Gastrointestinal Endoscopy Market By Product (Rigid Endoscopes, Flexible Endoscopes, Capsule Endoscopes, Disposable Endoscopes, Robot Assisted Endoscopes), By End-User (Hospitals, Ambulatory Surgery Centers/Clinics, Other End-Users), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

40300

-

Jan 2024

-

167

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

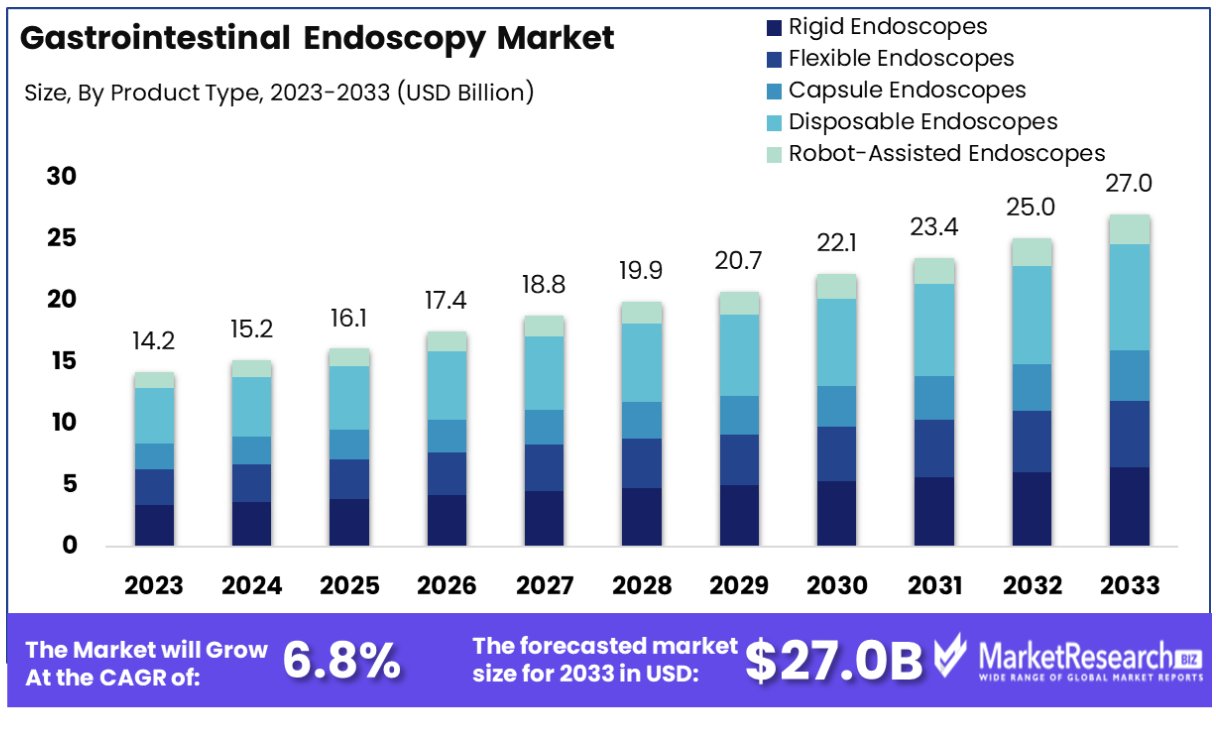

Gastrointestinal Endoscopy Market size is expected to be worth around USD 27.0 Bn by 2033 from USD 14.2Bn in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

Gastrointestinal endoscopy, an advanced medical technique, aids in diagnosing and treating GI conditions. It involves a flexible tube with a camera and light source to visualize internal organs. Goals encompass precise treatment, early disease detection, and improved patient outcomes.

The gastrointestinal endoscopy market is exhibiting remarkable growth, a trend underscored by several crucial factors. Firstly, a notable surge in digestive health issues has been observed. According to the American Gastroenterological Association, approximately 40% of Americans have curtailed routine activities in the past year due to digestive problems, impacting daily life significantly. This underscores a substantial need for efficient diagnostic and treatment methods.

Moreover, the global burden of digestive diseases is significant, as evidenced by the report of 88.99 million disability-adjusted life years (DALYs) attributed to these conditions in 2019. This represents a considerable 3.51% of global DALYs, highlighting the critical nature of gastrointestinal disorders on a global scale. In the United States alone, the prevalence of diagnosed ulcers in adults stands at 5.9%, translating to 14.8 million individuals. Such statistics reveal the extensive impact of gastrointestinal ailments and the corresponding demand for advanced diagnostic and treatment solutions.

