Medical Imaging Market By Type (Magnetic Resonance Imaging, Computed Tomography, X-ray), By Application (Cardiology, Neurology, Orthopedics), By End User (Hospitals, Specialty Clinics, Diagnostic Imaging Centers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

25834

-

March 2023

-

185

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

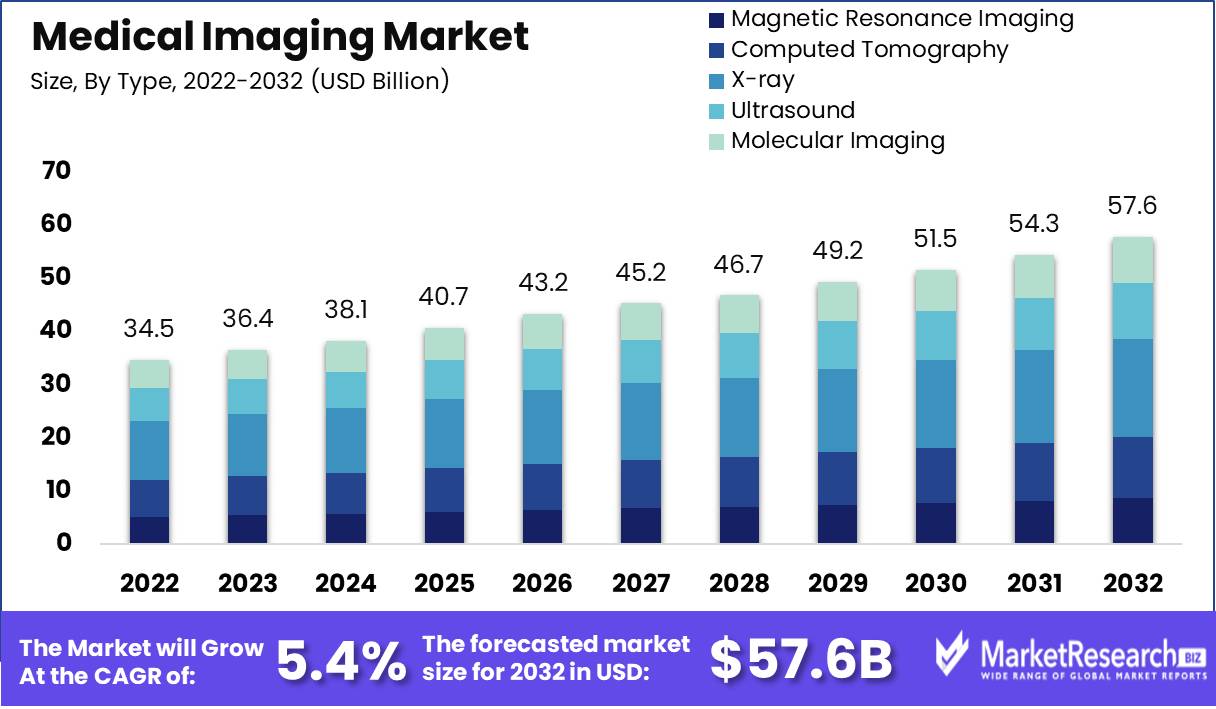

The global medical imaging market is expected to grow at a compound annual growth rate of 5.4% from USD 34.5 billion in 2022 to USD 57.6 billion in 2032.

Medical Imaging Market comprises various technologies and modalities designed to visualize the interior of the human body for diagnostic and therapeutic purposes. In recent years, the market share has experienced remarkable growth, primarily attributed to advancements in technology, the increase in healthcare expenditure, and the rising prevalence of chronic diseases.

In the healthcare sector, advancements in technology, strategic collaborations, and innovative imaging solutions have played a significant role in the growth of the Medical Imaging Market. The increasing demand for advanced imaging equipment, together with the adoption of cutting-edge technologies, is driving the market's expansion and reshaping its revenue share. Key companies and prominent players in the industry are actively participating in these developments. Such involvement is poised to positively influence the healthcare industry as a whole.

