions, such as anti-obesity drugs. These drugs offer a necessary intervention for individuals who find it challenging to manage their weight through diet and exercise alone.

The rise in obesity is not just a health concern but also a catalyst for market growth. The increasing number of obese individuals creates a larger customer base for pharmaceutical companies specializing in anti-obesity treatments. Furthermore, the awareness of obesity-related health risks motivates individuals to seek medical help, thus driving the demand for anti-obesity medications. This trend is expected to continue, contributing to the expansion of the market as more people seek effective ways to manage their weight and improve their health.

Changing Lifestyles and Dietary Habits Drive Market Growth

The shift towards sedentary lifestyles and unhealthy dietary habits has substantially contributed to the rising obesity rates, thereby driving the growth of the anti-obesity drugs market. Modern lifestyles often involve long hours of sitting, minimal physical activity, and increased consumption of convenience foods high in calories and low in nutrients. These factors have led to an increase in obesity, creating a significant need for weight management solutions. Anti-obesity drugs provide a practical option for those who struggle to achieve weight loss through lifestyle changes alone.

As more people face challenges in managing their weight due to busy schedules and poor dietary choices, the demand for pharmaceutical interventions has grown. Anti-obesity drugs help address the gap between lifestyle changes and effective weight loss, offering individuals a medically supported method to combat obesity. This demand is likely to increase as sedentary lifestyles and unhealthy eating habits continue to prevail, further driving the market growth for anti-obesity drugs. The convergence of these lifestyle factors with the need for effective weight management solutions underscores the market's expansion prospects.

Increasing Acceptance and Awareness Drive Market Growth

Growing acceptance and awareness of anti-obesity drugs as a legitimate treatment option significantly propel the market's growth. As obesity is increasingly recognized as a complex, multifactorial disease, there is a rising openness among healthcare professionals and patients to explore pharmacological interventions alongside lifestyle changes. This shift in perception is crucial in driving the demand for anti-obesity medications.

Healthcare professionals are now more likely to recommend anti-obesity drugs as part of a comprehensive weight management plan, acknowledging their role in effectively addressing obesity when lifestyle modifications alone are insufficient. Patients, in turn, are becoming more informed about the benefits and availability of these medications, leading to increased adoption rates. This growing acceptance is supported by ongoing research and positive outcomes associated with anti-obesity drugs, further validating their use. As awareness and acceptance continue to rise, the market for anti-obesity drugs is expected to expand, driven by the integration of these medications into broader weight loss and diet control strategies.

Restraining Factors

Safety Concerns and Side Effects Restrain Market Growth

Despite advancements in drug development, safety concerns and side effects limit the growth of the anti-obesity drugs market. Some anti-obesity drugs have been linked to cardiovascular risks, psychiatric disorders, and gastrointestinal issues. These potential side effects create hesitancy among healthcare professionals and patients.

For instance, the FDA has withdrawn or restricted the use of certain drugs due to safety concerns, reducing available treatment options. This withdrawal impacts market confidence and slows adoption rates of new drugs. As a result, the perception of risk associated with these medications continues to hinder market expansion.

Stringent Regulatory Environment Restrains Market Growth

The stringent regulatory environment significantly restrains the growth of the anti-obesity drugs market. The development and approval of these drugs are subject to rigorous scrutiny by authorities like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

These regulatory bodies enforce strict requirements, which can delay or even prevent the entry of new drugs into the market. This lengthy and complex approval process not only increases the time and cost involved in bringing new drugs to market but also discourages innovation. Consequently, fewer new drugs are available to meet the growing demand, limiting market expansion.

Drug Type Analysis

Prescription drugs dominate with 65% due to efficacy and tailored medical supervision.

The Anti Obesity Drugs Market can be segmented based on drug type into prescription drugs and over-the-counter (OTC) drugs. Prescription drugs hold the dominant position in the anti-obesity drugs market. These drugs are prescribed by healthcare professionals and are typically used for patients who have not succeeded with diet and exercise alone.