The market's growth is further fueled by technological innovations in gastrointestinal endoscopy. High-definition imaging systems have revolutionized the clarity of visuals available to healthcare professionals, significantly enhancing diagnostic accuracy. Additionally, the adoption of minimally invasive techniques, such as capsule endoscopy and virtual colonoscopy, has markedly improved patient experiences. These advancements are not only more comfortable for patients but also offer greater precision, contributing to their widespread acceptance in medical practice.

Investments from various sectors have been pivotal in driving market growth. Healthcare firms, research institutions, and technology providers have collectively contributed to the development of sophisticated devices, enhanced imaging techniques, and innovative software applications. These advancements enable more precise diagnoses and targeted treatments, integrating cutting-edge technologies like AI and machine learning for automated analysis. The market's expansion is further supported by its broad application across multiple medical fields, including gastroenterology, oncology, general surgery, urology, and gynecology.

The gastrointestinal endoscopy market's potential is widely acknowledged, attracting substantial investment from a diverse range of stakeholders. Healthcare providers, pharmaceutical companies, medical device manufacturers, and research organizations are all investing in this field, drawn by its capabilities in accurate diagnosis and targeted treatment. Collaboration and partnerships among these stakeholders are geared towards enhancing patient outcomes through innovative solutions, emphasizing the market's integral role in advancing healthcare.

Driving Factors

Growing demand for minimally invasive procedures

Minimally invasive procedures have become increasingly favored by patients and medical practitioners alike due to their numerous benefits. In the field of gastrointestinal procedures, endoscopy has become the go-to choice for diagnosing and treating various gastrointestinal disorders. Unlike traditional open surgeries, endoscopic procedures minimize tissue damage, reduce scarring, and result in faster patient recovery times. The demand for minimally invasive procedures, such as gastrointestinal endoscopy, is expected to witness significant growth owing to these advantages.

Expansion of screening and early detection programs

With the aim of detecting gastrointestinal diseases at early stages and improving patient outcomes, there has been a notable expansion of screening and early detection programs worldwide. National healthcare systems and organizations are increasingly prioritizing the implementation of screening programs for conditions like colorectal cancer, gastroesophageal reflux disease (GERD), and celiac disease. Gastrointestinal endoscopy plays a vital role in these programs as it enables the visualization and biopsy of suspicious lesions, allowing for early detection, intervention, and potentially life-saving treatment.

Rising adoption of sedation and patient comfort measures

Comfort and safety are significant concerns for patients undergoing gastrointestinal endoscopy procedures. As a result, there has been a rise in the adoption of sedation techniques and patient comfort measures. The use of conscious sedation during endoscopic procedures helps patients to relax, reduces anxiety, and promotes a more comfortable experience. Additionally, advancements in sedative medications and monitoring technologies have improved the safety profile of these procedures, further driving their adoption.

Restraining Factors

High Cost of Endoscopy Equipment and Procedures

The gastrointestinal endoscopy market is heavily reliant on technologically advanced equipment and instruments. These cutting-edge tools facilitate accurate diagnosis and effective treatment. However, the high cost of such equipment poses a significant challenge. Hospitals and healthcare facilities need to allocate substantial financial resources to acquire state-of-the-art endoscopy equipment. Additionally, the cost of consumables and disposable items used in the procedures further add to the overall expenses. As a result, healthcare providers may face financial constraints that limit their ability to invest in the latest endoscopy equipment, potentially affecting patient outcomes and advancements within the field.

Challenges in Training and Skill Development

To ensure safe and effective endoscopic procedures, a highly skilled workforce is required. However, training for gastrointestinal endoscopy is complex and demands significant expertise. It involves mastering various techniques, understanding anatomical complexities, and developing the ability to interpret endoscopic findings accurately. Limited training opportunities, particularly in developing regions, can hinder the development of a skilled endoscopy workforce. Moreover, the continuous advancements in endoscopic technology and evolving treatment modalities necessitate ongoing education and skill enhancement for healthcare professionals, posing additional challenges.

Product Analysis

The gastrointestinal endoscopy market exhibits rapid growth, driven by key segments like Flexible Endoscopes, which currently dominates and contributes substantially to revenue. Foreseeable trends indicate the continued dominance of this segment, ensuring a thriving industry ahead.