In September 2023, a significant milestone was achieved in the Medical Imaging Market when Mayo Clinic and GE HealthCare joined forces in a strategic collaboration. This partnership aims to harness Mayo Clinic's extensive clinical and research expertise alongside GE HealthCare's robust capabilities in research, engineering, and product development. Such collaborations between renowned healthcare institutions and industry leaders underscore a shared commitment to pushing the boundaries of medical imaging.

Another noteworthy development in 2023 pertains to the introduction of the Air Recon Deep Learning Software (ARDLS) by GE Healthcare. ARDLS has demonstrated its ability to enhance image quality, increase specificity, and dramatically reduce scan times by 50%. Particularly noteworthy is ARDLS's excellence in Magnetic Resonance Imaging (MRI) systems equipped with 3.0 Tesla (3.0T) magnets, delivering superior image resolution and sharper visuals compared to traditional 1.5T MRI machines. This advancement holds the potential to revolutionize diagnostic accuracy and improve patient experiences.

In 2023, Siemens Healthineers unveiled its NAEOTOM Alpha CT scanner, which utilizes an innovative tube technology to decrease radiation exposure by up to 50% compared to previous models. Such advancements are pivotal in ensuring patient safety and minimizing potential health risks associated with radiation exposure during imaging procedures.

Medical imaging technologies are at the forefront of diagnosing and monitoring these conditions, leading to a continuous surge in demand. As a result, manufacturers are focusing on developing more efficient and specialized imaging equipment and software tailored to specific medical conditions, further driving the market growth. As the Medical Imaging Market continues to evolve, it is evident that these trends and developments will play a pivotal role in sustaining its growth and impact on global healthcare.

Driving Factors

Increasing prevalence of chronic diseases:

Chronic diseases are long-lasting health conditions like diabetes, heart disease, and cancer. According to WHO, Chronic diseases affect 71% of global deaths. Medical imaging, such as MRI and CT scans, plays a crucial role in diagnosing and monitoring these diseases. It allows doctors to see detailed images of organs and tissues, helping them identify problems early and create effective treatment plans.

Rising demand for early detection:

Consider the potential to identify issues before they escalate; this is precisely what medical imaging offers. It serves as a robust diagnostic tool that enables physicians to detect health concerns in their early stages. When diseases are identified early, treatment tends to yield better outcomes, increasing the likelihood of patient recovery. This phenomenon contributes to the increasing demand for medical imaging services in the market.

Technological advancements:

Just like how smartphone keeps getting smarter and more capable, medical imaging technology is constantly improving. New innovations, such as 3D imaging and artificial intelligence are making medical images sharper and easier to interpret. This not only makes the job of healthcare professionals more accurate but also helps patients receive more precise and personalized care.

Growing geriatric population:

The world's population is aging, which means there are more elderly people now than ever before. Older adults tend to have more health concerns, and they may require more medical attention. Medical imaging is vital for monitoring their health and diagnosing age-related conditions like osteoporosis and dementia. It helps doctors ensure that elderly individuals receive appropriate care and maintain their quality of life.

Restraining Factors

High cost of medical imaging equipment:

Medical imaging equipment, such as MRI scanners, CT scanners, and ultrasound machines, can cost several million dollars each. This high initial investment cost can be a significant barrier for smaller healthcare facilities, clinics, and medical practices. Additionally, the ongoing maintenance and upgrade expenses can strain their budgets further. This cost factor can limit access to advanced medical imaging services in some regions and for certain healthcare providers.

Concerns about radiation exposure

Many medical imaging techniques, such as X-rays and CT scans, involve ionizing radiation. While these procedures are generally considered safe when performed by trained professionals and when the benefits outweigh the risks, concerns about radiation exposure persist. Patients and even some healthcare providers may worry about potential long-term effects of radiation, leading to hesitancy in recommending or undergoing certain imaging tests. This concern can lead to a preference for alternative diagnostic methods or less frequent use of radiation-based imaging.