The effectiveness of prescription drugs, such as Orlistat, Liraglutide, and Phentermine-Topiramate, contributes significantly to their dominance. These medications undergo rigorous clinical trials to ensure their efficacy and safety, gaining the trust of healthcare providers and patients alike. For example, Liraglutide, a GLP-1 receptor agonist, has shown considerable weight loss results, making it a preferred option among healthcare providers. The rigorous regulatory approvals for prescription drugs further ensure their quality, making them a reliable choice for obesity management.

In contrast, over-the-counter (OTC) drugs represent a smaller market share but are still essential. These drugs, such as Alli (a lower dose of Orlistat), are available without a prescription and appeal to individuals seeking weight management solutions without consulting a healthcare provider. OTC drugs are accessible and convenient, making them popular among consumers. However, the efficacy of OTC drugs may be lower than that of prescription drugs, which limits their market dominance. Despite this, the growing awareness and increasing number of obesity cases support the growth of the OTC segment, albeit at a slower rate compared to prescription drugs.

Mechanism of Action Analysis

GLP-1 receptor agonists dominate with 40% due to their efficacy and dual benefits in weight and glucose management.

The market for anti-obesity drugs can also be segmented based on their mechanism of action. GLP-1 receptor agonists are the dominant sub-segment in this category. These drugs, such as Liraglutide and Semaglutide, mimic the action of the GLP-1 hormone, which regulates appetite and insulin secretion. Their ability to promote significant weight loss and improve glycemic control in diabetic patients makes them highly effective. Clinical studies have shown that GLP-1 receptor agonists can lead to a 5-10% reduction in body weight, which is substantial compared to other anti-obesity drugs. This dual benefit of managing weight and blood glucose levels has increased their adoption among both patients and healthcare providers.

Appetite suppressants are another significant sub-segment. These drugs, including Phentermine and Lorcaserin, work by decreasing appetite and increasing feelings of fullness, helping reduce calorie intake. Fat absorption inhibitors, like Orlistat, prevent the absorption of fats from the diet, thus reducing caloric intake. Serotonin-norepinephrine reuptake inhibitors (SNRIs) and combination drugs, which combine different mechanisms, offer additional options for patients who may not respond to a single mechanism. While these other sub-segments contribute to market growth, GLP-1 receptor agonists' comprehensive benefits ensure their leading position.

Formulation Analysis

Tablets dominate with 50% due to convenience and widespread acceptance.

The anti-obesity drugs market can also be segmented by formulation. Tablets are the most dominant sub-segment within this category. They are easy to manufacture, store, and distribute, making them the most common form of medication. Patients also prefer tablets due to their convenience and ease of use. Popular anti-obesity drugs, such as Orlistat and Phentermine, are widely available in tablet form. The consistency and reliability of tablets contribute to their dominant market position, making them the preferred choice for both healthcare providers and patients.

Capsules, injections, and oral liquids also play significant roles in the market. Capsules offer a similar level of convenience as tablets but can be easier to swallow for some patients. Injections, such as those for GLP-1 receptor agonists, provide an effective alternative for patients who may not achieve desired results with oral medications. Oral liquids are useful for patients who have difficulty swallowing pills or capsules. These formulations ensure that a wide range of patient preferences and needs are met, supporting overall market growth.

End User Analysis

Hospitals dominate with 45% due to comprehensive care and monitoring.

The market for anti-obesity drugs can further be segmented based on end users. Hospitals are the leading end-user segment in the anti-obesity drugs market. They provide comprehensive care, including diagnosis, prescription, and monitoring of patients using anti-obesity drugs. Hospitals have access to a wide range of resources, including specialized healthcare professionals and advanced medical equipment, which ensures effective obesity management. The ability to provide personalized care plans and monitor patients closely enhances treatment outcomes, making hospitals the primary choice for obesity treatment.

Clinics, homecare settings, weight loss centers, and other settings also contribute to the market. Clinics offer convenient access to healthcare services and personalized care, making them popular among patients who prefer outpatient treatment. Homecare settings provide flexibility and comfort for patients managing their condition at home. Weight loss centers specialize in weight management and offer a variety of programs, including the use of anti-obesity drugs. These various end-user segments ensure that patients have multiple options for receiving treatment, supporting overall market growth.