The adoption of the Flexible Endoscopes Segment is largely driven by economic development in emerging economies. As these economies continue to grow and prosper, there is an increased focus on healthcare infrastructure development. This includes the establishment of modern medical facilities equipped with advanced endoscopy equipment, including flexible endoscopes.

Consumer trends and behaviors also play a significant role in the increased adoption of the Flexible Endoscopes Segment. Patients are becoming more aware of the benefits of early detection and preventive care, leading to a higher demand for gastrointestinal endoscopy procedures. Flexible endoscopes offer several advantages over their rigid counterparts, including enhanced maneuverability and patient comfort. These factors contribute to the preference for the Flexible Endoscopes Segment among consumers.

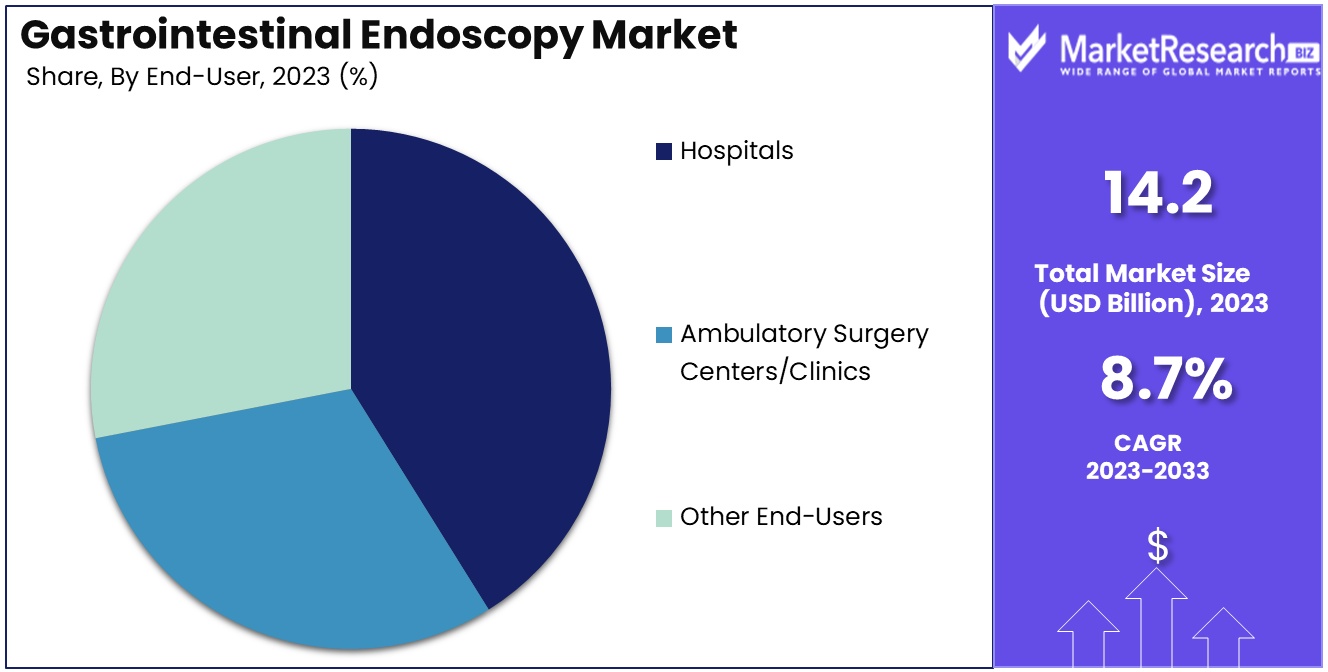

End-User Analysis

Hospitals play a crucial role in the gastrointestinal endoscopy market and dominate the industry's end-user segment. As healthcare facilities, hospitals are at the forefront of diagnosing and treating gastrointestinal disorders, making them a key driver of market growth.

The adoption of gastrointestinal endoscopy procedures, including both Flexible Endoscopes and GI Endoscopy, is strongly influenced by economic development in emerging economies. As these economies continue to grow, there is an increased focus on improving healthcare infrastructure, including the establishment of modern hospitals equipped with state-of-the-art endoscopy equipment.