Shortage of trained professionals

Properly operating and interpreting the results of medical imaging equipment requires skilled professionals, such as radiologic technologists and radiologists. There is a shortage of these trained experts in some regions, which can lead to delays in conducting tests and analyzing the results. Moreover, the complexity of modern imaging technology necessitates ongoing training and education, making it challenging for healthcare facilities to keep up with the demand for skilled staff. The shortage of professionals can result in slower diagnosis and treatment processes.

Frequent Product Recalls

Occasionally, medical imaging equipment faces product recalls due to malfunctions or safety concerns. These recalls can erode trust in the reliability of such devices and create a reluctance among healthcare providers to invest in new imaging technology. Patients and healthcare professionals may also become wary of using equipment that has been recalled in the past, leading to a negative impact the market growth. Frequent recalls can damage the reputation of manufacturers and hinder the adoption of new imaging technologies. Innovative applications of dementia care products within the Medical Imaging Market facilitate early diagnosis and monitoring of dementia-related conditions.

Type Analysis

In the medical imaging industry, the X-ray segment has undeniably emerged as a dominant force when analyzed by type. This remarkable dominance within the broader Medical Imaging Market can be attributed to several factors that collectively underscore the significance of X-ray technology in healthcare.

X-rays have a long-standing history of reliability and versatility. They are an indispensable tool for diagnosing a wide range of medical conditions, from fractures to lung diseases, offering physicians invaluable insights into the human body's inner workings. Their non-invasive nature and relatively low cost have further endeared them to both healthcare providers and patients alike.