Key Market Segments

By Drug Type

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

By Mechanism of Action

- Appetite Suppressants

- Fat Absorption Inhibitors

- Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs)

- GLP-1 Receptor Agonists

- Combination Drugs

- Others

By Formulation

- Tablets

- Capsules

- Injections

- Oral Liquids

- Others

By End User

- Hospitals

- Clinics

- Homecare Settings

- Weight Loss Centers

- Others

Growth Opportunities

Combination Therapies Offer Growth Opportunity

Combination therapies present a significant growth opportunity for the anti-obesity drugs market. This approach targets multiple pathways involved in weight regulation, enhancing the efficacy of treatments. By combining drugs with different mechanisms of action, researchers aim to achieve better results and reduce side effects.

This method addresses the complex nature of obesity, which often requires multifaceted solutions. As clinical trials continue to show promising results, the adoption of combination therapies is expected to rise. This trend could lead to the development of more effective and safer anti-obesity treatments, expanding market potential.

Personalized and Precision Medicine Offers Growth Opportunity

Personalized and precision medicine is gaining traction in obesity management, offering significant growth opportunities. This approach leverages genetic testing, biomarkers, and individualized treatment plans to tailor anti-obesity drugs to specific patient profiles. By doing so, the effectiveness of treatments improves while minimizing adverse effects.

Personalized medicine addresses the unique needs of each patient, making obesity management more efficient. As technological advancements in genetic testing and biomarker identification progress, the market for personalized anti-obesity treatments is expected to grow, driving innovation and market expansion.

Trending Factors

Expanding Indications Are Trending Factors

Expanding indications for anti-obesity drugs are trending factors in the market. Some drugs show benefits beyond weight management, such as improving glycemic control in type 2 diabetes patients and reducing cardiovascular risks. Exploring these additional benefits and obtaining regulatory approvals can significantly expand the market.

For instance, drugs like GLP-1 receptor agonists are being studied for their dual benefits in weight and glucose management. As research confirms these additional indications, the demand for multi-purpose anti-obesity drugs will increase, driving market growth and opening new avenues for development.

Adoption in Emerging Markets Are Trending Factors

Adoption of anti-obesity drugs in emerging markets is a trending factor contributing to market expansion. Countries like China, India, and those in Latin America are experiencing rising obesity rates due to increasing urbanization, changing lifestyles, and rising incomes. These factors drive the demand for effective weight management solutions.

As awareness and healthcare access improve in these regions, the adoption of anti-obesity drugs is expected to rise. This expansion into emerging markets represents a significant opportunity for growth, as pharmaceutical companies tap into these large, underserved populations.

Regional Analysis

North America Dominates with 38.6% Market Share

North America holds the dominant position in the anti-obesity drugs market, accounting for 38.6% of the global market share.

Several factors drive North America's high market share in the anti-obesity drugs market. High obesity rates are a primary factor, with the CDC reporting that 42.4% of American adults were obese in 2017-2018. The region has strong healthcare infrastructure and access to advanced medical treatments. Additionally, there is significant investment in research and development, leading to the availability of innovative anti-obesity drugs. Public awareness campaigns about the health risks of obesity also contribute to the growing demand for these medications.

Regional characteristics significantly impact the industry's performance in North America. The presence of major pharmaceutical companies and extensive healthcare facilities ensures easy access to anti-obesity treatments. High disposable incomes and robust health insurance coverage further facilitate the adoption of these drugs. Additionally, the FDA's stringent regulatory framework ensures the safety and efficacy of marketed drugs, enhancing consumer confidence and driving market growth.

Europe Market Share - 27.5%

Europe holds a 27.5% market share in the anti-obesity drugs market. Factors such as high obesity rates, a strong healthcare system, and significant investment in healthcare research contribute to this substantial share. Countries like the UK, Germany, and France are key players in the region's market dynamics, driving growth through advanced healthcare facilities and supportive government policies.

Asia Pacific Market Share - 18.2%

Asia Pacific accounts for 18.2% of the anti-obesity drugs market. Rapid urbanization, changing dietary habits, and rising obesity rates are driving the market in this region. Countries like China, India, and Japan are experiencing increased demand for anti-obesity drugs due to improved healthcare infrastructure and growing public awareness about obesity-related health risks.