The gastrointestinal endoscopy market is influenced by consumer trends and preferences. Patients now favor hospitals due to their comprehensive healthcare services, specialized medical equipment, and experienced professionals. Hospitals, offering a variety of diagnostic and treatment options, are the preferred choice for gastrointestinal endoscopy procedures. As a result, the hospital's Segment is expected to experience rapid growth in the market, attributed to rising healthcare expenditure, the importance of early detection and treatment of gastrointestinal disorders, and advancements in endoscopy technology.

Key Market Segments

By Product

- Rigid Endoscopes

- Flexible Endoscopes

- Capsule Endoscopes

- Disposable Endoscopes

- Robot-Assisted Endoscopes

By Application

- Gastrointestinal (GI) Endoscopy

- Urology Endoscopy (Cystoscopy)

- Obstetrics/Gynecology Endoscopy

- Arthroscopy

- Laparoscopy

- Bronchoscopy

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

By End-User

- Hospitals

- Ambulatory Surgery Centers/Clinics

- Other End-Users

Growth Opportunity

Integration of Virtual Reality in Gastrointestinal Endoscopy

Virtual reality (VR) has gained significant traction in various industries, and its application in healthcare is no exception. By combining VR technology with gastrointestinal endoscopy, healthcare professionals can enhance their diagnostic and therapeutic capabilities. VR can provide an immersive and realistic view of the gastrointestinal tract, enabling physicians to visualize complex anatomical structures and detect abnormalities with greater precision. This integration also offers a valuable training tool for medical students and residents, allowing them to practice procedures in a simulated environment. The integration of VR in gastrointestinal endoscopy holds immense potential for improved patient outcomes and advancements in the field.

Personalized Medicine and Precision Endoscopy

Advancements in genomics and molecular diagnostics have paved the way for precision medicine, tailoring therapies based on individual patient characteristics. In the gastrointestinal endoscopy market, personalized medicine can significantly enhance treatment outcomes and overall patient experience. By employing genetic profiling and biomarker analysis, gastroenterologists can identify patients at a higher risk of specific gastrointestinal diseases and tailor endoscopic interventions accordingly. Moreover, the integration of artificial intelligence and machine learning algorithms can assist in predicting disease progression, optimizing treatment strategies, and minimizing unnecessary procedures. The adoption of personalized medicine in gastrointestinal endoscopy not only improves patient outcomes but also drives growth by fostering precision-based diagnostics and therapies.

Latest Trends

Increasing Demand for Endoscopic Ultrasound and Capsule Endoscopy

Endoscopic ultrasound (EUS) has emerged as a valuable technique in GI endoscopy, allowing for detailed imaging of the digestive system, adjacent organs, and lymph nodes. With the ability to detect tumors, evaluate lesions, and guide fine-needle aspirations, EUS has become an indispensable tool in the diagnostic and staging processes for various GI diseases. Another notable advancement in GI endoscopy is capsule endoscopy, where patients swallow a small wireless camera that captures images of the gastrointestinal tract. This non-invasive technique has revolutionized the diagnosis of conditions such as Crohn's disease, gastrointestinal bleeding, and small bowel tumors, providing detailed images that were previously unattainable with traditional endoscopy.

Utilization of Advanced Imaging Modalities such as Confocal Laser Endomicroscopy

Confocal laser endomicroscopy (CLE) has gained considerable attention in the field of GI endoscopy. With its ability to provide real-time microscopic imaging of the mucosal layer, CLE enables clinicians to achieve in vivo histopathology during endoscopic procedures. This enhances the accuracy of diagnosis, helps identify early-stage lesions, and guides targeted interventions, ultimately improving patient outcomes.