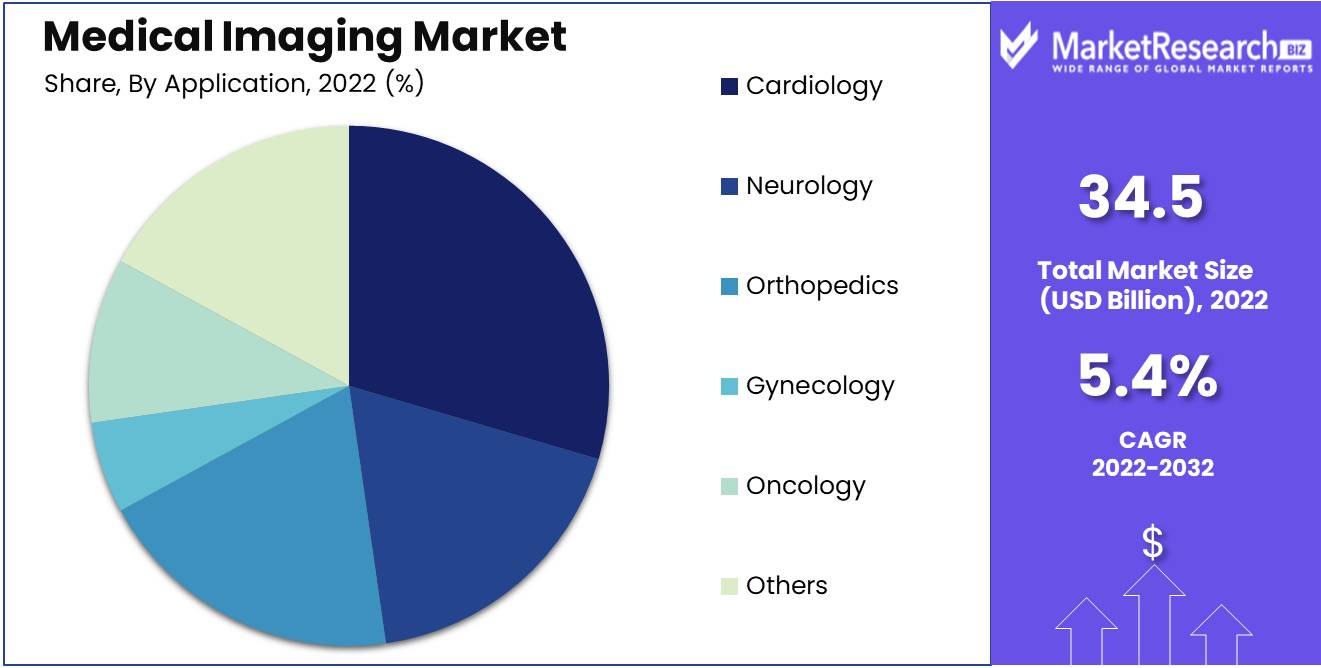

Application Analysis

The orthopedics segment has emerged as a dominant force within the medical imaging market, leading the way in terms of applications. This sector represents a critical dimension of healthcare, focusing on the diagnosis and treatment of musculoskeletal conditions and injuries. The dominance of orthopedics in medical imaging can be attributed to several key factors.

An aging global population has led to a marked increase in orthopedic issues, including osteoarthritis and fractures. These conditions require advanced imaging techniques for precise diagnosis and treatment planning. As a result, orthopedics has become a primary beneficiary of advancements in medical imaging technologies.

End-User Analysis

The hospital segment has long dominated the medical imaging market due to their integral role in healthcare delivery. As the epicenter of patient care across a broad range of medical specialties, hospitals require access to a diverse range of imaging modalities like X-rays, CT scans, MRIs, and ultrasounds to diagnose and monitor conditions. Their position as the central hub for treating patients gives hospitals an advantage in acquiring and utilizing the latest advancements in medical imaging technology.

Furthermore, hospitals typically have the infrastructure, finances, and patient volume necessary to justify investing in and relying heavily on medical imaging. Their substantial patient throughput and need for efficient care makes medical imaging a vital tool. With the resources to obtain the most advanced imaging applications and the patient demand to necessitate their use, hospitals are set to continue their dominance over the medical imaging market for the foreseeable future.

Segmentation Analysis

By Type

- Magnetic Resonance Imaging

- Computed Tomography

- X-ray

- Ultrasound

- Molecular Imaging

By Application

- Cardiology

- Neurology

- Orthopedics

- Gynecology

- Oncology

- Others

By End User

- Hospitals

- Specialty Clinics

- Diagnostic Imaging Centers

- Others

Growth Opportunity

Growth Opportunities in Emerging Countries:

The field of medical imaging is expanding rapidly in emerging countries. This means that in places where healthcare technology is just starting to develop, there are big chances for growth in the medical imaging sector. As these countries invest more in healthcare, they will need more medical imaging equipment and expertise, creating opportunities for businesses to provide these services and devices.

AI is Becoming More Important:

Artificial Intelligence (AI) is increasingly prominent in the field of medical imaging. Think of a computer program that assists doctors in quickly and accurately identifying diseases or injuries in X-rays or MRI scans. That's the role of AI in medical imaging. As AI technology continues to advance, numerous opportunities arise for companies to create and enhance AI solutions for medical imaging, ultimately enhancing the efficiency and accuracy of healthcare.

Hybrid Imaging Technologies:

Another growth factor within the medical imaging market pertains to hybrid imaging technologies. These technologies can be likened to harnessing the strengths of various superheroes. They merge two or more imaging modalities, such as CT scans and PET scans, to provide a more comprehensive view of a patient's internal condition. Companies involved in the development of these hybrid technologies are experiencing an expanding market, as both healthcare professionals and patients seek the most precise and comprehensive information for making healthcare decisions.

Latest Trends

Expanding Access to Healthcare in Developing Countries:

In recent times, there's been a big push to make healthcare more accessible in developing countries. Medical imaging plays a crucial role in this. New technologies are making it possible to set up smaller, more affordable imaging centers in places that didn't have access to advanced medical services before. This means more people in these areas can get the medical attention they need.

The Growth of Cloud-Based Medical Imaging Solutions:

Consider the possibility of storing and accessing your medical images, such as X-rays or MRIs, online. This is precisely what cloud-based medical imaging solutions offer. They are gaining popularity because they simplify the process of viewing and sharing images for both doctors and patients, regardless of location. It's akin to having your medical records stored in the cloud, contributing to greater flexibility and efficiency in healthcare.