Middle East & Africa Market Share - 8.4%

The Middle East & Africa region holds an 8.4% market share. Rising obesity rates, increasing healthcare spending, and growing awareness of obesity's health impacts are key factors driving market growth. Countries like Saudi Arabia and South Africa are leading the region's market expansion through initiatives to combat obesity and improve public health.

Latin America Market Share - 7.3%

Latin America accounts for 7.3% of the global anti-obesity drugs market. Factors such as increasing urbanization, changing lifestyles, and rising healthcare expenditure contribute to the market growth. Brazil and Mexico are significant players in this region, with efforts to address obesity through public health campaigns and improved access to medical treatments.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The anti-obesity drugs market is led by several key players. Novo Nordisk A/S and F. Hoffmann-La Roche Ltd are market leaders with strong product portfolios and significant market shares. Their advanced R&D capabilities and effective marketing strategies ensure their top positions.

GlaxoSmithKline plc and AstraZeneca also hold significant shares due to their extensive pharmaceutical expertise and global distribution networks. These companies benefit from well-established brands and strong market presence.

Boehringer Ingelheim International GmbH and Pfizer Inc. are notable for their innovative drug development. Their focus on new therapies and strategic partnerships enhances their market influence.

Merck & Co., Inc. and Johnson & Johnson Services, Inc. leverage their broad healthcare portfolios to maintain a competitive edge. Their diverse product lines and robust sales networks contribute to their strong market positions.

Takeda Pharmaceutical Company Limited and Eisai Co., Ltd. are recognized for their effective anti-obesity treatments and strong market penetration, particularly in Asia. Their strategic regional focus boosts their market impact.

Emerging companies like Orexigen Therapeutics, Inc., Rhythm Pharmaceuticals, Inc., and Zafgen, Inc. focus on novel treatments and specific patient needs. Their innovative approaches and potential for growth are noteworthy.

Vivus, Inc. and Norgine B.V. are smaller players that contribute through niche products and targeted marketing strategies. Their specialized solutions address specific market segments effectively.

Overall, these key players shape the anti-obesity drugs market with their strong R&D, effective marketing, and strategic positioning. Their combined efforts drive market growth and innovation.

Market Key Players

- Novo Nordisk A/S

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Pfizer Inc.

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc.

- Takeda Pharmaceutical Company Limited

- Eisai Co., Ltd.

- Orexigen Therapeutics, Inc.

- Rhythm Pharmaceuticals, Inc.

- Zafgen, Inc.

- Vivus, Inc.

- Norgine B.V.

- Other Key Players

Recent Developments

- June 2024: New research presented at ENDO 2024 shows that the anti-obesity medication Zepbound (tirzepatide) is effective for weight loss in individuals with multiple obesity-related medical conditions, contradicting the belief that those with more issues lose less weight.

- June 2024: The FDA recently approved the GLP-1 medication Zepbound (tirzepatide) for chronic weight management in adults with obesity or overweight and at least one weight-related condition. Zepbound is more effective than previous treatments and can lead to weight loss comparable to surgery.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 39.3 Billion CAGR (2024-2033) 24.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Prescription Drugs, Over-the-Counter (OTC) Drugs), By Mechanism of Action (Appetite Suppressants, Fat Absorption Inhibitors, Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs), GLP-1 Receptor Agonists, Combination Drugs, Others), By Formulation (Tablets, Capsules, Injections, Oral Liquids, Others), By End User (Hospitals, Clinics, Homecare Settings, Weight Loss Centers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Novo Nordisk A/S, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, AstraZeneca, Boehringer Ingelheim International GmbH, Pfizer Inc., Merck & Co., Inc., Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, Eisai Co., Ltd., Orexigen Therapeutics, Inc., Rhythm Pharmaceuticals, Inc., Zafgen, Inc., Vivus, Inc., Norgine B.V., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Novo Nordisk A/S

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- AstraZeneca

- Boehringer Ingelheim International GmbH

- Pfizer Inc.

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc.

- Takeda Pharmaceutical Company Limited

- Eisai Co., Ltd.

- Orexigen Therapeutics, Inc.

- Rhythm Pharmaceuticals, Inc.

- Zafgen, Inc.

- Vivus, Inc.

- Norgine B.V.

- Other Key Players