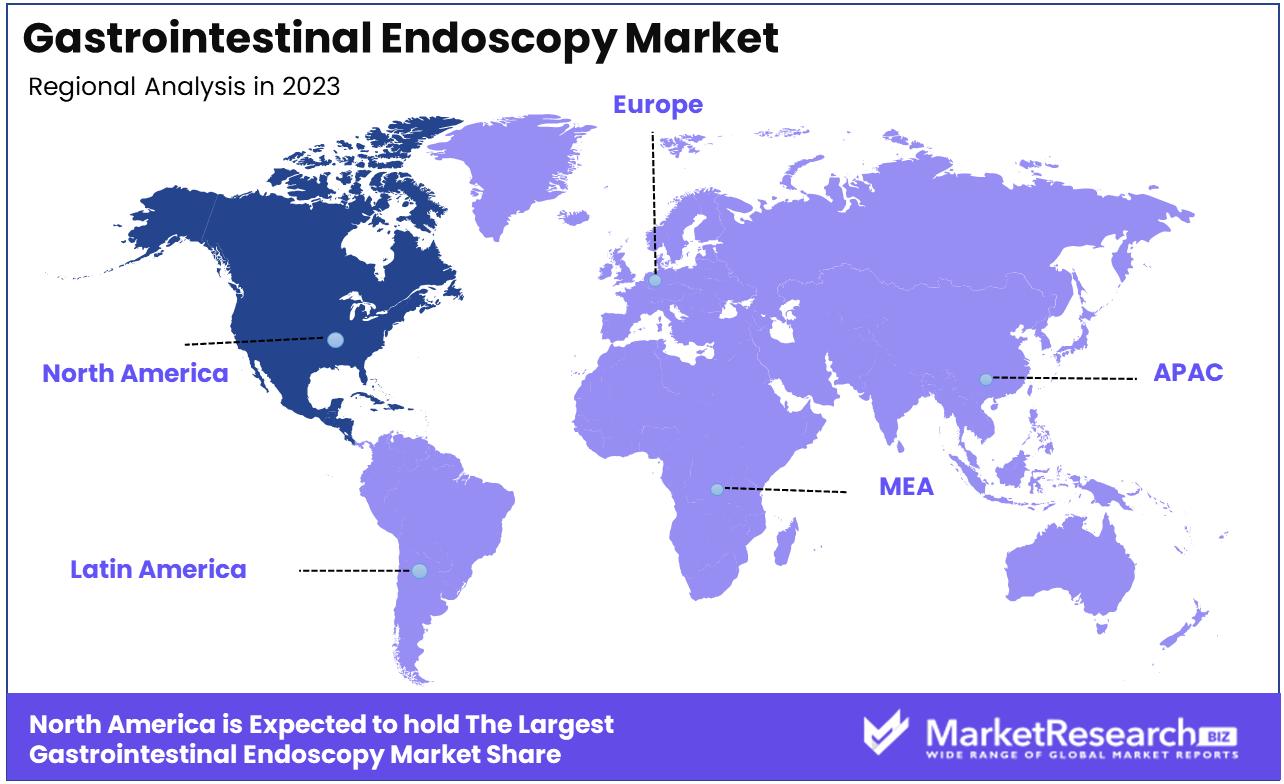

Regional Analysis

In today's fast-paced healthcare industry, gastrointestinal endoscopy stands out as a significant innovation, revolutionizing gastroenterology with precise diagnostics and efficient treatments. The market has experienced remarkable growth due to rising gastrointestinal disorder prevalence and the adoption of minimally invasive procedures. The surge in the elderly population, prone to such ailments, has escalated demand for advanced diagnostic tools.

North America, led by the United States and Canada, dominates the gastrointestinal endoscopy market, supported by a well-developed healthcare infrastructure, substantial research investments, and fruitful industry-academic collaborations. Renowned medical institutions and specialized training further contribute to the region's prominence.

Furthermore, North America boasts a well-established network of key market players, including medical device manufacturers and suppliers, insurance providers, and healthcare providers. The region's strategic partnerships and collaborations create a favorable environment for the growth and adoption of gastrointestinal endoscopy technology. Ongoing advancements in endoscopic equipment, such as high-definition imaging systems, robotic-assisted platforms, and capsule endoscopes, have further propelled the market in North America.

The region's dominance also stems from its favorable regulatory framework and reimbursement policies. The Food and Drug Administration (FDA) in the United States has implemented stringent regulations to ensure the safety and efficacy of gastrointestinal endoscopy devices, instilling confidence in both healthcare professionals and patients. Additionally, reimbursement policies in North America support the utilization of gastrointestinal endoscopy procedures, making them more accessible and affordable for individuals.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Intuitive Surgical Inc., a renowned US-based company, dominates the gastrointestinal endoscopy market with its revolutionary da Vinci Surgical System, enabling precise and minimally invasive robotic surgery. Patients experience reduced pain, fewer complications, and quicker recovery due to the system's enhanced precision and control through small incisions. Intuitive Surgical's dedication to medical innovation has earned them widespread recognition and trust in the industry.