The Increasing Popularity of Value-Based Healthcare:

Value-based healthcare is all about making sure patients get the best care possible while also keeping costs in check. Medical imaging is a big part of this because it helps doctors make more accurate diagnoses and treatment plans. By using imaging to its fullest potential, healthcare providers can offer better care at a lower cost, which is a win-win for everyone.

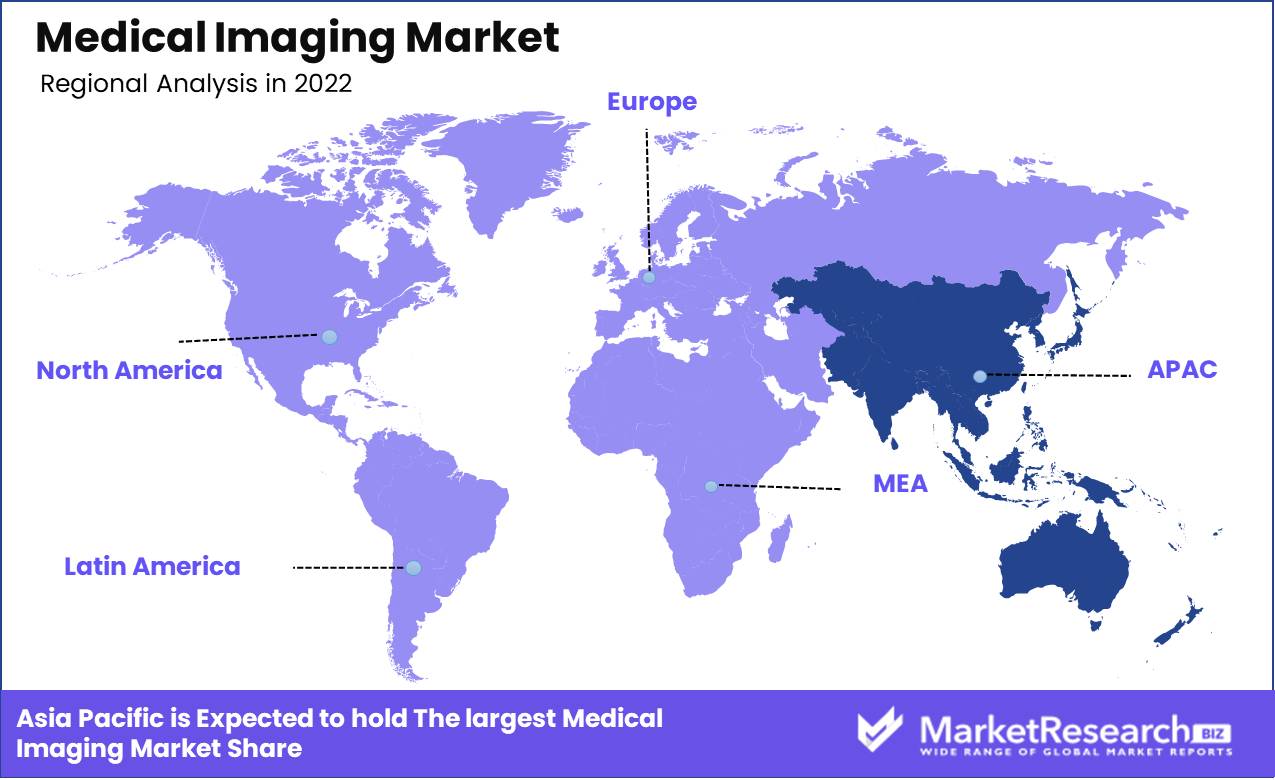

Regional Analysis

The Asia Pacific region has become a major player in the global medical imaging industry, as shown by a comprehensive analysis of the region. One reason for this is the large and growing population in Asia Pacific. More people means more demand for healthcare, including medical imaging services and equipment. Governments and private healthcare providers have been investing heavily to meet this demand. They are building healthcare facilities with state-of-the-art medical imaging technology.

Another factor is the increase in chronic diseases in Asia Pacific. There is also more awareness of the need to detect diseases early. This has further increased the demand for medical imaging. Additionally, Asia Pacific has a strong manufacturing industry. This allows the region to produce high-quality yet affordable medical imaging devices locally. It reduces the need to import them. The region's academic institutions, healthcare providers, and technology companies also work together. Their research and development drives innovation in medical imaging techniques.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Siemens Healthineers:

Siemens Healthineers is a global leader in medical imaging technology. They offer a wide range of products, including MRI, CT, and ultrasound systems. Their focus on innovation and quality has established them as a trusted name in the industry.

General Electric (GE) Healthcare:

GE Healthcare is another major player, known for its advanced medical imaging solutions. They provide a comprehensive portfolio of diagnostic imaging equipment, such as X-ray, MRI, and PET-CT scanners, catering to healthcare facilities worldwide.

Philips Healthcare:

Philips Healthcare specializes in innovative medical imaging and diagnostic solutions. They are recognized for their advanced radiology and cardiology systems, which are designed to enhance patient care and improve clinical outcomes.

Canon Medical Systems Corporation:

Formerly known as Toshiba Medical Systems, Canon Medical Systems is renowned for its high-quality diagnostic imaging equipment. They offer a range of imaging modalities, including CT, ultrasound, and X-ray machines, and focus on cutting-edge technology for improved patient care.

Other key players, such as Hitachi, Ltd., Hologic Inc., Butterfly Inc., Analogic, and so on, have also entered the market competition by introducing novel and technologically advanced devices.

Top Key Players

- Shimadzu Corporation

- Fujifilm Holdings Corporation

- Philips Healthcare

- GE Healthcare

- Fonar Corporation

- Samsung Medison

- HOYA Group Pentax

- Hitachi Medical Corporation

- Toshiba Corporation

- Hologic Inc

- Medtronic

- Carestream Health

- Siemens Healthcare

- Cubresa Inc

Recent Development

- In September 2023, Mayo Clinic and GE Healthcare announced a strategic collaboration in the field of medical imaging and theranostics. This collaboration aims to unite Mayo Clinic's clinical and research expertise with GE Healthcare's research, engineering, and product development capabilities to advance innovation in medical imaging and patient care.

- In 2023, GE Healthcare's Edison intelligence platform developed the Air Recon Deep Learning Software (ARDLS). ARDLS has improved image quality, specificity, and reduced MRI scan times by 50%, particularly in MRIs equipped with 3.0 Tesla (3.0T) magnets. 3.0T MRIs provide higher resolution and sharper images compared to 1.5T MRIs when using ARDLS.

- In 2023, GE Healthcare has launched its new Revolution Apex CT scanner, which features a new AI-powered platform called AIDR 3D that can reduce radiation exposure by up to 75% without sacrificing image quality.

- In 2023, Siemens Healthineers has introduced its new NAEOTOM Alpha CT scanner, which features a new tube technology that can reduce radiation exposure by up to 50%.

Report Scope

Report Features Description Market Value (2022) US$ 34.5 Bn Forecast Revenue (2032) US$ 57.6 Bn CAGR (2023-2032) 5.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Magnetic Resonance Imaging, Computed Tomography, X-ray), By Application (Cardiology, Neurology, Orthopedics), By End User (Hospitals, Specialty Clinics, Diagnostic Imaging Centers) Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Shimadzu Corporation, Fujifilm Holdings Corporation, Philips Healthcare, GE Healthcare, Fonar Corporation, Samsung Medison, HOYA Group Pentax, Hitachi Medical Corporation, Toshiba Corporation, Hologic Inc, Medtronic, Carestream Health, Siemens Healthcare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Shimadzu Corporation

- Fujifilm Holdings Corporation

- Philips Healthcare

- GE Healthcare

- Fonar Corporation

- Samsung Medison

- HOYA Group Pentax

- Hitachi Medical Corporation

- Toshiba Corporation

- Hologic Inc

- Medtronic

- Carestream Health

- Siemens Healthcare

- Cubresa Inc