Stryker, a key player in the gastrointestinal endoscopy market, stands out for its advanced medical devices and commitment to improving patient outcomes. They offer a wide range of innovative endoscopic devices, including flexible endoscopes, imaging systems, and visualization tools. With a global leadership position in gastrointestinal endoscopy, Stryker's dedication to enhancing surgical procedures solidifies their reputation in the industry.

Top Key Players in Gastrointestinal Endoscopy Market

- Intuitive Surgical Inc (U.S.)

- Stryker (U.S.)

- Medrobotics Corporation (U.S)

- Johnson & Johnson Private Limited (U.S.)

- Globus Medical (U.S.)

- NuVasive Inc. (U.S.)

- Smith + Nephew (U.K.)

- Titan Medical Inc (Canada)

- TransEnterix Inc (U.S.)

- University of Pittsburgh Medical Center (U.S.)

- Mazor Robotics (Israel)

- Auris Health Inc. (U.S.)

- Corindus Inc. (U.S.)

- Renishaw plc (U.K.)

- Medineering GmbH (Germany)

Recent Development

- In 2023, Olympus announced its groundbreaking gastrointestinal endoscopy system, the EVIS X1. This cutting-edge device boasts an array of advanced features, offering enhanced usability and precision. With an emphasis on user-friendliness, the EVIS X1 aims to equip medical professionals with a seamless and intuitive experience, revolutionizing the landscape of gastrointestinal endoscopy practices.

- In 2022, Fujifilm showcased its commitment to meeting the growing demand for gastrointestinal endoscopy devices by significantly expanding its production capacity in Japan. This expansion aims to maintain the supply-demand equilibrium in the market and ensure the timely availability of high-quality endoscopy systems. Fujifilm's dedication to increasing production capacity underscores its determination to address the evolving needs of healthcare professionals and patients alike.

- In 2021, Pentax Medical made waves by joining forces with the tech giant, Google, to develop an innovative gastrointestinal endoscopy system harnessing the power of artificial intelligence (AI). This collaboration aims to create an intelligent solution that can assist healthcare professionals in detecting and diagnosing gastrointestinal disorders more accurately and efficiently. The integration of AI technology is poised to revolutionize the field by improving diagnostic precision and patient outcomes.

- In 2020, Medtronic, a prominent player in medical technology, acquired GI Supply, a well-known provider of gastrointestinal endoscopy products and services. This move strengthens Medtronic's market standing and expands its offerings in gastrointestinal endoscopy. The collaboration between Medtronic and GI Supply seeks to foster innovation and cater to the ever-changing customer demands more efficiently.

Report Scope

Report Features Description Market Value (2023) USD 14.2 Bn Forecast Revenue (2033) USD 27.0 Bn CAGR (2024-2033) 6.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Rigid Endoscopes, Flexible Endoscopes, Capsule Endoscopes, Disposable Endoscopes, Robot Assisted Endoscopes)

By Application (Gastrointestinal (GI) Endoscopy, Urology Endoscopy (Cystoscopy), Obstetrics/Gynecology Endoscopy, Arthroscopy, Laparoscopy, Bronchoscopy, Mediastinoscopy, Otoscopy, Laryngoscopy)

By End-User (Hospitals, Ambulatory Surgery Centers/Clinics, Other End-Users)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Intuitive Surgical Inc (U.S.), Stryker (U.S.), Medrobotics Corporation (U.S), Johnson & Johnson Private Limited (U.S.), Globus medical (U.S.), NuVasive Inc. (U.S.), Smith + Nephew (U.K.), Titan Medical Inc (Canada), TransEnterix Inc (U.S.), University of Pittsburgh Medical Center (U.S.), Mazor Robotics (Israel), Auris Health Inc. (U.S.), Corindus Inc. (U.S.), Renishaw plc (U.K.), Medineering GmbH (Germany) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Intuitive Surgical Inc (U.S.)

- Stryker (U.S.)

- Medrobotics Corporation (U.S)

- Johnson & Johnson Private Limited (U.S.)

- Globus Medical (U.S.)

- NuVasive Inc. (U.S.)

- Smith + Nephew (U.K.)

- Titan Medical Inc (Canada)

- TransEnterix Inc (U.S.)

- University of Pittsburgh Medical Center (U.S.)

- Mazor Robotics (Israel)

- Auris Health Inc. (U.S.)

- Corindus Inc. (U.S.)

- Renishaw plc (U.K.)

- Medineering GmbH (Germany)